Professional Documents

Culture Documents

L06 ECO220 Print

Uploaded by

Ali SioOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L06 ECO220 Print

Uploaded by

Ali SioCopyright:

Available Formats

Logarithms in Regression

Analysis with Asiaphoria

and Dummy Variables

Lecture 6

Reading: “Logarithms in Regression Analysis

with Asiaphoria”

Overview of this Lecture

• Using natural logarithm transformations to

straighten scatter plots

– Interpreting coefficients when x and/or y are

logged

– Asiaphoria and Penn World Tables data

• The power and convenience of natural logs

• Regression when the x-variable is a dummy

– Combine everything: ln(y) and x is a dummy

Lecture 6 Slides, ECO220Y1Y, 1

2017 World Happiness Report (WHR)

• “Happiness is increasingly considered the

proper measure of social progress and the

goal of public policy. In June 2016, the OECD

committed itself ‘to redefine the growth

narrative to put people’s well-being at the

centre of governments’ efforts.’ In a recent

speech, the head of the UN Development

Program (UNDP) spoke against what she called

the ‘tyranny of GDP,’ arguing that what

matters is the quality of growth.” p. 3

https://worldhappiness.report/ed/2017/ 3

Worldwide Happiness Survey

• Huge annual survey in 150+ countries, each

w/ ~1,000 respondents, measuring happiness

– Cantril ladder: “Please imagine a ladder,

with steps numbered from 0 at the bottom

to 10 at the top. The top of the ladder

represents the best possible life for you and

the bottom of the ladder represents the

worst possible life for you. On which step

of the ladder would you say you personally

feel you stand at this time?”

4

Lecture 6 Slides, ECO220Y1Y, 2

Straightening a Scatter Plot

2016, n = 133 countries 2016, n = 133 countries

Cantril Ladder (mean reply)

Cantril Ladder (mean reply)

8 Costa 8

Rica Luxembourg

7 7

6 6

Singapore

5 Canada 5

4 4

3 South Sudan & Tanzania 3

0 20000 40000 60000 80000 100000 6 8 10 12

GDP per capita ln(GDP per capita)

Variable Mean S.D. Median Min. Max. 25th Per. 75th Per.

Cantril Ladder 5.41 1.13 5.43 2.89 7.66 4.52 6.12

GDP per capita 18,950 18,521 13,178 760 94,774 4,731 27,453

Ln(GDP per capita) 9.28 1.19 9.49 6.63 11.46 8.46 10.22

“GDP per capita is in terms of Purchasing Power Parity (PPP) adjusted to constant 2011

international dollars, taken from the World Development Indicators (WDI) released by

the World Bank in August 2016.” p. 17 of 2017 WHR 5

What to Log?

• Given a curved relationship, how do we know

whether to take the natural log of x, the

natural log of y, or the natural log of both?

– A quick rule of thumb: apply the natural log to the

positively skewed variable

– You can think about which variable would have

diminishing returns (applying the natural log to it)

– Of course, there’s always trial-by-error, so long as

you know how to use software

Lecture 6 Slides, ECO220Y1Y, 3

80 CASE 1: How to 80

straighten? Let’s try

60 60

everything.

y1

y1

40 40

20 20

0 0

0 1 2 3 4 5 -6 -4 -2 0 2

x1 ln(x1)

4 4

2 2

ln(y1)

ln(y1)

0 0

-2 -2

0 1 2 3 4 5 -6 -4 -2 0 2

x1 ln(x1)

6 6

4 4

y2

y2

2 CASE 2: How to 2

straighten? Let’s try

0

everything. 0

0 2 4 6 8 0 .5 1 1.5 2

x2 ln(x2)

2 2

1.5 1.5

ln(y2)

ln(y2)

1 1

.5 .5

0 0

0 2 4 6 8 0 .5 1 1.5 2

x2 ln(x2)

Lecture 6 Slides, ECO220Y1Y, 4

25 25

CASE 3: How to

20 straighten? Let’s try 20

15 everything. 15

y3

y3

10 10

5 5

0 0

0 5 10 15 20 0 1 2 3

x3 ln(x3)

4 4

2 2

ln(y3)

ln(y3)

