Professional Documents

Culture Documents

Sharnjeekaur T183

Uploaded by

Sharnjeet KaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sharnjeekaur T183

Uploaded by

Sharnjeet KaurCopyright:

Available Formats

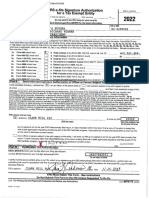

Canada Revenue Agence du revenu

Agency du Canada Protected B

when completed

Information Return for Electronic Filing of

an Individual's Income Tax and Benefit Return Tax year: 2022

The information on this form relates to the tax year shown in the top right corner. Before you fill out this form, read the information and instructions on page 2 . The

individual identified in Part A (or the individual's legal representative) must sign Part F . Your electronic filer must fill out Part C and Part D before submitting your

return. Give the signed original of this form to your electronic filer and keep a copy for yourself.

Part A – Identification and address as shown on your tax return (mandatory)

First name Last name Social insurance number

SHARNJEET KAUR X X X X X 1 3 4 8

Mailing address: Apt number – Street number - Street name PO Box RR City Prov./Terr Postal code

568 HIGHGLEN AVE MARKHAM O N L 3 S 4 N 4

Get your CRA mail electronically delivered in My Account (optional)

Email Address: SHARRYD619@GMAIL.COM

By giving an email address, I am registering to receive email notifications from the CRA and agreeing to the terms of use on page 2.

Part B – Declaration of amounts from your Income Tax and Benefit Return (mandatory)

Enter the following amounts from your return, if applicable:

Total income (line 15000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. Refund (line 48400) . . . . . . . ..

Taxable income (line 26000) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. or

Total federal non-refundable tax credits (line 35000) . . . . . . . . . . . . . . 2,159 70 Balance owing (line 48500) . . . .

Part C – Electronic filer identification (mandatory)

By signing Part F below, I declare that the following person or firm is electronically filing the new or the amended Income Tax and Benefit Return of the person

named in Part A. Part F must be signed before the return is electronically transmitted.

Name of person or firm: CMATAX Electronic filer number: V9472

Representative identifier (Rep ID): XXXXT98

Part D – Document Control number (mandatory)

The document control number generated for my electronic record: V9472223NF2E3

Part E - How do you want to receive your notices of assessment and reassessment? (select one or more of the following electronic

options)

I am registering (as indicated in Part A above) or I am already registered to receive email notifications from the CRA and can view and access my notices

of assessment and reassessment online.

I would like my electronic filer to receive a one time notice of assessment and reassessment electronically in their software and provide me with a copy.

I understand that by ticking (✓) this box, I am allowing the CRA to electronically provide my assessment results and my notices of assessment and

reassessment to the electronic filer (including a discounter) named in Part C. I will now receive a copy of my notices of assessment and reassessment

from my electronic filer. For more information, see the Express NOA section on page 2.

OR

I would like to receive paper notices of assessment and reassessment through Canada Post.

I will receive my notices of assessment and reassessment through Canada Post once my return or amended return has been assessed. If I have already

registered to receive email notifications from the CRA and I tick this box, I understand that I will not receive a copy of my notice through Canada Post.

Part F – Declaration and authorization (mandatory)

I declare that the information entered in Part A, B and C is correct and complete and fully discloses my income from all sources. I also declare that I have read

the information on page 2, and that the electronic filer identified in Part C is filing my return. I allow this electronic filer to communicate with the CRA

to correct any errors or omissions.

Signature (individual identified in PartA or legal representative) Name and title of legal representative

Year Month Day HH MM SS

Privacy Act, personal information bank number CRA PPU 211

T183 E (22) (Ce formulaire est disponible en français.) Page 1 of 2

You might also like

- Psych 1xx3 Quiz AnswersDocument55 pagesPsych 1xx3 Quiz Answerscutinhawayne100% (4)

- Luthfur Return2022Document2 pagesLuthfur Return2022Mohammad Luthfur RahmanNo ratings yet

- Antonio Morales Reyes T183 2023-03-30Document1 pageAntonio Morales Reyes T183 2023-03-30Antonio MoralesNo ratings yet

