Professional Documents

Culture Documents

Periodic - General Ledger

Periodic - General Ledger

Uploaded by

Jeon Cyrone Cuachon0 ratings0% found this document useful (0 votes)

13 views5 pagesThe document summarizes the transactions in various cash accounts for a business over the month of September. Key transactions include the owner investing $39,000 on September 1st, purchasing equipment and supplies throughout the month on a cash basis, borrowing $12,000 from the bank on September 16th, selling merchandise for cash and on accounts throughout the month, and paying various operating expenses at the end of the month including salaries, utilities, and rent. The cash balance across all accounts at the end of September is $9,400.

Original Description:

Original Title

PERIODIC - GENERAL LEDGER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes the transactions in various cash accounts for a business over the month of September. Key transactions include the owner investing $39,000 on September 1st, purchasing equipment and supplies throughout the month on a cash basis, borrowing $12,000 from the bank on September 16th, selling merchandise for cash and on accounts throughout the month, and paying various operating expenses at the end of the month including salaries, utilities, and rent. The cash balance across all accounts at the end of September is $9,400.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views5 pagesPeriodic - General Ledger

Periodic - General Ledger

Uploaded by

Jeon Cyrone CuachonThe document summarizes the transactions in various cash accounts for a business over the month of September. Key transactions include the owner investing $39,000 on September 1st, purchasing equipment and supplies throughout the month on a cash basis, borrowing $12,000 from the bank on September 16th, selling merchandise for cash and on accounts throughout the month, and paying various operating expenses at the end of the month including salaries, utilities, and rent. The cash balance across all accounts at the end of September is $9,400.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 5

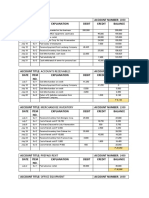

ACCOUNT TITLE: CASH ACCOUNT NUMBER: 1001

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 1 GJ-1 The owner invested in his business 39,000 39,000

September 2 GJ-1 Bought computer equipment, cash basis 10,000 29,000

September 3 GJ-1 Bought office supplies, cash basis 700 28,300

September 5 GJ-1 Paid freight on September 4 sale 200 28,100

September 11 GJ-2 Paid Lowtown Supply Co. 15,288 12,812

September 13 GJ-2 Received payment from September 4 14,896 27,708

sale

September 14 GJ-2 Bought Merchandise, cash basis 14,400 13,308

September 15 GJ-2 Paid employee salaries 1,500 11,808

September 16 GJ-2 Borrowed money from bank 12,000 23,808

September 17 GJ-2 Received refund from supplier 500 24,308

September 20 GJ-2 Freight cost on Sept. 18 purchase 700 23,608

September 23 GJ-2 Sold Merchandise, cash basis 16,400 40,008

September 26 GJ-3 Bought Merchandise, cash basis 12,300 27,708

September 27 GJ-3 Paid partial payment on Sept. 18 9,000 18,708

purchase

September 28 GJ-3 Cash withdrawal of owner for personal 2,008 16,700

use

September 29 GJ-3 Made cash refunds to customers 900 15,800

September 30 GJ-3 Paid the following expenses, cash basis 6,400 9,400

P 9,400

ACCOUNT TITLE: ACCOUNTS RECEIVABLES ACCOUNT NUMBER: 1202

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 4 GJ-1 Sold Merchandise on account 15,200 15,200

September 13 GJ-2 Received payment from September 4 15,200 0

sale

September 30 GJ-3 Sold Merchandise on account 13,700 13,700

P 13,700

ACCOUNT TITLE: SUPPLIES ACCOUNT NUMBER: 1400

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 3 GJ-1 Bought office supplies, cash basis 700 700

P 700

ACCOUNT TITLE: EQUIPMENT ACCOUNT NUMBER: 1500

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 2 GJ-1 Bought computer equipment, cash basis 10,000 10,000

P 10,000

ACCOUNT TITLE: ACCOUNTS PAYABLE ACCOUNT NUMBER: 2000

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 2 GJ-1 Bought merchandise on account 15,900 15,900

September 6 GJ-1 Received Credit from Lowtown Supply 300 15,600

Co.

