Professional Documents

Culture Documents

MI

MI

Uploaded by

Ralph Michael Condino0 ratings0% found this document useful (0 votes)

12 views27 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views27 pagesMI

MI

Uploaded by

Ralph Michael CondinoCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 27

MATHEMATICS

INVESTMENT

STOCKS, BONDS AND MUTUAL FUNDS

Financial risk is the chance you take of either making or losing money on an investment.

In most cases, the greater the risk, the more money you stand to gain or lose. Investment

opportunities range from low-risk conservative investments, such as government bonds

or certificates of deposit, to high-risk speculative investments, such as stocks. Selecting

the right investment depends on personal circumstances as well as general market

conditions.

Investments are based on liquidity, which indicates how easy it is to get your money out;

safety, how much risk is involved; and return, how much you can expect to earn.

Investment advice is available from stockbrokers, financial planners, and many other

sources. It is generally agreed that over the long run, a diversified portfolio, with a

mixture of stocks, bonds, cash equivalents, and sometimes, other types of investments, is

a sensible choice. Determining the correct portfolio mix is a decision that should be

based on the amount of assets available, the age of the investor, and the amount of risk

desired. In this chapter, three forms of investment—stocks, bonds, and mutual funds will

be discussed.

STOCKS

Understanding Stocks and Reading Stock Quotations

Corporations are built and expanded with money known as capital, which is raised by

issuing and selling shares of stock. Stocks represent ownership shares of a corporation.

Ownership in a company is measured by the number of shares an investor owns. These

investors, called stockholders, acquire not only a share of the ownership of the

corporation but also the right to receive income in the form of dividends. Each

ownership portion, or share, is represented by a stock certificate.

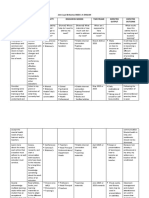

Stock quotation tables found in the business section of most newspapers provide

investors with a daily summary of what happened in the stock market during the previous

trading day. A portion of a typical stock quotation table from the Philippine Stock

Exchange is shown for illustration purposes. The listing reflects what transpired during a

specific trading day. As can be seen, stocks are classified according to the type of

business (i.e. banks, and food, beverage, and tobacco) to which they belong and are listed

alphabetically.

ae < a @ fe ga anes ae 7 & 7 >

52 Weeks rey. oe

Nich Low STOCKS EPS CLOSE OPEN HIGH LOW CLOSE VOLUME —-VALUE_-—«=«CHANGE RATIO.

BANKS

7050 4600 BDOLEASING 39100 6200 6200 6220 6180 62.00 3.450540 213457455 000 1586

740 5000 BANKOFTHEPHILISLANDS 3.6100 7630 7620 7620 7580 7610 690,780 52553103 (025) 2108)

595.00 370.00 CHIN BANKING CORP. 424600 47120 47120 47120 47120 47120 4980 «= 2.346578. 0.00 11:10,

20.70 1850 _EASTWEST BANK 37800 1940 1940 1950 1926 1950 292500 5674725 052516

10020 60.00 METROBANK 50200 94859465 9465 9300 9230 3686750 2a4ei9002 (163) 1859,

7780 4100. PHIL. NATLBANK 58300 7330 7330 7330 7250 73:15 186,700 © 10669,271 (0.20) 1255

4550 2675 RIZAL BANK 44300 445044004405 4355 a0 377,500 15610800 (2.12) 9.983

15520 77.00 secuRmTY sank 33.3400 146.00 14600. 14740 146.00 147.00 502420 73753310 0.68 11.02

140.00 58.00 UNION aanK 430.2809 101.00 10140 10140 10100 20100 25550 2,880,717 «a. 9.2

FOOD, BEVERAGE & TOBACCO

1358 800 AGRINURTURE goo 853855855 as] 51 47,700 406.218 (023) 1051

2395 1198 ALASKAMILK CORP, 1252 2000 2002000 2000 2000 100 2000» 000s 98

1.70 097 ALLIANCESELECTFOODS (00130) 140144148 1.42 146 1480000 2,085,420 © 4.29 (212.31)

3000 19.80 GINEBRASANMMIGUEL (35600) 2100 2050 2050 2080 20s0 19.300 «21150 (238) (578)

320.00 80.00 IOLLREEFOOOSCORP. «3.1380 101.00 10160 10160 9990 10000 281,720 28,7664 (099) 31.87

350 1.96 PEPSLCOLA 0.0800 340347 3523.45 «350 7,087,000 26,748070 2.98 8.75

403101 _geMconPonaTion 0.1610 399400409395 403 S.018000 20,027,750 100 25.03

3420 27,70 SANMIGUELEREWERY 0.7800 34.10 34.20 3420 3420 3420 «90,200 3058840 © zo (43.85.

