Professional Documents

Culture Documents

DIT Illustration

DIT Illustration

Uploaded by

Ambrose ApolinaryOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DIT Illustration

DIT Illustration

Uploaded by

Ambrose ApolinaryCopyright:

Available Formats

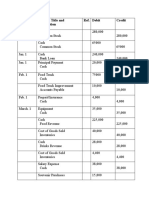

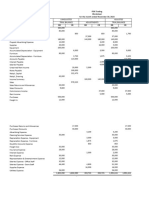

CLASS ILLUSTRATION (All figures are VAT exclusive)

Deductible Input Tax (DIT)

Assume you have figures that are Vat exclusive from a supplier who is Partial exempt trader

(PET) for the month of December 2020 and find the DIT for the purpose of calculating VAT

payable or Refundable.

Supplies (Sales) made VAT exclusive

Item Exempt Taxable

Bottled water 700,000

sugar 540,000

Toilet soap 360,000

Laundry soap 640,000

Wheat flour 3,000,000

Transportation of Laptops 800,000

Green beans 3,400,000

Unprocessed meat 2,800,000

Total 9,200,000 3,040,000

Purchases made VAT exclusive

Items Exempt Taxable

Bottled water 1,700,000

Electricity bill 350,000

sugar 1,500,000

Telephone charges 500,000

Canned beef 400,000

Refrigerator 2,000,000.00

Wheat flour 9,000,000

Green beans 3,000,000

Processed meat 6,000,000

soda 3,500,000

Transportation of beans 700,000

Unprocessed meat 2,800,000

15,600,000 16,650,000

From the formula:

Deductible Input tax (DIT)

T

Then, testing for ratio { }

A

T

{ } = 3,040,000

A

(3,040,000+9,200,000)

= 3,040,000

12,240,000

T

{ } = 0.2483=0.25=25% (Please approximate in two decimal places)

A

Therefore since the answer is between 0.1 and 0.9 then we use the whole formula of DIT

T

DIT = X + I { }

A

T= Total Values of taxable supplies (hereby referred to values of sales VAT exclusive)

A= Total Values of all supplies (hereby referred to both Taxable and exempt sales VAT

exclusive…A=T+E)

X=?

i. The value of X (Input tax directly attributable to taxable supplies)

Items (Taxable Purchases made) Taxable

Bottled water 1,700,000

sugar 1,500,000

Canned beef 400,000

Processed meat 6,000,000

soda 3,500,000

Transportation of beans 700,000

13,800,000

X= Value of taxable purchases * 18%

=13,800,000 * 18%

= Tshs.2,484,000/=

I=?

ii. The value of I (Input tax directly attributable to both supplies)

Items Taxable

Electricity bill 350,000

Telephone charges 500,000

Refrigerator 2,000,000.00

2,850,000

I = Value of dual items purchased/incured * 18%

I = Tshs.2,850,000 * 18%

I = Tshs.513,000/=

T

DIT = X + I { }

A

= 2,484,000 + 513,000 (0.2483)

= 2,611,377.9

Hence, this is the value to be used in computing VAT payable or Refundable depending

on the nature of the question i.e

VAT payable = Output tax - DIT

VAT payable = Output tax - 2,611,377.9

Or

VAT payable = DIT - Output tax

VAT Refundable = 2,611,377.9 – Input tax

NOTE.

• This is how we compute the value of DIT when the figures are VAT exclusive

• Now, try to compute the same value of DIT when the figures are VAT inclusive so

that you can explore the differences.

• Try to re-do the computation by using your calculator because I was rushing to an

invigilation and probably I might be wrong somewhere especially in the totals or

summations of figures.

• If I will set VAT question in your exam that involves computation of DIT then use

the above steps and not otherwise.

• Again, this illustration should not be used as a confirmation that VAT is already

one among the questions in your exam, just read everything we discussed. All the

best.