September 11 GJ-1 Paid Lowtown Supply Co. 15,600 0

September 18 GJ-2 Bought Merchandise, on account basis 14,200

September 27 GJ-3 Paid partial payment on Sept. 18 9,000 5,200

purchase

P 5,200

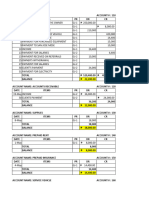

ACCOUNT TITLE: NOTES PAYABLE ACCOUNT NUMBER: 2100

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 16 GJ-2 Borrowed money from bank, notes 12,000 12,000

payable

P 12,000

ACCOUNT TITLE: H. LOPEZ, CAPITAL ACCOUNT NUMBER: 3000

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 1 GJ-1 The owner invested in his business 39,000 39,000

P 39,000

ACCOUNT TITLE: H. LOPEZ, DRAWINGS ACCOUNT NUMBER: 3100

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 28 GJ-3 Cash withdrawal of owner for personal 2,008 2,008

use

P 2,008

ACCOUNT TITLE: SALES ACCOUNT NUMBER: 4100

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 4 GJ-1 Sold Merchandise on account 15,200 15,200

September 23 GJ-2 Sold Merchandise, cash basis 16,400 31,600

September 30 GJ-3 Sold Merchandise on account 13,700 45,300

P 45,300

ACCOUNT TITLE: SALES RETURN AND ALLOWANCES ACCOUNT NUMBER: 4101

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 29 GJ-3 Made cash refunds to customers 900 900

P 900

ACCOUNT TITLE: SALES DISCOUNT ACCOUNT NUMBER: 4102

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 13 1 Received payment from September 4 304 304

sale

P 304

ACCOUNT TITLE: PURCHASES ACCOUNT NUMBER: 5100

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 2 GJ-1 Bought merchandise on account 15,900 15,900

September 14 GJ-2 Bought Merchandise, cash basis 14,400 30,300

September 18 GJ-2 Bought Merchandise, on account 14,200 44,500

September 26 GJ-3 Bought Merchandise, cash basis 12,300 56,800

P 56,800

ACCOUNT TITLE: PURCHASE RETURN AND ALLOWANCES ACCOUNT NUMBER: 5101

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 6 GJ-1 Received Credit from Lowtown Supply 300 300

Co.

September 17 GJ-2 Received refund from supplier 500 800

P 800

ACCOUNT TITLE: PURCHASE DISCOUNTS ACCOUNT NUMBER: 5102

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 11 GJ-1 Paid Lowtown Supply Co. 312 312

P 312

ACCOUNT TITLE: FREIGHT – IN ACCOUNT NUMBER: 5005

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 20 GJ-2 Freight cost on Sept. 18 purchase 700 700

P 700

ACCOUNT TITLE: FREIGHT – OUT ACCOUNT NUMBER: 5006

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 5 GJ-1 Paid freight on September 4 sale 200 200

P 200

ACCOUNT TITLE: SALARIES EXPENSE ACCOUNT NUMBER: 6100

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 15 GJ-2 Paid employee salaries 1,500 1,500

September 30 GJ-3 Paid various expenses 1,500 3,000

P 3,000

ACCOUNT TITLE: UTILITIES EXPENSE ACCOUNT NUMBER: 6200

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 30 GJ-3 Paid various expenses 400 400

P 400

ACCOUNT TITLE: RENT EXPENSE ACCOUNT NUMBER: 6300

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 30 GJ-3 Paid various expenses 3,500 3,500

P 3,500

ACCOUNT TITLE: ADVERTISING EXPENSE ACCOUNT NUMBER: 6400

DATE ITEM EXPLANATION DEBIT CREDIT BALANCE

NO.

September 30 GJ-3 Paid various expenses 1,000 1,000

P 1,000

Henry Lopez Merchandising

Unadjusted Trial Balance

For the Month Ended September, 2020.

ACCOUNT NO. ACCOUNT TITLE DEBIT CREDIT

1001 Cash 9,400

1202 Accounts Receivables 13,700

1400 Supplies 700

1500 Equipment 10,000

2000 Accounts Payable 5,200

2100 Notes Payable 12,000

3000 H. Lopez, Capital 39,000

3100 H. Lopez, Drawings 2,008

4100 Sales 45,300

4101 Sales Return and Allowances 900

4102 Sales Discount 304

5100 Purchases 56,800

5101 Purchase Return and Allowances 800

5102 Purchase Discount 312

5005 Freight-In 700

5006 Freight-Out 200

6100 Salaries Expense 3,000

6200 Utilities Expense 400

6300 Rent Expense 3,500

6400 Advertising Expense 1,000

P 102,612 P 102,612

You might also like

- Abuegmidterm Activity 1 Edgar DetoyaDocument21 pagesAbuegmidterm Activity 1 Edgar DetoyaAnonn78% (9)

- ACT Assignment FullDocument16 pagesACT Assignment Fullsadif sayeed100% (3)