18260 11020 SAN MIGUEL CORP. 49700 11300 11300 11300 11170 142.10 «131,900 14,795237(080)(22.56

0.25 0412 SWIFT FOOD, INC (0.0300) 0135 014 © 0.140.139 039360000 © Soasd 221.)

4298 3300 TANDUAY HOLDINGS: 0.3000 119011861250 tis 22.36 4637.60 56426758 3.874120

2658 12500 TARLAC 54800 500 1302 «1302 1288 «12.98 ©" 19000-47004 © (1347) 2.37

68.20 37.00 UNIVERSAL ROBINA 22500 3980 5950 60.75. $885 6060 173480 70870290 «147593

350 1.05 VICTORIAS MILUNG 0200 140 «140145. .g8 03,027,000 4.235110 0.00836

0.77 032 _virasicH cone. (5700) __063 064 069 064 0.68 10,3100 7137360 159 (2.2)

Each column entry in the stock quotation is explained below.

a, & b. 52 Weeks High and Low. The highest and lowest traded prices of a stock for the

past 52 weeks.

Name. The name of the listed company.

EPS (earnings per share). Calculated by dividing after-tax income by number of,

shares outstanding, Higher earnings result in higher stock value.

Prev Close (previous close). The closing price of the previous trading day.

Open. The opening price of the stock for the day.

High. The highest traded price of a stock during a specific trading period.

Low. The lowest traded price of a stock during a specific trading period.

Close. The closing price of the trading day.

Volume. The total number of shares traded during a given period.

Value. The amount of transactions in pesos traded for a period. It indicates how

much money is turned over from the trading of a particular stock.

1. % Change (percent change). Calculated as (i —¢//e. A negative value indicates that

the closing price for the day is lower than that for the previous day.

m. PE ratio (price earnings ratio). Calculated as i/d. It indicates how much an investor

pays for a company’s earning power. An ‘above 20° PE ratio reflects. investor

optimism as to higher future earnings of the company.

ao

Fre me

Illustration: From the stock quotation table on the previous page, explain the

information listed for Bank of the Philippine Islands (BPI) and Universal Robina.

BPI js listed second under the Banks classification. On that specific day, the

corporation’s stock opened at P76.20. The high for the day was P76.20 while the low,

P75.00. The stock closed at P76.10. 690,780 shares of stock were traced during the day.

On the same day, Universal Robina stock’s (second line under Food, Beverage and

Tobacco classification) open price was P59.90. The day’s high was P60.75 and low

P58.85. It finally closed at P60.60. 1,173,480 shares were traded throughout the day.

Scripless Trading

The Philippine Central Depository, Inc. established in March 1995, provides the

securities settlement system for both debt and equity instruments of the Philippine Stock

Exchange (PSE). Its computerized book-entry-settlement system paved the way for a

safe and efficient scripless trading. Scripless trading is the shift from physical transfer

of stock certificates to electronic book-entry of securities transactions. Investors who buy

shares at the PSE will not receive any stock certificate under this system although they

can specifically request for a certificate from their broker.

Dividends on Preferred and Common Stock

Generally, if the company does well, the investor or shareholder will receive dividends,

which are distributions of the company's profits. If the share price goes up, the

stockholder can sell the stock at a profit.

Many companies offer-two classes of stock to appeal to different types of investors.

These classes are known as common and preferred. With common stock, an investor

shares directly in the success or failure of the business. When the company does well, the

dividends and price of the stock may rise, and the investors make money. When the

company does poorly, it does not pay dividends and the price of the stock may fall.

With preferred stock, the dividends are fixed, regardless of how the company is doing.

When the board of directors of a company declare a dividend, the preferred stockholders

are paid before the common. If the company goes out of business, the preferred

stockholders have priority over the common stockholders as far as possibly getting back

some of their investment.

Preferred stock is issued either with or without a par value. When the stock has a par

value, the dividend is specified as a percent of par. For example, each share of 8%, P100

par value preferred stock pays a dividend of P8.00 per share (P100 * .08) per year. When

preferred stock has no par value, the dividend is stated as a peso amount.

Note, however, that Section 6 of the Corporation Code of the Philippines states that

preferred shares of stock may be issued only as par value shares.

