Professional Documents

Culture Documents

Critical Minerals

Critical Minerals

Uploaded by

Alan von AltendorfCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Bassbreaker 30R Service ManualDocument20 pagesBassbreaker 30R Service ManualMichaelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ac Spindle DL-SBZDocument91 pagesAc Spindle DL-SBZBa DuyNo ratings yet

- 10133ee206 Basic Electrical and Electronics Engineering PDFDocument1 page10133ee206 Basic Electrical and Electronics Engineering PDFMuruga Raj20% (5)

- MC 34118Document22 pagesMC 34118Nelson FreitasNo ratings yet

- Review of The Magnetocaloric Effect in Manganite MaterialsDocument16 pagesReview of The Magnetocaloric Effect in Manganite MaterialsDhaval RanavasiyaNo ratings yet

- ASR-3000 Service Manual PDFDocument23 pagesASR-3000 Service Manual PDFGencho VasilevNo ratings yet

- 7XV5450 Catalog SheetDocument2 pages7XV5450 Catalog SheetjolikayNo ratings yet

- 22nm Technology IntelDocument9 pages22nm Technology IntelKarim HakimNo ratings yet

- Europe Power Cord Specs PDFDocument9 pagesEurope Power Cord Specs PDFcurzNo ratings yet

- 2012 Spec Shts-Hauler1000-E 8-5-11,0Document6 pages2012 Spec Shts-Hauler1000-E 8-5-11,0Forklift Systems IncorporatedNo ratings yet

- Single Crystals, Powders and TwinsDocument48 pagesSingle Crystals, Powders and TwinsJabbar AkbarNo ratings yet

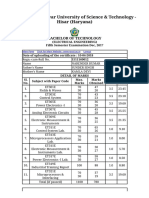

- Guru Jambheshwar University of Science & Technology - Hisar (Haryana)Document2 pagesGuru Jambheshwar University of Science & Technology - Hisar (Haryana)Hemanshu DurejaNo ratings yet

- ETR Junction Box-Switchgear Required (OP, WT, OS)Document24 pagesETR Junction Box-Switchgear Required (OP, WT, OS)Richard ChuaNo ratings yet

- AK31 TurretDocument34 pagesAK31 TurretVladimirAgeev100% (1)

- COS/MOS Series in 1968, As A Lower Power and More Versatile Alternative To TheDocument7 pagesCOS/MOS Series in 1968, As A Lower Power and More Versatile Alternative To Theprateek154uNo ratings yet

- Vocality Datasheet +RoIPDeploy INTLDocument2 pagesVocality Datasheet +RoIPDeploy INTLRaúl Cabeza0% (1)

- Running NotesDocument2 pagesRunning Notesjagadeesh_kumar_20No ratings yet

- Turns Ratio TestDocument3 pagesTurns Ratio TestGurunadha rao kankakalaNo ratings yet

- Datasheet Dc-m9204 & Di-M9204 Manual Call PointDocument4 pagesDatasheet Dc-m9204 & Di-M9204 Manual Call PointHajji MehdiNo ratings yet

- Chapter 12 Metallic-Cable-Transmission-Media PDFDocument36 pagesChapter 12 Metallic-Cable-Transmission-Media PDFNico RobinNo ratings yet

- IMD17/IMDE17: User ManualDocument13 pagesIMD17/IMDE17: User Manualfrank remediosNo ratings yet

- Omega Acb Users Manual PDFDocument123 pagesOmega Acb Users Manual PDFViswa Bhuvan100% (3)

- Power Vize ÖncesiDocument197 pagesPower Vize ÖncesiGe NNo ratings yet

- Irfp 27 N 60 KDocument11 pagesIrfp 27 N 60 Khey lightsNo ratings yet

- Intel Core M Mobile Comparer ChartDocument1 pageIntel Core M Mobile Comparer ChartUmar KhanNo ratings yet

- BELINEA 101536 - Service ManualDocument41 pagesBELINEA 101536 - Service ManualAlexandru Daniel BuleuNo ratings yet

- Thomson M300E512Document24 pagesThomson M300E512duskee4573100% (1)

- The Piezoelectric EffectDocument10 pagesThe Piezoelectric EffectDmytro RakNo ratings yet

- Company Profile CTI 0907Document16 pagesCompany Profile CTI 0907Niamat77No ratings yet

