Professional Documents

Culture Documents

Tax Compliance For Businessmen of Micro, Small and Medium Enterprises Sector in The Regional Economy

Uploaded by

Srikara SimhaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Compliance For Businessmen of Micro, Small and Medium Enterprises Sector in The Regional Economy

Uploaded by

Srikara SimhaCopyright:

Available Formats

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/308969746

TAX COMPLIANCE FOR BUSINESSMEN OF MICRO, SMALL AND MEDIUM

ENTERPRISES SECTOR IN THE REGIONAL ECONOMY

Article · September 2016

CITATIONS READS

6 3,044

2 authors:

Imam Mukhlis Timbul Hamonangan Simanjuntak

State University of Malang Universitas Kristen Maranatha

70 PUBLICATIONS 237 CITATIONS 9 PUBLICATIONS 75 CITATIONS

SEE PROFILE SEE PROFILE

Some of the authors of this publication are also working on these related projects:

Poverty: Indonesia and Turkey View project

circular economy View project

All content following this page was uploaded by Imam Mukhlis on 01 August 2018.

The user has requested enhancement of the downloaded file.

International Journal of Economics, Commerce and Management

United Kingdom Vol. IV, Issue 9, September 2016

http://ijecm.co.uk/ ISSN 2348 0386

TAX COMPLIANCE FOR BUSINESSMEN OF MICRO,

SMALL AND MEDIUM ENTERPRISES SECTOR

IN THE REGIONAL ECONOMY

Imam Mukhlis

Faculty of Economics, State University of Malang, East Java Province, Indonesia

imam.mukhlis.fe@um.ac.id, imm_mkl@yahoo.com

Timbul Hamonangan Simanjuntak

Faculty of Economics, Maranatha Christian University, West Java Province, Indonesia

monang_djp@yahoo.com

Abstract

This study is aimed to explore the characteristics of tax compliance for businesses of Micro,

Small and Medium Enterprises (SMEs) sector in the Districts/Cities in East Java Province,

Indonesia. The sampling method used is simple random sampling. The data collection method

used is questionnaire and in depth interview. The number of respondents that is used in this

study is 283 people from various fields of business, especially SMEs in the field of handicrafts.

This type of research is exploratory research. Furthermore, the method of analysis used is

descriptive. The results provide the conclusion that the level of tax compliance from SMEs

sector businesses is still low. It can be seen by the level of absence of tax identification number

(TIN) which is high (79% of respondents do not have a TIN), never punctual in paying taxes

(42% of respondents), never on time in delivering tax (42% of respondents), and have never

been willing to pay the tax (37% of respondents). Based on these results, the tax officials can

improve accessibility for the SMEs business sector in the fulfillment of the tax obligations. This

can be done by providing a range of additional services in the administration of TIN, tax

payment and reporting the tax. The services associated with the place, guidance, and tax laws

governing the taxation of accessibility for the business sector of SMEs.

Keywords: Taxpayers, Tax Compliance, Tax Reporting Micro Small and Medium Enterprises,

Indonesia

Licensed under Creative Common Page 116

International Journal of Economics, Commerce and Management, United Kingdom

INTRODUCTION

The small business sector of micro and medium enterprises (SMEs) play a significant role in

sustaining local economic activity; SMEs with all of their characteristics are able to provide a

large selection of economic activity is much needed by producers, consumers and

governments. Economic interactions among economic actors can provide wider space in

improving the added values to the economy. In economic activity in the real sector, SMEs actors

can perform economic activities primarily related to the fulfillment of people's lives. Commodities

that are traded include commodities of all types, such as; food, drinks, crafts, and services. The

continued development of SMEs sector, then, it will be able to make a positive contribution to

local economic development.

The developments in the early 2016 showed that in the first quarter of 2016, East Java's

economy compared to the first quarter of 2015 grew by 5.34 percent (BPS East Java, 2016).

Economic growth rate above 5% that reflects their optimism regional economic activity in the

midst of economic turmoil abroad who have slow down. The increase in economic growth

reflects the expansion of economic activity in both the scale of macro and micro scale. In the

role of macro-scale manufacturing industry and trade, hotels and restaurants is very important in

sustaining the GDP of East Java. While a micro scale of the role of SMEs is crucial in improving

the economic value in many areas.

Increasingly SMEs in the region's economic development is inseparable from the

business climate created in the area. The business climate associated with the policies or rules

associated with the development of SMEs in East Java. Based on the data until the end of

2015, there are 6,825,931 SMEs units’ are scattered in various districts / cities in East Java.

While the number of workers absorbed is 11,117,439 people. Among the number of SMEs, the

role of micro-enterprises, 95.72%; 3.84% of small businesses and medium-sized enterprises

consist of 0.45% (http://diskopumkm.jatimprov.go.id/). That number can grow even more, given

that many SMEs business operators informal nature. This type of business that is spread on a

wide range of activities such as trade, hotels, restaurants, transportation, agriculture, mining and

quarrying, manufacturing, financial and services sectors. The number of workers absorbed on

the number of SMEs reached.

As explained above, the development of SMEs is dynamic enough to provide a positive

contribution to regional development, especially in East Java. Contributions can be realized in

the form of increase in the GDP and tax revenue. The existence of SMEs can encourage the

kind of economic activity spread more widely as well as to provide employment of new labor

force. These conditions may encourage an increase in the GDP. Results of research conducted

by Beck, et al (2004) gives the strong correlation between SMEs sector to the GDP per capita in

Licensed under Creative Common Page 117

© Mukhlis & Simanjuntak

various countries (62 countries). Meanwhile, according to Katua (2014) SMEs sector can play

an important role in the creation of economic activities in the development.

