Professional Documents

Culture Documents

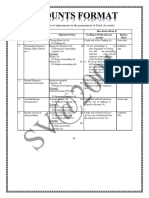

Electronic Cash/Credit Ledgers and Liability Register in GST

Uploaded by

Rohit BajpaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Electronic Cash/Credit Ledgers and Liability Register in GST

Uploaded by

Rohit BajpaiCopyright:

Available Formats

Electronic

Electronic Cash/Credit

GST

Cash/Credit

Electronic liability register

Ledgers

(GOODS AND SERVICES TAX)

o

The electronic liability register is maintained in FORM GST PMT-01

andLiability

Ledgers and Liability Register in GST

for each person liable to pay tax, interest, penalty, late fee or any

other amount on the common portal and all amounts payable by

Register in GST him shall be debited to the said register. The electronic liability

register will be maintained in two parts at the common portal. o

PartI IIwill

Part is for

bemaintaining the complete

for maintaining the returndescription

related of the transac-

liabilities. All

tions ofaccruing

liabilities all liabilities

dueaccruing,

to returnother than return

and payments related

made liabilities.

against the

Suchwill

same other liabilities may

be recorded in thisinclude

part ofthethefollowing:

register. Liabilities due to

opting for composition and cancellation

• Liabilities due to reduction or enhancement of registration

in thewill also

amount

be covered in this part. Such liabilities shall be populated

payable due to decision of appeal, rectification, revision, in the o

liability register

review, etc.;of the tax period in which the date of application o

or order falls, as the case may be.

• Refund of pre-deposit that can be claimed for a particular o

Part IIdemand

will beiffor maintaining

appeal is allowed; the complete description of the

transactions of all liabilities accruing, other than return related o

• Payment

liabilities. Such made against the

other liabilities mayshow cause

include notice or any other

the following:

payment made voluntarily;

o Liabilities due to reduction or enhancement in the amount An

• Reduction in amount of penalty (which would be automatically sh

shown)

review based on payment made after show cause notice or

etc.; au

Introduction within the time specified in the Act or the rules.

Introduction lia

On the common portal each registered taxpayer will have one o Refund of pre-deposit that can be claimed for a particular

On the register

electronic common portal

called the each registered

Electronic liability taxpayer

register and hastwoone Thedemand ID ifliability

electronic appeal register

is allowed; of the registered person indicates Th

electronic

electronic register

ledgers calledElectronic

namely the Electronic

Cash liability

Ledger register and two

and Electronic the following:

o Payment made against the show cause notice or any other st

electronic ledgers namely Electronic Cash Ledger and Electronic

• payment madepayable

the amount voluntarily;

towards tax, interest, late fee or any

taxCredit Ledger.

payable, These register

the amount availableand ledgers

to settle thereflect the liability

tax liability online,of other amount payable as per (which

the return furnished by the said in

o Reduction in amount of penalty would be automatically

and input credit balance. This is a handy tool provided in the GSTto

the taxpayer and the cash and input tax credit balance available

person; lia

settle wherein

such liability. shown) based on payment made after show cause notice or

system the This is a handy

registered tool provided

taxpayer can have in the GST system

information

about his liabilities and credits at a single location which about

wherein the registered taxpayer can have information can • the amount of tax, interest, penalty or any other amount

payable asliability

determined byofa the

proper officer in indicate

pursuancetheof El

behis liabilities,

viewed fromcashand

any place credits at a single

by simply logging location

into the which can be

common The electronic register person shall

viewed

portal. by him from

Electronic any place

liability by simply

register, logging

electronic intoledger

cash the common

and any

following: proceedings under the Act or as ascertained by the said Ev

portal. In case of any discrepancy in his electronic

electronic credit ledger of taxpayer will be updated on generation liability ledger, person; cr

electronic cash ledger or electronic credit ledger the registered o the amount payable towards tax, interest, late fee or any

• other

the amount

amountof tax andasinterest

payable per thepayable as a result by

return furnished of mismatch

the said or

beperson

generatedhas to atcommunicate

the common the same

portal fortoeach

the jurisdictional

debit or credit officer,

to of input

person; tax creditor any amount of interest that may accrue de

through the common portal in FORM GST PMT-04. from time to time; am

number relating to discharge of any liability shall be indicated in o the amount of tax, interest, penalty or any other amount m

