Professional Documents

Culture Documents

CTABrochureFinal Oct 2021

Uploaded by

Saad SuhailOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CTABrochureFinal Oct 2021

Uploaded by

Saad SuhailCopyright:

Available Formats

Chartered Tax Adviser

CTA

PREPARING YOUR EMERGING TALENT FOR

TOMORROW’S TAXATION WORLD

The Chartered Tax Adviser(CTA) is the highest-level tax qualification

in the UK

Integrity I Expertise I Excellence in Taxation

Why CIOT?

The Chartered Institute of Taxation (CIOT) is the leading body in the UK for taxation professionals dealing with all aspects

of taxation. Our primary purpose is to promote education in taxation. One of our key aims is to achieve a more efficient

and less complex tax system for all.

To become a member, students need to pass the CIOT qualification, called the Chartered Tax Adviser (CTA) qualification

and complete three years relevant professional experience.

19,000+ 38,000+

tax professionals via our connected charity,

Members Association of Taxation Technicians (ATT)

5,000+

40

branches across

the UK and

students worldwide

Why CTA?

“The CTA has been incredibly “ Achieving the CTA

valuable in consolidating qualification has helped

my existing knowledge and me enormously. It

strengthening my technical has given me in depth

knowledge. It’s made me more technical knowledge

well-rounded and given me about tax issues. Doing

more confidence as an adviser, the CTA has given me so

particularly in identifying much more confidence

opportunities and risk areas. in my job.

” ”

Matt Boggis Elizabeth Linsley

Client Manager, Creaseys Group Tax Assistant Manager, Landed Estates,

Limited Saffery Champness

“Doing the CTA qualification “ Gaining the CTA

helped me to develop my tech- qualification has helped

nical knowledge with a better deal with client queries,

ability to work independently quickly and efficiently.

from source materials, and It has also enabled

provided me with greater me to offer my clients

confidence. a better “all round”

” service.

”

Ellie Kaminski Craig Paterson

Manager, Corporate Tax, PwC Business Advisory Manager, Johnston

Carmichael

Integrity I Expertise I Excellence in Taxation

Qualification Overview

The CIOT offers the highest level tax qualification in the UK, the Chartered Tax Adviser (CTA) qualification.

The purpose of the CTA examination is to establish that students are capable of giving the very high standard of taxation

advice expected of a Chartered Tax Adviser. This involves evidencing knowledge of a wide range of tax issues and

demonstrating, in areas of tax chosen by them, in-depth competence and the ability to give concise and relevant written

advice which is comprehensive, technically correct and commercially sound.

The CTA comprises of both written examinations and computer based examinations, (CBEs). Whilst each CBE requires a

competent level of understanding, the Awareness, Advanced Technical and Application and Professional Skills question

papers develop the critical breath and depth of knowledge and the skills and behaviours needed by senior tax advisers.

There are four written papers There are three one-hour CBEs

• One Awareness paper • Professional Responsibilities and Ethics

• Two Advanced Technical papers • Law

• One Application and Professional Skills paper • Principles of Accounting

Awareness

Law

Application &

Professional

3 Years’ Skills

Principles of Professional

Accounting Experience

Professional

Advanced

Responsibilities

Technical

& Ethics

Integrity I Expertise I Excellence in Taxation

ATT CTA Tax Pathway

This route is ideal for new students wishing to study tax

who do not come from an accountancy background.

ACA CTA Joint Programme

The ATT CTA Tax Pathway offers a streamlined and

The CIOT and ICAEW have created a Joint Programme efficient route to membership of both the Association

that enables students to achieve two Chartered of Taxation Technicians and the Chartered Institute of

qualifications. The CTA qualification and the ICAEW Taxation. This route offers greater flexibility in the

Chartered accountancy qualification (ACA). choice of papers with the opportunity to specialise in a

particular area of tax at an early stage, rather than the

This Joint Programme helps students qualify in three ATT compulsory papers in the traditional sequential

to four years once they have undertaken relevant route of ATT and then CTA. Students are also exempt

professional work experience. from one paper.

