Professional Documents

Culture Documents

Finance Notes IV

Uploaded by

VARUN MONGACopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Finance Notes IV

Uploaded by

VARUN MONGACopyright:

Available Formats

FINANCIAL PLANNING AND CONTROL (CHAPTER 16)

The information derived from financial statement analysis can be used to establish future operating

goals (financial planning) and to determine how to meet established goals (financial control).

Developing pro forma (forecasted) financial statements is an important part of the planning and control

processes.

Sales Forecasts—probably the most important part of financial planning is the sales forecast; this

forecast generally is based on the trend in sales in recent periods, perhaps the last five to 10 years;

inaccurate sales forecasts can have serious repercussions—if the firm is too optimistic, such assets

as inventory will be built up too much, but if the firm is too conservative, it might miss valuable

opportunities in the market because demand cannot be met with existing production capabilities.

Projected (Pro Forma) Financial Statements—projected financial statements help the firm

determine the amount that is needed to finance expected future activities; the information from

these statements indicates how much financing will be generated by the firm internally and how

much must be generated externally (called additional funds needed) by borrowing or by selling

stock; following are the steps necessary to construct a pro forma balance sheet and a pro forma

income statement, which must be completed to determine the additional funds needed (AFN):

o Step 1: Forecast next period’s income statement—estimate the percentage growth (increase or

decrease) in sales, cost of goods sold, and other revenues and expenses, and then change the

current values by the estimates; one of the easiest ways to approach this task is to apply a single

growth rate, such as 8 percent, to all revenue and expense categories that change when

production changes; to be more accurate, however, each category should be examined

individually to determine the impact of any forecasted change; a projected income statement

might be as simple as the following:

Most Recent and Projected Income Statements (million of dollars, except per share data)

Most

Recent Forecast Initial

Results Basisa Forecast

Net sales $ 500.0 x 1.08 $ 540.0

Cost of goods sold (80% of sales) (400.0) x 1.08 (432.0)

Gross profit $ 100.0 $ 108.0

Fixed operating costs except depreciation ( 35.0) x 1.08 ( 37.8)

Depreciation ( 20.0) x 1.08 ( 21.6)

Earnings before interest and taxes (EBIT) $ 45.0 48.6

Less interest ( 12.0) ( 12.0)b

Earnings before taxes (EBT) $ 33.0 $ 36.6

Taxes (40%) ( 13.2) ( 14.6)

Net Income $ 19.8 $ 22.0

Forecasting, Planning, and Control – 1

Common dividends ( 10.0) ( 10.0)b

Addition to retained earnings $ 9.8 $ 12.0

Earnings per share $1.98 $2.20

Dividends per share $1.00 $1.00

Number of common shares (millions) 10.00 10.00

a

x 1.08 indicates “times (1 + g)”; used for items that grow proportionally with sales.

b

Indicates a figure carried over—that is, remains unchanged—for the preliminary, or initial,

forecast, because, at this point, we do not know whether additional funds are needed.

According to this forecast, the firm expects to grow by 8 percent next year. Notice that, in

addition to the variable revenues and expenses, the fixed costs and depreciation amounts are

increased by 8. This assumes the firm is currently operating at full capacity; if the firm is

not operating at full capacity, the forecasted amounts for fixed costs and depreciation either

would be about the same as the most recent figures (if the amount of existing plant and

equipment is sufficient to satisfy the increased production) or would change by a percent

different than 8 percent (if there is some free capacity, but not enough to meet all new

production requirements).

