Professional Documents

Culture Documents

3BHK Nurture

Uploaded by

ADESH0 ratings0% found this document useful (0 votes)

840 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

840 views1 page3BHK Nurture

Uploaded by

ADESHCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

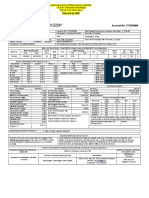

Project: Godrej Nurture, Pune Date: 22/10/2022

Head Office: Godrej Properties Limited

Godrej One, 5th Floor, Pirojshanagar, Eastern Express Highway,

Vikhroli (E), Mumbai - 400079, Tel: +91-22-6169 8606 Annexure F

Draft-a1u2s000001o6GlAAI

lalit.kumar@godrejproperties.com

Unit Details Sale Consideration

Tower 3 Carpet Area Rera (in Sq.mtr.) 91.01 Description Amount (INR)

Unit Number 104 Exclusive Area (in Sq.mtr.) 11.93 Flat/Unit Cost 9624192.00

Floor 1st Floor Total Area (in Sq.mtr.) 102.94 Sale Consideration (A) 9624192.00

Typology 3 BHK

Carpet Area Amount 8508817.89 Estimated Other Charges

Exclusive Area Amount 1115374.11 Description Amount (INR)

Facing Cityscape Electricity Charges 0.00

LEGAL CHARGES 0.00

Payment Plan Club Development Charges 0.00

Milestone % Amount (INR) GST (INR) Total Society Charges 5000.00

ON BOOKING 10 % 962419.20 48120.96 1010540.16 Estimated Maintenance Charges 57000.00

75 DAYS FROM BOOKING 10 % 962419.20 48120.96 1010540.16 CORPUS FUND 20000.00

ON COMPLETION OF EXCAVATION 10 % 962419.20 48120.96 1010540.16 SHARE MONEY 600.00

ON COMPLETION OF PLINTH BEAM 15 % 1443628.80 72181.44 1515810.24 Estimated other charges (B) 82600.00

ON COMPLETION OF 2ND SLAB 10 % 962419.20 48120.96 1010540.16

ON COMPLETION OF 9TH SLAB 10 % 962419.20 48120.96 1010540.16 Government Levies

ON COMPLETION OF SUPERSTRUCTURE 5% 481209.60 24060.48 505270.08 Description Amount (INR)

ON COMPLETION OF EXTERNAL PLUMBING, EXTERNAL Stamp Duty 673693.44

12.5 % 1203024.00 60151.20 1263175.20

PLASTER Registration Charges 30000.00

ON COMPLETION OF LIFTS 12.5 % 1203024.00 60151.20 1263175.20 Goods and Service Tax (GST) 492369.60

ON NOTICE OF POSSESSION 5% 563809.60 35220.48 599030.08 Total Govt. Levies incl. GST (C) 1196063.04

Payable at the time of registration 703693.44

Total 9706792.00 492369.60 10902855.04 Total Sale Price including Government

1,09,02,855.04

Levies (A+B+C)

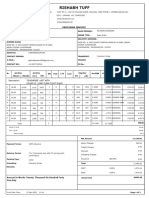

Terms & Conditions

-Areas, specifications, plans, images and other details are indicative and are subject to change in terms of applicable laws.

-Stamp duty, registration charges and Other Government taxes, duties, levies are to be borne by Applicant(s) on actual basis. All development charges / other levies, taxes, duties, cesses, / EDC / IDC, Land

under Construction tax (LUC), Goods and Services Tax (GST) and / or any other levies / taxes / duties / cesses levied currently and/or may be levied in future shall be borne by the Customer Payment of

Stamp duty and registration fees is prerequisite for registration of Agreement. After payment of Stamp Duty and Registration fees 15 days will be required for lining up of the registration of Agreement.

-Registration process & Advocate fees Rs 9500/- approx. to be paid directly to the advocate at the time of registration and is not included in the Total Flat Cost

-This is not an offer or an invitation to offer for sale of apartments/flats/units in this project. Subject to title and location clearances, necessary approvals/permissions.

-Taxes and Government duties/levies/cesses are non-refundable.