- Original DocumentDocument45 pagesOriginal Documentalbert anonuevoNo ratings yet

- Singh, Jashanpreet Tax PDF 2020 SignedDocument20 pagesSingh, Jashanpreet Tax PDF 2020 SignedJashan Dere AalaNo ratings yet

- 358 T1 2021 Corey - Duizendstraal T183Document2 pages358 T1 2021 Corey - Duizendstraal T183jeffcartier.66No ratings yet

- Eng 2022 Matchakalai, Suresh Kumar - EncryptedDocument4 pagesEng 2022 Matchakalai, Suresh Kumar - EncryptedkumarNo ratings yet

- Fowlis, Jesse - T183Document2 pagesFowlis, Jesse - T183End UserNo ratings yet

- T183 TemplateDocument2 pagesT183 TemplateEnd UserNo ratings yet

- 2010 Application For Extension of Time To File Form IT-9Document2 pages2010 Application For Extension of Time To File Form IT-9Tyler RoachNo ratings yet

- Client Benefit Retainer AgreementDocument4 pagesClient Benefit Retainer AgreementHarvey BenderNo ratings yet

- RTMF 990Document49 pagesRTMF 990Craig MaugerNo ratings yet

- 2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFDocument45 pages2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFRafael CarvalhoNo ratings yet

- Canada EngDocument3 pagesCanada Engpaolomarabella8No ratings yet

- FILING STATUS (Check One)Document3 pagesFILING STATUS (Check One)hypnotix-2000No ratings yet

- Request For Taxpayer Relief - Cancel or Waive Penalties and InterestDocument19 pagesRequest For Taxpayer Relief - Cancel or Waive Penalties and InterestJennifer LeetNo ratings yet

- US Internal Revenue Service: F8453ol - 2003Document2 pagesUS Internal Revenue Service: F8453ol - 2003IRSNo ratings yet

- Laura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyDocument144 pagesLaura and John Arnold Foundation 2022 Tax Forms, Obtained by Gabe KaminskyGabe KaminskyNo ratings yet

- Michigan Assessor Affidavit for PRE Interest WaiverDocument3 pagesMichigan Assessor Affidavit for PRE Interest WaiverBeng KalawNo ratings yet

- ACFrOgCz7a2LJCWlqslCg8U5un0u of-VEH6VB8dAwgmnT 50plDFbS07HZomG-A8e80zpyVXwpYhWIPc6w2Ug3E L1WK8595x3snx01H6WVjH04a LNSswdjEuF8DIDocument1 pageACFrOgCz7a2LJCWlqslCg8U5un0u of-VEH6VB8dAwgmnT 50plDFbS07HZomG-A8e80zpyVXwpYhWIPc6w2Ug3E L1WK8595x3snx01H6WVjH04a LNSswdjEuF8DIAsha KrishnaNo ratings yet

- 2017412294869DistributionFormOut PD PDFDocument27 pages2017412294869DistributionFormOut PD PDFMichael BowkerNo ratings yet

- Electronic/Magnetic Media Filing Transmittal For Wage and Withholding Tax ReturnsDocument1 pageElectronic/Magnetic Media Filing Transmittal For Wage and Withholding Tax ReturnsIRSNo ratings yet

- US Internal Revenue Service: f9325Document2 pagesUS Internal Revenue Service: f9325IRSNo ratings yet

- Cigna Claim FormDocument2 pagesCigna Claim FormLoganBohannonNo ratings yet

- T1 Adjustment Request: A IdentificationDocument2 pagesT1 Adjustment Request: A IdentificationraisanasirNo ratings yet

- NeecoDocument5 pagesNeecoMagno AnnNo ratings yet

- DO Not Mail: Yuancheng LUO 073805484Document1 pageDO Not Mail: Yuancheng LUO 073805484laxkor1No ratings yet

- E-Filing of Income Tax Returns / FormsDocument8 pagesE-Filing of Income Tax Returns / FormsAjit MoreNo ratings yet

- Internal Revenue ServiceDocument3 pagesInternal Revenue ServicetaxcrunchNo ratings yet