o Step 2: Forecast next period’s balance sheet—some accounts on the balance sheet, such as

inventories, receivables, payables, and other operating accounts, change “spontaneously” as

production changes (movements in these accounts generally result from day-to-day business

activities), while other accounts, such as long-term financing arrangements (bonds and equity),

remain constant until management makes decisions to raise new funds (movements in these

accounts require specific decisions and actions to be made). To determine the estimated

amounts in each balance sheet account, change the amount (balance) of each account that you

expect to be directly affected by any change in operating activities. In the current example, all

of the current assets and all of the current liabilities except notes payable should increase by 8

percent next year—notes payable is not a “spontaneous,” or operating, account in the sense that

the firm must make a deliberate, or conscious, decision to apply for such loans. Payables do,

however, represent spontaneous financing because the amount in payables increases or

decreases as the firm increases or decreases production (demand for products) rather than as the

result of a deliberate application for funds. Also, because the firm in our example currently

operates at full capacity, plant and equipment will have to increase to satisfy the expected sales

increase. As a result, the pro forma balance sheet for the firm might look something like this:

Forecasting, Planning, and Control – 2

Most Recent and Projected Balance Sheets (million of dollars)

Most

Recent Forecast Initial

Balances Basisa Forecast

Cash $ 15.0 x 1.08 $ 16.2

Accounts receivable 60.0 x 1.08 64.8

Inventories 90.0 x 1.08 97.2

Total current assets $165.0 $178.2

Net plant and equipment 120.0 x 1.08 129.6

Total Assets $285.0 $307.8

Accounts payable $ 20.0 x 1.08 $ 21.6

Accruals 15.0 x 1.08 16.2

Notes payable 13.0 13.0b

Total current liabilities $ 48.0 $ 50.8

Long-term bonds 100.0 100.0b

Total liabilities $148.0 $150.8

Common stock 46.0 46.0b

Retained earnings 91.0 +$12.0 d 103.0

Total owners’ equity $137.0 $149.0

Total Liabilities and Equity $285.0 $299.8

Additional funds needed (AFN) $ 8.0c

a

x 1.08 indicates “times (1 + g)”; used for items that grow proportionally with sales.

b

Indicates a figure carried over for the initial forecast. These amounts might be changed after if it is

determined that external, rather than spontaneous (internal), funds are needed to finance the growth.

c

The “Additional funds needed (AFN)” is computed by subtracting the amount of total liabilities

and equity from the amount of total assets. AFN represents the amount of external funds the firm

needs to support its forecasted growth. (There is a rounding difference in the final AFN result.)

d

The $12.0 million represents the “Addition to retained earnings” from the Projected Income

Statement given earlier.

The pro forma balance sheet indicates that, if the firm does not raise additional funds by

borrowing from the bank, issuing new bonds, or issuing new stock, it will be $8 million

dollars short of the financing that is needed to achieve its growth projections. Clearly, if the

firm finances the $8 million by issuing new stocks and bonds, there will be an impact on the

income statement and the amount by which retained earnings is expected to change because

interest will increase due increased debt and the total amount of dividends paid will

increase due to an increased number of shares outstanding (assuming the dividend per share

does not change). As a result, the firm actually requires more than $8 million in financing to

achieve its goals. To determine the total amount of financing needed, repeat the two steps

described here, each time recognizing the effects on the income statement and the balance

sheet, until the amount of additional funds needed is zero. In this case, the total amount of

additional financing needed to achieve the expected growth would be about $8.5 million

rather than $8 million if the firm raises the additional funds by borrowing $1.3 million from

Forecasting, Planning, and Control – 3

the bank at 7 percent interest, issuing $1.7 million of 10 percent bonds, and issuing $5.5

million of new common stock.

o Step 3: Raising the additional funds needed—how the additional funds needed ($8.5 million)

are raised depends on the firm’s preference for, and its ability to handle, additional debt relative

to equity—its combination of debt and equity—and the type of debt that is preferred; perhaps

the firm decides to raise the funds as described earlier or perhaps it prefers to issue a greater

amount of bonds than equity.

o Step 4: Financing feedbacks—because decisions to raise more funds via new debt issues and

new stock issues affect the expected total amount of interest and dividends paid by the firm,

which, in turn, affects the amount of income that is expected to be added to retained earnings,

the process of constructing pro forma statements is iterative—that is, you must repeat the steps

described here to construct financial statements until the amount of additional funds needed

equals zero; financing feedbacks indicate the overall effects of raising the additional funds

needed, AFN.

