Professional Documents

Culture Documents

Four Main Types of Budgets

Uploaded by

Rohit BajpaiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Four Main Types of Budgets

Uploaded by

Rohit BajpaiCopyright:

Available Formats

Four Main Types of Budgets/Budgeting Methods

There are four common types of budgets that companies use: (1)

incremental, (2) activity-based, (3) value proposition, and (4) zero-based.

These four budgeting methods each have their own advantages and

disadvantages, which will be discussed in more detail in this guide.

1. Incremental budgeting

Incremental budgeting takes last year’s actual figures and adds or subtracts

a percentage to obtain the current year’s budget. It is the most common

method of budgeting because it is simple and easy to understand.

Incremental budgeting is appropriate to use if the primary cost drivers do

not change from year to year. However, there are some problems with

using the method:

It is likely to perpetuate inefficiencies. For example, if a manager

knows that there is an opportunity to grow his budget by 10% every

year, he will simply take that opportunity to attain a bigger budget,

while not putting effort into seeking ways to cut costs or economize.

It is likely to result in budgetary slack. For example, a manager might

overstate the size of the budget that the team actually needs so it

appears that the team is always under budget.

It is also likely to ignore external drivers of activity and performance.

For example, there is very high inflation in certain input costs.

Incremental budgeting ignores any external factors and simply

assumes the cost will grow by, for example, 10% this year.

2. Activity-based budgeting

Activity-based budgeting is a top-down budgeting approach that

determines the amount of inputs required to support the targets or outputs

set by the company. For example, a company sets an output target of $100

million in revenues. The company will need to first determine the activities

that need to be undertaken to meet the sales target, and then find out the

costs of carrying out these activities.

3. Value proposition budgeting

In value proposition budgeting, the budgeter considers the following

questions:

Why is this amount included in the budget?

Does the item create value for customers, staff, or other

stakeholders?

Does the value of the item outweigh its cost? If not, then is there

another reason why the cost is justified?

Value proposition budgeting is really a mindset about making sure that

everything that is included in the budget delivers value for the business.

Value proposition budgeting aims to avoid unnecessary expenditures –

although it is not as precisely aimed at that goal as our final budgeting

option, zero-based budgeting.

4. Zero-based budgeting

As one of the most commonly used budgeting methods, zero-based

budgeting starts with the assumption that all department budgets are zero

and must be rebuilt from scratch. Managers must be able to justify every

single expense. No expenditures are automatically “okayed”. Zero-based

budgeting is very tight, aiming to avoid any and all expenditures that are

not considered absolutely essential to the company’s successful (profitable)

operation. This kind of bottom-up budgeting can be a highly effective way

to “shake things up”.

The zero-based approach is good to use when there is an urgent need for

cost containment, for example, in a situation where a company is going

through a financial restructuring or a major economic or market downturn

that requires it to reduce the budget dramatically.

Zero-based budgeting is best suited for addressing discretionary costs

rather than essential operating costs. However, it can be an extremely time-

consuming approach, so many companies only use this approach

occasionally.

Levels of Involvement in Budgeting Process

We want buy-in and acceptance from the entire organization in the

budgeting process, but we also want a well-defined budget and one that is

not manipulated by people. There is always a trade-off between goal

congruence and involvement. The three themes outlined below need to be

taken into consideration with all types of budgets.

Imposed budgeting

Imposed budgeting is a top-down process where executives adhere to a

goal that they set for the company. Managers follow the goals and impose

budget targets for activities and costs. It can be effective if a company is in

a turnaround situation where they need to meet some difficult goals, but

there might be very little goal congruence.

Negotiated budgeting

Negotiated budgeting is a combination of both top-down and bottom-up

budgeting methods. Executives may outline some of the targets they

would like to hit, but at the same time, there is shared responsibility for

budget preparation between managers and employees. This increased

involvement in the budgeting process by lower-level employees may make

it easier to adhere to budget targets, as the employees feel like they have a

more personal interest in the success of the budget plan.

Participative budgeting

Participative budgeting is a roll-up approach where employees work from

the bottom up to recommend targets to the executives. The executives

may provide some input, but they more or less take the recommendations

as given by department managers and other employees (within reason, of

course). Operations are treated as autonomous subsidiaries and are given

a lot of freedom to set up the budget.