You might also like

- Sample Sa S: Plan of Liquidation and Dissolution of XYZ CorporationDocument1 pageSample Sa S: Plan of Liquidation and Dissolution of XYZ Corporationbma0215No ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Tax 1 Notes-2019-20Document137 pagesTax 1 Notes-2019-20Gino GinoNo ratings yet

- Module B Corporate Financing - Part 2Document333 pagesModule B Corporate Financing - Part 2Darren Lau100% (1)

- Pig Farming BusinessDocument8 pagesPig Farming BusinessOni SundayNo ratings yet

- Ricard PangabnDocument15 pagesRicard PangabnTey-yah Malumbres100% (5)

- SOX ControlsDocument8 pagesSOX ControlsLiubomir GekovNo ratings yet

- Sustainable Development - Green TechnologyDocument53 pagesSustainable Development - Green TechnologyviancaNo ratings yet

- Chapter 10 Vat Still DueDocument7 pagesChapter 10 Vat Still DueHazel Jane EsclamadaNo ratings yet

- Handbook of Supply Chain 02Document8 pagesHandbook of Supply Chain 02JoyceNo ratings yet

- Case Study: SAINT ANDREW COLLEGE: Little Things Means A LotDocument1 pageCase Study: SAINT ANDREW COLLEGE: Little Things Means A LotJemark GatdulaNo ratings yet

- SITXFIN005 Assessment 1 - Short AnswersDocument24 pagesSITXFIN005 Assessment 1 - Short AnswersPratistha Gautam100% (1)

- Tanzania Institute of AccountancyDocument4 pagesTanzania Institute of Accountancysaidkhatib368No ratings yet

- GRP1 CalicoyDocument4 pagesGRP1 CalicoyAllanis Mae E. MateoNo ratings yet

- Worksheet - Service - Gracia Bigasan CoDocument4 pagesWorksheet - Service - Gracia Bigasan CoJasmine ActaNo ratings yet

- Financial PlanDocument13 pagesFinancial Planseleen16yahoo.comNo ratings yet

- VAT Past QuestionsDocument27 pagesVAT Past QuestionsNirmal ShresthaNo ratings yet

- Marketing ChecklistDocument3 pagesMarketing ChecklistphilkoyosNo ratings yet

- Tax First TakeDocument11 pagesTax First TakePau CaisipNo ratings yet

- Example: Partial Exempt Trader: Value (TSHS) VAT (TSHS) VAT (Inclusive)Document3 pagesExample: Partial Exempt Trader: Value (TSHS) VAT (TSHS) VAT (Inclusive)Cristian RenatusNo ratings yet

- Balance Balance Balance Balance Balance Balance Balance BalanceDocument4 pagesBalance Balance Balance Balance Balance Balance Balance BalanceFlorentinoNo ratings yet

- Amendment Tax qn15Document11 pagesAmendment Tax qn15Abdulkarim Hamisi KufakunogaNo ratings yet

- Monica Cement Company Journal Entries Account Titles Dr. CRDocument6 pagesMonica Cement Company Journal Entries Account Titles Dr. CRclarice_anneNo ratings yet

- Problem 1Document6 pagesProblem 1Elle VernezNo ratings yet

- Financial Plan General Description Amount JustificationDocument5 pagesFinancial Plan General Description Amount JustificationClaudio LaCervaNo ratings yet

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingNo ratings yet

- Cost Accounting FNLDocument13 pagesCost Accounting FNLImthe OneNo ratings yet

- Chap1-3 Illustration ProblemsDocument8 pagesChap1-3 Illustration ProblemscykablyatNo ratings yet

- Rms Balfin: Weekly Business Progress Report As at 11 JULY 2021Document7 pagesRms Balfin: Weekly Business Progress Report As at 11 JULY 2021elmudaaNo ratings yet

- Fine Manufacturing CompanyDocument4 pagesFine Manufacturing CompanyexquisiteNo ratings yet

- Jansen Balance SheetDocument3 pagesJansen Balance SheetRowella Mae VillenaNo ratings yet

- Budget Plan Safewood FixDocument1 pageBudget Plan Safewood FixCynthia Dhyaa NNo ratings yet