Other Considerations in Forecasting—some factors that make the forecasting process more

complex include:

o Excess capacity—if the firm has excess capacity, it might not have to add more plant and

equipment (i.e., build) to reach its growth expectations, or it might have to increase plant and

equipment by some percent less than the growth rate. To determine the level of sales current

plant capacity can handle, use the following equation:

Current sales level

Full capacity sales =

Percent of capacity used to

generate current sales level

Example: If the firm in our example was operating at 90 percent capacity rather than full

capacity, the level of sales it could generate with existing assets would be:

$500

Full capacity sales = = $555.6

0.90

In this situation, the firm would not need to add additional fixed assets to support its forecasted

8 percent growth next year. In fact, it would not need to raise additional external funds,

because the funds generated internally (spontaneously) would be sufficient to support the

forecasted growth.

o Economies of scale—due to economies of scale, the variable cost ratio might change with

changes in production activity—for example, if the firm increases its production significantly,

its variable cost ratio might decrease from 80 percent, which is its current level, to much less

than 80 percent.

Forecasting, Planning, and Control – 4

o Lumpy assets—assets generally are not completely divisible (that is, the asset cannot be

purchased in small dollar amounts, such as $1 or $5), and some assets might have to be

purchased in large increments rather than the smaller amounts the firm would prefer to

purchase to meet its growth expectations; “lumpy assets” must be purchased in discrete

increments, say, $15 million per addition, which means we cannot simply increase assets by a

growth rate like 8 percent.

Financial Control--Budgeting and Leverage—proper planning and control helps ensure the firm

meets its expectations, and, when results fall short of expectations, helps management determine

the reasons.

Operating breakeven analysis—operating breakeven is defined as the level of operations where the

net operating income, NOI, which is the same as earnings before interest and taxes, EBIT, equals

zero—that is, total operating costs, both fixed and variable, are just covered by sales revenues

o Breakeven graph—graphically the operating breakeven point, designated QOpBE in sales units

and SOpBE in sales dollars, is identified as the point where the line labeled “Total Sales”

intersects the line labeled “Total Operating Costs,” which is where EBIT = 0:

Dollars

Total sales (revenues)

Total operating costs

Operating Breakeven

in Dollars

Fixed operating costs

Operating Breakeven Units Produced and Sold

in Units

Forecasting, Planning, and Control – 5

o Breakeven computation—mathematically, the operating breakeven is:

Operating breakeven Total fixed operating costs

=QOpBE =

point in units sold Sales price Variable operating

per unit cost per unit

Operating breakeven Total fixed operating costs Total fixed operating costs

=SOpBE = =

point in sales dollars 1 Variable cost ratio 1 Total variable operating costs

Sales

o Using operating breakeven analysis—can provide information that helps make the following

decisions:

Determine the level of sales a new product must achieve to make a profit.

Indicate the impact of general growth on the cost structure of the firm.

Show how modernization to improve efficiency affects fixed and variable costs, thus

profitability of operations.

Operating Leverage—in business, leverage refers to the existence of fixed costs; the presence of

leverage means that a change in sales will result in a larger change in operating income (EBIT), net

income, or both; operating leverage exists if fixed operating costs, such as depreciation, are

present; the degree of operating leverage (DOL) is defined as the percent change in net operating

income, NOI, that results from a particular percent change in sales; mathematically, DOL is:

Sales Total variable costs Gross profit

DOL = =

Total variable Total fixed EBIT

Sales

operating costs operating costs

Example: Applying this equation to the forecasted income statement at the beginning of these

notes, we find the firm’s DOL is:

$540.0 $432.0 $108.0

DOL 2.22

$540.0 $432.0 ($37.8 $21.6) $48.6

Consequently, a 1 percent difference in forecasted sales will result in a 2.22 percent difference in

forecasted EBIT. Consider what would happen if forecasted sales turn out to be 10 percent less

than expected. Following is the income statement for this situation:

Forecasting, Planning, and Control – 6

Original If Sales are Percent

Forecast –10% of Forecast Difference

Net sales $540.0 $486.0 –10.0%

Cost of goods sold (432.0) (388.8) –10.0

Gross profit $108.00 $ 97.2 –10.0

Fixed operating costs, including depreciation ( 59.4) ( 59.4) 0.0

Earnings before interest and taxes (EBIT) $ 48.6 $ 37.8 –22.2

As you can see, if actual sales turn out to be 10 percent lower than the original sales forecast,

EBIT will be 22.2% lower than forecasted. That is, ∆EBIT = DOL x (–10%) = 2.22 x (–10%) =

22.2%.

o Operating leverage and operating breakeven—generally, the higher a firm’s DOL, the greater

the risk associated with its operations; also, the closer a firm operates to its operating breakeven

point, the riskier its operations are considered; thus, all else equal, firms with higher DOLs

operate closer to their breakeven points.

Dollars

Total sales (revenues)

Total operating costs

Operating Breakeven

Fixed operating costs

Firm A Firm B Units

Based on the breakeven chart, we can conclude that DOLA > DOLB.

Financial Breakeven Analysis—defined as the level of operating income (NOI or EBIT) that

covers all fixed financing charges—that is, where earnings per share, EPS, equal zero; for the most

part, fixed financial charges include interest paid on debt and preferred stock dividends; for firms

that do not have preferred stock, the financial breakeven point, EBITFinBE, is simply interest on

Forecasting, Planning, and Control – 7

debt; most firms do not have preferred stock.

o Breakeven graph—graphically, the financial breakeven point is:

Earnings per Share

(EPS)

Financial Breakeven

Point, EBITFinBE

EPS > 0

$0

EPS < 0 Earnings before Interest

and Taxes (EBIT)

o Breakeven computation--mathematically, the financial breakeven point is stated as:

Preferred dividend payments

EBIT FinBE = Interest costs +

1 - Tax rate

o Using financial breakeven analysis—financial breakeven analysis gives an indication how the

firm’s mix of debt and preferred stock (fixed financing) affects EPS.

Financial Leverage—financial leverage exists if the firm has fixed financial charges, such as

interest and preferred dividend payments; the degree of financial leverage is the percent change in

EPS that results from a particular percent change in net operating income (EBIT); mathematically,

the degree of financial leverage, DFL, can be written:

EBIT EBIT

DFL = =

EBIT - Financial BEP EBIT - Interest - Preferred dividends

1 - Tax rate

If a firm has no preferred stock, the DFL simplifies to:

EBIT

DFL =

EBIT - Interest

Generally, a firm with a high DFL is considered to have high risk associated with its financing.

Forecasting, Planning, and Control – 8

Example: Using the forecasted values, we can compute the DFL for the firm we introduced at the

beginning of these notes:

$48.6

DFL = = 1.33

$48.6 - $12.0

Thus, if EBIT is 22.2 percent lower than expected, as shown previously, then net income and

EPS will be 29.5 percent lower than expected. If you complete the income statement shown in

the section where we discussed DOL, you should find net income is $15.5, which is 29.5 percent

lower than the original forecast.

Combining Operating and Financial Leverage (DTL)—the degree of total leverage is the

combination of DOL and DFL; by definition, DTL is the percent change in EPS that is associated

with a particular percent change in sales; mathematically, DTL = DOL x DFL, or:

Gross profit EBIT Gross profit

DTL = DOL× DFL = × =

EBIT EBIT - Financial BEP EBIT - Financial BEP

Example: Continuing with the previous examples, we have:

DTL = DOL x DFL = 2.22 x 1.33 = 2.95

As the example indicates, a 10 percent decline in the forecasted sales resulted in a 29.5 percent

decline in net income, and thus in EPS.

All else equal, a higher degree of total leverage, DTL, is associated with greater total risk—both

operating risk and financial risk.

