Professional Documents

Culture Documents

Chapter 3: Employment Income Question 3.1-Answer

Uploaded by

Ak AlOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 3: Employment Income Question 3.1-Answer

Uploaded by

Ak AlCopyright:

Available Formats

Chapter 3: Employment Income

Question 3.1-Answer

Relief is available for the full cost of these journeys as the travel is undertaken in the

performance of Nida’s duties.

Question 3.2-Answer

Since the journey is substantially the same as Johan’s ordinary journey to work, tax relief is not

available.

Question 3.3-Answer

Although Maxwell is spending all of his time at the Morpeth branch it will not be treated as his

normal work place because his period of attendance will be less than 24 months. Thus Maxwell

can claim relief in full for the costs of travel from his home to the Morpeth branch.

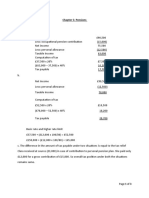

Question 3.4-Answer

(a)

Mileage allowance received (15,400 x 40p) £6,160

Less tax free (10,000 x 45p) + (5,400 x 25p) (5,850)

Taxable benefit 310

(b)

Mileage allowance received (15,400 x 25p) £3,850

Less tax free (10,000 x 45p) + (5,400 x 25p) (5,850)

Allowable deduction (2,000)

Question 3.5-Answer

Mileage allowance received (15,000 x 35p) £5,250

Less tax free (10,000 x 45p) + (5,000 x 25p) (5,750)

Allowable deduction (500)

Page 1 of 1

You might also like

- Chapter 3: Employment IncomeDocument3 pagesChapter 3: Employment IncomeAk AlNo ratings yet

- Chapter 4: Taxable and Exempt Benefits Question 4.1-AnswerDocument3 pagesChapter 4: Taxable and Exempt Benefits Question 4.1-AnswerAk AlNo ratings yet

- FC Answer KeyDocument4 pagesFC Answer KeyMergierose DalgoNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument10 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsMiguel Amihan100% (1)

- Answer Key Chapter 8 FranchiseDocument8 pagesAnswer Key Chapter 8 Franchisekaren perrerasNo ratings yet

- Sol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsDocument9 pagesSol. Man. - Chapter 4 Provisions, Cont. Liabs. & Cont. AssetsEinez B. CarilloNo ratings yet

- Cost Solution (Sir Jawad)Document11 pagesCost Solution (Sir Jawad)Tooba MaqboolNo ratings yet

- 4AC012 Answers To Week 3 Tutorial ExercisesDocument6 pages4AC012 Answers To Week 3 Tutorial ExercisesRohit Vijay PatilNo ratings yet

- MAE - P5 Chapter 6Document2 pagesMAE - P5 Chapter 6Leah Mae NolascoNo ratings yet

- Final Bomb (Before Main Body)Document7 pagesFinal Bomb (Before Main Body)Mohammad helal uddin ChowdhuryNo ratings yet

- Ma IiDocument2 pagesMa IiPryaNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For Corporations Prob 4Document3 pagesSol. Man. - Chapter 15 - Accounting For Corporations Prob 4ruth san joseNo ratings yet

- Homework 1Document5 pagesHomework 1zelihasekmen1453No ratings yet

- 1-2 2003 Dec ADocument10 pages1-2 2003 Dec AGalaxymeNo ratings yet

- Solutions To Management Accounting Exercises June 2020Document17 pagesSolutions To Management Accounting Exercises June 2020Petar PetrovicNo ratings yet

- Auditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DDocument14 pagesAuditing Problems Key Answers/solutions: Problem No. 1 1.A, 2.C, 3.B, 4.B, 5.DKim Cristian MaañoNo ratings yet

- Quiz 2Document5 pagesQuiz 2yolanda.eka31No ratings yet

- Relevant Costing - SolutionsDocument3 pagesRelevant Costing - SolutionsSwiss HanNo ratings yet

- Case Study LeasingDocument3 pagesCase Study LeasingNicolaus Chandra100% (2)

