Professional Documents

Culture Documents

ACCA - Chapter 5-6

Uploaded by

Bianca Alexa Sacabon0 ratings0% found this document useful (0 votes)

91 views7 pagesThis document defines and explains the key elements of financial statements. It discusses assets, liabilities, equity, income and expenses.

The main points are:

1) Financial statements group transactions into assets, liabilities, equity, income and expenses based on their economic characteristics.

2) Assets are economic resources controlled by the entity from past events that have potential to produce future benefits. Liabilities are present obligations to transfer economic resources arising from past events.

3) Income increases equity, such as from revenues and gains. Expenses decrease equity, such as using assets or increasing liabilities.

Original Description:

reading material

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines and explains the key elements of financial statements. It discusses assets, liabilities, equity, income and expenses.

The main points are:

1) Financial statements group transactions into assets, liabilities, equity, income and expenses based on their economic characteristics.

2) Assets are economic resources controlled by the entity from past events that have potential to produce future benefits. Liabilities are present obligations to transfer economic resources arising from past events.

3) Income increases equity, such as from revenues and gains. Expenses decrease equity, such as using assets or increasing liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

91 views7 pagesACCA - Chapter 5-6

Uploaded by

Bianca Alexa SacabonThis document defines and explains the key elements of financial statements. It discusses assets, liabilities, equity, income and expenses.

The main points are:

1) Financial statements group transactions into assets, liabilities, equity, income and expenses based on their economic characteristics.

2) Assets are economic resources controlled by the entity from past events that have potential to produce future benefits. Liabilities are present obligations to transfer economic resources arising from past events.

3) Income increases equity, such as from revenues and gains. Expenses decrease equity, such as using assets or increasing liabilities.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 7

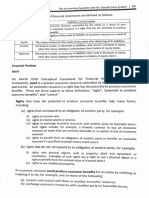

Chapter 5: ELEMENTS OF FINANCIAL STATEMENTS o Carrying amount of the asset given

Rights that have the potential to produce economic

FINANCIAL STATEMENTS - portray the financial effects of benefits:

transactions and other events by grouping them into 1. Rights that correspond to an obligation of

broad classes according to their economic characteristics. another entity

a. Right to receive cash

ELEMENTS OF FINANCIAL STATEMENTS b. Right to receive goods or services

The broad classes c. Right to exchange economic resources

Quantitative information reported in the with another party on favorable terms

statement of financial position and income d. Right to benefit from an obligation of

statement. another party if a specified uncertain

Building blocks from which FS are constructed. future event occurs

2. Rights that do not correspond to an obligation of

another entity

Financial Position a. Right over physical objects, such as

a. Asset property, plant and equipment or

b. Liability inventories

c. Equity b. Right to intellectual property

Assets – Liabilities = Equity 3. Rights established by contract or legislation

a. Owning a debt instrument or an equity

instrument or owning a registered patent.

Financial Performance

a. Income Potential to Produce Economic Benefits

b. Expense - For the potential to exist, it does not need to be

Income – Expenses = Profit certain or even likely that the right will produce

economic benefits. It is only necessary that the

right already exists.

Recognition – the process of incorporating an item that - The economic resource is the present right that

meets the definition of an element and satisfies the contains the potential and not the future

recognition criteria, into the statement of financial economic benefits that the right may produce.

position or statement of profit or loss and other

comprehensive income. An economic resource could produce economic

benefits if an entity is entitled:

ASSETS a. To receive contractual cash flow

A present economic resource controlled by the b. To exchange economic resources with another

entity as a result of past events. party on favorable terms

An economic resource is a right that has the c. To produce cash inflows or avoid cash outflows

potential to produce economic benefits. d. To receive cash by selling the economic resource

Thus, it is that the potential economic benefits no e. To extinguish a liability by transferring an

longer need to be expected to flow to the entity. economic resource

Essential Characteristics of an Asset Control of an Economic Resource

a) The asset is a present economic resource - An entity controls an asset if it has the present

b) The economic resource is a right that has the ability to direct the use of the asset and obtain

potential to produce economic benefits the economic benefits that flow from it.

c) The economic resource is controlled by the - Control is the ability to prevent others from

entity as a result of past events using such asset and therefore preventing

others from obtaining the economic benefits

Asset Measurement from the assets. Thus, it may arise if an entity

Cash transaction – Cash payment enforces legal rights.

