Professional Documents

Culture Documents

Cash Book (Bank Column) : Answer Key of BRS, Boe Inventory Q1. in The Books of G

Uploaded by

PRAKHAR MUNDRAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Book (Bank Column) : Answer Key of BRS, Boe Inventory Q1. in The Books of G

Uploaded by

PRAKHAR MUNDRACopyright:

Available Formats

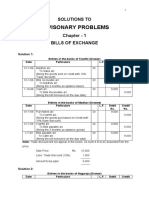

ANSWER KEY OF BRS, BOE INVENTORY

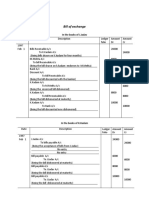

Q1. In the Books of G

Cash Book (Bank Column)

Receipts ` Payments `

To Balance b/d 4,45,000 By Insurance premium A/c 2,700

To Dividend A/c 4,000 By Correction of errors 500

To Rent A/c 60,000 By Bank charges 150

To Bill receivable A/c 5,900 By Bill payable 20,000

By Balance c/d 4,91,550

5,14,900 5,14,900

Bank Reconciliation Statement as on 30th June, 2021

`

Adjusted balance as per cash book 4,91,550

Add: Cheques issued but not presented for payment till 30th June, 2021 60,000

Less: Cheques paid into bank for collection but not collected till 30th (55,500)

June, 2021

Balance as per pass book 4,96,050

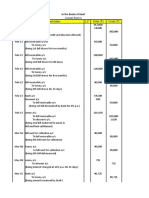

Q2. Journal Entries in the books of Mr. A

2020 (`) (`)

May,12 B’s A/c Dr. 36,470

To Sales account 36,470

(Being goods sold to B on credit)

May,12 Bills receivable (No. 1) A/c Dr. 16,470

Bills receivable (No. 2) A/c Dr. 20,000

To B’s A/c 36,470

(Being drawing of bills receivable No. 1 due for

maturity on 15.6.2020 and bills receivable No. 2

due for maturity on 14.8.2020)

OR

Bills receivable A/c Dr. 36,470

To B’s A/c 36,470

(Being acceptances received from B, one for

` 16,470 at one month and other for ` 20,000 at

3 months)

June,5 Bills for Collection A/c Dr. 36,470

To Bills receivable (No.1) A/cTo 16,470

Bills receivable (No.2) A/c 20,000

(Being both the bills sent to bank for collection)

OR

Bills for Collection A/c Dr. 36,470

To Bills receivables A/c 36,470

(Being B’s acceptances sent for collection ondue

dates)

June,15 Bank A/c Dr. 16,470

To Bills for Collection A/c 16,470

(Being amount received on retirement of Bills

receivable No. 1)

Aug. 14 B’s A/c Dr. 20,020

To Bills for Collection a/c 20,000

20

To Noting Charges or Bank Charges (Being

the amount due from Mr. B on dishonour

of his acceptance on presentation on the due

date)

480

Aug. 16 B’s A/c Dr. 480

To Interest a/c(Being interest due)

Aug. 16 Bank/Cash A/c Dr. 8020

To B’s A/c 8020

(Being cash received)

Aug. 16 Bills receivable (No. 3) A/c Dr. 12480

12480

To B’s A/c

(Being Bills receivable (No. 3) drawn accepted by

B)

OR

Alternatively combined entry may be given for

the above two entries:

Bank/Cash a/c Dr. 8020

Bills receivable a/c Dr. 12480

20500

To B’s A/c

(Being cash and new acceptance at 3 months

received from B)

Aug. 16 12480

Bills for Collection A/c Dr.

12480

To Bills receivable (No.3) A/c

(Being Bills receivable (No.3) sent to bank for

collection)

OR

Bills for collection A/c Dr.