CA CTA Joint Programme

The CIOT and Institute of Chartered

Direct CTA Route

Accountants of Scotland (ICAS) have

Access to the CTA qualification is open to anyone

entered into a partnership that enables

and there is no need to hold a prior qualification.

students to achieve two Chartered

However, if a student does not hold a qualification

qualifications. The CTA qualification and the

in accountancy or law we strongly recommend

ICAS Chartered accountancy qualification (CA).

registering for the Tax Pathway. This will give

students the best chance of success.

This Joint Programme helps students qualify in

three to four years once they have undertaken

relevant professional work experience.

Routes to CIOT Membership

The CTA is a modular examination structure which ensures a flexible work/study balance.

Integrity I Expertise I Excellence in Taxation

Flexible Examination Framework

Students can build an individual learning route that is relevant to their current role and responsibilities. This means they can

choose examinations relevant to their role and specialise in specific areas of taxation as they progress within the

organisation.

Some students may be exempt from one or more examinations depending on prior qualifications.

Written examinations are held in May and November each year at examinations centres around the UK.

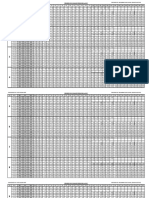

CTA Framework

Computer Based

3 COMPULSORY EXAMS* ONE HOUR IN LENGTH Examinations

The aim of the Computer Based

COMPUTER BASED EXAMINATIONS Examinations (CBE) is to test a

candidate’s knowledge of Law,

Principles of Accounting Law Professional Responsibilities Principles of Accounting and

& Ethics Professional Responsibilities and

Ethics within the relevant areas of

tax.

CHOOSE THREE MODULES* THREE HOURS IN LENGTH

Awareness Paper

The aim of the Awareness Paper is to

examine core areas of tax which may

AWARENESS fall outside of the students direct

remit.

Taxation of Individuals Inheritance Tax, Taxation of Unincorporated

Trusts & Estates Businesses The examination is one three-hour

paper covering five modules. Candi-

VAT including Stamp Taxes Corporation Tax The Awareness modules chosen must dates choose three modules and will

not be the same as the corresponding need to sit all chosen modules at the

Advanced Technical papers

same sitting. (These modules will

need to differ from the Advanced

Technical choices.)

CHOOSE TWO PAPERS * THREE HOURS IN LENGTH PLUS FIFTEEN MINUTES READING TIME Advanced Technical

The aim of the Advanced Technical

papers is to test the depth of a

ADVANCED TECHNICAL candidate’s knowledge within the

various areas of taxation at an

Taxation of Individuals Inheritance Tax, Taxation of Owner-Managed advanced level.

Trusts & Estates Businesses

Each Advanced Technical paper is a

Domestic Indirect Taxation Cross-Border Indirect Taxation Taxation of Major Corporates “stand-alone” paper. Students will

choose two papers from the choice

of seven and they will be required to

Human Capital Taxes The Advanced Technical papers answer all questions set.

chosen must not be the same as the

corresponding Awareness modules

COMPULSORY CHOOSE ONE * THREE HOURS IN LENGTH PLUS FIFTEEN MINUTES READING TIME

Application and

Professional Skills

The aim of the Application and

APPLICATION AND PROFESSIONAL SKILLS Professional Skills paper is to test

that the candidate has the necessary

Taxation of Individuals Inheritance Tax, Taxation of Owner-Managed

skills and expertise expected of a

Trusts & Estates Businesses

Chartered Tax Adviser. This is by

means of a tax based case study.

VAT & Taxation of Larger Companies Human Capital Taxes

Other Indirect Taxes & Groups Candidates will choose one of six

case study questions at the time

they register for the written paper.

Pre-seen information will be sent

Exemptions available for Awareness, Law and Principles of Accounting two weeks before the examination

*Special rules apply for Joint Programme Students takes place.