- Locomotive ElectricalDocument10 pagesLocomotive ElectricalSurendra Kumar100% (1)

Critical Minerals

Critical Minerals

Uploaded by

Alan von AltendorfCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Critical Minerals

Critical Minerals

Uploaded by

Alan von AltendorfCopyright:

Available Formats

CONFIDENTIAL

Discussion Document

Proposed Company Golden Critical Research

prepared by Alan von Altendorf CWSX, LLC March 2000

private and confidential to: Julie Smith Jeff Roys

CONFIDENTIAL

Executive Summary

Golden Critical Research (GCR) could be a joint venture, a corporation, or a limited liability partnership. It needs startup funding of roughly $200,000 of which half could be founder in-kind contributions. GCR's business mission is to collect and publish economic geology data, in a concise, actionable format for brokers and institutional investors. Revenue is derived from: high-priced professional annual subscriptions low-priced Joe Six-Pack free trial + monthly subscription Collection of data is from: USGS (quarterly + monthly) procurement DoD, EADS, Philips, Motorola, Apple Australia shipments to China subscription to 3rd party market research Our goal is to build a highly automated data-capture/aggregation and web publishing machine that needs minimum staff or supervision. This document contains preliminary information on Commodity Elements Critical Elements Rare Earth Elements World Supply & Demand Electronic Industry Data Sources

Marketing and publishing will be discussed in a separate report.

CONFIDENTIAL

1. Commodity Elements

TOP TEN MINING COMPANIES

CONFIDENTIAL

Chris Clugston, The Oil Drum December 2009 Following is a summary table from a work-in-process being conducted in conjunction with Dr. David Roper from Virginia Tech University. It contains projected global peak extraction (production) years and global peak supply years for 19 major metals (plus phosphate) based upon Verhulst curve fitting.

Peak Global Extraction (Production) Level and Supply Level Estimates for Major Metals US Peak Global Extraction Peak To Date Extraction To Date Bauxite Cadmium Chromium Cobalt Copper Gold Iron Ore Lead Lithium 1981 1969 1959 1958 1998 1998 1951 1970 1954 Est. Peak Extraction (Using USGS Reserves Data) Est. Peak Extraction (Using USGS Reserve Base Data) 2037 (1,400M MT) Est. Peak Supply (Recycling Included) 2040 (4,100M MT) 2002 (26K MT) 2035 (8.5M MT) 2040 (70K MT) 2030 (?) 2015 (2.3K MT) 2018 (3.9B MT) 2048 (20M MT) 2065 (130K MT) 2038 (37M MT) 2028 (4.2K MT) 2070 (8.7B MT) 2042 (16.8M MT) 2065 (57K MT) 2075 (195K MT)

2008 2035 (205M MT) (900M MT) 1988 (22K MT) 1988

2007 2028 (6.6M MT) (7.7M MT) 2008 2030 (71.8K MT) (68K MT) 2008 2020 (15.7M MT) (?) 2001 2003 (2.6K MT) (2.1K MT) 2008 2012 (2.2B MT) (2.5B MT) 2008 1990 (3.8M MT) (3.4M MT) 2008 2055 (27.4K MT) (86K MT)

CONFIDENTIAL

US Peak Global Extraction Peak To Date Extraction To Date Manganese Mercury Molybdenum Nickel PGM 1918 1943 1980 1997 2002

Est. Peak Extraction (Using USGS Reserves Data)

Est. Peak Extraction (Using USGS Reserve Base Data) 2023 (73M MT)

Est. Peak Supply (Recycling Included) 2050 (51M MT)

2008 2012 (14M MT) (18M MT) 1971 1971

2008 2020 (212K MT) (175K MT)

2027 (180K MT)

2035 (290K MT) 2080 (7.5M MT) 2110 (790 MT) 2030 (158M MT)

2007 2022 2030 (1.7M MT) (1.75M MT) (1.85M MT) 2006 (513 MT) 2006 (440 MT) 2010 (440 MT)