12480

To Bills receivable A/c 12480

(Being new acceptance sent to bank for

collection on due date)

OCT 1 BANK A/C 12240

REBATE AC 240

TO BILLS FOR COLLECTION 12480

(Being amount received on retirement of Bills

receivable (No.3))

Alternately combined entry may be given for the first three entries of Aug,16 :

Aug,16 Bank/ Cash A/c Dr. 8,020

Bills Receivable (No. 3) A/c Dr. 12,480

TO B;s ac 20020

To interest

480

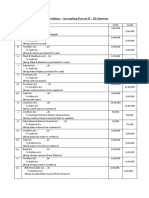

Q3. In the books of Suresh

Journal Entries

Date Particulars Debit Credit

Amount Amount

2020 ` `

April 15 Bills receivable account Dr. 15,000

To Anup’s account 15,000

(Being acceptance received from Anup for

mutual accommodation)

April 18 Bank account Dr. 14,700

Discount account Dr. 300

To Bills receivable account 15,000

(Being bill discounted with bank)

April 18 Anup’s account Dr. 5,000

To Bank account 4,900

To Discount account 100

(Being one-third proceeds of the bill sent

toAnup)

July 18 Anup’s account Dr. 17,500

To Bills payable account 17,500

(Being Acceptance given)

July 18 Bank account Dr. 2,825

Discount account (400x/3/4) Dr. 300

To Anup’s account 3,125

(Being proceeds of second bill received from

Anup)

Oct.21 Bills payable account Dr. 17,500

To Anup’s account 17,500

(Being bill dishonoured due to insolvency)

Oct.31 Anup’s account (10,000+3,125 ) Dr. 13,125

To Bank account 6,562.50

To deficiency ac 6,562.50

Q4. Statement of Valuation of Stock as on 31st March, 2021

`

Value of stock as on 1st April, 2020 28,00,000

Add: Purchases during the year 1,38,40,000

Add: Manufacturing expenses during the above period 28,00,000

1,94,40,000

Less: Cost of sales during the period:

Sales 2,08,80,000

Less: Gross profit 51,40,000 1,57,40,000

Value of stock as on 31.3.2021 37,00,000

Working Note:

`

Calculation of gross profit:

Gross profit on normal sales 25/100 x (2,08,80,000 -6,40,000) 50,60,000

Gross profit on the particular (abnormal) item 6,40,000 - (8,00,000 – 80,000

2,40,000)

51,40,000

The value of closing stock on 31st March, 2021 may, alternatively, be found out bypreparing

Trading Account for the year ended 31st March, 2021.

Alternatively the solution can be presented in the following manner:

Dr Trading account for the year ended 31st March, 2021 Cr

Normal Abnormal Total Normal Abnormal Total

To Opening 22,40,000 5,60,000 28,00,000 By Sales 2,02,40,000 6,40,000 2,08,80,000

Stock 13,8,40,000 0 1,38,40,000 By Closing 37,00,000 0 37,00,000

To Purchases 28,00,000 0 28,00,000 Stock

To Manufacturing

50,60,000 80,000 51,40,000

Expenses

To Gross Profit

(Working Note)*

Total 2,39,40,000 6,40,000 2,45,80,000 2,39,40,000 6,40,000 2,45,80,000

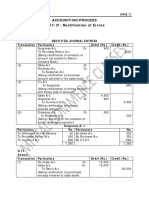

Q5. Oil Mill

Calculation of the value of Inventory as on 31-3-2021

Receipts Issues Balance

Date Units Rate Amount Unit Rate Amoun Units Rate Amount

s t

` ` ` ` ` `

1-1-2021 Balance Nil

1-1-2021 10 300 3,000 10 300 3,000

15-1-2021 5 300 1,500 5 300 1,500

1-2-2021 20 400 8,000 25 380 9,500

15-2-2021 10 380 3,800 15 380 5,700

20-2-2021 10 380 3,800 5 380 1,900

Therefore, the value of Inventory as on 31-3-2021 = 5 units @ `380 = `1,900

You might also like

- Accounts Class 12Document167 pagesAccounts Class 12Utkarsh Navandar100% (1)

