Professional Documents

Culture Documents

Kiids - 2023 01 10

Uploaded by

RabanBrunnerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kiids - 2023 01 10

Uploaded by

RabanBrunnerCopyright:

Available Formats

Key Investor Information

This document provides you with key investor information about this fund. It is not marketing material. The information is required by law to help you

understand the nature and the risks of investing in this fund. You are advised to read it so you can make an informed decision about whether to invest.

Fidelity Funds - Sustainable Climate Bond

Fund

a sub-fund of Fidelity Funds

A-ACC-USD (ISIN: LU2111945882)

This fund is managed by FIL Investment Management (Luxembourg) S.A.

Objectives and Investment Policy Risk and Reward Profile

n The fund aims to provide income and capital growth. Lower risk Higher risk

n The fund will invest at least 70% in global investment grade corporate

bonds.

n The fund focuses on management of climate related risks favouring Typically lower rewards Typically higher rewards

issuers with the lowest carbon profiles within their sectors, encouraging

transition to a greener environment through the selection of issuers on

an improving carbon transition path and investing in carefully selected

1 2 3 4 5 6 7

green bond issuers. n Historical data may not be a reliable indication for the future.

n The fund complies with a principle-based exclusion framework which n The risk category shown is not guaranteed and may change over time.

includes norm-based and negative screening of sectors, companies, n The lowest category does not mean a "risk free" investment.

practices based on specific ESG criteria to be determined by the

Investment Manager from time to time. n The risk and reward profile is classified by the level of historical

fluctuation of the Net Asset Values of the share class, and within this

n The fund will aim to have a lower carbon footprint compared to that of classification, categories 1-2 indicate a low level of historical fluctuations,

the broader market. 3-5 a medium level and 6-7 a high level.

n The fund adopts a Sustainable Thematic strategy under which 70% will n The value of your investment may fall as well as rise and you may get

be invested in securities that maintain sustainable characteristics. The back less than you originally invested.

fund promotes environmental and social characteristics pursuant to

article 8 of the SFDR. n The fund may invest in instruments denominated in currencies other than

the fund base currency. Changes in currency exchange rates can

n The fund assesses the sustainable characteristics of at least 90% of its therefore affect the value of your investment.

assets. The average ESG rating of the fund will exceed the average

ESG rating of its investment universe after excluding at least 20% of n Currency hedging may be used which aims to reduce the effect of such

assets with the lowest ESG ratings. changes. However, the effects may not be completely eliminated to the

degree expected.

n The fund will consider a wide range of environmental characteristics

and will be proactive in dealing with climate change through continual n The use of derivatives may result in ‘‘leverage’’ by which we mean a

engagement with global corporate bond issuers and by investing in level of exposure which could expose the fund to the potential of greater

carefully selected green bond issuers. gains or losses than would otherwise be the case.

n When investing in green, social and sustainability bonds, the Investment n There is a risk that the issuers of bonds may not be able to repay the

Manager employs a selection process mainly based on the money they have borrowed or make interest payments. While we seek

International Capital Market Association (‘ICMA’) Green and Social to mitigate this, the fund may be exposed to the risk of financial loss if it

Bond Principles (‘GSBP’) guidelines. Bonds certified as being compliant invests into an instrument issued by an entity that subsequently defaults

with Climate Bonds Initiative (‘CBI’) or European Green Bond Standards on its borrowings. Losses may also be realised if an entity that the fund

(‘EUGBS’) will be prioritised but the Investment Manager may use other is exposed to ceases to make interest payments over a period of time or

standards where appropriate. indefinitely. Bond prices have an inverse relationship with interest rates

such that when interest rates rise, bonds may fall in value. Rising interest

n As this fund may invest globally, it may invest in countries considered to rates may cause the value of your investment to fall.

be emerging markets.

n The fund may invest up to 10% directly in onshore China bonds listed or

n Emerging markets may be more volatile and it could be harder to sell or

trade securities. There may be less supervision, regulation and less well-

traded on any eligible market in China (with aggregate exposure defined procedures than in more developed countries. Emerging

including direct and indirect investments being less than 30%). markets can be sensitive to political instability, which can result in

n Less than 30% of the fund's assets will be invested in Hybrids or greater volatility and uncertainty, subjecting the fund to the risk of losses.

convertible bonds, with less than 20% of the total net assets to be

invested in contingent convertible bonds.

n The fund is actively managed. The Investment Manager will, when

selecting investments for the fund and for the purposes of monitoring

risk, reference Bloomberg Global Aggregate Corporate Index (the

‘‘Index’’). The fund’s performance can be assessed against its Index. The

Investment Manager has a wide range of discretion relative to the

Index. While the fund will hold assets that are components of the Index,

it may also invest in issuers, sectors, countries and security types that

are not included in, and that have different weightings from, the Index

in order to take advantage of investment opportunities.

n Income earned by the fund is accumulated in the share price.

n Shares can usually be bought and sold each business day of the fund.

