Professional Documents

Culture Documents

Speculation - Interglobe Aviation

Uploaded by

TOSHAK SHARMAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Speculation - Interglobe Aviation

Uploaded by

TOSHAK SHARMACopyright:

Available Formats

Background:

Interglobe aviations recorded its highest ever quarterly revenue in Oct-Dec at Rs. 15,410

crore. Net profit recorded during this tenure was 1422.6 crore, while the management

expected the momentum to continue in the same manner in the last quarter of financial

year 2022-23. (as per the post -earning’s conference call with the managers)

The purchase price of the call option was 59 and it was 48.5 for the put option as on

February 28th 2023.Owing to good fundamentals and strong management team, we

acquired 31 lots of 300 shares per lot of the company till March 31st 2023.

Multiple reasons backing growth

There was a sharp surge in travel and tourism post- covid which predicted an increase in airline stock

prices. Moreover , the G20 summit being presided over by India was aimed at providing an impetus to

the travel and tourism industry aiming to for sustainable and equitable growth and striking a goal to

reach US$ 1 trillion by 2047 in terms of the overall travel and tourism economy, including both,

domestic and international tourism. In addition, Indigo has placed an order of 500 aircrafts from

European giants Airbus and US Boeing as part of their expansion plans. Thus, the projected movement

of the stock was a big price change however the intense competition fro AirIndia, which had also

purchased 4700 aircrafts made the market prediction uncertain. This justified the selection of Long

Straddle for this particular stock

Details of the strategy:

Role of market participant: Speculator

Name of the strategy: Long Straddle

Date of execution: February 28th 2023

Underlying option contract: Call and Put options

Type: European

Strike price: Rs. 59 (call option)

Rs, 48.5 (put option)

Expiry date: 31 March 2023

st

Market lot size: 300 shares

No. of lots purchased: 31

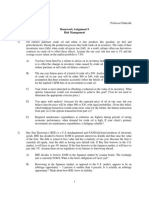

Graphical representation of the strategy:

RBL Bank - Protective Put strategy

1,500,000

1,400,000

1,300,000

1,200,000

1,100,000

1,000,000

900,000

800,000

700,000

9 9 9 9 9 9 9 9 9 9 9 9 9 9 9 9

l-1 ul-1 ul-1 ul-1 ul-1 ul-1 ul-1 ug-1 ug-1 ug-1 ug-1 ug-1 ug-1 ug-1 ug-1 ug-1

J- u J- J- J- J- J- J-

15 17 19 23 25 29 31 -A -A -A -A -A -A -A -A -A

02 06 08 13 16 20 22 26 28

Value of hedged portfolio Value of the unhedged portfolio

Cost of long position of shares

Excel file of the strategy:

Conclusion: The strategy was not successful, since the share price did not exhibit any

strong movement on either side. Main reason for this was more wrong timing than lack of

possibility of momentum. There were both, strong upwards and downward catalysts , but

they negated each other instead of affecting the stock price significantly

Note: The put option has been exercised on the date of expiry since, it had become in-the-

money.

Assumptions:

i. Transaction costs in executing a long straddle strategy is minimal and hence will not

significantly impact the results.

ii. Liquidity of call and put options is high enough for execution of this strategy.

You might also like

- Strategist Consulting Compendium Vol-2 Case BookDocument41 pagesStrategist Consulting Compendium Vol-2 Case BookAdwait Deshpande100% (1)

- Commodity Market Trading and Investment: A Practitioners Guide to the MarketsFrom EverandCommodity Market Trading and Investment: A Practitioners Guide to the MarketsNo ratings yet

- Case Solutions For Supply Chain ManagementDocument100 pagesCase Solutions For Supply Chain Managementcumimayang50% (2)

- Complete Forex Trading Guide - Forex - Doc-1Document228 pagesComplete Forex Trading Guide - Forex - Doc-1Raph Sun87% (46)

- IA Lottery WinnersDocument263 pagesIA Lottery WinnersKevin Glueck0% (1)

- 14e GNB ch01 SMDocument7 pages14e GNB ch01 SMOmerGull100% (1)

- CRG Ambhit CapitalDocument25 pagesCRG Ambhit Capitalsidhanti26No ratings yet

- Managerial Economics Practice Set 1 2018Document9 pagesManagerial Economics Practice Set 1 2018Sir Jay265No ratings yet