Phosphate Rock 1980 Silver Tin Titanium Tungsten Zinc 1916 1945 1964 1955 1969

2008 1988 (167M MT) (147M MT) 2008 2002 (20.9K MT) (15K MT) 2008 2008 (333K MT) (333K MT) 2007 2005 (10M MT) (7.9M MT) 2004 1990 (66.6K MT) (44K MT) 2008 2005 (11.3M MT) (9M MT) 2008 (16K MT) 2018 (730K MT) 2025 (9M MT) 2012 (53K MT) 2020 (10.3M MT)

2025 (28.5K MT) 2020 (675K MT) 2050 (20M MT) 2090 (155K MT) 2015 (13.1M MT)

Sources: USGS data - http://minerals.usgs.gov/ds/2005/140/ and http://minerals.usgs.gov/minerals/pubs/mcs/2009/mcs2009.pdf; and Dr. David Ropers Mineral Depletion page - http://www.roperld.com/science/minerals/minerals.htm.

CONFIDENTIAL

CONFIDENTIAL

CONFIDENTIAL

CONFIDENTIAL

2. Critical Elements

CONFIDENTIAL

Metals scarcity: A sobering perspective

December 2, 2009 Andre Diederen, PhD Delft University of Technology

Good examples of metals becoming scarce despite not yet having reached or surpassed peak production are various metals which are necessary for the green revolution, i.e. the transition towards a more sustainable economy. These include the platinum group metals, most of the rare earth metals (the rare earth metals are all 15 lanthanides plus yttrium plus scandium) and various minor metals like gallium, germanium, indium and tellurium which are mostly dependent on other (base) metals for primary production. We are not able to increase primary production of these metals fast enough to satisfy surging demand. Their applications include high efficiency solar cells, permanent-magnet drives and generators (wind mills, hybrid cars, electric cars), catalysts for cars and for petrochemical cracking, fuel cells, batteries and various electronic devices (from touch screens and harddrives to energy saving lighting). In the medium term the base metals tin, zinc and lead will reach peak primary production and so will a number of metals associated with primary production of these base metals plus some other metals. This large group of metals includes those necessary for the green revolution as well, like many metals required for different types of batteries (zinc, lead, cadmium, lithium) and tantalum required for compact capacitators in mobile electronic devices like mobile phones. But the consequences of metals scarcity will be serious for established sectors like the automotive and the chemical industries as well. An example is tungsten, with many applications in (amongst others) machining and steels. No later than halfway the 2030s the base metals copper and nickel and their associated byproducts cobalt and molybdenum may also reach their primary production peak. The meaning of an end to the production growth of a metal as important for our industrial civilization as copper should be obvious. At this point, primarily we have metals like aluminium and iron (and possibly magnesium) left at our disposal to sustain or even continue growing their primary production.

10

CONFIDENTIAL

11

CONFIDENTIAL

3. Rare Earth Elements

A Good Overview of Rare Earth Investments Posted By jkingsdale On September 12, 2009 @ 11:42 am In Rare Earth Element Miners | Jim Jubak just published a very useful survey course on Rare Earth Element investment opportunities. The good news is that he nails the facts. The bad news is that if hes writing about REEs, then the knowledge of this unusual investment niche is no longer very rare. Jubaks sense is that the stocks have become pricey. Hed like to buy Lynas (LYSCF) if the Chinese fund it but get less than control shares. (Who wouldnt?) That surely must be what the Australian government wants too. With the new interest in REEs as well as the global recovery going full swing, one would think there may well be new financing opportunities that would allow Lynas to move forward as an independent company rather than as a Chinese puppet. Meanwhile, if the Chinese deal were to happen as now proposed, there would be about 1.4 billion shares out, giving the company a current equity value of about $900 million. Given that Lynas controls the worlds largest REE deposit and has developed a sophisticated processing infrastructure, Lynas is clearly the class act of the group, but it is also priced that way.

12

CONFIDENTIAL

As readers know Ive owned Lynas and another Aussie company, Arafura (ARAFF) for about a year. With about 222M shares out, Arafura carries an equity valuation of about $175M. My other holding in the field is Avalon (AVARF), a Canadian miner with ore that has a particularly attractive mix of the more economically advantaged of the 17 rare earth elements. As the companys web site notes: The Lake Zone is particularly notable for its enrichment in the more valuable heavy rare earth elements (HREE) such as europium, terbium and dysprosium, relative to light rare earths (LREE) such as lanthanum and cerium. There are about 75 million shares outstanding giving the company a roughly $225M capitalization at the current $3 price. All the REE stocks have had multiples of appreciation in recent months. They may be fully priced in the short term. On the other hand, the pricing of the minerals has an enormous leverage on the earnings potential of these companies. A substantial shortfall in REE supply is projected by Jubek by 2015. In fact, with China reducing exports, it would not be unlikely for REE prices to start rising much sooner than that. If the REE prices were to grow substantially, there could be a good deal of upside potential still in these stocks. Here is Jim Jubaks analysis:

A Rare Opportunity in Mining Stocks

Alternative energy and other new technologies are driving demand for rare earth elements, but Chinas near monopoly on supplies is jacking up prices for Western mining companies. Lanthanum. Neodymium. Dysprosium. Terbium. The names dont exactly roll off the tongue, but these are four of the 17 rare earth elements. You cant build a Prius, an accurate missile, or a wind turbine without them. And thanks to the threat of an export boycott by China, which controls about 95% of the current global supply of rare earth elements, the stocks of the few non-Chinese companies with rare earth mines under construction are some of the hottest stocks on the worlds most speculative stock markets: Great Western Minerals Group (OTC: GWMGF), a company developing four rare earth projects, is up 948%, to 33 cents a share, in 2009. Thats a sluggish performance compared with Ucore Uranium (OTC: UURAF), which is developing a rare earth mine in southeastern Alaska. Shares of Ucore are up 4,181% in 2009, to 83 cents per share.

My advice, at this point, is to stand back and let the rockets cool. The speculators will move on to some other sector fairly soon. Use the time to separate the mining stories from the real mining companies. Because behind all this speculative smoke, there is a story of global demand thats real enough to make a few of these companies very profitable long-term investments.

13

CONFIDENTIAL

Heres the story in a nutshell: In my September 9 column, Plug Into Electric Car Batteries, I explained how the growing need for batteries used in hybrid and electric cars would cause demand for lithium, the key ingredient in the next generation of batteries, to surge from a projected 11,000 metric tons in 2012 to almost 90,000 metric tons in 2020. Well, the same need to develop less-polluting, more energy-efficient cars is driving demand for the rare earth elements. And so is the growing market for wind turbines. And the ever-present market for military guidance and control systems.

A Little Doesnt Go a Long Way Adding a bit of one of the 17 rare earth elements to a magnet in the engine of an electric or hybrid car increases the power and efficiency of the engine, because rare earth magnets are the strongest type of permanent magnets now made. Rare earthsnumbers 57 to 71 on the periodic table of elements improve the color in TV screens and in lasers. Youll also find rare earth elements in tunable microwave resonators, and terbium, number 65, is a key ingredient in low-energy light bulbs. And were not talking about trace amounts of these elements either. The electric motor in a Toyota Prius uses about two pounds of neodymium in its permanent magnets. Each Prius battery also uses 20 to 30 pounds of another rare earth element, lanthanum. Because the magnets in wind turbines are so hugeyou need big magnets to maximize the amount of electricity generated from each revolution of the relatively slow-moving blades-these generators need large amounts of rare earth elements. It takes about a ton of neodymium for every megawatt of generating capacity from wind turbines. Fortunately, despite their name, rare earth elements arent especially rare. Theyre found in relatively high concentrations in the earths crust. One, cerium, is the 25th most-abundant element in the crust. Global production came to about 140,000 metric tons of refined rare earths in 2008. Compare that with projected lithium production of 11,000 metric tons by 2012. But supplies of the rare earths that can be profitably mined arent distributed evenly across the globe. Partly, thats the luck of the geologic draw. But mostly, its a function of the huge environmental costs of mining these rare earths. The traditional method has been to bore holes into promising rock formations, pump acid down the holes to dissolve some of the rare earths and then pump the slurry into holding ponds for extraction of the rare earths. That extraction leaves behind a lake of water mixed with acid and various sundry-dissolved minerals.

14

CONFIDENTIAL

Mom and Pop Mining Its much, much cheaper if a company can get away with spending just about nothing on controlling and treating the resulting sludge. The worlds low-cost producers of rare earth elements are not huge and efficient open-pit mines, but small, completely unregulated mom and pop mining companies in China. The Chinese government is trying to force many of these companies out of business. The motive is a combination of desire to limit environmental damage in China and to exercise greater control over exports. Id say the latter dominates. Over the past 20 years, the accidents of geology and the realities of unequal regulation gradually led to the closure of most of the rare earth mines outside China. The worlds richest proven reserve of rare earths, a mine in Mountain Pass, California, stopped production in 2002, for example. But rising demand is starting to change that picture. Companies such as Lynas and Arafura Resources in Australia, Avalon Rare Metals, Great Western Minerals Group and Ucore Uranium in Canada, and Molycorp Minerals in the US have crept back onto the stage with plans to start mines or resume production at old mines. It took the Chinese overplaying their hand, however, to turn that modest trend into a speculators dream come true. The Chinese, remember, control about 95% of global production for all rare earths. They also control about 99% of the production for rare earth metals, such as dysprosium and terbium, and 95% of neodymium. Recently, China started to reduce the amount of rare earth metals that could be exported, and this year, the plan is to reduce exports further. The Chinese Ministry of Industry and Information Technology has cut authorized production targets this year by an additional 8.1%. Companies outside China face the very real possibility not only of paying higher prices, but of not being able to buy the raw materials they need at all.

Forcing Relocation This seems to be a key goal in Chinas strategy. By restricting exports, China would force hightechnology companies that need these rare earths to relocate production to China, accelerating the transfer of intellectual property to Chinese companies. Its no secret that China wants to create major wind, solar, and hybrid car industries. Thats made it possible once again to raise money to start or restart a rare earth mine outside China. For example, Chevron sold Molycorp Minerals, which it had acquired when it bought Unocal, to a group of investors that included Goldman Sachs in 2008. Molycorp will need Goldmans deep pockets, since it has to drain 95 million gallons of water out of the open pit mine in Mountain Pass and then strip away

15

CONFIDENTIAL

tons of rock before it can begin mining in 2012. Initially, Molycorp will process 1,000 tons of ore a day enough, the company estimates, to produce 20,000 metric tons of rare earth oxides annually. In Australia, Lynas and Arafura were relatively close to production until the global economic crisis pulled the financial rug out from under them. A planned bond offering by Lynas failed, and Arafura raised less money than it had hoped in its initial public offering. The Chinese stepped into the gap, buying 25% of Arafura and offering to buy 51.7% of Lynas. That second offer, which would give the Chinese majority control, has sent Australia into a frenzy, coming as it does on the heels of the detention in China of four staffers from miner Rio Tinto on charges of stealing state secrets. The Australian government has until September 17 to rule on the bid. Elsewhere, Ucore Uranium is at work on a project in Alaska, and Great Western Minerals is working to refurbish the Steenkampskraal mine in South Africa.

Caution Advised Be very careful when you evaluate any of these highly speculative stocks. Great Western Minerals submitted its application to update the mines paperwork only in April, and it is still updating its feasibility study. The risk is very real that some of these projects will never get to actual production. Why bother? Because Chinese production is projected to reach 160,000 metric tons a year by 2015 or so. That would be up from 139,000 tons in 2008. But global demand is projected to rise even faster, resulting in an annual shortfall of 40,000 tons by 2015. The two companies that Id be most interested in watching are Molycorp, should it ever go from a private to public company. The Mountain Pass mine is a huge proven reserve, and the group of private investors is solid. And Ill keep an eye on Lynas Corporation (OTC: LYSCF), provided the deal with China is for something less than majority control.

16

CONFIDENTIAL

17

CONFIDENTIAL

Rare Earth Mineral Prices Posted By jkingsdale On May 8, 2009 @ 3:44 pm In Rare Earth Element Miners | Shown below is part of the Great Western Minerals Group web site that compares the market value per tonne of their Hoidas Lake deposit of rare earth elements with other deposits as of February, 2008. If we assume that REE prices will rise somewhat as the recession ends, it is not unlikely that the Lynas Mt. Weld deposit would be worth $17,500 per tonne. The company plans to reach 20,100 tpa by phase 2 with half that achieved in phase 1. Therefore, gross revenues in Phase 1 would be roughly $184 million and $367 in Phase 2. It would not be unreasonable to think that in a few years when Phase 2 is achieved the company might have revenues of $400M. If the company can bring half of that to the bottom line in terms of cash flow, the cash flow would be about $200M or about $0.15 per share. At a multiple of 7, the stock would be worth about $1 per share, about 2.5 times its current price. The above is pure speculation on a number of fronts of which the most important are the price per tonne down the road and the per cent of revenue that sticks in the form of cash flow. I really have no basis for backing up either of these guesses. They are really just what if numbers.

Neodymium Magnets Provide Key to Understanding Rare Earth Trends Eamon Keane, Seeking Alpha, June 23, 2009 Rare metals are "the lifeline of industry" Japanese Rare Metals Task Force For an excellent primer on rare earth (RE) metals read this article. They are present in small quantities in almost every technological device from TVs to electric windows. However with the world turning to technology to ameliorate our energy crisis, the demand for REs is set to ramp up. Are there enough REs to go around?The current state of REs may be summarised by a couple of graphs (Source USGS):

18

CONFIDENTIAL

Despite having just 30% of RE reserves, China has a virtual monopoly on the production of REs. The reasons for this are that China's RE mines are relatively high grade and low cost, which led to a collapse in production in the US. To analyse the situation going forward I'm going to drill down into the use of Neodymium-Iron-Boron magnets (NdFeB).Neodymium-Iron-Boron "The global market demands for rare earth resources can be satisfied if the demand for the NdFeB industry is satisfied" Prof. Feng Hong: CEO, China Rare Earth Office This is true because REs always occur together and thus if Neodymium is going to be extracted, the others will be also. NdFeB magnets are the fastest growing segment of the rare earths.The US government studied the supply of REs and published a criticality index:

Tonnage of NdFeB magnets is growing at 16% per year:

19

CONFIDENTIAL

What this graph shows is that the majority of NdFeB magnets are now made in China (77% based on the above graph) and this share is growing. The three emerging big users of NdFeB magnets are electric bicycles, hybrid cars and wind turbines. Electric Bicycles There are 100 million electric bicycles (EBs) on the road in China today; they outnumber cars 4:1. Of the 23 million EBs sold worldwide last year, 21 million were sold in China. The following graph delineates this (Source):

These EBs contain lightweight, compact, NdFeB magnets for their miniature motors. They use approximately 350grams of NdFeB per bicycle. The chemical formula is (Nd-2-Fe-14-B) so this yields 86g Nd/EB. In 2007, EBs accounted for 5800 tons NdFeB or 13% of the worldwide total. I don't have figures for the neodymium produced in 2008 but if it was the same as 2007, the share would have increased to 18%. The average growth rate for the past 8 years was 35%. If this continues then by 2014 Chinese demand would be 100 million/year or 35000 tons NdFeB.

20

CONFIDENTIAL

There does not appear to be an alternative to NdFeB in bicycles due to space and weight considerations. The price of NdFeB magnets are about $40/kg so the bicycle contains $14 of magnets and $1.70 of Nd @ current $20/kg.Nd. EBs retail @ $290 and neodymium represents 0.6% of that.Hybrid CarsHybrid electric vehicles (HEVs), plug-in hybrids (PHEVs) and pure electric (EVs) all require an electric motor. At present the vast preponderance of HEVs, including the Prius, use a Permanent Magnet Brushless Direct Current (PMDC) motor. These contain NdFeB magnets and there is no alternative (you could argue Sm-11.2%-Co-53.3%-Fe-27.5% (wt%) but the high reliance on cobalt is an Achilles' heel). The best performance one is a sintered magnet of composition Nd-31%-Dy4.5%-Co-2%-Fe-61.5%-B-1% (wt%). Dysprosium is critical in this application to give resistance to demagnetization at high temperatures as the magnet reaches service temperatures of 160C. A motor can be up to 100kW although 55kW is a reasonable figure. For a 55kW motor 0.65kg of NdDy-Co-Fe-B is required which gives 200g Nd/Motor (3.6g/kW) and 30g Dy/Motor (0.55g/kW). A 25kW generator is typically required to recoup braking energy so for analysis purposes a hybrid vehicle contains 288g Nd and 44g Dy. At $20/kg a car contains $5.76 worth of Nd and at $110/kg Dy a car contains $4.84 worth of Dy. At $10.60 worth of REs per car and a selling price of, say, $20,000, REs represent 0.05% of sticker price. If you accept John Petersen's analysis that binding targets on fuel standards imply an impending widespread adoption of hybrid technology then it is clear use of motors is set to take off. The current use of hybrids is very small (1m Priuses sold to date). If, for example, half of the EU's 15million new cars were hybrids in 2012; 2160 tons Nd (8802 tons NdFeB) and 330 tons Dy (390 tons Dysprosium oxide). Thus 20% extra Neodymium would have to be produced and 25% more Dysprosium (based on 2005 prodution of 1400 tons). Dysprosium is especially rare and Dysprosium reserves are almost entirely located in China. Japan is painfully aware of this fact and is scouring the globe looking for Dy deposits while also trying to develop magnets without Dy.This seems like a good point to stop. There is an alternative to PMDC motors - AC induction motors - which I'll discuss in a follow-up if there's any interest. I'll furthermore analyse the use of NdFeB in wind turbines.RE miners and investors can judge the direction of the industry if they understand the dynamics of NdFeB. My interim observation is that magnets represent a very small proportion of the sticker price of EBs and cars in particular. This would indicate that they are capable of absorbing a higher Neodymium price and manufacturers would be prepared to accept this for diversity and security of supply. This may make production of REs in the US and elsewhere more economic. Resources: USGS: [1],[2] Jack Lifton: [1],[2], [3], [4], [5],[6],[7],[8],[9],[10],[11],[12] GWMG: [1], [2] Hard Assets Investor: [1],[2],[3] NdFeB: [1] 21

CONFIDENTIAL

4. World Supply & Demand

22

CONFIDENTIAL

23

CONFIDENTIAL

24

CONFIDENTIAL

25

CONFIDENTIAL

EXPORT RESTRICTIONS

MERGERS & ACQUISITIONS

26

CONFIDENTIAL

PROJECTED DEMAND

27

CONFIDENTIAL

PER CAPITA CONSUMPTION

28

CONFIDENTIAL

5. Electronics Industry

Material Scarcity Report Materials Innovation Institute, Delft 2009 Gold (Au) en platinum (Pt) are two scarce elements used in semiconductor devices, which are considered as critical elements (see figure 23, where the elements of the periodic system are split in three categories of scarcity). Gold is used in applications like bonding and ultra high frequency devices and platinum is applied in specialty devices for components like high density capacitors and ferro-electric memories. Gold bonding is more and more replaced by copper bonding. For platinum, no alternatives are available yet. Due to ever rising prices and the competition of other industries the use in catalytic converters for cars and the production of jewelry the semiconductor industry has started dedicated research efforts to look for substitutes and alternative designs. A substitute for platinum could be to look for substrates made of different conducting materials. An example of alternative designs with less use of platinum is to go for thinner layers. This has the short term benefit of reduction of the use of platinum, but an adverse effect on the long term: it makes recycling of platinum difficult or impossible. In a harsh economic climate like we live in today, industry will tend to go for the short term financial benefit. Shortages of materials caused by export restrictions or regional conflicts are more difficult to anticipate by the semiconductor industry. Take for an example the possible export restrictions of China on REM elements (see section 3.5). REM elements are used in minute quantities in devices like mobile telephones, in LED lights and in displays. Again, these products have a high added value, so industry can afford high prices for these elements. However if shortages occur, substitutes must be found. At present, the authors of this study are not aware of research on this point. The semiconductor industry is driven, as any industry, by economic factors like profit and continuity. Research for substitutes for scarce materials is driven by the costs of these materials. The industry is certainly susceptible for societal goals, like saving the environment and avoiding use of toxic materials. The REACH73 regulation, which limits or forbids the use of certain chemical elements, has triggered a serious research effort in the semiconductor industry and resulted, for instance, in a strong reduction of the use of lead for soldering.

REACH is the Regulation on Registration, Evaluation, Authorisation and Restriction of Chemicals. It entered into force on 1st June 2007. It streamlines and improves the former legislative framework on chemicals of the European Union (EU).

