Professional Documents

Culture Documents

Ap1 Agenda Planning and Feedback Asaf Mar 2023

Uploaded by

zakaria aouamOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ap1 Agenda Planning and Feedback Asaf Mar 2023

Uploaded by

zakaria aouamCopyright:

Available Formats

Staff paper

Agenda reference: 1

Accounting Standards Advisory Forum meeting

Date March 2023

Project ASAF

Topic ASAF planning and feedback from previous meetings

Contacts Fred Nieto (fnieto@ifrs.org)

This paper has been prepared for discussion at a public meeting of the Accounting Standards Advisory Forum (ASAF).

This paper does not represent the views of the International Accounting Standards Board (IASB) or any individual IASB

member. Any comments in the paper do not purport to set out what would be an acceptable or unacceptable application of

IFRS® Accounting Standards. The IASB’s technical decisions are made in public and are reported in the IASB Update.

Introduction

1. The aim of this paper is to:

(a) discuss the agenda topics for the July 2023 meeting of the Accounting Standards Advisory

Forum (ASAF); and

(b) provide ASAF members with feedback on how the staff or the International Accounting

Standards Board (IASB) have considered (or will consider) the advice given at the September

2022 and December 2022 ASAF meetings.

2. Information about the IASB’s work plan and the status of projects is available on the IFRS Foundation

website.

Structure of the paper and questions for ASAF members

3. There are two appendices to this paper:

(a) Appendix A sets out the suggested agenda topics for the July 2023 ASAF meeting; and

(b) Appendix B sets out a table summarising the feedback from the September 2022 and

December 2022 ASAF meetings and how the staff or the IASB have considered (or will

consider) this feedback.

Questions for ASAF members

1. Do ASAF members have any comments on the proposed agenda topics for the July 2023

ASAF meeting or wish to add items arising from their jurisdiction to the proposed agenda

topics (Appendix A)?

2. Do ASAF members have any comments on how the feedback from the September 2022 and

December 2022 ASAF meetings has been (or will be) used by the staff or the IASB

(Appendix B)?

ASAF―ASAF planning and feedback from previous meetings Page 1 of 11

Staff paper

Agenda reference: 1

Appendix A—ASAF agenda topics

Agenda topic Purpose of the discussion

July 2022 ASAF meeting (Actual)

Seek ASAF members’ views on the IASB’s discussions and tentative

decisions to respond to the main challenges identified during 2020 outreach.

Dynamic Risk Management

Seek ASAF members’ input on whether equity should be eligible for

designation in the DRM model.

Disclosure Initiative— Seek ASAF members’ views on the interaction between local regulations and

Subsidiaries without Public the proposed IFRS Accounting Standard Subsidiaries without Public

Accountability: Disclosures Accountability: Disclosures.

Disclosure Initiative— Seek advice from ASAF members on the next steps for the project.

Targeted Standards-level

Review of Disclosures

Seek ASAF members’ views on whether the IASB’s tentative decisions on

Financial Instruments with financial instruments with contingent settlement provisions and the effects of

Characteristics of Equity laws on the contractual terms would resolve practice issues or would have

any unintended consequences.

Seek ASAF members’ advice on possible ways forward for the IASB’s

preliminary views related to (a) additional disclosure objectives in IFRS 3;

Goodwill and Impairment

and (b) improving disclosures about subsequent performance of business

combinations and expected synergies.

Seek ASAF members’ views on whether some of the application questions

Post-implementation raised in responses to the Request for Information Post-implementation

Review of IFRS 9— Review of IFRS 9—Classification and Measurement could be suitable for

Classification and submission to the IFRS Interpretations Committee.

Measurement Seek input from ASAF members on the topic of ESG-linked features in the

light of the IASB’s discussions in April 2022 and May 2022.

Seek ASAF members’ advice on the IASB’s discussion on (a) income and

expenses of limited recurrence (unusual income and expenses); and (b)

Primary Financial

analysis of operating expenses by nature in the notes when an entity reports

Statements

operating expenses by function in the statement of profit or loss. Ask whether

ASAF members would like to conduct targeted outreach.

Review of the IFRS for Provide an update about the project and the forthcoming Exposure Draft

SMEs Accounting Standard proposing amendments to the IFRS for SMEs Accounting Standard.