- Assignment No 1 FinalDocument13 pagesAssignment No 1 FinalMuhammad AwaisNo ratings yet

- Solution Ultimate Sample Paper 2Document7 pagesSolution Ultimate Sample Paper 2Nitin KumarNo ratings yet

- Accountingkey (CH 3) 908Document8 pagesAccountingkey (CH 3) 908yasir habibNo ratings yet

- Kapoor Software LTD CRCTD AnswerDocument9 pagesKapoor Software LTD CRCTD AnswerMaryNo ratings yet

- SolutionDocument23 pagesSolutionKavita WadhwaNo ratings yet

- F004 Bills of Exchange, Sale or Return and ADD Teachers Test 4Document11 pagesF004 Bills of Exchange, Sale or Return and ADD Teachers Test 4bhumikaaNo ratings yet

- Accounts ProjectDocument21 pagesAccounts Projectkaid30306No ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyDocument3 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 3 AccountancyManaswi WareNo ratings yet

- Ans - 21.11.23 CA-foun. MTP Accounts Dec. 23Document10 pagesAns - 21.11.23 CA-foun. MTP Accounts Dec. 23RohitNo ratings yet

- CLASS WORK 2 (7 DEC) CHP 6Document10 pagesCLASS WORK 2 (7 DEC) CHP 6Isha KatiyarNo ratings yet

- CA Foundation Accounts A MTP 2 June 2023Document12 pagesCA Foundation Accounts A MTP 2 June 2023Vranda RastogiNo ratings yet

- ProblemsDocument12 pagesProblemsShereen FathimaNo ratings yet

- Assignment - Journal (P2)Document1 pageAssignment - Journal (P2)MD. Arif HossainNo ratings yet

- Marking Scheme Mock Test I 2023 24Document9 pagesMarking Scheme Mock Test I 2023 24HARSH CHAURASIYANo ratings yet

- Cia-2 AccountsDocument8 pagesCia-2 Accountskavya.j1104No ratings yet

- AccountsDocument43 pagesAccountsgogunikhilNo ratings yet

- Q.1 Record This Transactions in Cash Book and Other LedgersDocument7 pagesQ.1 Record This Transactions in Cash Book and Other LedgersAnuj GohainNo ratings yet

- Addendum (30.8.2022)Document4 pagesAddendum (30.8.2022)Arjita DubeyNo ratings yet

- H077 Bills of ExchangeDocument5 pagesH077 Bills of ExchangeIsha KatiyarNo ratings yet

- Additional Illustrations-13Document9 pagesAdditional Illustrations-13Gulneer LambaNo ratings yet

- Additional Illustration 17Document2 pagesAdditional Illustration 17ROHIT PAREEKNo ratings yet

- Journal Problems For AssignmentDocument2 pagesJournal Problems For AssignmentMD. Arif HossainNo ratings yet

- Accounts 1Document3 pagesAccounts 1Akhil JainNo ratings yet

- Department of Technical Education Andhra PradeshDocument66 pagesDepartment of Technical Education Andhra Pradeshapi-3849444No ratings yet

- Paper2 Set1 SolutionDocument5 pagesPaper2 Set1 Solutionadityatiwari122006No ratings yet

- Ca FND Accounting Process - IiDocument11 pagesCa FND Accounting Process - IiPraveen kumarNo ratings yet

- Kendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyDocument4 pagesKendriya Vidyalaya Sangathan, Lucknow Region TERM-II 2021-22 Marking Scheme Class - XI Subject - AccountancyThe Web RendezvousNo ratings yet

- RKG Accounts (XI) CH 9 To 16 SolDocument3 pagesRKG Accounts (XI) CH 9 To 16 SolJohn WickNo ratings yet

- CA Final FR A MTP 2 May 2024 Castudynotes ComDocument14 pagesCA Final FR A MTP 2 May 2024 Castudynotes Compabitrarijal1227No ratings yet