- ACC111 Project Ram WholesaleDocument42 pagesACC111 Project Ram WholesaleHashimRazaNo ratings yet

- Perpetual - General LedgerDocument4 pagesPerpetual - General LedgerJeon Cyrone CuachonNo ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Mr. Pedro Periodic Transaction Complete 11.10.21Document60 pagesMr. Pedro Periodic Transaction Complete 11.10.21AYLEYA L. MAGDAONGNo ratings yet

- BB PT Sentosa ManufakturDocument26 pagesBB PT Sentosa ManufakturSiti ZahraNo ratings yet

- Ledger 4Document5 pagesLedger 4lindzy.amurao01No ratings yet

- 4.day Books, Ledgers, Contras and Types of AccountsDocument18 pages4.day Books, Ledgers, Contras and Types of AccountsMumba KennedyNo ratings yet

- FABM - L-10Document16 pagesFABM - L-10Seve HanesNo ratings yet

- Detoya Tax ConsultantDocument12 pagesDetoya Tax ConsultantLIMOS JR. ROMEO P.No ratings yet

- Semi-Final Exam Coverage Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessDocument10 pagesSemi-Final Exam Coverage Business Transactions and Their Analysis As Applied To The Accounting Cycle of A Service BusinessSarah Mae GonzalesNo ratings yet

- Tugas 6 Akuntasi Untuk Bisnis - Muhammad Marhandega Wijaya - AK4402 - 1402204284Document14 pagesTugas 6 Akuntasi Untuk Bisnis - Muhammad Marhandega Wijaya - AK4402 - 1402204284marhandega10No ratings yet

- Audit Prob Q6 Proof of Cash 2021Document9 pagesAudit Prob Q6 Proof of Cash 2021Ivy BautistaNo ratings yet

- Quiz - Periodic Acctg CycleDocument7 pagesQuiz - Periodic Acctg CycleGalang, Princess T.No ratings yet

- PERIODICDocument9 pagesPERIODICJeon Cyrone CuachonNo ratings yet

- G3 Posting Guidelines For Merchandising BusinessDocument8 pagesG3 Posting Guidelines For Merchandising Businesschrystineetiu1322No ratings yet

- Module 4 Key To CorrectionsDocument4 pagesModule 4 Key To CorrectionsPlame GaseroNo ratings yet

- Book Keeping EXAMPLEDocument4 pagesBook Keeping EXAMPLE12-GOLD AGDON, EARLNo ratings yet

- Praktek Siklus Akutansi (Profektual) (Siti Rahmiatul Fawziah)Document36 pagesPraktek Siklus Akutansi (Profektual) (Siti Rahmiatul Fawziah)siti.rahmiatul.fawziahNo ratings yet

- Republic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorDocument7 pagesRepublic of The Philippines ISO 9001:2015 CERTIFIED: Prepared By: GERLY S. RADAM/instructor RALYN T. JAGUROS/instructorJessie Mark AnapadaNo ratings yet

- General Journal: Date Details Folio DR$ CR$ August 1Document2 pagesGeneral Journal: Date Details Folio DR$ CR$ August 1Andy PersaudNo ratings yet

- Acctg Quiz MerchDocument7 pagesAcctg Quiz MerchGalang, Princess T.No ratings yet

- Queen MannylynDocument15 pagesQueen MannylynSeoonnho KimNo ratings yet

- Accounting Cycle of A Service Business JOURNALIZINGDocument13 pagesAccounting Cycle of A Service Business JOURNALIZINGJae LucienNo ratings yet

- Format AccountingDocument59 pagesFormat AccountingbagdutamandiriNo ratings yet

- Activity/Assignment #2 - Financial Models - Comparative DataDocument5 pagesActivity/Assignment #2 - Financial Models - Comparative DataNazzer NacuspagNo ratings yet

- BB PT SantosaDocument62 pagesBB PT SantosaSiti ZahraNo ratings yet

- November, 2018: Xyz Supply Chain Trial BalanceDocument2 pagesNovember, 2018: Xyz Supply Chain Trial BalanceLeah BausinNo ratings yet

- Fabm Module 10 Quarter 1Document8 pagesFabm Module 10 Quarter 1Rhea Alipio SadorraNo ratings yet

- IPCC Account Current ChapterDocument6 pagesIPCC Account Current ChapterHarish KumarNo ratings yet

- Wagwag EnterprisesDocument11 pagesWagwag EnterprisesTaneo, Anesa P.No ratings yet

- Case 1: Control Account and Subsidiary Ledger ReconciliationDocument5 pagesCase 1: Control Account and Subsidiary Ledger Reconciliationkat kaleNo ratings yet

