Professional Documents

Culture Documents

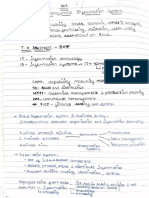

Self Read - DBM - Session 4

Self Read - DBM - Session 4

Uploaded by

Love Sandy0 ratings0% found this document useful (0 votes)

35 views9 pagesExcel functions finance

Original Title

Self Read_DBM_Session 4

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentExcel functions finance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views9 pagesSelf Read - DBM - Session 4

Self Read - DBM - Session 4

Uploaded by

Love SandyExcel functions finance

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 9

More Excel financial functions

Questions answered in this chapter:

+ You are buying a copier. Would you rather pay $11,000 today of $3,000 a year for five years?

+ Ifatthe end of each of the next 40 years, | invest $2,000 a year toward my retirement and earn 8

percent a year on my investments, how much will | have when | retire?

+ 1am borrowing $10,000 for 10 months with an annual interest rate of 8 percent. What are my

monthly payments? How much principal and interest am | paying each month?

+ Iwant to borrow $80,000 and make monthly payments for 10 years. The maximum monthly

payment I can afford is $1,000, What is the maximum interest ratel| can afford?

If | borrow $100,000 at 8 percent interest and make payments of $10,000 per year, how many years

will it take me to pay back the loan?

+ I'ma CPA and often have to work with complicated methods for depreciating machinery cost. Does

Excel have functions to help me compute depreciation?

When we borrow money to buy a car or house, we always wonder if we are getting a good deal. When

‘we save for retirement, we are curious how large a nest egg we'll have when we retire. in our daily work

and personal lives, financial questions similar to these often arise. Knowledge of the Excel PV, FV, PMT,

PMT, TPMT, CUMPRINC, CUMIPMT, RATE, and NPER functions makes it easy to answer these types of ques-

tions,

Answers to this chapter's questions

You are buying a copier. Would you rather pay $11,000 today or $3,000 a year for five years?

‘The key to answering this question is being able to value the annual payments of $3,000 per year. As-

sume the cost of capital is 12 percent per year. You could use the NPV function to answer this question,

but the Excel PV function provides a much quicker way to solve it. A stream of cash flow that involves

the same amount of cash outflow (or inflow) each period is called an annuity. Assuming that each

period's interest rate is the same, you can easily value an annuity by using the Excel PV function, The

PV function returns the value in today's dollars of a series of future payments, under the assumption of

periodic, constant payments and a constant interest rate. The syntax of the PV function is PV(rate, #pe

Comet], Lv], Ltype]), where pmt, fy, and type are optional arguments.

Note When working with Microsoft Excel financial functions, luse the following conven-

tions for the signs of pm (payment) and Fv (future value}: money received has a positive sign

and money paid out has a negative sign.

7

= Rates the interest rate per period. For example, if you borrow money at 6 percent per year and

the period is a year, then rate=0.06. If the period is a month, then rate=0.06/12-0.005.

= fper is the number of periods in the annuity. For our copier example, #per=S. If payments on

the copier are made each month for five years, then #per=60. Your rate must, of course, be con-

sistent with #per. That is, if #per implies a period is a month, you must use a monthly interest

rate; if #per implies a period isa year, you must use an annual interest rate.

= Pmt is the payment made each period. For our copier example, pmt=-$3,000. A payment has

a negative sign, whereas money received has a positive sign. At least one instance of pmt or Fv

must be included,

= Fvisthe cash balance (or future value) you want to have after the last payment is made. For our

copier example, fv=0. For example, if you want to have a $500 cash balance after the last pay-

ment, then fv=$500. f you want to make an additional $500 payment at the end of a problem

Fv=-$500. If Fv is omitted, itis assumed to equal 0.

= Typeis either 0 or 1 and indicates when payments are made, When type is omitted or equal

t0 0, payments are made at the end of each period. When types1, payments are made at the

beginning of each period. Note that you may also write True instead of 1 and False instead of

0 inall functions discussed in this chapter.