-The Customer shall deduct the applicable Tax Deduction at Source (TDS) at the time of making actual payment or credit of such sum to the account of the Developer, as per section 194IA of the Income Tax

Act, 1961. Applicant(s) shall submit the original TDS certificate within the prescribed timelines mentioned in the Income Tax Act 1961

-Estimated Other Charges is payable by the Customer, at the time of offer of possession. (Maintenance charges does not include the property taxes levied by authorities [including property tax ] on the

property or transaction and is payable separately by the Customer. All outgoings, water charges, common electricity charges, and other common essential services & utilities, will be paid from maintenance

charges) The Estimated Other Charges mentioned above are tentative and are subject to change, without notice. The same shall be borne by the Customers upon demand by the Developer

-This is not an offer or an invitation to offer for sale of apartments/flats/units in this project

-Cancellation charges - 20% amount of the Total Consideration will be forfeited upon cancellation of the apartment / flat

- No modifications of whatsoever nature are allowed in the apartment / flat.

- Shifting or change of apartment is not allowed.

- Property Tax is not part of Maintenance fee. Taxes and Government duties/levies/cesses are non-refundable

-This cost sheet forms a part of the Application Form. The aforementioned payment milestones and events are in reference to the respective tower/building

-GST amount calculated is as per the current applicable GST rates. Final sales consideration amount may change depending upon the applicable GST rates as decided by regulatory authorities from time to

time. Current GST rate is 8% on certain components of for affordable housing project and on other charges GST rate is 18%. However government has shown an intention to significantly reduce this rate and

further action is awaited in this regard. Customer agrees and understands that the GST amount shown here may vary and customer will have to pay the GST/taxes amount as per actuals rates applicable on

the date of milestones. GST rates of 1%/5%/18% mentioned in the cost sheet is basis the information of proposed change in GST rates on immovable property available in public domain and are been

mentioned only for information purposes. The Developer makes no warranty or representation the GST rates charged on the sale consideration would correspond to the rates mentioned here and the

Customer shall be responsible and liable to pay GST as per the rates prescribed by the regulatory authorities from time to time on demanded by the developer without any liability / demand to the Developer.

On account of change in GST law, in case there is any input credit loss to the developer, then the developer shall suitably increase the price to offset the input credit loss of GST caused to the developer on

account of change in GST Law.

-At the time of Registration please carry 1 passport size photograph of applicant , original and photocopy of address proof - PAN Card , Driving Licence , Passport , Ration Card , Voter ID , Electricity bill , OCI

(Any one ) , Proof of Indian Origin.

-Timely payment of consideration and all other amounts payable by the Customer is of the essence. All delayed payments would attract Interest as per the terms of the Application Form

-Any statutory taxes , levies etc shall be extra , to be paid by the customer

-Kindly note that possession of the said flat will be given 15 days after receiving all the payments and developer issuing possession intimation

-Prior to agreement client should submit the loan sanction letter from the bank , if any.

-Execution of agreement will be subject to clearance of the payment made by the client.

-All charges mentioned in the terms and conditions are over and above the Total Flat Cost. 1 square meter = 10.7639 square feet. Area in Square feet is only for reference, and not as unit of sale. The Flat is

sold in square meters only. MAHARERA No. P52100020686 In case of Stacked Car Parking, you will cooperate will co-parking flat owner.

- SDR rates as per current regulations by govt., basis the Date of Registration.

As-Is 1st Sep'20 to 31st Dec'20 1st Jan'21 to 31st Mar'21

6% + 30,000/- 3% + 30,000/- 4% + 30,000/-

Primary Applicant: 2nd Applicant: 3rd Applicant:

You might also like

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- 3bhk New SourcingDocument1 page3bhk New Sourcingkailas aherNo ratings yet

- 2BHK GFGDocument1 page2BHK GFGADESHNo ratings yet

- 2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureDocument1 page2 BHK L (824 Sq. FT) City Facing Cost Sheet - Godrej NurtureAvinash ChavanNo ratings yet

- Cost Sheet For 2 BHKDocument1 pageCost Sheet For 2 BHKBharat SharmaNo ratings yet

- Meterbill 112350Document1 pageMeterbill 112350navdeepdecentNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument22 pagesSummary of Current Charges (RS) : Talk To Us SMSRuben PrattNo ratings yet

- Unit Details Sale ConsiderationDocument1 pageUnit Details Sale ConsiderationcubadesignstudNo ratings yet

- Site Grading, Subgrade Excavate (Cut & Fill) Excavation (Cut) & Backfilling Compacted To 90% MDDDocument13 pagesSite Grading, Subgrade Excavate (Cut & Fill) Excavation (Cut) & Backfilling Compacted To 90% MDDEdgar QuinonesNo ratings yet