• the amount payable on reverse charge basis;

the corresponding entry in the electronic liability register. In case ot

Electronic liability register • any

theproceedings underunder

amount payable the Act

the or as ascertained

Composition levy by the said

scheme;

of any discrepancy in his electronic liability ledger, electronic cash Th

The electronic

ledger liability

or electronic register

credit ledgeris maintained in FORM

the registered GSThas

person PMT-01

to person;

• Any other amount payable under the GST Act. PM

for each registered person liable to pay tax, interest, penalty, late o the amount of tax and interest payable as a result of mismatch fe

fee orthrough

matter, any other

theamount

common onportal

the common

in FORMportal and all amounts

GST PMT-04. Any

ofamount

input taxofcredit

demand debited in the electronic liability register am

payable by him gets debited to the said register. The electronic shall stand reduced to the extent of relief given by the appellate

or any amount of interest that may accrue from time to time; ta

liability register is maintained in two parts at the common portal. authority or Appellate Tribunal or court and the electronic liability re

register shall be credited accordingly.

Part I is for maintaining the return related liabilities. All liabilities

th

accruing due to return and payments made against the same are The amount of penalty imposed or liable to be imposed shall stand

recorded in this part of the register. Liabilities due to opting for reduced partly or fully, as the case may be, if the registeredperson

composition and cancellation of registration are also covered in makes the payment of tax, interest and penalty specified in the

this part. Such liabilities are populated in the liability register of show cause notice or demand order and the electronic liability

the tax period in which the date of application or order falls, as register shall be credited accordingly.

the case may be.

Directorate General of Taxpayer Services

CENTRAL BOARD OF INDIRECT TAXES & CUSTOMS

www.cbic.gov.in

GST

Electronic Cash/Credit Ledgers

(GOODS AND SERVICES TAX)

and Liability Register in GST

Electronic cash ledger through the common portal to the bank or electronic gateway

Every deposit made by a person by internet banking or by using through which the deposit was initiated.

credit or debit cards or National Electronic Fund Transfer (NEFT) The amount deducted under section 51 or collected under section

or Real Time Gross Settlement (RTGS) or by over the counter 52, as the case may be shall be credited to the electronic cash ledger

deposit on account of tax, interest, penalty, fee or any other of the registered person from whom the said amount was deducted

amount is credited to the respective electronic cash ledger. The or, as the case may be, collected.

amount available in the electronic cash ledger may be used for

making any payment towards tax, interest, penalty, fees or any The amount available in the electronic cash ledger may be used

other amount payable. for making any payment towards tax, interest, penalty, fees or any

other amount payable under the provisions of CGST/SGST/UTGST/

The electronic cash ledger is maintained in FORM GST PMT-05 for IGST Act(s).

each registered person, liable to pay tax, interest, penalty, late

fee or any other amount, on the common portal for crediting the Refund from cash ledger can only be claimed only when all the

amount deposited and debiting the payment therefrom towards return related liabilities for that tax period have been discharged. A

tax, interest, penalty, fee or any other amount. The payment registered person, claiming refund of any balance in the electronic

required to be made by an unregistered person, can be made cash ledger can claim such refund under section 54 of the CGST Act,

on the basis of a temporary identification number generated 2017.

through the common portal.

Presently if an amount is deposited in wrong head, the registered

A challan in FORM GST PMT-06 can be generated on the common

person would have to deposit the amount afresh in correct head

portal in which the details of the amount to be deposited

and claim refund of the amount deposited in a wrong head. A facility

towards tax, interest, penalty, fees or any other amount is to be

for transfer of amount lying in one head to another head in the

entered. This challan is valid for a period of fifteen days.

electronic cash ledger is being created shortly.

The deposit can be made through any of the following modes,

namely: Electronic credit ledger:

(i) Internet Banking through authorised banks; The electronic credit ledger is maintained in FORM GST PMT-02 for

each registered person on the common portal and every claim of

(ii) Credit card or Debit card through the authorised bank;

input tax credit is to be credited to this ledger.The input tax credit as

(iii) NEFT or RTGS from any bank; or self-assessed in the return by a registered person is credited to his

(iv) Over the Counter payment through authorised banks for electronic credit ledger. The only way the electronic credit ledger

deposits up to Rs 10,000/- per challan per tax period, by cash, can be credited is through filing of returns. Earlier the amount of

cheque or demand draft. transitional credit was also credited to the electronic credit ledger

on filing of FORM GST TRAN-1 and FORM GST TRAN-2. It may be

When the payment is made by way of NEFT or RTGS mode from noted that last date for filing of these two forms has already expired

any bank, the mandate form is generated along with the challan long back. The amount available in the electronic credit ledger can

on the common portal and the same has to be submitted to be used for making any payment towards output tax under the

the bank from where the payment is to be made. The mandate CGST/SGTS/UTGST/IGST/ Cess Acts.