Figure 10-1 illustrates the worksheet PV from the file named Excelfinfunctions.xlsx and indicat

to solve our copier problem.

how

a 5

2 PMT

[Pay $3000

for 5 years

lend of

S|year $10,814.33

[Pay $3000

tor 5 years,

beginning

4 lotyear $12,112.05

[Extra $500

[payment

lend of

lyear Srend

lof year

5 |payments $14,098.04 [=PW(0.A2.4

-3000,-500,0)

FIGURE10-1 Example of the PV function.

In cell B3, | computed the present value of paying $3,000 at the end of each year, for five years, with a 12

percent cost of capital, by using the formula =PV(O. 12,5,-3000,0,0). Excel returns an NPV of $10,814.33,

By omitting the last two arguments, | obtained the same answer with the formula =PV(O.12,5,-3000).

Thus it isa better deal to make payments at the end of the year than to pay out $11,000 today.

If you make payments on the copier of $3,000 at the beginning of each year for five years, the NPV

of the payments is computed in cell B4 with the formula =PV(0. 12,5,-3000,0,1). Note that changing

More Excel financial functions

the last argument from 0 to 1 changes the calculations from end of the year to beginning of the year.

You can see that the present value of our payments is $12,112.05. Therefore, it's better to pay $11,000

today than make payments at the beginning of the year.

Suppose you pay $3,000 at the end of each year and must include an extra $500 payment at the end

of Year 5. You can now find the present value of all our payments in cell BS by including a future value

of $500 with the formula =PV(O. 12, 5 ,-3000-, 500, 0). Note that the $3,000 and $500 cash flows have

negative signs because you are paying out the money. The present value of all these payments is equal

to $11,098.04,

If at the end of each of the next 40 years, | invest $2,000 a year toward my retirement and

earn 8 percent a year on my investments, how much ave when I retire?

In this situation, we want to know the value of an annuity in terms of future dollars (40 years from now) and

not today’s dollars. This is ajob for the Excel FV (future value) function. The FV function gives the future

value of an investment assuming periodic, constant payments with a constant interest rate. The syntax of

the FV function is FV(rate, #per, [emt], [pv] , [typel]), where pm, py, and type are optional arguments:

Rate is the interest rate per period. In our case, rate equals 0.08.

= Per is the number of periods in the future at which you want the future value computed. #Per

is also the number of periods during which the annuity payment is received. in our case, #per

equals 40.

= Pmt is the payment made each period. In our case, pmt equals $2,000, The negative sign indi-

cates we are paying money into an account. At least one instance of pmt or py must be included

= Pvisthe amount of money (in today’s dollars) owed right now. In our case, pv equals $0. Iftoday

we owe someone $10,000, then pv equals $10,000 because the lender gave us $10,000 and we

received it. If today we have $10,000 in the bank, then pv equals ~$10, 000 because we must

have paid $10,000 into our bank account. If pv is omitted, its assumed to equal 0

= Type is 0 or 1 and indicates when payments are due, or money is deposited. If type equals 0 or

is omitted, then money is deposited at the end of the period. In our case, type is 0 or omitted. If

type equals 1, then payments are made, or money is deposited at the beginning of the period.

In worksheet FV of file named Excelfinfunctions.xsx (see Figure 10-2),| entered in cell B3 the formula

=FV(0.08, 40,~2000, 0,0) to find that our nest egg will be worth $518,113.04 in 40 years. Note that I

entered a negative value for the annual payment. did this because the $2,000 is paid into our account

If deposits were made at the beginning of each year for 40 years, the formula (entered in cell Ba)

=FV(0.08,40,-2000,0, 1) would yield the value in 40 years of our nest egg: $559,562.08,

Finally, suppose that in addition to investing $2,000 at the end of each of the next 40 years, you ini-

tially have $30,000 to invest. If you earn 8 percent per year on your investments, how much money will

you have when you retire in 40 years? You can answer this question by setting pv equal to -$30,000

in the FV function. The negative sign is used because you have deposited, or paid, $30,000 into your

account. In cell BS of worksheet FY, the formula =FV(O.08, 40,-2000, -30000,0) yields a future value

of $1,169,848 .68,

More Excel financial functions 79

80

2v

Invest

‘2000 end

lof year for

3 ADyears $518,413.04 =FV(0.08,40,2000,0.0)

Invest

‘2000

beginning

lot year for

4 40 years $550,582.08 =FV(0,0.40,2000,0.1)

wth

'$30000 and

invest

‘2000 pee

year at ond

‘of year for

“5.40 years $1,160,848.68 =FV(0.08,40,2000,-30000,0)

