Professional Documents

Culture Documents

3bhk New Sourcing

Uploaded by

kailas aher0 ratings0% found this document useful (0 votes)

19 views1 pageOriginal Title

3bhk new Sourcing (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

19 views1 page3bhk New Sourcing

Uploaded by

kailas aherCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

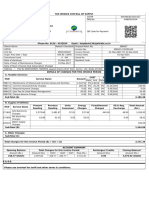

Project: Godrej Rejuve, Pune Date: 29/05/2021

Head Office: Godrej Properties Limited

Godrej One, 5th Floor, Pirojshanagar, Eastern Express Highway,

Vikhroli (E), Mumbai - 400079, Tel: +91-22-6169 8606 Annexure F

Draft-a1u2s000000l2XRAAY

shyam.agarwal@godrejproperties.com

Unit Details Sale Consideration

Tower T7 Carpet Area Rera (in Sq.mtr.) 81.97 Description Amount (INR)

Unit Number A1704 Exclusive Area (in Sq.mtr.) 15.07 Flat/Unit Cost 9150323.00

Floor 17th Floor Total Area (in Sq.mtr.) 97.04 Sale Consideration (A) 9150323.00

Typology 3 BHK

Carpet Area Amount 7729307.26 Estimated Other Charges

Exclusive Area Amount 1421015.74 Description Amount (INR)

Facing Garden Electricity Charges 0.00

LEGAL CHARGES 0.00

Payment Plan Club Development Charges 0.00

Milestone % Amount (INR) GST (INR) Total Estimated Maintanence Charges 56742.00

ON BOOKING 10 % 915032.30 109803.88 1024836.18 Society Charges 5000.00

75 DAYS FROM BOOKING 10 % 915032.30 109803.88 1024836.18 CORPUS FUND 20000.00

ON COMPLETION OF EXCAVATION 10 % 915032.30 109803.88 1024836.18 SHARE MONEY 600.00

ON COMPLETION OF PLINTH BEAM 15 % 1372548.45 164705.81 1537254.26 Estimated other charges (B) 82342.00

ON COMPLETION OF 2ND SLAB 10 % 915032.30 109803.88 1024836.18

ON COMPLETION OF 9TH SLAB 10 % 915032.30 109803.88 1024836.18 Government Levies

ON COMPLETION OF SUPERSTRUCTURE 5% 457516.15 54901.94 512418.09 Description Amount (INR)

ON COMPLETION OF EXTERNAL PLUMBING, EXTERNAL Stamp Duty 549019.38

12.5 % 1143790.38 137254.85 1281045.23

PLASTER Registration Charges 30000.00

ON COMPLETION OF LIFTS 12.5 % 1143790.38 137254.85 1281045.23 Goods and Service Tax (GST) 1109152.32

ON NOTICE OF POSSESSION 5% 539858.15 66015.50 605873.65 Total Govt. Levies incl. GST (C) 1688171.70

Payable at the time of registration 579019.38

Total 9232665.00 1109152.35 10920836.73 Total Sale Price including Government

1,09,20,836.70

Levies (A+B+C)

Terms & Conditions

** Proportionate common area charges including club house development charges calculated on the carpet area are included in the carpet area itself.

** Areas, specifications, plans, images and other details are indicative and are subject to change in terms of applicable laws.

** Stamp duty, registration charges and Other Government taxes, duties, levies are to be borne by Applicant(s) on actual basis. All development charges / other levies, taxes, duties, cesses, / EDC / IDC,

Land under Construction tax (LUC), Goods and Services Tax (GST) and / or any other levies / taxes / duties / cesses levied currently and/or may be levied in future shall be borne by the Customer.

** Registration process & Advocate fees Rs 9500/- approx. to be paid in cash directly to the advocate at the time of registration and is not included in the Total Flat Cost.