On the other hand, it can also be explained that the existence of these SMEs can create

new businesses that involve both producers and consumers. This of course can provide new

opportunities for the emergence of new taxpayer or tax object in economic activity. The taxpayer

is usahan economic actors who have a certain income. This revenue can be created because

the business they work by rapidly expanding SMEs business operators in the development of

regional economy. Indicators of the development efforts of SMEs can be seen from the

development of business and the increasing SMEs SME businesses from various age groups.

With conditions growing SMEs, of course, an increasing number of new taxpayers who have the

ability to pay taxes. Improving the ability of this tax can ultimately improve tax collections. In

relation to the results of research conducted by Mukhlis, et al (2015) provided a different

perspective related to tax compliance, where the education factor taxation and tax knowledge

can affect tax compliance SMEs sector businesses in East Java, Indonesia. The results of this

study can be categorized as non-economic factors that affect tax compliance. Meanwhile,

according to Misu (2011) economic factors in the form of income level can play an important

role in influencing public tax compliance. Both non-economic factors and economic factors that

cumulatively can determine the degree of tax compliance SMEs sector businesses. Including

the identification of factors into both of these factors can facilitate in addressing the issues of tax

compliance levels are still low. The businessmen of SMEs sector in developing countries is still

dominated by the high level of education that have not, it becomes a challenge in the

development of tax knowledge in Indonesia.

Based on the explanation above, this paper aims to describe the characteristics of SMEs

sector businesses in East Java Province Indonesia in connection with tax compliance.

LITERATURE REVIEW

SMEs in many respects have an important role in building the economy of a country.

Experience of economic crisis that hit Indonesia in 1997-1998, the rate of recover the economy

can run linear and quick due to the role of SMEs in the economy sector. SMEs sector can be

said to be a catalyst in the process of saving the national economy. In this case, according to

Beck and Levin (2005) SMEs sector can promote competitiveness and entrepreneurship that

can provide external benefits in the form of expansion of economic activity, innovation and

overall productivity. In the era of today's global economy, a competitive advantage be a key to

success to build the economy. SMEs sector can be a leading sector in economic empowerment

and increase the added value of the economic resources available in the area.

Licensed under Creative Common Page 118

International Journal of Economics, Commerce and Management, United Kingdom

Tax compliance concerning the behavior is heavily influenced by various factors, such as

economic and psychological factors. Influence of economic factors on tax compliance is

described by Alingham and Sandmo (1972). In this case, the tax compliance declares income

expressed as influenced by the level of income, rates, their audit and penalty rate. Meanwhile,

in the perspective of the psychology of the various studies existing theories, models of tax

compliance can adopt the Theory of Planned Behavior developed by Ajzen (1991). This theory

explains the factors that shape a person's behavior. In empirical studies, Theory of Planned

Behavior is used to analyze the factors affecting tax compliance in various countries; as an

illustration of the use of this theory can be presented on a study conducted by the Langham,

et.al (2012) in Australia. Based on these results indicate that the desire to obey the tax (the

intention to comply) may not always be a strong predictor of the behavior to comply taxes. In

this case there are various complexities and difficulties in measuring performance improvement

of tax compliance.

The existence of SMEs sector can play an important role in improving tax compliance.

Results of research conducted by Atawodi (2012); Mukhlis, et al (2013); Mukhlis, et al (2015)

provided an explanation of some of the factors that could affect tax compliance of SMEs sector

businesses in many developing countries. In other words, by enhancing the knowledge and

education of taxation is good then it can increase tax compliance on the businessmen SMEs

sector. SMEs sector with all the characteristics of local shows real existence in running the

economy. SMEs business character like; does not require formal education, does not require

big capital, the business type is varied according to the needs of society, and business activities

are easy to do. With a variety of characters such business, SMEs sector may have the space

and flexibility of a dynamic and sustainable businesses. If the SMEs sector can be managed

properly, then the potential to support increased tax revenue will also increase. Nevertheless, a

variety of ways for businesses of tax compliance can be increased; one through socialization

and educational activities tax to businesses in the sector of SMEs.

Many of the laws were formulated in connection with an increase in tax revenue from

businesses. One of the rules is associated with the acquisition of gross entrepreneurs in

business. In this case that is subject to Income Tax (VAT) is income from business derived by

the taxpayer with a gross turnover (turnover) that does not exceed 4.8 billion in the first tax year.

Government Regulation No. 46 of 2013 contains the Income Tax on Income from Business

Received or obtained Taxpayers Who Have Specific Gross Circulation. In this regulation

governed Income Tax (VAT), which shall be final on income received or accrued by the

taxpayer with a gross turnover of certain restrictions.

Licensed under Creative Common Page 119

© Mukhlis & Simanjuntak

RESEARCH METHODOLOGY

Based on the research objectives, this is an exploratory research. Exploratory research exposes

a fact by promoting in-depth observation of the phenomenon observed. The phenomena

observed in nature contain elements of novelty, unique and widely studied by other researchers.

The data used in this study primary data obtained by using questionnaires and indept

interviews. The population in this study is business engaged in small and medium enterprises

which are located in different cities/regencies in East Java, Indonesia. The selection of

respondents’ as the research sample using simple random sampling technique. Respondents in

this study are SMEs business people on handicraft sector in various cities/regencies in East

Java, Indonesia. Data collection is done within a month from February to April 2016. Existing

data analyzed descriptively to find tax compliance characteristics of SMEs sector businesses in

various cities / regencies in East Java.