September 2022 ASAF meeting (Actual)

Seek advice from ASAF members on some aspects of the project, including

Disclosure Initiative— whether to retain the requirement that the ultimate or any intermediate parent

Subsidiaries without Public financial statements should be available for public use, the approach to

Accountability: Disclosures addressing the proposed disclosure requirements and the structure of the

Standard.

Post-implementation Seek advice from ASAF members on matters to be considered in the Post-

Review of IFRS 9— implementation Review of impairment requirements in IFRS 9.

Impairment requirements

Seek ASAF members’ advice on recent IASB’s discussions on total allowed

Rate-regulated Activities

compensation and the scope of the Accounting Standard to be issued.

Presentation by the UK Endorsement Board of a research paper on a hybrid

Goodwill and Impairment

approach to subsequent measurement of goodwill.

ASAF―ASAF planning and feedback from previous meetings Page 2 of 11

Staff paper

Agenda reference: 1

December 2022 ASAF meeting (Actual)

Seek ASAF members’ advice on staff’s initial views on how to respond to

Business Combinations

feedback on selecting the measurement method(s) to apply to business

under Common Control

combinations under common control.

Seek input from ASAF members to help assess the implications on IASB’s

Equity Method

tentative decisions in ASAF members’ jurisdictions.

Post-implementation Seek advice from ASAF members on matters to be considered in the Post-

Review of IFRS 15 implementation Review of IFRS 15.

Seek input from ASAF members on discount rates for provisions within the

scope of IAS 37 Provisions, Contingent Liabilities and Contingent Assets—

Provisions—Targeted

specifically, whether discount rates for provisions should reflect the entity’s

Improvements

own credit risk and whether financial statements currently disclose enough

information about the rates entities use to discount provisions.

Primary Financial Update on targeted outreach

Statements

Variable and contingent Presentation by EFRAG of its research project on variable and contingent

consideration consideration.

March 2023 ASAF meeting (Actual)

Seek ASAF members’ input for the effects analysis on the potential

Equity Method

amendments (preferred approach)

Seek ASAF members’ advice on the IASB’s recent discussions on the scope

Rate-regulated Activities

and total allowed compensation of the Accounting Standard to be issued.

Disclosure Initiative – Seek ASAF members’ advice on the expected benefits and costs of the

Subsidiaries without Public proposals for stakeholders in their jurisdiction to help develop the Effects

Accountability: Disclosures Analysis.

Provide ASAF members with a brief update on Connectivity between the

IASB and ISSB

work of the IASB and the work of the ISSB before opening up the discussion

Connectivity

for Q&A with ASAF members.

Primary Financial Seek ASAF members’ advice on the IASB’s recent tentative decisions.

Statements

Business Combinations— Seek ASAF members’ feedback on some suggestions respondents to the

Disclosures, Goodwill and Discussion Paper had for changes to the impairment test of cash-generating

Impairment units containing goodwill.

July 2023 ASAF meeting (proposed)

Seek input from ASAF members as part of the early-stage research on the

Climate-related risks (in the

IASB’s recently launched project on Climate-related risks (in the Financial

Financial Statements)

Statements)

Provisions – Targeted Seek ASAF members’ advice and views on the IASB’s recent discussions on

Improvements IAS 37 Provisions, Contingent Liabilities and Contingent Assets

Presentation by EFRAG the feedback received on Discussion Paper “Better

Intangibles Information on Intangibles – Which is the Best Way to Go?” and EFRAG´s

current recommendations in response to the feedback.

ASAF―ASAF planning and feedback from previous meetings Page 3 of 11

Staff paper

Agenda reference: 1

Appendix B—Feedback from the September 2022 and December 2022

ASAF meeting

How the advice has been/will be

Topic Summary of ASAF advice

applied

Rate-regulated Activities (September 2022)

The purpose of this session was to update ASAF members on the redeliberations of the Exposure

Draft Regulatory Assets and Regulatory Liabilities and seek their views on whether the tentative

decisions to date on scope and total allowed compensation help address stakeholders’ concerns

about the proposals.

Total allowed ASAF members overall welcomed the IASB's The IASB will continue to

compensation tentative decisions: (a) to focus the application redeliberate the project proposals

guidance of the final Accounting Standard at future meetings.

(Standard) on differences in timing instead of

specifying the components of total allowed

compensation; and (b) on regulatory returns on

assets not yet available for use.

Detailed feedback provided by ASAF members is

summarised in paragraphs 25–26 of the

September 2022 meeting summary note.