- Yield Curve Spread TradesDocument12 pagesYield Curve Spread TradesAnonymous iVNvuRKGV100% (3)

- Activity Design TagaytayDocument6 pagesActivity Design TagaytayYlloy AnalabNo ratings yet

- Engineering Economics Project ReportDocument9 pagesEngineering Economics Project ReportAbdulwahab AlmaimaniNo ratings yet

- PNB - List of Projects PDFDocument39 pagesPNB - List of Projects PDFVaibhav ShardaNo ratings yet

- BIMBSec - Wah Seong Julimar 20120522Document2 pagesBIMBSec - Wah Seong Julimar 20120522Bimb SecNo ratings yet

- Analysis of Automatic Strangle Trade On Expansive Symbols of Korean Option MarketDocument3 pagesAnalysis of Automatic Strangle Trade On Expansive Symbols of Korean Option MarketPrashantKumarNo ratings yet

- Measuring RiskDocument12 pagesMeasuring RiskKasmawati HammaNo ratings yet

- Financial Market Paper 2Document26 pagesFinancial Market Paper 2ZuherNo ratings yet

- Market Pulse 130619Document5 pagesMarket Pulse 130619ventriaNo ratings yet

- FEDocument12 pagesFEThaddee Nibamureke0% (1)

- Morning - India 20231027 Mosl Mi PG042Document42 pagesMorning - India 20231027 Mosl Mi PG042Karthick JayNo ratings yet

- Market Outlook Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook Market Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- FR MJ23 Examiner's Report - FINALDocument24 pagesFR MJ23 Examiner's Report - FINALdeepshikhagupta514No ratings yet

- Capstone Project-Sanjay.c.m-1-1Document56 pagesCapstone Project-Sanjay.c.m-1-1jagadeesh jagadeeshNo ratings yet

- Sovrenn Times 20 Dec 2023Document21 pagesSovrenn Times 20 Dec 2023zillionpplNo ratings yet

- SM Simulation Group7 Bright SideDocument18 pagesSM Simulation Group7 Bright SideAvishek PanigrahiNo ratings yet

- Reflection 28-3-24Document1 pageReflection 28-3-24sumabdulrahumanNo ratings yet

- The Marketing Plan For British Airways' LHR-JFK and JFK-LHR RoutesDocument8 pagesThe Marketing Plan For British Airways' LHR-JFK and JFK-LHR RoutesMartyna StackiewiczNo ratings yet

- Sustainability 12 06791 With CoverDocument22 pagesSustainability 12 06791 With CoverMeta GoNo ratings yet

- Presntation B188F A3Document26 pagesPresntation B188F A3fuyuhao629No ratings yet

- SSRN Id4729284Document25 pagesSSRN Id4729284shankavkaushik2022No ratings yet

- Investment Analysis.Document11 pagesInvestment Analysis.Eric AwinoNo ratings yet

- Session 7&8 2023 Go First and Multitech DistDocument13 pagesSession 7&8 2023 Go First and Multitech Distyashs-pgdm-2022-24No ratings yet

- Exmar Example Marketing Plan DetailsDocument66 pagesExmar Example Marketing Plan DetailsZeng FanNo ratings yet

- IJCRT1892153Document4 pagesIJCRT1892153Lakshmi vanahalliNo ratings yet

- Market Outlook 22nd March 2012Document4 pagesMarket Outlook 22nd March 2012Angel BrokingNo ratings yet

- Your Week in Egypt - Vodafone CashDocument34 pagesYour Week in Egypt - Vodafone Cashmarwan_amaraNo ratings yet

- Effectiveness of Nifty Stocks and Options Strategy Introduced by National Stock ExchangeDocument9 pagesEffectiveness of Nifty Stocks and Options Strategy Introduced by National Stock ExchangeMohammadimran ShaikhNo ratings yet

- Could A Trader Using Only "Old" Technical Indicator Be Successful at The Forex Market?Document8 pagesCould A Trader Using Only "Old" Technical Indicator Be Successful at The Forex Market?HaichuNo ratings yet

- Technical Analysis of Infosys Technology by Bipul KumarDocument66 pagesTechnical Analysis of Infosys Technology by Bipul Kumarram801No ratings yet

- Homework Assignment 8 Risk ManagementDocument5 pagesHomework Assignment 8 Risk ManagementJorge SmithNo ratings yet

- Bi-Weekly Portfolio Performance UpdatesDocument11 pagesBi-Weekly Portfolio Performance Updatesbsmt22098No ratings yet

