Professional Documents

Culture Documents

NAU Accounting Skills Assessment Practice Exam Revised 0416

NAU Accounting Skills Assessment Practice Exam Revised 0416

Uploaded by

Abdeljalil OuiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NAU Accounting Skills Assessment Practice Exam Revised 0416

NAU Accounting Skills Assessment Practice Exam Revised 0416

Uploaded by

Abdeljalil OuiCopyright:

Available Formats

NAU ACCOUNTING SKILLS ASSESSMENT

PRACTICE EXAM & KEY

1. A company received cash and issued common stock. What was the effect on the accounting

equation?

Stockholders’

Assets Liabilities Equity

A. + NE +

B. - NE -

C. + + NE

D. - - NE

2. A company purchased land by issuing a note payable. What was the effect on the accounting

equation?

Stockholders’

Assets Liabilities Equity

A. - - NE

B. + + NE

C. + NE +

D. - NE -

3. Which of the following financial statements is concerned with the financial position of an

enterprise at a point in time?

A. Retained Earnings Statement.

B. Balance Sheet.

C. Income Statement.

D. Statement of Cash Flows.

4. Cash was collected from a customer on account. Which accounts were debited and credited?

Debit Credit

A. Accounts Receivable Cash

B. Cash Service Revenue

C. Cash Accounts Receivable

D. Cash Accounts Payable

5. Which pair of accounts is increased by recording a credit?

A. Common Stock and Rent Expense.

B. Cash and Accounts Receivable.

C. Treasury Stock and Common Stock.

D. Notes Payable and Service Revenue.

6. Which of the following errors will cause a trial balance to be out of balance?

A. A debit to Office Equipment is incorrectly debited to Office Supplies.

B. The bookkeeper forgot to journalize a transaction.

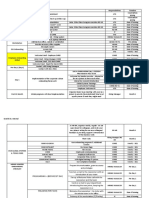

C. The bookkeeper forgot to post a journal entry to the ledger.

D. A credit was posted to an account as a debit.

Accounting Skills Assessment Practice Exam Page 1 of 11

7. When a magazine company receives advance payment for a subscription, it

A. Debits Cash and credits Subscriptions Revenue.

B. Debits Cash and credits Unearned Subscriptions Revenue.

C. Debits Unearned Subscriptions Revenue and credits Cash.

D. Debits Prepaid Subscriptions and credits Cash.

8. The Supplies account had a $360 debit balance at the end of the accounting period before

adjustment for supplies used, and an inventory of $80 worth of unused supplies were on hand.

Which of the following is the required adjusting entry?

A. Debit Supplies $280 and credit Supplies Expense $280.

B. Debit Supplies Expense $280 and credit Supplies $280.

C. Debit Supplies $80 and credit Supplies Expense $80.

D. Debit Supplies Expense $80 and credit Supplies $80.

9. A company’s weekly payroll of $750 is paid on Fridays. There are five days in a pay period.

Assume that the last day of the month falls on Wednesday. Which of the following is the required

adjusting entry?

A. Debit Unpaid Salaries and credit Salaries Payable for $450.

B. Debit Salaries Expense and credit Salaries Payable for $450.

C. Debit Salaries Expense and credit Salaries Payable for $300.

D. Debit Salaries Payable and credit Salaries Expense for $450.

10. A company had the following balance sheet accounts and balances:

Accounts Payable $ 24,000 Cash $12,000

Accounts Receivable 4,000 Common Stock ?

Buildings & Equipment (net) 68,000 Retained Earnings 8,000

What is the balance of the Common Stock account?

A. $76,000

B. $68,000

C. $60,000

D. $52,000

11. An accountant is preparing adjusting journal entries. Which of the following entries could not

possibly be a correct adjusting journal entry?

A. Rent Expense 5,000

Rent Payable 5,000

B. Accounts Receivable 5,000

Service Revenue 5,000

C. Interest Expense 5,000

Interest Revenue 5,000

D. Unearned Revenue 5,000

Service Revenue 5,000

12. A company declared cash dividends of $0.20 per share. If there are 500,000 shares of common

stock authorized, 100,000 shares issued, and 80,000 shares outstanding at the date of

declaration, what is the amount that the company should record for the dividend?

