Professional Documents

Culture Documents

Garcia Sanmateo Project

Uploaded by

noirri kajiuraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Garcia Sanmateo Project

Uploaded by

noirri kajiuraCopyright:

Available Formats

BULACAN STATE UNIVERSITY

BUSTOS CAMPUS

L. Mercado Street corner C.L. Hilario Street, Poblacion, Bustos 3007, Bulacan

044-7618303

PROJECT

IN

INCOME TAX

Submitted by:

AMETHYST MARGARET DR. GARCIA

STUDENT

JESSICA COLLEEN DR. SAN MATEO

STUDENT

Submitted to:

MA’AM CINDI ESPIRITU

SUBJECT INSTRUCTOR

1. Bureau of Treasury

The Bureau of Treasury (BTR) have a purpose of increasing the firm's worth towards

its owners and also consequently responsible for securing the adequacy of the

government's financial resources, which would include active management and

investment of excess cash along with providing funds for different governmental

initiatives and projects.

Policy Procedures Results

Artificial Intelligence • The cornerstone to • Artificial intelligence can

(AI) creation. Treasury achieving the support business treasurers

intelligent machines will artificial to remain aware of vast

indeed automate todays intelligence amounts of data that would

modern cash and possibility is data. otherwise need time-

treasury operations and Treasury is consuming human

will also advocate steps improving its data interpretation. These

to be taken and discover collection platform enables employees

policy deviations with capabilities through to focus on tasks which

the use of machine business provide organizations a

learning. intelligence competitive advantage.

programs.

• Artificial Intelligence (AI)

• A solution in may raise the overall

Payables, effectiveness of many

Receivables, and occupations by increasing

Reporting that AI their efficacy while lowering

may enable the demands of work.

employees spend

less time manually • One of the Treasurer's

doing foreseeable critical challenges is that

as well as routine corporate cash be given to

operations, illegitimate receivers. AI,

handling exceptions notably machine learning,

and conflicts, and can serve to prevent this.

detecting risk.

• Adopting technological

• An AI method advances was hard and

itself and campaign expensive, but it is the only

against option to do something

misappropriation of about it. Treasury and

funds financial professionals have

a rare chance to not only

stay up with innovative

developments like AI, but

moreover embrace them.

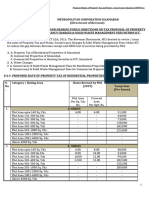

2. Bureau of Local Government Finance

The Bureau of Local Government Finance (BLGF) Deliver technical guidance and

help to Department officials in the formulation and implementation of policies, rules,

and regulations governing local taxation, real property valuation/assessments, and the

administration of local government's financial affairs. BLGF is mandated to assist the

Department of Finance in providing consultative services and technical assistance to

the local governments and the general public on local taxation, real property

assessment, and other related matters.

Policy Procedures Results

The Department should • Publish an official • Taxpayers will know if the

have the proper paper or videos that department collects a fair

information and guidance show how they review amount of their tax based

for the taxpayer on how the and approve the on the property or

taxes are paid and budgets, tax rates, and properties they have.

calculated. tax levies for ensuring

property tax • The department can assess

assessment. the value of your property

and/or the tax rate to

• The Department should increase or decrease your

change its approach bill without a doubt

away from simply because they are

processing taxpayer transparent in assessing the

data and toward tax for the property.

strategic improvements

in compliance, policies, • Taxpayers can disagree

and efficiency. Modern with your property tax bill

revenue strategies will, if proven wrong on the

to a large extent, be calculation for their

dependent on digital property tax assessments,

platforms in order to they can check with the

effectively pursue local tax authority on how

critical policy to formally request a

objectives. reassessment.

3. Insurance Commission

The Insurance Commission is a government agency that reports to the Department of

Finance. The Commission oversees and stabilizes the operations of life and non-life

insurance companies, mutual benefit associations, and charitable trusts. Insurance

agents, general agents, resident agents, underwriters, brokers, adjusters, and actuaries

are all licensed by it. It also has the right to suspend or cancel such licenses.

Policy Procedures Results

Stricter requirements of • The Insurance • Insurance Commissions

the Republic Act No. Commission must with reliable, improved

10173, otherwise known acknowledge efficient legal systems are more

as the Data Privacy Act and equitable initiatives highly probable trusted by

of 2012. that would strengthen the the public. In a broad sense,

proceeding, liability law, advancements in the rule of

liability rules, and law spur growth who value

conceptual rein. the safety, security, and

protection provided by the

• The Insurance truthful, righteous, and

Commission must always morally acceptable

respect citizens' department. Furthermore, a

privileges and follow the department that has grown

overall data privacy with improving rule of law

principles and lawful policies have grown for a

requirements outlined in short time before falling

the Act backward, causing long-

term economic and limited

growth.

