Professional Documents

Culture Documents

Sharpe 1992

Uploaded by

Nguyễn Thanh PhongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sharpe 1992

Uploaded by

Nguyễn Thanh PhongCopyright:

Available Formats

First, we measure fund exposures and determine asset allocations.

We implement the ten asset class

model consists of nine sectoral indexes and SBI rate/Bills. The purpose is to identify the sector to which

the average equity funds primarily allocate and also the sector in which the average funds ignore. We

also estimate the style of each fund. The factors represent independent variables of the model. The

benchmarks are mutually exclusive and exhaustive. Next, we use the constrained regression and

quadratic programming by using Excel Solver for asset allocation/ fund style, and then compare the

results. The sectoral model is written as follow:

Where R is the return on the fund i, F1 is agriculture index, bi1 is the exposure to agriculture index, Ft is

the mining index, bi2 is the exposure to mining, and so on, with constraints that all the factor

sensitivities are non-negative and lie between zero and one (0 < bij < 1) and add up to one (Σbij=1). The

definition of the independent variables is shown in Table 2. The style analysis results provide coefficients

to a constrained regression that can be interpreted as style weights. The portfolio of indices, weighted

by their style weights, represent a reasonable passive alternative to the fund’s active management that

provides the same exposure to the chosen asset classes (Ibbotson, 2002). Second, we analyse style drifts

recall that style identified in the model is an overall style that potentially changes during 60 months. As a

fund’s style may change over time, rolling 30-month periods are used to determine the customized

benchmark for each period. We measure 30 style regressions from October 2006 to March 2009. The

fund style in October 2006 is obtained from April 2004-September 2006 regression (30 months prior),

style in November 2006 is obtained from May 2004-October 2006 observation, and so on. The R2

obtained from both average style and rolling window can identify whether the low R2 management

following an active strategy or a result of improper benchmark measure. Finally, we implement

performance evaluation of equity by this return-based style analysis approach. The style model

represents the fund’s investment pattern so that it is defined as benchmark portfolio with passive mix.

The fund performance is evaluated by comparing the actual fund return with the return obtained from

benchmark portfolio. The result of this difference named selection return. Assumed that the active

manager declares the fund style at the beginning of each period and is engaged only in picking

undervalued securities within each style benchmark asset class; and that the style benchmark is a more

approriate benchmark for measuring performance than the commonly used composite index. The

following steps for each month t are: 1. The fund’s style is estimated, using NAV returns from month t-

30 through t-1 (same with rolling window). The length of the estimation period tries to balance between

opposing issues. A longer estimation period reduces “noise” and provide a more accuracy of the fund’s

style exposure. However, for active manager who dynamically rotate among several class assets, a

longer estimation periode will not produces accurate estimates. 2. The return on the resulting style

(using the coefficients estimated in step 1) is calculated for the month t. 3. The difference between

actual NAV return in month t and that of the style

You might also like

- Financial Statement Analysis: Business Strategy & Competitive AdvantageFrom EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- 2008 Dow Award WinnerDocument13 pages2008 Dow Award WinnerSergio GonzalesNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- Assessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsDocument9 pagesAssessment Module Code: AF5008 Module Title: Financial Mathematics and StatisticsUmar AliNo ratings yet

- Performance Attribution For Equity Portfolios PDFDocument11 pagesPerformance Attribution For Equity Portfolios PDFelz0rr0No ratings yet

- Analyzing Mutual Fund RiskDocument7 pagesAnalyzing Mutual Fund RiskSriKesavaNo ratings yet

- 101 - Performance EvaluationDocument28 pages101 - Performance EvaluationLyn EveNo ratings yet

- Attribution of Portfolio Performance Relative To An IndexDocument16 pagesAttribution of Portfolio Performance Relative To An IndexhaginileNo ratings yet

- AlternativeEdge Snapshot - Equity Hedge Fund Performance 2014 - EuropeDocument8 pagesAlternativeEdge Snapshot - Equity Hedge Fund Performance 2014 - EuropeAnonymous x0WJveDbPGNo ratings yet

