Professional Documents

Culture Documents

Article Manuel Vicente Takes Somoil Into Big League With Lourenco S - 109681641 109681641

Uploaded by

Luzolo MiguelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Article Manuel Vicente Takes Somoil Into Big League With Lourenco S - 109681641 109681641

Uploaded by

Luzolo MiguelCopyright:

Available Formats

28/02/2023

ANGOLA ENERGY

Manuel Vicente takes Somoil into

big league with Lourenco's

Copy exclusively for Ian CLOKE - Subscriber # AA047055

backing

Angolan junior Somoil has increased its asset portfolio through a

number of purchase since the start of last year. Behind this

expansion is Manuel Vicente, the oil strategist of former

president José Eduardo dos Santos, who is also close to Joao

Lourenco.

Manuel Vicente at the COP21 World Climate Change Conference 2015, France, 30

November 2015. © Etienne Laurent/EPA/MaxPPP

Africa Intelligence - 142 rue Montmartre - 75002 Paris, France - Tel: + 33 1 44 88 26 10

| Page 1/3

client@indigo-net.com - Africaintelligence.com

ANGOLA : Manuel Vicente takes Somoil into big league with

Lourenco's backing

Somoil has spent more than $1.2bn on acquisitions in the offshore oil sector since

the start of 2022. This has resulted in an exceptional change of dimension for the

company, which for a long time contented itself with its interests in minor

offshore permits like 03/05 and 02/05, and the FS, FST and CON-1 onshore

blocks.

Copy exclusively for Ian CLOKE - Subscriber # AA047055

As we revealed (AI, 02/02/23), Somoil has been able to make all these acquisitions

after having benefited, like other Angolan companies, from an amnesty granted at

the start of Joao Lourenco's presidency, which enabled it to repatriate funds it had

been holding outside the country. On 26 June 2018, Lourenco allowed Angolan

citizens 180 days to bring their capital back into the country without having to

face legal action or tax penalties.

Inseparable pair

Manuel Vicente, who was Angolan vice president from 2012 to 2017, is officially no

longer a shareholder in Somoil and his name appears on none of its official

documents. He is nevertheless the driving force behind the company's expansion.

He is being backed in this by Lourenco, who is determined to make the company

the success story of an Angolan oil industry that is largely dominated by Western

majors. The fact that Lourenco chose Vicente's company for this purpose was no

coincidence, moreover.

When Lourenco was ousted from his post as secretary general of the ruling MPLA

by José Eduardo dos Santos in 2003 for having been too open about his

presidential ambitions, Vicente, who was then head of Sonangol, aided him

financially and helped him maintain contact with dos Santos. Lourenco went on

to become defence minister in 2014, vice chairman of the MPLA in 2016 and was

then selected as the party's candidate in the 2017 presidential elections, which he

won.

Lourenco and Vicente have been inseparable since the early 2000s and Vicente,

who now lives in Dubai for part of the year, continues to advise Lourenco on

financial and oil matters. It is highly unlikely, therefore, that there will be any

attempt to prosecute Vicente over his management of the country's oil interests

during the dos Santos years. In January 2018, Lourenco had no qualms about

creating a diplomatic incident, moreover, by forcing Portugal to allow a

Africa Intelligence - 142 rue Montmartre - 75002 Paris, France - Tel: + 33 1 44 88 26 10

| Page 2/3

client@indigo-net.com - Africaintelligence.com

ANGOLA : Manuel Vicente takes Somoil into big league with

Lourenco's backing

corruption case opened against Vicente by a Portuguese magistrate to be dealt

with in Angola. At the time, Vicente had immunity from prosecution in Angola,

which meant that he was not prosecuted.

Permits aplenty

Copy exclusively for Ian CLOKE - Subscriber # AA047055

In mid-February, Somoil, now headed by former Sonangol executive Edson dos

Santos, paid $830m for Galp's 9% stake in Chevron-operated Block 14 and its 4.5%

holding in Block 14-K, also operated by Chevron, as well as its 5% stake in Block

32, which was brought into production by TotalEnergies in 2018. Altogether, Galp

interests represent a production total of 10,400 bpd.

This purchase, which still has to be approved by the regulatory authority, the

ANPG, is only the latest in a long series. In 2022, Somoil bought the interests of

Japan's Inpex and France's TotalEnergies on blocks 14 (20%) and 14T (10%), as

well as the 2.5% stake held by Thailand's PTTEP in the TotalEnergies-operated

Block 17/06. At the start of last year, with Sonangol P&P, it also paid out $355m for

stakes in blocks 18 (8.28%), 31 (10%) and 27 (25%).