0 0

-2 -2

-4 -4

0 5 10 15 20 0 1 2 3

x3 ln(x3)

Functional Form

• Some common functional forms in economics:

– Linear: 𝑌 = 𝑎 + 𝑏𝑋

– Log-log (constant elasticity): ln 𝑌 = 𝑎 + 𝑏 ln(𝑋)

– Semi-log (log-lin): ln 𝑌 = 𝑎 + 𝑏𝑋

– Lin-log: 𝑌 = 𝑎 + 𝑏 ln(𝑋)

• Next, review first two in a demand context

and then summarize all four

• “Logarithms in Regression Analysis with Asiaphoria”

10

Lecture 6 Slides, ECO220Y1Y, 5

Elasticity of Demand: %%

%

• Recall ECO101/102: 𝜀 = 𝜂 =

%

∗ Recall the Prerequisite

• With calculus: = = Review.

∗

Table III. Own and Cross Price Elasticities

with respect to the price of

Cottonelle Charmin Angel Soft

Elasticity of Cottonelle -3.304 0.737 0.621

the demand Charmin 0.242 -2.292 0.262

for Angel Soft 0.765 1.132 -4.066

Hausman and Leonard (2002) “The Competitive Effects of a New Product Introduction:

A Case Study” p. 251 https://onlinelibrary.wiley.com/doi/epdf/10.1111/1467-6451.00176 11

Demand Specifications

𝑃 Demand Demand unit

• Linear specifications elastic: elastic: 𝜀 = −1

𝑎 𝜀 < −1

of demand: Demand

𝑎

𝑄= − 𝑃 inelastic:

2 𝜀 > −1

– Graph: 𝑃 = 𝑎 − 𝑏𝑄

0 𝑎 𝑎 𝑄

– Elasticity: 𝜀 = −

𝑃 2𝑏 𝑏

• Constant elasticity

function form: Elasticity is same all

ln 𝑄 = 𝑎 − 𝑏 ln(𝑃) along demand curve

– Elasticity 𝜀 = −𝑏

𝑄 12

Lecture 6 Slides, ECO220Y1Y, 6

Constant Elasticity (log-log; log-linear)

ln 𝑄 = 𝑎 − 𝑏 ln(𝑃) ln(Q) = 7 - 3.6ln(P)

2 4 6 8 10

exp(ln 𝑄 ) = exp 𝑎 − 𝑏 ln 𝑃

P

𝑄 = exp 𝑎 exp −𝑏 ln 𝑃

𝑄 = exp 𝑎 exp ln 𝑃

0 20 40 60 80 100

𝑄=𝑒 𝑃 Q

% ∗

𝑒𝑙𝑎𝑠𝑡𝑖𝑐𝑖𝑡𝑦 = = =

% ∗

𝑒𝑙𝑎𝑠𝑡𝑖𝑐𝑖𝑡𝑦 = = 𝑒 −𝑏 𝑃 = −𝑏

13

Regression Result What is 𝒃𝟏 ?

𝑦 =𝑏 +𝑏 𝑥 Slope: a one unit in 𝑥 is associated

with a 𝑏 unit in 𝑦 on average

Elasticity: a one percent in 𝑥 is

ln(𝑦 ) = 𝑏 + 𝑏 ln(𝑥 ) associated with approximately a 𝑏

percent in 𝑦 on average

“Semi-elasticity”: a one unit in 𝑥 is

ln(𝑦 ) = 𝑏 + 𝑏 𝑥 associated with approximately a

100*𝑏 percent in 𝑦 on average

(no name): a one percent in 𝑥 is

𝑦 = 𝑏 + 𝑏 ln(𝑥 ) associated with approximately a

𝑏 /100 unit in 𝑦 on average

Note well: A full interpretation must specify the context, give

variable descriptions, be clear on causality, and provide the

specific units of measurement of any non-logged variables.

14

Lecture 6 Slides, ECO220Y1Y, 7

Interpret the Results

2016, n = 133 countries, R-squared = 0.645

cantril_hat = -1.679 + 0.764*ln(gdp)

Cantril Ladder (mean reply)

8

7 Do these

data have

6

summary

5 values

4 (Section

3

19.4)?