Using Leverage and Forecasting for Control—knowledge of the degree of leverage, whether

operating, financial, or both, helps determine how a change in sales will affect income—operating

income, net income, or both; greater leverage indicates greater changes in income (either EBIT or

net income) will result from changes in sales; greater variability associated with greater leverage

suggests greater risk; a firm that is considered to have greater risk will have a higher weighted

average cost of capital (WACC = r) than a firm that is considered to have less risk.

Financial Planning and Control Summary Questions—You should answer these questions as a

summary for the chapter and to help you study for the exam.

o What general process must be followed to construct pro forma financial statements? What does AFN

mean and why is it important in the construction of pro formas? Why does the process of constructing

pro formas have to be repetitive? What are some factors that affect, or might complicate, the process?

o What is the operating breakeven and financial breakeven. Why is it important to conduct breakeven

analyses?

o What is leverage? What is operating leverage? Financial leverage? What information does the degree of

leverage, whether operating, financial, or total, provide?

Forecasting, Planning, and Control – 9

You might also like

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- CPA Review Notes 2019 - BEC (Business Environment Concepts)From EverandCPA Review Notes 2019 - BEC (Business Environment Concepts)Rating: 4 out of 5 stars4/5 (9)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- A. Calculate Watkins's Value of OperationsDocument20 pagesA. Calculate Watkins's Value of OperationsNarmeen Khan100% (1)

- PARTNERSHIPDocument153 pagesPARTNERSHIPJoen SinamagNo ratings yet

- Investor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?Document76 pagesInvestor Diary Expert Stock Analysis Excel (V-3) : How To Use This Spreadsheet?AkhileshChauhanNo ratings yet

- Ch12 P11 Build A ModelDocument7 pagesCh12 P11 Build A ModelRayudu RamisettiNo ratings yet

- Chapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceDocument19 pagesChapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceHenry RizqyNo ratings yet

- Ch17-Ppt-Financial Planning and ControlDocument45 pagesCh17-Ppt-Financial Planning and Controlmuhammadosama100% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Form IEPF-7 - Vedanta - IntDiv2018-19Document70 pagesForm IEPF-7 - Vedanta - IntDiv2018-19james fellow100% (1)

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ajith V0% (1)

- FM LMSDocument36 pagesFM LMSJuliana Waniwan100% (1)

- Accountancy Project Class 12 Cash Flow StatementDocument3 pagesAccountancy Project Class 12 Cash Flow StatementKasi Nath0% (5)

- Ch12 Excel ModelDocument23 pagesCh12 Excel ModelDan Johnson50% (2)

- Financial Planning and Control (Chapter 17)Document7 pagesFinancial Planning and Control (Chapter 17)Angelica D. SabenianoNo ratings yet

- Financial PlanningDocument28 pagesFinancial Planningmarina servanNo ratings yet

- MBA 570 Min Case CHP 14 WK 2Document11 pagesMBA 570 Min Case CHP 14 WK 2chastityc2001No ratings yet

- Corporate Valuation and Financial PlanningDocument52 pagesCorporate Valuation and Financial Planningsidra imtiazNo ratings yet

- Chap 12 SolutionDocument15 pagesChap 12 SolutionMarium Raza0% (1)

- CF5e PPT Ch12Document52 pagesCF5e PPT Ch12Thang NguyenNo ratings yet

- Chapter 13. CH 13-11 Build A Model: (Par Plus PIC)Document7 pagesChapter 13. CH 13-11 Build A Model: (Par Plus PIC)AmmarNo ratings yet

- 06 Financial Planning Part ADocument38 pages06 Financial Planning Part Agopika.7mNo ratings yet

- Integrative ProblemDocument3 pagesIntegrative ProblemImelda AngelesNo ratings yet

- 2012-04-13 042436 Finance SandersonicDocument4 pages2012-04-13 042436 Finance SandersonicSai Swaroop MandalNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningTamiratNo ratings yet