A. $4,000

B. $16,000

C. $20,000

D. $100,000

Accounting Skills Assessment Practice Exam Page 2 of 11

13. What is the amount of Income from Operations that a company should report on its current year

multiple-step income statement based on the following data?

Cost of goods sold $ 250,000 Net sales $ 600,000

Income taxes expense 50,000 Selling, general &

Interest expense 25,000 administrative expenses 150,000

A. $350,000

B. $200,000

C. $175,000

D. $125,000

14. A company sold equipment for $100,000; the equipment had cost $300,000 and had accumulated

depreciation of $180,000. The company’s journal entry to record the sale of the equipment would

include a

A. Credit to Sale of Equipment for $100,000.

B. Credit to Equipment for $120,000.

C. Debit to Equipment for $300,000.

D. Debit to Loss on Sale of Equipment for $20,000.

15. Which of the following should be classified as a current asset?

A. Accounts Receivable.

B. Accumulated Depreciation.

C. Franchises.

D. Land Held for Future Use.

16. Which of the following is most likely to appear on the balance sheet as a current liability?

A. Bonds Payable.

B. Accumulated Depreciation.

C. Long-term Notes Payable.

D. Wages Payable.

17. Gross profit equals the difference between net sales and

A. Net Income.

B. Operating Expenses.

C. Cost of Goods Sold plus Operating Expenses.

D. Cost of Goods Sold.

18. Under the perpetual inventory system, in addition to making the entry to record a sale, a

company would

A. Make no additional entry until the end of the period.

B. Debit Cost of Goods Sold and credit Inventory.

C. Debit Cost of Goods Sold and credit Purchases.

D. Debit Inventory and credit Cost of Goods Sold.

Accounting Skills Assessment Practice Exam Page 3 of 11

19. The Allowance for Doubtful Accounts is necessary because

A. Uncollected accounts that are written off must be accumulated in a separate account.

B. When recording Bad Debts Expense, it is not possible to predict specifically which

accounts will not be collected.

C. Management should know how much in credit losses have occurred over the years.

D. A liability results when a credit sale is made.

20. The general ledger account for Accounts Receivable shows a debit balance of $50,000. The

Allowance for Doubtful Accounts has a credit balance of $1,000. If management estimates that

5% of Accounts Receivable will prove uncollectible, Bad Debts Expense would be recorded for

A. $1,500.

B. $2,540.

C. $2,500.

D. $3,500.

21. Interest on a 3-month, 10 percent, $10,000 note receivable is

A. $ 250.

B. $2,500.

C. $ 288.

D. $1,000.

22. The inventory costing method that matches recent costs with recent revenues is

A. Last-in, First-out (LIFO).

B. First-in, First-out (FIFO).

C. Average Cost.

D. Specific Identification.

__________________________________________________________________

Use the following information to answer the next three questions.

Beginning inventory 100 units @ $8.00 = $ 800

Purchase # 1 200 units @ $6.00 = 1,200

Purchase # 2 100 units @ $12.00 = 1,200

Total 400 units $3,200

Ending inventory is 150 units.

23. What is ending inventory under the average cost method?

A. $1,200.

B. $2,000.

C. $ 300.

D. $ 500.

24. What is cost of goods sold under LIFO?

A. $1,100.

B. $1,700.

C. $1,500.

D. $2,100.

25. What is cost of goods sold under FIFO?

A. $1,500.

B. $1,100.

C. $1,700.

D. $2,100.

_________________________________________________________________

Accounting Skills Assessment Practice Exam Page 4 of 11

Use the following information to answer the next three questions.

Nicholson purchased a piece of equipment on for $60,000. The equipment has an estimated useful life of

eight years or 50,000 units of production and an estimated salvage value of $6,000.