- CGT Case 6Document4 pagesCGT Case 6Wajih RehmanNo ratings yet

- F2 Past Paper - Ans12-2001Document9 pagesF2 Past Paper - Ans12-2001ArsalanACCANo ratings yet

- Solution ManualDocument12 pagesSolution ManualReyna BaculioNo ratings yet

- STANDARD COSTING (Solutions)Document7 pagesSTANDARD COSTING (Solutions)Mohammad UmairNo ratings yet

- CAF 2 Spring 2023Document8 pagesCAF 2 Spring 2023murtazahamza721No ratings yet

- Solution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267Document74 pagesSolution - All - IA - PDF - Filename UTF-8''Solution All IA8902905257801997267sarojNo ratings yet

- Past Year 2019 Sem 2 Ans (ZW)Document4 pagesPast Year 2019 Sem 2 Ans (ZW)zhaoweiNo ratings yet

- Part18 SolutionsDocument2 pagesPart18 SolutionsMuhammad AliNo ratings yet

- F2 Past Paper - Ans05-2005Document10 pagesF2 Past Paper - Ans05-2005ArsalanACCANo ratings yet

- CH 5 Solutions FinalDocument14 pagesCH 5 Solutions FinalAbner MolinaNo ratings yet

- Sol. Man. - Chapter 15 - Accounting For CorporationsDocument15 pagesSol. Man. - Chapter 15 - Accounting For Corporationspehik100% (1)

- Hire Puchase & Instalment Purchase System Problems & Answer - 1 - 21Document37 pagesHire Puchase & Instalment Purchase System Problems & Answer - 1 - 21anand dpiNo ratings yet

- Bunyan LumberDocument8 pagesBunyan LumberDinh JamieNo ratings yet

- CORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 CompleteDocument8 pagesCORRECTED SOL. MAN. - CHAPTER 15 - ACCOUNTING FOR CORPORATIONS PROB 2-3 Completeruth san joseNo ratings yet

- F2 Past Paper - Ans06-2003Document13 pagesF2 Past Paper - Ans06-2003ArsalanACCANo ratings yet

- Higher National Certificate in ConstructionDocument11 pagesHigher National Certificate in ConstructionMark GilbertNo ratings yet

- Akbi 3 7-10Document4 pagesAkbi 3 7-10rinziarevyNo ratings yet

- Module 2 SolutionsDocument3 pagesModule 2 SolutionsNeha Wadhwani AhujaNo ratings yet

- CVP Test SolutionDocument2 pagesCVP Test Solutionahsaankhan2811No ratings yet

- Q2 Feb 2022Document3 pagesQ2 Feb 2022aisyahinafaryanis14No ratings yet

- Revision Question Topic 3,4-AnswerDocument5 pagesRevision Question Topic 3,4-AnswerNur WahidaNo ratings yet

- Ch6è Ç Ä È È È É¡ Ç ®Document7 pagesCh6è Ç Ä È È È É¡ Ç ®fgknpqvfzcNo ratings yet

- Intermediate Accounting 3Document18 pagesIntermediate Accounting 3Cristine MayNo ratings yet

- Present Worth Analysis: Solutions To End-Of-Chapter ProblemsDocument12 pagesPresent Worth Analysis: Solutions To End-Of-Chapter ProblemsenmanuelkasparianNo ratings yet

- SFM Old Course Paper SolutionDocument21 pagesSFM Old Course Paper SolutionAnonymous Hwn2EoGmpNo ratings yet

- Topic 3 Extra Questions Suggested AnswersDocument4 pagesTopic 3 Extra Questions Suggested AnswersThirusha balamuraliNo ratings yet

- Income Tax LiabilityDocument25 pagesIncome Tax LiabilitySIRUI DINGNo ratings yet

- Moodle 3C AnswerDocument5 pagesMoodle 3C AnswerPhát GamingNo ratings yet

- Solutions To Sample Variable Absorption and Job Order CostingDocument7 pagesSolutions To Sample Variable Absorption and Job Order CostingWinter's ClandestineNo ratings yet