Noncash or exchange transaction

o Fair value of the asset given

o Fair value of the asset received

LIABILITY

Present obligation of an entity to transfer an

economic resource as a result of past events. EQUITY

The new definition clarifies that a liability is the residual interest in the assets of the entity after

obligation to transfer economic resource and not deducting all liabilities.

the ultimate outflow of economic benefits.

INCOME

Essential Characteristics of a Liability Increases in assets or decreases in liabilities that

- The entity has an obligation result in increases in equity, OTHER THAN those

- The entity liable must be identified. relating to contributions from equity holders.

However, it is not necessary that the Income is increases in economic benefits during

payee or the entity to whom the the accounting period in the form of inflows or

obligation is owed be identified. enhancements of assets or decreases of liabilities

- The obligation if to transfer an economic that result in increases in equity, other than those

resource relating to contributions from equity participants.

- The obligation is a present obligation that exists Income encompasses both revenue and gains.

as a result of past events

- Means that liability is not recognized Revenue – arises in the course of the ordinary regular

unless incurred. activities and is referred to by variety of different names

including sales, fees, interest, dividends, royalties and

Obligation – is a duty or responsibility that an entity has rent.

no practical ability to avoid. Obligations can either be The essence of revenue is regularity.

legal or constructive.

a. Legal Obligation – obligations may be legally Gains – represent other items that meet the definition of

enforceable as a consequence of a binding income and do not arise in the course of the ordinary

contract or statutory requirement. regular activities. Gains include gain from disposal of

b. Constructive Obligations – arise from normal noncurrent asset, unrealized gain on trading investment

business practice, custom and desire to and gain from exportation.

maintain good business relations or act in an

equitable manner. Point of Sale – Recognition of Income

Transfer of an Economic Resource STATEMENT OF FINANCIAL PERFORMANCE

Refers to the income statement and a statement

Obligations to transfer an economic resource include: presenting other comprehensive income.

a. Obligation to pay cash

b. Obligation to deliver goods or noncash Income Statement / Statement of Profit or Loss

resources - is the primary source of information about an

c. Obligation to provide services at some future entity’s financial performance. As a general rule,

time all income and expenses are included in profit or

d. Obligation to exchange economic resources with loss.

another party on unfavorable terms - However, in developing accounting standards,

e. Obligation to transfer an economic resource if there are some items of income and expenses

specified uncertain future event occurs that are included in other comprehensive

income and not in profit or loss if such

Past Event – an obligation exists as a result of presentation provide more relevant and

past event if both of the following conditions are faithfully represented information about

satisfied: financial information.

a. An entity has already obtained

economic benefits

b. An entity must transfer an economic

resource

EXPENSE

Decreases in assets or increases in liabilities that

result in decreases in equity, OTHER THAN those

relating to distributions to equity holders.

Decreases in economic benefits during the

accounting period in the form of outflows or

depletions of assets or incurrences of liabilities

that result in decreases in equity, other than those

relating to distributions to equity participants.

The definition of expense has changed to reflect the

change in the definition of asset and liability.

Expenses encompasses losses as well as

those expenses that arise in the course of

regular activities.

Expenses that arise in the course of ordinary

regular activities include cost of goods sold,

wages and depreciation.

Losses do not arise in the course of ordinary

regular activities and include losses

resulting from disasters.

Expense Recognition Principle

1. Direct association or matching

2. Systematic and rational allocation

3. Immediate recognition

Measurement – the process of determining the

monetary amounts at which the elements of the

financial statements are to be recognized and

carried in the statement of financial position and

statement of comprehensive income.

However, in certain condition, income may be

recognized at the point of production, during

production and at the point of collection.