- Nepa Projection AmitDocument43 pagesNepa Projection AmitDaya SharmaNo ratings yet

- Foot Bridge 2nd SWA BillingFINALDocument2 pagesFoot Bridge 2nd SWA BillingFINALcimpstazNo ratings yet

- Final Report - Financial ModelDocument10 pagesFinal Report - Financial ModelDrishti SrivatavaNo ratings yet

- Cestrum BS-Mar 23 ConsolDocument35 pagesCestrum BS-Mar 23 Consolprimestuff09No ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohanNo ratings yet

- Sep 22Document1 pageSep 22krishna tiwari (OHRWA TM)No ratings yet

- Report 3525Document1 pageReport 3525ypr accountsNo ratings yet

- Inv TG B1 50939724 101360733900 September 2021Document2 pagesInv TG B1 50939724 101360733900 September 2021b kranthi kumarNo ratings yet

- Asphalt Pavement Itemized Breakdown - Rev1Document1 pageAsphalt Pavement Itemized Breakdown - Rev1jmc buildersNo ratings yet

- KA Yagi & Co. 2022-2023Document1 pageKA Yagi & Co. 2022-2023Tania AkterNo ratings yet

- WWReC Jefferson 2Br Sample Computations - Sept2009Document1 pageWWReC Jefferson 2Br Sample Computations - Sept2009Evelyn L. AguinaldoNo ratings yet

- Axrb With Spot Oct2020Document1 pageAxrb With Spot Oct2020Liv ValdezNo ratings yet

- Aluminium Glaz Panel Pi-1062Document2 pagesAluminium Glaz Panel Pi-1062krishnansubbulakshmiNo ratings yet

- Sadguru Construction Cma 16-17 To 2020-21Document8 pagesSadguru Construction Cma 16-17 To 2020-21vdtaudit 1No ratings yet

- LLBB (Thi Is GOOD)Document2 pagesLLBB (Thi Is GOOD)Hadi GhamarzadehNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument2 pagesSummary of Current Charges (RS) : Talk To Us SMSmadhumohan100% (1)

- Oxford PaintsDocument6 pagesOxford PaintsAnshikaNo ratings yet

- Summary For Customer Account Number (CAN) 1624259261Document2 pagesSummary For Customer Account Number (CAN) 1624259261Joris YapNo ratings yet

- Claims Adjustment Report: Description Price Parts Tinsmith PaintingDocument2 pagesClaims Adjustment Report: Description Price Parts Tinsmith PaintingMark Dave Joven Lamasan AlentonNo ratings yet

- Financial ModellingDocument12 pagesFinancial ModellingGAYATHRI NATESHNo ratings yet

- Summary For Customer Account Number (CAN) 0112813839Document2 pagesSummary For Customer Account Number (CAN) 0112813839Xerxes BelanteNo ratings yet

- Bandra Plot Valuation Icici HFC Revised As Per SurajDocument2 pagesBandra Plot Valuation Icici HFC Revised As Per SurajParin MaruNo ratings yet

- Your Account SummaryDocument17 pagesYour Account Summaryg_pushpaNo ratings yet

- 1 (1) 23359934Document12 pages1 (1) 23359934alpesh ramaniNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- Usa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Feb 2008Document58 pagesUsa Courtney Downs Leaseco, LLC Balance Sheet Books Accrual Feb 2008MarcyNo ratings yet

- EPF Universal Account Number: LIC ID / Policy IDDocument2 pagesEPF Universal Account Number: LIC ID / Policy IDBiswajit DasNo ratings yet

- Balance Sheel TIPLDocument4 pagesBalance Sheel TIPLVivek PatilNo ratings yet

- View BillDocument1 pageView BillAnonymous y1DnDY100% (1)

- EPF Universal Account NumberDocument1 pageEPF Universal Account NumberetrshillongNo ratings yet

- Jaipur Telecom District: Account SummaryDocument3 pagesJaipur Telecom District: Account SummaryManish SwamiNo ratings yet

- Dakshin Haryana Bijli Vitran NigamDocument3 pagesDakshin Haryana Bijli Vitran NigamSumit GuptaNo ratings yet

- UrvishaDocument1 pageUrvishacathedraliteeNo ratings yet

- Financials Mosaic Prop Dec 31 2016Document27 pagesFinancials Mosaic Prop Dec 31 2016Muhammad TalhaNo ratings yet

- Electricity Bill: Account No: 7791830000Document1 pageElectricity Bill: Account No: 7791830000Jai Mata diNo ratings yet