- Journal Entire in The Books of MR Venugopal-2Document10 pagesJournal Entire in The Books of MR Venugopal-2Teja Yadav100% (1)

- Ledger AccountsDocument4 pagesLedger AccountsSailesh VasaNo ratings yet

- CLASS WORK 2 (11 DEC) CHP 6Document14 pagesCLASS WORK 2 (11 DEC) CHP 6Isha KatiyarNo ratings yet

- Bank Reconciliation StatementDocument9 pagesBank Reconciliation StatementMarvin tvNo ratings yet

- Xi See Acc 2021 Set 2 MsDocument5 pagesXi See Acc 2021 Set 2 Mss1672snehil6353No ratings yet

- CA Foundation Accounting SolutionsDocument117 pagesCA Foundation Accounting SolutionsAkash AjayNo ratings yet

- Answer SheetDocument7 pagesAnswer SheetDeepak KaphleNo ratings yet

- Ledger 23 07 1Document10 pagesLedger 23 07 1Arman AhmedNo ratings yet

- Accounts AssignmentDocument18 pagesAccounts AssignmentDevanshi RaghuvanshiNo ratings yet

- Accounts Sample Paper 03 0253b13dc89ddDocument25 pagesAccounts Sample Paper 03 0253b13dc89ddPalashNo ratings yet

- Ledger PostingDocument3 pagesLedger Postingdeo omachNo ratings yet

- Additional Illustrations-14Document8 pagesAdditional Illustrations-14Gulneer LambaNo ratings yet

- Accountancy-Books of Prime EntryDocument8 pagesAccountancy-Books of Prime EntryGedie Rocamora100% (1)

- The Schram Academy: Accounts ProjectDocument17 pagesThe Schram Academy: Accounts ProjectVarshini KNo ratings yet

- Double Column Cash Book 6 MarksDocument5 pagesDouble Column Cash Book 6 MarksGagan VNo ratings yet

- FA Problems SolutionsDocument246 pagesFA Problems SolutionsK. Pavithraa SreeNo ratings yet

- Solutions To Revisionary ProblemsDocument58 pagesSolutions To Revisionary ProblemsM JEEVARATHNAM NAIDUNo ratings yet

- Solutions To Revisionary Problems IIDocument53 pagesSolutions To Revisionary Problems IIM JEEVARATHNAM NAIDUNo ratings yet

- BRSDocument2 pagesBRSexcelclassesjindNo ratings yet

- Accounts Assignment 1Document8 pagesAccounts Assignment 1Devanshi RaghuvanshiNo ratings yet

- MTP-1 (Solutions (QR Code) )Document13 pagesMTP-1 (Solutions (QR Code) )ajay.007.sngNo ratings yet

- Reading of Ledger AccountDocument18 pagesReading of Ledger Accountneeru79200050% (2)

- Habib MD Martujaq3 - CopDocument29 pagesHabib MD Martujaq3 - CopArman AhmedNo ratings yet

- Retirement of Partnership FirmDocument3 pagesRetirement of Partnership FirmPawan Bhati 33No ratings yet

- Quiz CCEDocument5 pagesQuiz CCEwesNo ratings yet

- Pre AssessmentDocument9 pagesPre AssessmentVenkatramana KNo ratings yet

- Accounts HWDocument12 pagesAccounts HWAastha AgarwalNo ratings yet

- Cbse cl12 Ead Accountancy Answers To Sample Paper 6Document15 pagesCbse cl12 Ead Accountancy Answers To Sample Paper 6amaankhan828768No ratings yet

- RKG Class 11 Accounts Mock 1 SolDocument14 pagesRKG Class 11 Accounts Mock 1 SolSangket MukherjeeNo ratings yet

- How To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionFrom EverandHow To File Your Own Bankruptcy: The Step-by-Step Handbook to Filing Your Own Bankruptcy PetitionNo ratings yet

- Financing New Venture (EP60010)Document20 pagesFinancing New Venture (EP60010)Manish MeenaNo ratings yet

