Professional Documents

Culture Documents

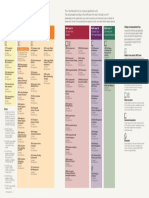

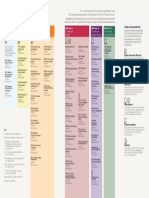

Personal Finance Qualifications Framework

Uploaded by

bim0 ratings0% found this document useful (0 votes)

10 views1 pageThis document outlines the framework for personal finance qualification units from levels 2 through 6. The units are grouped by difficulty and cover topics like life and pensions foundations, financial services regulation, mortgage advice, investment planning, and pensions administration. Depending on the desired qualification, students will need to complete one or more of these units, with assessments including multiple choice exams, written exams, and coursework assignments. Study hours and credit values are provided for each unit.

Original Description:

Original Title

personal-finance-qualifications-framework

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the framework for personal finance qualification units from levels 2 through 6. The units are grouped by difficulty and cover topics like life and pensions foundations, financial services regulation, mortgage advice, investment planning, and pensions administration. Depending on the desired qualification, students will need to complete one or more of these units, with assessments including multiple choice exams, written exams, and coursework assignments. Study hours and credit values are provided for each unit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pagePersonal Finance Qualifications Framework

Uploaded by

bimThis document outlines the framework for personal finance qualification units from levels 2 through 6. The units are grouped by difficulty and cover topics like life and pensions foundations, financial services regulation, mortgage advice, investment planning, and pensions administration. Depending on the desired qualification, students will need to complete one or more of these units, with assessments including multiple choice exams, written exams, and coursework assignments. Study hours and credit values are provided for each unit.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Personal Finance units This is the framework for our personal finance qualification units.

They are grouped according to their difficulty, from level 2 through to level 6.

Depending on the qualification you want to achieve, you’ll need to study a number of

these units. Some of our qualifications require just one unit, while others require several.

Study and assessment key

RQF level: 2 RQF level: RQF level: 3 RQF level: 4 RQF level: 6

CII credit level: 3 equivalent CII credit level: CII credit level: CII credit level: Assessment methods vary depending

on the unit’s level and subject matter.

Award CII credit level: Certificate Diploma Advanced Diploma

Each unit within the framework has

Certificate

been assigned an icon to identify the

assessment method from the

options below.

(LF1) Life and Pensions Not available in the UK (CF1) UK Financial (LP3) Life and (J02) Trusts (J10) Discretionary (AF1) Personal Tax and

Foundations Services, Regulation Pensions Principles 20 credits Investment Trust Planning

0 credits The following units and Ethics 4 and Practices 4 100 study hours Management 30 credits

40 study hours are not registered 15 credits 10 credits 20 credits 150 study hours Multiple choice question (MCQ) exam

as part of the UK’s 60 study hours 50 study hours (J05) Pension 80 study hours Study is based on a specified enrolment period,

Regulated Qualifications Income Options (AF4) Investment from 01 September–31 August for UK exams,

Framework (RQF). (CF6) Mortgage Advice (R05) Financial 20 credits (J12) Securities Advice Planning and 01 May–30 April for non-UK exams. MCQ

20 credits Protection 100 study hours and Dealing 30 credits exams can be sat at UK and international online

(AWB) Award in 100 study hours 10 credits 20 credits 150 study hours exam centres, subject to availability, or via

Bancassurance 50 study hours (J07) Supervision in a 70 study hours remote invigilation.

(non-UK) (CF8) Long Term Regulated Environment (AF5) Financial

15 credits Care Insurance 20 credits (R01) Financial Planning Process

60 study hours 15 credits 100 study hours Services, Regulation 30 credits

70 study hours and Ethics 4 150 study hours

(AWF) Award in 20 credits

Written exam

(R06) Financial Study is based on a 12 month enrolment period

Financial Planning (ER1) Equity Release Planning Practice 60 study hours (AF7) Pension Transfers

(non-UK) 1 from the date of purchase. Most exams are on-

15 credits 30 credits 20 credits screen written exams and some may be available

15 credits 70 study hours 100 study hours (R02) Investment 100 study hours

60 study hours Principles and Risk by remote invigilation.