- CHAPTER II - Financial Analysis and PlanningDocument84 pagesCHAPTER II - Financial Analysis and PlanningMan TKNo ratings yet

- Chapter 12 Mini Case SolutionsDocument10 pagesChapter 12 Mini Case SolutionsFarhanie NordinNo ratings yet

- Financial Statements, Cash Flow AnalysisDocument41 pagesFinancial Statements, Cash Flow AnalysisMinhaz Ahmed0% (1)

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- 12 Problem: 10: Corporate Valuation and Financial PlanningDocument141 pages12 Problem: 10: Corporate Valuation and Financial PlanningMarium RazaNo ratings yet

- Chapter TwoDocument19 pagesChapter TwoTemesgen LealemNo ratings yet

- Financial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsDocument9 pagesFinancial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsArpit BhawsarNo ratings yet

- Financial Statement Analysis: Curriculum Designed For Use With The Iowa Electronic MarketsDocument37 pagesFinancial Statement Analysis: Curriculum Designed For Use With The Iowa Electronic MarketsArnab BaruaNo ratings yet

- Ratio Analysis and ExamplesDocument18 pagesRatio Analysis and ExamplesUnique OfficialsNo ratings yet

- FINA 410 Exercises NOV PDFDocument7 pagesFINA 410 Exercises NOV PDFDrSwati BhargavaNo ratings yet

- 05 Test Bank For Business FinanceDocument46 pages05 Test Bank For Business FinanceBabatunde Victor AjalaNo ratings yet

- PART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%Document5 pagesPART I: Discussion Ques Ons: Submission Date: On or Before Final Examination Total Weight: 30%jaNo ratings yet

- EFM2e, CH 02, SlidesDocument19 pagesEFM2e, CH 02, SlidesEricLiangtoNo ratings yet

- ExamDocument2 pagesExamAnonymous Uya1CUAqjNo ratings yet

- Financial Forecasting SamarakoonDocument33 pagesFinancial Forecasting SamarakoonEyael ShimleasNo ratings yet

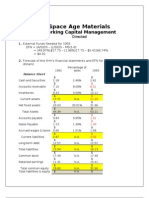

- Space Age Materials: Working Capital ManagementDocument4 pagesSpace Age Materials: Working Capital ManagementChris204267% (3)

- Financial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsDocument10 pagesFinancial Planning and Forecasting Financial Statements: Answers To End-Of-Chapter QuestionsBilal RazzaqNo ratings yet

- IFM11 Solution To Ch09 P11 Build A ModelDocument18 pagesIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNo ratings yet

- Financial Planning Process: ForecastingDocument10 pagesFinancial Planning Process: ForecastingFantayNo ratings yet

- Financial Planning and Forecasting Pro Forma Financial StatementsDocument22 pagesFinancial Planning and Forecasting Pro Forma Financial StatementsCOLONEL ZIKRIA0% (1)

- AAP Q4 2022 Earnings - FinalDocument10 pagesAAP Q4 2022 Earnings - FinalDaniel KwanNo ratings yet

- Exam 1 Fall 19Document9 pagesExam 1 Fall 19April Grace TrinidadNo ratings yet

- Exercise 5 SolutionDocument4 pagesExercise 5 SolutioneyNo ratings yet

- Valuing and Acquiring A Business: Hawawini & Viallet 1Document53 pagesValuing and Acquiring A Business: Hawawini & Viallet 1Kishore ReddyNo ratings yet

- COMM 324 A4 SolutionsDocument6 pagesCOMM 324 A4 SolutionsdorianNo ratings yet

- C. R. Bard, Inc. 2015 Annual ReportDocument20 pagesC. R. Bard, Inc. 2015 Annual ReportRavi HNo ratings yet

- Iefinmt Reviewer For Quiz (#1) : I. Definition of TermsDocument11 pagesIefinmt Reviewer For Quiz (#1) : I. Definition of TermspppppNo ratings yet

- 11Document6 pages11Daud Khan YousafzaiNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- T C C (C 11) : HE Ost of Apital HapterDocument11 pagesT C C (C 11) : HE Ost of Apital HapterVARUN MONGANo ratings yet