ANALYSIS AND DISCUSSION OF RESULTS

Results of empirical studies on tax compliance entrepreneurs in SMEs sector in various districts/

cities of East Java Province Indonesia's important to give informed about the character of tax

compliance in various areas. These characters concerning aspects of the age composition are

main indicators in tax compliance. Based on the number of respondents who provided feedback

answer as many as 283 entrepreneurs of SMEs in the various districts / municipalities in East

Java Province. Among the existing respondents, the age structure as follows:

Table 1: Composition of Respondents Age

No. Age Interval (Year) Number of Respondent (people) Percentage

1 19-24 10 3,53

2 25-30 17 6,01

3 31-36 21 7,42

4 37-42 56 19,79

5 43-48 88 31,10

6 49-54 55 19,43

7 55-60 22 7,77

8 61-66 7 2,47

9 67-72 1 0,35

10 73-78 1 0,35

Does not provide answer for age 5 1,77

Respondents in this study include the age group in the age range of 19 years to 66 years of

age. The composition of the respondents are in the age range 43 years to 48 years by (31.10),

followed by the age group in a span of 37 years up to the age of 42 years (19.79%) and the age

Licensed under Creative Common Page 120

International Journal of Economics, Commerce and Management, United Kingdom

range of 49 years to 54 years of age (19, 43%). In general, the distributions of the largest age

group in this study respondents in the span of 37 years to 54 years (70.32%). This shows that

SMEs business operators in this respondent has the characteristics of productive age and reach

a period of business development. It certainly gives strength and opportunities in business

development in the SMEs sector in the global era. In addition, also in the age range of the level

of maturity and knowledge on various issues in relation to the business has the greater degree

of accuracy. At the level of maturity and knowledge of the higher, it is possible knowledge about

taxes can be obtained by the business sector SMEs through both electronic and print media.

In relation to the fulfillment of the obligations of the tax administration businesses SMEs

sector in various districts / cities in East Java Province can be described through a proprietary

indicator Taxpayer Identification Number (TIN). Based on the results of the questionnaire

suggests that as many as 58 businesses already have a TIN, while there is one person who is

still processing of filing a tax ID, and the remaining 224 people do not have a TIN in business. In

other words, about 79 percent of businesses surveyed SMEs sector does not have a TIN.

Based on interviews with several businesses, the reason they have a TIN expressed the

opinion as follows: "..........I take care of my TIN in order to get easy access for my business

activities, for example in a loan application to the bank or get help from the local government ...."

Another respondent gives his statement: "......... TIN needs to be owned by the business

because it is the duty as citizens who obey the tax ... .."

The results of this in-depth interview to explain a person has a TIN in the areas of

business that they do. Awareness of the tax in the form of ownership of TIN is based on a

variety of benefits resulting from the ownership of TIN. The reason is the economic benefit that

can be derived by the taxpayer in the implementation of tax compliance. In certain situations,

TIN ownership is also based on the availability of facilities and infrastructure in the process of

TIN ownership, ease of procedure, and the technical assistance of the relevant authorities.

However, interviews with actors other SMEs also provide overview of the implementation of its

obligations as a state's orientation in terms of taxation. One is the tax obligations of individuals

in possession of TIN. Therefore the two reasons above become important information in an

effort to increase public interest in the ownership of TIN, especially for businesses in the sector

of SMEs.

While the results of another interview SMEs sector to businesses that do not have a TIN

has the statement as follows:"...... I do not have a TIN because I do not know the procedures

and requirements for obtaining a tax ID card ... .." Another respondent stated: "......... I do not

know what the function of TIN for businesses. Businessmen are basically have a high need of

funds for the sake of development of their business... ". Other respondents gave a statement as

Licensed under Creative Common Page 121

© Mukhlis & Simanjuntak

follows: "...... I have a home out of town; I do not know how to take care of TIN. My daily job has

not allowed me to take care of TIN.

For some SMEs businesses sector, TIN is still a rare thing. In other words, many of the

businesses that do not have a TIN for various reasons; among the many reasons that exist,

related to the understanding of the TIN good taxpayer relates to the definition, how to obtain and

benefits have a TIN for the business developed by the community.

Tax compliance indicators used in this study using indicators developed by Brown and

Mazur (2003). Based on the results if the data is performed can be generated information

relating to tax compliance SMEs sector businesses.

Table 2: Indicators of Tax Compliance for SMEs Businessmen Sector

Variable No Indicator Answer

1 2 3 4

Tax 1 Does the taxpayer file on time? 118 79 37 49

Compliance (42%) (28%) (13%) (17%)

2 Does the taxpayer report his/her 118 88 42 35

tax liability accurately? (42%) (31%) (15%) (12%)

3 Does the taxpayer pay the full 103 91 46 42

amount he/she reported as tax (37%) (32%) (16%) (15%)

liability?

Description: 1 = never; 2 = seldom; 3 = often; 4 = always

The results of questionnaires given a result that the tax compliance variable can be measured

using three indicators; for the first indicator can be responded well by 283 people. For indicator

2 responded to by 283 people and for the indicator to 3 282 people responded by SMEs sector

businesses. Within the individual tax compliance indicators provide results that among all the

indicators that there is a choice answers on a scale of 1 has the highest percentage. In other

words, every indicator of tax compliance, respondents gave the answer choices on a scale of 1

(meaning never) is greater than the other answer choices (scale 2, 3, and 4). For example,

based on indicators of the taxpayer file on time, respondents gave the answer choices on a

scale of 1 of 118 people (42%). This means that as many as 42% of respondents claimed never

to have timely tax payments. Meanwhile, 49 respondents or 17% which gives the choice of

answers on a scale of 4; this means that the respondent businesses only 17% of SMEs sector

that is always on the tax payments.