- Audit of Inventory (Acctg 502)Document6 pagesAudit of Inventory (Acctg 502)Mistletoe MasatoNo ratings yet

- Audit of InventoriesDocument4 pagesAudit of InventoriesMc Gavriel VillenaNo ratings yet

- Subsidiary Ledger (Final)Document25 pagesSubsidiary Ledger (Final)Escalo Alvin M.No ratings yet

- General Journal - Howard's Travel AgencyDocument10 pagesGeneral Journal - Howard's Travel Agencytristan ignatiusNo ratings yet

- Tugas 4 Akuntansi Bisnis Muhammad Marhandega Wijaya (1402204284) - AK4402Document4 pagesTugas 4 Akuntansi Bisnis Muhammad Marhandega Wijaya (1402204284) - AK4402marhandega10No ratings yet

- Nama:Ebenezer Sitanggang Kelas:AK-45-06 NIM:1402210186Document7 pagesNama:Ebenezer Sitanggang Kelas:AK-45-06 NIM:1402210186eben gntgNo ratings yet

- ADRIANO, Glecy C. CAÑADA, Lyka Joyce MDocument14 pagesADRIANO, Glecy C. CAÑADA, Lyka Joyce MADRIANO, Glecy C.No ratings yet

- Tugas 4 Akuntansi Bisnis Muhammad Marhandega Wijaya (1402204284) - AK4402Document5 pagesTugas 4 Akuntansi Bisnis Muhammad Marhandega Wijaya (1402204284) - AK4402marhandega10No ratings yet

- Kertas Kerja Buku BesarDocument19 pagesKertas Kerja Buku Besarfebidwi317No ratings yet

- Quiz CashDocument1 pageQuiz CashGalang, Princess T.No ratings yet

- Activity Sheet 6 10Document9 pagesActivity Sheet 6 10Yaxi AxhiaNo ratings yet

- Izzy Trading - Transaction Entries - General Book of Accounts - SOLUTIONS-1Document21 pagesIzzy Trading - Transaction Entries - General Book of Accounts - SOLUTIONS-1Franze Beatriz FLORESNo ratings yet

- Fabm1 q3 Mod9 TrialbalanceDocument11 pagesFabm1 q3 Mod9 TrialbalanceXedric JuantaNo ratings yet

- Additional ActivitiesDocument4 pagesAdditional Activitiesyesha rodasNo ratings yet

- Audit of InventoryDocument7 pagesAudit of InventoryDianne Antoinette Basallo0% (1)

- Audit of Inventory PDFDocument7 pagesAudit of Inventory PDFMae-shane SagayoNo ratings yet

- Sales Returns JournalDocument6 pagesSales Returns JournalfelixultemaNo ratings yet

- Akuntansi DagangDocument13 pagesAkuntansi DagangAsmarani SiregarNo ratings yet

- AccountingDocument6 pagesAccountingVeso OjiamboNo ratings yet

- General Ledger MedinaDocument4 pagesGeneral Ledger MedinasarahNo ratings yet

- Name: Grade: SubjectDocument5 pagesName: Grade: SubjectArkar.myanmar 2018100% (1)

- Ud. Semesta Trial Balance, Per 31 Desember 2019 Kode Nama Akun Debet KreditDocument3 pagesUd. Semesta Trial Balance, Per 31 Desember 2019 Kode Nama Akun Debet KreditSahril DiasNo ratings yet

- Accounting Problem 5Document8 pagesAccounting Problem 5Carlo AniNo ratings yet

- Books of Original Entry (An Introduction)Document5 pagesBooks of Original Entry (An Introduction)Joshua BrownNo ratings yet

- FEU HO1 Audit of Inventories 2017 PDFDocument4 pagesFEU HO1 Audit of Inventories 2017 PDFJoshuaNo ratings yet

- UntitledDocument1 pageUntitledJeon Cyrone CuachonNo ratings yet

- Periodic - Financial StatementsDocument3 pagesPeriodic - Financial StatementsJeon Cyrone CuachonNo ratings yet

- PERIODICDocument9 pagesPERIODICJeon Cyrone CuachonNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- Perpetual - Financial StatementsDocument4 pagesPerpetual - Financial StatementsJeon Cyrone CuachonNo ratings yet

- Analysis and Interpretation of Financial Statements 1Document61 pagesAnalysis and Interpretation of Financial Statements 1Jeon Cyrone CuachonNo ratings yet

- Cpar Week 4 - CuachonDocument11 pagesCpar Week 4 - CuachonJeon Cyrone CuachonNo ratings yet