Integrity I Expertise I Excellence in Taxation

CTA Benefits

Achieving the CTA qualification means that students have the confidence and capability of giving a very high

standard of taxation advice. Over the course of their training they gradually build their knowledge, a core benefit

of the CTA flexible examination framework.

Benefits of CTA training Benefits of CIOT Membership

• Chartered status and a professional • Use of the descriptive letters CTA and Institute badge

advantage • Monthly journal “Tax Adviser” which

• Enhanced productivity, competitiveness and includes articles, current tax notes, digests of

confidence tax cases and news from the Institute

• Faster navigation of complex taxation • Entry into the on-line Directory of Chartered Tax

legislation Advisers

• Independent benchmark of knowledge and • Opportunity for attendance at the Institute’s Residential

technical excellence and one-day conferences

• Engagement and retention • Opportunity for participation in technical and social

• Greater job satisfaction from employees activities organised by the branches

Tuition Providers

The Institute sets the examination syllabus but does not offer tuition. The three principal tutorial organisations

are listed below alphabetically. Please contact the tuition providers and visit their websites for prices and

course dates.

BPP Professional Education Kaplan Financial Tolley Exam Training

Tel no 020 8746 4150 Tel no 020 3486 3080 Tel no 020 3364 4500

Email tax@bpp.com Email taxinfo@kaplan.co.uk Email examtraning@lexisnexis.co.uk

Web bpp.com/courses/tax Web kaplan.co.uk/courses/cta Web tolley.co.uk/exam-training

Integrity I Expertise I Excellence in Taxation

Exemptions available Student Resources

from certain papers

Students who have passed the full examination To support students over the course of their CTA studies

requirement from other specified professional bodies we offer a range of services and resources.

can apply for exemptions.

• Branch events

Visit: tax.org.uk/exemptions • Discounts on LexisNexis Legislation

• Student Exam Focus Days

Please note that: • Past written question papers

• Examiners’ suggested answers to the written

• Students must apply for an exemption papers

before the closing date of their last written exam • Past examination answers to the written papers

• There is no expiry date for exemptions • Mock CBEs

• There is a fee. Please visit the website for • Study Manuals for CBEs

more information • LinkedIn - “The CTA Student Group”

• Tax Adviser - monthly journal which includes

articles, current tax notes, digests of tax cases

and news from the CIOT

• Student Calendar

• Bi-annual Student Newsletter

• NUS Extra (Totum) discount card

Integrity I Expertise I Excellence in Taxation

Registering as a CTA Student

To register simply visit: https://www.tax.org.uk/students-and-qualifications/registration/register-student

Students need to be registered for at least four months before they are permitted to enter for a written examination:

• register by last day of December to enter for the May examination

• register by last day of June to enter for the November examination

The registration period lasts for three years (four for the ACA CTA and CA CTA Joint Programme and five for tax

pathway).

Examination entry is a separate process.

For more information please visit tax.org.uk

Reproduction, copying or extracting by any means of the tax.org.uk

whole or part of this publication must not be undertaken +44 (0)20 7340 0550

without the written permission of the CIOT. education@ciot.org.uk

Copyright © Chartered Institute of Taxation

Chartered Institute of Taxation

08/2019 30 Monck Street, London

SW1P 2AP

Integrity I Expertise I Excellence in Taxation

You might also like

- CIOT CTA Brochure (Web) v2Document14 pagesCIOT CTA Brochure (Web) v2SyedNo ratings yet

- DT Dan UX - 29042019Document21 pagesDT Dan UX - 29042019Alvica DianNo ratings yet

- Forensic Accounting RevisedDocument4 pagesForensic Accounting RevisedMurthyNo ratings yet

- Education SectorDocument18 pagesEducation SectormarketingNo ratings yet

- Tax Payer CharterDocument6 pagesTax Payer CharterMr. JalilNo ratings yet

- Taxpayers' Charter: Our VisionDocument6 pagesTaxpayers' Charter: Our VisionroheelNo ratings yet

- ..Document6 pages..Yonie HubillaNo ratings yet

- ISACA CISA 40th Anniversary Infographic 0618Document2 pagesISACA CISA 40th Anniversary Infographic 0618K142084 Arsalan MehmoodNo ratings yet