Chapter 6: RERCOGNITION AND MEASUREMENT

EXPENSE RECOGNITION

RECOGNITION

Expense Recognition Principle:

As the process of capturing for inclusion in the

EXPENSES are recognized when incurred.

financial statements an item that meets the

DEFINITION of an ASSET, LIABILITY, EQUITY,

When are Expenses Incurred?

INCOME OR EXPENSE.

MATCHING PRINCIPLE – generation of revenue

The amount at which an asset, a liability or

is not without any cost. There has got to be

equity is recognized in the statement of financial

some cost in earning a revenue. It requires that

position is reported as carrying amount.

those costs and expense incurred in earning a

Recognition links the elements to the financial

revenue shall be reported in the same period.

statement of financial position and statement of

financial performance.

Matching Principle Application:

For example, the recognition of income happens

simultaneously with the recognition of an

1. Cause and Effect Association

increase in asset and decrease in liability.

- expense is recognized when the

revenue is already recognized.

Recognition Criteria:

- The reason is presumed direct

Only items that meet the definition of an

association of the expense with

asset, liability or equity are recognized in

specific income.

the statement of financial position.

- Strict Matching Principle

Only items that meet the definition of an

income or expense are recognized in the

2. Systematic and Rational Allocation

statement of financial performance.

- some costs are expensed by simply

Items are recognized only when their

allocating them over the periods

recognition provides users of FS with

benefited.

information that is both relevant and

- The reason for this principle is that the

faithfully represented.

cost incurred will benefit future

Recognition does not focus anymore on

periods and that there is an absence

how probable economic benefits will flow

of a direct or clear association of the

to or from the entity and that the cost can

expense with specific revenue.

be measured reliably.

- When economic benefits are

An asset or liability and any corresponding

expected to arise over several

income or expense can exist even if the

accounting periods and the

probability of inflow or outflow of the

association with income can only be

benefits is low.

broadly or indirectly determined,

expenses are recognized on the basis

INCOME RECOGNITION

of systematic and allocation

procedures.

Basic Principle: INCOME shall be recognized when

EARNED.

3. Immediate Recognition

- the cost incurred is expensed

When is Income Considered to be Earned?

OUTRIGHT because of uncertainty of

In the sale of goods in the ordinary course of

future economic benefits or difficulty

business, the point of sale is the point of

of reliably associating certain costs

income recognition.

with future revenue.

Stated differently, legal title to the goods passes - An expense is recognized

to the buyer at the point of sale. immediately:

a. When an expenditure d. Accrual of interest to reflect any

produces no future financing component of the asset

economic benefit. e. Amortized cost measurement of

b. When cost incurred does financial asset

not qualify or ceases to

qualify for recognition as

an asset. 2. Historical cost of a liability is updated

DERECOGNITION because of

The removal of all or part of a recognized asset a. Payment made or satisfying an

or liability from the statement of financial obligation to deliver goods

position. b. Increase in value of the obligation

It occurs normally when an item no longer to transfer economic resources

meets the definition of an asset or a liability. such that the liability becomes

onerous

Derecognition of an Asset – entity loses c. Accrual of interest to reflect any

control of all or part of the asset financing component of the

Derecognition of a Liability – entity no liability

longer has a present obligation for all or d. Amortized cost measurement of

part of the liability. financial liability

MEASUREMENT 2. CURRENT VALUE

- Defined as quantifying in monetary terms the a) Fair Value

elements in the financial statements. - Fair value of an asset is the price

that would be received to sell an

Categories: asset in an orderly transaction

between market participants at

1. HISTORICAL COST measurement date.

- Historical cost of an asset or original - Fair value of liability is the price that

acquisition cost of an asset is the cost would paid to transfer a liability in an

incurred in acquiring or creating the asset orderly transaction between market

comprising the consideration paid plus participants at the measurement

transaction cost. date

- Historical cost of a liability is the - Fair value is an exit price or exit

consideration received to incur the liability value.

minus transaction costs. - Fair value can be observed directly

- Historical cost is the entry price or entry using market price of the asset or

value to acquire an asset or to incur a liability in an active market. In cases

liability. where fair value cannot be directly

- An application of the historical cost measured, an entity can use present

measurement is to measure financial asset value of cash flows.

and financial liability at amortized cost. - Fair value is not adjusted for

- Amortized cost reflects the estimate of transaction cost. The reason is that

future cash flows discounted at a rate such cost is a characteristic of the

determined at initial recognition. transaction and not of the asset or

liability.