Cumulative preferred stock receives dividends each year. When no dividends are paid

one year, the amount owed, known as dividends in arrears, accumulates. Common

stockholders cannot receive any dividends until all the dividends in arrears have been

paid to cumulative preferred stockholders.

Preferred stock is further divided into categories known as non-participating, which

means the stockholders receive only the fixed dividend and no more; and participating,

which means the stockholders may receive additional dividends if the company does

well. Convertible preferred means the stock may be exchanged for a specified number

of common shares in the future.

Cash and/or property dividends received by a resident citizen-stockholder from a

domestic corporation is subject to 10% final tax effective year 2000. The amount the

stockholder will receive shall be net of the 10% final tax.

The steps to distribute dividends on preferred and common stock follow:

If the preferred stock is cumulative, any dividends that are in arrears are paid first;

then the preferred dividend is paid for the current period. When the dividend per

share is stated in pesos (no-par stock), go to Step 2. When the dividend per share is

stated as a percent (par stock), multiply the par value by the dividend rate.

Dividend per share (preferred) = Par value « Dividend rate

Calculate the total amount of the preferred stock dividend by multiplying the number

of preferred shares by the dividend per share.

Total preferred dividend = Number of shares x Dividend per share

Calculate the total common stock dividend by subtracting the total preferred stock

dividend from the total dividend declared.

Total common dividend = Total dividend — Total preferred dividend

Calculate the dividends per share for common stock by dividing the total common

stock dividend by the number of shares of common stock.

Total common dividend

Dive per share enninan) =) ree

Mlustration: Kash Corporation has 2,500,000 shares of common stock outstanding, Ifa

dividend of P4,000,000 was declared by the company directors last year, what are the

dividends per share of common stock?

Since Kash has no preferred stock, the common shareholders will receive the entire

dividend. Go directly to Step 4.

e Total c dividens 4,000,000

Dividend per share (common) = ee = Om aM = P1.60 per shi

Illustration: The board of directors of Sabell Developers, Inc. declared a dividend of

P300,000. The company has 60,000 shares of preferred stock that pay P0.50 per share

and 100,000 shares of common stock. Calculate the amount of dividends due the

preferred shareholders and the dividend per share of common stock.

1. Since the preferred dividend is stated in pesos (P0.50 per share), the first step is

dispensed with. Proceed to step 2.

2. Total preferred dividend = Number of shares » Dividend per share

Total preferred dividend = 60,000 * .50 = P30,000

3. Total common dividend = Total dividend — Total preferred dividend

Total common dividend = 300,000 ~ 30,000 = P270,000

L

4.

Dividend per share (common) =

‘Total common dividend

No. of shares (common)

Illustration: Mog Company has 100,000 shares of P100 par value, 6%, cumulative

preferred stock and 2,500,000 shares of common stock. Although no diyidend was

declared last year, a P5,000,000 dividend has been declared this year. Calculate the

amount of dividends: due the preferred shareholders and the dividend per share of

common stock,

1, Because the preferred stock is cumulative, and the company did not pay dividends

last year, the preferred shareholders are entitled to the dividends in arrears and the

dividends for the current period.

Dividend per share (preferred) = Par value = Dividend rate

Dividend per share (preferred) = 100 x .06 = P6.00 per share

of 20, or 20:1, means that buyers are willing to pay 20 times the current earnings for a

share of stock. The price-earnings ratio of a stock is most useful when compared with the

P/E ratios of the company in previous years and with the ratios of other companies in the

same industry.

The price-earnings ratio of a stock is computed as follows:

1. Divide the current price of the stock by the earnings per.share for the past 12 months:

. i 7 Current price per share

Price-earnings ratio =

Earnings per share

-2. Round answer to the nearest whole number (may be written as a ratio, x:1).

Illustration: Alix stock is currently selling at P104.75. If the company had earnings per

share of P3.60 last year, calculate the price-earnings ratio of the stock.

. f «) . _Current price per share

Price-earnings ratio = ——WEEBE price pet Share —

Earnings per share

Price earnings rato “ue = 29.0972 = 29 or 29:1

The ratio shows that investors are currently willing to pay 29 times the earnings for |

share of Alix stock.

Cost, Proceeds and Gain (or Loss) on a Stock Transaction

Investors take on the risks of purchasing stocks in the hope of making money. Although

they are more risky than many other types of investment, over the years stocks have

shown they are capable of generating spectacular returns in some periods and steady

returns in the long run. One investment strategy is to buy stocks and keep them for the

dividends paid by the company each quarter. Another strategy is to make money from

the profit (or loss) of buying and selling the stock. Simply put, investors generally want

to buy low and sell high.

