Professional Documents

Culture Documents

Gamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of The

Gamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of The

Uploaded by

Love Sandy0 ratings0% found this document useful (0 votes)

38 views1 pageGamma Ltd is considering either leasing or buying equipment worth Rs. 800 lakhs that has an 8 year life. The annual lease rent would be Rs. 160 lakhs. The company must cover insurance, maintenance, and operating expenses under both options. The document asks to (a) calculate the incremental cash flows, (b) use the equivalent annual cost method to evaluate the lease proposal, and (c) calculate the net annual lease payment.

Original Description:

Original Title

Untitled

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGamma Ltd is considering either leasing or buying equipment worth Rs. 800 lakhs that has an 8 year life. The annual lease rent would be Rs. 160 lakhs. The company must cover insurance, maintenance, and operating expenses under both options. The document asks to (a) calculate the incremental cash flows, (b) use the equivalent annual cost method to evaluate the lease proposal, and (c) calculate the net annual lease payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

38 views1 pageGamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of The

Gamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of The

Uploaded by

Love SandyGamma Ltd is considering either leasing or buying equipment worth Rs. 800 lakhs that has an 8 year life. The annual lease rent would be Rs. 160 lakhs. The company must cover insurance, maintenance, and operating expenses under both options. The document asks to (a) calculate the incremental cash flows, (b) use the equivalent annual cost method to evaluate the lease proposal, and (c) calculate the net annual lease payment.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

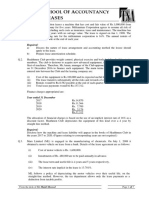

• Gamma Ltd. is considering a lease of an equipment costing Rs800 lakhs.

Life of the

machine is expected to be 8 yrs. Instead of buying, the same equipment can be leased for

8 years with an annual lease rent (payable at the end of the year) of Rs160 lakhs from

Mfrs. The company will have to take care of insurance, maintenance and operating

expenses in both the alternatives-leasing or buying. Assuming the Straight Line Deprn

method; Tax rate of 35% and a borrowing rate of 14%.

(a) Calculate incremental cash flow

(b) Use ELM to evaluate the lease proposal

(c) Calculate NAL

Mousumi Bhattacharya_CF_2022-2024_07.02.2023

You might also like

- Problems On Lease and Hire PurchaseDocument2 pagesProblems On Lease and Hire Purchase29_ramesh17050% (2)

- IIFL Car Lease Policy: 1. Objective of The PolicyDocument5 pagesIIFL Car Lease Policy: 1. Objective of The PolicyNanda Babani0% (1)

- Aafr Ifrs 16 Icap Past Papers With SolutionDocument8 pagesAafr Ifrs 16 Icap Past Papers With SolutionAqib SheikhNo ratings yet

- Questions On LeasingDocument5 pagesQuestions On Leasingriteshsoni100% (2)

- Term Loan and Lease FinancingDocument3 pagesTerm Loan and Lease FinancingSoo CealNo ratings yet

- Class Exercise - 3 Lease FinancingDocument4 pagesClass Exercise - 3 Lease Financinggaurav shettyNo ratings yet

- Class Leasing ProblemsDocument5 pagesClass Leasing Problemskarthinathan100% (1)

- Leasing QuestionsDocument2 pagesLeasing Questionssujal JainNo ratings yet

- IFRS 16 13102022 100655am 1Document3 pagesIFRS 16 13102022 100655am 1Adnan MaqboolNo ratings yet

- LeaseDocument1 pageLeaseNuzat Nawar TofaNo ratings yet

- Leasing 2-1Document6 pagesLeasing 2-1Madhuri kumariNo ratings yet

- Module-Leasing and Hire Purchase Calculation of Lease RentalsDocument5 pagesModule-Leasing and Hire Purchase Calculation of Lease RentalsSINDHU NNo ratings yet

- Lesse Evaluation ProblemsDocument3 pagesLesse Evaluation ProblemsAnshuNo ratings yet

- SFM Exam Capsule Question Part Old Syllabus PDFDocument77 pagesSFM Exam Capsule Question Part Old Syllabus PDFKrishna AdhikariNo ratings yet

- Assignment Question CH3Document1 pageAssignment Question CH3Sarose Thapa0% (1)

- Leasing & HP ProbDocument3 pagesLeasing & HP ProbAmruta PeriNo ratings yet

- Lease Financing Final NotesDocument2 pagesLease Financing Final NotesGLOBUS CYBERNo ratings yet

- 8 - 21 - LeasingDocument2 pages8 - 21 - LeasingPham Ngoc VanNo ratings yet

- Tutorial 5 Leasing QuestionsDocument1 pageTutorial 5 Leasing QuestionskhalidNo ratings yet

- Unit-VI: Leasing, Hire-Purchase & Project FinanceDocument16 pagesUnit-VI: Leasing, Hire-Purchase & Project Financerohit_hedaoo7131No ratings yet

- Assignment 1 PDFDocument2 pagesAssignment 1 PDFRohan SahdevNo ratings yet

- Assignment P16 4Document1 pageAssignment P16 4Rameez Hassan RanaNo ratings yet

- Assignment Questions LeasingDocument2 pagesAssignment Questions LeasingPuneet MurarkaNo ratings yet

- Business Finance DecisionsDocument4 pagesBusiness Finance DecisionsCISA PwCNo ratings yet