6 8 10 12

ln(GDP per capita)

For countries with GDP per capita that is 10% higher, we observe

mean happiness, which is measured on a 10-point Cantril ladder

scale, that is approximately 0.08 points higher on average. 15

Fortune 500 Companies, 2013

Y-hat = 20.4 + 0.1X, R2 = 0.11

500

Wal-Mart & Exxon Mobile

Revenues ($b)

400

300

200

Fannie Mae, J.P. Morgan

100 Chase, Bank of America,

0 Freddie Mac, Citigroup,

0 1000 2000 3000

Assets ($b) Wells Fargo

Fortune 500 Companies, 2013

Y-hat = 16.1 + 0.1X, R2 = 0.17

250

Chevron

Revenues ($b)

200

150 Goldman Sachs, MetLife,

100 Morgan Stanley, Prudential

50 Financial, GE, AIG, TIAA-CREF,

0 Berkshire Hathaway

0 200 400 600 800 1000

Assets ($b)

http://money.cnn.com/magazines/fortune/fortune500/2013/full_list/ 16

Lecture 6 Slides, ECO220Y1Y, 8

Fortune 500 Companies, 2013

Y-hat = 13.7 + 0.2X, R2 = 0.15 Clearly the problem is not outliers

200

as it may have first appeared.

Revenues ($b)

150

100 Instead, the problem is that the

50 functional form is not linear so

0 linear descriptive techniques

0 100 200 300 400

Assets ($b) (OLS, R2) are NOT appropriate.

150

100

residual

50

-50

0 20 40 60 80

Y-hat

17

Fortune 500 Companies, 2013 Fortune 500 Companies, 2013

Y-hat = 20.4 + 0.1X, R2 = 0.11 Y-hat = 1.4 + 0.4X, R2 = 0.42

500 6

Ln Revenues ($b)

Revenues ($b)

400 5

300 4

200 3

100 2

0 1

0 1000 2000 3000 -2 0 2 4 6 8

Assets ($b) Ln Assets ($b)

Fortune 500 Companies, FAKE DATA Fortune 500 Companies, FAKE DATA

Y-hat = 16.6 + 0.1X, R2 = 0.22 Y-hat = 1.4 + 0.4X, R2 = 0.42

250 6 How to

Ln Revenues ($b)

Revenues ($b)

200

4 interpret

150

100

1.4?

2

50

0 0

0 500 1000 1500 -2 0 2 4 6 8

Assets ($b) Ln Assets ($b)

Firms w/ 1 billion in assets have revenues of ≈4 billion (𝑒 . ). 18

Lecture 6 Slides, ECO220Y1Y, 9

Penn World Tables (PWT) 10.0

• High-quality publicly available data, which are

periodically updated (10.0 released Jan 2021)

– Pritchett and Summers (2014) “Asiaphoria Meets

Regression to the Mean” use PWT 8.0

– It contains country-level GDP measures – more

than one variable measuring GDP depending on

researcher’s purpose – for each year

• Are these data cross-sectional, time series or panel?

– Can use these data to compute growth rates

19

Getting from GDP levels to growth

China, n = 35 years China, R-squared = 0.983

Real GDP/capita 2011US$

12000 ln_gdp_hat = -115.730 + 0.062*year

9.5

ln(Real GDP/capita)

10000

9

8000

8.5

6000 8

4000 7.5

2000 7

1980 1987 1994 2001 2008 2014 1980 1987 1994 2001 2008 2014

Year Year

How to interpret 0.062? What does the 𝑅 value of 0.983 mean?

Over the period from 1980 through 2014 in China, real GDP per capita

has risen at an impressive rate of about 6.2% annually on average.

“Real GDP/capita” is rgdpna/pop from PWT 9.0 (DACM): rgdpna is “Real GDP at

constant 2011 national prices (in mil. 2011US$)” and pop is “Population (in millions).”