You might also like

- Job CardDocument1 pageJob CardRoshan KaluarachchiNo ratings yet

- Region 3Document406 pagesRegion 3Hashim HanifNo ratings yet

- English Entrance ExamDocument15 pagesEnglish Entrance ExamAlexandra OanaNo ratings yet

- Preboring Using Vibro HammerDocument4 pagesPreboring Using Vibro Hammerakash nairNo ratings yet

- Tesco Annual Report 2021Document220 pagesTesco Annual Report 2021johnny smity100% (1)

- Capital Asset ProcedureDocument25 pagesCapital Asset Procedureslamy09No ratings yet

- RFP Strategic Organizational Review Final 15sep2010Document64 pagesRFP Strategic Organizational Review Final 15sep2010chris3432No ratings yet

- Final Swot and HR ChllangesDocument36 pagesFinal Swot and HR ChllangesIzazul Haque EffendyNo ratings yet

- Ms HaulageDocument34 pagesMs HaulagePatman MutomboNo ratings yet

- Alternative InvestmentsDocument18 pagesAlternative InvestmentsSenthil Kumar KNo ratings yet

- Ao2 Acma 05 October 2011Document11 pagesAo2 Acma 05 October 2011cl1veNo ratings yet

- Rich Dad Poor Dad PresentationDocument31 pagesRich Dad Poor Dad Presentationbindu15100% (1)

- 2020 ExxonMobil Investor DayDocument162 pages2020 ExxonMobil Investor DayPetr KryuchkovNo ratings yet

- M2 CompetenciesDocument31 pagesM2 CompetenciesDon de Vera100% (1)

- Balanced ScorecardDocument8 pagesBalanced ScorecardFitriana NugrahaNo ratings yet

- International Equity FinancingDocument14 pagesInternational Equity FinancingMuazzam Mughal100% (1)

- Building Your Company's VisionDocument15 pagesBuilding Your Company's VisionJose Carlos BulaNo ratings yet

- GE 9 CellDocument20 pagesGE 9 CellakhilNo ratings yet

- Wharton Strategic Business Planning Part 33785Document54 pagesWharton Strategic Business Planning Part 33785earl58100% (1)

- Consortium Agreement - Letstrack EffizentDocument5 pagesConsortium Agreement - Letstrack EffizentVishal GuptaNo ratings yet

- Business and Finance TerminologyDocument15 pagesBusiness and Finance TerminologyKat KatNo ratings yet

- Common Stocks and Uncommon Profits and Other WritingsDocument13 pagesCommon Stocks and Uncommon Profits and Other WritingsAnirbanDeshmukhNo ratings yet

- LURN: Street Vending PresentationDocument23 pagesLURN: Street Vending PresentationlurnnetworkNo ratings yet

- THE USE OF COCONUT FIBRE AS STANDARD PHDocument3 pagesTHE USE OF COCONUT FIBRE AS STANDARD PHKenn RubisNo ratings yet

- Four Main Types of BudgetsDocument4 pagesFour Main Types of BudgetsGodu lokalNo ratings yet

- Types of BudgetsDocument5 pagesTypes of BudgetsSaydwali KhanNo ratings yet

- Pa 214 Reports On Different Types of BudgetingDocument5 pagesPa 214 Reports On Different Types of BudgetingSharon LopezNo ratings yet

- Method of BudgetingDocument2 pagesMethod of BudgetingNAMRATA SHARMANo ratings yet

- What Is A BudgetDocument6 pagesWhat Is A BudgetFentahun AmareNo ratings yet

- Budgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToDocument6 pagesBudgeting Is A Process. This Means Budgeting Is A Number of Activities Performed in Order ToJoy VNo ratings yet

- Divine Word College of Vigan Vigan City, Ilocos Sur Graduate School of Business AdministrationDocument7 pagesDivine Word College of Vigan Vigan City, Ilocos Sur Graduate School of Business AdministrationJoy VNo ratings yet

- Budgets and Managing MoneyDocument51 pagesBudgets and Managing MoneyIrtiza Shahriar ChowdhuryNo ratings yet