The cost! of purchasing stock includes not only the purchase price but also brokerage

commission. Brokerage commission rates are competitive, and vary from broker to

broker. Nowadays, commission rates range from 0.25% to 1.5%.

On the other hand, the proceeds? from selling stock include the selling price less

brokerage commission.

The proceeds from sale less the cost of purchasing stock is the gain or loss.

' Also includes Philippine Central Depository (PCD) Fee, Securities Clearing Corporation of the Philippines (SCCP) Fee,

Transfer Fee, plus related Value-Added Tax (VAT), Documentary Stamps Tax (DST) and all other costs incurred in the

acquisition of securities.

® Also to be deducted from selling price are Philippine Central Depository (PCD) Fees, Securities Clearing Corporation of

the Philippines (SCCP) Fee, Cancellation Fee, plus related VAT, Stock Transaction Tax (1/2 of 1% of value of transaction

in lieu of Capital Gains Tax) and all other costs incurred in the sale of securities,

Return on Investment

The return on investment (ROT) measures the total monetary gain on a stock for an

investor. It is found by adding the amount that a stock has gone up in value during one

year (net gain), assuming it was sold at the end of one year, to the total dividends paid to

the investor, minus, of course, any commissions and other fees.

Ror = —Netgain + Total dividends

Total cost of stock purchase

Illustration: Using the data in the previous illustration and assuming that a total of

P1,300 in dividends was received for the year, Ben’s ROI is calculated as follows:

s (12,805 — 10,150) + 1,300

Rl 10,150

= 0.3897 or 38.97%

Ben’s ROI at 38.97% is a very good return.

BONDS

A bond is a formal unconditional promise made under seal to pay a specified sum of

money at a determinable future date, and to make periodic interest payments at a stated

rate until the principal sum is paid. It is a contract of debt whereby one party called the

borrows fund from another party called the investor. A bond is evidenced by a

The contractual agreement between the issuer and investor is contained in

another document known as bond indenture.

The basic difference between stock and bond is that with stock, the investor becomes a

part owner of the corporation; while with bonds, the investor becomes a creditor. Bonds

are known as fixed-income securities because the issuer promises to pay a specified

amount of interest regularly.

Interest from bonds received by a resident citizen-investor is generally taxed at 20% final

tax. The amount the investor will receive shall be net of the 20% final tax.

When bonds are issued by a corporation, they may be purchased by investors at face

value, and held until the maturity date; or they may be bought and sold through

authorized brokers and banks. Generally, bonds are issued in small denominations such

as P100, P1,000 or P10,000 to enable more investors to purcha For instance,

a P50,000,01 issue may be issued in denomination of P1,000. ;, there shall be

50,000 bonds with face of P1,000 each:

If the quoted price in the market pertains to bonds, it means percent of the face value of

the bonds, For instance, if the investment in P2,000,000 face value bonds of FH

Company, costing P1,700,000, is quoted at 90, the market value thereof is P1,800,000,

computed by multiplying the face of P2,000,000 by 90%.

Bonds pay a fixed interest rate, also known as the coupon rate. This rate is a fixed

percentage of the face value that will be paid to the bondholder on a regular basis usually

semi-annually such as January | and July 1, or February | and August 1, or March | and

September 1, and so on.

During the period between the issue date and the maturity date, bond prices fluctuate in

the opposite direction of prevailing interest rates. Assuming you buy a bond with a

coupon rate of 8%. If interest rates in the marketplace fall to 7%, newly issued bonds

will have a rate lower than yours, thus making yours more attractive and driving the price

above the face value. When this occurs, the bonds are said to be selling at a premium.

On the other hand, if interest rates rise to 9%, new bonds would have a higher rate than

yours, thus making yours less attractive and pushing the price down, below face. If

bonds sell below face, it is known as selling at a discount. At maturity, the bond returns

to its face value.

For example, a company might issue a P1,000 face value, 7% bond, maturing in the year

2025. The bondholder in this case would receive a fixed interest payment of P70 per year

(P1,000 x .07), or P35 semi-annually, until the bond matures. This is regardless of

whether the bond was bought at a discount, at face value or at a premium. At maturity,

the company repays the loan by paying the bondholder the face value of the bond.