- SSRN Id3150525 PDFDocument66 pagesSSRN Id3150525 PDFRafael JudsonNo ratings yet

- Portfolio AnalysisDocument18 pagesPortfolio Analysissubscription accountNo ratings yet

- Chapter - Iii Research MethodologyDocument6 pagesChapter - Iii Research MethodologyPrince KumarNo ratings yet

- Ratio Analysis of TafeDocument56 pagesRatio Analysis of TafeGourav AoliyaNo ratings yet

- R08 Statistical Concepts and Market Return 2017 Level I NotesDocument31 pagesR08 Statistical Concepts and Market Return 2017 Level I NotesSumaira ShahidNo ratings yet

- Cross Section of Expected Stock Returns in Ise: June 2000Document28 pagesCross Section of Expected Stock Returns in Ise: June 2000epsieurigaNo ratings yet

- Group 1 - FAR 1Document9 pagesGroup 1 - FAR 1Jelian TangaroNo ratings yet

- Instructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Document8 pagesInstructions:: FINA 6216 ASSIGNMENT 1: Asset Allocation (25 Points)Mathew SawyerNo ratings yet

- Final 1Document57 pagesFinal 1rajinikanth dasiNo ratings yet

- Perf BrinsonDocument7 pagesPerf BrinsonAyo CokerNo ratings yet

- Department of CommerceDocument72 pagesDepartment of CommercePrasun SenNo ratings yet

- Portfolio Performance Attributions FinalDocument27 pagesPortfolio Performance Attributions FinalOussama BOUDCHICHINo ratings yet

- Lecture 1: Fundamentals of Mean-Variance Analysis: Prof. Massimo GuidolinDocument48 pagesLecture 1: Fundamentals of Mean-Variance Analysis: Prof. Massimo GuidolinAVNo ratings yet

- s5 Bogojevic-Arsic Vesna 109Document6 pagess5 Bogojevic-Arsic Vesna 109nileshbalaNo ratings yet

- Index NumbersDocument20 pagesIndex NumbersmbapritiNo ratings yet

- Quan Sty 4Document13 pagesQuan Sty 4verybad19No ratings yet

- 8 Equity Valuation Using MultiplesDocument40 pages8 Equity Valuation Using MultiplesHuicai MaiNo ratings yet

- Attribution GuideDocument6 pagesAttribution Guidevicky.sajnaniNo ratings yet

- Dan Gode-Affect CocDocument32 pagesDan Gode-Affect CocShanti PertiwiNo ratings yet

- Financial Statement AnalysisDocument10 pagesFinancial Statement AnalysisLeonilaEnriquezNo ratings yet

- A Valuation Study of Stock Market Seasonality and The Size EffectDocument26 pagesA Valuation Study of Stock Market Seasonality and The Size EffectDibyendu DasNo ratings yet

- Assignment - Evening StudentsDocument3 pagesAssignment - Evening StudentsBimal KrishnaNo ratings yet

- Analysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadaviDocument24 pagesAnalysis of Indices: Presented By: Harshit Dave (12) Nikhil Kohok (26) Deepika Mahale Suman Pandita Mumtaz TadavimndeepikaNo ratings yet

- SSRN Id4336419Document26 pagesSSRN Id4336419brineshrimpNo ratings yet

- Analyzing Mutal Fund PerformanceDocument4 pagesAnalyzing Mutal Fund PerformanceMeghananda s oNo ratings yet

- Managing Bond Portfolios Ch16 ActivepassivDocument17 pagesManaging Bond Portfolios Ch16 ActivepassivKumarNo ratings yet

- Equal Weight Indexes MethodologyDocument8 pagesEqual Weight Indexes MethodologythickskinNo ratings yet

- 05 Euro Aggregate Corporate Index FactsheetDocument2 pages05 Euro Aggregate Corporate Index FactsheetRoberto PerezNo ratings yet