• Privacy protection is critical

to ensuring fundamental

human rights, safety, and

identity. It allows people to

freely develop their own

dispositions.

• With a stricter policy personal

information is vulnerable to

misuse in the absence of these

laws, which can result mostly

in a violation of privacy and

also cybersecurity threats such

as identity theft and

transaction fraud.

You might also like

- FL PROPERTY TAXES Essay 20 PagesDocument20 pagesFL PROPERTY TAXES Essay 20 Pagesjoerocketman100% (1)

- Real Estate Investment DecisionsDocument117 pagesReal Estate Investment Decisionssilva92186% (22)

- Taguig City Ordinance No. 034-17Document12 pagesTaguig City Ordinance No. 034-17Kristine Pacariem100% (9)

- Fundamentals of TaxationDocument36 pagesFundamentals of TaxationAyesha Pahm100% (1)

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Ey Digital Transformation in InsuranceDocument18 pagesEy Digital Transformation in InsuranceSandeepPattathil100% (6)

- Direct Taxation (Section A) : The Institute of Cost Accountants of IndiaDocument628 pagesDirect Taxation (Section A) : The Institute of Cost Accountants of IndiakrupithkNo ratings yet

- Cir Vs CA and Ymca (Summary)Document4 pagesCir Vs CA and Ymca (Summary)ian clark MarinduqueNo ratings yet

- Indirect Taxation (Section B) : The Institute of Cost Accountants of IndiaDocument344 pagesIndirect Taxation (Section B) : The Institute of Cost Accountants of IndiaSagar Verma100% (1)

- Digital Banking Playbook Final 1Document21 pagesDigital Banking Playbook Final 1hiteshgoel100% (2)

- Flowchart Real Property TaxDocument1 pageFlowchart Real Property TaxPrincess Mae SamborioNo ratings yet

- Sindh Land Revenue Act 1967Document62 pagesSindh Land Revenue Act 1967Tarique Jamali100% (1)

- Vitug Reviewer PDFDocument5 pagesVitug Reviewer PDFDavid TanNo ratings yet

- 3 FELS Energy Inc. v. Province of BatangasDocument2 pages3 FELS Energy Inc. v. Province of BatangasNur Omar100% (1)

- Revenue Assurance - The Intellectual AcuityDocument14 pagesRevenue Assurance - The Intellectual AcuitySutapriya DasNo ratings yet

- Digital SWOT AnalysisDocument3 pagesDigital SWOT Analysisdanny lastNo ratings yet

- (F) Philippine Ports Authority vs. City of IloiloDocument2 pages(F) Philippine Ports Authority vs. City of IloilojakezhanNo ratings yet

- ACCA SBR Notes - AsraDocument69 pagesACCA SBR Notes - AsraReem Javed100% (1)

- Artificial Intelligence - Entering The World of Tax: October 2019Document8 pagesArtificial Intelligence - Entering The World of Tax: October 2019Muhammad TariqNo ratings yet

- Tomorrows accountantDocument1 pageTomorrows accountantKathrine YapNo ratings yet

- Automate Banking Compliance and Scale InnovationDocument15 pagesAutomate Banking Compliance and Scale InnovationMIGUELNo ratings yet

- Lusterio, Glorielyn-SHS FABM 1-WEEK 1 WLASDocument8 pagesLusterio, Glorielyn-SHS FABM 1-WEEK 1 WLASGlorielyn LusterioNo ratings yet

- Revenue Collection Systems: A Proposal for an Automated Quarry Revenue Collection SystemDocument9 pagesRevenue Collection Systems: A Proposal for an Automated Quarry Revenue Collection SystemKola SamuelNo ratings yet

- Waste Management Accounting Fraud Case StudyDocument7 pagesWaste Management Accounting Fraud Case StudyNisa SuriantoNo ratings yet

- Business Process Improvement & Digitalization For Mining v1.2Document19 pagesBusiness Process Improvement & Digitalization For Mining v1.2firmanNo ratings yet

- E-Invoicing: The State of Play in AustraliaDocument52 pagesE-Invoicing: The State of Play in AustraliaAdrian PelivanNo ratings yet

- In Fs Digital India Disruption NoexpDocument36 pagesIn Fs Digital India Disruption Noexpatique mohammedNo ratings yet

- 76896cajournal Nov2023 18Document3 pages76896cajournal Nov2023 18tejveersingh7137No ratings yet

- Management Information Systems IDocument7 pagesManagement Information Systems IFabrizio MarrazzaNo ratings yet

- Form 4 Study Guide-2021-2022Document65 pagesForm 4 Study Guide-2021-2022Varsha GhanashNo ratings yet