- F18 BFDDocument4 pagesF18 BFDHaiderRazaNo ratings yet

- Corporate Finance II Tutorials - Lease - QuestionsDocument2 pagesCorporate Finance II Tutorials - Lease - Questionsngoniwessy0% (1)

- Revision Progress Test 1 - Investment AppraisalDocument5 pagesRevision Progress Test 1 - Investment Appraisalsamuel_dwumfourNo ratings yet

- CH 20 Leasing ProblemsDocument3 pagesCH 20 Leasing ProblemsFaiza Khan33% (3)

- Fonderia Di Torino S11Document3 pagesFonderia Di Torino S11virginiafeeNo ratings yet

- IFRS-16 LeasesDocument7 pagesIFRS-16 LeasesHuzaifa WaseemNo ratings yet

- Simad University: Learning ObjectiveDocument9 pagesSimad University: Learning ObjectiveYusuf HusseinNo ratings yet

- 0126financial and Corporate ReportingDocument6 pages0126financial and Corporate ReportingSmag SmagNo ratings yet

- FAR-II Test IFRS-16 (AB)Document2 pagesFAR-II Test IFRS-16 (AB)Waseim khan Barik zaiNo ratings yet

- Practice Problem - LeasesDocument2 pagesPractice Problem - LeasesNitinNo ratings yet

- Leasing NotesDocument7 pagesLeasing NotesSanthoshShivanNo ratings yet

- 5 Hire - Purchase - System PDFDocument17 pages5 Hire - Purchase - System PDFnavin_raghu0% (1)

- As 19 - Leases: Practical QuestionsDocument2 pagesAs 19 - Leases: Practical QuestionsTejaswiniReddyNo ratings yet

- As 19 - Leases: Practical QuestionsDocument2 pagesAs 19 - Leases: Practical QuestionsHimanshu YadavNo ratings yet

- As 19 - Leases: Practical QuestionsDocument2 pagesAs 19 - Leases: Practical QuestionsHimanshu YadavNo ratings yet

- Leases AS PDFDocument2 pagesLeases AS PDFHimanshu YadavNo ratings yet

- Fin 427 HW 3Document2 pagesFin 427 HW 3B M Rakib HassanNo ratings yet

- Chapter 4 Lease vs. BuyDocument2 pagesChapter 4 Lease vs. Buymogibol791No ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- Assignment 1 - 2020Document3 pagesAssignment 1 - 2020Sarose ThapaNo ratings yet

- Capital Budgeting TechniquesDocument2 pagesCapital Budgeting TechniquesmananipratikNo ratings yet

- Clever Blade CertificateDocument1 pageClever Blade CertificateMurli MundraNo ratings yet

- Exam Question PaperDocument2 pagesExam Question Papersreyans banthiaNo ratings yet

- Capital BudgetingDocument25 pagesCapital BudgetingadarshpoudelNo ratings yet

- Capital Budgeting AssignmentDocument3 pagesCapital Budgeting AssignmentRobert JohnsonNo ratings yet

- Section A - QuestionsDocument27 pagesSection A - Questionsnek_akhtar87250% (1)

- Assignment 4Document2 pagesAssignment 4Ahmed BeheryNo ratings yet

- Engineering Economics & Costing AssignmnetDocument1 pageEngineering Economics & Costing AssignmnetSachin SahooNo ratings yet

- Written AssignmentDocument2 pagesWritten Assignmentjigme phuntshoNo ratings yet

- Depreciation Basic - Problem1Document2 pagesDepreciation Basic - Problem1Pallavi Ingale0% (1)

- Assignment On DepreciationDocument4 pagesAssignment On DepreciationNouman MujahidNo ratings yet

- Cash Flow Estimation - ReplacementDocument1 pageCash Flow Estimation - ReplacementAbhishek GhoshNo ratings yet

- Tractor PlusDocument10 pagesTractor Plusprasadkh90No ratings yet

- The Right of Use AssetDocument7 pagesThe Right of Use AssetKyle EspinozaNo ratings yet

- Accounting/Reporting Framework and Taxation of LeasingDocument42 pagesAccounting/Reporting Framework and Taxation of LeasingAdison Growar SatyeNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- TapScanner 08-16-2022-01 52Document2 pagesTapScanner 08-16-2022-01 52Love SandyNo ratings yet

- TapScanner 08-06-2022-23 53Document3 pagesTapScanner 08-06-2022-23 53Love SandyNo ratings yet

- TapScanner 07-19-2022-23 44Document9 pagesTapScanner 07-19-2022-23 44Love SandyNo ratings yet

- Presentation 2Document2 pagesPresentation 2Love SandyNo ratings yet

- Self Read - DBM - Session 4Document9 pagesSelf Read - DBM - Session 4Love SandyNo ratings yet

- Biz Strategy AnalysisDocument21 pagesBiz Strategy AnalysisLove SandyNo ratings yet

- Valsession 10Document29 pagesValsession 10Love SandyNo ratings yet

- UntitledDocument29 pagesUntitledLove SandyNo ratings yet

- The Five Pillars of Good Corporate GovernanceDocument6 pagesThe Five Pillars of Good Corporate GovernanceLove SandyNo ratings yet

- Dciak: We-Nit,)Document21 pagesDciak: We-Nit,)Love SandyNo ratings yet

- Leopie, Rro Onment: It-Nleumation TeohnoiagyDocument16 pagesLeopie, Rro Onment: It-Nleumation TeohnoiagyLove SandyNo ratings yet