(FA1) Life Office 20 credits

(HFE) Award in Financial Administration 4 60 study hours

Planning (Hong Kong) 2

10 credits

15 credits (J09) Paraplanning (R03) Personal Taxation (AF6) Senior Coursework assignments

60 study hours

60 study hours 30 credits 10 credits Management Study is based on a 12 month enrolment period

100 study hours 50 study hours and Supervision

(FA2) Pensions from the date of purchase. Candidates must pass

(AWP) Award in 30 credits three written assignments, each typically

Administration 4 150 study hours

Investment Planning (R04) Pensions and 2,000-3,000 words.

(non-UK) 3 10 credits

60 study hours Retirement Planning

10 credits 10 credits (AF8) Retirement

60 study hours 50 study hours Income Planning

(FA5) Individual 30 credits

Notes Savings Account 150 study hours

Administration 4 (R07) Advanced

1. Unit AWF is also Mortgage Advice

10 credits

available in Arabic 70 study hours 15 credits

(AWA). 70 study hours

2. Unit HFE is also (GR1) Group Risk

available in Traditional 10 credits

Chinese (HFT). 50 study hours

3. Unit AWP is also

(LP1) Life and Pensions

available in Traditional

Customer Operations 4

Chinese (WPT).

15 credits

4. These units are listed 60 study hours

by the FCA as meeting

appropriate qualification (LP2) Financial

requirements (typically Services Products

as part of a qualification and Solutions 4

or in combination) 20 credits

for specific regulated 100 study hours

activities. Other FCA

requirements may apply

for these activities.

2022 qualifications

You might also like

- Insurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentDocument1 pageInsurance Units: RQF Level: 2 RQF Level: 3 RQF Level: 4 RQF Level: 6 RQF Level: 7 RQF Level: 3 EquivalentAnkit DasNo ratings yet

- CACI Insurance Qualifications FrameworkDocument1 pageCACI Insurance Qualifications FrameworkAshwin PrakashNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkContentsNo ratings yet

- Id Learner Guide v2 FinalDocument11 pagesId Learner Guide v2 FinalSachin SahooNo ratings yet

- Unit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016Document32 pagesUnit 2 - Investment Practice Mock Exam One Version 14 - Tested From 1 December 2016vantrang0310No ratings yet

- Level 4 SRM Qualification SpecificationDocument19 pagesLevel 4 SRM Qualification Specification360channels720No ratings yet

- Certpay Qualification SpecificationDocument8 pagesCertpay Qualification SpecificationBalakrishna RaoNo ratings yet

- Certpay Qualification SpecificationDocument18 pagesCertpay Qualification SpecificationGopi Krishna ReddyNo ratings yet

- UmalusiDocument24 pagesUmalusiActor CharumaNo ratings yet

- Qspec Certificate in Regulated Financial Services OperationsDocument5 pagesQspec Certificate in Regulated Financial Services OperationsbimNo ratings yet

- Id Learner Guide v3.1Document11 pagesId Learner Guide v3.1Saddam KhalifaNo ratings yet

- NSQF - Basic CosmetologyDocument13 pagesNSQF - Basic CosmetologyBalaji Pvt ITINo ratings yet

- Business Administration - Finance Program (With Work EXPERIENCE) (B150)Document7 pagesBusiness Administration - Finance Program (With Work EXPERIENCE) (B150)Juan EstebanNo ratings yet

- CHECKLIST FOR OFFICE OF THE CAMPUS DIRECTOR - For Auditor Use 2Document4 pagesCHECKLIST FOR OFFICE OF THE CAMPUS DIRECTOR - For Auditor Use 2Mary Lyn RaseNo ratings yet

- Audit Notes 5th Semester CUDocument123 pagesAudit Notes 5th Semester CUβιshακhα•様75% (4)