- Report Y6-Company FDocument30 pagesReport Y6-Company FNHI DUONG YENNo ratings yet

- Asset Pricing M107 Coursework 23 24Document3 pagesAsset Pricing M107 Coursework 23 24Ali Abdul RasheedNo ratings yet

- Futures: Distinction in Between Futures Contract and Forward ContractDocument85 pagesFutures: Distinction in Between Futures Contract and Forward ContractRDHNo ratings yet

- Top Picks: Research TeamDocument30 pagesTop Picks: Research TeamPooja AgarwalNo ratings yet

- Keerthi Reddy - CommodityDocument9 pagesKeerthi Reddy - CommodityMOHAMMED KHAYYUMNo ratings yet

- Sustainability 12 07031Document16 pagesSustainability 12 07031LokolNo ratings yet

- Test 2Document49 pagesTest 2jsmosselaarNo ratings yet

- Uti Bond Fund PDFDocument2 pagesUti Bond Fund PDFBhavesh ShuklaNo ratings yet

- IMT 09 Security Analysis & Portfolio Management M2Document4 pagesIMT 09 Security Analysis & Portfolio Management M2solvedcareNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAleenaSheikhNo ratings yet

- Stock Price Prediction and Analysis Using Machine Learning TechniquesDocument8 pagesStock Price Prediction and Analysis Using Machine Learning TechniquesIJRASETPublications100% (1)

- Vol 4 No. 20 July 29, 2013 - Passive Commodity Index InvestmentsDocument1 pageVol 4 No. 20 July 29, 2013 - Passive Commodity Index InvestmentsvejayNo ratings yet

- MBA Case Study Finance AssignmentDocument15 pagesMBA Case Study Finance AssignmentsimmonelleNo ratings yet

- CAPMDocument5 pagesCAPMpraveenbtech430No ratings yet

- SMBD DayDocument8 pagesSMBD Daymimansa.dadheech.25jNo ratings yet

- Chapter 6 Security AnalysisDocument46 pagesChapter 6 Security AnalysisAshraf KhamisaNo ratings yet

- MM - 160810 - 01Document10 pagesMM - 160810 - 01Apurv RajNo ratings yet

- P4 RM March 2016 AnswersDocument29 pagesP4 RM March 2016 AnswerswaqarakramNo ratings yet

- STRADDLE: A Short Straddle Is An Options: Strategy 1Document2 pagesSTRADDLE: A Short Straddle Is An Options: Strategy 1bhrigu sudNo ratings yet

- Easy Jet EssayDocument18 pagesEasy Jet Essaygabriel.pl91No ratings yet

- Ultratech Cement Event Update - 120914Document8 pagesUltratech Cement Event Update - 120914Roushan KumarNo ratings yet

- SL& C Study 9Document37 pagesSL& C Study 9abhibth151No ratings yet

- Market Outlook 25th November 2011Document5 pagesMarket Outlook 25th November 2011Angel BrokingNo ratings yet

- Investments Portfolio 2020Document5 pagesInvestments Portfolio 2020Raissa KoffiNo ratings yet

- WP 406Document34 pagesWP 406NDameanNo ratings yet

- ACCA p4 2007 Dec QuestionDocument13 pagesACCA p4 2007 Dec QuestiondhaneshwareeNo ratings yet

- Financial Markets for CommoditiesFrom EverandFinancial Markets for CommoditiesJoel PriolonNo ratings yet

- Thespo Audition Day 3Document4 pagesThespo Audition Day 3TOSHAK SHARMANo ratings yet

- Technical AnalysisDocument4 pagesTechnical AnalysisTOSHAK SHARMANo ratings yet

- UntitledDocument8 pagesUntitledTOSHAK SHARMANo ratings yet

- Cameron and QuinnDocument15 pagesCameron and QuinnTOSHAK SHARMANo ratings yet

- Risk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranDocument2 pagesRisk management for weather-sensitive industries- Many businesses and industries face risk due to changes in weather conditions, such as energy companies, agriculture, manufacturing, construction, and tranTOSHAK SHARMANo ratings yet

- International Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaDocument28 pagesInternational Marketing "Country Notebook" Export of Cardamom To Saudi ArabiaPurohit SagarNo ratings yet

- Konsep DasarDocument89 pagesKonsep DasarKeluargo Sumuyud Ginemnyo HandayaniNo ratings yet