For the second tax compliance indicators that the taxpayer report his / her tax liability

accurately, demonstrate that respondents chose the answer on a scale of 118 people or 42%.

This means that as many as 118 businesses or 42% of SMEs sector is never on time for

Licensed under Creative Common Page 122

International Journal of Economics, Commerce and Management, United Kingdom

submission of the report of the notification (SPT) taxes. While as many as 35 respondents or

12% said that always timely in the delivery of its tax return.

For the third indicator that the taxpayer pay the full amount he/she Reported as tax

liability, shows that as many as 103, or about 37% of respondents who said never willing to pay

taxes. Meanwhile, as many as 42 people or 15% said that always willing to pay his tax

obligations.

The results of this study indicate a low level of tax compliance SMEs sector businesses

in various districts / cities in East Java Province, Indonesia. The low ownership TIN, not timely

payment of taxes, not timely in the delivery of SPT and are not willing to pay taxes is an

indicator that represents the individual tax compliance. Perception of the taxpayer on the tax

obligations shows the degree of willingness of taxpayers in performing the obligations inherent

in the individual in accordance with applicable regulations. However, this perception is still

limited to the attitude of the taxpayer on the implementation of tax laws through three indicators

of tax compliance as described above. Obviously there are other factors that influence the

perception of taxpayers in the SMEs sector in East Java Province.

These findings were also corroborated by the results of interviews conducted with some

of the entrepreneurs in the SMEs sector. In this case the low level of tax compliance can be

caused by misunderstanding factors of the public on payment mechanisms and delivery of tax

returns. This incomprehension concerning the knowledge of taxpayers against what should be

done related to tax liabilities for these types of activities in the SMEs sector. Knowledge on

unequal society will have an impact on tax revenue short of targets based on the potential of

existing taxation. In addition to the problem of incomprehension, of trust (trust) communities

against tax management is also a cause of the low tax compliance SMEs sector businesses.

Trust the taxpayer to the tax authorities is an important factor that can foster the image of

taxpayers towards tax management. High trust will be able to foster a positive perception of

taxpayers regarding tax liabilities and tax to the welfare of society. This is supported by the

results of interviews with businesses associated with non-compliance tax reasons:"... ..I still

think whether tax money can be managed well by the government. From some news suggests

many individual cases of corruption related to tax fraud in the form of tax money, corruption

utilization of funds from central government finances or local government comes from taxes and

inequality of development in the various regions...." Another respondent commented: "... ..I am

as citizens expect much so that corruption cases can be solved with a good tax. Poor people

are still in need of development outcomes that are not poor anymore and can prosper...."

The results are consistent with the results of research by Mukhlis, et al (2015) which

emphasizes that education and knowledge are good taxes to increase tax compliance business

Licensed under Creative Common Page 123

© Mukhlis & Simanjuntak

operators. Through education, taxation implemented most efficiently and drive to improve tax

compliance, it can be expected tax compliance can be increased. In this case the trust factor

and ease is also instrumental in the implementation of tax obligations for the business sector

SMEs in the region. In this case, it takes policies to encourage the utilization of tax management

and tax can be directed to activities that touch the lives of many people. Tax dissemination

efforts could emphasis on the active participation of communities to understand correctly the tax

in an effort to improve the lives of people. In this case the real interaction between tax officials

with entrepreneurs in the SMEs sector can be directed towards improving public knowledge of

tax and expansion of tax services to the whole society.

The problem of the low level of tax compliance remains a concern various researchers to

examine in more depth. The review involves the identification of factors that influence the impact

of tax compliance, and policy to improve tax compliance. The results of these studies are

integrated with the development of theories that are relevant in explaining the tax compliance. In

some conclusion, the complexity and difficulty in analyzing both related to compliance

measurement indicators, selection of methods of analysis, and determination of variables in tax

compliance. In this case Langham, et.al (2012) conducted a study on tax compliance of small

and medium businesses (small and medium enterprises) in Australia in the psychological

perspective using Azjen theory (1991). Based on these results indicate that the desire to obey

the tax (the intention to comply) may not always be a strong predictor of the behavior to comply

taxes. In other words there are in fact other factors that may affect the level of tax compliance in

the sector, especially SMEs.

CONCLUSION

Tax compliance is a taxpayer's behavior in performing their tax obligations in accordance with

applicable regulations. The size of the tax compliance rate is determined by several factors that

are multidimensional. These factors may also be categorized as a factor of economic and non-

economic factors. This study focuses on the exploration tax compliance characteristics of SMEs

sector businesses located in different districts / cities in East Java Province, Indonesia.

The results provide the conclusion that most respondents age range in the interval

between the ages of 43 years to 48 years of 33.1%. This shows the great potential in the

development of SMEs sector in the region, due in part businesses still in the productive age

range. An important result of this research is the level of tax compliance business operators in

the sector SMEs in the region are still low; this is indicated by the level of ownership of

Taxpayer Identification Number (TIN). From the data that can be collected as many as 283

respondents, 79% of SMEs sector businesses do not have a TIN. In addition, also based on

Licensed under Creative Common Page 124

International Journal of Economics, Commerce and Management, United Kingdom

three indicators of tax compliance proposed by Brown and Mazur (2003) showed that the level

of tax compliance SMEs sector businesses in various districts / cities in East Java, Indonesia is

still low. This is supported by the response of businesses to the questionnaire that was

delivered with the majority of respondents said never be punctual in paying taxes (42%), never

on time in delivering report notification letter (SPT) tax (42%), and never willing to paying taxes

(37%)

POLICY RECOMMENDATIONS

Based on these results, the recommendations policy that can be delivered are:

a. The government needs to improve accessibility for the business sector SMEs in the

fulfillment of the tax obligations. This can be done by providing a range of additional

services in the administration of TIN, tax payment and reporting SPT.

b. The tax apparatus may provide socialization in real terms to businesses on taxation laws in

the field of SMEs. This activity can be carried out in the centers and the activities of SMEs

in the market. To support the success rate of this activity, it takes taxes volunteers that can

be collected from various existing tax communities.

c. For other researchers, it is suggested in order to explore the tax compliance from another

perspective, as a moral perspective and local knowledge that exist in the community of

taxpayers.

