Professional Documents

Culture Documents

DRC 03 Letters-1

Uploaded by

anjani deviOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DRC 03 Letters-1

Uploaded by

anjani deviCopyright:

Available Formats

1|Page

केन्द्रीय कर अधीक्षक का कायाालय, तेनाली जीएसटी रें ज:

19-15-47, तीसरी मंजजल, साईबाबा मंदिर के सामने, बोस रोड, तेनाली-522201

OFFICE OF THE SUPERINTENDENT OF CENTRAL TAX

TENALI GST RANGE: 19-15-47,3rd FLOOR, OPP SAIBABA TEMPLE,

BOSE ROAD, TENALI-522201

Email Id: tenaligstrange@gmail.com Tel No: 08644-222211

MOST URGENT/ TOP PRIORITY

DIN-20230755YK000000B4D0

O.C. No. 148 /2023. Dt: 12.07.2023.

To

M/s. A KANAKA RATNAM CONTRACTORS

GSTIN 37AAHFA8272H1Z8

14-8-10/1,,,Ponnuruvari Street, Morrispet,Tenali,Guntur,522202

Sub:- Verification of payment made by you by way of DRC-03-reg.

****

Gentlemen,

Please refer to the above mentioned subject. In this regard, you are requested to

submit the details/supporting documents for which the payment has been made under

the following DRC-03 challans, to this Office within a week from the date of receipt of

this letter.

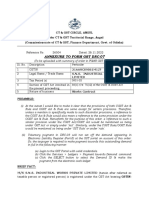

CRN CRN Date Cause of Amt F.Y.

payment

AD3706230 30-06-2023 Annual return 1618 2020-2021

11929U

AD3706230 30-06-2023 Voluntary 23082 2018-2019

12234G

AD3706230 30-06-2023 Voluntary 30176 2019-2020

12161L

Whereas as envisaged under the law Voluntary Payment (Payments through

Form GST DRC-03) made by you on the GST Portal, may be on the following scenarios

(not exhaustive) i.e., for any causes like Audit, Investigation, Voluntary Payment, SCN,

Annual Return, Reconciliation Statement or Others like difference between GSTR -1

and GSTR-3B etc.

Such Payment can also be voluntarily made by taxpayer for a self-ascertained

liability or in response to the show cause notice (SCN) raised by the tax authorities, u/s

73 or 74 of the CGST Act, 2017, within 30 days of issuance of SCN or even before

issuance of the SCN.

The above facility is given to taxpayers to make payment on voluntary basis,

through Form GST DRC-03 (refer Rule 142(2) or 142(3) of the CGST Rules, 2017). After

filing DRC-03 by you, the DRC-03 is displayed on the dashboard of the undersigned,

who in turn verifies himself or re-assigns to the proper officer depending upon monetary

limit, since the verification of DRC-03 falls in the ambit of adjudication and it is

mandatory that the Jurisdictional Range Office should check and verify the details

available.

2|Page

Since the verification of DRC-03 falls in the ambit of adjudication, the verification

process is to be approved by the proper officer for adjudication depending upon

monetary limit enumerated in Board’s Circular no. 3/3/2017 dated 05.07.2017 and

Circular no. 31/05/2018 dated 09.02.2018. Unless the voluntary payment made by you

is not processed by the competent authority depending on the monetary limits as

envisaged in the said circulars for the purpose of adjudication, the voluntary payment

made in GSTN in form DRC-03, will not be adjudged against the short payment/non-

payment etc., noticed either by you or Department and failing which normal course of

action will be initiated by the Department under section 73/74 ibid for recovery of

interest and mandatory penalties and the benefit of reduced penalties or no penalties

as envisaged under Section 73 and 74 as the case may be, will not be available to you.

In view of the above legal provision, you are requested to furnish the information

pertaining to the details mentioned in the above table, either in person or through email,

giving cogent reasons as to why short payment, reversal of irregular credit, or payment,

interest etc., were made in Form DRC-3, so as to enable this office for issuance of

acknowledgment timely in DRC4/5 as the case may be. In case the payments pertain to

audit, anti evasion, or DGGI the process will be done by respective authorities to

complete the audit or investigation process as the case may be and acknowledgement

for receiving/adding the same against your liabilities will be given under Form DRC

04/05 by their vertical offices depending upon the reasons given by you along with

documentary proof.

Further you are also requested to deposit the interest accrued, if any on the above

said amount under the provisions of Section 50 of CGST Act, 2017 under intimation to

this office at the earliest in case if any, is required to be paid by you for availing of

reduced penalties as envisaged under S.74(6) or no penalties under Section 73(6).