- Data Analyst Cover Letter ExampleDocument1 pageData Analyst Cover Letter ExampleJohn Rei CabuñasNo ratings yet

- VICELP Brochure RebrandingV3Document6 pagesVICELP Brochure RebrandingV3bbbyfbq29qNo ratings yet

- 75354cajournal August2023 5Document4 pages75354cajournal August2023 5S M SHEKARNo ratings yet

- Final Ict Field AttachmentDocument21 pagesFinal Ict Field AttachmentHaron HB WritersNo ratings yet

- Harnessing The Power of Cognitive Technology To Transform The AuditDocument16 pagesHarnessing The Power of Cognitive Technology To Transform The Auditdozierjohn021No ratings yet

- ATT Prospectus 2023Document21 pagesATT Prospectus 2023miguel gumucioNo ratings yet

- Get Cisco CertifiedDocument16 pagesGet Cisco CertifiedAna C ArenasNo ratings yet

- Value & Opportunity - Accounting TechniciansDocument2 pagesValue & Opportunity - Accounting TechniciansAli AyubNo ratings yet

- STR Ujjwal - PDF MainDocument54 pagesSTR Ujjwal - PDF MainRitesh OPNo ratings yet

- The Value of Certification and IT Professional Practice: Engr. Marvin D. MayormenteDocument26 pagesThe Value of Certification and IT Professional Practice: Engr. Marvin D. MayormenteLeah BobisNo ratings yet

- Easy Bank Pitch DeckDocument12 pagesEasy Bank Pitch DeckSami LoukilNo ratings yet

- Akountmate PVT LTD - Pitch DeckDocument14 pagesAkountmate PVT LTD - Pitch DeckRida AkhlaqNo ratings yet

- Indusrial Training Report. (Accounting)Document71 pagesIndusrial Training Report. (Accounting)sen2000fc1095% (81)

- Chapter 8Document71 pagesChapter 8Sree Mathi SuntheriNo ratings yet

- CAT BrochureDocument10 pagesCAT Brochureyfarhana2002No ratings yet

- CIOT Prospectus 2023Document25 pagesCIOT Prospectus 2023Saad SuhailNo ratings yet

- CIOT Prospectus 2023Document25 pagesCIOT Prospectus 2023andileNo ratings yet

- Final Ict Field Industrial Attachment ReportDocument21 pagesFinal Ict Field Industrial Attachment ReportHaron HB Writers100% (2)

- Executive Certification 1658560573Document28 pagesExecutive Certification 1658560573Arjun AgarwalNo ratings yet

- Business Continuity Training, Certification, Consulting, Asessment and A...Document15 pagesBusiness Continuity Training, Certification, Consulting, Asessment and A...homsomNo ratings yet

- Candidate Handbook: Ccep-I CertificationDocument52 pagesCandidate Handbook: Ccep-I CertificationKarem MahmoudNo ratings yet

- Breakthrough Business Development: A 90-Day Plan to Build Your Client Base and Take Your Business to the Next LevelFrom EverandBreakthrough Business Development: A 90-Day Plan to Build Your Client Base and Take Your Business to the Next LevelNo ratings yet

- CTA Course Information and RegulationsDocument49 pagesCTA Course Information and Regulationshassan1989No ratings yet

- RSM Webinar - Vat Updates 2022Document44 pagesRSM Webinar - Vat Updates 2022Iqbhal RamadhanNo ratings yet

- Certificate Course On Forensic Accounting & Fraud Detection Using IT & CAATsDocument4 pagesCertificate Course On Forensic Accounting & Fraud Detection Using IT & CAATsHarumNo ratings yet

- BlockchainDocument5 pagesBlockchainraulsinNo ratings yet

- BGM On Litigation ManagementDocument129 pagesBGM On Litigation ManagementLakshay AggarwalNo ratings yet

- BCM Workshop - Dec 2019 v3Document2 pagesBCM Workshop - Dec 2019 v3indra gNo ratings yet