** Taxes and Government duties/levies/cesses are non-refundable.

** The Customer shall deduct the applicable Tax Deduction at Source (TDS) at the time of making actual payment or credit of such sum to the account of the Developer, as per section 194IA of the Income

Tax Act, 1961. Applicant(s) shall submit the original TDS certificate within the prescribed timelines mentioned in the Income Tax Act 1961.

------------------------------------------------------------------------------------------------------------------------------------

** This is not an offer or an invitation to offer for sale of apartments/flats/units in this project.

** Cancellation charges - 20% amount of the Total Consideration will be forfeited upon cancellation of the apartment / flat.

** No modifications of whatsoever nature are allowed in the apartment / flat.

** Shifting or change of apartment is not allowed.

** Property Tax is not part of Maintenance fee. Taxes and Government duties/levies/cesses are non-refundable.

** This cost sheet forms a part of the Application Form. The aforementioned payment milestones and events are in reference to the respective tower/building.

** GST amount calculated is as per the current applicable GST rates. Final sales consideration amount may change depending upon the applicable GST rates as decided by regulatory authorities from time to

time. Customer agrees and understands that the GST amount shown here may vary and customer will have to pay the GST/taxes amount as per actuals rates applicable on the date of milestones. The

Developer makes no warranty or representation the GST rates charged on the sale consideration would correspond to the rates mentioned here and the Customer shall be responsible and liable to pay GST

as per the rates prescribed by the regulatory authorities from time to time on demanded by the developer without any liability / demand to the Developer.

** The total cost of the Apartment is the final negotiated price after considering GST benefit / GST Credit pass back .

----------------------------------------------------------------------------------------------------------------------------------------

** At the time of Registration please carry 1 passport size photograph of applicant , original and photocopy of address proof - PAN Card , Driving Licence , Passport , Ration Card , Voter ID , Electricity bill ,

OCI (Any one ) , Proof of Indian Origin.

** Timely payment of consideration and all other amounts payable by the Customer is of the essence. All delayed payments would attract Interest as per the terms of the Application Form.

** Any statutory taxes , levies etc shall be extra , to be paid by the customer.

** Kindly note that possession of the said flat will be given 15 days after receiving all the payments and developer issuing possession intimation.

** Prior to agreement client should submit the loan sanction letter from the bank , if any.

** Execution of agreement will be subject to clearance of the payment made by the client.

** All charges mentioned in the terms and conditions are over and above the Total Flat Cost.

** 1 square meter = 10.7639 square feet.

Primary Applicant: 2nd Applicant: 3rd Applicant:

You might also like

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- 3BHK NurtureDocument1 page3BHK NurtureADESHNo ratings yet

- 2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureDocument1 page2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureAvinash ChavanNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- Unit Details Sale ConsiderationDocument1 pageUnit Details Sale ConsiderationcubadesignstudNo ratings yet

- Cost Sheet For 2 BHKDocument1 pageCost Sheet For 2 BHKBharat SharmaNo ratings yet

- UrvishaDocument1 pageUrvishacathedraliteeNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument22 pagesSummary of Current Charges (RS) : Talk To Us SMSRuben PrattNo ratings yet

- Vaswani Menlo Park - Price Chart - Sep 22Document1 pageVaswani Menlo Park - Price Chart - Sep 22priyabrat.77No ratings yet

- KA Yagi & Co. 2022-2023Document1 pageKA Yagi & Co. 2022-2023Tania AkterNo ratings yet

- Applicant Has Copies of Tax Paid Receipt, Katha, Building Plan & Power of Attorney. The Building Attracts Prorata For All Floors On Commercial RatesDocument1 pageApplicant Has Copies of Tax Paid Receipt, Katha, Building Plan & Power of Attorney. The Building Attracts Prorata For All Floors On Commercial Ratesdeepashree_krNo ratings yet

- Meterbill 112350Document1 pageMeterbill 112350navdeepdecentNo ratings yet

- Report 3525Document1 pageReport 3525ypr accountsNo ratings yet

- Bill of Quantities: Iv. Total Construction Cost (I + Ii + Iii)Document1 pageBill of Quantities: Iv. Total Construction Cost (I + Ii + Iii)paideng13No ratings yet