- Finance Notes - VDocument8 pagesFinance Notes - VVARUN MONGANo ratings yet

- Finance Notes IIIDocument246 pagesFinance Notes IIIVARUN MONGANo ratings yet

- Capbud CFDocument8 pagesCapbud CFVARUN MONGANo ratings yet

- Finance NotesDocument14 pagesFinance NotesVARUN MONGANo ratings yet

- Chapter 13 - Working Capital ManagementDocument38 pagesChapter 13 - Working Capital ManagementAn TuanNo ratings yet

- Evince Textiles LimitedDocument3 pagesEvince Textiles LimitedAnsary LabibNo ratings yet

- Nurul HidayanitaDocument11 pagesNurul HidayanitanurulNo ratings yet

- ETSY - Etsy, IncDocument10 pagesETSY - Etsy, Incdantulo1234No ratings yet

- Accounts Questions Compiler PDFDocument187 pagesAccounts Questions Compiler PDFBrinda RNo ratings yet

- CFAR Time Variation in The Equity Risk PremiumDocument16 pagesCFAR Time Variation in The Equity Risk Premiumpby5145No ratings yet

- Unit 2 Financial PlanningDocument10 pagesUnit 2 Financial PlanningMalde KhuntiNo ratings yet

- Partnership AccountDocument9 pagesPartnership Accountndanujoy180No ratings yet

- 8 Business Purchase and MergerDocument39 pages8 Business Purchase and Mergerprincessaay99No ratings yet

- Kustia Sugar Mills Ltd. Audit Report 2021-2022Document20 pagesKustia Sugar Mills Ltd. Audit Report 2021-2022Prosad DharNo ratings yet

- VIDYA SAGAR Analysis - FR-3Document4 pagesVIDYA SAGAR Analysis - FR-3Dharani SsNo ratings yet

- BBA II Chapter 2 Sale of Partnership ProblemsDocument14 pagesBBA II Chapter 2 Sale of Partnership ProblemsSiddharth SalgaonkarNo ratings yet

- Moniepoint Document 2023-07-28T05 05.xlaDocument42 pagesMoniepoint Document 2023-07-28T05 05.xlacurtispengeleroyNo ratings yet

- GT CAPITAL HOLDINGS, INC. - SEC 17-C - Press Release - 3july23Document5 pagesGT CAPITAL HOLDINGS, INC. - SEC 17-C - Press Release - 3july23Diyo NagamoraNo ratings yet

- 06 0453 0253385 00 - Statement - 2023 02 10Document5 pages06 0453 0253385 00 - Statement - 2023 02 10Bikramjeet SinghNo ratings yet

- IGCSE Accounting - Revision NotesDocument42 pagesIGCSE Accounting - Revision Notesfathimath ahmedNo ratings yet

- 2021-11 Financial Statement - LMS0729sDocument5 pages2021-11 Financial Statement - LMS0729salexgambrel0No ratings yet

- Chapter 5 FMDocument22 pagesChapter 5 FMHananNo ratings yet

- Dwnload Full Financial and Managerial Accounting 4th Edition Wild Test Bank PDFDocument20 pagesDwnload Full Financial and Managerial Accounting 4th Edition Wild Test Bank PDFlanguor.shete0wkzrt100% (13)

- Module 1 Capital MarketDocument6 pagesModule 1 Capital MarketNovelyn Cena100% (1)

- Hots CompanyDocument5 pagesHots CompanySaloni JainNo ratings yet

- Accounting For Business Combination - AssessmentsDocument114 pagesAccounting For Business Combination - AssessmentsArn KylaNo ratings yet

- HomeworkDocument3 pagesHomeworkKressida BanhNo ratings yet

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- MGT101 Mcq's Final Term by Vu Topper RMDocument72 pagesMGT101 Mcq's Final Term by Vu Topper RMMuhammad HassanNo ratings yet