FIGURE 10-2. Example of FV function,

1am borrowing $10,000 for 10 months with an annual interest rate of 8 percent. What are my

monthly payments? How much principal and interest am i paying each month?

‘The Excel PMT function computes the periodic payments for a loan, assuming constant payments and a

constant interest rate. The syntax of the PMT function is PMT rate, #per,pv. LfvJ. [type]), where fv

and type are optional arguments

= Rate is the per-period interest rate of the loan. In this example, | will use one month as 2 period,

so rate equals 0.08/12=0 .006666667.

= Per is the number of payments made. In this case, #per equals 10.

= Pvisthe present value of all the payments That is, pv is the amount of the loan. In this case, pv

equals $10,000. Pv is positive because we are receiving the $10,000,

= Fvindicates the future value of the final loan balance you want to have after making the last

payment. In our case, Fv equals 0. If fv is omitted, Excel assumes that it equals 0. Suppose you

have taken out a balloon loan for which you make payments at the end of each month, but at

the conclusion of the loan you pay off the final balance by making a $1,000 balloon payment.

Then fv equals -$1, 000. The $1,000 is negative because we are paying it out.

= Types 0 or 1 and indicates when payments are due. If type equals 0 or is omitted, then pay-

ments are made at the end of the period. first assumed end-of-month payments, so type is 0

or omitted, If type equals 1, then payments are made, or money is deposited at the beginning

of the period.

In cell G1 of the worksheet PMT in the file named Excelfinfunctions xlsx (see Figure 10-3), | computed

the monthly payment on a 10-month loan for $10,000, assuming an 8 percent annual interest rate and

end-of-month payments with the formula =-PMT'(0.08/12,10,10000,0,0). The monthly payment is

$1,037.03. The PMT function by itself returns a negative value because we are making payments to the

company giving us the loan

More Excel financial functions

Ifyou want to, you can use the Excel TPMT and PPNT functions to compute the amount of interest

paid each month toward the loan and the amount of the balance paid down each month. (This is called

the payment on the principal)

sesrane Men

5 the See Port, er nm

FIGURE10-3 Examples of the PMT, PPMT, CUMPRINC, CUMIPMT, and IPMT functions.

To determine the interest paid each month, use the TPMT (interest payment) function. The syntax

of the IPMT function is IPMT (rate, per ,#per,pv, [fv] , [type]), where fv and type are optional

arguments. The per argument indicates the period number for which you compute the interest

The other arguments mean the same as they do for the PMT function. Similarly, to determine the

amount paid toward the principal each month, you can use the PPMT (principal payment) function.

‘The syntax of the PPMT function is PPMT Crate,per, #per pv, [fv], [type]. The meaning of each

argument is the same as itis for the IPMT function. By copying from F6 to F7:F16 the formu

PPHT(0.08/12,C6,10, 10000,0,0), you can compute the amount of each month's payment that is

applied to the principal. For example, during Month 1 you pay only $970.37 toward the principal. As

expected, the amount paid toward the principal increases each month. The minus sign (before PNT) is

needed because the principal is paid to the company giving you the loan, and PPMT will return a nega-

tive number. By copying from G6 to G7-GI6 the formula =-IPMT(0.08/12,C6,10, 10000,0,0), you can

compute the amount of interest paid each month. For example, in Month 1 you pay $66.67 in interest.

Of course, the amount of interest paid each month decreases.

Note that each month, (Interest Paid)+(Payment Toward Principal)=CTotal Payment).