- Equity Valuation Using MultiplesDocument38 pagesEquity Valuation Using MultiplesHuicai MaiNo ratings yet

- Quantitative TechniquesDocument15 pagesQuantitative Techniquesabsharaliks82No ratings yet

- DTU406 - Lecture 6 - Portfolio Management and Style AnalysisDocument14 pagesDTU406 - Lecture 6 - Portfolio Management and Style AnalysisThuc NguyenNo ratings yet

- What Affects The Implied Cost of Equity Capital?: Dgode@stern - Nyu.eduDocument32 pagesWhat Affects The Implied Cost of Equity Capital?: Dgode@stern - Nyu.edueko triyantoNo ratings yet

- Module-Financial Analysis and Reporting 2Document5 pagesModule-Financial Analysis and Reporting 2Christy BascoNo ratings yet

- Course OutlineDocument3 pagesCourse Outlinemdarafathossaen89No ratings yet

- Update The Barclays Euro Government Inflation-Linked Bond EGILB IndexDocument6 pagesUpdate The Barclays Euro Government Inflation-Linked Bond EGILB IndexabandegenialNo ratings yet

- 807512Document24 pages807512Shweta SrivastavaNo ratings yet

- Analysis of The Albanian Banking System in A Risk Performance FrameworkDocument44 pagesAnalysis of The Albanian Banking System in A Risk Performance FrameworkYogesh MungurNo ratings yet

- Time Series Momentum For Improved Factor TimingDocument22 pagesTime Series Momentum For Improved Factor TimingLydia AndersonNo ratings yet

- SSRN-id 433100Document24 pagesSSRN-id 433100Radhika ThakkarNo ratings yet

- Market Indices/ Stock IndexDocument2 pagesMarket Indices/ Stock IndexDipikaVermaniNo ratings yet

- IntroductionDocument5 pagesIntroductionDushyant ChouhanNo ratings yet

- Techniques of Financial Analysis: Unit 2Document33 pagesTechniques of Financial Analysis: Unit 2RAHUL GHOSALENo ratings yet

- An International Analysis of Earnings, Stock Prices andDocument38 pagesAn International Analysis of Earnings, Stock Prices andelielo0604No ratings yet

- FRP Mid TermDocument3 pagesFRP Mid TermShivam MongaNo ratings yet

- Determinants of Market Price in Stock Market (Karachi Stock Exchange)Document7 pagesDeterminants of Market Price in Stock Market (Karachi Stock Exchange)Rana ShahzaibNo ratings yet

- FINC ProjectDocument4 pagesFINC Project可惜可惜No ratings yet

- Asset Allocation: Management Style and Performance Measurement by William F SharpeDocument42 pagesAsset Allocation: Management Style and Performance Measurement by William F SharpeAdnan KamalNo ratings yet

- BarraOne Performance Attribution - Brinson Vs Factor BasedDocument14 pagesBarraOne Performance Attribution - Brinson Vs Factor BasedGeorgi MitovNo ratings yet

- Lecture 10 NotesDocument58 pagesLecture 10 Notesdaniel.wallworkNo ratings yet

- Systematically Trading FX Mean Reversion in The Long Run 1680234492Document32 pagesSystematically Trading FX Mean Reversion in The Long Run 1680234492Jaehyun KimNo ratings yet

- CFA Performance Evaluation Amp AttributionDocument38 pagesCFA Performance Evaluation Amp AttributionverashelleyNo ratings yet

- Wiska Varitain - 0912Document18 pagesWiska Varitain - 0912Anonymous hHWOMl4FvNo ratings yet

- Taylorism vs. FordismDocument2 pagesTaylorism vs. FordismLiv Maloney67% (3)

- GST RATE LIST - pdf-3Document6 pagesGST RATE LIST - pdf-3Niteesh KumarNo ratings yet

- Economics - Economics - Cheat - SheetDocument1 pageEconomics - Economics - Cheat - SheetranaurNo ratings yet