There are different types of bonds. Secured bonds are backed by a lien on a plant,

equipment, or other corporate asset. Unsecured bonds, also known as debentures, are

backed only by the general credit of the issuing corporation. Some bonds are

convertible, which means they can be converted into, or exchanged for, a specified

number of shares of common stock. Callable bonds give the issuer the right to call or

redeem the bonds before the maturity date. Calling bonds might occur when interest

rates are falling and the company can issue new bonds at a lower rate. Serial bonds are

those which have a series of maturity dates or those bonds which are payable in

installments. Bonds with a single maturity date are called term bonds.

Cost, Proceeds and Gain (or Loss) on a Bond Transaction

The cost of bonds includes the purchase price (current market price plus accrued interest),

broker’s commission, taxes and other charges incurred in their acquisition.

As noted earlier, bonds pay interest semi-annually, such as on January I and July 1.

When bonds are traded between the stated interest payment dates, the buyer must pay the

interest accumulated from the last payment date to the seller. This interest due the seller

is known as the accrued interest. The accrued interest on the bond is calculated using

the formula J= PRT where P is the face value of the bond, & is the coupon rate, and Tis

the number of days since the last payment date divided by 360. When time is stated in

months, the time denominator is 12.

Similar to stocks, when bonds are bought and sold a brokerage charge is normally added

to the price of the bond. Taxes (i.e. documentary stamp tax) and other charges related to

the acquisition of the bond form part of the cost.

The proceeds from sale of bonds is determined by deducting from the sales price) the

related broker’s commission, taxes and other fees. ).

Gain (or loss) from a bond transaction is the difference between the proceeds from the

sale and the cost of purchase. From the accounting viewpoint, the difference between

sales proceeds and the purchase price of the bond is not all gain but is a combination of

interest income and gain on sale.

Gains realized from sale of bonds with a maturity of more than five (5) years shall be

excluded from gross income and consequently exempt from income tax.

Current Yield for a Bond

Just as with stocks, the current yield of a bond is a simple measure of the return on

investment based on the current market price. When bonds are purchased at face, the

current yield is equal to the coupon rate. For example, a bond purchased at face for

P1,000, with a coupon rate of 7%, pays interest of P70 per year (P1,000 « .07), and has a

yield of 7% (70/100 = .07). If the bond is purchased at a discount, say P875, it still pays

P70; however, the yield is 8% (70/875 = .08). If the bond is purchased at a premium, say

P1,165, it still pays P70; however, now the yield is only 6% (70/1165 = .06)

Calculating the current yield for a bond entails the following steps:

1. Calculate the annual interest and current price of the bond.

2. Divide the annual interest of the bond by the current market price:

ve Annual interest

Current yield = —2RUS Interest

Current market price

3. Convert the answer to a percent, rounded to the nearest tenth.

MUTUAL FUNDS

Mario Francisco wants to invest some money in the stock market, but does not want to

spend a lot of time following the stock market and studying which stocks are good

investments. Consequently, he decides to purchase mutual funds.

A mutual fund is a fund managed by an investment company. Depending on the type of

fund, the investment company buys stocks, bonds, and other investments on behalf of the

fund. The money in the fund may come from individuals and institutions. When you

invest money in the fund, you receive shares. As an investor, you are an owner of the

fund. The investment company acts as your advisor, buying and selling stocks or bonds it

feels are good investments. Some mutual funds do not have a fixed number of shares but

issues new shares as it takes in money and redeems them as investors withdraw. Some

funds, however, after reaching a certain size, will stop accepting new investors and will

not issue any new shares. There are different types of mutual funds, some having high

growth potential but high risk and others having lower growth potential but less risk.

A load mutual fund charges you a fee when you buy or sell (redeem) shares; a no-load

mutual fund does not charge investors this fee. The load may range between 0.25 to 3%

based on the amount invested. Some mutual funds charge early redemption fee at 1%.

This is to discourage the investor from redeeming his shares earlier than the required

minimum holding period. Management, advisory and distribution fees range between

0.75% to 2% per annum based on the net asset value of the fund.

The price of a mutual fund share is calculated by dividing the fund's net assets (assets

minus liabilities) by the number of shares outstanding. This price, or value, is called the

net asset value (NAY). The net asset values are calculated at the end of each day using

the closing price of each security in the portfolio. When you redeem your shares, the

fund pays you cash based on the net value on that day.

Cash and/or property dividends received by a resident citizen-stockholder from a mutual

fund company is subject to 10% final tax effective year 2000. The amount the investor

will receive shall be net of the 10% final tax. Gains derived by investors from redemption

of shares of stock in a mutual fund are exempt from capital gains tax.