form remains valid for a period of fifteen days from the date of

generation of challan. In case a registered person has claimed refund of any unutilized

On successful credit of the amount to the concerned government amount from the electronic credit ledger in accordance with the

account maintained in the authorised bank, a Challan provisions of section 54, the amount to the extent of the claim is

Identification Number (CIN) is generated by the collecting bank debited in the said ledger.

and the same is indicated in the challan.On receipt of the CIN

from the collecting bank, the said amount gets credited to the If the refund so filed is rejected, either fully or partly, the amount

electronic cash ledger of the registered person on whose behalf debited to the extent of rejection, is re-credited to the electronic

the deposit has been made and the common portal makes credit ledger by the proper officer by an order made in FORM GST

available a receipt to this effect. PMT-03.

In case the bank account is debited but CIN has not been Unless otherwise allowed, entries are not allowed to be made

generated or generated but not communicated to the common directly in the electronic credit ledger under any circumstance.

portal, then the said person has to represent electronically in

FORM GST PMT-07

Prepared by: National Academy of Customs, Indirect Taxes & Narcotics

Follow us on:

@CBIC_India cbicindia

You might also like

- Corporations in Financial Difficulty: Mcgraw-Hill/ IrwinDocument27 pagesCorporations in Financial Difficulty: Mcgraw-Hill/ IrwinEva almahNo ratings yet

- Settlement of ClaimsDocument14 pagesSettlement of ClaimsshikhaNo ratings yet

- New Charts of Insolvency Bankruptcy Code 2016 PDFDocument9 pagesNew Charts of Insolvency Bankruptcy Code 2016 PDFDeepak WadhwaNo ratings yet

- Financial Reporting - SampleDocument42 pagesFinancial Reporting - Samplefchemtai4966No ratings yet

- Accounting Notes Fs 1Document1 pageAccounting Notes Fs 1sara 1No ratings yet

- Amortization Pattern Check Reconciliation: Andreea Lungu-Tranole Alexandra-Elena DrugaDocument15 pagesAmortization Pattern Check Reconciliation: Andreea Lungu-Tranole Alexandra-Elena DrugaAdrian StefanescuNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- Alinas YnchauDocument43 pagesAlinas YnchauRabelais MedinaNo ratings yet

- Rue I: Leder of Comment NoDocument1 pageRue I: Leder of Comment NodreaammmNo ratings yet

- Lease Assets Assessment Dec19 CHI Template 01012020 321052022Document7 pagesLease Assets Assessment Dec19 CHI Template 01012020 321052022Steven LaiNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetRathnaNo ratings yet

- SUMMARY WEEK 9 - Deqsha NovendraDocument2 pagesSUMMARY WEEK 9 - Deqsha NovendraDeqsha NovendraNo ratings yet

- SLA Lease AccountingDocument13 pagesSLA Lease AccountingBhavikNo ratings yet

- Resct PolicyDocument640 pagesResct Policyd_narnoliaNo ratings yet

- Adjustments at A GlanceDocument1 pageAdjustments at A GlanceMuhammad UmarNo ratings yet

- FlowCharts 9Document2 pagesFlowCharts 9sopandebnath03No ratings yet

- Cheat Sheet For Final Summary PDFDocument2 pagesCheat Sheet For Final Summary PDFQuy TranNo ratings yet

- Beaches and Resorts TariffsDocument31 pagesBeaches and Resorts TariffskudaNo ratings yet

- Annual Report of IOCL 157Document1 pageAnnual Report of IOCL 157Nikunj ParmarNo ratings yet

- Municipal Debt ReliefDocument29 pagesMunicipal Debt ReliefBenny BerniceNo ratings yet

- Sa Oct08 Irons PDFDocument3 pagesSa Oct08 Irons PDFIfra38No ratings yet

- Parcel BF QRDocument5 pagesParcel BF QRGunina GNo ratings yet

- FAR Lesson 3 ExercisesDocument11 pagesFAR Lesson 3 Exercisesjepsyut75% (4)

- Mapa Conceptual Análisis FinancieroDocument4 pagesMapa Conceptual Análisis FinancieroRoberto SantosNo ratings yet