- Parmar Vishal HaryanaDocument1 pageParmar Vishal HaryanaANISH SHAIKHNo ratings yet

- Pimpri Chinchwad Municipal Corporation, Pimpri, Pune-411 018Document2 pagesPimpri Chinchwad Municipal Corporation, Pimpri, Pune-411 018Manoj SinghNo ratings yet

- Budget at A GlanceDocument33 pagesBudget at A GlanceDebdoot GhoshNo ratings yet

- Pi. No. 6100 - Gobind GlassDocument3 pagesPi. No. 6100 - Gobind Glassmash00009999No ratings yet

- 2 Bedrooms CreekDocument1 page2 Bedrooms CreekAli KhaNo ratings yet

- Document PDFDocument1 pageDocument PDFNaveen GoyalNo ratings yet

- Ong816 Bills Nov 2022Document2 pagesOng816 Bills Nov 2022Pavan KumarNo ratings yet

- PCMC Receipt 1Document1 pagePCMC Receipt 1Manoj SinghNo ratings yet

- Summary For Customer Account Number (CAN) 133568798-5: Electric BillDocument2 pagesSummary For Customer Account Number (CAN) 133568798-5: Electric BillDenice MapayeNo ratings yet

- TMRD Sample Comp APR2020 With SpotDocument1 pageTMRD Sample Comp APR2020 With SpotLiv ValdezNo ratings yet

- Tax Invoice - 300020230000007126Document1 pageTax Invoice - 300020230000007126Hisham HussainNo ratings yet

- Electricity Bill Duplicate Bill: Account No: 2551001000Document1 pageElectricity Bill Duplicate Bill: Account No: 2551001000ParvezNo ratings yet

- Vavediya Roshanbhai UpDocument1 pageVavediya Roshanbhai UpANISH SHAIKHNo ratings yet

- Meralco Bill 427881610101 01102020 - 1Document2 pagesMeralco Bill 427881610101 01102020 - 1Mary Louise80% (10)

- FE-Deck 2022Document59 pagesFE-Deck 2022ADESHNo ratings yet

- Gahunje Phase 5 Colour Plan Single Page WiroDocument48 pagesGahunje Phase 5 Colour Plan Single Page WiroADESHNo ratings yet

- 3 BHK Cost SheetDocument6 pages3 BHK Cost SheetADESHNo ratings yet

- Sagar Vaibhav - (Brief)Document16 pagesSagar Vaibhav - (Brief)ADESHNo ratings yet

- Kumar Park Infinia - Route 2Document4 pagesKumar Park Infinia - Route 2ADESHNo ratings yet

- GST Certificate - UpdatedDocument2 pagesGST Certificate - UpdatedADESHNo ratings yet

- Arushi Sharma - SR - Marketing MGRDocument3 pagesArushi Sharma - SR - Marketing MGRADESHNo ratings yet

- Kumar Park Infinia - Print AdDocument5 pagesKumar Park Infinia - Print AdADESHNo ratings yet

- Dubai - Brochure Artwork - Compressed (1) - CompressedDocument16 pagesDubai - Brochure Artwork - Compressed (1) - CompressedADESHNo ratings yet

- Kumar Park Infinia RevisedDocument4 pagesKumar Park Infinia RevisedADESHNo ratings yet

- Kumar Park Infinia - Leaflet (Front-Back)Document7 pagesKumar Park Infinia - Leaflet (Front-Back)ADESHNo ratings yet

- CW Ebook 2Document28 pagesCW Ebook 2ADESHNo ratings yet

- Job Ready Program GuidelinesDocument46 pagesJob Ready Program GuidelinesTallha GillaniNo ratings yet

- Overview and Features of GST: D.P. Nagendra Kumar Director General, GST Intelligence (South)Document8 pagesOverview and Features of GST: D.P. Nagendra Kumar Director General, GST Intelligence (South)ALL YOU NEEDNo ratings yet

- Assessment 501Document46 pagesAssessment 501Harmanpreet Kaur50% (2)

- Practicesheet - Input Tax CreditDocument5 pagesPracticesheet - Input Tax CreditHemmu sahuNo ratings yet

- Draft Agr of Sale GMR Owners Share 22 06 20 Ver 2 - DocxDocument19 pagesDraft Agr of Sale GMR Owners Share 22 06 20 Ver 2 - DocxVenkat DhruvaNo ratings yet