26. The amount of depreciation to be recorded for year 2 using the straight-line method of

calculating depreciation, is

A. $ 7,500.

B. $ 6,750.

C. $15,000.

D. $13,500.

27. The amount of depreciation to be recorded for year 1 using the double-declining balance

method, is

A. $13,500.

B. $ 6,000.

C. $15,000.

D. $12,000.

28. The amount of depreciation to be recorded in year 1 using the units-of-activity method and

assuming that 6,500 units are produced, is

A. $4,680.

B. $7,800.

C. $5,200.

D. $7,020.

_________________________________________________________________

29. Jones borrowed $960 from the bank, issuing a 12.5%, 4-month promissory note. Assuming that

the note is issued and paid in the same accounting period, Jones’ entry on the date of payment

will include a

A. Debit to Notes Payable for $960.

B. Debit to Interest Payable for $40.

C. Credit to Cash for $960.

D. Debit to Interest Receivable for $40.

30. On June, 30, 2011, Riddle Corporation issued $500,000 of 8%, 5-year bonds at 100. Interest is

payable semi-annually. The journal entry to record the semiannual interest payment on

December 31, 2011 would credit

A. Interest Expense for $20,000.

B. Cash for $20,000.

C. Cash for $200,000.

D. Bonds Payable for $500,000.

31. Discount on bonds payable should be reported on the balance sheet of the issuing corporation as

a(n)

A. Direct deduction from the face amount of the bonds payable in the long-term liability

section.

B. Direct deduction from retained earnings in the stockholders’ equity section.

C. Asset.

D. Direct addition to the face amount of the bonds payable in the long-term liability section.

Accounting Skills Assessment Practice Exam Page 5 of 11

32. Bonds with a face value of $10,000 were issued at 97. The Cash account will be debited for

A. $970.

B. $10,097.

C. $10,000.

D. $9,700.

33. The following accounts appear in the ledger of Saphire Corporation on December 31, 2011:

Preferred Stock $30,000

Common Stock 60,000

Paid-in Capital in Excess of Par Value, Preferred 7,000

Paid-in Capital in Excess of Par Value, Common 18,000

Retained Earnings 40,000

Treasury Stock 5,000

A balance sheet prepared on December 31, 2011, would report total paid-in capital of

A. $115,000.

B. $ 90,000.

C. $155,000.

D. $160,000.

34. If Saphire Corporation has 80,000 shares of common stock authorized, 50,000 shares of common

stock issued, and holds 4,000 shares of common stock as treasury stock, the total number of

outstanding common shares is

A. 34,000.

B. 76,000.

C. 46,000.

D. 30,000.

35. The Paid-in Capital in Excess of Par Value account normally is credited in a journal entry to

record the issuance of stock when

A. The earnings per share of the stock exceeds par value.

B. The number of shares issued exceeds the par value.

C. Stock is sold at an amount greater than par value.

D. The stated value of the capital stock is greater than the par value.

36. What effect will the purchase of treasury stock have on total stockholders’ equity?

A. Increase.

B. Decrease.

C. No effect.

D. Cannot determine from the information given.

37. Martinez Corporation has 30,000 shares of $10 par value common stock outstanding. On March

17, the Board of Directors declared a 10 percent stock dividend. Market value of the stock was

$13 on March 17. The effect of the declaration and issuance of the stock dividend for Martinez

would include a

A. Decrease to Cash for $39,000.

B. Decrease to Retained Earnings for $39,000.

C. Decrease to Retained Earnings for $30,000.

D. Increase to Common Stock for $39,000.

Accounting Skills Assessment Practice Exam Page 6 of 11

38. The primary purpose of the statement of cash flows is to provide information

A. Regarding the results of operations for a period of time.

B. Regarding a company’s financial position at the end of an accounting period.

C. About a company’s cash receipts and cash payments during an accounting period.

D. About a company’s investing and financing activities.

39. The following data are available for Allen Clapp Corporation:

Net income $200,000

Depreciation expense 40,000

Dividends paid 60,000

Gain on sale of land 10,000

Decrease in accounts receivable 20,000

Decrease in accounts payable 30,000

How much is cash provided by operating activities using the indirect method for the statement of

cash flows?

A. $240,000

B. $280,000

C. $160,000

D. $220,000

40. The following are data concerning cash received or paid from various transactions for Orange

Peels Corporation:

Sale of land $100,000

Sale of equipment 50,000

Issuance of common stock 70,000

Purchase of equipment 30,000

Payment of cash dividends 60,000

How much is net cash provided by investing activities in the statement of cash flows?