- Oxygen Cost Sheet 2040 Sky CityDocument10 pagesOxygen Cost Sheet 2040 Sky CityAbhi SharmaNo ratings yet

- TMRD Sample Comp APR2020 With SpotDocument1 pageTMRD Sample Comp APR2020 With SpotLiv ValdezNo ratings yet

- RKC KosmosDocument2 pagesRKC Kosmosamritam yadavNo ratings yet

- Axrb With Spot Oct2020Document1 pageAxrb With Spot Oct2020Liv ValdezNo ratings yet

- Rate KatahariDocument1 pageRate KatahariROSHAN CHAUDHARYNo ratings yet

- Inv TG B1 55043301 101584892514 July 2021Document2 pagesInv TG B1 55043301 101584892514 July 202118-208 LingaNo ratings yet

- Morefields - Cost Break Up - Plot 170Document1 pageMorefields - Cost Break Up - Plot 170ObnoNo ratings yet

- Financial ModellingDocument12 pagesFinancial ModellingGAYATHRI NATESHNo ratings yet

- Service Estimate: CustomerDocument2 pagesService Estimate: CustomerazharNo ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- Car Lease CalculationsDocument90 pagesCar Lease CalculationsNiraj KumarNo ratings yet

- IF23062235463006 InvoiceDocument1 pageIF23062235463006 InvoiceAnilkumarNo ratings yet

- IF23050633774478 InvoiceDocument1 pageIF23050633774478 InvoiceAnshum GuptaNo ratings yet

- Account Statement - Kosmos - Jan 2018Document2 pagesAccount Statement - Kosmos - Jan 2018Abhay Kumar JhaNo ratings yet

- DBP Sheet Nexa FinalDocument26 pagesDBP Sheet Nexa FinalSameer AgrawalNo ratings yet

- BM2008I002097905Document6 pagesBM2008I002097905Nishant MeghwalNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet

- Nepa Projection AmitDocument43 pagesNepa Projection AmitDaya SharmaNo ratings yet

- Katahri QuotationDocument1 pageKatahri QuotationROSHAN CHAUDHARYNo ratings yet

- PSB Ame 05-19Document203 pagesPSB Ame 05-19Ryan DizonNo ratings yet

- Total Operating Costs Overheads: Administration License FeeDocument10 pagesTotal Operating Costs Overheads: Administration License FeeAshish Mani LamichhaneNo ratings yet

- Draft: Veridian at Emerald Isle 11B 1502 549.82Document1 pageDraft: Veridian at Emerald Isle 11B 1502 549.82sachinNo ratings yet

- Ac Bill For 1412 - LCTDocument1 pageAc Bill For 1412 - LCTkcatolico00No ratings yet

- Template M/S Laxmi Enterprises Dabur: Gross Profit (Income)Document10 pagesTemplate M/S Laxmi Enterprises Dabur: Gross Profit (Income)trisanka banikNo ratings yet

- Asphalt Pavement Itemized Breakdown - Rev1Document1 pageAsphalt Pavement Itemized Breakdown - Rev1jmc buildersNo ratings yet

- ACT Apr 23 BillDocument2 pagesACT Apr 23 BillKrishna Kumar Rajasekhar NaiduNo ratings yet

- DEY AMIT KUMAR InternetDocument2 pagesDEY AMIT KUMAR InternetITNo ratings yet

- NTVDocument2 pagesNTVManoj AryalNo ratings yet

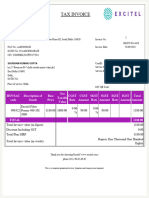

- Tax Invoice - 300020230000007126Document1 pageTax Invoice - 300020230000007126Hisham HussainNo ratings yet

- Site Grading, Subgrade Excavate (Cut & Fill) Excavation (Cut) & Backfilling Compacted To 90% MDDDocument13 pagesSite Grading, Subgrade Excavate (Cut & Fill) Excavation (Cut) & Backfilling Compacted To 90% MDDEdgar QuinonesNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument9 pagesSummary of Current Charges (RS) : Talk To Us SMSrupanshuNo ratings yet