20

Lecture 6 Slides, ECO220Y1Y, 10

Sometimes ln() is just convenient

Bangladesh, n = 11 years Bangladesh, n = 11 years

R-squared = 0.983 R-squared = 0.992

ln(Real GDP per capita)

gdp_hat = -182922.8 + 92.3*year ln_gdp_hat = -78.796 + 0.043*year

Real GDP per capita

2600 7.9

2400 7.8

2200 7.7

2000 7.6

1800 7.5

1600 7.4

2000 2002 2004 2006 2008 2010 2000 2002 2004 2006 2008 2010

Year Year

How to interpret -182922.9?

21

Pritchett and Summers (2014)

• One goal of the paper is to assess how well

past growth rates predict future growth rates

using a cross-section of countries

• To obtain the data on GDP growth rates, they

run many regressions and retrieve the OLS

coefficients: these populate the variables that

measure growth rates in each decade

– Growth rates allow cross-country comparisons

22

Lecture 6 Slides, ECO220Y1Y, 11

China, n = 11 years China, n = 11 years

R-squared = 0.83 R-squared = 0.93

ln_gdp_hat = -40.102 + 0.024*year ln_gdp_hat = -91.889 + 0.050*year

ln(Real GDP/capita)

ln(Real GDP/capita)

7.3 7.8

7.7

7.2

7.6

7.1 7.5

7.4

7 7.3

1970 1972 1974 1976 1978 1980 1980 1982 1984 1986 1988 1990

Year Year

China, n = 11 years China, n = 11 years

R-squared = 0.97 R-squared = 1.00

ln_gdp_hat = -113.762 + 0.061*year ln_gdp_hat = -162.308 + 0.085*year

ln(Real GDP/capita)

ln(Real GDP/capita)

8.4 9.2

8.2 9

8 8.8

7.8 8.6

8.4

7.6

1990 1992 1994 1996 1998 2000 2000 2002 2004 2006 2008 2010

Year Year

Repeat for each of 141 other countries to get growth rates? 23

Germany, n = 11 years Costa Rica, n = 11 years

R-squared = 0.77 R-squared = 0.94

Real GDP/capita 2011US$

Real GDP/capita 2011US$

gdp_hat = -887715 + 462*year gdp_hat = -424851 + 217*year

42000 9000

41000 8500

40000 8000

39000

7500

38000

37000 7000

2000 2002 2004 2006 2008 2010 1990 1992 1994 1996 1998 2000

Year Year

Canada, n = 11 years Egypt, n = 11 years

R-squared = 0.89 R-squared = 0.85

Real GDP/capita 2011US$

Real GDP/capita 2011US$

gdp_hat = -1027284 + 533*year gdp_hat = -247075 + 127*year

4000

32000

31000 3500

30000 3000

29000

28000 2500

27000 2000

1980 1982 1984 1986 1988 1990 1970 1972 1974 1976 1978 1980

Year Year

Are growth levels comparable across countries? Over time? 24

Lecture 6 Slides, ECO220Y1Y, 12

Regression when x is a dummy

• Recall that a dummy variable (also called an

indicator variable or a fixed effect) takes only

two possible values: 0 and 1

• Codes categorical information so we can use

methods (e.g. OLS, correlation, mean, s.d.,

etc.) usually reserved for interval variables

– For example, a dummy variable named “emp” is 1

if a person is employed and 0 otherwise

25

Happier in the OECD?

2016, n = 141 countries, R-squared = 0.383 Interpret 5.002?

cantril_hat = 5.002 + 1.650*OECD

In 2016 the mean

Cantril Ladder (mean reply)

8

happiness in non-

7

OECD countries is

6 only 5 on the Cantril

5 Ladder, which is on a

4

10-point scale.

3

Interpret 1.650? (Are

these observational or

0 .2 .4 .6 .8 1

OECD (=1 if OECD member, =0 otherwise) experimental data?)

In 2016, on average people living in OECD countries are a

whopping 1.7 units happier – on a 10-point Cantril Ladder scale –

compared to those living in non-OECD countries. 26

Lecture 6 Slides, ECO220Y1Y, 13

What if reverse definition of dummy?