Sometimes the total is off by a penny because of rounding,

You can also create the ending balances for each month in column H by using the relationship (End-

‘ing Month t Balance)=(Beginning Month t Balance)-(Month t Payment toward Principal)

Note that in Month 1, Beginning Balance equals $10,000. In column D, | created each month's beginning

balance by using the relationship (for t=2, 3, 10) (Beginning Month t Balance)=(Ending

Month t-1 Balance)

Of course, Ending Month 10 Balance equals $0 (in cell H15), as it should

More Excel financial functions 81

a2

Interest each month can be computed as (Month t Interest)=(Interest rate)* (Beginning

Month t Balance). For example, the Month 3 interest payment can be computed as

= (0 ,0066667)*(S8,052.80), which equals $53.69.

Of course, the NPV of all payments is exactly $10,000. | checked this in cell D17 with the formula

NPV(0.08/12,E6:E15), Note the cell D17 formula is =NPV(E1, E6:E15), and the cell E1 formula is

=0.08/12 (see Figure 10-3)

Ifthe payments are made at the beginning of each month, the amount of each payment is com-

puted in cell D19 with the formula =-PNT (0.08/12, 10,10000,0,1). Changing the last argument to 1

changes each payment to the beginning of the month, Because the lender is getting her money earlier,

monthly payments are less than the end-of-month case. If you pay at the beginning of the month, the

monthly payment is $1,030.16.

Finally, suppose that you want to make a balloon payment of $1,000 at the end of 10 months. if you

make your monthly payments at the end of each month, the formula =-PMT(0.08/12,10, 10000,

=1000,0) in cell D20 computes your monthly payment. The monthly payment turns out to be $940,

Because $1,000 of the loan is not being paid with monthly payments, it makes sense that your new

monthly payment is less than the original end-of-month payment of $1,037.03,

CUMPRINC and CUMIPMT functions

You'll often want to accumulate the interest or principal paid during several periods. The CUMPRINC and

‘CUMIPMT functions make this a snap.

The CUMPRINC (cumulative principal) function computes the principal paid between two periods

(inclusive). The syntax of the CUMPRINC function is CUNPRINC(rate, #per,pv, start period, end

period, type). Rate, #per, py, and type have the same meanings as described previously

The CUMIPMT (cumulative interest payment) function computes the interest paid between two pe-

riods (inclusive). The syntax of the CUMIPMT function is CUMIPMT(rate, fnper,pv,start period,end

period, type). Rate, #per, pv, and type have the same meanings as described previously. For exam-

ple, in cell F19 on the PMT worksheet, | computed the interest paid during months 2 through 4 ($161.01)

by using the formula =CUMIPHT(0.08/12, 10,10000,2,4,0). In cell G19, I computed the principal paid

offin months 2 through 4 ($2,950.08) by using the formula =CUMPRINC(O.08/12, 10, 10000,2, 4,0)

I want to borrow $80,000 and make monthly payments for 10 years. The maximum monthly

payment i can afford is $1,000. What is the maximum interest rate i can afford?

Given a borrowed amount, the length of a loan, and the payment each period, the RATE function tells

you the rate of the loan. The syntax of the RATE function is RATE (#per.,pmt ,pv, Lfv] , [type], Lgue

s]), where fv, type, and guess are optional arguments. #Per, pmt, py, fv, and type have the same

meanings as previously described. Guess s simply a guess at what the loan rate is, Usually, guess can

be omitted. Entering in cell D9 of worksheet Rate (in the file named Excelfinfunctions.xIsx) the formula

=RATE(120,-1000,80000,0,0,) yields 0.7241 percent as the monthly rate. | am assuming end-of-

month payments (see Figure 10-4).

More Excel financial functions

D E E s H

6 BORROWING $80,000

7 120 MONTHLY PAYMENTS OF $1000 PER MONTH

8 WHAT IS MAX RATE YOU CAN HANDLE?

8 0,72410% =RATE(120,-1000,80000,0,0)

10 IF YOU CAN PAY $10,000 AT END

‘11 WHAT IS MAX RATE YOU CAN HANDLE?

42, 0.810% =RATE(120,-1000,80000,-10000,0,0)

8

te

4 4000.08 =P¥o 00724, 120-100.00)

8 cnecnt

ial { 1

ie

FIGURE10-4 Example of the RATE function.