- A. Hand Book of Agriculture PDFDocument42 pagesA. Hand Book of Agriculture PDFMuqtar Khan100% (2)

- Anuitas DimukaDocument22 pagesAnuitas DimukaNegara AnimeNo ratings yet

- Annex 3A Modified Form A DepartmentAgency Performance Report 52218 1Document3 pagesAnnex 3A Modified Form A DepartmentAgency Performance Report 52218 1pauletricielNo ratings yet

- Chap 014Document45 pagesChap 014Aditya HidayatNo ratings yet

- Department/Agency:: I. Streamlining and Process Improvement of The Agency's Critical ServicesDocument2 pagesDepartment/Agency:: I. Streamlining and Process Improvement of The Agency's Critical ServicesPatrick GoNo ratings yet

- FORMATDocument10 pagesFORMATShreeram vikiNo ratings yet

- PDFDocument347 pagesPDFkevin kimani chege100% (1)

- Activity Diagram - Case Studies - SOLUTIONDocument1 pageActivity Diagram - Case Studies - SOLUTIONSorin GabrielNo ratings yet

- Sched DDocument2 pagesSched DZach EdwardsNo ratings yet

- Chapter 14Document21 pagesChapter 14Kim Patrice NavarraNo ratings yet

- Adjustments:: Outstanding/Prepaid ExpenditureDocument25 pagesAdjustments:: Outstanding/Prepaid ExpenditureParag DhandeNo ratings yet

- The Accounting Cycle:: Capturing Economic EventsDocument44 pagesThe Accounting Cycle:: Capturing Economic Eventsasifmalik2No ratings yet

- Ifrs Debt Modifications Ifrs 9Document8 pagesIfrs Debt Modifications Ifrs 9Paul DoroinNo ratings yet

- 19e (12-00) Develop The Audit Program - Prepaid Expenses and Other AssetsDocument2 pages19e (12-00) Develop The Audit Program - Prepaid Expenses and Other AssetsTran AnhNo ratings yet

- Constructive Cash Distributions in A Partnership - How and When TDocument8 pagesConstructive Cash Distributions in A Partnership - How and When TAleaNo ratings yet

- Updated Ror Accounting 2021Document7 pagesUpdated Ror Accounting 2021IFSU DQuANo ratings yet

- Goods and Services Tax - Negative Liablity StatementDocument2 pagesGoods and Services Tax - Negative Liablity StatementANAND AND COMPANYNo ratings yet

- Loan Amortization ScheduleDocument18 pagesLoan Amortization SchedulejlscdsNo ratings yet

- Indian Accounting Standard 37: Contingent LiabilityDocument14 pagesIndian Accounting Standard 37: Contingent LiabilityRITZ BROWNNo ratings yet

- Bài Tập PTTCDocument19 pagesBài Tập PTTCQuyên NguyễnNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument1 pageChapter 4 - Completing The Accounting CycleLê Nguyễn Anh ThưNo ratings yet

- ICA Comments Responses 06112020Document13 pagesICA Comments Responses 06112020Rohit Anand DasNo ratings yet

- Current Liabilities Provisions Contingencies: CERCADO, Geran Kearn L. BSA-2 ACC 221 2:15-4:15PM April 5, 2021Document2 pagesCurrent Liabilities Provisions Contingencies: CERCADO, Geran Kearn L. BSA-2 ACC 221 2:15-4:15PM April 5, 2021Kearn CercadoNo ratings yet

- Financial Reporting WDocument345 pagesFinancial Reporting Wgordonomond2022No ratings yet

- 3 AccountingDocument39 pages3 AccountingSaltanat ShamovaNo ratings yet

- Hand Book of Agriculture Dr. SurjuseDocument40 pagesHand Book of Agriculture Dr. SurjuseMuqtar KhanNo ratings yet

- Prof El 1 Fourth Activity. PosaDocument10 pagesProf El 1 Fourth Activity. PosaSufea PosaNo ratings yet

- Wacc Calculation SimplifiedDocument2 pagesWacc Calculation SimplifiedPranjalNo ratings yet

- AdjustmentDocument8 pagesAdjustmentBibin SavioNo ratings yet

- Chapter 4 Concept MapDocument1 pageChapter 4 Concept MapClyde SaladagaNo ratings yet

- Bonds PayableDocument1 pageBonds PayableHeaven HeartNo ratings yet

- Corrigendum of SoftDocument11 pagesCorrigendum of SoftAdarsh V KesavanNo ratings yet