A. $190,000

B. $120,000

C. $130,000

D $150,000

41. Ibram Corporation had 200,000 shares of $1 par value common stock outstanding. If Ibram

announces a 4-for-1 stock split, the par value and number of shares outstanding after the stock

split would be:

A. $.25 par; 800,000 shares.

B. $.25 par; 200,000 shares.

C. $1 par; 50,000 shares.

D. $1 par; 800,000 shares.

Accounting Skills Assessment Practice Exam Page 7 of 11

_______________________________________________________________

Use the following information to answer the next 4 questions. Formulas for ratio calculations are

on the last page of this exam.

Hasbro, Inc. is a “worldwide leader in children’s and family leisure time products and services” with a wide

range of toys and games, entertainment offerings, and licensed products. The following information was

provided in Hasbro’s most recent consolidated financial statements (amounts in thousands):

For the Year Ended Dec. 26 2010

Net revenues $ 4,002,161

Cost of sales 1,712,126

Operating profit 587,859

Net earnings 397,752

At Dec. 26 and Dec. 27 2010 2009

Accounts receivable, less allowance for doubtful accounts $ 961,252 $ 1,038,802

Current assets 2,221,049 2,045,032

Total assets 4,093,226 3,896,892

Current liabilities 718,801 815,888

Total liabilities 2,477,806 2,302,120

Total shareholders’ equity 1,615,420 1,594,772

42. What is Hasbro’s profit margin ratio for 2010?

A. 0.1%

B. 9.9%

C. 14.7%

D. 57.2%

43. What is Hasbro’s current ratio for 2010?

A. $1,502,248

B. 0.3 : 1

C. 1.7 : 1

D. 3.1 : 1

44. What is Hasbro’s debt-to-total assets ratio for 2010?

A. 60.5%

B. 43.0%

C. 39.5%

D. 32.4%

45. What is Hasbro’s 2010 return on assets?

A. 14.36 %

B. 9.96 %

C. 9.72 %

D. 0.10 %

_______________________________________________________________

Accounting Skills Assessment Practice Exam Page 8 of 11

The following questions test basic math reasoning skills that are used in accounting.

_______________________________________________________________

Use the following information to answer the next three questions.

Future Value of Present Value of

Future Value of $1 Ordinary Annuity Present Value of Ordinary of $1 at

Periods at 12 Percent of $1 at 12 Percent $1 at 12 Percent 12 Percent

1 1.120 1.000 0.893 0.893

2 1.254 2.120 0.797 1.690

3 1.405 3.374 0.712 2.402

46. A single deposit of $800 made at the beginning period 1 would grow to how much at the end of

three years, assuming a 12 percent interest rate?

A. $1,254.

B. $ 896.

C. $1,124.

D. $2,699.

47. If an accumulation of $500 is desired at the end of three years, what amount must be deposited

now to accomplish that goal, assuming a 12 percent interest rate?

A. $148.

B. $356.

C. $446.

D. $268.

48. A deposit of $200 made at the end of each year for three years would grow to how much,

assuming a 12 percent rate?

A. $843.

B. $841.

C. $675.

D. $672.

__________________________________________________________________

49. A company has budgeted $328,000 to be used by both the marketing department and the finance

department. The marketing department uses cash at the rate of $42,000 per month, which is

three times the rate of the finance department. How many months until the budgeted amount is

used up? Round all amounts to the nearest tenth.

A. 7.8 months

B. 5.9 months

C. 2.6 months

D. 6.2 months

50. At the end of a year, a company's net income increased 30%. At the end of the second year, the

income decreased 25% from the previous year. What was the percentage change for the two

years?

A. (2.5%) decrease

B. 2.5% increase

C. (5.0%) decrease

D. 5.0% increase

Accounting Skills Assessment Practice Exam Page 9 of 11

51. You just paid $35,640 for a car, including sales tax. The sales tax rate is 8%. What is the pre-tax

price of the car?

A. $35,640

B. $32,789

C. $33,000

D. $35,355

52. The Ames and Johnson partnership allocates profits and losses 80% to Ames and 20% to

Johnson. Smith enters the partnership and receives a 25% share of profits and losses. What

share of profits and losses does Ames now share?

A. 80%

B. 70%

C. 55%

D. 60%

53. At the beginning of last year your departmental budget was 40% of the total budget. This year it

was 30% of the total budget. What percent did your budget decrease from last year?

A. 25%

B. 10%

C. 12%

D. 33%

54. Johnson Company purchased merchandise with an invoice cost of $90,000. The vendor's terms

offered a 4% discount on any part of the invoice paid within 10 days. Johnson Company made a

cash payment of $48,000 within the 10 days. How much did Johnson Company still owe after

making the payment?

A. $42,000

B. $40,000

C. $43,920

D. $40,080

55. In which year was Matrix Connections’ highest overall revenue based on these three products?

A. 2010

B. 2011

C. 2012

D. Cannot be determined

Accounting Skills Assessment Practice Exam Page 10 of 11

Solutions to Practice Exam

Multiple Choice

1. A 2. B 3. B 4. C 5. D 6. D 7. B 8. B 9. B 10. D

11. C 12. B 13. B 14. D 15. A 16. D 17. D 18. B 19. B 20. A

21. A 22. A 23. A 24. D 25. C 26. B 27. C 28. D 29. A 30. B

31. A 32. D 33. A 34. C 35. C 36. B 37. B 38. C 39. D 40. B

41. A 42. B 43. D 44. A 45. C 46. C 47. B 48. C 49. B 50. A

51. C 52. D 53. A 54. B 55. A

Need more practice or review. Check out the suggestions on the Professional Program in

Accountancy webpage

(http://franke.nau.edu/oas/current_students/professional_program_in_accountancy)

Accounting Skills Assessment Practice Exam Page 11 of 11

You might also like

- CA Inter DT Handwritten Notes May 2024Document89 pagesCA Inter DT Handwritten Notes May 2024narayan100% (2)

- Pilot TestDocument4 pagesPilot TestTrang Nguyễn QuỳnhNo ratings yet

- Acct 2301 Exam 2 - v2 Key2Document11 pagesAcct 2301 Exam 2 - v2 Key2iLeegendNo ratings yet

- Phil Tax Midterm ExamDocument25 pagesPhil Tax Midterm ExamSherina Manlises100% (2)

- Appraisal Ce Exam 1 Review PDFDocument30 pagesAppraisal Ce Exam 1 Review PDFAmeerNo ratings yet

- Introduction To Petroleum Products Tank Farm OperationsDocument13 pagesIntroduction To Petroleum Products Tank Farm OperationsSabitu Ajadi MutairuNo ratings yet

- Financial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizDocument3 pagesFinancial & Managerial Accounting For Mbas, 5Th Edition by Easton, Halsey, Mcanally, Hartgraves & Morse Practice QuizLevi AlvesNo ratings yet

- Bills of Exchange (Drafts) : Sample L/CDocument4 pagesBills of Exchange (Drafts) : Sample L/Cjuan andres praxedes mateo100% (3)

- Financial Accounting Quiz 1Document16 pagesFinancial Accounting Quiz 1arnel buan100% (1)

- Law On Obligations and Contracts Pq1-Prelim ExamDocument10 pagesLaw On Obligations and Contracts Pq1-Prelim ExamDanica Vetuz100% (5)

- NVCC Accounting ACC 211 EXAM 1 PracticeDocument12 pagesNVCC Accounting ACC 211 EXAM 1 Practiceflak27bl2No ratings yet

- Acc 211 MidtermDocument8 pagesAcc 211 MidtermRinaldi Sinaga100% (2)

- R1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Document8 pagesR1 (Answers) 20200915174338prl3 - v1 - 0 - Exercise - Year - End - Qu - Bec - 2017 - 0120Arslan HafeezNo ratings yet

- Fin22 Cash Flow and LevarageDocument3 pagesFin22 Cash Flow and LevarageJoeNo ratings yet

- Quiz Chapter 4 - Chapter 8Document11 pagesQuiz Chapter 4 - Chapter 8Fäb RiceNo ratings yet

- Chapter 4 Question ReviewDocument11 pagesChapter 4 Question ReviewNayan SahaNo ratings yet

- Additional Exam Practice QUESTIONSDocument8 pagesAdditional Exam Practice QUESTIONSShaunny BravoNo ratings yet

- PST Quiz PA Chap 2Document5 pagesPST Quiz PA Chap 2Phuong PhamNo ratings yet

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaNo ratings yet

- Bsba - Bacc-1 - Midterm Exam - ADocument3 pagesBsba - Bacc-1 - Midterm Exam - AMechileNo ratings yet

- Prepare and Match ReciptsDocument15 pagesPrepare and Match Reciptstafese kuracheNo ratings yet

- Bank Document and Bank Transaction Related To Bank Chapter 7 12 Abm BDocument18 pagesBank Document and Bank Transaction Related To Bank Chapter 7 12 Abm BRichard Yap100% (1)

- ACC111 Final ExamDocument10 pagesACC111 Final ExamGayle Montecillo Pantonial OndoyNo ratings yet

- Accounting Concepts and Accounting Equation DrillsDocument3 pagesAccounting Concepts and Accounting Equation Drillsken garciaNo ratings yet

- Ifrs, Basd Financial Stetmt Analysis Ch2Document14 pagesIfrs, Basd Financial Stetmt Analysis Ch2Slemon YiheyisNo ratings yet

- Answers R41920 Acctg Varsity Basic Acctg Level 2Document12 pagesAnswers R41920 Acctg Varsity Basic Acctg Level 2John AceNo ratings yet

- Administer Financial Accounts (ModuleDocument11 pagesAdminister Financial Accounts (ModuleFelekePhiliphosNo ratings yet

- Accounting For Merchandising Business: Learning OutcomesDocument22 pagesAccounting For Merchandising Business: Learning Outcomeslemon100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument13 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionMarielle Mae BurbosNo ratings yet

- Cash Flow QuizDocument1 pageCash Flow QuizDan David FLoresNo ratings yet

- Chapter ThreeDocument20 pagesChapter ThreeNatty STAN100% (1)

- Quizzer (Cash To Inventory Valuation) KeyDocument10 pagesQuizzer (Cash To Inventory Valuation) KeyLouie Miguel DulguimeNo ratings yet

- Of Alabang: Multiple ChoiceDocument8 pagesOf Alabang: Multiple ChoiceLEE ANNNo ratings yet

- ACC100.101 Preliminary Examination - For PostingDocument5 pagesACC100.101 Preliminary Examination - For PostingRAMOS, Aliyah Faith P.No ratings yet

- Test Bank - Problems and Essays 2008Document148 pagesTest Bank - Problems and Essays 2008okkie50% (6)

- Cpa ReviewerDocument5 pagesCpa ReviewerArlene Magalang NatividadNo ratings yet

- Sample Audit ReportsDocument44 pagesSample Audit Reportsyeosuf100% (1)

- Trial Balance Adjustments Profit or Loss Financial PositionDocument3 pagesTrial Balance Adjustments Profit or Loss Financial PositionCoke Aidenry Saludo100% (1)

- CH 7, 8Document4 pagesCH 7, 8Irfan UllahNo ratings yet

- ACC 430 Chapter 10Document20 pagesACC 430 Chapter 10vikkiNo ratings yet

- Adv - Acc Mock Exam With SolutionsDocument8 pagesAdv - Acc Mock Exam With SolutionsGiorgio AtanasovNo ratings yet

- Level 4 ThoeryDocument25 pagesLevel 4 ThoeryEdomNo ratings yet

- FundAcct I @2015 AssignmntDocument6 pagesFundAcct I @2015 AssignmntGedion FeredeNo ratings yet

- Cash Flows 500Document41 pagesCash Flows 500MUNAWAR ALI100% (2)

- Module 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVDocument56 pagesModule 1C - ACCCOB2 - Conceptual Framework For Financial Reporting - FHVCale Robert RascoNo ratings yet

- Accntng For Non Profit OrganizationsDocument40 pagesAccntng For Non Profit OrganizationsDharwin CorpuzNo ratings yet

- Basic Accounting: Multiple ChoiceDocument38 pagesBasic Accounting: Multiple ChoiceErika GambolNo ratings yet

- Accounting Test Prep 1Document9 pagesAccounting Test Prep 1Swathi ShekarNo ratings yet

- BUS 201 Review For Exam 2Document7 pagesBUS 201 Review For Exam 2Brandilynn WoodsNo ratings yet

- Financial Statements Are A Collection of SummaryDocument10 pagesFinancial Statements Are A Collection of Summarygbless ceasarNo ratings yet

- ACC 111 - Financial Accounting and ReportingDocument37 pagesACC 111 - Financial Accounting and ReportingYuki GraceNo ratings yet

- Public Sector AccountingDocument9 pagesPublic Sector AccountingBekanaNo ratings yet

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- Advanced Financial Accounting-Part 2Document4 pagesAdvanced Financial Accounting-Part 2gundapola83% (6)

- Basic AccountingDocument6 pagesBasic AccountingViolet Gomez RedNo ratings yet

- Salosagcol Compilation of Practice Set Questions With Answers On Audit in GeneralDocument13 pagesSalosagcol Compilation of Practice Set Questions With Answers On Audit in GeneralKristineNo ratings yet

- Group AssignmentDocument2 pagesGroup AssignmentibsaashekaNo ratings yet

- Individual Assignment Financial Accounting and Report 1Document7 pagesIndividual Assignment Financial Accounting and Report 1Sahal Cabdi AxmedNo ratings yet

- Post Quiz 4 - AF101Document11 pagesPost Quiz 4 - AF101Moira Emma N. EdmondNo ratings yet

- Financial Accounting & Reporting ReviewerDocument21 pagesFinancial Accounting & Reporting ReviewerRosemarie GoNo ratings yet

- Exercise - Income ApproachDocument1 pageExercise - Income ApproachThùy Linh Vũ NguyễnNo ratings yet

- Financial Report DraftDocument28 pagesFinancial Report Draftjayar medicoNo ratings yet

- Total Cost $15,000,000Document4 pagesTotal Cost $15,000,000Arianne Shae DomingoNo ratings yet

- Basic Accounting QuestionnaireDocument7 pagesBasic Accounting QuestionnaireSVTKhsiaNo ratings yet

- Pilot Test 2023Document6 pagesPilot Test 2023bapeboiz1510No ratings yet

- Tong Hop Cau HoiDocument44 pagesTong Hop Cau HoiVu Truc Ngan (K17 HCM)No ratings yet

- Chapter 4 Lesson 18 My Family ReviewDocument20 pagesChapter 4 Lesson 18 My Family ReviewDanica VetuzNo ratings yet

- Chapter 4 Lesson 17 My FamilyDocument21 pagesChapter 4 Lesson 17 My FamilyDanica VetuzNo ratings yet

- Topic NINE Seeing A Doctor: Lesson 50 Does He Have A Fever?Document24 pagesTopic NINE Seeing A Doctor: Lesson 50 Does He Have A Fever?Danica VetuzNo ratings yet

- Topic NINE Seeing A Doctor: Lesson 51 Can You Call An Ambulance?Document21 pagesTopic NINE Seeing A Doctor: Lesson 51 Can You Call An Ambulance?Danica VetuzNo ratings yet

- Chapter 6 Lesson 23 On The RoadDocument22 pagesChapter 6 Lesson 23 On The RoadDanica VetuzNo ratings yet

- Unit 1 Questions: Lesson 02Document11 pagesUnit 1 Questions: Lesson 02Danica VetuzNo ratings yet

- Chapter 6 Lesson 26 On The Road ReviewDocument25 pagesChapter 6 Lesson 26 On The Road ReviewDanica VetuzNo ratings yet

- Unit 1 Questions: What's Your Name?Document11 pagesUnit 1 Questions: What's Your Name?Danica VetuzNo ratings yet

- W6 Module 5 Dupont System of AnalysisDocument14 pagesW6 Module 5 Dupont System of AnalysisDanica VetuzNo ratings yet

- W7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDocument8 pagesW7 Module 6 COMPARATIVE FINANCIAL STATEMENT ANALYSISDanica VetuzNo ratings yet

- W6-Module Offical Hand Signals in VolleyballDocument14 pagesW6-Module Offical Hand Signals in VolleyballDanica VetuzNo ratings yet

- Chapter 7 Lesson 27 SeasonsDocument22 pagesChapter 7 Lesson 27 SeasonsDanica VetuzNo ratings yet

- W4 Module 4 FINANCIAL RATIOS Part 2BDocument12 pagesW4 Module 4 FINANCIAL RATIOS Part 2BDanica VetuzNo ratings yet

- W9 Lesson 7 - Ecosystem Management - ModuleDocument16 pagesW9 Lesson 7 - Ecosystem Management - ModuleDanica VetuzNo ratings yet

- Training Team - Trainer - Pre-TaskDocument4 pagesTraining Team - Trainer - Pre-TaskDanica VetuzNo ratings yet

- W6-Module Concept of Income-Part 1Document14 pagesW6-Module Concept of Income-Part 1Danica VetuzNo ratings yet

- Sources of Long-Term Financing Part 1Document24 pagesSources of Long-Term Financing Part 1Danica VetuzNo ratings yet

- W7-Module Concept of Income-Part 2Document21 pagesW7-Module Concept of Income-Part 2Danica VetuzNo ratings yet

- W12-Module Penalties and Remedies of The Taxpayer - PPTDocument20 pagesW12-Module Penalties and Remedies of The Taxpayer - PPTDanica VetuzNo ratings yet

- Aud Prob Prelim Exam No AnswersDocument19 pagesAud Prob Prelim Exam No AnswersKrista CandareNo ratings yet

- December 15, 2023Document6 pagesDecember 15, 2023Medina County CommissionersNo ratings yet

- Flying - November 2023Document104 pagesFlying - November 2023tedoy.pideloNo ratings yet

- CompetititionDocument3 pagesCompetititionZaheen KhanNo ratings yet

- Griffin Mgmt12e IM Ch09Document13 pagesGriffin Mgmt12e IM Ch09Srinivas RaoNo ratings yet

- Upgrade To Paltalk ExtremeDocument32 pagesUpgrade To Paltalk ExtremeAnik GuptaNo ratings yet

- Onboarding Induction Checklist InternalDocument3 pagesOnboarding Induction Checklist Internaldarsh makhariaNo ratings yet

- MODULE 4 Group 6Document17 pagesMODULE 4 Group 6Denisse Nicole SerutNo ratings yet

- Applied Entrepreneurship: Prepared By: Kristine Diane C. Cerdeña, LPTDocument22 pagesApplied Entrepreneurship: Prepared By: Kristine Diane C. Cerdeña, LPTRommel LegaspiNo ratings yet

- About Us - Hackveda LimitedDocument2 pagesAbout Us - Hackveda Limited19BMA111 GOKULNo ratings yet

- Unit 3Document11 pagesUnit 3mussaiyibNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- 523050657510169601Document2 pages523050657510169601vishalyadav5656No ratings yet

- Suggested Answers:: Revision Exercise For Final Chapter: Time Value of MoneyDocument3 pagesSuggested Answers:: Revision Exercise For Final Chapter: Time Value of Money王宇璇No ratings yet

- New Page 1Document2 pagesNew Page 1Mary SosaNo ratings yet

- ATI Aerospace New Products and CapabilitiesDocument4 pagesATI Aerospace New Products and CapabilitiesShreya SharadNo ratings yet

- 2019 Cipm l1v1r3Document28 pages2019 Cipm l1v1r3Edwin Hao MengguangNo ratings yet

- Universiti Kuala Lumpur Human Factors: JANUARY 2022 ASSIGNMENT 1 - Introduction To Human FactorDocument2 pagesUniversiti Kuala Lumpur Human Factors: JANUARY 2022 ASSIGNMENT 1 - Introduction To Human FactorMWPNo ratings yet

- Department of Education: Republic of The PhilippinesDocument4 pagesDepartment of Education: Republic of The PhilippinesRochelle May CanlasNo ratings yet

- ReportDocument18 pagesReportVAIJAYANTI JENANo ratings yet

- PC 102 Professional Skills Gathering Agenda For Week 10Document3 pagesPC 102 Professional Skills Gathering Agenda For Week 10George CernikNo ratings yet

- Abdi Transformer NewDocument3 pagesAbdi Transformer NewabrhamNo ratings yet

- Break Up of NAAC CriterionsDocument9 pagesBreak Up of NAAC Criterionssandeep cNo ratings yet

- Marketing Mix of PatanjaliDocument10 pagesMarketing Mix of PatanjaliDevendra GehlotNo ratings yet

- Kos MapDocument67 pagesKos MapHiwot YimerNo ratings yet

- SAP License QUICK GUIDEDocument6 pagesSAP License QUICK GUIDEAnonymous h19lskP2UVNo ratings yet