Key Investor Information Fidelity Funds - Sustainable Climate Bond Fund

Charges for this fund (ISIN: LU2111945882)

The charges you pay are used to pay the costs of running the fund, including the costs of marketing and distributing it. These charges reduce the potential

growth of your investment.

One-off charges taken before or after you invest The entry and exit charges shown are maximum figures. In some cases you

might pay less - you can find this out from your financial adviser / distributor.

Entry charge 3.50%

Exit charge N/A The ongoing charges figure is based on expenses for the year ending

This is the maximum that might be taken out of your money before it is 30/04/2021. This figure may vary from year to year. It excludes:

invested or before the proceeds of your investment are paid out.

n performance fees (where applicable);

Charges taken from the fund over a year portfolio transaction costs, except in the case of an entry/exit charge paid

n

Ongoing charges 1.08% by the fund when buying or selling units in another collective investment

undertaking.

Charges taken from the fund under certain specific For more information about charges, including the possibility that swing pricing

conditions may apply, please consult the most recent Prospectus.

Performance fee N/A

Past Performance

Past performance is not a guide to

0% future performance results.

If any, the past performance shown

takes into account the ongoing charges

with exception of any applicable

entry/exit charges.

The fund was launched on 29/07/2009.

-3.9 This class was launched on 05/02/2020.

-5%

Past performance has been calculated

2017 2018 2019 2020 2021 in USD.

n Class

Y

If applicable, events in the fund's life which may have affected the performance history are highlighted as an ‘*’; in

the chart, which may include changes to the fund's objective and details of such events can be found on our

website or by requesting it from your appointed representative or your usual Fidelity contact. If applicable, the

Objectives and Investment Policy section shall refer to a benchmark and information on previous benchmarks may

be found in the annual report and accounts.

Practical Information

n The depositary is Brown Brothers Harriman (Luxembourg) S.C.A.

n For more information, please consult the Prospectus and latest Reports and Accounts which can be obtained free of charge in English and other main

languages from FIL Investment Management (Luxembourg) S.A., the distributors or online at any time.

n Details of the summary Remuneration Policy are available via https://www.fil.com. A paper copy can be obtained free of charge in English from FIL

Investment Management (Luxembourg) S.A.

n The Net Asset Values per Share are available at the registered office of Fidelity Funds (the 'UCITS'). They are also published online at

www.fidelityinternational.com where other information is available.

n The tax legislation in Luxembourg may have an impact on your personal tax position. For further details you should consult a tax advisor.

n FIL Investment Management (Luxembourg) S.A. may be held liable solely on the basis of any statement contained in this document that is misleading,

inaccurate or inconsistent with the relevant parts of the Prospectus for the UCITS.

n This document describes a sub-fund and share class of the UCITS. The Prospectus and Reports and Accounts are prepared for the entire UCITS.

n The assets and liabilities of each sub-fund of the UCITS are segregated by law and with that assets of this sub-fund will not be used to pay liabilities of

other sub-funds.

n More share classes are available for this UCITS. Details can be found in the Prospectus.

n You have the right to switch from this share class into the same or possibly other share class types of this or another sub-fund. In some cases, the full

entry charge may apply. Details on switching rules can be found in the Prospectus.

Country in which this fund is authorised: Luxembourg. The Supervisory Authority is: Commission de Surveillance du

Secteur Financier.

Country in which FIL Investment Management (Luxembourg) S.A. is authorised: Luxembourg. The Supervisory Authority is:

Commission de Surveillance du Secteur Financier.

This key investor information is accurate as at 19/07/2022.