- Hybrid Financing: Preferred Stock, Warrants, and ConvertiblesDocument45 pagesHybrid Financing: Preferred Stock, Warrants, and ConvertiblesKim Cristian Maaño0% (1)

- Bureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CityDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of Finance Quezon CitygelskNo ratings yet

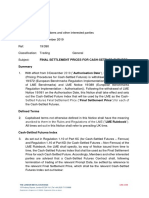

- 19 390 Final Settlement Prices For Cash Settled FuturesDocument4 pages19 390 Final Settlement Prices For Cash Settled FuturesAmer ZamanNo ratings yet

- FrancisHunt - The Market Sniper - TraderProfileDocument4 pagesFrancisHunt - The Market Sniper - TraderProfileAndrei Cojocaru100% (1)

- Case 01 (DSP Final)Document46 pagesCase 01 (DSP Final)2rmj100% (5)

- Cost of CapitalDocument53 pagesCost of CapitalHasan Farooq KhanNo ratings yet

- Management Advisory Services: The Review School of AccountancyDocument15 pagesManagement Advisory Services: The Review School of AccountancyNamnam KimNo ratings yet

- BCK Test Paper (40 Marks) Nov 2023 With AnswersDocument6 pagesBCK Test Paper (40 Marks) Nov 2023 With Answersbaidshruti123No ratings yet

- Mba Project 3rd SemDocument109 pagesMba Project 3rd SemrupshikhaNo ratings yet

- Accounting For DerivativesDocument42 pagesAccounting For DerivativesSanath Fernando100% (1)

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Liquidation Based ValuationDocument45 pagesLiquidation Based ValuationMagic ShopNo ratings yet

- Security Analysis and Portfolio Management: Multiple Choice QuestionsDocument2 pagesSecurity Analysis and Portfolio Management: Multiple Choice QuestionsSundarachselvan SubramanianNo ratings yet

- HW 3Document3 pagesHW 3chocolatedoggy12100% (1)

- Prudential Credit GuidelinesDocument8 pagesPrudential Credit GuidelinesRhea SimoneNo ratings yet

- Cyber ScamDocument11 pagesCyber ScamGinger KalaivaniNo ratings yet

- Advanced Accounting 13th Edition Hoyle Solutions Manual DownloadDocument65 pagesAdvanced Accounting 13th Edition Hoyle Solutions Manual DownloadMay Madrigal100% (23)

- Literature Review of Real Estate Sector in IndiaDocument6 pagesLiterature Review of Real Estate Sector in Indiagvyztm2f100% (1)

- Investment in Turkey 2019Document144 pagesInvestment in Turkey 2019ngwaNo ratings yet

- Summers-Barsky Gold ThesisDocument4 pagesSummers-Barsky Gold Thesisdwk3zwbx100% (2)

- Stocks and SharesDocument23 pagesStocks and Sharesmanish_sher100% (1)

- Overview of Vie Tin BankDocument2 pagesOverview of Vie Tin BankTran DatNo ratings yet

- Answer Sheet For Fixed Income ValuationDocument3 pagesAnswer Sheet For Fixed Income ValuationAbdullah QureshiNo ratings yet

- Cash Flow From Assets - Solution PDFDocument3 pagesCash Flow From Assets - Solution PDFSeptian Sugestyo PutroNo ratings yet

- Going Public - Ryan WilkinsDocument1 pageGoing Public - Ryan WilkinsStradlingNo ratings yet

- PMB Memo With Action PlanDocument29 pagesPMB Memo With Action PlansaharaReporters headlines96% (25)

- Axis Top Picks - Apr 2024 - Final - 01-04-2024 - 16Document82 pagesAxis Top Picks - Apr 2024 - Final - 01-04-2024 - 16RASHMIN GADHIYANo ratings yet

- FM Leverage SailDocument19 pagesFM Leverage SailMohammad Yusuf NabeelNo ratings yet