- What Is The Difference Between Socialism and Communism?Document2 pagesWhat Is The Difference Between Socialism and Communism?Muhammad AhmadNo ratings yet

- Community-Assisted Hydro Logic Monitoring - A Kalinga ExperienceDocument15 pagesCommunity-Assisted Hydro Logic Monitoring - A Kalinga ExperienceDan PeckleyNo ratings yet

- 018Document19 pages018mazhararshadNo ratings yet

- TCS On Sale of GoodsDocument16 pagesTCS On Sale of GoodsAshish ModiNo ratings yet

- Aggregate Transportation With Diffrent LeadsDocument25 pagesAggregate Transportation With Diffrent LeadsRavi ValakrishnanNo ratings yet

- PENGENALAN TTL Rev 1 PDFDocument25 pagesPENGENALAN TTL Rev 1 PDFJoni IrawanNo ratings yet

- Poverty As A ChallengeDocument23 pagesPoverty As A ChallengePreetha Balaji100% (1)

- Marine Insurance QuestionnaireDocument4 pagesMarine Insurance QuestionnaireSuraj Theruvath100% (5)

- Silver DBQDocument3 pagesSilver DBQapi-462415004No ratings yet

- Welcome To S. Chand Publishing - Order Receipt PDFDocument1 pageWelcome To S. Chand Publishing - Order Receipt PDFJagan EashwarNo ratings yet

- History and Development of Banking in NepalDocument5 pagesHistory and Development of Banking in NepalPRiNCEMagNus100% (1)

- Beyond GDP Conference Brussels Saboia Ana Brazilian Institute for Geography and Statistics(IBGE) Brazil Saks Katrin European Parliament Belgium Saliez Jean-Yves Inter Environnement Wallonie Belgium Saltelli Andrea Joint Research Centre Italy Salvaris Mike RMIT University Australia Sanchez Juana International Statistical Literacy Project USA Shenna Sanchez Vrije Universiteit Brussel, WWF Philippines Sansoni Michele ARPA Emilia-Romagna Italy Santagata Giulio Government of Italy Italy Santos Jacqueline Federal Ministry of Economy Belgium Sasi Kimmo Eduskunta, MP & member of the Parliamentary Assembly of the Council of Europe Finland Saulnier Jerome European Commission Belgium Scaffi di Alessandra Cafebabel.com Italy Scaglione Giovanna Ministry of Economy and Finance ItalyDocument46 pagesBeyond GDP Conference Brussels Saboia Ana Brazilian Institute for Geography and Statistics(IBGE) Brazil Saks Katrin European Parliament Belgium Saliez Jean-Yves Inter Environnement Wallonie Belgium Saltelli Andrea Joint Research Centre Italy Salvaris Mike RMIT University Australia Sanchez Juana International Statistical Literacy Project USA Shenna Sanchez Vrije Universiteit Brussel, WWF Philippines Sansoni Michele ARPA Emilia-Romagna Italy Santagata Giulio Government of Italy Italy Santos Jacqueline Federal Ministry of Economy Belgium Sasi Kimmo Eduskunta, MP & member of the Parliamentary Assembly of the Council of Europe Finland Saulnier Jerome European Commission Belgium Scaffi di Alessandra Cafebabel.com Italy Scaglione Giovanna Ministry of Economy and Finance ItalyEUBeyondGDPNo ratings yet

- Malta Comp Reg & TaxDocument5 pagesMalta Comp Reg & TaxGigi LunetteNo ratings yet

- James Robertson Financial Disclosure Report For 2010Document7 pagesJames Robertson Financial Disclosure Report For 2010Judicial Watch, Inc.No ratings yet

- TTDocument53 pagesTTNeha KothariNo ratings yet

- Giải Chi Tiết Toeic Reading 2022Document17 pagesGiải Chi Tiết Toeic Reading 2022Lê Nguyễn Minh ThùyNo ratings yet

- Unified TC 1.3Document2 pagesUnified TC 1.3wahab ahamedNo ratings yet

- A Taxonomy For Reconfigurable Manufacturing SystemDocument2 pagesA Taxonomy For Reconfigurable Manufacturing SystemOlayinka OlabanjiNo ratings yet

- Sharing Capex DemandDocument277 pagesSharing Capex DemandUD BLOGNo ratings yet

- Cash Receipt .,,a: A - oDocument3 pagesCash Receipt .,,a: A - oSanjay VarmaNo ratings yet