- Related Party DiscloseDocument5 pagesRelated Party DiscloseSelvi SNo ratings yet

- (Reviewer) Credit Transactions (San Beda)Document34 pages(Reviewer) Credit Transactions (San Beda)Carl Joshua Dayrit100% (1)

- Fma 03 (I)Document43 pagesFma 03 (I)Av ElaNo ratings yet

- Treatise On Capital BudgetingDocument6 pagesTreatise On Capital BudgetingRohit BajpaiNo ratings yet

- Cash Flow EstimationDocument10 pagesCash Flow EstimationRohit BajpaiNo ratings yet

- Discounted Cash FlowsDocument4 pagesDiscounted Cash FlowsRohit BajpaiNo ratings yet

- Free Cash Flow To Equity InvestorsDocument11 pagesFree Cash Flow To Equity InvestorsRohit BajpaiNo ratings yet

- Estimation of Costs and Benefits of A ProposalDocument12 pagesEstimation of Costs and Benefits of A ProposalRohit BajpaiNo ratings yet

- Working Capital Management Debendra ShawDocument6 pagesWorking Capital Management Debendra ShawRohit BajpaiNo ratings yet

- What Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMDocument4 pagesWhat Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMRohit BajpaiNo ratings yet

- What Is Working Capital FinanceDocument3 pagesWhat Is Working Capital FinanceRohit BajpaiNo ratings yet

- Valuation of Securities Using Standard Valuation MethodsDocument3 pagesValuation of Securities Using Standard Valuation MethodsRohit BajpaiNo ratings yet

- Security Valuation: Meaning and FactorsDocument7 pagesSecurity Valuation: Meaning and FactorsRohit BajpaiNo ratings yet

- What Is Working Capital ManagementDocument3 pagesWhat Is Working Capital ManagementRohit BajpaiNo ratings yet

- Understanding Working CapitalDocument11 pagesUnderstanding Working CapitalRohit BajpaiNo ratings yet

- What Is Working CapitalDocument4 pagesWhat Is Working CapitalRohit BajpaiNo ratings yet

- Need For Working CapitalDocument6 pagesNeed For Working CapitalRohit BajpaiNo ratings yet

- Understanding Budget VariancesDocument2 pagesUnderstanding Budget VariancesRohit BajpaiNo ratings yet

- Definition of Supply Under GSTDocument8 pagesDefinition of Supply Under GSTRohit Bajpai100% (1)

- Accounting Notes: Static Vs Flexible BudgetsDocument5 pagesAccounting Notes: Static Vs Flexible BudgetsRohit BajpaiNo ratings yet

- Supply Between Related Persons or Distinct PersonsDocument3 pagesSupply Between Related Persons or Distinct PersonsRohit BajpaiNo ratings yet

- Explaining Budget VariancesDocument2 pagesExplaining Budget VariancesRohit BajpaiNo ratings yet

- What Does Supply Mean Under GSTDocument5 pagesWhat Does Supply Mean Under GSTRohit BajpaiNo ratings yet

- GST Update08012022Document50 pagesGST Update08012022Rohit BajpaiNo ratings yet

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTRohit BajpaiNo ratings yet

- Budgeting Vs Financial ForecatingDocument3 pagesBudgeting Vs Financial ForecatingRohit BajpaiNo ratings yet

- Pace and Supply Under GSTDocument14 pagesPace and Supply Under GSTRohit BajpaiNo ratings yet

- What Is The Definition of Financial ForecastingDocument10 pagesWhat Is The Definition of Financial ForecastingRohit BajpaiNo ratings yet

- Financial Forecasting Vs BudgetingDocument2 pagesFinancial Forecasting Vs BudgetingRohit BajpaiNo ratings yet

- Four Main Types of BudgetsDocument5 pagesFour Main Types of BudgetsRohit BajpaiNo ratings yet

- Financial Budget: What Is A Budget?Document5 pagesFinancial Budget: What Is A Budget?Rohit BajpaiNo ratings yet

- Business Budget: What Is It & Why Is It Important?: ClutchDocument8 pagesBusiness Budget: What Is It & Why Is It Important?: ClutchRohit Bajpai100% (1)

- Dela Cruz - Cloud Computing-1Document4 pagesDela Cruz - Cloud Computing-1Charles TuazonNo ratings yet

- ABRERA Activity 2 - Transaction AnalysisDocument2 pagesABRERA Activity 2 - Transaction AnalysisZoram AbreraNo ratings yet

