Professional Documents

Culture Documents

MAF653 FINANCIAL MARKET - Exercise 4

MAF653 FINANCIAL MARKET - Exercise 4

Uploaded by

miss aindatOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAF653 FINANCIAL MARKET - Exercise 4

MAF653 FINANCIAL MARKET - Exercise 4

Uploaded by

miss aindatCopyright:

Available Formats

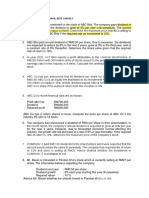

1.

JB007 Bhd is a company producing health medical supplies had invited public to

subscribe a straight bond issued by the firm in the year 2019. Beginning of January

2020, Mr. James purchased a bond from JB007 Bhd with the following information:

Annual coupon payment : RM 100

Maturity Date : December 2030

Principal at par value : RM 1,000

Required:

Calculate for the yield to maturity if the bond is currently selling at RM 1,250 in the

market.

2. VDT Bhd plans to issue a bond as part of funding the firm’s capital expenditure projects.

VDT Bhd will issue a 7% convertible bond with 5 years of maturity period. The bond has

a par value of RM100. The market price for the VDT Bhd’s share is RM6.50 and the

conversion price is 5% of the par value of the bond. Current market price for the bond is

RM115.

Required:

Advise whether it is profitable for the bondholders to convert their bonds into common

stock.

You might also like

- Finance Business Cases ExamplesDocument4 pagesFinance Business Cases Examplestebobe7929No ratings yet

- Mutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1From EverandMutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Rating: 4 out of 5 stars4/5 (2)

- Centrum Private Credit Fund - Annual NewsLetterDocument17 pagesCentrum Private Credit Fund - Annual NewsLettersuraj211198No ratings yet

- FAR570 Jul 2020 Set 1 (Sesi 1) - QDocument4 pagesFAR570 Jul 2020 Set 1 (Sesi 1) - QNURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- Chapter 21 Reclassification of Financial Assets PDFDocument1 pageChapter 21 Reclassification of Financial Assets PDFRonNo ratings yet

- Basic Derivatives PDFDocument2 pagesBasic Derivatives PDFlcNo ratings yet

- FAR210 TOPIC 5 TUTORIAL PAYABLES QsDocument6 pagesFAR210 TOPIC 5 TUTORIAL PAYABLES QsNUR AYUNI BALQISH AHMAD MULIADINo ratings yet

- Tutorial 2-2Document3 pagesTutorial 2-2Tan Zhao FeiNo ratings yet

- 78337bos62701 9Document10 pages78337bos62701 9nerises364No ratings yet

- JS Summary ReportDocument2 pagesJS Summary ReportHariesya IvanNo ratings yet

- 12.feb 2022Document8 pages12.feb 2022paan tiktokNo ratings yet

- May 23Document35 pagesMay 23abhishekag.blyNo ratings yet

- Tutorial 8 Questions (Chapter 5Document2 pagesTutorial 8 Questions (Chapter 5tan JiayeeNo ratings yet

- PropertyRecovery On Track-MIDF-060522Document3 pagesPropertyRecovery On Track-MIDF-060522ALA Meditation - Relaxing MusicNo ratings yet

- PresentationDocument16 pagesPresentationShilpa SabbarwalNo ratings yet

- TOPIC 4 Discussion Questions APRIL 2023Document2 pagesTOPIC 4 Discussion Questions APRIL 2023Miera FrnhNo ratings yet

- Audit of Long-Term LiabilitiesDocument3 pagesAudit of Long-Term LiabilitiesRonamae RevillaNo ratings yet

- Powerpack 240522Document2 pagesPowerpack 240522sibabrata chatterjeeNo ratings yet

- MSME Relief PackageDocument9 pagesMSME Relief Packageajay khandelwalNo ratings yet

- Assignment 3Document13 pagesAssignment 3Hamsa VahiniNo ratings yet

- Exercise (Chapter 3: MFRS 123 Borrowing Cost)Document6 pagesExercise (Chapter 3: MFRS 123 Borrowing Cost)just jumperNo ratings yet

- International Taxation May 23 Suggested AnswersDocument37 pagesInternational Taxation May 23 Suggested AnswersNINTE THANDHANo ratings yet

- 6 January 2021-11amDocument11 pages6 January 2021-11amChenluyan YangNo ratings yet