- Seminar 11 Introduction and Demonstration of Finance and Taxation System& Discussion 5 The Best Practice Case of Tax DigitizationDocument51 pagesSeminar 11 Introduction and Demonstration of Finance and Taxation System& Discussion 5 The Best Practice Case of Tax DigitizationPoun GerrNo ratings yet

- Bureau of Internal Revenue - Dedicated Region Cloud at Customer Proposal - v5Document39 pagesBureau of Internal Revenue - Dedicated Region Cloud at Customer Proposal - v5bre tambakNo ratings yet

- Quarterly Bulletin Q1Document8 pagesQuarterly Bulletin Q1Akmal RosliNo ratings yet

- Chapter 1Document12 pagesChapter 1Nur DinieNo ratings yet

- Accountant Competence in Information Technology First Name Last Name InstitutionDocument7 pagesAccountant Competence in Information Technology First Name Last Name InstitutionRizza L. MacarandanNo ratings yet

- Fundamental Ethical and Professional Principles (A) : Acca Strategic Business Reporting (SBR)Document109 pagesFundamental Ethical and Professional Principles (A) : Acca Strategic Business Reporting (SBR)Pratham BarotNo ratings yet

- Real Estate Industry Analysis Covid19-2Document2 pagesReal Estate Industry Analysis Covid19-2rohanNo ratings yet

- O W21 - Smarika, Annie - INFO8475 - Assignment 2Document13 pagesO W21 - Smarika, Annie - INFO8475 - Assignment 2Janam PatelNo ratings yet

- ACCA FR Short Summary of All StandardsDocument55 pagesACCA FR Short Summary of All StandardsManiesh MahajanNo ratings yet

- 74978cajournal July2023 27Document2 pages74978cajournal July2023 27S M SHEKARNo ratings yet

- FY24 Field Service GPT (SFS) First Call Deck - Partner ReadyDocument67 pagesFY24 Field Service GPT (SFS) First Call Deck - Partner Readyluis.arriola.sfNo ratings yet

- Different Methods of Depreciation On Property Plant and Equipment AcadDocument13 pagesDifferent Methods of Depreciation On Property Plant and Equipment AcadAya Mellise CoderiasNo ratings yet

- Financial ServicesDocument4 pagesFinancial ServicesRohit PatilNo ratings yet

- Fintech: Skill Sets of Fintech Product ManagerDocument3 pagesFintech: Skill Sets of Fintech Product ManagerIshita FudduNo ratings yet

- The Union Budget 2022 - Analysed: SME OwnersDocument2 pagesThe Union Budget 2022 - Analysed: SME OwnersMoksh RanaNo ratings yet

- Business Research and Innovation Initiative Master DeckDocument38 pagesBusiness Research and Innovation Initiative Master DeckNapolion ChikaraNo ratings yet

- Ebook How Accounting Firms Are Taking Advantage of Digital Disruption To Drive GrowthDocument8 pagesEbook How Accounting Firms Are Taking Advantage of Digital Disruption To Drive GrowthIonut BogdanNo ratings yet

- Banking IndustryDocument10 pagesBanking Industryudit dubeyNo ratings yet

- UntitledDocument28 pagesUntitledBusiness UpdateNo ratings yet

- Future of AuditingDocument6 pagesFuture of AuditingeogollaNo ratings yet

- How The Utility of Tomorrow Is EvolvingDocument6 pagesHow The Utility of Tomorrow Is EvolvingManu KapoorNo ratings yet

- Requirements:: Case Study No. 1 - Preliminary Engagement ActivitiesDocument4 pagesRequirements:: Case Study No. 1 - Preliminary Engagement ActivitiesElizabethNo ratings yet

- Inteligencia PredictivaDocument16 pagesInteligencia PredictivaLiliana ToroNo ratings yet

- EPM Cloud Tax Reporting Overview - EMEA Training May 2020Document25 pagesEPM Cloud Tax Reporting Overview - EMEA Training May 2020zaymounNo ratings yet

- Solution 3.1b Uta SummaryDocument6 pagesSolution 3.1b Uta SummaryrickmortyNo ratings yet

- DT Dan UX - 29042019Document21 pagesDT Dan UX - 29042019Alvica DianNo ratings yet

- 0.Bai1.AI and Transformed Accounting For SustainabilityDocument16 pages0.Bai1.AI and Transformed Accounting For Sustainabilitybe binhNo ratings yet

- The Automated Actuarial: Trust and Transformation in Actuarial SciencesDocument4 pagesThe Automated Actuarial: Trust and Transformation in Actuarial SciencesBakari HamisiNo ratings yet

- ACCA SBR Short Summary of All Standards For September 2020 Exam - AsraDocument69 pagesACCA SBR Short Summary of All Standards For September 2020 Exam - AsraKubNo ratings yet

- ACCA SBR Notes - AsraDocument69 pagesACCA SBR Notes - AsraReem JavedNo ratings yet