- NSDC - An Overview and Opportunities in Skill FinancingDocument21 pagesNSDC - An Overview and Opportunities in Skill Financingarchish10No ratings yet

- Qspec Diploma in Financial PlanningDocument6 pagesQspec Diploma in Financial PlanningbimNo ratings yet

- CFA Exams DetailsDocument4 pagesCFA Exams DetailsrohitNo ratings yet

- NEBOSH ND in Occupational HS Syllabus Guide (NEW)Document11 pagesNEBOSH ND in Occupational HS Syllabus Guide (NEW)Anushka SeebaluckNo ratings yet

- Qspec Diploma in Regulated Financial PlanningDocument5 pagesQspec Diploma in Regulated Financial PlanningbimNo ratings yet

- Cqi Certificate in Quality Management: Frequently Asked Questions (Faqs) ForDocument4 pagesCqi Certificate in Quality Management: Frequently Asked Questions (Faqs) Forippon_osotoNo ratings yet

- Qualifying Assessment Test and Pre-Requisite Competencies: Directive 1.20Document23 pagesQualifying Assessment Test and Pre-Requisite Competencies: Directive 1.20Muhammad HasnainNo ratings yet

- Exposure Draft of Directive 1.20 Qualifying Assessment Test and Pre-Requisite CompetenciesDocument22 pagesExposure Draft of Directive 1.20 Qualifying Assessment Test and Pre-Requisite CompetenciesJohnNo ratings yet

- BVOC HM Syllabus With Final ChangesDocument58 pagesBVOC HM Syllabus With Final ChangesGovind SharmaNo ratings yet

- IMC Unit 1 Mock Exam 1 V15Document25 pagesIMC Unit 1 Mock Exam 1 V15SATHISH SNo ratings yet

- Asme Ande-1-2015 PDFDocument20 pagesAsme Ande-1-2015 PDFHoang Diep PhanNo ratings yet

- CASS Level 6 Diploma in Occupational Health and Safety Management FinalDocument10 pagesCASS Level 6 Diploma in Occupational Health and Safety Management FinalSaqlain SiddiquieNo ratings yet

- CASS Level 6 Diploma in Occupational Health and Safety Management FinalDocument10 pagesCASS Level 6 Diploma in Occupational Health and Safety Management FinalSaqlain SiddiquieNo ratings yet

- Skillsfirst DIploma in Adult Care HandbookDocument119 pagesSkillsfirst DIploma in Adult Care HandbookLiza Gomez100% (1)

- CASS Qualifi Extended L3 DiplomaDocument8 pagesCASS Qualifi Extended L3 DiplomasirkeciiNo ratings yet

- 5000 Awesome Facts About Everything 5000Document29 pages5000 Awesome Facts About Everything 5000S M GHODKENo ratings yet

- Directive1.20 2021 27012022Document23 pagesDirective1.20 2021 27012022Brainiac MubeenNo ratings yet

- CBIC 2020 Candidate Handbook CBIC 2020 Candidate HandbookDocument16 pagesCBIC 2020 Candidate Handbook CBIC 2020 Candidate HandbookAsif Iqbal100% (1)

- Continuing Professional Education Policy: Requirements For Certification & Qualification ProgramsDocument11 pagesContinuing Professional Education Policy: Requirements For Certification & Qualification ProgramsHammadNo ratings yet

- CTFC Qualification Specification-Specification PDFDocument14 pagesCTFC Qualification Specification-Specification PDFDr M R aggarwaalNo ratings yet

- Certificate in Procurement and Supply Operations: Unit Content GuideDocument18 pagesCertificate in Procurement and Supply Operations: Unit Content GuideFix JnrNo ratings yet

- QMS - Delegate Acitivity ManualDocument49 pagesQMS - Delegate Acitivity ManualReuban S100% (1)

- GFSI Scheme ComparisonDocument1 pageGFSI Scheme ComparisonHugo E. PonceNo ratings yet

- Manual2 Assessment of NVQF Qualifications PDFDocument27 pagesManual2 Assessment of NVQF Qualifications PDFKhalid Hussain MashoriNo ratings yet

- 2.4.1 SAQA Criteria and Guidelines For AssessmentDocument71 pages2.4.1 SAQA Criteria and Guidelines For AssessmentDonald CageNo ratings yet

- Insurance Qualifications FrameworkDocument1 pageInsurance Qualifications FrameworkWill SackettNo ratings yet

- Audit 5sem BhalotiaDocument123 pagesAudit 5sem Bhalotiatamal mondal0% (1)

- Qualifying Assessment Test and Pre-Requisite Competencies: Directive 1.20Document23 pagesQualifying Assessment Test and Pre-Requisite Competencies: Directive 1.20Rana Muhammad Ayyaz RasulNo ratings yet

- ProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1Document13 pagesProQual L3 Award in Emergency Rescue and Recovery of Casulaties From Confined Spaces October 2018 1GermimeeNo ratings yet

- Level 7 Diploma in Accounting and FinanceDocument26 pagesLevel 7 Diploma in Accounting and FinanceDavid Faulkner100% (1)

- Capacity Building in BanksDocument7 pagesCapacity Building in BanksPritiAggarwalNo ratings yet

- QMS Delelgate Activity Manual LA 21-05-2021Document40 pagesQMS Delelgate Activity Manual LA 21-05-2021rty2No ratings yet

- Academic-Credit-Framework 2008Document23 pagesAcademic-Credit-Framework 2008Amna SalikNo ratings yet

- MBA OSCM IIM MumbaiDocument7 pagesMBA OSCM IIM Mumbai4th2001No ratings yet

- Criteria Wise Requirement 1 NBADocument47 pagesCriteria Wise Requirement 1 NBAArun prasath100% (1)

- International Gemological Institute (IGI) India PVT LTD: Responsible Jewellery CouncilDocument6 pagesInternational Gemological Institute (IGI) India PVT LTD: Responsible Jewellery CouncilJanez ForstnaricNo ratings yet

- 1106-02 L2 Qualification Handbook v3Document60 pages1106-02 L2 Qualification Handbook v3Atif MahmoodNo ratings yet

- Benchmarking Report of The Philippines To ASEAN Guiding PrinciplesDocument88 pagesBenchmarking Report of The Philippines To ASEAN Guiding PrinciplesAllan GalineaNo ratings yet

- 3 3 3-OHSMS-LAC - Delelgate Activity Manual-20-JULY-2020Document33 pages3 3 3-OHSMS-LAC - Delelgate Activity Manual-20-JULY-2020walidNo ratings yet

- CIIA Programme Information BookletDocument6 pagesCIIA Programme Information BookletCarl RossNo ratings yet

- Acf8 (RN) Mar19 LR PDFDocument84 pagesAcf8 (RN) Mar19 LR PDFDiana IlievaNo ratings yet

- Key Area IiDocument14 pagesKey Area IiRobert M. MaluyaNo ratings yet

- SAVE International Certification Examination Study GuideDocument43 pagesSAVE International Certification Examination Study Guidem.kalifardiNo ratings yet

- Pmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationFrom EverandPmi-Acp Exam Prep Study Guide: Extra Preparation for Pmi-Acp Certification ExaminationNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Cii Qualifications BrochureDocument45 pagesCii Qualifications BrochurebimNo ratings yet

- Qspec Diploma in Regulated Financial PlanningDocument5 pagesQspec Diploma in Regulated Financial PlanningbimNo ratings yet

- Qspec Certificate in Regulated Financial Services OperationsDocument5 pagesQspec Certificate in Regulated Financial Services OperationsbimNo ratings yet

- Qspec Diploma in Financial PlanningDocument6 pagesQspec Diploma in Financial PlanningbimNo ratings yet

- Smartly Guide To Gen AI For Digital Advertising ExcellenceDocument16 pagesSmartly Guide To Gen AI For Digital Advertising ExcellenceDivyansh ApurvaNo ratings yet