Scope ASAF members generally agreed with the IASB’s The IASB will continue to

tentative decisions on the scope of the Standard redeliberate the project proposals

dealing with the term ‘customers’ and with the at future meetings.

interaction between the model and IFRS 9

Financial Instruments.

Detailed feedback provided by ASAF members is

summarised in paragraph 27 of the September

2022 meeting summary note.

ASAF―ASAF planning and feedback from previous meetings Page 4 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Subsidiaries without Public Accountability: Disclosures (September 2022)

The purpose of this session was to provide ASAF members an update on the Disclosure Initiative –

Subsidiaries without Public Accountability: Disclosures project, and to ask ASAF members’ views

on: (a) removing the requirement that for a subsidiary to be eligible to apply the proposed IFRS

Accounting Standard (draft Standard) the parent’s consolidated financial statements be ‘available’

for public use; (b) the staff’s suggested approach for analysing comments received on the

proposed disclosure requirements; and (c) responding to feedback on the structure of the draft

Standard.

Parent’s ASAF members had mixed views on removing In November 2022 the IASB met to

consolidated the requirement that for a subsidiary to be eligible consider feedback on aspects of

financial to apply the draft Standard the parent’s the proposed scope of the draft

statement be Standard including whether the

consolidated financial statements be ‘available for

available for parent’s consolidated financial

public use public use. statements should be available for

Detailed feedback provided by ASAF members is public use.

summarised in paragraphs 5–9 of the September

2022 meeting summary note.

ASAF―ASAF planning and feedback from previous meetings Page 5 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Staff’s ASAF members generally agreed with the staff’s In October 2022 the IASB met to

suggested suggested process for responding to the discuss the staff’s recommended

process to feedback on the disclosure requirements process to address comments on

address proposed disclosure requirements

proposed in the draft Standard.

comments on in the draft Standard.

proposed Detailed feedback provided by ASAF members is The IASB decided that the staff

disclosure summarised in paragraphs 10–12 of the should analyse the comments

requirements September 2022 meeting summary note. received on the proposed

disclosure requirements in the draft

Standard in three steps:

(a) Step 1—stratify the comments

on the proposed disclosure

requirements based on how the

proposed disclosure

requirements were developed;

(b) Step 2—assess the comments

received against a set of

factors: the principles on users’

information needs of non-

publicly accountable entities’

financial statements, cost and

benefit, distribution of the

comments received, overall

usefulness of information and

previous IASB discussions and

decisions on the disclosure

requirement; and

(c) Step 3—recommend any

changes to the proposed

disclosure requirements to the

IASB.:

Responding to ASAF members had mixed views on the structure In October 2022 the IASB met to

feedback on the of the draft Standard as it relates to: (a) discuss the feedback on the

structure of the Disclosure requirements in IFRS Accounting structure of the draft Standard.

draft Standard

Standards replaced by the draft Standard; and (b) The IASB tentatively decided to:

Disclosure requirements that remain applicable in

(a) omit Appendix A proposed in

other IFRS Accounting Standards. the draft Standard.

Detailed feedback provided by ASAF members is (b) replace the footnotes with

summarised in paragraphs 10–12 of the cross-references to disclosure

September 2022 meeting summary note. requirements that remain

applicable in other IFRS

Accounting Standards, under

each IFRS Accounting

Standard subheading.

ASAF―ASAF planning and feedback from previous meetings Page 6 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Post-implementation Review of IFRS 9— Impairment (September 2022)

The purpose of this session was for ASAF members to share their views on applying the

impairment requirements in IFRS 9 Financial Instruments and on matters that the IASB might

consider in the post-implementation review (PIR) of these requirements.

ASAF members were asked whether: (a) there are fundamental questions on the clarity and

suitability of the objectives or principles in the impairment requirements—that is, if there are fatal

flaws in the requirements; (b) the benefits to investors arising from applying the requirements are

significantly lower than expected; and (c) the costs of applying some or all of the requirements and

auditing and enforcing their application are significantly greater than expected.

Matters to ASAF members suggested the IASB consider At the February 2023 IASB

consider in the various topics as part of the PIR, including: (a) meeting, the IASB discussed the

PIR Significant Increases in Credit Risk (SICR); (b) feedback received from outreach,

including feedback from ASAF

Incorporation of forward-looking information in

members. The IASB considered

measurement of Expected Credit Losses (ECL); this feedback in deciding on which

(c) Credit risk disclosures in IFRS 7; (d) matters to ask questions about in

Application of the ECL model to intercompany the Request for Information, which

loans; (e) Definition of credit losses (f) Financial is expected to be published by end

guarantees and loan commitments. ASAF of May 2023.

members noted that various industries found the

transition to IFRS 15 challenging, in particular

those with long-term or complex contracts with

many customers. Several members noted that

overall, the benefits of IFRS 15 outweighed the

costs.