Historical Cost Updated

b) Value in Use for Asset

1. Historical cost of an asset is updated - The present value of the cash flows

because of that an entity expects to derive from

a. Depreciation and amortization the use of an asset and from the

b. Payment received as a result of ultimate disposal.

disposing part or all of the asset - Does not include transaction cost on

c. Impairment acquiring the asset but includes

transaction cost on the disposal of Historical cost is the measurement basis most

the asset. commonly adopted in preparing financial

- Value in use is an exit price or exit statements. In many situations, it is simpler and less

value. costly to measure historical cost than it is to

measure a current value.

In addition, historical cost is generally well

understood and verifiable.

The IASB did not mandate a single measurement

c) Fulfillment for Liability basis because the different measurement bases

- Present value of cash that an entity could produce useful information under different

expects to transfer in paying or circumstances.

settling a liability. BASIC PRINCIPLES

- Fulfillment value is the present value

of cash that an entity expects to Objectivity Principle

transfer in paying or settling a States that all business transactions that will be

liability. entered in the accounting records must be duly

- Fulfillment value does not include supported by verifiable evidence.

transaction cost on incurring a

liability but includes transaction cost Historical Cost

on fulfillment of a liability. Means that all properties and services acquired

- Fulfillment value is an exit price or by the business must be recorded at its original

exit value. acquisition cost.

d) Current Cost Revenue Recognition Principle

- Current cost of an asset is the cost of States that income is recognized in the

an equivalent asset at the accounting period when the goods are delivered

measurement date comprising the or services are performed.

consideration paid and transaction

cost. Expense Recognition Principle

- Current cost of a liability is the Expenses should be recognized in the

consideration that would be received accounting period in which goods and services

less any transaction cost at are used up to produce revenue and not when

measurement date. the entity pays for those goods and services.

- Similar to historical cost, current cost

is also based on the entry price or Adequate Disclosure

entry value but reflects market Requires that all relevant information that

conditions on measurement date. would affect the user’s understanding and

assessment of the accounting entity be

Selecting a Measurement Basis disclosed in the FS.

In selecting a measurement basis for an asset or a

liability and for the related income and expense, it is Consistency Principle

necessary to consider the nature of the information Use the same accounting method from period to

that the measurement basis will produce. period to achieve comparability over time within

In most cases, no single factor will determine which a single enterprise.

measurement basis should be selected.

The relative importance of each factor will depend Accrual Basis

on facts and circumstances. The effects of transactions and other events are

The information produced by the measurement recognized when they occur and not as cash or

basis must be useful to the users of financial its equivalent is received or paid. This means

statements. that the accountant records revenues as they

To achieve this, the information must be both are earned and expenses as they are incurred.

relevant and faithfully represented.

You might also like

- Note Payable: D. DiscountDocument13 pagesNote Payable: D. DiscountANDI TE'A MARI SIMBALA100% (3)

- Module 1 Intermediate Accounting 2Document37 pagesModule 1 Intermediate Accounting 2Andrei GoNo ratings yet

- The Lion of Judah PDFDocument19 pagesThe Lion of Judah PDFMichael SympsonNo ratings yet

- Bro Foreclosed PropertyDocument19 pagesBro Foreclosed PropertyAnthony SerranoNo ratings yet

- 1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistDocument8 pages1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistNick RamboNo ratings yet

- NEW TimelineDocument11 pagesNEW TimelineoldpaljimNo ratings yet

- ACCA - Chapter 5-6 (A5)Document6 pagesACCA - Chapter 5-6 (A5)Bianca Alexa SacabonNo ratings yet

- ACCA - Chapter 5-6Document7 pagesACCA - Chapter 5-6Bianca Alexa SacabonNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 5 - NotesDocument4 pagesConceptual Framework and Accounting Standards - Chapter 5 - NotesKhey KheyNo ratings yet