- Documents To SignDocument15 pagesDocuments To SignKaren CooperNo ratings yet

- Cicortflorina 8879Document2 pagesCicortflorina 8879Florin Cicort100% (3)

- Tax Return - 2018-2019Document30 pagesTax Return - 2018-2019kutner8181No ratings yet

- PSL08DDocument2 pagesPSL08DNenad MarkovićNo ratings yet

- SPM Application ProcedureDocument11 pagesSPM Application ProcedureJimi SolomonNo ratings yet

- U.S. Individual Income Tax Declaration For An IRS E-File Online ReturnDocument2 pagesU.S. Individual Income Tax Declaration For An IRS E-File Online ReturnIRSNo ratings yet

- All Withholding Is A Gift!Document8 pagesAll Withholding Is A Gift!Tom Harkins100% (2)

- TIN Issuance for MF-NGO ClientsDocument3 pagesTIN Issuance for MF-NGO ClientsLarry Tobias Jr.No ratings yet

- Dixo2460 19i FCDocument32 pagesDixo2460 19i FCHengki Yono100% (1)

- Online Filing of The Personal Income Tax Return by An Accredited PersonDocument2 pagesOnline Filing of The Personal Income Tax Return by An Accredited PersondtoxidNo ratings yet

- US Internal Revenue Service: f8453 - 1992Document2 pagesUS Internal Revenue Service: f8453 - 1992IRSNo ratings yet

- CRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Document2 pagesCRS Tax Residency Self Certification Form For Controlling Persons (CRS-CP)Salman ArshadNo ratings yet

- b616c - MR Zamir Haider Shah Satr 2021-2022 SignedDocument14 pagesb616c - MR Zamir Haider Shah Satr 2021-2022 SignedJaved ShahNo ratings yet

- Declaration by EmployeeDocument1 pageDeclaration by EmployeesaifullahNo ratings yet

- Form 1199aDocument4 pagesForm 1199aCesc SurdykNo ratings yet

- 2018 Xiaohe Huang Tax ReturnDocument48 pages2018 Xiaohe Huang Tax ReturnKaren Xie100% (2)

- 2023 Winter Storm Penalty WaiverDocument2 pages2023 Winter Storm Penalty WaiverFOX54 News HuntsvilleNo ratings yet

- 2306 - 2307Document57 pages2306 - 2307Dearly EnzoNo ratings yet

- 11.21.19 FEC Letter To The Omar CampaignDocument2 pages11.21.19 FEC Letter To The Omar CampaignFluenceMedia100% (2)

- Claim Form BDocument1 pageClaim Form BsathyaNo ratings yet

- Third Party Verification of Results - CabridgeDocument2 pagesThird Party Verification of Results - CabridgeAhdgNo ratings yet

- Request by Fiduciary For Distribution of United States Treasury Securities - Request-Ofpublic - DebtDocument5 pagesRequest by Fiduciary For Distribution of United States Treasury Securities - Request-Ofpublic - Debtal moore75% (4)

- 2551QDocument3 pages2551QJerry Bantilan JrNo ratings yet

- Direct Deposit Sign-Up Form: Section 1 (To Be Completed by Payee) A D E FDocument4 pagesDirect Deposit Sign-Up Form: Section 1 (To Be Completed by Payee) A D E FJ.D WorldclassNo ratings yet

- RCCL Claim FormDec2023Document2 pagesRCCL Claim FormDec2023rogeliolacsamanaNo ratings yet

- 2013 Financial StatementsDocument31 pages2013 Financial Statementsapi-307029847100% (1)

- Direct Deposit Sign-Up Form (Argentina)Document3 pagesDirect Deposit Sign-Up Form (Argentina)shahid2opuNo ratings yet

- IRS e-file Acknowledgement for Tax Year 2016Document2 pagesIRS e-file Acknowledgement for Tax Year 2016anandrapakaNo ratings yet

- How To Make Statutory License Royalty Payments by ACH CreditDocument4 pagesHow To Make Statutory License Royalty Payments by ACH CreditrenebavardNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Retrenchment StrategiesDocument3 pagesRetrenchment StrategiesSABRI AKBAL MOHAMED HASSAN100% (3)