- Alba, Camille Joy M. MGT211: Total Cost 240,000.00Document4 pagesAlba, Camille Joy M. MGT211: Total Cost 240,000.00Camille Joy AlbaNo ratings yet

- Chapter 1 - Liabilities - Intermediate Accounting II PDFDocument4 pagesChapter 1 - Liabilities - Intermediate Accounting II PDFJaypee Verzo SaltaNo ratings yet

- Tax267 Ex3Document4 pagesTax267 Ex3SITI NUR DIANA SELAMATNo ratings yet

- BackgroundDocument6 pagesBackgroundSyed Ali Hussain BokhariNo ratings yet

- Solution Assignment Chapter 9 10 1Document14 pagesSolution Assignment Chapter 9 10 1Huynh Ng Quynh NhuNo ratings yet

- Quiz CVP and Decision MakingDocument9 pagesQuiz CVP and Decision Makingabdulrahimrasul05No ratings yet

- Household Income and Expenditure List1Document6 pagesHousehold Income and Expenditure List1Eddie C. Resurreccion Jr.No ratings yet

- Tugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42Document3 pagesTugas Chapter 4 - Tri Sasmita - 1181002091 - Corfin 42WisnualdiwibowoNo ratings yet

- Actual Material Standard Material Actual Labor Predetermined Overhead Yes Yes Yes YesDocument6 pagesActual Material Standard Material Actual Labor Predetermined Overhead Yes Yes Yes YesSarah SarmientoNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 5Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 5Roshan RamkhalawonNo ratings yet

- Chapter 4 - ForecastingDocument26 pagesChapter 4 - ForecastingAk AlNo ratings yet

- ProductivityDocument6 pagesProductivityAk AlNo ratings yet

- Chapter 5: Pensions Question 5.1-AnswerDocument3 pagesChapter 5: Pensions Question 5.1-AnswerAk AlNo ratings yet

- Chapter 3: Employment Income Question 3.1: Qualifying Travelling CostDocument3 pagesChapter 3: Employment Income Question 3.1: Qualifying Travelling CostAk AlNo ratings yet

- UntitledDocument2 pagesUntitledAk AlNo ratings yet

- Chapter 6: Property Income Question 6.1 - AnswerDocument3 pagesChapter 6: Property Income Question 6.1 - AnswerAk AlNo ratings yet

- Chapter 3 - ProductivityDocument5 pagesChapter 3 - ProductivityAk AlNo ratings yet

- Chapter 5: Pensions Question 5.1: Compute Taxable Income in Case of Pension ContributionsDocument4 pagesChapter 5: Pensions Question 5.1: Compute Taxable Income in Case of Pension ContributionsAk AlNo ratings yet

- UntitledDocument3 pagesUntitledAk AlNo ratings yet

- Chapter 4 - ForecastingDocument3 pagesChapter 4 - ForecastingAk AlNo ratings yet

- Marketing Product: Difference Between Products & Brands Product BrandsDocument3 pagesMarketing Product: Difference Between Products & Brands Product BrandsAk AlNo ratings yet

- Chapter 6: Property Income Question 6.1: Compute Property Business IncomeDocument7 pagesChapter 6: Property Income Question 6.1: Compute Property Business IncomeAk AlNo ratings yet

- UntitledDocument2 pagesUntitledAk AlNo ratings yet

- Chapter 3Document2 pagesChapter 3Ak AlNo ratings yet

- Chapter 2 - SolutionDocument12 pagesChapter 2 - SolutionAk AlNo ratings yet

- UntitledDocument4 pagesUntitledAk AlNo ratings yet

- UntitledDocument3 pagesUntitledAk AlNo ratings yet

- Chapter 4Document3 pagesChapter 4Ak AlNo ratings yet

- Chapter 4: Taxable and Exempt Benefits Question 4.1. Compute Taxable Benefit For AccommodationDocument5 pagesChapter 4: Taxable and Exempt Benefits Question 4.1. Compute Taxable Benefit For AccommodationAk AlNo ratings yet

- Chapter 4Document2 pagesChapter 4Ak AlNo ratings yet