© Copyright Africa Intelligence.

Reproduction and dissemination prohibited (Intranet...) without written

permission - 109237100.0

Publication edited by

Indigo Publications (Paris, France)

Published on AfricaIntelligence.com (Commission paritaire 1225

Y 92894)

Africa Intelligence - 142 rue Montmartre - 75002 Paris, France - Tel: + 33 1 44 88 26 10

| Page 3/3

client@indigo-net.com - Africaintelligence.com

You might also like

- Pestal FranceDocument5 pagesPestal FranceNikhil Vijapur100% (1)

- France PestelDocument4 pagesFrance PestelJenab Pathan94% (16)

- Critical Reflections On Oil Governance Discourse in UgandaDocument26 pagesCritical Reflections On Oil Governance Discourse in UgandaAfrican Centre for Media ExcellenceNo ratings yet

- France Ext Env Final 2Document14 pagesFrance Ext Env Final 2ashaannigeriNo ratings yet

- Total Company: Grupi: Revo Nasvrela Mulanika Rita Mauntana Sari Rion Nugraha Rizki BudimanDocument13 pagesTotal Company: Grupi: Revo Nasvrela Mulanika Rita Mauntana Sari Rion Nugraha Rizki BudimananchaNo ratings yet

- Privatization Experiences in FranceDocument55 pagesPrivatization Experiences in FranceWongaNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument6 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- Plastic Omnium 2015 RegistrationDocument208 pagesPlastic Omnium 2015 Registrationgsravan_23No ratings yet

- Tunisia Tax: New Legal Framework ProjectDocument7 pagesTunisia Tax: New Legal Framework Projectch_nassim7679No ratings yet

- France PestelDocument4 pagesFrance PestelSuraj OVNo ratings yet

- CountryevalDocument13 pagesCountryevalapi-527120183No ratings yet

- Pronto ProDocument6 pagesPronto ProSamima AkteriNo ratings yet

- Unquote 110827Document56 pagesUnquote 110827Giuseppe BoemoNo ratings yet

- TNC2Document13 pagesTNC2ZhiXian Chin100% (1)

- PEst Analysis of Mecca ColaDocument3 pagesPEst Analysis of Mecca Colaanon_314850343No ratings yet

- Economic Situation in FranceDocument3 pagesEconomic Situation in FranceAnıl AlbayrakNo ratings yet

- Sustainability Case Study: Cogitel (Tunisia)Document4 pagesSustainability Case Study: Cogitel (Tunisia)IFC SustainabilityNo ratings yet

- Icade Has Announced The Signature of A New Sale Agreement in The "La Factory" Building in Boulogne and The Signature of A New LeaseDocument1 pageIcade Has Announced The Signature of A New Sale Agreement in The "La Factory" Building in Boulogne and The Signature of A New LeaseIcadeNo ratings yet

- Invest in France AgencyDocument34 pagesInvest in France AgencyGaurav MalikNo ratings yet

- Raj IBSDocument21 pagesRaj IBSraj bhadauriaNo ratings yet

- DB Report Trafigura Angola February 2013 EDocument7 pagesDB Report Trafigura Angola February 2013 Ekr2983No ratings yet

- Capital HumainDocument13 pagesCapital HumainMourad HriguefNo ratings yet

- France Country PPR 1,2,3Document21 pagesFrance Country PPR 1,2,3tejasNo ratings yet

- Gulfood Dubai 2020: FEBRUARY 16-20, 2020 Dubai World Trade CenterDocument60 pagesGulfood Dubai 2020: FEBRUARY 16-20, 2020 Dubai World Trade CenterVYAPAR INDIANo ratings yet

- The Automobile Assembly Industry in Portugal (1960-1988)Document28 pagesThe Automobile Assembly Industry in Portugal (1960-1988)benazechNo ratings yet

- Pest Analysis PortugalDocument10 pagesPest Analysis PortugalSergiu KrkNo ratings yet

- In Brief: Bouygues ConstructionDocument36 pagesIn Brief: Bouygues ConstructionLeonidas Zapata OlivaresNo ratings yet