In cell D1S, I verified the RATE function calculation. The formula =PV(.007241,120,-1000,0,0)

yields $80,000.08. This shows that payments of $1,000 at the end of each month for 120 months havea

present value of $80,000.08.

Ifyou could pay back $10,000 during month 120, the maximum rate you could handle would be

given by the formula =RATE(120, -1000, 80000,-10000,0,0). In cell D12, this formula yields a monthly

rate of 0.818 percent,

If | borrow $100,000 at 8 percent interest and make payments of $10,000 per year, how many

years will it take me to pay back the loan?

Given the size of a loan, the payments each period, and the loan rate, the NPER (number of periods)

function tells you how many periods it takes to pay back a loan. The syntax of the NPER function is

NPER(rate, pnt, pv, [fv] , [type]), in which fv and type are optional arguments.

Assuming end-of-year payments, the formula =NPER(0..08 ,-10000, 100000,0,0) in cell D7 of the

worksheet named Nper (in the file named Excelfinfunctions.xlsx) yields 20.91 years (see Figure 10-5).

Thus, 20 years of payments will not quite pay back the loan, but 21 years will overpay the loan. To verify

the calculation, in cells D10 and D11 | used the PV function to show that paying $10,000 per year for 20,

years pays back $98,181.47, and paying back $10,000 for 21 years pays back $100,168.03.

Suppose that you are planning to pay back $40,000 in the final payment period. How many years

will it take to pay back the loan? | entered in cell D14 the formula =NPER(O..08,-10000, 100000,

~40000,0), which shows that it will take 15.90 years to pay back the loan. Thus, 15 years of payments

will not quite pay off the loan, and 16 years of payments will slightly overpay the loan,

I'ma CPA and often have to work with complicated methods for depreciating machinery

cost. Does Excel have functions to help me compute depreciation?

Depreciation is the reduction in the long-lived assets from use or obsolescence. The three most com-

monly used methods for computing depreciation are the following:

= Straight-Line depreciation (SLN)

m= Sum-of-Years’ Digits depreciation (SYD)

= Double-Declining-Balance depreciation (DDB)

More Excel financial functions 83

84

Borrow $100000 8%

‘ANNUAL PAYMENTS OF $10,000 PER YEAR

END OF YEAR PAYMENT

HOW MANY YEARS?

20.91237108

20 YEARS WILL NOT PAY IT OFF; 24 WILL

‘CHECK

20 YEARS $08,101.47

21 YEARS $100,168.03

IF WE PAY $40,000 AT END OF PROBLEM

16,9012328

45 YEARS WILL NOT PAY IT OFF: 16 YEARS WILL

FIGURE10-5 Example of the NPER function.

(or

Let's consider a new machine that is worth $15,000 and over five years will be depreciated to a final

salvage value) of $3000. The question is how the various depreciation methods allocate $15,000 -

$3000 = $12,000 of depreciation over five years.

= The Straight-Line deprecation method (SLN) simply depreciates the machine’s value an equal

amount (in this case, $12,000/5 = $2400) during each year.

= When there are N total years, the Sum-of-Years’ Digits method (SYD) allocates during year1

a fraction (N-I+1) /(N*(N+1) /2) of the Cost Salvage Value. (N*(N+1)/2) is the sum of the

integers 1,2, [ell,N. In our example, 5/15 of total depreciation occurs during Year 1, 4/15 during

Year 2, and so on.

If we define Book Value = Cost - Accumulated Depreciation, then for depreciation over

Nyears, the Double-Declining-Balance method (DDB) calculates depreciation during a year

as 2*Book Value)/N. In our example, N = 5. During each year, depreciation should equal 40

percent of the Book Value. Unfortunately, DDB as we just described may not allocate exactly

an amount equal to Cost - Salvage Value to depreciation. In such cases, DDB adjusts deprecia-

tion during the last few years, so total Depreciation would equal Cost — Salvage Value. In our

example, DDB allocates 0.4*$15,000 = $6000 during Year 1,0.4*$9000 = $3600 during Year

2, and 0.4*($5400) = $2160 during Year 3. If we allocated 0.4*($3240) = $1296 to Year 4

depreciation, our total depreciation would exceed $12,000. Therefore, Year 4 Depreciation

= $12,000 - ($6000+ $3600 + $2160) = $240, and Year 5 Depreciation = 0.