- DataBoiler Volcker619 CommentsDocument30 pagesDataBoiler Volcker619 CommentstabbforumNo ratings yet

- Notes 1: "Accounting Is The Language of Business."Document4 pagesNotes 1: "Accounting Is The Language of Business."Krissha GalonNo ratings yet

- Auditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions ManualDocument16 pagesAuditing Assurance Services and Ethics in Australia 9th Edition Arens Solutions Manualterrysmithnoejaxfwbz100% (14)

- S&A - Govt Portals For MSMEs PDFDocument4 pagesS&A - Govt Portals For MSMEs PDFSahaj SrivastavaNo ratings yet

- Computerized Accounting Options for NonprofitsDocument4 pagesComputerized Accounting Options for Nonprofitsadityakumar94No ratings yet

- Imawebinarppt 09 Feb 22 Final 21644418622863Document30 pagesImawebinarppt 09 Feb 22 Final 21644418622863DARSHAN HULSURKARNo ratings yet

- Todays-Interdisciplinary-Auditors Joa Eng 0919Document5 pagesTodays-Interdisciplinary-Auditors Joa Eng 0919Koyel BanerjeeNo ratings yet

- Micro Financing SolutionDocument2 pagesMicro Financing SolutionUmang Mahesh DadhichNo ratings yet

- The Rise of The Exponential Underwriter 1615942321Document24 pagesThe Rise of The Exponential Underwriter 1615942321Pankaj BazaariNo ratings yet

- Implementation of a Central Electronic Mail & Filing StructureFrom EverandImplementation of a Central Electronic Mail & Filing StructureNo ratings yet

- The Tamil Nadu District Municipalities Act, 1920Document337 pagesThe Tamil Nadu District Municipalities Act, 1920Sidhardh MuthusamyNo ratings yet

- Individual and corporate community tax obligationsDocument1 pageIndividual and corporate community tax obligationsCams DlunaNo ratings yet

- 2021 Carter AssessmentDocument1 page2021 Carter AssessmentMary LandersNo ratings yet

- Villanueva V City of IloiloDocument1 pageVillanueva V City of IloilorobbyNo ratings yet

- Connect Southeast Michigan Financial AnalysisDocument45 pagesConnect Southeast Michigan Financial AnalysisAnonymous dp5b3X1NA0% (1)

- Manual On Real Prtoperty AppraisalDocument32 pagesManual On Real Prtoperty AppraisalSharon GonzalesNo ratings yet

- Economic Development Incentive Agreement - Clovis Barker Business Park LPDocument16 pagesEconomic Development Incentive Agreement - Clovis Barker Business Park LPnotdescriptNo ratings yet

- Fundamentals of RP Taxation, Dynamics of Business Tax and Business Related TaxesDocument21 pagesFundamentals of RP Taxation, Dynamics of Business Tax and Business Related TaxesJAHARA PANDAPATANNo ratings yet

- Tax AssignmentDocument5 pagesTax AssignmentdevNo ratings yet

- Phil. Journalists, Inc. v. CIR, G.R. No. 162852, Dec. 16, 2004.)Document104 pagesPhil. Journalists, Inc. v. CIR, G.R. No. 162852, Dec. 16, 2004.)Alvin III SiapianNo ratings yet

- City of Kenner Legals: Hearings Mayor Council MembersDocument1 pageCity of Kenner Legals: Hearings Mayor Council MembersThe AdvocateNo ratings yet

- Simplified - Chapter 8 - PAD320Document1 pageSimplified - Chapter 8 - PAD320Mohd Adib DanialNo ratings yet

- Proposed CDA & MCI Taxes & Charges Revision 2023Document15 pagesProposed CDA & MCI Taxes & Charges Revision 2023shoaibajamalNo ratings yet

- Resume Penilaian AsetDocument7 pagesResume Penilaian AsetTyron SagimanNo ratings yet

- Housing ReportDocument6 pagesHousing ReportJasmin QuebidoNo ratings yet

- TAXATION MODULE: HKICPA LEVELS AND TAXONOMYDocument8 pagesTAXATION MODULE: HKICPA LEVELS AND TAXONOMYKC LNo ratings yet

- Pre-Week Notes On LTC, RPTCDocument14 pagesPre-Week Notes On LTC, RPTCKareen MoncadaNo ratings yet

- Real Property Taxation Group 3Document38 pagesReal Property Taxation Group 3Glem Maquiling JosolNo ratings yet

- The Peoples BudgetDocument14 pagesThe Peoples BudgetActionNewsJaxNo ratings yet

- Deloitte CN Tax HK Tax Guide en 210928Document20 pagesDeloitte CN Tax HK Tax Guide en 210928Franklin ClintonNo ratings yet