29

CONFIDENTIAL

30

CONFIDENTIAL

EUROPEAN IMPORTS

31

CONFIDENTIAL

32

CONFIDENTIAL

6. Data Sources

33

CONFIDENTIAL

34

CONFIDENTIAL

Appendices

1. Seeking Alpha The Road Ahead for Rare Earth Metals 2. National Academy of Science Critical Minerals 3. Kessler Mineral Supply & Demand Into the 21st Century 4. Citi Australia Coal 5. OneTouch (example of data provider)

35

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Bassbreaker 30R Service ManualDocument20 pagesBassbreaker 30R Service ManualMichaelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ac Spindle DL-SBZDocument91 pagesAc Spindle DL-SBZBa DuyNo ratings yet

- 10133ee206 Basic Electrical and Electronics Engineering PDFDocument1 page10133ee206 Basic Electrical and Electronics Engineering PDFMuruga Raj20% (5)

- MC 34118Document22 pagesMC 34118Nelson FreitasNo ratings yet

- Review of The Magnetocaloric Effect in Manganite MaterialsDocument16 pagesReview of The Magnetocaloric Effect in Manganite MaterialsDhaval RanavasiyaNo ratings yet

- ASR-3000 Service Manual PDFDocument23 pagesASR-3000 Service Manual PDFGencho VasilevNo ratings yet

- 7XV5450 Catalog SheetDocument2 pages7XV5450 Catalog SheetjolikayNo ratings yet

- 22nm Technology IntelDocument9 pages22nm Technology IntelKarim HakimNo ratings yet

- Europe Power Cord Specs PDFDocument9 pagesEurope Power Cord Specs PDFcurzNo ratings yet

- 2012 Spec Shts-Hauler1000-E 8-5-11,0Document6 pages2012 Spec Shts-Hauler1000-E 8-5-11,0Forklift Systems IncorporatedNo ratings yet

- Single Crystals, Powders and TwinsDocument48 pagesSingle Crystals, Powders and TwinsJabbar AkbarNo ratings yet

- Guru Jambheshwar University of Science & Technology - Hisar (Haryana)Document2 pagesGuru Jambheshwar University of Science & Technology - Hisar (Haryana)Hemanshu DurejaNo ratings yet

- ETR Junction Box-Switchgear Required (OP, WT, OS)Document24 pagesETR Junction Box-Switchgear Required (OP, WT, OS)Richard ChuaNo ratings yet

- AK31 TurretDocument34 pagesAK31 TurretVladimirAgeev100% (1)

- COS/MOS Series in 1968, As A Lower Power and More Versatile Alternative To TheDocument7 pagesCOS/MOS Series in 1968, As A Lower Power and More Versatile Alternative To Theprateek154uNo ratings yet

- Vocality Datasheet +RoIPDeploy INTLDocument2 pagesVocality Datasheet +RoIPDeploy INTLRaúl Cabeza0% (1)

- Running NotesDocument2 pagesRunning Notesjagadeesh_kumar_20No ratings yet

- Turns Ratio TestDocument3 pagesTurns Ratio TestGurunadha rao kankakalaNo ratings yet

- Datasheet Dc-m9204 & Di-M9204 Manual Call PointDocument4 pagesDatasheet Dc-m9204 & Di-M9204 Manual Call PointHajji MehdiNo ratings yet

- Chapter 12 Metallic-Cable-Transmission-Media PDFDocument36 pagesChapter 12 Metallic-Cable-Transmission-Media PDFNico RobinNo ratings yet

- IMD17/IMDE17: User ManualDocument13 pagesIMD17/IMDE17: User Manualfrank remediosNo ratings yet

- Omega Acb Users Manual PDFDocument123 pagesOmega Acb Users Manual PDFViswa Bhuvan100% (3)

- Power Vize ÖncesiDocument197 pagesPower Vize ÖncesiGe NNo ratings yet

- Irfp 27 N 60 KDocument11 pagesIrfp 27 N 60 Khey lightsNo ratings yet

- Intel Core M Mobile Comparer ChartDocument1 pageIntel Core M Mobile Comparer ChartUmar KhanNo ratings yet

- BELINEA 101536 - Service ManualDocument41 pagesBELINEA 101536 - Service ManualAlexandru Daniel BuleuNo ratings yet

- Thomson M300E512Document24 pagesThomson M300E512duskee4573100% (1)

- The Piezoelectric EffectDocument10 pagesThe Piezoelectric EffectDmytro RakNo ratings yet

- Company Profile CTI 0907Document16 pagesCompany Profile CTI 0907Niamat77No ratings yet

- Locomotive ElectricalDocument10 pagesLocomotive ElectricalSurendra Kumar100% (1)