LIMITATION OF THE STUDY

Limitation of the study is the small sample size compared with the total population of businesses

in the SME sector. There were difficulties in determining the amount of a representative sample

representative of the overall population. Therefore, other researchers may use other sampling

techniques in analyzing the object of SMEs. In addition, also the method of analysis used only

descriptive so not describe the depth of the problem. Therefore, in another study could be

developed another method of analysis using either a qualitative and quantitative approach.

REFERENCES

Ajzen, I.(1991).The Theory of Planned Behavior. Organizational Behavior and Human Decision

Processes, 50(2),179-211.

Allingham, Michael G. and Agnar Sandmo (1972). Income Tax Evasion: A Theoritical Analysis, Journal of

Public Economics, 1: 323-338.

Atawodi,Ojochogwu Winnie dan Stephen Aanu Ojeka. (2012). Factors That Affect Tax Compliance

among Small and Medium Enterprises (SMEs) in North Central Nigeria, International Journal of Business

and Management, 7(12),87-96.

Licensed under Creative Common Page 125

© Mukhlis & Simanjuntak

Beck, Thorsten, Asli Demirguc-Kunt, and Ross Levine. (2004). SMEs, Growth, and Poverty:Cross-

Country Evidence, research paper, available from,

siteresources.worldbank.org/.../SMEs_Growth_and_Poverty_C. (accessed 20 May, 2016).

Beck, Demirguc-Kunt, Levine.(2005). SMEs, Growth, and Poverty: Cross-Country Evidence. Journal of

Economic Growth, 10:199–229, available from

http://siteresources.worldbank.org/INTFR/Resources/SMEs_Growth_and_Poverty_Cross_Country_Evide

nce.pdf (accessed 10 May, 2016).

Brown, Robert E. and Mark J. Mazur. (2003).IRS’s Comprehensive Approach to Compliance

Measurement, paper, Internal Revenue Service, Washington, Juni, 1-18.

Katua, Ngui Thomas. (2014), The Role of SMEs in Employment Creation and Economic Growth in

Selected Countries, International Journal of Education and Research, 2(12), December,461-472.

Langham, Jo’Anne, Neil Paulsen and Charmine E. J. Härtel. (2012). Improving Tax Compliance

Strategies:Can the Theory of Planned Behaviour Predict Business Compliance?, eJournal of Tax

Research, 10(2),364-402.

Misu Nicoleta Barbuta. (2011). A Review of Factors for Tax Compliance, paper Annals of “Dunarea de

Jos” University of Galati Fascicle I. Economics and Applied Informatics Years XVII – no 1, available from

www.ann.ugal.ro/eco (accessed 02 Feburary, 2015).

Mukhlis, Imam, Sugeng Hadi Utomo, Yuli Soesetyo. (2013). Increasing Tax Compliance Through

Strengtheing Capacity of Education Sector for Export Oriented SMEs Handicarft Field in East Java

Indonesia, European Scientific Journal,10(7), March,170-184

----------------------.(2015). The Role of Taxation Education on Taxation Knowledge and Its Effect on Tax

Fairness as well as Tax Compliance on Handicraft SMEs Sectors in Indonesia, International Journal of

Financial Research, 6(4), Oktober,161-169

Licensed under Creative Common Page 126

View publication stats

You might also like

- Applied Entrepreneurship: In Philippine Context for Senior High SchoolFrom EverandApplied Entrepreneurship: In Philippine Context for Senior High SchoolNo ratings yet

- Tax Policy Implications for Nigerian SME GrowthDocument12 pagesTax Policy Implications for Nigerian SME GrowthXhaNo ratings yet

- Challenges of Implementing Computerized Accounting System in Small and Medium Enterprises in Ampara DistrictDocument10 pagesChallenges of Implementing Computerized Accounting System in Small and Medium Enterprises in Ampara DistrictMohamed Sajir100% (4)

- Tax Incentives and Growth of SMEs in NigeriaDocument19 pagesTax Incentives and Growth of SMEs in NigeriaSuleiman Abubakar AuduNo ratings yet

- Effect of Multiple Taxation On The Performance ofDocument12 pagesEffect of Multiple Taxation On The Performance ofshackeristNo ratings yet

- 606-Texto Del Artículo-2677-1-10-20190704Document25 pages606-Texto Del Artículo-2677-1-10-20190704jorgeNo ratings yet

- Accounting Information: Business Scale, Msme Business Age and Owner Education LevelDocument7 pagesAccounting Information: Business Scale, Msme Business Age and Owner Education LevelThe IjbmtNo ratings yet

- Gla Pro WorkDocument26 pagesGla Pro WorkEric AddoNo ratings yet

- [EJAVEC] modelling micro enterprises' behavioral intention to adopt integrated islamic crowdfunding-micro enterprise (IICME) model as a source of financing in east java, indDocument20 pages[EJAVEC] modelling micro enterprises' behavioral intention to adopt integrated islamic crowdfunding-micro enterprise (IICME) model as a source of financing in east java, indchintiaarchivesNo ratings yet