- Final ProntoProDocument9 pagesFinal ProntoProSamima AkteriNo ratings yet

- Cimpor Afi FinalDocument19 pagesCimpor Afi FinalEdouard EricNo ratings yet

- Eramet PR Covid 19 20200330 PDFDocument3 pagesEramet PR Covid 19 20200330 PDFMcZeONo ratings yet

- The Determining Factors of Foreign Direct Investment in MoroccoDocument19 pagesThe Determining Factors of Foreign Direct Investment in MoroccoAbid KhanNo ratings yet

- Oil Exploration and Production in Africa Since 2014: Evolution of The Key Players and Their StrategiesDocument32 pagesOil Exploration and Production in Africa Since 2014: Evolution of The Key Players and Their StrategiesMelo L'infatiguableNo ratings yet

- CS - SIT SIT Investe in Tunisia Nell'apertura Di Un Hub Per La Produzione Di Componenti Elettroniche e Plastiche - ENGDocument2 pagesCS - SIT SIT Investe in Tunisia Nell'apertura Di Un Hub Per La Produzione Di Componenti Elettroniche e Plastiche - ENGAymen SyOudNo ratings yet

- Orange SaDocument12 pagesOrange SaRizwan KhanNo ratings yet

- Globalisation - Challenges, Rewards, QuestionDocument11 pagesGlobalisation - Challenges, Rewards, QuestionPamela QuinteroNo ratings yet

- ODL RapportAnnuel 2021 FINAL BDDocument75 pagesODL RapportAnnuel 2021 FINAL BDCesare Antonio Fabio RiilloNo ratings yet

- Greasy Palms BuyersDocument70 pagesGreasy Palms BuyersEmun KirosNo ratings yet

- Brochure Maritime Industry 2015 PDFDocument4 pagesBrochure Maritime Industry 2015 PDFManagement ProductiesNo ratings yet

- News Coverage - France: Economy and Business News From The Past WeekDocument5 pagesNews Coverage - France: Economy and Business News From The Past Weekapi-248259954No ratings yet

- ECO - Bonn Climate Negotiations - May 19 2012Document2 pagesECO - Bonn Climate Negotiations - May 19 2012kylegraceyNo ratings yet

- Rspo Letter From CasinoDocument1 pageRspo Letter From CasinoFriscaUtamiNafratilovaHNo ratings yet

- 2013prange EncyclopediaMultinationalsDocument12 pages2013prange EncyclopediaMultinationals20-224-Jessica ArmeisNo ratings yet

- FINALDocument30 pagesFINALAnindit BorkotokyNo ratings yet

- Multinational Corporations in The Global EconomyDocument21 pagesMultinational Corporations in The Global EconomyswapnilnemadeNo ratings yet

- Annual Report 2009Document338 pagesAnnual Report 2009ferrovialNo ratings yet

- Vav HvacDocument47 pagesVav HvacMuraryspotty100% (1)

- PR MT 10 06 2021 - PH - Nis - 0Document2 pagesPR MT 10 06 2021 - PH - Nis - 0elvis ehoroNo ratings yet

- Eramet PR Lithium Project 20200408Document2 pagesEramet PR Lithium Project 20200408Kaizen Mejora ContinuaNo ratings yet

- Bonatelli Wines Is A Premier Wine Company Based in AustraliaDocument6 pagesBonatelli Wines Is A Premier Wine Company Based in AustraliasammyNo ratings yet

- The Multinational CorporationDocument17 pagesThe Multinational CorporationCristina SavaNo ratings yet

- RP - Icade Le BeauvaisisDocument1 pageRP - Icade Le BeauvaisisIcadeNo ratings yet

- Agrotourism PaperDocument18 pagesAgrotourism PaperToni Filiposki100% (1)

- Laatste Nieuws.20140807.231719Document2 pagesLaatste Nieuws.20140807.231719lizardwindow3No ratings yet

- InvestorEvent 2010Document246 pagesInvestorEvent 2010indra purnamaNo ratings yet

- Documento NuevoDocument7 pagesDocumento NuevovalentinaNo ratings yet

- Profit en Catalogue PE 2017Document54 pagesProfit en Catalogue PE 2017dokundotNo ratings yet

- Epure Factsheet Jobs GrowthDocument2 pagesEpure Factsheet Jobs GrowthlualineNo ratings yet

- The French Job Market and Industries That Are Currently ThrivingDocument2 pagesThe French Job Market and Industries That Are Currently ThrivingAvinash Totad RajappaNo ratings yet