Detailed feedback provided by ASAF members is

summarised in paragraphs 20–23 of the

September 2022 meeting summary note.

ASAF―ASAF planning and feedback from previous meetings Page 7 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Primary Financial Statements (December 2022)

The purpose of this session was to provide ASAF members with an update on the targeted outreach

held between September and December 2022. The staff thanked members for their involvement in

organising, attending and summarising meetings with stakeholders in their jurisdictions.

Targeted The staff provided a summary of the principal At its January 2023 meeting, the

Outreach messages received during the meetings. Overall, IASB discussed the feedback from

ASAF members agreed with the direction of the targeted outreach and next steps.

As a result, the IASB decided to

IASB’s redeliberations and said that they would

add four topics to its redliberation

prefer for the project to be completed as soon as plan:

possible.

(a) whether it should reconfirm

Detailed feedback provided by ASAF members is its decision on

summarised in paragraphs 6-9 of the December classification of income

2022 meeting summary note. and expense from

associates and joint

ventures accounted for

using the equity method;

(b) whether it should develop

application guidance for

classifying income and

expense from off-balance-

sheet items;

(c) whether it should develop

guidance for including

interest expense on lease

liabilities in operating profit

if subleasing is a main

business activity; and

(d) whether it should develop

further application

guidance for the proposed

rebuttable presumption in

the definition of

management performance

measures.

ASAF―ASAF planning and feedback from previous meetings Page 8 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Post-implementation Review of IFRS 15 Revenue from Contracts with Customers (December 2022)

The purpose of this session was for ASAF members to share their overall views on IFRS 15

Revenue from Contracts with Customers, and, in particular, on: (a) the application matters on which

the IASB should seek feedback as part of the post-implementation review (PIR) of IFRS 15; (b) the

transition to IFRS 15; and (c) the benefits and costs of implementing and applying the Standard.

Matters to All ASAF members said that overall IFRS 15 is The IASB will consider ASAF

consider in the working well and has achieved its objective members’ comments on these

PIR although applying the Standard can still be matters as it develops the Request

for Information on this PIR.

challenging. ASAF members suggested the IASB

seek feedback on various topics as part of the

PIR of IFRS 15, including: the relationship

between IFRS 15 and other IFRS Accounting

Standards, principal versus agent considerations,

the timing of revenue recognition, variable

consideration, licencing and various other

matters.

Detailed feedback provided by ASAF members is

summarised in paragraphs 15-27 of the

December 2022 meeting summary note.

Business Combinations under Common Control (December 2022)

The purpose of this session was to update ASAF members on the IASB’s Business Combinations

under Common Control (BCUCC) project and ask ASAF members’ views on particular aspects of

the staff’s analysis on selecting the measurement method(s) to apply to BCUCCs.

Staff’s initial ASAF members had mixed views on the staff’s The staff will consider ASAF

views on the initial view on the principle for selecting the members’ comments on these

principle for measurement method. Some members said they matters as part of future

selecting which deliberations with the IASB.

would prefer an entity to evaluate the substance

measurement a

receiving entity of each BCUCC to determine which

would apply to measurement method to apply, but, for practical [ Richard – note that Example of

BCUCCs reasons, accepted the staff’s initial views while BCUCC text in AP1 for the last

another member said that a book-value method appearance at ASAF can be found

should apply to all BCUCCs for a number of on page 4 of AP1 from Oct-2021

reasons. ASAF meeting ]

Detailed feedback provided by ASAF members is

summarised in paragraphs 30–36 of the

December 2022 meeting summary note.

ASAF―ASAF planning and feedback from previous meetings Page 9 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Staff’s initial ASAF members had mixed views on whether an The staff will consider ASAF

views on exception should be made for BCUCCs which members’ comments on these

whether a affect insignificant Non-Controlling Shareholders. matters as part of future

receiving entity deliberations with the IASB.

A few members disagreed with the potential

would be

permitted or government-related entities exception.

required to Detailed feedback provided by ASAF members is

deviate from the summarised in paragraphs 37–47 of the

principle

(referred to December 2022 meeting summary note.

collectively as

‘exceptions’)

Provisions – Discount rates (December 2022)

The purpose of this session was to obtain ASAF members views on discount rates used to measure

long-term provisions within the scope of IAS 37 Provisions, Contingent Liabilities and Contingent

Assets, and information disclosed about the rates used.

On discount rates for provisions, ASAF members were asked: (i) whether the IASB should amend

IAS 37 to specify the treatment of non-performance risk (ii) if so, which of nine factors already

identified by the IASB should carry most weight in deciding whether to require or to prohibit the

inclusion of non-performance risk; and (iii) whether the IASB should consider other factors. On

disclosure of information about rates used to discount provisions, ASAF members were asked: (i)

whether the IASB should add to IAS 37 a requirement to disclose information about rates used; and

(ii) if so, what information IAS 37 would require an entity to disclose.

Discount rates Most ASAF members agreed that the IASB could The IASB will be asked to make

for provisions reduce diversity in practice by amending IAS 37 decisions on these matters at a

to specify the treatment of non-performance risk. future IASB meeting. The staff will

consider ASAF members’

Detailed feedback provided by ASAF members is comments in developing its

summarised in paragraphs 39–60 of the recommendations.

December 2022 meeting summary note.

Disclosure of ASAF members said they thought IAS 37 should

information require an entity to disclose information about the

about rates used rates used to discount provisions and shared

to discount

detail about the rationale for their views.

provisions

Detailed feedback provided by ASAF members is

summarised in paragraphs 61–64 of the

December 2022 meeting summary note.

ASAF―ASAF planning and feedback from previous meetings Page 10 of 11

Staff paper

Agenda reference: 1

How the advice has been/will be

Topic Summary of ASAF advice

applied

Equity Method (December 2022)

The purpose of this session was to update ASAF members on the progress of the Equity Method

project and to obtain ASAF members views on four alternatives identified by the staff to answer the

application question: How should an investor recognise gains and losses that arise from the sale of

a subsidiary to its associate applying the requirements of IFRS 10 Consolidated Financial

Statements and IAS 28 Investments in Associates and Joint Ventures; and discount rates used to

measure long-term provisions within the scope of IAS 37 Provisions, Contingent Liabilities and

Contingent Assets, and information disclosed about the rates used.

Four ASAF members provided a range of views on the At its January 2023 meeting, the

alternatives four alternatives identified by the staff. ASAF IASB continued discussing the four

identified to members also provided views on other alternatives presented to ASAF

answer the members.

application questions relating to the Equity

application Method. The IASB considered the views

question expressed from ASAF members as

Detailed feedback provided by ASAF members is well as the input from other

summarised in paragraphs 66–72 of the stakeholders.

December 2022 meeting summary note.

The IASB asked the staff to:

(a) continue exploring two of the

alternatives;

(b) undertake targeted outreach

with users of financial

statements; and

(c) prepare a decision-making

paper for consideration at a

future meeting.

For ASAF March 2023 meeting, the

staff will present the IASB’s

tentative answers to other

application questions; and ask

ASAF members on their views on

the potential effects.

ASAF―ASAF planning and feedback from previous meetings Page 11 of 11

You might also like

- ACCA F7 Course NotesDocument272 pagesACCA F7 Course NotesNagendra Krishnamurthy50% (4)

- 101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Document3,032 pages101 MA (Account) Heavy Merge 3032 Pages (Sppu - Mba)Adwait BowlekarNo ratings yet

- AccountingDocument220 pagesAccountingbicky1800% (3)

- Try To Figure OutDocument9 pagesTry To Figure OutMaria25% (8)

- Audit Lanjutan Fraud and Forensic InvestigationDocument37 pagesAudit Lanjutan Fraud and Forensic InvestigationYouJianNo ratings yet

- Asaf 05 Goodwill and Impairment April 2018Document43 pagesAsaf 05 Goodwill and Impairment April 2018Angel ONo ratings yet

- A Study of International Accounting Standard and Indian Accounting StandardDocument7 pagesA Study of International Accounting Standard and Indian Accounting Standardprashant pathakNo ratings yet

- AP18 Goodwill and Impairment ProjectDocument7 pagesAP18 Goodwill and Impairment Projectstudentul1986No ratings yet

- Ap4 Goodwill and ImpairmentDocument51 pagesAp4 Goodwill and ImpairmentFabioCidralNo ratings yet

- Ap5c Agenda Consultation FeedbackDocument5 pagesAp5c Agenda Consultation FeedbackJesús David Izquierdo DíazNo ratings yet

- Asaf 01f CF Illustrative ExamplesDocument42 pagesAsaf 01f CF Illustrative ExamplesMohammedYousifSalihNo ratings yet

- Ap20b DiapDocument13 pagesAp20b DiapJhaan Key Losita�oNo ratings yet

- Ap07 Update On Trustee Activities Apr 2023Document24 pagesAp07 Update On Trustee Activities Apr 2023Emad ZaidNo ratings yet

- Conceptual Framework Feedback StatementDocument24 pagesConceptual Framework Feedback StatementSittie CasanguanNo ratings yet

- Conceptual Framework Feedback StatementDocument24 pagesConceptual Framework Feedback StatementKyon DassanNo ratings yet

- Conceptual FrameworkDocument13 pagesConceptual Frameworkreagan blaireNo ratings yet

- E-Technical Update Jan2010Document11 pagesE-Technical Update Jan2010shakiraliqureshiNo ratings yet

- Webinar Slides Third Agenda ConsultationDocument31 pagesWebinar Slides Third Agenda ConsultationTehreem JunaidNo ratings yet

- FrameworkDocument3 pagesFrameworkVola AriNo ratings yet

- Ap1 Power Purchase Agreements Asaf January 2024Document31 pagesAp1 Power Purchase Agreements Asaf January 2024Anil HarichandreNo ratings yet

- IASB Agrees Re-Deliberation Plan For Amendments To Ifrs 17: Insurance Accounting AlertDocument9 pagesIASB Agrees Re-Deliberation Plan For Amendments To Ifrs 17: Insurance Accounting AlertCarlo Garcia, CPANo ratings yet

- Financial Instruments With Characteristics of Equity: Key Themes Emerging From FeedbackDocument49 pagesFinancial Instruments With Characteristics of Equity: Key Themes Emerging From FeedbackRauful SworanNo ratings yet

- Agenda Item 2A SWP 2nd Read Consultation Paper Mark Up From First ReadDocument43 pagesAgenda Item 2A SWP 2nd Read Consultation Paper Mark Up From First ReadAnkaj NandaNo ratings yet

- IAASB Exposure Draft Proposed ISA 240 Revised FraudDocument162 pagesIAASB Exposure Draft Proposed ISA 240 Revised FraudUmmar FarooqNo ratings yet

- Applicability of Standards/Guidance Notes/Legislative Amendments Etc. For November, 2018 ExaminationDocument20 pagesApplicability of Standards/Guidance Notes/Legislative Amendments Etc. For November, 2018 Examinationraja soniNo ratings yet

- Ap21a PfsDocument26 pagesAp21a PfsJanelle Dela CruzNo ratings yet

- Iaasb Due Process and Working ProceduresDocument2 pagesIaasb Due Process and Working ProceduresKrizel rochaNo ratings yet

- Ap6d Contractual CashflowDocument24 pagesAp6d Contractual CashflowNISSIBETINo ratings yet

- Ap3a Disclosure Requirements About Assessment of Going ConcernDocument33 pagesAp3a Disclosure Requirements About Assessment of Going ConcernBidhan SapkotaNo ratings yet

- 06-03 ASAF Agenda Paper AP04 Goodwill and Impairment Presentation (For Background Only)Document15 pages06-03 ASAF Agenda Paper AP04 Goodwill and Impairment Presentation (For Background Only)leesombatpaiboon.sNo ratings yet

- In Focus: FASB Concepts Statement No. 8, Conceptual Framework For Elements of Financial StatementsDocument2 pagesIn Focus: FASB Concepts Statement No. 8, Conceptual Framework For Elements of Financial StatementsThiago AlvesNo ratings yet

- The Standard of Setting Process of Internation Financial Reporting Standards by The International Accounting Standards BoardDocument5 pagesThe Standard of Setting Process of Internation Financial Reporting Standards by The International Accounting Standards BoardkhanjahidNo ratings yet

- Ap21c PfsDocument19 pagesAp21c PfsAaditya PanwarNo ratings yet

- W06 IASB Governance New2023Document30 pagesW06 IASB Governance New2023Hera KristianaNo ratings yet

- Ap5 Cmac GPF Ifrs9 C M EdDocument15 pagesAp5 Cmac GPF Ifrs9 C M EdMohammedYousifSalihNo ratings yet