- Market Performance and Business Strategy Their Impacts On Micro, Small, Medium-Scale Enterprise's Tax ObligationDocument15 pagesMarket Performance and Business Strategy Their Impacts On Micro, Small, Medium-Scale Enterprise's Tax ObligationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- B. Research Chapter 1Document26 pagesB. Research Chapter 1dominicNo ratings yet

- Effect of Smes Performance Indicator of Business Turnover As A Dimension of Economic Growth: Borama CaseDocument14 pagesEffect of Smes Performance Indicator of Business Turnover As A Dimension of Economic Growth: Borama CaseBeteck LiamNo ratings yet

- Running Head: Effects of Tax Policies On Smes: January 2022Document11 pagesRunning Head: Effects of Tax Policies On Smes: January 2022georgeNo ratings yet

- Impact of GST on SMEs in Johor BahruDocument11 pagesImpact of GST on SMEs in Johor BahruAmirahNo ratings yet

- Article+4+ (1074) ++Rai+Gina Copyedited+ (29-37)Document9 pagesArticle+4+ (1074) ++Rai+Gina Copyedited+ (29-37)Vanesa Amalia DuatiNo ratings yet

- Relationship Between Tax Policy and Growth of SMEs in NigeriaDocument11 pagesRelationship Between Tax Policy and Growth of SMEs in NigeriaHermenegildo Valente MatsinheNo ratings yet

- Readiness Dalam Penerapan Standar Akuntansi KeuanganDocument10 pagesReadiness Dalam Penerapan Standar Akuntansi KeuanganSylvi LorensiaNo ratings yet

- Hnin Yu Hlaing - 05 Factors Influencing Labor Productivity of MSMEs in Tanintharyi RegionDocument9 pagesHnin Yu Hlaing - 05 Factors Influencing Labor Productivity of MSMEs in Tanintharyi RegionKyaw Moe ThuNo ratings yet

- ANALISIS FAKTOR-FAKTOR YANG MEMENGARUHI PENGGUNAAN INFORMASI AKUNTANSI PADA UMKM KOTA BATAM (Dian Efriyenty - 2020)Document14 pagesANALISIS FAKTOR-FAKTOR YANG MEMENGARUHI PENGGUNAAN INFORMASI AKUNTANSI PADA UMKM KOTA BATAM (Dian Efriyenty - 2020)Jessica SiagianNo ratings yet

- Micro and Small Enterprises in Nepal Prospects and ChallengesDocument12 pagesMicro and Small Enterprises in Nepal Prospects and ChallengesMonish ShresthaNo ratings yet

- Factors That in Uence Financial Literacy On Small Medium Enterprises: A Literature ReviewDocument19 pagesFactors That in Uence Financial Literacy On Small Medium Enterprises: A Literature ReviewwindyNo ratings yet

- 1002 - Gede Oka Restu Pratama - UTS EFSP-1Document14 pages1002 - Gede Oka Restu Pratama - UTS EFSP-1Oka Restu.35No ratings yet

- 3.Man-Factors That Affect Tax Compliance Among Small and Medium Enterprises - Dr. Isaac IkporDocument12 pages3.Man-Factors That Affect Tax Compliance Among Small and Medium Enterprises - Dr. Isaac IkporImpact JournalsNo ratings yet

- DR Phelistas 4Document28 pagesDR Phelistas 4raymund sumayloNo ratings yet

- Effect of Taxpayer Education on Voluntary ComplianceDocument12 pagesEffect of Taxpayer Education on Voluntary CompliancewhNo ratings yet

- MSME Concept PaperDocument7 pagesMSME Concept PaperJoshua ReyesNo ratings yet

- The Study of SME's Contribution To Myanmar's Economic DevelopmentDocument8 pagesThe Study of SME's Contribution To Myanmar's Economic DevelopmentTHAN HANNo ratings yet

- Putra - 2019 - Analysis of Factors Affecting The Interests of SMEs Using Accounting ApplicationsDocument10 pagesPutra - 2019 - Analysis of Factors Affecting The Interests of SMEs Using Accounting ApplicationsYananto Mihadi PutraNo ratings yet

- 94-Article Text-373-1-10-20200811Document10 pages94-Article Text-373-1-10-20200811Muthia CristineNo ratings yet

- Research 14Document11 pagesResearch 14Sandakelum PriyamanthaNo ratings yet

- The Benefit of Internal Control For Small Business CompanyDocument8 pagesThe Benefit of Internal Control For Small Business CompanyJoko SusiloNo ratings yet

- 207-Article Text-821-1-10-20230511Document12 pages207-Article Text-821-1-10-20230511Sherly AuliaNo ratings yet

- Pengaruh Pengetahuan Dan Perilaku Keuangan Terhadap Perkembangan Umkm Di Provinsi Sumatera Utara JanuardinDocument10 pagesPengaruh Pengetahuan Dan Perilaku Keuangan Terhadap Perkembangan Umkm Di Provinsi Sumatera Utara JanuardinMuhammad FaisalNo ratings yet

- 1012 3187 1 PBDocument10 pages1012 3187 1 PBA. Isma NursyamsuNo ratings yet

- Thesis On Micro Small and Medium EnterprisesDocument7 pagesThesis On Micro Small and Medium Enterprisesafcnfajtd100% (2)

- Role of SMEs in Employment and Economic GrowthDocument14 pagesRole of SMEs in Employment and Economic GrowthIan OdhiamboNo ratings yet

- Micro, Small and Medium Enterprises Survey in Nigeria by SmedanDocument182 pagesMicro, Small and Medium Enterprises Survey in Nigeria by Smedanleye02100% (2)