- Conceptual Framework Elements of Financial StatementsDocument18 pagesConceptual Framework Elements of Financial StatementsmaricrisNo ratings yet

- Chapter 5 SummaryDocument4 pagesChapter 5 SummaryXiaoyu KensameNo ratings yet

- Chapter 5 Cfas ReportDocument22 pagesChapter 5 Cfas ReportJames Baryl GarceloNo ratings yet

- CF Elements, Recognition and Measurement, Capital MaintenanceDocument11 pagesCF Elements, Recognition and Measurement, Capital Maintenancepanda 1No ratings yet

- Current LiabilitiesDocument3 pagesCurrent Liabilitiesreymonastrera07No ratings yet

- Chapter 1 Current LiabilitiesDocument5 pagesChapter 1 Current LiabilitiesEUNICE NATASHA CABARABAN LIMNo ratings yet

- Acc124 Week 1 Ulo DDocument3 pagesAcc124 Week 1 Ulo DBaby Leonor RazonableNo ratings yet

- Chapter 5 Conceptual Framework - Elements of Financial StatementsDocument4 pagesChapter 5 Conceptual Framework - Elements of Financial StatementsEllen MaskariñoNo ratings yet

- Intermediate Accounting 2Document2 pagesIntermediate Accounting 2Jemima FernandezNo ratings yet

- Chapter 5 Elements of Financial StatementsDocument6 pagesChapter 5 Elements of Financial StatementsMicsjadeCastilloNo ratings yet

- Chapter 1: Objectives of Financial ReportingDocument10 pagesChapter 1: Objectives of Financial ReportingJamNo ratings yet

- Conceptual Framework Module 4Document4 pagesConceptual Framework Module 4Jaime LaronaNo ratings yet

- AssetDocument1 pageAssetShoyo HinataNo ratings yet

- Intermediate Accounting 2Document3 pagesIntermediate Accounting 2Ghie RodriguezNo ratings yet

- Further Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofDocument8 pagesFurther Sub Classifications of The Line Items Shall Be Disclosed Either Directly in The Statement ofMichael AquinoNo ratings yet

- CONCEPTUAL FRAMEWORK - Elements of Financial Statements: by The Entity As A Result of Past EventsDocument5 pagesCONCEPTUAL FRAMEWORK - Elements of Financial Statements: by The Entity As A Result of Past EventsAllaine ElfaNo ratings yet

- Cfas 4-5Document37 pagesCfas 4-5Joyme CorpusNo ratings yet

- Notes FAR 2Document9 pagesNotes FAR 2ALLYSA DENIELLE SAYATNo ratings yet

- Current LiabilityDocument5 pagesCurrent LiabilityMaria AngelicaNo ratings yet

- CFAS (Chapter 5)Document4 pagesCFAS (Chapter 5)RINCONADA ReynalynNo ratings yet

- Acc203 - Cfas - 08.19.23Document15 pagesAcc203 - Cfas - 08.19.23Hailsey WinterNo ratings yet

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Document16 pagesBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNo ratings yet

- Activity 2Document2 pagesActivity 2alyNo ratings yet

- Week 5 Financial Statement and The Reporting Entity Part 1Document7 pagesWeek 5 Financial Statement and The Reporting Entity Part 1Roshane Deil PascualNo ratings yet

- Ia2 ReviewerDocument7 pagesIa2 ReviewerAiden MagnoNo ratings yet

- MODULE 2-Accounting Equation and Double Entry SystemDocument16 pagesMODULE 2-Accounting Equation and Double Entry SystemlorieferpaloganNo ratings yet

- CFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Document3 pagesCFAS PAS 32 Financial Instruments and PFRS 9 Measurement of F Asset Topic 5Erica mae BodosoNo ratings yet

- Reviewer For BAFACR4X Accounting Intermediate 3Document1 pageReviewer For BAFACR4X Accounting Intermediate 3June Maylyn MarzoNo ratings yet

- Conceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIDocument16 pagesConceptual Framework and Theoretical Structure of Financial Accounting and Reporting, Part IIJi BaltazarNo ratings yet