- Original For Buyer: Pricing Description Rate Per TE (INR) Amount (INR)Document1 pageOriginal For Buyer: Pricing Description Rate Per TE (INR) Amount (INR)Ambreesh YadavNo ratings yet

- Cost Sheet Miracle MileDocument1 pageCost Sheet Miracle Milesushil aroraNo ratings yet

- Final Report - Financial ModelDocument10 pagesFinal Report - Financial ModelDrishti SrivatavaNo ratings yet

- Bandra Plot Valuation Icici HFC Revised As Per SurajDocument2 pagesBandra Plot Valuation Icici HFC Revised As Per SurajParin MaruNo ratings yet

- 15 - 85 Emi Holiday Plan PDFDocument2 pages15 - 85 Emi Holiday Plan PDFJasvinder SolankiNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohanNo ratings yet

- Consolidated Invoice-156Document3 pagesConsolidated Invoice-156gounderstoneNo ratings yet

- A Unit InformationDocument2 pagesA Unit InformationSampath RNo ratings yet

- Sync Tower S Sample Computation Project Completion: Q2 2024Document1 pageSync Tower S Sample Computation Project Completion: Q2 2024Isang PescasioNo ratings yet

- D.A. Abcede & Associates MEC Vista GL Taft PropertiesDocument7 pagesD.A. Abcede & Associates MEC Vista GL Taft PropertiesJusto Tenero PocongNo ratings yet

- Bill-Sep 2023Document1 pageBill-Sep 2023shubham1996subuNo ratings yet

- Meralco Bill 427881610101 12102019Document2 pagesMeralco Bill 427881610101 12102019Mary Louise100% (1)

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohan100% (1)

- 151642608-Aug 19Document1 page151642608-Aug 19VIVEK SHAKYANo ratings yet

- Godrej Parkridge Flipchart - V1-1-50-22Document1 pageGodrej Parkridge Flipchart - V1-1-50-22kailas aherNo ratings yet

- Godrej Parkridge Flipchart - V1-1-50-16Document1 pageGodrej Parkridge Flipchart - V1-1-50-16kailas aherNo ratings yet

- Godrej Parkridge Flipchart - Final - UpdatedDocument52 pagesGodrej Parkridge Flipchart - Final - UpdatedChinmay Deshpande100% (1)

- Godrej Parkridge Flipchart - V1-1-50-17Document1 pageGodrej Parkridge Flipchart - V1-1-50-17kailas aherNo ratings yet

- Godrej Parkridge Flipchart - V1-1-50-2Document1 pageGodrej Parkridge Flipchart - V1-1-50-2kailas aherNo ratings yet

- Godrej Parkridge Flipchart - V1-1-50-15Document1 pageGodrej Parkridge Flipchart - V1-1-50-15kailas aherNo ratings yet

- 3bhk New SourcingDocument1 page3bhk New Sourcingkailas aherNo ratings yet

- 3bhk New SourcingDocument1 page3bhk New Sourcingkailas aherNo ratings yet

- Proprietorship Declaration - Format RevDocument1 pageProprietorship Declaration - Format Revkailas aherNo ratings yet

- Mahalunge Brokerage Invoice FormatDocument1 pageMahalunge Brokerage Invoice Formatkailas aherNo ratings yet

- Copy em DeclarationDocument2 pagesCopy em Declarationkailas aherNo ratings yet

- GPL - Channel Partner Agreement - HO - v3 - 05092017 - FinalDocument20 pagesGPL - Channel Partner Agreement - HO - v3 - 05092017 - Finalkailas aherNo ratings yet