- The Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595Document17 pagesThe Influence of Financial Literacy On Smes Performance Through Access 1528 2635 24-5-595rexNo ratings yet

- Factors Influencing Development of Microenterprises in BangladeshDocument11 pagesFactors Influencing Development of Microenterprises in BangladeshSuborna BaruaNo ratings yet

- Analytical Study On Demonetization Effects On Micro, Small and Medium EnterprisesDocument8 pagesAnalytical Study On Demonetization Effects On Micro, Small and Medium EnterpriseschamheartyouNo ratings yet

- Modernization Strategies for Small Scale Industries in IndiaDocument6 pagesModernization Strategies for Small Scale Industries in IndiaMukesh ManwaniNo ratings yet

- Impact Analysis of Tax Policy and The Performance of Small and MediumDocument25 pagesImpact Analysis of Tax Policy and The Performance of Small and Mediumkara albueraNo ratings yet

- 10556-Article Text-31892-1-10-20210130Document4 pages10556-Article Text-31892-1-10-20210130cabdijibaar barreNo ratings yet

- The Opportunities and Threats of Small and Medium Enterprises in Pekanbaru: Comparison Between Smes in Food and Restaurant IndustriesDocument10 pagesThe Opportunities and Threats of Small and Medium Enterprises in Pekanbaru: Comparison Between Smes in Food and Restaurant IndustriesfitriNo ratings yet

- Discuss EconomDocument3 pagesDiscuss EconomJOSHUA DEBORAH PEACENo ratings yet

- The Assistance For Small To Medium Enterprises in Preparing Financial Reports at East Kasiyan Village, Puger Sub District Jember RegencyDocument5 pagesThe Assistance For Small To Medium Enterprises in Preparing Financial Reports at East Kasiyan Village, Puger Sub District Jember RegencyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Micro Business Development Strategies for Aerocity OpportunitiesDocument14 pagesMicro Business Development Strategies for Aerocity OpportunitiesMade Yoga PradnyanaNo ratings yet

- Factors Affecting Growth of Small and Medium Enterprises in Sri LankaDocument10 pagesFactors Affecting Growth of Small and Medium Enterprises in Sri LankaCHANI GUNASEKARANo ratings yet

- Faktor-Faktor Yang Memengaruhi PenggunaanDocument25 pagesFaktor-Faktor Yang Memengaruhi PenggunaanNOVIA FITRIANINo ratings yet

- IJCRT2105017Document7 pagesIJCRT2105017G LifecareNo ratings yet

- Role of SME's in Economic GrowthDocument7 pagesRole of SME's in Economic GrowthAlina JamilNo ratings yet

- Financial Literacy and Performance EditedDocument10 pagesFinancial Literacy and Performance EditedOIRCNo ratings yet

- SME Readiness for Implementing SAK EMKM StandardsDocument16 pagesSME Readiness for Implementing SAK EMKM StandardsGaa SabrinaNo ratings yet

- Analisis Pemetaan Permasalahan Pembukuan Umkm Di Daerah Istimewa YogyakartaDocument10 pagesAnalisis Pemetaan Permasalahan Pembukuan Umkm Di Daerah Istimewa YogyakartaNanda KarinaNo ratings yet

- Ahmad, M. A. R., Mohd, M., & Mohd. Asri Mohd. Noor. (2007) - The Effects of KnowledgeDocument10 pagesAhmad, M. A. R., Mohd, M., & Mohd. Asri Mohd. Noor. (2007) - The Effects of KnowledgeWenona Maryam JayaNo ratings yet

- Journal of Accounting Business and ManagementDocument13 pagesJournal of Accounting Business and ManagementAlbert KurniawanNo ratings yet

- Submitted To Madurai Kamaraj University in Partial Fulfilment of The Requirement For The Degree ofDocument6 pagesSubmitted To Madurai Kamaraj University in Partial Fulfilment of The Requirement For The Degree ofChasity MorseNo ratings yet

- 125987475Document8 pages125987475ficky alkarimNo ratings yet

- Benard ProposalDocument17 pagesBenard ProposalTheophilus AshiabieNo ratings yet

- Balance of PaymentDocument17 pagesBalance of PaymentSudeshna SarkarNo ratings yet

- Working Paper 191: Systemic Sovereign Risk: Macroeconomic Implications in The Mplicatio Euro Area oDocument67 pagesWorking Paper 191: Systemic Sovereign Risk: Macroeconomic Implications in The Mplicatio Euro Area oSrikara SimhaNo ratings yet

- Perception of Tax Payers Towards GST: A Fiscal and Social Psychology Model ApproachDocument19 pagesPerception of Tax Payers Towards GST: A Fiscal and Social Psychology Model ApproachSrikara SimhaNo ratings yet

- Ble Case 6Document3 pagesBle Case 6Srikara SimhaNo ratings yet

- Strengthening Science and Tech for Arab Disaster Risk ReductionDocument21 pagesStrengthening Science and Tech for Arab Disaster Risk ReductionSrikara SimhaNo ratings yet

- Jet AirwaysDocument2 pagesJet AirwaysSrikara SimhaNo ratings yet

- Case CollaborationDocument2 pagesCase CollaborationSrikara SimhaNo ratings yet

- The Impact of Tax and Expenditure Policies On Income DisttributioDocument37 pagesThe Impact of Tax and Expenditure Policies On Income DisttributioAmbright MullerNo ratings yet

- Indian Rural SectorDocument8 pagesIndian Rural SectorSrikara SimhaNo ratings yet

