Professional Documents

Culture Documents

Untitled

Uploaded by

Czarina Joy Pena0 ratings0% found this document useful (0 votes)

10 views1 pageCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views1 pageUntitled

Uploaded by

Czarina Joy PenaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

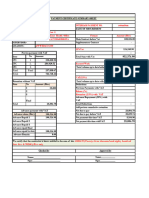

Undeclared Sales P 1,282,341.

00

Multiply by: Gross Profit Ratio 18%

Additional Taxable Gross Income 230,821.38

Undeclared Purchases P 2,321,402.00

Divide by: Cost of Sales Ratio 82%

Related Undeclared Sales 2,830,978.00

Multiply by: Gross Profit Ratio 18%

Additional Taxable Gross Income 509,576.04

Taxable Income Per Return P 120,000.00

Add: Additional Taxable Gross Income

Undeclared Sales P 230,821.38

Undeclared Purchases 509,576.04 740,397.42

Total 860,397.42

Multiply by: VAT Rate 30%

Output Tax Due 258,119.22

Input Tax on Total 3,235.22

VAT Due on Total 254,844.00

Surcharge 127,442.00

Interest 12,744.20

TOTAL DEFICIENCY INCOME TAX DUE P 395,070.20

Undeclared Sales P 1,282.341.00

Undeclared Purchases 2,830,978.00

Total 4,113,319

Multiply by: VAT Rate 12%

Output Tax Due 493,598.28

Input Tax on Total -

VAT Due on Total 493,598.28

Surcharge 246,799.14

Interest 14,807.96

TOTAL VAT DEFICIENCY DUE 755,205.38

TOTAL DEFICIENCY INCOME TAX DUE 395,070.20

TOTAL DEFICIENCY TAX DUE P 1,150,275.58

You might also like

- Dizon Lands Realty and Development Corporation - 2.17.2022Document6 pagesDizon Lands Realty and Development Corporation - 2.17.2022Kervin GalangNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Mercury Drug v. CaDocument9 pagesMercury Drug v. CaJolynnah DiñoNo ratings yet

- New Manoj Grill UdhyogDocument24 pagesNew Manoj Grill UdhyoggpdharanNo ratings yet

- Total Value Addition 156,896Document2 pagesTotal Value Addition 156,896Shahbaz ArtsNo ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Acctg SCIoutput FundamentalsDocument2 pagesAcctg SCIoutput FundamentalsSaeym SegoviaNo ratings yet

- ST Lukes Predominance TestDocument12 pagesST Lukes Predominance TestCARLO JOSE BACTOLNo ratings yet

- 2023 11 qWIavwwVV0gWRmwVnoUpdgDocument1 page2023 11 qWIavwwVV0gWRmwVnoUpdgnsmankr1No ratings yet

- Tax Comp FLE02-1Document9 pagesTax Comp FLE02-1Lenielyn UbaldoNo ratings yet

- C.T.A. Case No. 8508 - Medtex Corp. v. Commissioner of Internal Revenue - PEZA 5%Document29 pagesC.T.A. Case No. 8508 - Medtex Corp. v. Commissioner of Internal Revenue - PEZA 5%Johnallen MarillaNo ratings yet

- Arbitrage Limit: Total Deductible Interest ExpenseDocument2 pagesArbitrage Limit: Total Deductible Interest ExpenseLyka RoguelNo ratings yet

- In Come Statement Ga NotDocument1 pageIn Come Statement Ga NotCharmelyn EliseoNo ratings yet

- 53078-2015-Medtecs International Corp. Limited V.20190421-5466-E0telyDocument38 pages53078-2015-Medtecs International Corp. Limited V.20190421-5466-E0telyDyan de la FuenteNo ratings yet

- Navana CNG Limited IncomeDocument4 pagesNavana CNG Limited IncomeHridoyNo ratings yet

- Less: Cost of Goods Sold: Net Income After Tax: 474,222.00Document3 pagesLess: Cost of Goods Sold: Net Income After Tax: 474,222.00Daniella Mae ElipNo ratings yet

- PAYMENT 1 MOYALE PrintedDocument77 pagesPAYMENT 1 MOYALE Printediqramoyale022No ratings yet

- Test DaburDocument10 pagesTest DaburMohit ChughNo ratings yet

- Merial PH CTA CaseDocument102 pagesMerial PH CTA CaseLarry Tobias Jr.No ratings yet

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- Letter of Protest For PANDocument5 pagesLetter of Protest For PANzldenqueNo ratings yet

- Preliminary Assessment NoticeDocument3 pagesPreliminary Assessment NoticeHanabishi RekkaNo ratings yet

- Excel 1 ConsolidationDocument8 pagesExcel 1 Consolidationanushree sarpotdarNo ratings yet

- Net SalesDocument8 pagesNet SalesKara Sophia BatucanNo ratings yet

- Account Cca (AutoRecovered) 1Document13 pagesAccount Cca (AutoRecovered) 1Saloni BaisNo ratings yet

- GST Report Upto DecemberDocument1 pageGST Report Upto Decembertaxsachin16No ratings yet

- Vat Summary-30-09-2010Document2 pagesVat Summary-30-09-2010anon_978060No ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- Statement of Profit and Loss HighlightsDocument1 pageStatement of Profit and Loss HighlightsPrathi KarthikNo ratings yet

- Group ProjectDocument9 pagesGroup ProjectsnsahaNo ratings yet

- Statement of Financial Performance 2020Document6 pagesStatement of Financial Performance 2020JCandz AmallaNo ratings yet

- AK2 13 Kheisya Laba RugiDocument1 pageAK2 13 Kheisya Laba RugiKheisya Siva Qolbi Kiss PutriXI AKL 2No ratings yet

- Profit or LossDocument1 pageProfit or LossKryss Clyde TabliganNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- Unit 11: Tax Outflow Arising From The Salvage Value in Year 3Document7 pagesUnit 11: Tax Outflow Arising From The Salvage Value in Year 3Prashant NeupaneNo ratings yet

- Tambunting Pawnshop Vs CIRDocument10 pagesTambunting Pawnshop Vs CIRMayr TeruelNo ratings yet

- Monthly payslip summary for Ankit KumarDocument1 pageMonthly payslip summary for Ankit Kumarrajkannamdu100% (1)

- Interiam Payment No. Drainege Ditch Lot - 1 East Hararge Zone Health OfficeDocument1 pageInteriam Payment No. Drainege Ditch Lot - 1 East Hararge Zone Health OfficeRiyaad MandisaNo ratings yet

- FS Group 2Document5 pagesFS Group 2Ge-Ann BonuanNo ratings yet

- Bata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Document1 pageBata India Limited: Statement of Profit and Loss For The Fifteen Month Period Ended 31St March, 2015Viswateja KrottapalliNo ratings yet

- Philippine Chemical Firm's Tax DisputeDocument22 pagesPhilippine Chemical Firm's Tax Disputeaudreydql5No ratings yet

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Q4 2020 Revenue PerformanceDocument11 pagesQ4 2020 Revenue PerformanceVoiture GermanNo ratings yet

- Gopal Ji Steel GSTR3B April To June 2022Document1 pageGopal Ji Steel GSTR3B April To June 2022Nikita VarshneyNo ratings yet

- Case Analysis Tempo Manufacturing Inc.Document2 pagesCase Analysis Tempo Manufacturing Inc.Mihaela MendozaNo ratings yet

- Computations of VATDocument21 pagesComputations of VATMikee TanNo ratings yet

- Second Division (G.R. No. 165451, December 03, 2014)Document21 pagesSecond Division (G.R. No. 165451, December 03, 2014)Ana GNo ratings yet

- Deferred TaxDocument14 pagesDeferred Taxiftekharul alamNo ratings yet

- Cs Garment v. CirDocument19 pagesCs Garment v. CirIris MendiolaNo ratings yet

- Republic of The Philippines Court of Tax Appeals Quezon City First DivisionDocument79 pagesRepublic of The Philippines Court of Tax Appeals Quezon City First DivisionYna YnaNo ratings yet

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- PIDILITE INDS FINANCIALS AND KEY METRICSDocument16 pagesPIDILITE INDS FINANCIALS AND KEY METRICSsamay gargNo ratings yet

- Fort Bonifacio Development Corp. v. CIR (CTA 7696 & 7728, July 15, 2015)Document120 pagesFort Bonifacio Development Corp. v. CIR (CTA 7696 & 7728, July 15, 2015)Kriszan ManiponNo ratings yet

- Union Cement Holdings Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 6799, (July 12, 2010)Document11 pagesUnion Cement Holdings Corp. v. Commissioner of Internal Revenue, C.T.A. Case No. 6799, (July 12, 2010)Kriszan ManiponNo ratings yet

- VatDocument23 pagesVatMichole chin MallariNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- JYB Manufacturing Project Cost and Income ProjectionsDocument20 pagesJYB Manufacturing Project Cost and Income ProjectionsRenelyn DavidNo ratings yet

- Gen Principles DigestDocument12 pagesGen Principles DigestCzarina Joy PenaNo ratings yet

- Estimated Salary For The Year (Document9 pagesEstimated Salary For The Year (Czarina Joy PenaNo ratings yet

- Tax Rev Income Tax Syllabus With Assignment of CaesesDocument4 pagesTax Rev Income Tax Syllabus With Assignment of CaesesCzarina Joy PenaNo ratings yet

- Philippine Bureau of Internal Revenue formal tax demand letterDocument1 pagePhilippine Bureau of Internal Revenue formal tax demand letterCzarina Joy PenaNo ratings yet

- Income TaxDocument2 pagesIncome TaxCzarina Joy PenaNo ratings yet

- 1 LoaDocument1 page1 LoaCzarina Joy PenaNo ratings yet

- Tax ExamDocument2 pagesTax ExamCzarina Joy PenaNo ratings yet

- July 3, 2018: Hermilando Mandanas, Et Al., Petitioners Executive Secretary Paquito Ochoa, Et Al., RespondentsDocument3 pagesJuly 3, 2018: Hermilando Mandanas, Et Al., Petitioners Executive Secretary Paquito Ochoa, Et Al., RespondentsDayanarah MarandaNo ratings yet

- Mateo VS Beracah 2020-FCDocument24 pagesMateo VS Beracah 2020-FCCzarina Joy PenaNo ratings yet

- BOOSTING INNOVATIONDocument23 pagesBOOSTING INNOVATIONCzarina Joy PenaNo ratings yet

- 2 Notice of DiscrepancyDocument1 page2 Notice of DiscrepancyCzarina Joy PenaNo ratings yet

- Petitioner, Present: - Versus - CARPIO, J., Chairperson, Nachura, Peralta, ABAD, and Mendoza, JJDocument24 pagesPetitioner, Present: - Versus - CARPIO, J., Chairperson, Nachura, Peralta, ABAD, and Mendoza, JJCzarina Joy PenaNo ratings yet

- Philippine Rabbit Bus Lines v. Phil-American ForwardersDocument341 pagesPhilippine Rabbit Bus Lines v. Phil-American ForwardersCzarina Joy PenaNo ratings yet

- Homework 3 REMDocument26 pagesHomework 3 REMCzarina Joy PenaNo ratings yet

- Urban Form Determinant PDFDocument2 pagesUrban Form Determinant PDFSobia AhsanNo ratings yet

- MAE - Pratice - Cost Sheet - SolutionDocument12 pagesMAE - Pratice - Cost Sheet - SolutionDhairya MudgalNo ratings yet

- Utility Bill Template 02Document5 pagesUtility Bill Template 02dzh4422No ratings yet

- eProcurement System Government of IndiaDocument2 pageseProcurement System Government of Indiasugirtha pradeepNo ratings yet

- Roster Artisti Musical Events Solutions (Alin Voica)Document5 pagesRoster Artisti Musical Events Solutions (Alin Voica)AlexandruConstantinescuNo ratings yet

- Poverty and Unequal Disctribution of IncomeDocument11 pagesPoverty and Unequal Disctribution of IncomeLeo SuingNo ratings yet

- PWC Payments Handbook 2023Document34 pagesPWC Payments Handbook 2023Koshur KottNo ratings yet

- Team 5: Nikhil Nag Pavithra Ramashesh Athri Rana Debnath Shalini H. SDocument26 pagesTeam 5: Nikhil Nag Pavithra Ramashesh Athri Rana Debnath Shalini H. Snikhil nagNo ratings yet

- Impact & Influence of Ukraine & Russia War On TourismDocument3 pagesImpact & Influence of Ukraine & Russia War On TourismInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Types of RiskDocument6 pagesTypes of RiskNayan kakiNo ratings yet

- Contemporary World MODULE 1Document24 pagesContemporary World MODULE 1Tracy Mae Estefanio100% (2)

- DMM Proposal 220624Document51 pagesDMM Proposal 220624Teddy SusantoNo ratings yet

- SK Annual Procurement Plan 2021Document2 pagesSK Annual Procurement Plan 2021John reymart BergoniaNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- Gibbons Stamp Monthly Mess With LinkgsDocument4 pagesGibbons Stamp Monthly Mess With LinkgsbNo ratings yet

- Geme CostDocument6 pagesGeme CostBiruk Chuchu NigusuNo ratings yet

- 7th Floor, New Administrative Building, Central Railway, D.N. Road, CST, Mumbai - 400 001, Phone No. 022 - 22626343, Fax No. 022 - 22626392Document2 pages7th Floor, New Administrative Building, Central Railway, D.N. Road, CST, Mumbai - 400 001, Phone No. 022 - 22626343, Fax No. 022 - 22626392Samiksha SinghNo ratings yet

- New Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test BankDocument15 pagesNew Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Test Banknathanmelanie53f18f100% (27)

- Succession - Rosita A. MallariDocument4 pagesSuccession - Rosita A. Mallarimichael lumboyNo ratings yet

- European Union: Harvard Model United Nations 2023Document34 pagesEuropean Union: Harvard Model United Nations 2023Ahmed FarazNo ratings yet

- Crypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDocument10 pagesCrypto Signal Date Target To Buy 1st Target 2nd Target Price Done (Date) Price Trading Flat FormDinuka ChathurangaNo ratings yet

- 158015-063447 20200630 PDFDocument10 pages158015-063447 20200630 PDFHafizNo ratings yet

- Impact of Small and Medium Enterprises On EconomicDocument6 pagesImpact of Small and Medium Enterprises On EconomicPeter EzeNo ratings yet

- Macro Educational Planning Mechanisms PhilippinesDocument28 pagesMacro Educational Planning Mechanisms PhilippinesPaula Bianca Ferrer50% (2)

- Chapter 13 Section 1: The Growth of Industrial ProsperityDocument9 pagesChapter 13 Section 1: The Growth of Industrial ProsperityJacori LandrumNo ratings yet

- Art of Being MinimalistDocument70 pagesArt of Being MinimalistbluexizorNo ratings yet

- Afar 07 15 NpoDocument6 pagesAfar 07 15 NpoLeo M. SalibioNo ratings yet

- 1.2 Slides - Factors of ProductionDocument11 pages1.2 Slides - Factors of ProductionJIE MIN CHANNo ratings yet

- Product Overview: Available in 2" & 4" Depths With Steel Support FrameDocument2 pagesProduct Overview: Available in 2" & 4" Depths With Steel Support FrameluisNo ratings yet

- Open and Voluntary Membership: Formation of CooperativesDocument3 pagesOpen and Voluntary Membership: Formation of CooperativesCOLLINS MWANGI NJOROGENo ratings yet

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyFrom EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNo ratings yet

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- Lower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2019-2020: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderRating: 5 out of 5 stars5/5 (4)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyFrom EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyRating: 4 out of 5 stars4/5 (52)

- How to get US Bank Account for Non US ResidentFrom EverandHow to get US Bank Account for Non US ResidentRating: 5 out of 5 stars5/5 (1)

- Lower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderFrom EverandLower Your Taxes - BIG TIME! 2023-2024: Small Business Wealth Building and Tax Reduction Secrets from an IRS InsiderNo ratings yet

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesFrom EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesRating: 4 out of 5 stars4/5 (9)

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessFrom EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessRating: 5 out of 5 stars5/5 (5)

- The Hidden Wealth of Nations: The Scourge of Tax HavensFrom EverandThe Hidden Wealth of Nations: The Scourge of Tax HavensRating: 4 out of 5 stars4/5 (11)

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesFrom EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesRating: 3 out of 5 stars3/5 (3)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- Taxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipFrom EverandTaxes for Small Business: The Ultimate Guide to Small Business Taxes Including LLC Taxes, Payroll Taxes, and Self-Employed Taxes as a Sole ProprietorshipNo ratings yet

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProFrom EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProRating: 4.5 out of 5 stars4.5/5 (43)

- Tax Savvy for Small Business: A Complete Tax Strategy GuideFrom EverandTax Savvy for Small Business: A Complete Tax Strategy GuideRating: 5 out of 5 stars5/5 (1)

- What Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemFrom EverandWhat Everyone Needs to Know about Tax: An Introduction to the UK Tax SystemNo ratings yet

- Founding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationFrom EverandFounding Finance: How Debt, Speculation, Foreclosures, Protests, and Crackdowns Made Us a NationNo ratings yet

- Freight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesFrom EverandFreight Broker Business Startup: Step-by-Step Guide to Start, Grow and Run Your Own Freight Brokerage Company In in Less Than 4 Weeks. Includes Business Plan TemplatesRating: 5 out of 5 stars5/5 (1)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)From EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Rating: 4.5 out of 5 stars4.5/5 (43)