- Steve (Till Trial Balance Fixed)Document5 pagesSteve (Till Trial Balance Fixed)A StrangerNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Manan Aggarwal - FINAL ACCOUNT-questionsDocument10 pagesManan Aggarwal - FINAL ACCOUNT-questionsManan AggarwalNo ratings yet

- Assignment On TaxationDocument2 pagesAssignment On TaxationKal KalNo ratings yet

- Answer c21Document8 pagesAnswer c21Võ Huỳnh BăngNo ratings yet

- ABC 10-ColumnDocument1 pageABC 10-Columnpor wansNo ratings yet

- WorksheetsDocument2 pagesWorksheetsSarifeMacawadibSaid100% (5)

- Answer To Exercises To AnswerDocument9 pagesAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNo ratings yet

- Exercise 6-23 Upeng VeggiesDocument18 pagesExercise 6-23 Upeng VeggiesjunjunNo ratings yet

- Business Plan For Dairy Farm 30 Animals Final11Document17 pagesBusiness Plan For Dairy Farm 30 Animals Final11dauda kizitoNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- Haliza Nabila Putri - b1024201030 2021 Jan Introduction To AccountingDocument4 pagesHaliza Nabila Putri - b1024201030 2021 Jan Introduction To AccountingHaliza Nabila PutriNo ratings yet

- Jawaban & Latihan UAS AKDAS 1Document15 pagesJawaban & Latihan UAS AKDAS 1Cindy Tri WidiaNo ratings yet

- AC - IntAcctg1 Quiz 2 Solution GuideDocument6 pagesAC - IntAcctg1 Quiz 2 Solution Guidejohn hellNo ratings yet

- Allan & WallyDocument10 pagesAllan & WallyLaura OliviaNo ratings yet

- Tako Yaki Catering ServiceDocument4 pagesTako Yaki Catering ServiceRoma Jane AmorNo ratings yet

- Project Proposal 2Document9 pagesProject Proposal 2katinuke8No ratings yet

- Alomia - Ae 112 Midterm Sa1 SolutionDocument9 pagesAlomia - Ae 112 Midterm Sa1 SolutionRica Ann RoxasNo ratings yet

- Fruit Juice Business PlanDocument7 pagesFruit Juice Business PlanOni SundayNo ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- Worksheet With FSDocument8 pagesWorksheet With FSMilrosePaulinePascuaGudaNo ratings yet

- Coffe Shop Feasibility Report-ArsalanDocument10 pagesCoffe Shop Feasibility Report-Arsalanarsalan javedNo ratings yet

- GROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALDocument5 pagesGROUP WORK-Agriculture Biological Asset and Agricultural Produce13-FINALREMBRANDT KEN LEDESMANo ratings yet

- Ricard Pangabn PDF FreeDocument15 pagesRicard Pangabn PDF FreeKatrina TabiosNo ratings yet

- FABM 2 - Long ExerciseDocument11 pagesFABM 2 - Long ExerciseyanaNo ratings yet

- Business Proposal FinalDocument5 pagesBusiness Proposal FinalStrangerthings EditsNo ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Tugas AbrahamDocument5 pagesTugas AbrahamHana MariaNo ratings yet

- Notes To Financial StatementDocument2 pagesNotes To Financial StatementYel De LeonNo ratings yet

- Manabat - Problem 5 & Problem 8Document5 pagesManabat - Problem 5 & Problem 8Reugi ManabatNo ratings yet

- Activity 03 Name: - ID No.: - Score: - Rating: - Problem 01Document3 pagesActivity 03 Name: - ID No.: - Score: - Rating: - Problem 01Ellyssa Ann MorenoNo ratings yet

- James 1 ST ExelDocument2 pagesJames 1 ST ExelJAMES HAROLD GUMOLON MAGHANOYNo ratings yet

- Final Accounts QuestionDocument12 pagesFinal Accounts Questionadityatiwari122006No ratings yet

- Adjusting FS ServiceDocument17 pagesAdjusting FS ServiceJasmine Acta100% (1)

- Assignment On LCNRV and GP MethodDocument6 pagesAssignment On LCNRV and GP MethodAdam CuencaNo ratings yet