You might also like

- Vanguard InvestingDocument40 pagesVanguard InvestingrasmussenmachineNo ratings yet

- Et2, CH1 - 2Document37 pagesEt2, CH1 - 2RabanBrunnerNo ratings yet

- Chapter FiveDocument14 pagesChapter Fivemubarek oumerNo ratings yet

- Project Mangement FullDocument20 pagesProject Mangement FullggyutuygjNo ratings yet

- Entrance Conference Agenda Template - Audit TeamDocument2 pagesEntrance Conference Agenda Template - Audit TeamDoug Pug86% (7)

- Production Integration With SAP EWM: Course Outline Course Version: 16 Course Duration: 2 Day(s)Document17 pagesProduction Integration With SAP EWM: Course Outline Course Version: 16 Course Duration: 2 Day(s)Tito MandoNo ratings yet

- Vanguard Principles InvestingDocument40 pagesVanguard Principles InvestingRemo RaulisonNo ratings yet

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Key Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIDocument2 pagesKey Investor Information: Credit Suisse (Lux) Fixed Maturity Bond Fund 2021 S-IIanushreerNo ratings yet

- Fidelity Funds - Iberia Fund: Key Investor InformationDocument2 pagesFidelity Funds - Iberia Fund: Key Investor InformationMNo ratings yet

- Key Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesDocument2 pagesKey Investor Information: JPM Europe Equity Plus A (Perf) (Acc) - EUR Objectives, Process and PoliciesAl BoscoNo ratings yet

- Docrep O00008095 00000001 0003 2021 04 26 Ki en 0000Document2 pagesDocrep O00008095 00000001 0003 2021 04 26 Ki en 0000Geeta RawatNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0650751489Isabelle ChapuysNo ratings yet

- Takafulink Fund Fact SheetDocument31 pagesTakafulink Fund Fact SheetCikgu AbdullahNo ratings yet

- HLMM US Fund KIID Class A Acc 0922 1Document2 pagesHLMM US Fund KIID Class A Acc 0922 1bhupstaNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Isabelle ChapuysNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment Policyduc anhNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0929190568Isabelle ChapuysNo ratings yet

- Ishares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares J.P. Morgan $ em Corp Bond Ucits Etf: Objectives and Investment PolicyIulian Claudiu PascalNo ratings yet

- Key Investor Information: JPM Global Research Enhanced Index Equity (ESG) UCITS ETF - USD (Acc)Document2 pagesKey Investor Information: JPM Global Research Enhanced Index Equity (ESG) UCITS ETF - USD (Acc)sinwha321No ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment PolicyGeorgio RomaniNo ratings yet

- PRUlink Dana Urudana Urus 2 2011Document7 pagesPRUlink Dana Urudana Urus 2 2011shadowz123456No ratings yet

- Amundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsDocument2 pagesAmundi Funds Pioneer Flexible Opportunities - I Usd A Sub-Fund of The Sicav Amundi FundsFlamain HugoNo ratings yet

- Factsheet March2022 1649167929Document5 pagesFactsheet March2022 1649167929BISWAJITNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0794389287Isabelle ChapuysNo ratings yet

- Wisdomtree Cloud Computing Ucits Etf-Usd Acc: Key Investor InformationDocument2 pagesWisdomtree Cloud Computing Ucits Etf-Usd Acc: Key Investor Informationduc anhNo ratings yet

- T Class Shares in Fundsmith Equity Fund: Key Investor InformationDocument2 pagesT Class Shares in Fundsmith Equity Fund: Key Investor InformationJohn SmithNo ratings yet

- Ucits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enDocument2 pagesUcits Kiid Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur GB Ie00b41n0724 enja1220087No ratings yet

- Fsuu - Ebi GBP Cash Margin Fund (Eng)Document2 pagesFsuu - Ebi GBP Cash Margin Fund (Eng)Gangi Reddy UbbaraNo ratings yet

- Docrep O00000908 00000039 0001 2022 02 18 Ki en 0000Document2 pagesDocrep O00000908 00000039 0001 2022 02 18 Ki en 0000Geeta RawatNo ratings yet

- Kiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enDocument2 pagesKiid Ishares Core Global Aggregate Bond Ucits Etf Usd Hedged Acc GB Ie00bz043r46 enAl BoscoNo ratings yet

- Balanced Fund Equity Fund: ProspectusDocument32 pagesBalanced Fund Equity Fund: ProspectuswkletterNo ratings yet

- Kiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enDocument2 pagesKiid Ishares Agribusiness Ucits Etf Usd Acc GB Ie00b6r52143 enfraknoNo ratings yet

- Key Investor Information: HL Select Global Growth SharesDocument2 pagesKey Investor Information: HL Select Global Growth SharesMerabharat BharatNo ratings yet

- Non-UCITS Retail Scheme Key Investor Information: Objectives and Investment PolicyDocument2 pagesNon-UCITS Retail Scheme Key Investor Information: Objectives and Investment Policysinwha321No ratings yet