- BudgetingDocument7 pagesBudgetingGc Abdul RehmanNo ratings yet

- Types of Budgets - The Four Most Common Budgeting MethodsDocument8 pagesTypes of Budgets - The Four Most Common Budgeting MethodsPAK & CANADA TRADING LLC.No ratings yet

- Four Planning Approaches To Operating BudgetingDocument14 pagesFour Planning Approaches To Operating BudgetingAbdul Halim JoharNo ratings yet

- Budget in 1Document9 pagesBudget in 1Tanwi Jain100% (1)

- The Budgeting ProcessDocument3 pagesThe Budgeting Processammadey21@gmail.comNo ratings yet

- Budget Analyst Interview QuestionsDocument6 pagesBudget Analyst Interview QuestionsFLORENCE DE CASTRONo ratings yet

- The fundamental-WPS OfficeDocument6 pagesThe fundamental-WPS Officeolagbenrogloria79No ratings yet

- Ebook by AshwaniDocument13 pagesEbook by AshwaniAshwani AggarwalNo ratings yet

- Marketing BudgetDocument13 pagesMarketing Budgetshahbazahmad0057No ratings yet

- What Is Zero Based Budgeting (ZBB) ?: Management ToolDocument35 pagesWhat Is Zero Based Budgeting (ZBB) ?: Management ToolApoorva BadolaNo ratings yet

- Budget Management-OPMAN NotesDocument5 pagesBudget Management-OPMAN NotesMaricar DomingoNo ratings yet

- Budgeting MethodDocument5 pagesBudgeting MethodNikkiyalNo ratings yet

- BAF3105-Performance Measurement and ControlDocument11 pagesBAF3105-Performance Measurement and ControlJEFF SHIKALINo ratings yet

- United States Federal Budget: Revenue ExpensesDocument4 pagesUnited States Federal Budget: Revenue ExpensesSharmarke Mohamed AhmedNo ratings yet

- The Role of Budgeting in Management Planning and Control: Ing, and Flexible BudgetsDocument0 pagesThe Role of Budgeting in Management Planning and Control: Ing, and Flexible BudgetstuibidienNo ratings yet

- What Is Budgeting?: Strategy Into Targets and BudgetsDocument11 pagesWhat Is Budgeting?: Strategy Into Targets and BudgetsAriela DavisNo ratings yet

- Catalog SCHPDFDocument26 pagesCatalog SCHPDFNasif JameelNo ratings yet

- What Is A BudgetDocument7 pagesWhat Is A BudgetMichaelNo ratings yet

- 23 - Budgeting For Planning and ControlDocument37 pages23 - Budgeting For Planning and ControlEka FalahNo ratings yet

- 1) Identify The Five Budgeting Methods and Briefly Describe EachDocument3 pages1) Identify The Five Budgeting Methods and Briefly Describe EachREDAPPLE MEDIANo ratings yet

- Ebook by AshwaniDocument13 pagesEbook by AshwaniAshwani AggarwalNo ratings yet

- Zero Based BudgetingDocument16 pagesZero Based BudgetingDNo ratings yet

- Case 5A - M. Gerry Naufal. R. G. - 29123123 - YP69ADocument5 pagesCase 5A - M. Gerry Naufal. R. G. - 29123123 - YP69Am.gerryNo ratings yet

- Page 1 of 9Document9 pagesPage 1 of 9Gemechis LemaNo ratings yet

- BudgetDocument6 pagesBudgetKedar SonawaneNo ratings yet

- Lesson 14 TextbookDocument36 pagesLesson 14 Textbookluo jamesNo ratings yet

- What Is A Budget? When Preparing Budgets, What Budget Must A Manufacturing Company Start With?Document2 pagesWhat Is A Budget? When Preparing Budgets, What Budget Must A Manufacturing Company Start With?duongNo ratings yet

- Working Capital Management Debendra ShawDocument6 pagesWorking Capital Management Debendra ShawRohit BajpaiNo ratings yet

- What Is Working CapitalDocument4 pagesWhat Is Working CapitalRohit BajpaiNo ratings yet

- Estimation of Costs and Benefits of A ProposalDocument12 pagesEstimation of Costs and Benefits of A ProposalRohit BajpaiNo ratings yet