- Machine Design 2021 Guidelines and MechanicsDocument2 pagesMachine Design 2021 Guidelines and Mechanicsreneil llegueNo ratings yet

- Brochure - OasisDocument24 pagesBrochure - OasisVivek RNo ratings yet

- Bassoon (FAGOT) : See AlsoDocument36 pagesBassoon (FAGOT) : See Alsocarlos tarancón0% (1)

- IoT Security Checklist Web 10 17 r1Document39 pagesIoT Security Checklist Web 10 17 r1SubinNo ratings yet

- Data Mining in IoTDocument29 pagesData Mining in IoTRohit Mukherjee100% (1)

- Chemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFDocument178 pagesChemical & Biological Depopulation (By Water Floridation and Food Additives or Preservatives) PDFsogunmola100% (2)

- Nursing Assessment in Family Nursing PracticeDocument22 pagesNursing Assessment in Family Nursing PracticeHydra Olivar - PantilganNo ratings yet

- TESP12201R0Document20 pagesTESP12201R0Muhammad AliNo ratings yet

- Coal Mining Technology and SafetyDocument313 pagesCoal Mining Technology and Safetymuratandac3357No ratings yet

- QSasDocument50 pagesQSasArvin Delos ReyesNo ratings yet

- The Handmaid's TaleDocument40 pagesThe Handmaid's Taleleher shahNo ratings yet

- 3-A Y 3-B Brenda Franco DíazDocument4 pages3-A Y 3-B Brenda Franco DíazBRENDA FRANCO DIAZNo ratings yet

- 全新全真题库一 PDFDocument36 pages全新全真题库一 PDFTzarlene100% (1)

- Adolescents' Gender and Their Social Adjustment The Role of The Counsellor in NigeriaDocument20 pagesAdolescents' Gender and Their Social Adjustment The Role of The Counsellor in NigeriaEfosaNo ratings yet

- PedagogicalDocument94 pagesPedagogicalEdson MorenoNo ratings yet

- V13 D03 1 PDFDocument45 pagesV13 D03 1 PDFFredy Camayo De La CruzNo ratings yet

- Lesson Plan 1Document3 pagesLesson Plan 1api-311983208No ratings yet

- Gracella Irwana - G - Pert 04 - Sia - 1Document35 pagesGracella Irwana - G - Pert 04 - Sia - 1Gracella IrwanaNo ratings yet

- Citrus Information Kit-Update: Reprint - Information Current in 1998Document53 pagesCitrus Information Kit-Update: Reprint - Information Current in 1998hamsa sewakNo ratings yet

- Operation and Maintenance Manual Compressor Models: P105WJD, P130DWJD, P160DWJD, P175DWJDDocument70 pagesOperation and Maintenance Manual Compressor Models: P105WJD, P130DWJD, P160DWJD, P175DWJDManuel ParreñoNo ratings yet

- LP Pe 3Q - ShaynevillafuerteDocument3 pagesLP Pe 3Q - ShaynevillafuerteMa. Shayne Rose VillafuerteNo ratings yet

- (Ebook - Antroposofia - EnG) - Rudolf Steiner - Fundamentals of TheraphyDocument58 pages(Ebook - Antroposofia - EnG) - Rudolf Steiner - Fundamentals of Theraphyblueyes247No ratings yet

- Teamcenter 10.1: Publication Number PLM00015 JDocument122 pagesTeamcenter 10.1: Publication Number PLM00015 JmohanNo ratings yet

- What Is Urban PlanningDocument33 pagesWhat Is Urban PlanningDivine Grace FernandoNo ratings yet

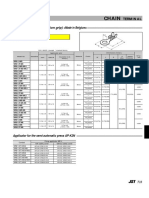

- Chain: SRB Series (With Insulation Grip)Document1 pageChain: SRB Series (With Insulation Grip)shankarNo ratings yet

- 2nd Second Sun of Advent (B)Document4 pages2nd Second Sun of Advent (B)Max PolakNo ratings yet