Professional Documents

Culture Documents

Wa 8

Wa 8

Uploaded by

Muhammad nasirOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wa 8

Wa 8

Uploaded by

Muhammad nasirCopyright:

Available Formats

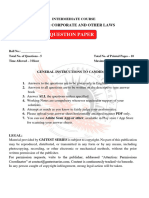

Business Finance-II (FIN507)

Weekly Assignment # 8

Instructor: Sana Tauseef

Semester: Spring 2023

Due Date: April 09, 2023, 11 p.m.

1. Suppose that the management of a company with poor future prospects

recommends to the board of directors an increase in its dividend. Management

explains to the board that investors may then believe that the company has

positive future prospects, leading to an increase in share value and shareholder

wealth. State whether such imitation is likely to achieve the stated objective over

the long term and justify your answer.

(4-6 lines)

2. May 2018, Globus Maritime Ltd, a Greek dry bulk shipping company providing

worldwide maritime transportation services, was warned by NASDAQ that it no

longer met the continuing listing requirements once its share price had traded

below the US$1 a share minimum price requirement for 30 consecutive business

days. Globus was given until the end of October 2018 to regain compliance.

Globus announced a 1 for 10 reverse split to occur on 15 October. On 12

October, shares were trading at US$4.25 before the reverse split had taken

place. If the reverse split were to take place when the share price was US$4.25,

find the expected stock price after a 1-for-10 reverse split, assuming no other

factors affect the split.

3. List the PSX listed companies that bought back shares during 2022-2023. Also

mention the number of shares bought back and number of shares outstanding

pre-transaction.

4. (Case: Sunar Factory: Investment Opportunity and a Financing Dilemma)

Project the annual cash flows related to the new investment for the next five years.

Is it a good/justified investment opportunity based on the expected return?

You might also like

- MGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsDocument5 pagesMGMT 702 Fall 2021 Research and Case Analysis No. 1 (10%) Part B (Warren Buffett and Berkshire Hathaway Inc.) - QuestionsJesus D. RiosNo ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- BFC 5926 Final Group AssignmentDocument12 pagesBFC 5926 Final Group AssignmentMengdi ZhangNo ratings yet

- Afin209 D 1 2020 2Document10 pagesAfin209 D 1 2020 2Kaso MuseNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabusmyash6136No ratings yet

- 4 Financial ManagementDocument5 pages4 Financial ManagementBizness Zenius Hant100% (1)

- Qtns On Sources of CapitalDocument4 pagesQtns On Sources of Capitalsalongo geofNo ratings yet

- Honors Abp 1Document13 pagesHonors Abp 1api-433316001No ratings yet

- Project Proposal OF MUTUAL FUNDSDocument7 pagesProject Proposal OF MUTUAL FUNDSPrateek Pasari100% (1)

- Mahesh, Project ProposalDocument7 pagesMahesh, Project ProposalPrateek PasariNo ratings yet

- Ep Group 2 Syllabus Dec 05032023Document81 pagesEp Group 2 Syllabus Dec 05032023deepanshudonaladsingh11arosaryNo ratings yet

- HSC SP Q.5. Answer in Brief PDFDocument4 pagesHSC SP Q.5. Answer in Brief PDFTanya SinghNo ratings yet

- Assignment & Case Study - Roles of Financial Markets and InstitutionsDocument3 pagesAssignment & Case Study - Roles of Financial Markets and InstitutionsMahnoor ShafiqNo ratings yet

- Far660 - Special Feb 2020 QuestionDocument5 pagesFar660 - Special Feb 2020 QuestionHanis ZahiraNo ratings yet

- Financial Management: Page 1 of 4Document4 pagesFinancial Management: Page 1 of 4Bizness Zenius HantNo ratings yet

- 3 Best Multi Asset Allocation Fund For 2024Document9 pages3 Best Multi Asset Allocation Fund For 2024chachinNo ratings yet

- Cp1a 052023Document4 pagesCp1a 052023Wilson ManyongaNo ratings yet

- A Project Report ON Mutual Fund Market: Executive Summary 3Document45 pagesA Project Report ON Mutual Fund Market: Executive Summary 3gsmarothiya19896349No ratings yet

- Falcon FundDocument33 pagesFalcon FundARYA SHETHNo ratings yet

- Examination: Subject SA6 Investment Specialist ApplicationsDocument148 pagesExamination: Subject SA6 Investment Specialist Applicationschan chadoNo ratings yet

- Chapter 1: The Investment EnvironmentDocument6 pagesChapter 1: The Investment EnvironmentShamaas HussainNo ratings yet

- New Waste UploadDocument8 pagesNew Waste UploadGautam ShahNo ratings yet

- AMBSCTFDocument2 pagesAMBSCTFckzeoNo ratings yet

- IDFC Emergin Businesses NFODocument5 pagesIDFC Emergin Businesses NFOfinancialbondingNo ratings yet

- Mutual Funds Investment - 7 Favourite Stocks of Mutual Funds Over Past One Year - The Economic TimesDocument13 pagesMutual Funds Investment - 7 Favourite Stocks of Mutual Funds Over Past One Year - The Economic TimesAnupNo ratings yet

- Far660 - Dec 2019 QuestionDocument5 pagesFar660 - Dec 2019 QuestionHanis ZahiraNo ratings yet

- Audit Report Eastland Equity BerhadDocument64 pagesAudit Report Eastland Equity BerhadFatin Nabilah RoslanNo ratings yet