- Project On GSTDocument42 pagesProject On GSTMegha R57% (7)

- Contoh PolisiDocument13 pagesContoh PolisiJayZx WayNo ratings yet

- GST Rahul 1 Project WorkDocument29 pagesGST Rahul 1 Project WorkRohan 70KNo ratings yet

- RecipientDocument2 pagesRecipientAmanSharmaNo ratings yet

- Fiscal Policy Strategy 2020 21Document24 pagesFiscal Policy Strategy 2020 21Lalmuanawma MualchinNo ratings yet

- Construction Industry and Service Tax Amendments in Union Budget 2010Document16 pagesConstruction Industry and Service Tax Amendments in Union Budget 2010coolchaserNo ratings yet

- RMC No. 42-03Document8 pagesRMC No. 42-03Rachel Ann CastroNo ratings yet

- A EduAchieve JunDocument14 pagesA EduAchieve JunkimikononNo ratings yet

- Sponsorship Agreement Template SampleDocument6 pagesSponsorship Agreement Template SampleLegal ZebraNo ratings yet

- Law of TaxationDocument13 pagesLaw of TaxationAar ManojNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- Iesco Online BillDocument2 pagesIesco Online BillAli AsifNo ratings yet

- Terms Conditions For Prospectus 2022Document6 pagesTerms Conditions For Prospectus 2022Saumya KhatriNo ratings yet

- Part 1 BRBCL P2aDocument147 pagesPart 1 BRBCL P2aKunal SinghNo ratings yet

- Electronic Cash/Credit Ledgers and Liability Register in GSTDocument2 pagesElectronic Cash/Credit Ledgers and Liability Register in GSTRohit BajpaiNo ratings yet

- 8 - GST-8-EXAMPLES - Email BEFORE The SessionDocument2 pages8 - GST-8-EXAMPLES - Email BEFORE The SessionMighty SinghNo ratings yet

- PRSR Co Company ProfileDocument10 pagesPRSR Co Company ProfileGIRISH B MNo ratings yet

- Brief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inDocument5 pagesBrief Analysis of Section 7 (1) (A) of CGST Act 2017 - Scope of Supply - Taxguru - inPrakhar MaheshwariNo ratings yet

- Taxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - FinalDocument22 pagesTaxation TX (MYS) SyllandSG Dec 2018 - Sep 2019 - Finalkucing kerongNo ratings yet

- 133 GST JudgmentsDocument224 pages133 GST Judgmentsrohit100% (1)

- Appendix - Business Model: Patrick's Cod Fishing LTDDocument4 pagesAppendix - Business Model: Patrick's Cod Fishing LTDsamra azadNo ratings yet

- AT 6th Edition (May 2023)Document508 pagesAT 6th Edition (May 2023)myturtle gameNo ratings yet

- Home Unverified User - CRM - GST Suvidha Kendra FranchiseDocument9 pagesHome Unverified User - CRM - GST Suvidha Kendra FranchiseTapan SahooNo ratings yet

- Local FieldsDocument65 pagesLocal FieldssayeedNo ratings yet

- Input Tax Credit Under GST by CA. Nagesh Jadhav PDFDocument22 pagesInput Tax Credit Under GST by CA. Nagesh Jadhav PDFLumita SinghNo ratings yet

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionRating: 5 out of 5 stars5/5 (27)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- Decrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationFrom EverandDecrypting Crypto Taxes: The Complete Guide to Cryptocurrency and NFT TaxationNo ratings yet

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Taxes Have Consequences: An Income Tax History of the United StatesFrom EverandTaxes Have Consequences: An Income Tax History of the United StatesNo ratings yet

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingFrom EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingRating: 5 out of 5 stars5/5 (3)

- Beat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012From EverandBeat Estate Tax Forever: The Unprecedented $5 Million Opportunity in 2012No ratings yet

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionFrom EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNo ratings yet

- U.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadFrom EverandU.S. Taxes for Worldly Americans: The Traveling Expat's Guide to Living, Working, and Staying Tax Compliant AbroadNo ratings yet

- Bookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesFrom EverandBookkeeping for Small Business: The Most Complete and Updated Guide with Tips and Tricks to Track Income & Expenses and Prepare for TaxesNo ratings yet

- Canadian International Taxation: Income Tax Rules for ResidentsFrom EverandCanadian International Taxation: Income Tax Rules for ResidentsNo ratings yet

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsFrom EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business QuestionsRating: 3.5 out of 5 stars3.5/5 (9)