- Case StudyDocument10 pagesCase Studyamit sharmaNo ratings yet

- FINC 302 Assign 1 - City CampusDocument3 pagesFINC 302 Assign 1 - City CampusSEYRAM ADADEVOHNo ratings yet

- IDBI MergerDocument5 pagesIDBI MergerprajuprathuNo ratings yet

- FM SharesDocument13 pagesFM Sharestrsrinivasa456No ratings yet

- 6 SynopsisDocument2 pages6 SynopsisYeasin TusherNo ratings yet

- T6 LendingDocument7 pagesT6 Lendingkhongst-wb22No ratings yet

- Fin376 - 20224 Case StudyDocument6 pagesFin376 - 20224 Case Study2023502163No ratings yet

- BM Group Assignment 1 Group 1Document37 pagesBM Group Assignment 1 Group 1Pranav MandlikNo ratings yet

- Strategic or Institutional Management Is The Conduct of Drafting, ImplementingDocument8 pagesStrategic or Institutional Management Is The Conduct of Drafting, ImplementingAnwara KonaNo ratings yet

- 4b. Tutorial 4bDocument1 page4b. Tutorial 4bSiew Hui En A20A1947No ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- Tutorial 1 & 2Document11 pagesTutorial 1 & 2Annyi Chan100% (1)

- Before The National Company Law Tribunal at Bengaluru Application No. 5/ 2021 in IBC Application No. 100/ 2021Document6 pagesBefore The National Company Law Tribunal at Bengaluru Application No. 5/ 2021 in IBC Application No. 100/ 2021Shivamp6No ratings yet

- Bond ValuationDocument3 pagesBond ValuationShaji KuttyNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementRohit GoyalNo ratings yet

- NBFCDocument20 pagesNBFCVipul Sah100% (1)

- ControllingDocument11 pagesControllinghtethtethlaingNo ratings yet

- Share Based DiscussionDocument2 pagesShare Based DiscussionSpongebob SquarepantsNo ratings yet

- Bwff1013 Foundations of Finance Quiz #3Document8 pagesBwff1013 Foundations of Finance Quiz #3tivaashiniNo ratings yet

- BM-Group Assignment-1 - Group-1 NewDocument36 pagesBM-Group Assignment-1 - Group-1 NewPranav MandlikNo ratings yet

- Far570 Q Set 1Document8 pagesFar570 Q Set 1NURUL NAZAHANNIE MOHAMAD NAJIBNo ratings yet

- 5 6123157989974082089Document33 pages5 6123157989974082089Udai SankarNo ratings yet

- ACCTGREV1 - 002 Notes Payable and RestructuringDocument2 pagesACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNo ratings yet

- 3 ReportDocument49 pages3 Reportahmedtariq3001No ratings yet

- Loan Services of Trust BankDocument19 pagesLoan Services of Trust BankMd. Shahnewaz KhanNo ratings yet

- AL Financial Management Nov Dec 2016Document4 pagesAL Financial Management Nov Dec 2016hyp siinNo ratings yet

- Bank of BarodaDocument17 pagesBank of Barodashortbig09No ratings yet

- Analysis of Bank StatmentsDocument5 pagesAnalysis of Bank Statmentssagar_lawteNo ratings yet

- Exercises Compound Financial InstrumentsDocument1 pageExercises Compound Financial InstrumentsQueeny Mae Cantre ReutaNo ratings yet

- In 2014 Dub Tarun Founded A Firm Using 200 000Document1 pageIn 2014 Dub Tarun Founded A Firm Using 200 000Let's Talk With HassanNo ratings yet

- Advisor Former Managing Director & Chief Executive Officer: Presented byDocument19 pagesAdvisor Former Managing Director & Chief Executive Officer: Presented byFahomeda Rahman SumoniNo ratings yet

- Bond Exercises Nov 2022Document2 pagesBond Exercises Nov 2022paan tiktokNo ratings yet

- 6 BondDocument18 pages6 Bondßïshñü PhüyãlNo ratings yet

- Module 1 and 3 AssignmentDocument12 pagesModule 1 and 3 AssignmentPrincess Maeca OngNo ratings yet

- Harith Fadli Bin Hashim-AgDocument2 pagesHarith Fadli Bin Hashim-AgReal NurulNo ratings yet

- Session 1 Handout ExDocument2 pagesSession 1 Handout ExasimmishraNo ratings yet