- Treatise On Capital BudgetingDocument6 pagesTreatise On Capital BudgetingRohit BajpaiNo ratings yet

- Free Cash Flow To Equity InvestorsDocument11 pagesFree Cash Flow To Equity InvestorsRohit BajpaiNo ratings yet

- Cash Flow EstimationDocument10 pagesCash Flow EstimationRohit BajpaiNo ratings yet

- Security Valuation: Meaning and FactorsDocument7 pagesSecurity Valuation: Meaning and FactorsRohit BajpaiNo ratings yet

- What Is Working Capital ManagementDocument3 pagesWhat Is Working Capital ManagementRohit BajpaiNo ratings yet

- Understanding Working CapitalDocument11 pagesUnderstanding Working CapitalRohit BajpaiNo ratings yet

- What Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMDocument4 pagesWhat Is Valuation?: Capital Structure Market Value Fundamental Analysis Capm DDMRohit BajpaiNo ratings yet

- Explaining Budget VariancesDocument2 pagesExplaining Budget VariancesRohit BajpaiNo ratings yet

- Definition of Supply Under GSTDocument8 pagesDefinition of Supply Under GSTRohit Bajpai100% (1)

- Accounting Notes: Static Vs Flexible BudgetsDocument5 pagesAccounting Notes: Static Vs Flexible BudgetsRohit BajpaiNo ratings yet

- GST Update08012022Document50 pagesGST Update08012022Rohit BajpaiNo ratings yet

- What Does Supply Mean Under GSTDocument5 pagesWhat Does Supply Mean Under GSTRohit BajpaiNo ratings yet

- Understanding Budget VariancesDocument2 pagesUnderstanding Budget VariancesRohit BajpaiNo ratings yet

- Need For Working CapitalDocument6 pagesNeed For Working CapitalRohit BajpaiNo ratings yet

- Supply Between Related Persons or Distinct PersonsDocument3 pagesSupply Between Related Persons or Distinct PersonsRohit BajpaiNo ratings yet

- Electronic Cash/Credit Ledgers and Liability Register in GSTDocument2 pagesElectronic Cash/Credit Ledgers and Liability Register in GSTRohit BajpaiNo ratings yet

- What Is The Definition of Financial ForecastingDocument10 pagesWhat Is The Definition of Financial ForecastingRohit BajpaiNo ratings yet

- Pace and Supply Under GSTDocument14 pagesPace and Supply Under GSTRohit BajpaiNo ratings yet

- Meaning and Scope of Supply Under GSTDocument5 pagesMeaning and Scope of Supply Under GSTRohit BajpaiNo ratings yet

- Budgeting Vs Financial ForecatingDocument3 pagesBudgeting Vs Financial ForecatingRohit BajpaiNo ratings yet

- Financial Forecasting Vs BudgetingDocument2 pagesFinancial Forecasting Vs BudgetingRohit BajpaiNo ratings yet

- Business Budget: What Is It & Why Is It Important?: ClutchDocument8 pagesBusiness Budget: What Is It & Why Is It Important?: ClutchRohit Bajpai100% (1)

- Financial Budget: What Is A Budget?Document5 pagesFinancial Budget: What Is A Budget?Rohit BajpaiNo ratings yet

- What Is Auditing?: The Three Different Types of AuditsDocument4 pagesWhat Is Auditing?: The Three Different Types of AuditsRohit BajpaiNo ratings yet

- How The IRS Works: Functions and Audits: Internal Revenue ServiceDocument4 pagesHow The IRS Works: Functions and Audits: Internal Revenue ServiceRohit BajpaiNo ratings yet

- An IRS Audit Is A ReviewDocument4 pagesAn IRS Audit Is A ReviewRohit BajpaiNo ratings yet

- Building A Budget: Credit Card DebtDocument5 pagesBuilding A Budget: Credit Card DebtRohit BajpaiNo ratings yet

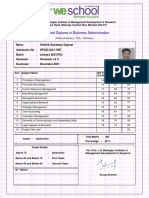

- Advanced Diploma in Business Administration: Hrithik Sandeep GajmalDocument1 pageAdvanced Diploma in Business Administration: Hrithik Sandeep GajmalNandanNo ratings yet