- 3rd International Virtual Conference The Ecology of New Economy Post Covid-19Document2 pages3rd International Virtual Conference The Ecology of New Economy Post Covid-19HOD BCANo ratings yet

- Management of Financial Institutions - BNK604 Power Point Slides Lecture 02Document35 pagesManagement of Financial Institutions - BNK604 Power Point Slides Lecture 02suma100% (4)

- Cir VS Luzon DrugDocument9 pagesCir VS Luzon DrugYvon BaguioNo ratings yet

- Questionnare Black BookDocument4 pagesQuestionnare Black BookAkshada PawarNo ratings yet

- Building Brand EquityDocument3 pagesBuilding Brand EquityGlorrya TambotoNo ratings yet

- Entities That Can Be Marketed: Goods Services EventsDocument2 pagesEntities That Can Be Marketed: Goods Services EventsPrayaansh MehtaNo ratings yet

- IEEFA Briefing Note IndianElectricityCoalPricing 4 May 2014Document16 pagesIEEFA Briefing Note IndianElectricityCoalPricing 4 May 2014Arun ParikshatNo ratings yet

- Bharti Airtel in Africa: Group - 11Document15 pagesBharti Airtel in Africa: Group - 11Srijani DharaNo ratings yet

- SaurabhDocument16 pagesSaurabhAkshay Singh100% (1)

- Mahima Summer Intern ProjectDocument16 pagesMahima Summer Intern ProjectMahima ChauhanNo ratings yet

- Case-1: Dow-DupontDocument4 pagesCase-1: Dow-DupontMedhaNo ratings yet

- Introduction To SecuritizationDocument5 pagesIntroduction To SecuritizationdvmbaNo ratings yet

- Vairamani Mini ProjectDocument45 pagesVairamani Mini Projecttn63 villanNo ratings yet

- Eco 415 Economics: University of Technology Mara Seremban 3Document3 pagesEco 415 Economics: University of Technology Mara Seremban 3Muhd ThawriqueNo ratings yet

- Exam ReviewerDocument10 pagesExam Reviewerjoseph christopher vicenteNo ratings yet

- June 2010 Ec3Document20 pagesJune 2010 Ec3profoundlifeNo ratings yet

- Monitor Deloitte Case Study Example FootlooseDocument20 pagesMonitor Deloitte Case Study Example FootlooseBarshan chakrabortyNo ratings yet

- OBEYADocument6 pagesOBEYAwilsonsilveiraNo ratings yet

- Indonesia Jakarta Rental Apartment Q1 2021Document2 pagesIndonesia Jakarta Rental Apartment Q1 2021Grace SaragihNo ratings yet

- exam1BD SolutionsDocument8 pagesexam1BD SolutionsGamze ŞenNo ratings yet

- CH 10Document29 pagesCH 10BensonChiuNo ratings yet

- MOT Final Project: Keepy CementDocument28 pagesMOT Final Project: Keepy Cementmurary123No ratings yet

- Project X - Business Plan Competition - : Shubham Parihar 2019109 PGDM 2019-21 GIM Umesh Jhawar 2019119 PGDM 2019-21 GIMDocument12 pagesProject X - Business Plan Competition - : Shubham Parihar 2019109 PGDM 2019-21 GIM Umesh Jhawar 2019119 PGDM 2019-21 GIMShubham PariharNo ratings yet

- Team BuildingDocument8 pagesTeam BuildingdollyguptaNo ratings yet

- Economic and Financial Challenges After COVID-19: Manoj Kumar Shivani Thakur Kavita Bangarwa Rakesh Kumar Sunita PooniyaDocument5 pagesEconomic and Financial Challenges After COVID-19: Manoj Kumar Shivani Thakur Kavita Bangarwa Rakesh Kumar Sunita Pooniya2K20/PHDUECO/501 MANOJ KUMARNo ratings yet

- Tendernotice 1Document2 pagesTendernotice 1Ali Asghar ShahNo ratings yet

- IMS ManualDocument70 pagesIMS ManualCandice100% (3)

- Strategic Cost Management Has Become An Essential Area Now DaysDocument8 pagesStrategic Cost Management Has Become An Essential Area Now Daysdeepakarora201188No ratings yet

- Rsa 6 (1) .875 10-15-19Document9 pagesRsa 6 (1) .875 10-15-19sdgm1No ratings yet

- Customer Perception Towards Bharti Axa Life Insurance Co. Ltd. atDocument94 pagesCustomer Perception Towards Bharti Axa Life Insurance Co. Ltd. atShubham MishraNo ratings yet