- 75352cajournal August2023 3Document1 page75352cajournal August2023 3S M SHEKARNo ratings yet

- Professional Level Tax ComplianceDocument28 pagesProfessional Level Tax CompliancevikkyNo ratings yet

- Garcia Sanmateo ProjectDocument4 pagesGarcia Sanmateo Projectnoirri kajiuraNo ratings yet

- Winter Spring 2011 TaCCs Brochure FinalDocument6 pagesWinter Spring 2011 TaCCs Brochure FinalnewquadelinfoNo ratings yet

- CA Journal - June 2023Document116 pagesCA Journal - June 2023Sandeep BhandariNo ratings yet

- Indusrial Training Report AccountingDocument72 pagesIndusrial Training Report AccountingfuzaaaaaNo ratings yet

- Info-Tech Pricing ProposalDocument4 pagesInfo-Tech Pricing ProposalPravs AnsNo ratings yet

- PWC Annual Report 2022 2023Document119 pagesPWC Annual Report 2022 2023vikassharma7068No ratings yet

- This Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewDocument5 pagesThis Study Resource Was: Chapter 2-Professional Practice of Accountancy: An OverviewNhel AlvaroNo ratings yet

- Franchise Tax Board JobsDocument24 pagesFranchise Tax Board JobsAbdullah KhanNo ratings yet

- PM-Buyers Guide 2023-UPDATED-0999666667Document44 pagesPM-Buyers Guide 2023-UPDATED-0999666667Mike AndrésNo ratings yet

- Aus Campus Digital Flyer 2023Document20 pagesAus Campus Digital Flyer 2023Mavia KaziNo ratings yet

- JACKLINE NEW RESEARCH (Recovered)Document57 pagesJACKLINE NEW RESEARCH (Recovered)jupiter stationeryNo ratings yet

- Law Workbook 2021Document362 pagesLaw Workbook 2021Lâm Bulls100% (1)

- The Ultimate Guide To The: Be The Expert in Risk Assessment and Security AuthorizationDocument12 pagesThe Ultimate Guide To The: Be The Expert in Risk Assessment and Security AuthorizationZeeshan RanaNo ratings yet

- Laundry Data Management SystemDocument49 pagesLaundry Data Management SystemWillie MNo ratings yet

- JAJ Customs Brokers OrgDocument5 pagesJAJ Customs Brokers Orgjessa lubayNo ratings yet

- Nos NTQF Level$ Catering and Hospitality Level 4Document57 pagesNos NTQF Level$ Catering and Hospitality Level 4joseph ndagaNo ratings yet

- Industrial Training ReportDocument15 pagesIndustrial Training ReportCHa_Mukhtar_1035No ratings yet

- 2165 CCST Brochure WebDocument5 pages2165 CCST Brochure WebgminayasNo ratings yet

- Young Pro Value Prop '14Document9 pagesYoung Pro Value Prop '14Amit KumarNo ratings yet

- Digital-Skills-Retail Certificate of Achievement 5dyk3d0Document2 pagesDigital-Skills-Retail Certificate of Achievement 5dyk3d0Việt QuốcNo ratings yet

- YMSGlobal Team Resolution 2020 Final 2Document3 pagesYMSGlobal Team Resolution 2020 Final 2hemanth kumarNo ratings yet

- Why Get Certified: 13 Reasons For Seeking Training and CertificationDocument17 pagesWhy Get Certified: 13 Reasons For Seeking Training and CertificationAlex T.No ratings yet

- MoH Advertisement - 92 - For - The - Doctors&Nurses04042023.pdf-1680676041519Document1 pageMoH Advertisement - 92 - For - The - Doctors&Nurses04042023.pdf-1680676041519Saad SuhailNo ratings yet

- TimeTable Phase II 2023Document1 pageTimeTable Phase II 2023Saad SuhailNo ratings yet

- Master of Business Administration (723AA.6) : Domestic StudentsDocument12 pagesMaster of Business Administration (723AA.6) : Domestic StudentsSaad SuhailNo ratings yet