Yours sincerely,

Sd/-

(CH. SRINIVASA RAO)

SUPERINTENDENT OF CGST

TENALI CGST RANGE

Ph: 8247831998

You might also like

- Signed SCN of PP PlasticsDocument4 pagesSigned SCN of PP PlasticsADARSH TIWARINo ratings yet

- Sri ByraveshwaraDocument3 pagesSri Byraveshwarahemanth1234No ratings yet

- DRC-03 (4) Applicability and Procedure To Pay Additional TaxDocument3 pagesDRC-03 (4) Applicability and Procedure To Pay Additional Taxevertry27387No ratings yet

- Circular No.59Document6 pagesCircular No.59Hr legaladviserNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Ref: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Document4 pagesRef: GSTN: Sub: Reply To Your Notice For Payment of Interest Period: July'2017 To Nov'2018Nikhil JainNo ratings yet

- Sri Chowdeshwari Rice TradersDocument2 pagesSri Chowdeshwari Rice Tradershemanth1234No ratings yet

- Unit 5 GSTDocument3 pagesUnit 5 GSTNishu KatiyarNo ratings yet

- Tax AssignmentDocument6 pagesTax AssignmentShubh DixitNo ratings yet

- MB ComDocument2 pagesMB Comsatyanand guptaNo ratings yet

- J 2020 SCC OnLine Tri 598 2021 87 GSTR 170 2021 52 G Rameshananda Gmailcom 20231212 121104 1 27Document27 pagesJ 2020 SCC OnLine Tri 598 2021 87 GSTR 170 2021 52 G Rameshananda Gmailcom 20231212 121104 1 27r.preethimanasaug22No ratings yet

- Annexure-X - Waiver of SCN & PenaltyDocument3 pagesAnnexure-X - Waiver of SCN & Penaltyvishnuprakash1990No ratings yet

- Demand and RecoveryDocument9 pagesDemand and RecoverySaumya AllapartiNo ratings yet

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Demand Pre - Intimation LetterDocument2 pagesDemand Pre - Intimation LetterAMIT TIWARINo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- DRC07 Order ZD181223066048F 20231231023238Document4 pagesDRC07 Order ZD181223066048F 20231231023238tuensangnagaland2018No ratings yet

- Instruction No 022022 GST Dated 22032022Document13 pagesInstruction No 022022 GST Dated 22032022GroupA PreventiveNo ratings yet

- GST - Demand and RecoveryDocument32 pagesGST - Demand and Recoverydhruv MahajanNo ratings yet

- ITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CDocument6 pagesITC Utilization in DRC-03 For GSTR-9 Amp GSTR-9CChaithanya RajuNo ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document16 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017j0d3No ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Annexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedDocument5 pagesAnnexure To Form GST Drc-07: 21AAVCS9861M1ZF S.N.S. Industrial Works Private LimitedBiswajit MishraNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- 3a Notices Ysk Amar SubDocument1,066 pages3a Notices Ysk Amar SubKrishna ReddyNo ratings yet

- Tax Doctrines in Dimaampao CasesDocument3 pagesTax Doctrines in Dimaampao CasesDiane UyNo ratings yet

- HERITAGEDocument2 pagesHERITAGEhemanth1234No ratings yet

- Response To SCNDocument2 pagesResponse To SCNshikshadhariwal1No ratings yet

- Circular-ITR of Salaried Employees-Suspicious Claims..Document9 pagesCircular-ITR of Salaried Employees-Suspicious Claims..Damodar SurisettyNo ratings yet

- Article On Assessment and AuditDocument33 pagesArticle On Assessment and Auditmks895525No ratings yet

- Demands & Recovery Under GST - Section 73 - CGST Act 2017 - Taxguru - inDocument4 pagesDemands & Recovery Under GST - Section 73 - CGST Act 2017 - Taxguru - inAdarsh TripathiNo ratings yet

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- GSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inDocument4 pagesGSTR-3B Vs GSTR 1 Mismatch - Rule 88C Perspective - Taxguru - inRamkumar SNo ratings yet

- Skyline Pipes para WiseDocument4 pagesSkyline Pipes para WiseAjay SinghNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- Office of The Assistant Commissioner Central GST Division: Rajkot - IDocument2 pagesOffice of The Assistant Commissioner Central GST Division: Rajkot - INitish MittalNo ratings yet

- Swiggy DFDocument2 pagesSwiggy DFhemanth1234No ratings yet

- Summary of Notifications Issued by CBIC Dated March 31 2023 PDFDocument14 pagesSummary of Notifications Issued by CBIC Dated March 31 2023 PDFclareson serraoNo ratings yet

- Chapter 14 TDS TCS Under GSTDocument17 pagesChapter 14 TDS TCS Under GSTDR. PREETI JINDALNo ratings yet

- GST UpdatesDocument10 pagesGST Updatesswati.gargchdNo ratings yet

- APL01Document6 pagesAPL01auditrovjyNo ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- GST Update130620Document23 pagesGST Update130620Raju SomaniNo ratings yet

- Dot Notice Za360120004512f 20200127041536Document5 pagesDot Notice Za360120004512f 20200127041536Gopikrishna KNo ratings yet