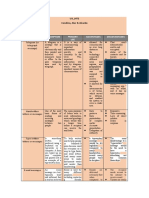

Interpreting a Mutual Fund Quotation

The following illustration shows a mutual fund quotation and its interpretation.

Illustration: Equity Fund

NET YID

FUND NAV CHG eabl

| Fixed Income Fund {79.47 008 ND

Equity Fund 255.82

Balanced Fund 135.67 oo ae

FUND. Equity Fund is the name of the fund. The Fund aims to achieve long-term

capital growth,

NAV. Today, P255.82 is the net asset value per share.

NET CHG (net change). It is the difference between the price paid for the last share

today and the price paid for the last share the previous trading day. The Equity Fund

closed P0.03 higher than yesterday’s closing price.

YTD % RET (year-to-date percentage return). The Fund has a 30.31% return

since January 1.

Return on Investment

Aimee Bolivia invested in Growth Fund, a mutual fund. To determine whether she had

made a wise choice, she wanted to calculate her return on investment. The return on

investment for a mutual fund depends on the increase in net asset value and on the

dividends paid from the fund. The following formula is used to calculate a mutual fund's

return on investment:

End-of-year NAV + Dividend dist

Return on investment =

uutions

Beginning-year NAV

Beginning-year NAV

Illustration: Growth Fund's net asset value on January 1 was P100. During the year, the

fund distributed P25 per share to investors. At the end of the year, the net asset value was

P104. Calculate the return on investment.

Return on investment =

End-of-year NAV + Dividend distributions ~ Beginning-year NAV

Beginning-year NAV

104 + 25-100

100

29

100

0.29

The return on investment is 29%.

Thank you...

and hope our sharing will give

you enough insights to make

your teaching — learning

process more meaningful.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- CON LDocument11 pagesCON LRalph Michael CondinoNo ratings yet

- Quiz7 PDFDocument5 pagesQuiz7 PDFRalph Michael CondinoNo ratings yet

- LogicDocument14 pagesLogicRalph Michael CondinoNo ratings yet

- Proof of Work PDFDocument40 pagesProof of Work PDFRalph Michael CondinoNo ratings yet

- A. Illustrate The Graphs of The Following Function. Determine Also Their Domain and RangeDocument16 pagesA. Illustrate The Graphs of The Following Function. Determine Also Their Domain and RangeRalph Michael CondinoNo ratings yet

- CONq 2Document1 pageCONq 2Ralph Michael CondinoNo ratings yet

- Changing Self in The Digital Age: The Impact of Digital Technology On The Self and PersonDocument15 pagesChanging Self in The Digital Age: The Impact of Digital Technology On The Self and PersonRalph Michael CondinoNo ratings yet

- Student of The Day PDFDocument1 pageStudent of The Day PDFRalph Michael CondinoNo ratings yet

- MODULEDocument2 pagesMODULERalph Michael CondinoNo ratings yet

- GGDocument4 pagesGGRalph Michael CondinoNo ratings yet

- L2 Integrals PDFDocument2 pagesL2 Integrals PDFRalph Michael CondinoNo ratings yet

- Module 8 PDFDocument2 pagesModule 8 PDFRalph Michael CondinoNo ratings yet

- SSDocument35 pagesSSRalph Michael CondinoNo ratings yet

- John Loyd Brillantes BSED 1-A ENGLISH Training Need Objective Activity Resources Needed Time Frame Expected Output Expected OutcomeDocument3 pagesJohn Loyd Brillantes BSED 1-A ENGLISH Training Need Objective Activity Resources Needed Time Frame Expected Output Expected OutcomeRalph Michael CondinoNo ratings yet

- Galfo, Requilme & Roa-Assignment 5Document5 pagesGalfo, Requilme & Roa-Assignment 5Ralph Michael CondinoNo ratings yet

- Assignment 5Document7 pagesAssignment 5Ralph Michael CondinoNo ratings yet

- Unit1 Lesson 2 Task 1 - TemplateDocument1 pageUnit1 Lesson 2 Task 1 - TemplateRalph Michael CondinoNo ratings yet

- Assignment 5Document7 pagesAssignment 5Ralph Michael CondinoNo ratings yet

- The Teaching Profession: Ed 202 - Unit 1 Lesson 1-3Document6 pagesThe Teaching Profession: Ed 202 - Unit 1 Lesson 1-3Ralph Michael CondinoNo ratings yet

- U3 - L4T2 Condino, Alar, AlcardeDocument3 pagesU3 - L4T2 Condino, Alar, AlcardeRalph Michael CondinoNo ratings yet