- MCMC2Document5 pagesMCMC2Saad SuhailNo ratings yet

- New Fee StructureDocument1 pageNew Fee StructureSaad SuhailNo ratings yet

- Adv 05 23 ExtendedDocument1 pageAdv 05 23 ExtendedSaad SuhailNo ratings yet

- Peiw 02 Workforce Job Offer FormDocument5 pagesPeiw 02 Workforce Job Offer FormSaad SuhailNo ratings yet

- Frais de Visa - ANGLAISDocument1 pageFrais de Visa - ANGLAISSaad SuhailNo ratings yet

- OASIS Guide For Employer-April+2022Document28 pagesOASIS Guide For Employer-April+2022Saad SuhailNo ratings yet

- Ip 22 12 2022Document8 pagesIp 22 12 2022Saad SuhailNo ratings yet

- TOR AD Onsite DeptDocument1 pageTOR AD Onsite DeptSaad SuhailNo ratings yet

- PTVAcademyTrainingCourse2021 2022Document16 pagesPTVAcademyTrainingCourse2021 2022Saad SuhailNo ratings yet

- Retirement of Pakistan Audit and Acconts Service For The Year 2022Document1 pageRetirement of Pakistan Audit and Acconts Service For The Year 2022Saad SuhailNo ratings yet

- AD Onsite Department 003Document1 pageAD Onsite Department 003Saad SuhailNo ratings yet

- CIOT Prospectus 2023Document25 pagesCIOT Prospectus 2023Saad SuhailNo ratings yet

- Implementation of Notification NO - FD (SR-I) 1522010 Dated 21-07-2014 & 28-12-2015 Regarding The Time Scale BS-16 of PST (S)Document1 pageImplementation of Notification NO - FD (SR-I) 1522010 Dated 21-07-2014 & 28-12-2015 Regarding The Time Scale BS-16 of PST (S)Saad SuhailNo ratings yet

- TA DA Form For Federal Govt EmployeesDocument2 pagesTA DA Form For Federal Govt EmployeesSaad SuhailNo ratings yet

- Syllabus: 34 Mid Career Management CourseDocument46 pagesSyllabus: 34 Mid Career Management CourseSaad SuhailNo ratings yet

- Fo 1Document16 pagesFo 1Saad SuhailNo ratings yet

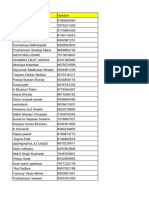

- Pay Scale by Saad SuhailDocument6 pagesPay Scale by Saad SuhailSaad SuhailNo ratings yet

- Statement of Cash Flows: Josh AharonoffDocument13 pagesStatement of Cash Flows: Josh AharonoffSaad SuhailNo ratings yet

- Addendum13 07 2018Document10 pagesAddendum13 07 2018Saad SuhailNo ratings yet

- Day 10 Session 3-4Document34 pagesDay 10 Session 3-4Saad SuhailNo ratings yet

- Presentmsosections I II 20200721122442Document58 pagesPresentmsosections I II 20200721122442Saad SuhailNo ratings yet

- 75 Nite e 1920 CompositeDocument92 pages75 Nite e 1920 CompositeSaad SuhailNo ratings yet

- PACManual 20201127161742Document22 pagesPACManual 20201127161742Saad SuhailNo ratings yet

- Solutions - Winter Exam 2019Document47 pagesSolutions - Winter Exam 2019Saad SuhailNo ratings yet

- CPWD - 6 CPWD: Government of India Central Public Works Department Notice Inviting TenderDocument40 pagesCPWD - 6 CPWD: Government of India Central Public Works Department Notice Inviting TenderSaad SuhailNo ratings yet

- 80-Rules For SentencesDocument19 pages80-Rules For SentencesSaad SuhailNo ratings yet

- Learning DisabilitiesDocument54 pagesLearning Disabilitiessainudheen100% (2)

