Professional Documents

Culture Documents

Draft I 1075644 2023

Draft I 1075644 2023

Uploaded by

IGST Refund Cell & Export Assessment Air0 ratings0% found this document useful (0 votes)

9 views1 pageThis document is a note regarding a CPGRAMS complaint filed by Ratheesh M.C. about not receiving IGST refunds. It summarizes that the shipping bill referenced in the complaint shows a status of "Not Ready" in reports, meaning GSTN has not transmitted the required GSTR-1 return data to Customs to make the bill eligible for refund processing. As the data transmission is handled by GSTN, not Customs, the exporter needs to check with GSTN about the reason for the missing data integration to Icegate.

Original Description:

Original Title

Draft_I_1075644_2023

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a note regarding a CPGRAMS complaint filed by Ratheesh M.C. about not receiving IGST refunds. It summarizes that the shipping bill referenced in the complaint shows a status of "Not Ready" in reports, meaning GSTN has not transmitted the required GSTR-1 return data to Customs to make the bill eligible for refund processing. As the data transmission is handled by GSTN, not Customs, the exporter needs to check with GSTN about the reason for the missing data integration to Icegate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views1 pageDraft I 1075644 2023

Draft I 1075644 2023

Uploaded by

IGST Refund Cell & Export Assessment AirThis document is a note regarding a CPGRAMS complaint filed by Ratheesh M.C. about not receiving IGST refunds. It summarizes that the shipping bill referenced in the complaint shows a status of "Not Ready" in reports, meaning GSTN has not transmitted the required GSTR-1 return data to Customs to make the bill eligible for refund processing. As the data transmission is handled by GSTN, not Customs, the exporter needs to check with GSTN about the reason for the missing data integration to Icegate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

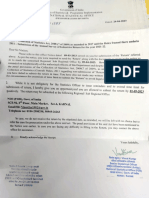

ACC/IGST/IGST/27/2021-EA-O/O PR COMMR-CUS-ACC-CHENNAI

I/1075644/2023

IGST REFUNDS-CELL

NOTE

Sub: IGST Refunds not received - CPGRAMS Registration. No.

DORVU/E/2023/0000633 dated 12.02.2023 filed by Ratheesh M C –

reg.

Ref: Mail received from CIU section dated 13.03.2023 – reg.

***

Please refer to the above captioned subject and reference.

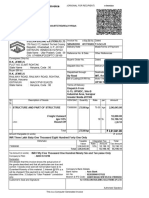

1. In this regard, it is informed that Mr. Ratheesh M C requesting the pending

IGST Refunds on their export vide Shipping Bill(SB) No.7621048 dated

27.07.2017 filed by M/S. Centum Controls Pvt. Ltd. However, on verification of

said SB and generation of “IGST SB-GSTN INTEGRATION STATUS REPORT -” and “SB-

IGST CLAIMED STATUS REPORT ”, it is observed that the SB status for generation of

IGST scroll against the said shipping bill is shown as “Not Ready” , which implies

GSTN has not transmitted the GSTR 1 returns data to Customs Icegate , which is a

prerequisite condition for the said SB to be status “Ready” for generation of IGST

Refunds Scroll. Further, IGST Refund process is fully automated and no human

intervention is feasible for data integration from GSTIN to Icegate.

.

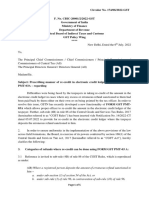

2. Hence, as customs has no role in “ GSTN transmitting GSTR1 returns data”

, it is role of exporter to find out the reasons for non-receipt of data from GSTN and

an option to check the validation status for his SB has been provided in ICEGATE

website login.

(M. DIVYA)

DEPUTY COMMISSIONER OF CUSTOMS

(IGST REFUNDS-CELL-CHENNAI-VII)

Date: 17-03-2023

To

The Deputy/Assistant Commissioner of Customs,

CIU,Chennai-VII.

You might also like

- E-Way Bill System PDFDocument1 pageE-Way Bill System PDFDevendra Rajak0% (1)

- Annexure-X - Waiver of SCN & PenaltyDocument3 pagesAnnexure-X - Waiver of SCN & Penaltyvishnuprakash1990No ratings yet

- DRC 03Document2 pagesDRC 03sridhar samalaNo ratings yet

- Subject: Intelligence/ Information No. AZDAC/96/2023-24Document14 pagesSubject: Intelligence/ Information No. AZDAC/96/2023-24IAS MeenaNo ratings yet

- Ad 235364101123Document3 pagesAd 235364101123mitzz39No ratings yet

- Digitally Proceedings of P Hanumantharao & Sons 2018-19 S-73Document31 pagesDigitally Proceedings of P Hanumantharao & Sons 2018-19 S-73CTOAUDIT1 BLYNo ratings yet

- E-Way Bill System1 PDFDocument2 pagesE-Way Bill System1 PDFjubin4snapNo ratings yet

- Indirect Tax Newsletter - July 2023Document15 pagesIndirect Tax Newsletter - July 2023ELP LawNo ratings yet

- AOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Document3 pagesAOVPS7267Q - Show Cause Notice Us 270A - 1049078824 (1) - 25012023Basavaraj KorishettarNo ratings yet

- GST Recap 20.05.2023 To 26.05.2023Document3 pagesGST Recap 20.05.2023 To 26.05.2023blalsteel.pvtltdNo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