- E InvoiceDocument1 pageE Invoicegurdyal672No ratings yet

- ST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesDocument9 pagesST ND: 1 - Ca Shubham Khaitan S.Khaitan and AssociatesTaruna BajajNo ratings yet

- Final: Form GST DRC - 03Document3 pagesFinal: Form GST DRC - 03manoj kumar singodiyaNo ratings yet

- Tax Collector Correspondence3362544Document1 pageTax Collector Correspondence3362544hamza awanNo ratings yet

- Cancellation of RegistrationDocument2 pagesCancellation of RegistrationRajdev AssociatesNo ratings yet

- Complete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - inDocument3 pagesComplete Guide On Revocation of Cancellation of GST Registration (As Per Latest Notification) - Taxguru - insuraj shekhawatNo ratings yet

- FAQsonTDS 230221 120909Document8 pagesFAQsonTDS 230221 120909Bharath UGNo ratings yet

- SKSE Securities LimitedDocument2 pagesSKSE Securities LimitedsunitdaveNo ratings yet

- WT Form 19Document2 pagesWT Form 19sukanyaNo ratings yet

- Krrish 18-19 DRC 01Document2 pagesKrrish 18-19 DRC 01Sb SharmaNo ratings yet

- P.P.T On Duties - Responsibilities of DDO For GSTDocument30 pagesP.P.T On Duties - Responsibilities of DDO For GSTBilal A BarbhuiyaNo ratings yet

- Demand & RecoveryDocument24 pagesDemand & Recoverygeegostral chhabraNo ratings yet

- Icf PoDocument3 pagesIcf PoManojNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Ply Home: Tax InvoiceDocument2 pagesPly Home: Tax InvoiceAvik KhandelwalNo ratings yet

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountnehalNo ratings yet

- Assessment & AuditDocument24 pagesAssessment & Audit9punitagrawalNo ratings yet

- Max Life Insurance Company Limited: Proposal NumberDocument5 pagesMax Life Insurance Company Limited: Proposal NumberShrishti VermaNo ratings yet

- TicketDocument2 pagesTicketbikram kumarNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Document3 pagesIrctcs E-Ticketing Service Electronic Reservation Slip (Personal User)Akhilesh Kumar SinghNo ratings yet

- Oneplus 9 RDocument1 pageOneplus 9 R1CG20CS032 JAYANTH SHREE VISHNUNo ratings yet

- Invoice 141Document1 pageInvoice 141United KingdomNo ratings yet

- GST Rahul 1 Project Work PDFDocument29 pagesGST Rahul 1 Project Work PDFHENA KHANNo ratings yet

- Cab Receipt 1Document3 pagesCab Receipt 1Rishab ManochaNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Yogesh BadeNo ratings yet

- Pryj VGLB Exp Sleeper Class (SL)Document2 pagesPryj VGLB Exp Sleeper Class (SL)suresh muthuramanNo ratings yet

- Finalisation Account Under GSTDocument20 pagesFinalisation Account Under GSTkbharathNo ratings yet

- InvoiceDocument1 pageInvoicehicanukissmeNo ratings yet

- Surat Mahuva SF Third Ac (3A)Document2 pagesSurat Mahuva SF Third Ac (3A)Keval VithaniNo ratings yet

- Consult CA LiveDocument18 pagesConsult CA LivePrince N RaviNo ratings yet

- Assignment IDocument6 pagesAssignment Imark assainNo ratings yet

- Railway TicketDocument1 pageRailway TicketshrihariNo ratings yet

- 410 For BhiwandiDocument9 pages410 For BhiwandirajasmudafaleNo ratings yet

- Bis2020 21267Document2 pagesBis2020 21267Rucha BhorNo ratings yet

- Customer Signature and SealDocument4 pagesCustomer Signature and SealKasiv72No ratings yet

- UntitledDocument37 pagesUntitledMohitrajranikashyapNo ratings yet

- Itt Filter MediaDocument41 pagesItt Filter MediaANIMESH JAINNo ratings yet

- February 2022: Monthly Current AffairsDocument63 pagesFebruary 2022: Monthly Current AffairsParam ChauhanNo ratings yet

- Goods and Services TaxDocument20 pagesGoods and Services TaxBunny BeeNo ratings yet

- 3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065Document2 pages3 BMW Motorrad Price March 2021.PDF - Asset.1616655326065AnilNo ratings yet

- Your Vi Bill: Ms Raymons ProcessorsDocument9 pagesYour Vi Bill: Ms Raymons ProcessorsNeha BhardwajNo ratings yet

- FTCCI Review-September, 2020 PDFDocument44 pagesFTCCI Review-September, 2020 PDFSai KrishnaNo ratings yet

- No:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDDocument1 pageNo:-0000647261 - Issue Date 02.12.2022: Sristisanchar Webnet LTDsreyanshauddyNo ratings yet

- TTD Accommodation ReceiptDocument1 pageTTD Accommodation ReceiptDeepak RaguNo ratings yet