2016, n = 141 countries, R-squared = 0.383 2016, n = 141 countries, R-squared = 0.383

cantril_hat = 5.002 + 1.650*OECD cantril_hat = 6.652 + -1.650*non-OECD

Cantril Ladder (mean reply)

Cantril Ladder (mean reply)

8 8

7 7

6 6

5 5

4 4

3 3

0 .2 .4 .6 .8 1 0 .2 .4 .6 .8 1

OECD (=1 if OECD member, =0 otherwise) non-OECD (=1 if non-OECD member, =0 otherwise)

27

Natural Logs and Dummies

2016, n =2016, R-squared

141 countries, = 0.327

R-squared = 0.383 2016, n 2016, R-squared

= 141 countries, = 0.327

R-squared = 0.383

cantril_hat = 5.002

ln(cantril)_hat + 1.650*OECD

= 1.59 + 0.30*OECD cantril_hat = 6.652

ln(cantril)_hat + -1.650*non-OECD

= 1.89 + -0.30*nOECD

Cantril Ladder (mean reply)

reply)

8 8

2 2

ln(Cantril Ladder)

Ladder)

7 7

1.8 1.8

Ladder (mean

6 1.6 61.6

ln(Cantril

5 1.4 51.4

4 1.2 41.2

Cantril

3 1 3 1

0 .2 .4 .6 .8 1 0 .2 .4 .6 .8 1

0 .2 .4 OECD

.6 .8 1 0 .2 non-OECD

.4 .6

(nOECD) .8 1

OECD (=1 if OECD member, =0 otherwise) non-OECD (=1 if non-OECD member, =0 otherwise)

(6.652 – 5.002)/5.002 = 0.33 (5.002 – 6.652)/6.652 = –0.25

Remember: Interpretations with logs are approximate.

Cantril Ladder Mean S.D. Median Min. Max.

34 OECD countries 6.652 0.730 6.824 5.303 7.660

107 non-OECD countries 5.002 0.950 5.100 2.693 7.136

28

Lecture 6 Slides, ECO220Y1Y, 14

Recap

• Used natural log transformations – on x, on y,

or both – to straighten scatter plots, deal with

seeming outliers, and ease interpretation

– How these affect interpretation of OLS coefficients

– PWT data and Asiaphoria case study

• Interpretations when x variable is a dummy

– When y is a regular interval (quantitative) variable

– When y has been logged

29

Lecture 6 Slides, ECO220Y1Y, 15

You might also like

- Anis Case Study of Soft Drink Demand EstimationDocument10 pagesAnis Case Study of Soft Drink Demand EstimationNorhanisah Han75% (4)

- STAT1400 Week2-Lecture 3-1Document23 pagesSTAT1400 Week2-Lecture 3-1Sameer GuptaNo ratings yet

- RM Assignment 2Document9 pagesRM Assignment 27 EduNo ratings yet

- 7 QC Tools FinalDocument106 pages7 QC Tools FinalpeaceNo ratings yet

- GUT-6000B Digital IC TesterDocument29 pagesGUT-6000B Digital IC Testeromnia MohammedNo ratings yet

- Ejes Estriados IsoDocument2 pagesEjes Estriados Isofredy pabonNo ratings yet

- Normal Probability DistributionsDocument72 pagesNormal Probability Distributionsyeshwanth sunnapuNo ratings yet

- 10-Introduction To Discrete OptimizationDocument32 pages10-Introduction To Discrete OptimizationshermaineNo ratings yet

- (USED) OR1 - 04 - Formulations (Case Studies)Document19 pages(USED) OR1 - 04 - Formulations (Case Studies)FrandesNo ratings yet

- An AlisaDocument18 pagesAn AlisaJames WelsonNo ratings yet

- Tugas x1 x1Document8 pagesTugas x1 x1Dewa Gede Soja PrabawaNo ratings yet

- Attendance October 2020 Covid19-Lockdown 10.01.20 Rev.5Document9 pagesAttendance October 2020 Covid19-Lockdown 10.01.20 Rev.5aron james empigNo ratings yet

- Day 1 - Minitab Basic - Master Seven Tools PlusDocument77 pagesDay 1 - Minitab Basic - Master Seven Tools PlusHudian NurSahriNo ratings yet

- STAT 512 Mathematical Statistics: Lecture NotesDocument120 pagesSTAT 512 Mathematical Statistics: Lecture NotesArif Nur AlfiyanNo ratings yet

- Soal UAS StatekBis Final Exam - 22 Dec 2016 - Edited PS-EnglishDocument7 pagesSoal UAS StatekBis Final Exam - 22 Dec 2016 - Edited PS-EnglishMei Liyanti Roito TampubolonNo ratings yet

- 1308-306-INS-SPC-001 - Instrument General Specification Rev.1Document82 pages1308-306-INS-SPC-001 - Instrument General Specification Rev.1AyahKenzieNo ratings yet

- Chapter 4 - Value at RiskDocument50 pagesChapter 4 - Value at RiskVishwajit GoudNo ratings yet

- Descriptive Statistics and Probability Distributions: Session 1Document34 pagesDescriptive Statistics and Probability Distributions: Session 1Anyone SomeoneNo ratings yet

- Statistics For Business and EconomicsDocument11 pagesStatistics For Business and EconomicsLakshya Pratap Singh RathoreNo ratings yet

- Lec 3 - 4 - Linear Regression PDFDocument1 pageLec 3 - 4 - Linear Regression PDFAhmed SamyNo ratings yet

- Capm - Risk and ReturnDocument81 pagesCapm - Risk and ReturnBeatriz DinisNo ratings yet

- 7 QC ToolsDocument116 pages7 QC ToolsAyalew TayeNo ratings yet

- Vlookup Example FileDocument26 pagesVlookup Example Filerohailamjad601No ratings yet

- 04 Population Mini LabsDocument6 pages04 Population Mini Labsproshni0714No ratings yet

- Statistics and Probaility Performance TaskDocument3 pagesStatistics and Probaility Performance TaskIrish ChangliNo ratings yet

- Advanced Analysis of Engineering Data: IENG Course ProjectDocument22 pagesAdvanced Analysis of Engineering Data: IENG Course ProjectAbdu AbdoulayeNo ratings yet

- QM ReviewerDocument20 pagesQM ReviewerCj RomeroNo ratings yet

- Class 2024 - LinRegDocument47 pagesClass 2024 - LinRegYoussraNo ratings yet

- Chapter 3 Exponential Functions ReviewDocument10 pagesChapter 3 Exponential Functions Reviewstealthysky0129No ratings yet

- Parametros de Score de CalcioDocument2 pagesParametros de Score de CalcioDouglas A. G MartinezNo ratings yet

- Lee and Carter Go Machine Learning: Recurrent Neural NetworksDocument30 pagesLee and Carter Go Machine Learning: Recurrent Neural Networkspapatest123No ratings yet

- Chapt 06Document12 pagesChapt 06ReevesNo ratings yet

- 8 Index Models and APTDocument63 pages8 Index Models and APTShazelNo ratings yet

- BA 545 Case StudyDocument3 pagesBA 545 Case Studytiffany reavesNo ratings yet

- BDA Assignment (Savi Bilandi)Document10 pagesBDA Assignment (Savi Bilandi)SAVINo ratings yet

- Statistik Dalam Hidrologi Uji Kecocokan Data Terhadap Distribusi Kemnungkinan (Goodness of Fit of Data To Probability Distibution)Document63 pagesStatistik Dalam Hidrologi Uji Kecocokan Data Terhadap Distribusi Kemnungkinan (Goodness of Fit of Data To Probability Distibution)Kartika SukmaNo ratings yet

- Forecasting MethodsDocument38 pagesForecasting MethodsabrilNo ratings yet

- Quiz 11.1-11.4 Per5Document2 pagesQuiz 11.1-11.4 Per5Dylan StotzNo ratings yet

- Assignment 1Document9 pagesAssignment 1Shahin AktarNo ratings yet

- Assignment 2 ECO204 PDFDocument3 pagesAssignment 2 ECO204 PDFsochNo ratings yet

- KB Raborife Stability of de Assignment 10Document25 pagesKB Raborife Stability of de Assignment 10Kagi RaborifeNo ratings yet

- Assignment 1 - Part 1: InstructionsDocument14 pagesAssignment 1 - Part 1: InstructionsSteven BrownNo ratings yet

- Structure of The Report-S2Document15 pagesStructure of The Report-S2anitaNo ratings yet