- Zee Creative ThinkingDocument1 pageZee Creative ThinkingAmbrose ApolinaryNo ratings yet

- Tutorial QuestionsDocument7 pagesTutorial QuestionsAmbrose ApolinaryNo ratings yet

- The Institute of Finance Management (Ifm)Document37 pagesThe Institute of Finance Management (Ifm)Ambrose ApolinaryNo ratings yet

- Fau Presentation-1Document4 pagesFau Presentation-1Ambrose ApolinaryNo ratings yet

- Tax Administration.: A. Give The Meaning of The Following Words As Applied in Local GovernmentDocument11 pagesTax Administration.: A. Give The Meaning of The Following Words As Applied in Local GovernmentAmbrose ApolinaryNo ratings yet

- BN4206 Riks and ValueDocument10 pagesBN4206 Riks and ValueKarma SherpaNo ratings yet

- Dean Mor ResumeDocument1 pageDean Mor ResumeDean MorNo ratings yet

- Cimpor Afi FinalDocument19 pagesCimpor Afi FinalEdouard EricNo ratings yet

- Multiple Choice Questions: D. Economic Order Quantity (EOQ)Document2 pagesMultiple Choice Questions: D. Economic Order Quantity (EOQ)Vivek Singh SohalNo ratings yet

- Relationship Manager: About MNC, Neg & FsDocument2 pagesRelationship Manager: About MNC, Neg & FsAbc AbcNo ratings yet

- Monetary Policy AssignmentDocument5 pagesMonetary Policy Assignmentjosephnyamai1998No ratings yet

- Banglalink Nabeela PPT Final (Iv-Vi)Document6 pagesBanglalink Nabeela PPT Final (Iv-Vi)Shahrear AkibNo ratings yet

- HCL S 4HANA Migration Factory Brochure 1603297112Document5 pagesHCL S 4HANA Migration Factory Brochure 1603297112Surajit DuttaNo ratings yet

- Financial and Managerial Accounting 18Th Edition Williams Solutions Manual Full Chapter PDFDocument35 pagesFinancial and Managerial Accounting 18Th Edition Williams Solutions Manual Full Chapter PDFclitusarielbeehax100% (12)

- Post Show Report: 2021 Hybrid EditionDocument10 pagesPost Show Report: 2021 Hybrid EditionAtul GoyalNo ratings yet

- E-Marketing, 3rd Edition: Chapter 1: The Big PictureDocument40 pagesE-Marketing, 3rd Edition: Chapter 1: The Big PictureHassam MughalNo ratings yet

- Adoption of Cloud Computing in Retailing IndustryDocument4 pagesAdoption of Cloud Computing in Retailing IndustrySUSHMITA RATHORE Student, Jaipuria IndoreNo ratings yet

- Niraj ParabDocument9 pagesNiraj ParabnickNo ratings yet

- Sales Management 1Document7 pagesSales Management 1Mahendr ChoudharyNo ratings yet

- Pad201 Dhaka WasaDocument21 pagesPad201 Dhaka Wasataseen rajNo ratings yet

- Cambridge IGCSE: Accounting 0452/22Document20 pagesCambridge IGCSE: Accounting 0452/22Valerine VictoriaNo ratings yet

- Module 4 - Deterministic Inventory ModelsDocument6 pagesModule 4 - Deterministic Inventory ModelsvinnyNo ratings yet

- Cashbu 1Document4 pagesCashbu 1ANAND SRINIVASANNo ratings yet

- Labour Laws For QatarDocument8 pagesLabour Laws For QatarRami BalbesiNo ratings yet

- BC 201-Total Quality ManagementDocument17 pagesBC 201-Total Quality ManagementDeisy Rabe LlantoNo ratings yet

- Aud Application 2 - Handout 4 Gov. Grant (UST)Document2 pagesAud Application 2 - Handout 4 Gov. Grant (UST)RNo ratings yet

- Money ClaimDocument1 pageMoney Claimalexander ongkiatcoNo ratings yet