- Signed SCN of PP PlasticsDocument4 pagesSigned SCN of PP PlasticsADARSH TIWARINo ratings yet

- PRADIPDocument7 pagesPRADIPGovindNo ratings yet

- DRC03Document2 pagesDRC03GiriTelecomNo ratings yet

- Document 1Document2 pagesDocument 1gstceraslmNo ratings yet

- Krrish 18-19 DRC 01Document2 pagesKrrish 18-19 DRC 01Sb SharmaNo ratings yet

- Invoice 227 Quarantine RevisedDocument2 pagesInvoice 227 Quarantine RevisedkishorNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- Review Meeting Convened by The Commissioner at 1100 Hrs On 05102023Document2 pagesReview Meeting Convened by The Commissioner at 1100 Hrs On 05102023div.7003No ratings yet

- Accounting Voucher 65Document8 pagesAccounting Voucher 65robin.panwar50No ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionAnkur MishraNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- E-Way Bill System 223 ExtendedDocument1 pageE-Way Bill System 223 ExtendedkishorNo ratings yet

- Goi Circulars & Enc Memos On Pmgsy Pending Issues 070324Document109 pagesGoi Circulars & Enc Memos On Pmgsy Pending Issues 070324sdeepika_bNo ratings yet

- Pov 5509783Document3 pagesPov 5509783Sameer MahajanNo ratings yet

- DRC03Document2 pagesDRC03sumitsharmaNo ratings yet

- BhatjanglaDocument1 pageBhatjanglaabhisek royNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- CG07BA9723Document1 pageCG07BA9723Manish SinghNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender Decisionmitzz39No ratings yet

- GST Amendments For June 22 Students by CA Vivek GabaDocument6 pagesGST Amendments For June 22 Students by CA Vivek GabayashNo ratings yet

- SYNOPSISDocument2 pagesSYNOPSISnoorensaba01No ratings yet

- Anti Virus+Extn Cord 5mtrDocument1 pageAnti Virus+Extn Cord 5mtrameenskollam716No ratings yet

- Law 2 New 123Document1 pageLaw 2 New 123mahendra kumarNo ratings yet

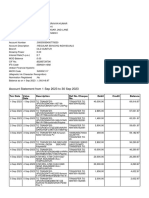

- IDFCFIRSTBankstatement 10091249069Document4 pagesIDFCFIRSTBankstatement 10091249069designNo ratings yet

- Form GST ASMT - 11 - NNNNNDocument2 pagesForm GST ASMT - 11 - NNNNNGovindNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- IDFCFIRSTBankstatement 52005195725Document17 pagesIDFCFIRSTBankstatement 52005195725madhukar sahayNo ratings yet

- This Is An Auto-Generated Purchase Order Based On Online Tender DecisionDocument3 pagesThis Is An Auto-Generated Purchase Order Based On Online Tender DecisionvivekNo ratings yet

- Clarification Regarding Submission of TA Claims Dated 01.04.2024Document5 pagesClarification Regarding Submission of TA Claims Dated 01.04.2024Chotu GuptaNo ratings yet

- Statecircular 291022Document6 pagesStatecircular 291022King KiteNo ratings yet

- Ya X6 Ve Trmonk U4 CsDocument3 pagesYa X6 Ve Trmonk U4 CskarishmathullaNo ratings yet

- DRC 03Document2 pagesDRC 03acpandey.lawfirmNo ratings yet

- Icf PoDocument3 pagesIcf PoManojNo ratings yet

- Latest Updates in GST - NovDocument6 pagesLatest Updates in GST - NovVishwanath HollaNo ratings yet

- Ram NameDocument2 pagesRam NameStock PsychologistNo ratings yet

- Circular CGST 131 NewDocument5 pagesCircular CGST 131 NewSanjeev BorgohainNo ratings yet

- CTG FormDocument3 pagesCTG FormSamant LeoNo ratings yet

- Simi Powlein SBIDocument8 pagesSimi Powlein SBIbindu mathaiNo ratings yet

- Sotck Yard PO On SAIL-90225022-SWRDocument3 pagesSotck Yard PO On SAIL-90225022-SWRManojNo ratings yet

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- VILGST - SGST - High Court Cases - 2022-VIL-124-GUJDocument17 pagesVILGST - SGST - High Court Cases - 2022-VIL-124-GUJJAYKISHAN VIDHWANINo ratings yet

- E-Way BillDocument1 pageE-Way BillBeer SinghNo ratings yet

- AMNPR3273M - Issue Letter - 1054531107 (1) - 23072023Document3 pagesAMNPR3273M - Issue Letter - 1054531107 (1) - 23072023prakash reddyNo ratings yet

- AITPN6389G - Issue Letter - 1053923881 (1) - 23062023Document2 pagesAITPN6389G - Issue Letter - 1053923881 (1) - 23062023Peddaiah KarthiNo ratings yet

- Final: Form GST DRC - 03Document3 pagesFinal: Form GST DRC - 03manoj kumar singodiyaNo ratings yet

- GST Amendment SheetDocument31 pagesGST Amendment Sheet10poolcardNo ratings yet

- Adobe Scan Apr 27, 2023Document1 pageAdobe Scan Apr 27, 2023Tina KhandelwalNo ratings yet

- Almaty–Issyk-Kul Altnernative Road Economic Impact AssessmentFrom EverandAlmaty–Issyk-Kul Altnernative Road Economic Impact AssessmentNo ratings yet