- Linear ProgrammingDocument26 pagesLinear ProgrammingSheetal SinghNo ratings yet

- IASSC Exam Packet: Version: 1.2.0M Publish Date: 12.12.2010Document21 pagesIASSC Exam Packet: Version: 1.2.0M Publish Date: 12.12.2010ShaikhRizwanNo ratings yet

- Toulouse Course NotesDocument110 pagesToulouse Course NoteskayraNo ratings yet

- Problem On Discrete Frequency Data (Central Tendency)Document3 pagesProblem On Discrete Frequency Data (Central Tendency)arkadigseoNo ratings yet

- Uts 2Document10 pagesUts 2Uciha IkhsanNo ratings yet

- Computational Engineering: Tackling Turbulence With (Super) ComputersDocument15 pagesComputational Engineering: Tackling Turbulence With (Super) ComputersCarlos Aparisi CanteroNo ratings yet

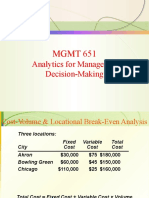

- MGMT651 Session2 ClassNotes SUA19Document35 pagesMGMT651 Session2 ClassNotes SUA19Samaki KubwaNo ratings yet

- Financial Metrics ExampleDocument2 pagesFinancial Metrics ExampleSourav shabuNo ratings yet

- Optimal Alpha ModelingDocument46 pagesOptimal Alpha ModelingSrinivasaNo ratings yet

- Dzexams Bem 2018Document62 pagesDzexams Bem 2018koubi enactaNo ratings yet

- Chapter 3 Quantifying Capsicum Frutescens Lip Plumping EffectDocument8 pagesChapter 3 Quantifying Capsicum Frutescens Lip Plumping EffectMhea Nicole QuilabNo ratings yet

- ANOVA (Analysis of Variance) : Dr. Rachita GuptaDocument13 pagesANOVA (Analysis of Variance) : Dr. Rachita GuptaMunish KanwarNo ratings yet

- F ANCOVADocument18 pagesF ANCOVAfandy seyNo ratings yet

- 01 3raaanvarinsireviewDocument22 pages01 3raaanvarinsireviewPerwira DKINo ratings yet

- Lab Manual Csc356 Hci 5Document7 pagesLab Manual Csc356 Hci 5Muhammad Zeeshan TassawarNo ratings yet

- Introductory Statistics: Student Solutions Manual To AccompanyDocument192 pagesIntroductory Statistics: Student Solutions Manual To AccompanySughand JeswaniNo ratings yet

- L07 ECO220 PrintDocument15 pagesL07 ECO220 PrintAli SioNo ratings yet

- L03 ECO220 PrintDocument15 pagesL03 ECO220 PrintAli SioNo ratings yet

- L05 ECO220 PrintDocument18 pagesL05 ECO220 PrintAli SioNo ratings yet

- L04 ECO220 PrintDocument15 pagesL04 ECO220 PrintAli SioNo ratings yet

- L02 ECO220 PrintDocument18 pagesL02 ECO220 PrintAli SioNo ratings yet

- L01 ECO220 PrintDocument17 pagesL01 ECO220 PrintAli SioNo ratings yet

- Hrm370 Final Project (Group 7)Document40 pagesHrm370 Final Project (Group 7)মোঃ আসাদুজ্জামান শাওনNo ratings yet

- Pengaruh Kepemilikan Institusional, Intellectual Capital, Dan (Studi Kasus Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2014-2017)Document14 pagesPengaruh Kepemilikan Institusional, Intellectual Capital, Dan (Studi Kasus Pada Perusahaan Manufaktur Yang Terdaftar Di Bursa Efek Indonesia Tahun 2014-2017)Aula NasyrahNo ratings yet

- How To Present Data Analysis in Research PaperDocument7 pagesHow To Present Data Analysis in Research PapergqsrcuplgNo ratings yet

- SciencedirectDocument5 pagesSciencedirectGerardus BanyuNo ratings yet

- Internal Assessment - IB ChemistryDocument16 pagesInternal Assessment - IB ChemistryrosemKate522967% (3)

- Horngren Ima16 Tif 03 GEDocument47 pagesHorngren Ima16 Tif 03 GEasem shabanNo ratings yet