- ACCT1002 M1 Workshop QuestionsDocument2 pagesACCT1002 M1 Workshop QuestionsMadeline WheelerNo ratings yet

- Demerger of BajajDocument30 pagesDemerger of BajajNikhil100% (1)

- Fixed DepositsDocument1 pageFixed DepositsTiso Blackstar GroupNo ratings yet

- Brand Awareness of Presto Lite BatteryDocument62 pagesBrand Awareness of Presto Lite Batteryravi_shah333No ratings yet

- Contract Drafting BrochureDocument10 pagesContract Drafting BrochureUtkarshini SinhaNo ratings yet

- Hansa - 2015.12Document100 pagesHansa - 2015.12Alessandro CastagnaNo ratings yet

- New Common App EssayDocument1 pageNew Common App Essayapi-404348823No ratings yet

- Case Analysis: A Simple Strategy at Costco: Informative Background InformationDocument15 pagesCase Analysis: A Simple Strategy at Costco: Informative Background InformationFred Nazareno CerezoNo ratings yet

- Q2, Module 2, Lesson 2Document9 pagesQ2, Module 2, Lesson 2Jerome A. Gomez67% (3)

- Maintenance and Warranty Processing (274) : S/4HANA 1610 2017Document24 pagesMaintenance and Warranty Processing (274) : S/4HANA 1610 2017Secret EarthNo ratings yet

- CASE STUDY - Ventiv-WorldpayDocument3 pagesCASE STUDY - Ventiv-WorldpayNeelabhNo ratings yet

- AB Gustaf Kähr: Has Been Found To Conform To PEFC StandardDocument2 pagesAB Gustaf Kähr: Has Been Found To Conform To PEFC StandardLeenaNo ratings yet

- Dharavi Redevelopment ProjectDocument1 pageDharavi Redevelopment ProjectDanish MallickNo ratings yet

- Brand Guidelines Oracle PDFDocument39 pagesBrand Guidelines Oracle PDFMarco CanoNo ratings yet

- Sticky Branding Work BookDocument38 pagesSticky Branding Work BookChjk PinkNo ratings yet

- Economics Basics-Demand & SupplyDocument8 pagesEconomics Basics-Demand & SupplyNahiyan Islam ApuNo ratings yet

- Chapter Four: Capital StructureDocument28 pagesChapter Four: Capital StructureFantayNo ratings yet

- Elon MuskDocument3 pagesElon Muskrosemarie.reas.gsbmNo ratings yet

- Project Management Processes Methodologies and Economics 2nd Edition Shtub Solutions ManualDocument11 pagesProject Management Processes Methodologies and Economics 2nd Edition Shtub Solutions Manualashleygonzalezcqyxzgwdsa100% (10)

- Whistleblower #1 AffidavitDocument3 pagesWhistleblower #1 AffidavitSteve BirrNo ratings yet

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument53 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaSanaka LogesNo ratings yet

- Imron Sahid NugrohoDocument7 pagesImron Sahid NugrohoAnanda LukmanNo ratings yet

- Business and IndustyDocument3 pagesBusiness and IndustysantoshskpurNo ratings yet

- Project-II - Mohit Jain - 073Document79 pagesProject-II - Mohit Jain - 073rahulNo ratings yet

- Unwomen What Is Local Government and How Is It OrganizedDocument42 pagesUnwomen What Is Local Government and How Is It OrganizedHifsa AimenNo ratings yet

- ACCOUNTINGDocument12 pagesACCOUNTINGharoonadnan196No ratings yet

- BDA Advises Con Cung On Sale of Minority Stake To Quadria CapitalDocument4 pagesBDA Advises Con Cung On Sale of Minority Stake To Quadria CapitalPR.comNo ratings yet

- ATS Friendly Smart CV TemplateDocument2 pagesATS Friendly Smart CV TemplateAbdulfatai AbdulrasheedNo ratings yet

- Fat Test (Jawaban)Document19 pagesFat Test (Jawaban)Carat ForeverNo ratings yet