- Key Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")Document2 pagesKey Investor Information: Vanguard S&P 500 UCITS ETF (The "Fund")sinwha321No ratings yet

- Sa 2113062 Vanguard Investment Principles EngDocument41 pagesSa 2113062 Vanguard Investment Principles EnganyirobleszapataNo ratings yet

- 2002 - Blackrock - Ishares Msci Usa Momentum Factor Esg Ucits Etf Usd AccDocument2 pages2002 - Blackrock - Ishares Msci Usa Momentum Factor Esg Ucits Etf Usd Accmarc mennellNo ratings yet

- CAPMDocument43 pagesCAPMEsha TibrewalNo ratings yet

- Fundsmith Equity Fund I Class KIID (For Institutional Investors)Document2 pagesFundsmith Equity Fund I Class KIID (For Institutional Investors)John SmithNo ratings yet

- Kiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 YcapfundDocument2 pagesKiidoc 2020 02 24 en Lu 2020 02 24 Lu1744468221 Ycapfundmatthieu massieNo ratings yet

- Active Muni Bond ManagementDocument2 pagesActive Muni Bond ManagementBijan PajoohiNo ratings yet

- Kiddoc 2023 10 30 en CH 2023 11 01 Ie00bdfc6q91Document3 pagesKiddoc 2023 10 30 en CH 2023 11 01 Ie00bdfc6q91trobertson041No ratings yet

- Public Tactical Allocation Fund (Ptaf) : Responsibility StatementDocument5 pagesPublic Tactical Allocation Fund (Ptaf) : Responsibility StatementKong Hung XiNo ratings yet

- Capital Market and Portfolio ManagementDocument10 pagesCapital Market and Portfolio ManagementFlora ChauhanNo ratings yet

- Key Investor Information: Objectives and Investment PolicyDocument2 pagesKey Investor Information: Objectives and Investment Policysinwha321No ratings yet

- Kiid Emqq IE00BFYN8Y92 en GBDocument2 pagesKiid Emqq IE00BFYN8Y92 en GBMónica CletoNo ratings yet

- P 09 P Smallcap PKF - EngDocument5 pagesP 09 P Smallcap PKF - EngherbertNo ratings yet

- Key Information and Investment Disclosure Statement: Metro World Equity Feeder FundDocument3 pagesKey Information and Investment Disclosure Statement: Metro World Equity Feeder FundMartin MartelNo ratings yet

- Hedge Fund: Investment Fund Regulation Taxation Performance Fee Assets Investment Management FirmDocument31 pagesHedge Fund: Investment Fund Regulation Taxation Performance Fee Assets Investment Management Firmkishorepatil8887No ratings yet

- Mutual Funds in IndiaDocument14 pagesMutual Funds in IndiaHarsh MittalNo ratings yet

- CT Uk Smaller Companies Fund (The "Fund")Document2 pagesCT Uk Smaller Companies Fund (The "Fund")KrisssszNo ratings yet

- Kiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 enDocument2 pagesKiid Ishares Core Msci em Imi Ucits Etf Usd Acc GB Ie00bkm4gz66 endasadsNo ratings yet

- Ishares Msci World Esg Screened Ucits Etf: Objectives and Investment PolicyDocument2 pagesIshares Msci World Esg Screened Ucits Etf: Objectives and Investment PolicyxacaxaNo ratings yet

- PB China Pacific Equity Fund (Pbcpef)Document5 pagesPB China Pacific Equity Fund (Pbcpef)Nik Hairi OmarNo ratings yet

- Dynamic Total Return Fund Nov 30: Constantly Pursuing Volatility-Managed Growth 2015Document2 pagesDynamic Total Return Fund Nov 30: Constantly Pursuing Volatility-Managed Growth 2015wesleybean9381No ratings yet

- KID - My Choice - Higher Fund 2021Document3 pagesKID - My Choice - Higher Fund 2021AntNE Property ServicesNo ratings yet

- Kiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enDocument2 pagesKiid Ishares Dow Jones Global Sustainability Screened Ucits Etf Usd Acc GB Ie00b57x3v84 enxacaxaNo ratings yet

- TRF Summary ProspectusDocument4 pagesTRF Summary ProspectusZerohedgeNo ratings yet

- IDFC Government Securities Fund: Key Information MemorandumDocument19 pagesIDFC Government Securities Fund: Key Information MemorandumRakesh KumarNo ratings yet

- Chapter 7Document11 pagesChapter 7Seid KassawNo ratings yet

- Eu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enDocument3 pagesEu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enAllanNo ratings yet

- Kiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Document2 pagesKiidoc 2020 07 22 en CH 2020 07 30 Lu1516025506Isabelle ChapuysNo ratings yet

- KKR KioDocument2 pagesKKR KioHungreo411No ratings yet

- Asset Allocation Webcast: Live Webcast Hosted byDocument60 pagesAsset Allocation Webcast: Live Webcast Hosted bysuperinvestorbulletiNo ratings yet

- Conductors Orchestra Program - SP2023Document2 pagesConductors Orchestra Program - SP2023RabanBrunnerNo ratings yet

- Dress Broadway Band PDFDocument1 pageDress Broadway Band PDFRabanBrunnerNo ratings yet

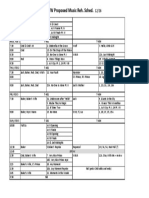

- Proposed Music Reh. Sched.Document1 pageProposed Music Reh. Sched.RabanBrunnerNo ratings yet

- American Musicological Society University of California Press Journal of The American Musicological SocietyDocument44 pagesAmerican Musicological Society University of California Press Journal of The American Musicological SocietyRabanBrunner100% (1)

- MOU With DCB Bank 9may16Document10 pagesMOU With DCB Bank 9may16Sainik AddaNo ratings yet

- Merrita Francis ResumeDocument2 pagesMerrita Francis Resumeapi-534828135No ratings yet

- Case StudyDocument35 pagesCase Studytuan nasiruddinNo ratings yet

- Messier's Reign at Vivendi UniversalDocument14 pagesMessier's Reign at Vivendi Universalsandycse2005No ratings yet

- ECON 1000 Exam Review Q41-61Document5 pagesECON 1000 Exam Review Q41-61Slock TruNo ratings yet

- Learning and Growth Perspective Learning and Growth PerspectiveDocument13 pagesLearning and Growth Perspective Learning and Growth PerspectiveNaimatul Jannat MoulyNo ratings yet

- Chapter 1Document4 pagesChapter 1sadsadsa100% (1)

- Dec 2019Document20 pagesDec 2019Anjana TimalsinaNo ratings yet

- Britannia Final StageDocument167 pagesBritannia Final Stagenbane2121No ratings yet

- HRD 2103 General EconomicsDocument3 pagesHRD 2103 General EconomicsJohn MbugiNo ratings yet

- 1+UOB BnF+Recruitment+Forum+2019Document6 pages1+UOB BnF+Recruitment+Forum+2019fatma1351No ratings yet

- Godrej Marketing Plan NewDocument9 pagesGodrej Marketing Plan Newlalit mishraNo ratings yet

- Buffer Profile and Buffer Level Determination For Demand Driven MRPDocument3 pagesBuffer Profile and Buffer Level Determination For Demand Driven MRPPrerak GargNo ratings yet

- Strategic Management (MGMT 2301) : The Cost Leadership StrategyDocument8 pagesStrategic Management (MGMT 2301) : The Cost Leadership StrategyDusmahomedNo ratings yet

- JOHANSSON - ChapDocument38 pagesJOHANSSON - Chaplow profileNo ratings yet

- Chapter 16 DCF With Inflation and Taxation: Learning ObjectivesDocument19 pagesChapter 16 DCF With Inflation and Taxation: Learning ObjectivesDani ShaNo ratings yet

- Accounting EntriesDocument3 pagesAccounting EntriesShashankSinghNo ratings yet

- Wise, Formerly TransferWise Online Money TransfeDocument2 pagesWise, Formerly TransferWise Online Money TransfeSRINI TNNo ratings yet

- The Strategy For Chinese Brands: Part 1 - The Perception ChallengeDocument8 pagesThe Strategy For Chinese Brands: Part 1 - The Perception ChallengeAanal PrajapatiNo ratings yet

- Data First WblsDocument11 pagesData First WblsGellie De VeraNo ratings yet

- CH 1 Information-technology-For-management Test BankDocument25 pagesCH 1 Information-technology-For-management Test Bankalfyomar79No ratings yet

- RocheDocument5 pagesRochePrattouNo ratings yet

- Simple and Compound InterestDocument22 pagesSimple and Compound InterestNadeth DayaoNo ratings yet

- Central Bank Digital Currencies. Motives, Economic Implications and The Research FrontierDocument30 pagesCentral Bank Digital Currencies. Motives, Economic Implications and The Research FrontierguymbulaNo ratings yet

- Practice Examination in Auditing TheoryDocument28 pagesPractice Examination in Auditing TheoryGabriel PonceNo ratings yet