- Impact of Job Satisfaction On Employee Performance 2Document13 pagesImpact of Job Satisfaction On Employee Performance 2rashid awanNo ratings yet

- JAAUTH - Volume 24 - Issue 2 - Pages 367-382Document16 pagesJAAUTH - Volume 24 - Issue 2 - Pages 367-382Meril IbrahemNo ratings yet

- Adoc - Pub - Analisis Implementasi Sistem Manajemen Mutu Iso 90Document11 pagesAdoc - Pub - Analisis Implementasi Sistem Manajemen Mutu Iso 90maisyaNo ratings yet

- Green Marketing Mix Effect On Consumers Buying Decisions in BangladeshDocument9 pagesGreen Marketing Mix Effect On Consumers Buying Decisions in BangladeshAfichNo ratings yet

- Flex Work SystemDocument17 pagesFlex Work SystemUmair KhanNo ratings yet

- Analysis of The Influence of Leadership, Work Environment, and Work Discipline As Intervening Variables On Employee Performance (Case Study at The DKI Jakarta Provincial Environmental Office)Document6 pagesAnalysis of The Influence of Leadership, Work Environment, and Work Discipline As Intervening Variables On Employee Performance (Case Study at The DKI Jakarta Provincial Environmental Office)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Cab Fare Prediction Report by Abhinav JhaDocument41 pagesCab Fare Prediction Report by Abhinav JhaVAISHALI KAULNo ratings yet

- The Role of Weber 'S Law in Human Time PerceptionDocument13 pagesThe Role of Weber 'S Law in Human Time Perceptiondielan wuNo ratings yet

- Demand and Supply Analysis For Pakistan Sugar MarketDocument2 pagesDemand and Supply Analysis For Pakistan Sugar MarketNayem Uddin Hoque TusherNo ratings yet

- LAMPIRAN 16 Uji MANOVADocument2 pagesLAMPIRAN 16 Uji MANOVAAhmad Safi'iNo ratings yet

- Firm Size Proxies and The Value Relevance of Predictive Stock Return ModelsDocument24 pagesFirm Size Proxies and The Value Relevance of Predictive Stock Return ModelsDEVIRA BELLAROSE PRATIWINo ratings yet

- ECO 550 Test BankDocument192 pagesECO 550 Test BankGroovyGuy9933% (3)

- The Influence of Training Towards Nurse Performance in Emergency Unit at Cibabat General Hospital CimahiDocument10 pagesThe Influence of Training Towards Nurse Performance in Emergency Unit at Cibabat General Hospital CimahiArya KresnadanaNo ratings yet

- Impact of Covid 19 On Employee Retention in The Hospitality IndustryDocument11 pagesImpact of Covid 19 On Employee Retention in The Hospitality IndustryGeorgeta CazacNo ratings yet

- The Relationship Between Macro Economic Variables and Stock Market Performance in KenyaDocument13 pagesThe Relationship Between Macro Economic Variables and Stock Market Performance in KenyaMhdfadli SaputraNo ratings yet

- Training (Job Satisfaction)Document16 pagesTraining (Job Satisfaction)yousuf AhmedNo ratings yet

- Data Mining in Excel Using XL MinerDocument66 pagesData Mining in Excel Using XL Minerchintan18No ratings yet

- RegressionDocument19 pagesRegressionShardul PatelNo ratings yet

- Chapter # 6: Multiple Regression Analysis: The Problem of EstimationDocument43 pagesChapter # 6: Multiple Regression Analysis: The Problem of EstimationRas DawitNo ratings yet

- Stanley - Yang - Thesis PDFDocument31 pagesStanley - Yang - Thesis PDFdfy19No ratings yet

- MDSDocument38 pagesMDSVeeral PanwalaNo ratings yet

- Krajewski Ism Ch13 SolutionDocument29 pagesKrajewski Ism Ch13 Solutionalex_sasc100% (1)

- Managerial Economics in A Global Economy, 5th Edition by Dominick SalvatoreDocument26 pagesManagerial Economics in A Global Economy, 5th Edition by Dominick Salvatoredoni zupeNo ratings yet