- Chapter 4Document9 pagesChapter 4Louie Ann CasabarNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionThea Gwyneth RodriguezNo ratings yet

- Chapter 1 - Introduction To Financial StatementsDocument7 pagesChapter 1 - Introduction To Financial StatementsAyessa Joy TajaleNo ratings yet

- Accounting NotesDocument3 pagesAccounting NotesDorothy LeeNo ratings yet

- Chapter 4 Conceptual Framework RevisedDocument9 pagesChapter 4 Conceptual Framework RevisedKrizzia Kaye MonterosoNo ratings yet

- 1st Quarter DiscussionDocument10 pages1st Quarter DiscussionCHARVIE KYLE RAMIREZNo ratings yet

- LiabilitiesDocument4 pagesLiabilitiessafe.skies00No ratings yet

- Chapter 05 - Conceptual Framework Elements of Financial StatementsDocument5 pagesChapter 05 - Conceptual Framework Elements of Financial StatementsKimberly Claire AtienzaNo ratings yet

- QUESTION 5-10 Multiple Choice (ACP) : A. Asset, Liability and EquityDocument5 pagesQUESTION 5-10 Multiple Choice (ACP) : A. Asset, Liability and EquityJanine CamachoNo ratings yet

- Conceptual Framework: Elements of Financial StatementsDocument170 pagesConceptual Framework: Elements of Financial StatementsXander Clock0% (1)

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Chapter 12 LiabilitiesDocument5 pagesChapter 12 LiabilitiesAngelica Joy ManaoisNo ratings yet

- Economic Resource Is A Right That Has The Potential To Produce EconomicDocument1 pageEconomic Resource Is A Right That Has The Potential To Produce EconomicJashen GatanNo ratings yet

- Chapter 5 PDFDocument3 pagesChapter 5 PDFthatfuturecpaNo ratings yet

- Seminar 1A - Group Reporting: (A) Power Over The InvesteeDocument44 pagesSeminar 1A - Group Reporting: (A) Power Over The InvesteeJasmine TayNo ratings yet

- Module 25.3 - Presentation of Financial StatementsDocument5 pagesModule 25.3 - Presentation of Financial StatementsJoshua DaarolNo ratings yet

- Liabilities: Ransfer of An Economic ResourcesDocument19 pagesLiabilities: Ransfer of An Economic ResourcesSisiw WasyerNo ratings yet

- All Book Answers 1Document50 pagesAll Book Answers 1Josh Gabriel BorrasNo ratings yet

- Basic Accounting ReviewDocument75 pagesBasic Accounting ReviewSofie SergioNo ratings yet

- 1accounting Equation RevisedDocument4 pages1accounting Equation RevisedReniel MillarNo ratings yet

- NotesDocument7 pagesNotesHi NameNo ratings yet

- Module 04 - Financial InstrumentsDocument19 pagesModule 04 - Financial Instrumentsapostol ignacioNo ratings yet

- Cfas - FinalsDocument28 pagesCfas - Finalsfrincese gabrielNo ratings yet

- Intacc Chapter 1Document2 pagesIntacc Chapter 1Niño Albert EugenioNo ratings yet

- Definition Explained:: Liabilities A Liability Is ADocument26 pagesDefinition Explained:: Liabilities A Liability Is ACurtain SoenNo ratings yet

- Module 1 Current LiabilitiesDocument13 pagesModule 1 Current LiabilitiesLea Yvette SaladinoNo ratings yet

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingFrom EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNo ratings yet

- ACCA - Chapter 1-4Document5 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- ACCA - Chapter 1Document4 pagesACCA - Chapter 1Bianca Alexa SacabonNo ratings yet

- ACCA - Chapter 1-4Document10 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Acca - Chapter 1-9 SummaryDocument5 pagesAcca - Chapter 1-9 SummaryBianca Alexa SacabonNo ratings yet

- ACCA - Chapter 1Document11 pagesACCA - Chapter 1Bianca Alexa SacabonNo ratings yet