Fortunately, Excel has a function for each type of depreciation:

= For Straight-Line depreciation, the function SLN(Cost, Sal vage_value, Year's) computes each

year’s depreciation.

= For Sum-of-Years' Digits depreciation, the function SYD (Cost, Sal vage_value, Years, i) com-

putes depreciation during year i

= For Double-Declining-Balance depreciation, the function DDB(Cost, Salvage_value, Years, i)

computes Year i depreciation

More Excel financial functions

Therefore, after creating range names for cells C2:C4 based on the range B2:84 (as shown in Figure

10-6 and the file named Depreciationexamples.xisx), we can compute depreciation for each of the

three methods as follows

= Compute Straight-Line depreciation by copying from E8 to F8:/8 the formula

=SLN(Cost, Salvage_Value, Years).

= Compute Sum-of- Years’ Digits depreciation by copying from E9 to F9:J9 the formula =

SYD(Cost, Salvage_value, Years, £7).

= Compute Double-Declining-Balance depreciation by copying from E10 to F10:10 the formula =

DDB (Cost, Salvage_value, Years £7).

Note that both SYD and DDB front load more of the depreciation to early years,

eons sine Rego naost jamal noo! neo! “Sine

FIGURE10-6 Examples of Excel depreciation functions,

Problems

Unless otherwise mentioned, all payments are made at the end of the period.

1. Youhave just won the lottery. At the end of each of the next 20 years, you will receive a pay-

ment of $50,000. Ifthe cost of capital is 10 percent per year, what is the present value of your

lottery winnings?

2. perpetuity is an annuity that is received forever. If| rent out my house and at the beginning of

teach year | receive $14,000, what is the value of this perpetuity? Assume an annual 10 percent

cost of capital. Hint: Use the PV function and let the number of periods be many!

3. Inow have $250,000 in the bank. At the end of each of the next 20 years, | withdraw $15,000. If

eam 8 percent per year on my investments, how much money will | have in 20 years?

4, [deposit $2,000 per month (at the end of each month) over the next 10 years. My investments

earn 0.8 percent per month, | would like to have $1 million in 10 years. How much money should

I deposit now?

5. An NBA player is receiving $15 million at the end of each of the next seven years. He can earn 6

percent per year on his investments, What is the present value of his future salary payments?

More Excel financial functions 85

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- TapScanner 08-16-2022-01 52Document2 pagesTapScanner 08-16-2022-01 52Love SandyNo ratings yet

- TapScanner 08-06-2022-23 53Document3 pagesTapScanner 08-06-2022-23 53Love SandyNo ratings yet

- Biz Strategy AnalysisDocument21 pagesBiz Strategy AnalysisLove SandyNo ratings yet

- Presentation 2Document2 pagesPresentation 2Love SandyNo ratings yet

- TapScanner 07-19-2022-23 44Document9 pagesTapScanner 07-19-2022-23 44Love SandyNo ratings yet

- Valsession 10Document29 pagesValsession 10Love SandyNo ratings yet

- Gamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of TheDocument1 pageGamma Ltd. Is Considering A Lease of An Equipment Costing Rs800 Lakhs. Life of TheLove SandyNo ratings yet

- UntitledDocument29 pagesUntitledLove SandyNo ratings yet

- The Five Pillars of Good Corporate GovernanceDocument6 pagesThe Five Pillars of Good Corporate GovernanceLove SandyNo ratings yet

- Dciak: We-Nit,)Document21 pagesDciak: We-Nit,)Love SandyNo ratings yet

- Leopie, Rro Onment: It-Nleumation TeohnoiagyDocument16 pagesLeopie, Rro Onment: It-Nleumation TeohnoiagyLove SandyNo ratings yet