- Business Analysis: (B) What Is An Operating Turnaround Strategy ? 4Document4 pagesBusiness Analysis: (B) What Is An Operating Turnaround Strategy ? 4Davies MumbaNo ratings yet

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대No ratings yet

- Research Paper On Mutual Funds in India PDFDocument6 pagesResearch Paper On Mutual Funds in India PDFlxeikcvnd100% (1)

- LOFC Documents - CSE Upload - 21511135431836783Document85 pagesLOFC Documents - CSE Upload - 21511135431836783Ksijj OlajjaNo ratings yet

- FSM PPT ContentDocument7 pagesFSM PPT ContentSejal MishraNo ratings yet

- Assessment InformationDocument9 pagesAssessment InformationAduda Ruiz BenahNo ratings yet

- FM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2Document138 pagesFM Theory Book - B73e8e56 Ad98 4d52 B7e7 Fb1341e39ab2sakshimandrupkar02No ratings yet

- Kotak AMCDocument5 pagesKotak AMCBISHWA RATANNo ratings yet

- Group Assignment FNC3213 Ii 2022-23Document5 pagesGroup Assignment FNC3213 Ii 2022-23najihahNo ratings yet

- Comparative Analysis of Three Asset Management Companies PDFDocument103 pagesComparative Analysis of Three Asset Management Companies PDFAayushi PatelNo ratings yet

- A Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIADocument45 pagesA Project Report On "PERFORMANCE ANALYSIS OF MUTUAL FUND TAX SAVINGS SCHEME IN INDIAKiran AryaNo ratings yet

- Working and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaDocument9 pagesWorking and Organization of Mutual Fund Company: Roshan Shukla and Shikha GuptaGhulam NabiNo ratings yet

- Comparative Analysis of Three Asset Management CompaniesDocument103 pagesComparative Analysis of Three Asset Management CompaniesNikhil Bhutada50% (4)

- Corporate Restructuring and InsolvencyDocument19 pagesCorporate Restructuring and InsolvencyJayachandra JcNo ratings yet

- Private Equity Research PapersDocument5 pagesPrivate Equity Research Papersc9rvz6mm100% (1)

- Research Papers On Mutual Funds PDFDocument7 pagesResearch Papers On Mutual Funds PDFafmcueagg100% (1)

- 2-Webinar QuestionsDocument11 pages2-Webinar QuestionshusseinNo ratings yet

- Assignment 3 Risk and ReturnDocument2 pagesAssignment 3 Risk and ReturnQurat SaboorNo ratings yet

- What To Evaluate in A Mutual Fund Factsheet - Investor EducationDocument3 pagesWhat To Evaluate in A Mutual Fund Factsheet - Investor EducationAnkit SharmaNo ratings yet

- Capital Markets and Securities Laws in English Dec 2014Document4 pagesCapital Markets and Securities Laws in English Dec 2014சுப்பிரமணிய தமிழ்No ratings yet

- Mutual Funds in Dse: How To Fix The Broken Cog of The Machine ?Document7 pagesMutual Funds in Dse: How To Fix The Broken Cog of The Machine ?Mohammad AshrafulNo ratings yet

- Determinants of Capital StructureDocument15 pagesDeterminants of Capital StructureDipinderNo ratings yet

- 2019 - Dec 2019 - Fin645 - 541 - 651 - 630Document4 pages2019 - Dec 2019 - Fin645 - 541 - 651 - 630Allieya AlawiNo ratings yet

- Bbmf2023 Principle of Investment Tutorial 1: Introduction To InvestmentDocument9 pagesBbmf2023 Principle of Investment Tutorial 1: Introduction To InvestmentKÃLÅÏ SMÎLĒYNo ratings yet

- Chapter 1: The Investment Environment: Problem SetsDocument5 pagesChapter 1: The Investment Environment: Problem SetsGrant LiNo ratings yet

- P 8 A Na T2 LW 2 PCFZCOp 7 Oy 5 L CVa BU7 RXBH Z4 J Ix Y64Document10 pagesP 8 A Na T2 LW 2 PCFZCOp 7 Oy 5 L CVa BU7 RXBH Z4 J Ix Y64lusamotuNo ratings yet

- 71475exam57501 p6f 2Document37 pages71475exam57501 p6f 2Anagha ReddyNo ratings yet

- 6 Financial Markets Institutions and Services - Prof. Vinay DuttaDocument3 pages6 Financial Markets Institutions and Services - Prof. Vinay DuttaParas KhuranaNo ratings yet

- AD 472 Case Study 3Document1 pageAD 472 Case Study 3arifismailbayrakNo ratings yet

- UntitledDocument9 pagesUntitledSHER LYN LOWNo ratings yet

- Business Development Strategy for the Upstream Oil and Gas IndustryFrom EverandBusiness Development Strategy for the Upstream Oil and Gas IndustryRating: 5 out of 5 stars5/5 (1)

- Portfolio Management - Part 2: Portfolio Management, #2From EverandPortfolio Management - Part 2: Portfolio Management, #2Rating: 5 out of 5 stars5/5 (9)

- Mutual Funds in India: Structure, Performance and UndercurrentsFrom EverandMutual Funds in India: Structure, Performance and UndercurrentsNo ratings yet

- Class Qs Part 2Document3 pagesClass Qs Part 2Muhammad nasirNo ratings yet

- Wa 6Document2 pagesWa 6Muhammad nasirNo ratings yet

- ABR Questionnaire: Group MembersDocument9 pagesABR Questionnaire: Group MembersMuhammad nasirNo ratings yet

- Hassaan's WorkDocument2 pagesHassaan's WorkMuhammad nasirNo ratings yet