- Newest Accoplishment Report in Esp 2018 2019Document6 pagesNewest Accoplishment Report in Esp 2018 2019Michael Vincent de Vera100% (1)

- Project Management Unit (Pmu) Primary & Secondary Healthcare Department Government of The PunjabDocument2 pagesProject Management Unit (Pmu) Primary & Secondary Healthcare Department Government of The PunjabAhus MalikNo ratings yet

- Raiseplus Weekly Plan For Blended Learning: Paaralang Pampurok NG Hilagang SipocotDocument4 pagesRaiseplus Weekly Plan For Blended Learning: Paaralang Pampurok NG Hilagang SipocotFE FEDERICONo ratings yet

- Family WellbeingDocument301 pagesFamily Wellbeingsteph otthNo ratings yet

- Marksheet SSC JeetDocument1 pageMarksheet SSC JeetDinesh ShindeNo ratings yet

- 6 Months To 6 Figures - Peter VoogdDocument431 pages6 Months To 6 Figures - Peter VoogdCourage Kanyonganise80% (5)

- Video Editing Training DesignDocument4 pagesVideo Editing Training Designliezl ann g. valdezNo ratings yet

- Josie White ResumeDocument2 pagesJosie White Resumeapi-327047642No ratings yet

- Springbrook Blueprint Volume 51 Issue 1Document12 pagesSpringbrook Blueprint Volume 51 Issue 1springbrook_bpNo ratings yet

- West India Database July2021 To SEP 2021Document88 pagesWest India Database July2021 To SEP 2021Akash NetkeNo ratings yet

- CLP - Operations Management and TQMDocument10 pagesCLP - Operations Management and TQMALMIRA LOUISE PALOMARIANo ratings yet

- Lesson Plan ObservationDocument4 pagesLesson Plan ObservationCristina SarmientoNo ratings yet

- Chapter 5 UnescoDocument21 pagesChapter 5 UnescosydjjNo ratings yet

- IT Strategic Plan Final BookletDocument13 pagesIT Strategic Plan Final BookletbelayNo ratings yet

- ANGELIC - Salient Features of K To 12 - SPTOPDocument16 pagesANGELIC - Salient Features of K To 12 - SPTOPAngelic AlmaydaNo ratings yet

- Guideline PracticumDocument37 pagesGuideline PracticumMAAbuBakarNo ratings yet

- Monday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson LogDocument8 pagesMonday Tuesday Wednesday Thursday Friday: GRADES 1 To 12 Daily Lesson LogHazell Ruth Ensomo-AlmonteNo ratings yet

- Erasmus+ International Credit Mobility: Guide For ApplicantsDocument12 pagesErasmus+ International Credit Mobility: Guide For ApplicantsHouda MannaiNo ratings yet

- Lmpact of Global Is at Ion On LADAKH (A Cultural Perspective)Document4 pagesLmpact of Global Is at Ion On LADAKH (A Cultural Perspective)Prtk NayakNo ratings yet

- Questionnaire For Syllabus Design 2Document7 pagesQuestionnaire For Syllabus Design 2Talha MaqsoodNo ratings yet

- Co 2Document5 pagesCo 2Maricel QuiachonNo ratings yet

- Racism in The ClassroomDocument30 pagesRacism in The ClassroomStephenPortsmouth100% (1)

- ULM Official Transcript PDFDocument3 pagesULM Official Transcript PDFКристина ПарфениNo ratings yet

- 21st Century Literature From The Philippines and The World: Quarter 1 - Module 5Document31 pages21st Century Literature From The Philippines and The World: Quarter 1 - Module 5Danvictor Lofranco67% (3)

- Lets SparDocument3 pagesLets Sparapi-296514525No ratings yet

- Angles in Nature: Objectives & OutcomesDocument3 pagesAngles in Nature: Objectives & OutcomesramyaNo ratings yet

- AIPMT Question PapersDocument2 pagesAIPMT Question Papersadarsharma100% (1)

- Critical Book RiviewDocument15 pagesCritical Book RiviewLamtiur SilabanNo ratings yet