- Bank DetailsDocument1 pageBank Detailskailas aherNo ratings yet

- New Text DocumentDocument1 pageNew Text Documentkailas aherNo ratings yet

- Essay TrafficDocument1 pageEssay Traffickailas aherNo ratings yet

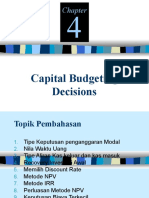

- Chapter 4-Capital BudgetingDocument66 pagesChapter 4-Capital Budgetingm_agungNo ratings yet

- Case Study - Stock Pitch GuideDocument7 pagesCase Study - Stock Pitch GuideMuyuchen Shi100% (1)

- Jason Matheson Paystub 2Document1 pageJason Matheson Paystub 2wadewilliamsperling1992No ratings yet

- MR - Swapnil Suresh Soni: Mobile BankingDocument2 pagesMR - Swapnil Suresh Soni: Mobile Bankingsappy soniNo ratings yet

- Financial Analysis and Management Decision Making: Tata Jaguar Case StudyDocument5 pagesFinancial Analysis and Management Decision Making: Tata Jaguar Case StudyAnjay BaliNo ratings yet

- Shreve Stochcal4fin 1Document52 pagesShreve Stochcal4fin 1Daniel HeNo ratings yet

- Project Management Chapter 8 Investment Criteria Question AnswersDocument6 pagesProject Management Chapter 8 Investment Criteria Question AnswersAkm EngidaNo ratings yet

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalNo ratings yet

- 23 - Gonzales v. PCIBDocument1 page23 - Gonzales v. PCIBeieipayadNo ratings yet

- Booster Juice Inc..EditedDocument15 pagesBooster Juice Inc..EditedBrian MachariaNo ratings yet

- I0136p2100444756Document1 pageI0136p2100444756Prince Anuj SinghNo ratings yet

- Foreign Currency TransactionsDocument14 pagesForeign Currency TransactionsXavier AresNo ratings yet

- Working Capital ManagementDocument14 pagesWorking Capital Managementgopalagarwal2387No ratings yet

- Training Lecture Sheet Mostafa KamalDocument19 pagesTraining Lecture Sheet Mostafa KamalArif Uz ZamanNo ratings yet

- RFL ElictronicsDocument14 pagesRFL ElictronicsAntora HoqueNo ratings yet

- 4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFDocument21 pages4ef1c - HDT - Sebi - Sharemarket - 2020B1 @ PDFMohan DNo ratings yet

- Entrepreneurship Essentials - Unit 14 - Week 11Document1 pageEntrepreneurship Essentials - Unit 14 - Week 11SANDEEP JADAUN67% (3)

- Life Cycle Cost AnalysisDocument18 pagesLife Cycle Cost AnalysisRaymon PrakashNo ratings yet

- Investment BankingDocument28 pagesInvestment Bankinganbubalraj100% (3)

- LLM Final BUsiness and CorporateDocument143 pagesLLM Final BUsiness and CorporateASHU KNo ratings yet

- Lesson 7 - Financial ForecastingDocument24 pagesLesson 7 - Financial Forecastingkylasaragosa04No ratings yet

- Diagnostic Test CashDocument2 pagesDiagnostic Test CashJoannah maeNo ratings yet

- Indian Overseas Bant: 344r yHTE/Useful TipsDocument1 pageIndian Overseas Bant: 344r yHTE/Useful Tipssvignesh singhNo ratings yet

- Priority Pass LoungesDocument2 pagesPriority Pass LoungesAayush ChelawatNo ratings yet

- Et Al.Document162 pagesEt Al.Yessy YasmaraldaNo ratings yet

- NIA DurgapurDocument4 pagesNIA DurgapurNikher VermaNo ratings yet

- National Income New PDFDocument25 pagesNational Income New PDFLaksh SahniNo ratings yet

- INDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFDocument3 pagesINDIVIDUAL QUIZ BFM 4273 Islamic Trade Finance PDFNORSARINA SIRI BIBFNo ratings yet

- Challan Form No.32-A: State Bank of PakistanDocument1 pageChallan Form No.32-A: State Bank of PakistanZubair KhanNo ratings yet

- ELSSDocument15 pagesELSSSecure Plus100% (1)