- AP06-Pollutant Pricing MechanismsDocument2 pagesAP06-Pollutant Pricing Mechanismsstudentul1986No ratings yet

- Ind AS Alert: Marching Towards Better Reporting StructureDocument1 pageInd AS Alert: Marching Towards Better Reporting StructureKAJALINo ratings yet

- IAASB Quality Management ISA 220 Basis For ConclusionsDocument21 pagesIAASB Quality Management ISA 220 Basis For ConclusionsJACKELINE LOPEZNo ratings yet

- Ap18c SimplificationsDocument16 pagesAp18c SimplificationsRemaining lifeNo ratings yet

- Conceptual-Framework-July-2013 PDFDocument14 pagesConceptual-Framework-July-2013 PDFUsama RajputNo ratings yet

- Snapshot Ed General Presentation DisclosuresDocument20 pagesSnapshot Ed General Presentation DisclosuresAsad MuhammadNo ratings yet

- Publikasi Ketujuh TF-CCRDocument6 pagesPublikasi Ketujuh TF-CCRRiny AgustinNo ratings yet

- Summary Note of The Accounting Standards Advisory Forum: Region MembersDocument32 pagesSummary Note of The Accounting Standards Advisory Forum: Region MembersAbdelmadjid djibrineNo ratings yet

- IASB Update September 2009Document9 pagesIASB Update September 2009Gon FreecsNo ratings yet

- CS Executive Company Accounts Notes FinalDocument41 pagesCS Executive Company Accounts Notes FinalShivam GuptaNo ratings yet

- Ap3b Time Frame For An Assessment of Going ConcernDocument14 pagesAp3b Time Frame For An Assessment of Going ConcernBidhan SapkotaNo ratings yet

- Staff Paper: IASB Agenda RefDocument7 pagesStaff Paper: IASB Agenda Refstudentul1986No ratings yet

- Summary of IFRSDocument15 pagesSummary of IFRSHariantoPratamaPuteraNo ratings yet

- IFRS Exposure Draft - Snapshot, IFRS Sustainability Disclosure Standards.Document16 pagesIFRS Exposure Draft - Snapshot, IFRS Sustainability Disclosure Standards.james jiangNo ratings yet

- Staff Paper: IASB Agenda RefDocument15 pagesStaff Paper: IASB Agenda RefJesús David Izquierdo DíazNo ratings yet

- Building On The SASB 29 March Final RELEASE - WEBDocument2 pagesBuilding On The SASB 29 March Final RELEASE - WEBTassadit BOUSBAINENo ratings yet

- Assignment Cover Sheet: Northrise UniversityDocument6 pagesAssignment Cover Sheet: Northrise UniversitySapcon ThePhoenixNo ratings yet

- Acca f7 Course NotesDocument202 pagesAcca f7 Course NotessajedulNo ratings yet

- Staff Paper: October 2019Document19 pagesStaff Paper: October 2019Shahin AlamNo ratings yet

- Study Guidelines For May, 2019 Examinations: Final New Course Paper 1: Financial ReportingDocument2 pagesStudy Guidelines For May, 2019 Examinations: Final New Course Paper 1: Financial Reportingaman vermaNo ratings yet

- Chapter One: (A) Discuss Why There Is A Need To Develop An Agreed International Conceptual Frame Work and TheDocument9 pagesChapter One: (A) Discuss Why There Is A Need To Develop An Agreed International Conceptual Frame Work and TheZoora SavioNo ratings yet

- International Standard On Quality Management (ISQM) 1 (Previously International Standard On Quality Control 1)Document44 pagesInternational Standard On Quality Management (ISQM) 1 (Previously International Standard On Quality Control 1)ALEJANDRA MATOSNo ratings yet

- Iasb 2019Document7 pagesIasb 2019Daisy TruongNo ratings yet

- The Standard Setting Process International Financial Reporting StandardsDocument5 pagesThe Standard Setting Process International Financial Reporting Standardsroland rukandeNo ratings yet

- Blue Ribbon Panel ReportDocument70 pagesBlue Ribbon Panel ReportDuong DoNo ratings yet

- Agenda Item 7-B: Review, OtherDocument6 pagesAgenda Item 7-B: Review, OtherKrizel rochaNo ratings yet

- Skill Tut w1Document12 pagesSkill Tut w1AbigailNo ratings yet

- Semiconductors Standard 2018Document28 pagesSemiconductors Standard 2018zakaria aouamNo ratings yet