- INCOME TAX AUTHORITIES AND POWERSDocument13 pagesINCOME TAX AUTHORITIES AND POWERSSrikara SimhaNo ratings yet

- Types StrategyDocument10 pagesTypes StrategySrikara SimhaNo ratings yet

- INCOME TAX AUTHORITIES AND POWERSDocument13 pagesINCOME TAX AUTHORITIES AND POWERSSrikara SimhaNo ratings yet

- Economic Crisis and Its Impact On Economic Development Special Reference To SrilankaDocument7 pagesEconomic Crisis and Its Impact On Economic Development Special Reference To SrilankaCNo ratings yet

- Presentation IFMDocument11 pagesPresentation IFMSrikara SimhaNo ratings yet

- Oil PricesDocument7 pagesOil PricesSrikara SimhaNo ratings yet

- Presentation IFMDocument11 pagesPresentation IFMSrikara SimhaNo ratings yet

- Tax Answers - Chapter 3Document4 pagesTax Answers - Chapter 3Jonathan VelaNo ratings yet

- ELP-Exclusive Analysis Budget 2017Document66 pagesELP-Exclusive Analysis Budget 2017Panache ZNo ratings yet

- Afu 08609: Treasury Management Lecture Notes: Management of The Bank'S Balance SheetDocument25 pagesAfu 08609: Treasury Management Lecture Notes: Management of The Bank'S Balance SheetPoula paulsenNo ratings yet

- The Employee'S Provident Act1952: Name: Yogesh SinghDocument10 pagesThe Employee'S Provident Act1952: Name: Yogesh Singhyogesh singhNo ratings yet

- Purchase of Land - Legal Checklists - Property BytesDocument12 pagesPurchase of Land - Legal Checklists - Property BytesSivashankar DhanarajNo ratings yet

- List of QuotesDocument6 pagesList of QuotesنورإيماننبيلةNo ratings yet

- Chapter 27 HW FinalDocument4 pagesChapter 27 HW FinalGabriel Aaron DionneNo ratings yet

- Guide to Donating and Claiming a Tax Deduction for Your Vehicle DonationDocument16 pagesGuide to Donating and Claiming a Tax Deduction for Your Vehicle DonationFlorinNo ratings yet

- ACC 1311 Introduction To Financial AccouDocument67 pagesACC 1311 Introduction To Financial AccouSharon Rose Galope100% (1)

- Dallas Council Budget WorkshopDocument159 pagesDallas Council Budget WorkshopRobert WilonskyNo ratings yet

- Estate Tax Gross EstateDocument13 pagesEstate Tax Gross Estatefernan opeliñaNo ratings yet

- Feastival 2019 InvoiceDocument1 pageFeastival 2019 InvoiceAnonymous 31FcJqNo ratings yet

- Errors: Objectives: Define and Identify Types of Errors. Give Examples of ErrorsDocument31 pagesErrors: Objectives: Define and Identify Types of Errors. Give Examples of ErrorsPang SiulienNo ratings yet

- Lass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)Document10 pagesLass 12 Subject Economics Paper Set 1 With Solutions: (Macro Economics) Question 1: (Marks 1)sandeep11116No ratings yet

- France: International Trading Project ReportDocument23 pagesFrance: International Trading Project Reportfun_maduraiNo ratings yet

- Setup Accounts Receivable Application for <Company Long NameDocument83 pagesSetup Accounts Receivable Application for <Company Long Nameajain366No ratings yet

- Budget Analysis 2017-18 HighlightsDocument10 pagesBudget Analysis 2017-18 HighlightsShatrughna SamalNo ratings yet

- WORKING CAPITAL DocxDocument16 pagesWORKING CAPITAL DocxGab IgnacioNo ratings yet

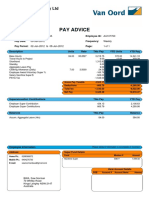

- Van Oord Australia Pty Ltd pays its employeesDocument1 pageVan Oord Australia Pty Ltd pays its employeesNorman BwaNo ratings yet

- BIR Form 2303 Registration GuideDocument2 pagesBIR Form 2303 Registration Guidejennifer alianzaNo ratings yet

- Udu Franchise ModelDocument3 pagesUdu Franchise Modeltinditi123No ratings yet

- Nishat Cash FlowDocument2 pagesNishat Cash FlowomairNo ratings yet

- JURNAL Siti Fatimah, (11021800330) (AutoRecovered)Document9 pagesJURNAL Siti Fatimah, (11021800330) (AutoRecovered)Adhya FauzanNo ratings yet

- CIVIL LAW MOCK BARscscscsDocument2 pagesCIVIL LAW MOCK BARscscscsChristopher Joselle MolatoNo ratings yet

- Bill FormatDocument4 pagesBill FormatMaaz KhanNo ratings yet

- 23-24 International Student Financial Aid ApplicationDocument5 pages23-24 International Student Financial Aid ApplicationbussraadiguzelNo ratings yet

- Econ ExamDocument24 pagesEcon ExamMariia AndreikoNo ratings yet

- Income From SalaryDocument54 pagesIncome From SalaryMohsin ShaikhNo ratings yet

- 48 Salary ProcessDocument33 pages48 Salary ProcessbapigangNo ratings yet

- Revenue Regulations No. 31-2020Document2 pagesRevenue Regulations No. 31-2020zelayneNo ratings yet

![[EJAVEC] modelling micro enterprises' behavioral intention to adopt integrated islamic crowdfunding-micro enterprise (IICME) model as a source of financing in east java, ind](https://imgv2-1-f.scribdassets.com/img/document/725153049/149x198/3c60dbb134/1713695610?v=1)