- ACCA - Chapter 1-4 (A5)Document11 pagesACCA - Chapter 1-4 (A5)Bianca Alexa SacabonNo ratings yet

- ACCA - Chapter 1-4Document11 pagesACCA - Chapter 1-4Bianca Alexa SacabonNo ratings yet

- Armed Forces in Public Security in Brazil (V 20-10-2023) - EbookDocument278 pagesArmed Forces in Public Security in Brazil (V 20-10-2023) - EbookmichelmorenolaraNo ratings yet

- Causa and Consideration - A Comparative OverviewDocument13 pagesCausa and Consideration - A Comparative OverviewMohamed Abulinein100% (1)

- VenutiDocument5 pagesVenutihanifkhairullahNo ratings yet

- Profitfleet Incorporated: MG MarilaoDocument2 pagesProfitfleet Incorporated: MG MarilaoBusico DorisNo ratings yet

- All India Bank Officers AssociationDocument14 pagesAll India Bank Officers AssociationIndiranNo ratings yet

- KMRC MTN 2021 Information Memorandum January 2022Document142 pagesKMRC MTN 2021 Information Memorandum January 2022K MNo ratings yet

- Damodaram Sanjivayya National Law University, VisakhpatnamDocument18 pagesDamodaram Sanjivayya National Law University, VisakhpatnamvishnuameyaNo ratings yet

- Writing A Report or StatementDocument4 pagesWriting A Report or StatementEnglish with Chloe'No ratings yet

- Va Tech ReportDocument260 pagesVa Tech Reportbigcee64No ratings yet

- Eutropije-Breviarium Historiae RomanaeDocument95 pagesEutropije-Breviarium Historiae RomanaeedinjuveNo ratings yet

- The Pakistan Policy Symposium: Introducing The Pakistan Policy Symposium Policy Brief SeriesDocument4 pagesThe Pakistan Policy Symposium: Introducing The Pakistan Policy Symposium Policy Brief SeriesThe Wilson CenterNo ratings yet

- Macasiano vs. Diokno, G.R. No. 97764, August 10, 1992 - Full TextDocument8 pagesMacasiano vs. Diokno, G.R. No. 97764, August 10, 1992 - Full TextMarianne Hope VillasNo ratings yet

- The Study of Public PolicyDocument4 pagesThe Study of Public PolicyAlfian Faisal100% (1)

- APEC Business Travel CardDocument2 pagesAPEC Business Travel CardTGL Indonesia LogisticsNo ratings yet

- Health PromisesDocument4 pagesHealth PromisesRobert Woeger100% (1)

- AKSI Annual Report 2018Document126 pagesAKSI Annual Report 2018Rahmi AnggianiNo ratings yet

- Auditing Theory: All of TheseDocument7 pagesAuditing Theory: All of TheseKIM RAGANo ratings yet

- 9.1.1.7 Lab - Encrypting and Decrypting Data Using A Hacker Tool - OK PDFDocument6 pages9.1.1.7 Lab - Encrypting and Decrypting Data Using A Hacker Tool - OK PDFInteresting facts ChannelNo ratings yet

- Synd UPI TCDocument9 pagesSynd UPI TCneel bhangureNo ratings yet

- DocDocument19 pagesDocChris Jay LatibanNo ratings yet

- Observations On Poverty and Poor in Plato and Aristotle, Cicero and SenecaDocument26 pagesObservations On Poverty and Poor in Plato and Aristotle, Cicero and SenecaJuanNo ratings yet

- Employment Application Form: Private & ConfidentialDocument5 pagesEmployment Application Form: Private & ConfidentialMaleni JayasankarNo ratings yet

- Waymo-Uber LawsuitDocument96 pagesWaymo-Uber LawsuitNat LevyNo ratings yet

- TransactionSummary PDFDocument2 pagesTransactionSummary PDFWenjie65No ratings yet

- Character Backgrounds For Dungeons & Dragons (D&D) Fifth Edition (5e) - D&D BeyondDocument1 pageCharacter Backgrounds For Dungeons & Dragons (D&D) Fifth Edition (5e) - D&D BeyondRalph KingNo ratings yet