0% found this document useful (0 votes)

1K views3 pagesOnline Statement

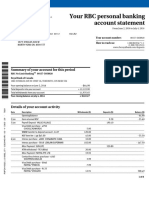

The statement details deposits and withdrawals from a CIBC bank account over a month. It lists transaction dates, descriptions, deposit and withdrawal amounts and the running balance. It also provides the account holder name and number as well as contact information for the bank.

Uploaded by

Long LeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

1K views3 pagesOnline Statement

The statement details deposits and withdrawals from a CIBC bank account over a month. It lists transaction dates, descriptions, deposit and withdrawal amounts and the running balance. It also provides the account holder name and number as well as contact information for the bank.

Uploaded by

Long LeeCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

- Account Summary

- Transaction Details

- Important Information