- IBM TS2900 Tape Autoloader RBDocument11 pagesIBM TS2900 Tape Autoloader RBLeonNo ratings yet

- Health Fitness Guide UK 2018 MayDocument100 pagesHealth Fitness Guide UK 2018 MayMitch Yeoh100% (2)

- PhoneFreedom 365 0 Instalment Postpaid Phone Plan DigiDocument1 pagePhoneFreedom 365 0 Instalment Postpaid Phone Plan DigiJals JNo ratings yet

- Engagement LetterDocument1 pageEngagement LetterCrystal Jenn Balaba100% (1)

- A Primer On Financial Time Series AnalysisDocument93 pagesA Primer On Financial Time Series AnalysisKM AgritechNo ratings yet

- Theory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressDocument1,076 pagesTheory and Practice of Crown and Bridge Prosthodontics 4nbsped CompressYuganya SriNo ratings yet

- Deutsche BankDocument4 pagesDeutsche BankMukesh KumarNo ratings yet

- 3343 - C-Data-EPON-OLT-FD1108S-CLI-User-Manual-V1-3Document82 pages3343 - C-Data-EPON-OLT-FD1108S-CLI-User-Manual-V1-3Roar ZoneNo ratings yet

- Basketball 2011: Johnson CountyDocument25 pagesBasketball 2011: Johnson CountyctrnewsNo ratings yet

- 01 A Brief Introduction To Cloud ComputingDocument25 pages01 A Brief Introduction To Cloud ComputingfirasibraheemNo ratings yet

- Mycophenolic Acid Chapter-1Document34 pagesMycophenolic Acid Chapter-1NabilaNo ratings yet

- READMEDocument3 pagesREADMERadu TimisNo ratings yet

- D41P-6 Kepb002901Document387 pagesD41P-6 Kepb002901LuzioNeto100% (1)

- Unit 5 EstándarDocument2 pagesUnit 5 EstándardechillbroNo ratings yet

- Physical Science 1Document25 pagesPhysical Science 1EJ RamosNo ratings yet

- Nigeria Emergency Plan NemanigeriaDocument47 pagesNigeria Emergency Plan NemanigeriaJasmine Daisy100% (1)

- 2.2valves, Alarm - Ul Product IqDocument1 page2.2valves, Alarm - Ul Product Iqbhima irabattiNo ratings yet

- Public OpinionDocument7 pagesPublic OpinionSona Grewal100% (1)

- Unit 2 Water Treatment Ce3303Document18 pagesUnit 2 Water Treatment Ce3303shivaNo ratings yet

- Medication Calculation Examination Study Guide: IV CalculationsDocument2 pagesMedication Calculation Examination Study Guide: IV Calculationswaqas_xsNo ratings yet

- CD 1 - Screening & DiagnosisDocument27 pagesCD 1 - Screening & DiagnosiskhairulfatinNo ratings yet

- RTR Piping Inspection GuideDocument17 pagesRTR Piping Inspection GuideFlorante NoblezaNo ratings yet

- Textbook of Heat Transfer Sukhatme S PDocument122 pagesTextbook of Heat Transfer Sukhatme S PSamer HouzaynNo ratings yet

- Notes (Net) para Sa KritikaDocument4 pagesNotes (Net) para Sa KritikaClaire CastillanoNo ratings yet

- A Report On Kantajew MandirDocument21 pagesA Report On Kantajew MandirMariam Nazia 1831388030No ratings yet

- LESSON 9 Steam Generators 2Document12 pagesLESSON 9 Steam Generators 2Salt PapiNo ratings yet

- Technical Information System Overview Prosafe-Com 3.00 Prosafe-ComDocument49 pagesTechnical Information System Overview Prosafe-Com 3.00 Prosafe-Comshekoofe danaNo ratings yet

- Creating Literacy Instruction For All Students ResourceDocument25 pagesCreating Literacy Instruction For All Students ResourceNicole RickettsNo ratings yet