- Four Fold TestDocument19 pagesFour Fold TestNeil John CallanganNo ratings yet

- LllllllolllDocument24 pagesLllllllolllAgustiar ZhengNo ratings yet

- Profile Options in Oracle Projects: System Administrator's Guide)Document16 pagesProfile Options in Oracle Projects: System Administrator's Guide)hello1982No ratings yet

- Apr Form No. 02Document4 pagesApr Form No. 02Francis Gavin Delos ReyesNo ratings yet

- Lowrider - June 2018Document92 pagesLowrider - June 2018Big Flores100% (2)

- Questionnaire For Financial Advosory SurveyDocument2 pagesQuestionnaire For Financial Advosory SurveyharishmnNo ratings yet

- Equity Research Report - CIMB 27 Sept 2016Document14 pagesEquity Research Report - CIMB 27 Sept 2016Endi SingarimbunNo ratings yet

- The Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureDocument17 pagesThe Functional Structure 2. Divisional Structure 3. The Strategic Business Unit (SBU) Structure 4. The Matrix StructureYousab KaldasNo ratings yet

- LandersMembership PDFDocument2 pagesLandersMembership PDFRoiland Atienza BaybayonNo ratings yet

- POM TopicsDocument2 pagesPOM TopicsAnkit SankheNo ratings yet

- OpenText Business Center Capture For SAP Solutions 16.3 - Customization Guide English (CPBC160300-CGD-EN-01) PDFDocument278 pagesOpenText Business Center Capture For SAP Solutions 16.3 - Customization Guide English (CPBC160300-CGD-EN-01) PDFAshish Yadav100% (2)

- Literature ReviewDocument6 pagesLiterature Reviewanon_230550501No ratings yet

- Wipro Internship ExperienceDocument3 pagesWipro Internship ExperienceSimranjeet SinghNo ratings yet

- Is The Really Ford's Way Forward?Document23 pagesIs The Really Ford's Way Forward?Gisela Vania AlineNo ratings yet

- Differences Between QuickBooks Pro Premier and EnterpriseDocument7 pagesDifferences Between QuickBooks Pro Premier and Enterpriseathancox5837No ratings yet

- Chapter 16 Personal SellingDocument26 pagesChapter 16 Personal SellingKaloyNo ratings yet

- H Paper EastWest Bank 2Document4 pagesH Paper EastWest Bank 2Justin Dan A. OrculloNo ratings yet

- PAM Contract 2006 Handbook (First Edition)Document258 pagesPAM Contract 2006 Handbook (First Edition)Jonathan ChongNo ratings yet

- Production SystemDocument5 pagesProduction SystemPratiksinh VaghelaNo ratings yet

- HBO Jieliang Home PhoneDocument6 pagesHBO Jieliang Home PhoneAshish BhalotiaNo ratings yet

- Guidance To BS 7121 Part 2 2003Document4 pagesGuidance To BS 7121 Part 2 2003mokshanNo ratings yet

- IC Accounts Payable Ledger 9467Document2 pagesIC Accounts Payable Ledger 9467Rahul BadaikNo ratings yet

- Wipro WInsights Sustainability ReportingDocument3 pagesWipro WInsights Sustainability ReportingHemant ChaturvediNo ratings yet

- Lovell, Jonathan PDFDocument2 pagesLovell, Jonathan PDFAnonymous viLMwYNo ratings yet

- RC SCM310 ProductionOrdersDocument327 pagesRC SCM310 ProductionOrdersRRROMANCANo ratings yet

- Intramuros Adminstration - Exec Summary 06Document9 pagesIntramuros Adminstration - Exec Summary 06Anonymous p47liBNo ratings yet

- Business Management Ethics 1Document29 pagesBusiness Management Ethics 1Christy Malabanan100% (1)

- Reference Form 2011Document473 pagesReference Form 2011LightRINo ratings yet

- L&T Infotech Announces Appointment of Sudhir Chaturvedi As President - Sales (Company Update)Document3 pagesL&T Infotech Announces Appointment of Sudhir Chaturvedi As President - Sales (Company Update)Shyam SunderNo ratings yet