- Variable Costing Discussion ProblemsDocument2 pagesVariable Costing Discussion ProblemsVatchdemonNo ratings yet

- Barbrik Project Limited: Salary Slip For The Month: Jun-2019Document1 pageBarbrik Project Limited: Salary Slip For The Month: Jun-2019Sanjay Kumar PandeyNo ratings yet

- Raj Rishi Bhartrihari Matsya University, Alwar: Affiliation Form For Additional Subjects/Increased SeatsDocument3 pagesRaj Rishi Bhartrihari Matsya University, Alwar: Affiliation Form For Additional Subjects/Increased SeatsDeepak KumarNo ratings yet

- Trariti Consulitng Group Turnaround Case 1Document4 pagesTrariti Consulitng Group Turnaround Case 1Vansh AggarwalNo ratings yet

- Reema KhanDocument1 pageReema Khanattock jadeedNo ratings yet

- Labor Laws and Management in The Tourism EstablishmentsDocument6 pagesLabor Laws and Management in The Tourism EstablishmentsLayna AcostaNo ratings yet

- Code of Federal Regulations, Title 37 Patents, Trademarks and CopyrightsDocument549 pagesCode of Federal Regulations, Title 37 Patents, Trademarks and CopyrightsGiuseppinaNo ratings yet

- Business Studies - Class 11 NotesDocument106 pagesBusiness Studies - Class 11 Notessaanvi padhye100% (1)

- Word Level Type Meaning Example: InvestigationDocument4 pagesWord Level Type Meaning Example: InvestigationZubaida MhdNo ratings yet

- Provide SHORT and SIMPLE Answers To The Following QuestionsDocument3 pagesProvide SHORT and SIMPLE Answers To The Following QuestionsMITA AGUSTIANANo ratings yet

- Business Plan Project Student TemplateDocument16 pagesBusiness Plan Project Student TemplateMiomayaNo ratings yet

- Dharavi Redevelopment ProjectDocument1 pageDharavi Redevelopment ProjectDanish MallickNo ratings yet

- ACCO 420 Case 1 - FINALDocument5 pagesACCO 420 Case 1 - FINALJane YangNo ratings yet

- ImagineFX - May 2024Document100 pagesImagineFX - May 2024sunil bohraNo ratings yet

- Team Charter: Process and Quality Improvement of Product XDocument2 pagesTeam Charter: Process and Quality Improvement of Product XDeepti Mhatre100% (1)

- Week 6 Entrepreneurship and InnovationDocument25 pagesWeek 6 Entrepreneurship and InnovationHamada BakheetNo ratings yet

- Accounting in Mesopotamia, Circa 3500 B.C.Document6 pagesAccounting in Mesopotamia, Circa 3500 B.C.AMAURYNo ratings yet

- Achieving Superior QualityDocument2 pagesAchieving Superior QualityPradeep ChintuNo ratings yet

- A FrAmework For Successful Hotel DevelopmentsDocument16 pagesA FrAmework For Successful Hotel DevelopmentsMurat KaraNo ratings yet

- Cambridge IGCSE™: Economics 0455/21 May/June 2021Document26 pagesCambridge IGCSE™: Economics 0455/21 May/June 2021Linh HoàngNo ratings yet

- Planning Engineer ResponsibilitiesDocument4 pagesPlanning Engineer ResponsibilitiesOmerson RagupathyNo ratings yet

- Ericsson Oil Gas Solution BriefDocument7 pagesEricsson Oil Gas Solution BriefTanesan WyotNo ratings yet

- Kelvin Lau MWI +RRDocument18 pagesKelvin Lau MWI +RRUniversityJCNo ratings yet

- Application of Queuing Theory in Construction: June 2012Document8 pagesApplication of Queuing Theory in Construction: June 2012ضیاء گل مروتNo ratings yet

- Business and IndustyDocument3 pagesBusiness and IndustysantoshskpurNo ratings yet

- CH 19 - Interim Financial ReportingDocument4 pagesCH 19 - Interim Financial ReportingJoyce Anne GarduqueNo ratings yet

- Summary Strategic Management 2Document12 pagesSummary Strategic Management 2Mariët KrebsNo ratings yet

- RFP DOCUMENT FOR EPC 28.11.2018 - Copy 2Document84 pagesRFP DOCUMENT FOR EPC 28.11.2018 - Copy 2Nitu SinghNo ratings yet