- Job Title Reference Code:: Sustainability Analyst (CC & RPRTG) EC-2005963Document1 pageJob Title Reference Code:: Sustainability Analyst (CC & RPRTG) EC-2005963zakaria aouamNo ratings yet

- Wind Technology Project Developers Standard 2018Document17 pagesWind Technology Project Developers Standard 2018zakaria aouamNo ratings yet

- To Become A Sustainability AnalystDocument9 pagesTo Become A Sustainability Analystzakaria aouamNo ratings yet

- Oil Gas Midstream BFC 2018Document22 pagesOil Gas Midstream BFC 2018zakaria aouamNo ratings yet

- Biofuels: Sustainability Accounting StandardDocument21 pagesBiofuels: Sustainability Accounting Standardzakaria aouamNo ratings yet

- Depreciation RKDocument22 pagesDepreciation RKTushar Singla100% (1)

- Cash Versus Accrual Basis AccountingDocument6 pagesCash Versus Accrual Basis AccountingomoshNo ratings yet

- 2Q 2019 MDKA Merdeka+Copper+Gold+TbkDocument102 pages2Q 2019 MDKA Merdeka+Copper+Gold+TbkChoirul HidayantoNo ratings yet

- Case Study BoeingDocument4 pagesCase Study BoeingIrmaNo ratings yet

- Imran. Javaid - FCCA ACA CVDocument5 pagesImran. Javaid - FCCA ACA CVImran JavaidNo ratings yet

- Accounting Process-QuestionnairesDocument7 pagesAccounting Process-QuestionnairesJennifer ArcadioNo ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- Audit Committee Characteristics and Sustainable Growth Among Selected ListDocument13 pagesAudit Committee Characteristics and Sustainable Growth Among Selected ListReni Mustika SariNo ratings yet

- FABM - L-10Document16 pagesFABM - L-10Seve HanesNo ratings yet

- Auditing I: Chapter 6 (Internal Control in A Financial Statement Audit)Document16 pagesAuditing I: Chapter 6 (Internal Control in A Financial Statement Audit)CrystalNo ratings yet

- ISO 8.2.2 Internal Auditor Explained - What You Need To KnowDocument13 pagesISO 8.2.2 Internal Auditor Explained - What You Need To Knowarulj75No ratings yet

- ExercisesDocument5 pagesExercisesSandip GhoshNo ratings yet

- TEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 CompleteDocument70 pagesTEST BANK For Advanced Financial Accounting 13th Edition by Theodore Christensen Verified Chapter's 1 - 20 Completemarcuskenyatta275No ratings yet

- Audit of Non-Current AssetsDocument15 pagesAudit of Non-Current AssetsArlyn Pearl PradoNo ratings yet

- Current Issue in Forensic Accounting Research and Practices 12102023Document41 pagesCurrent Issue in Forensic Accounting Research and Practices 12102023GDPNo ratings yet

- Activity Group 2Document17 pagesActivity Group 2Shann 2No ratings yet

- ACC 711 Practice Test CH 1 - 4Document12 pagesACC 711 Practice Test CH 1 - 4lmngangNo ratings yet

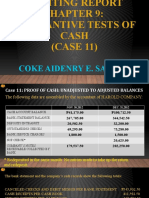

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Essentials of College and University AccountingDocument121 pagesEssentials of College and University AccountingLith CloNo ratings yet

- Ifsa Chapter9Document42 pagesIfsa Chapter9Iwan PutraNo ratings yet

- ExercisesDocument2 pagesExercisesMuhammad Aiman Md NorNo ratings yet

- Cengage Book List PDFDocument20 pagesCengage Book List PDFasd123412100% (1)

- PFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial StatementsDocument5 pagesPFRS 3 - Business Combination, PAS 27 - Consolidated and Separate Financial Statementsd.pagkatoytoyNo ratings yet

- Presentation by MATRADE PDFDocument49 pagesPresentation by MATRADE PDFmmadihahNo ratings yet

- Wiley P2 Sec-A FlashcardDocument29 pagesWiley P2 Sec-A FlashcardnaxahejNo ratings yet

- Annual Financial Statements - December 31 2011 Final - Sedar FiledDocument27 pagesAnnual Financial Statements - December 31 2011 Final - Sedar Filedvenga1932No ratings yet

- Lembar Jawaban-2 Tugas KelompokDocument36 pagesLembar Jawaban-2 Tugas KelompokranjanisalsabilaaaNo ratings yet