- Dami SB Agrinutrition ProposalDocument14 pagesDami SB Agrinutrition ProposalGianluca LucchinNo ratings yet

- Silicon Europe: The Great Adventure of the Global Chip Industry and an Italian-French Company that Makes the World Go RoundFrom EverandSilicon Europe: The Great Adventure of the Global Chip Industry and an Italian-French Company that Makes the World Go RoundNo ratings yet

- Labor Costs in Manufacturing IndustriesDocument18 pagesLabor Costs in Manufacturing Industriesminhduc2010No ratings yet

- This Study Resource WasDocument2 pagesThis Study Resource WasAron Rabino ManaloNo ratings yet

- Faktor Resiko TBDocument15 pagesFaktor Resiko TBdrnurmayasarisihombingNo ratings yet

- Global Marketing DjarumDocument20 pagesGlobal Marketing DjarumcindyoclNo ratings yet

- TATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaDocument1 pageTATA 1MG Healthcare Solutions Private Limited: Wadi On Jalamb Road Khamgaon,, Buldhana, 444303, IndiaTejas Talole0% (1)

- Commercial Law Reviewer, MercantileDocument60 pagesCommercial Law Reviewer, MercantilecelestezerosevenNo ratings yet

- Shubham Moon-OPPO Smartphones-2019170900010011-MBA Marketing 1Document30 pagesShubham Moon-OPPO Smartphones-2019170900010011-MBA Marketing 1shubham moonNo ratings yet

- Golden Rules For AccountingDocument4 pagesGolden Rules For AccountingRoshani ChaudhariNo ratings yet

- Affiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Document20 pagesAffiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Endubai SuryawanshiNo ratings yet

- Press Release JFSL and Blackrock Agree To Form JVDocument3 pagesPress Release JFSL and Blackrock Agree To Form JVvikaskfeaindia15No ratings yet

- Typeform Invoice BTLWMgTYQCPq91RjvDocument1 pageTypeform Invoice BTLWMgTYQCPq91RjvAakash vermaNo ratings yet

- While It Is True That Increases in Efficiency Generate Productivity IncreasesDocument3 pagesWhile It Is True That Increases in Efficiency Generate Productivity Increasesgod of thunder ThorNo ratings yet

- Proof of Residence LeaseDocument13 pagesProof of Residence Leaseapi-366174595No ratings yet

- Day 1 Preparation AssignmentDocument2 pagesDay 1 Preparation AssignmentKevin KimNo ratings yet

- Business Plan CafeDocument10 pagesBusiness Plan CafeNO NAME100% (1)

- MID-TERM EXAM 1 Sem 1, 2023 24 - ValuationDocument2 pagesMID-TERM EXAM 1 Sem 1, 2023 24 - Valuationphamvi44552002No ratings yet

- InternationalDocument14 pagesInternationalFunwayo ShabaNo ratings yet

- Pt. Patco Elektronik Teknologi Standard Operating Procedure PurchasingDocument8 pagesPt. Patco Elektronik Teknologi Standard Operating Procedure Purchasingmochammad iqbal100% (1)

- Tenant Verification Form PDFDocument2 pagesTenant Verification Form PDFmohit kumarNo ratings yet

- Assignment of Contract (Correct Version)Document2 pagesAssignment of Contract (Correct Version)Heru Atiba El - BeyNo ratings yet

- Other SourceDocument43 pagesOther SourceJai RajNo ratings yet

- Confusion of GoodsDocument1 pageConfusion of GoodsJames AndrinNo ratings yet

- Chapter 4-Product and Service Design NewDocument104 pagesChapter 4-Product and Service Design Newsp914132No ratings yet

- Salem2019 PDFDocument10 pagesSalem2019 PDFRifa ArvandoNo ratings yet

- Cambridge IGCSE™: Business Studies 0450/11Document23 pagesCambridge IGCSE™: Business Studies 0450/11eulalialamNo ratings yet

- frdA190220A1421665 PDFDocument2 pagesfrdA190220A1421665 PDFVeritaserumNo ratings yet

- ECO Ebook by CA Mayank KothariDocument404 pagesECO Ebook by CA Mayank KothariHemanthNo ratings yet

- GiftDocument6 pagesGiftalive2flirtNo ratings yet

- Food DayDocument15 pagesFood DaydigdagNo ratings yet

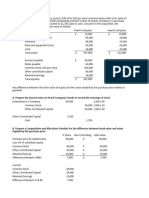

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet