Professional Documents

Culture Documents

Allocation and Apportionment and Job and Batch Costing Worked Example Question 5

Uploaded by

Roshan RamkhalawonCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allocation and Apportionment and Job and Batch Costing Worked Example Question 5

Uploaded by

Roshan RamkhalawonCopyright:

Available Formats

Allocation and Apportionment and Job and Batch Costing Solution

Question 5

(a). Total direct cost

Mynor Hanbridge

(2 X 6 X 800) (3 X 5 X 600)

Direct Materials 9 600 9 000

(4 X 9 X 800) (4.5 X 10 X 600)

Direct Labour 28 800 27 000

TOTAL 38 400 36 000

(b).Overheads for 3 months ended 31 March 2015

Total Mynor Hanbridge Sales and

Administration

$ $ $ $

23 600 X (3/12) (3200/5900) X 5 900 (2700/5900) X 5900

Supervisor’s 5 900 3 200 2 700 0

salary

50 000 X (3/12) (2500/5000) X 12500 (2000/5000) X 12500 (500/5000) X 12500

Rent 12 500 6 250 5 000 1 250

(12000/30000) X 6000 (15000/30000) X 6000 (3000/30000) X 6000

Power 6 000 2 400 3 000 600

20% X 9000 X 3/12 20 % X 8000 X 3/12 20 % X 3 000 X 3/12

Depreciation 1 000 450 400 150

Sales and 13 550 0 0 13 550

administration

TOTAL 38 950 12 300 11 100 15 550

Labour hours:

Mynor (800 X 4) 3 200

Hanbridge (600 X 4.5) 2 700

Total hours 5 900

(c). Value of inventory

Mynor Handbridge

$ $

Value per unit 63.38 78.50

(800 – 700) (600 – 400)

Number of units in inventory 100 200

Total value of inventory 6 338 15 700

Total cost Mynor = 38 400 + 12 300 = $50 700

Cost per unit = 50 700 / 800 = $63.38

Total cost Handbridge = 36 000 + 11 100 = $47 100

Cost per unit = 47 100 / 600 = $78.50

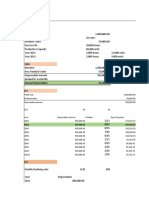

(d). Manufacturing Account for the three months ended 31 March 2015

Direct Materials (9 600 + 9 000) 18 600

Direct Labour (28 800 + 27 000) 55 800

Prime Cost 74 400

Add Overheads (12 300 + 11 100) 23 400

Cost of production 97 800

(e). Income Statement for the three months ended 31 March 2015

Revenue (700 X 90) + (400 X 120) 111 000

Less cost of sales

Cost of production 97 800

Less closing inventory (6 338 + 15 700) (22 038) (75 762)

Gross Profit 35 238

Less Expenses

Sales and administration (15 550)

Profit 3 months ended 31 March 2005 19 688

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 10Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 10Roshan RamkhalawonNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Relevant CostsDocument7 pagesRelevant CostsPalesaNo ratings yet

- Installment MethodDocument4 pagesInstallment Methodjessica amorosoNo ratings yet

- COMA211 Textbook Ch13Document17 pagesCOMA211 Textbook Ch13Palesa SemakaleNo ratings yet

- Chapter 10 Exercises Acc101Document6 pagesChapter 10 Exercises Acc101Nguyen Thi Van Anh (K17 HL)No ratings yet

- Moong Leah Sophia - PPEDocument8 pagesMoong Leah Sophia - PPEKate Crystel reyesNo ratings yet

- Property, Plant and Equipment DepreciationDocument13 pagesProperty, Plant and Equipment DepreciationJannelle SalacNo ratings yet

- Manac3 Supplementary June Memo 2023Document11 pagesManac3 Supplementary June Memo 2023LuciaNo ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Document15 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1B 1Rezzan Joy Camara MejiaNo ratings yet

- 2276 Chapter 35Document3 pages2276 Chapter 35tinotendazhuwao63No ratings yet

- BAC1054 Assigment 1Document4 pagesBAC1054 Assigment 1N GunasekaramNo ratings yet

- Homework SolutionsDocument5 pagesHomework SolutionsAnonymous CuUAaRSNNo ratings yet

- Solutions To Management Accounting Exercises June 2020Document17 pagesSolutions To Management Accounting Exercises June 2020Petar PetrovicNo ratings yet

- Business Finance Decision Suggested Solution Test # 2: Answer - 1Document4 pagesBusiness Finance Decision Suggested Solution Test # 2: Answer - 1Syed Muhammad Kazim RazaNo ratings yet

- SG2 4Document3 pagesSG2 4snfrcbkb88No ratings yet

- Acc 8Document7 pagesAcc 8Izzah NawawiNo ratings yet

- Far160 Dec2018 Q1Document3 pagesFar160 Dec2018 Q1Nur Anis AqilahNo ratings yet

- W14 - As8 Maranan, A2aDocument3 pagesW14 - As8 Maranan, A2aJere Mae MarananNo ratings yet

- Accounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Document6 pagesAccounting English Medium: Paper Based Revision Programme Marking Guide - Revision Paper - 34Malar SrirengarajahNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

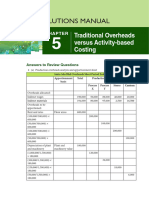

- Ch05 Traditional Overheads Versus Activity-Based CostingDocument15 pagesCh05 Traditional Overheads Versus Activity-Based CostingAndrew ChongNo ratings yet

- Madaraka Ltd. income statement and financialsDocument17 pagesMadaraka Ltd. income statement and financialsMaryjoy KilonzoNo ratings yet

- CMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSDocument5 pagesCMA JUNE 2021 EXAM P1 PROCESS COSTING SOLUTIONSTameemmahmud rokibNo ratings yet

- XYZ Company flexible budget and variance analysisDocument15 pagesXYZ Company flexible budget and variance analysisTanvir OnifNo ratings yet

- Sol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BDocument10 pagesSol. Man. - Chapter 16 - Ppe Part 2 - Ia Part 1BMahasia MANDIGAN100% (1)

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument16 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseChrismae Monteverde SantosNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- Pre-Final Exam in Audit 2-3Document5 pagesPre-Final Exam in Audit 2-3Shr BnNo ratings yet

- Acc116 Assignment Ahmad Irfan Bin Zakaria 2020836308Document7 pagesAcc116 Assignment Ahmad Irfan Bin Zakaria 2020836308Siti RuzanaNo ratings yet

- Set 19 3Document6 pagesSet 19 3Caro Kan LopezNo ratings yet

- Maf251 Q5 Sept2015 DianaDocument1 pageMaf251 Q5 Sept2015 DianaSITI NUR DIANA SELAMATNo ratings yet

- Financial Reporting Test AnswersDocument5 pagesFinancial Reporting Test AnswersAthira Adriana Bt RemlanNo ratings yet

- FManAcc Teaching Week 11 Seminar Answers Part 1 2023 - 2024 - TaggedDocument5 pagesFManAcc Teaching Week 11 Seminar Answers Part 1 2023 - 2024 - Taggedredwaanmo19No ratings yet

- Assignment 2 Taxation AtxDocument17 pagesAssignment 2 Taxation Atxiknowu250No ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Chapter 16 ExcelDocument13 pagesChapter 16 ExcelKiminosunoo LelNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Chapter 16 ExcelDocument12 pagesChapter 16 ExcelKiminosunoo LelNo ratings yet

- Tutorial 6 Q1 2 and 4 Excel AnswersDocument23 pagesTutorial 6 Q1 2 and 4 Excel AnswersMurali RasamahNo ratings yet

- Tutorial 12Document15 pagesTutorial 12lkaixin 02No ratings yet

- Accounting calculations and journal entriesDocument6 pagesAccounting calculations and journal entriesZatsumono YamamotoNo ratings yet

- Installment SalesDocument13 pagesInstallment SalesMichael BongalontaNo ratings yet

- CPA review exam solutions for management advisory servicesDocument6 pagesCPA review exam solutions for management advisory servicesMark Anthony Casupang100% (1)

- Assignment: Lecturer, Southeast Business School (SBS), Southeast UniversityDocument4 pagesAssignment: Lecturer, Southeast Business School (SBS), Southeast UniversityMd. Shaidur JamanNo ratings yet

- Ma IiDocument2 pagesMa IiPryaNo ratings yet

- BudgetDocument7 pagesBudgetvasanthgurusamynsNo ratings yet

- Overhead cost analysis sheetDocument5 pagesOverhead cost analysis sheetNur ImaninaNo ratings yet

- Ia Forcadela Part IIIDocument5 pagesIa Forcadela Part IIIMary Joanne forcadelaNo ratings yet

- Alba, Camille Joy M. MGT211: Total Cost 240,000.00Document4 pagesAlba, Camille Joy M. MGT211: Total Cost 240,000.00Camille Joy AlbaNo ratings yet

- MTP 12 16 Answers 1696782053Document14 pagesMTP 12 16 Answers 1696782053harshallahotNo ratings yet

- BIL Basic Overheads: A. State One (1) Suitable Overheads Cost For The Respective Basic BelowDocument4 pagesBIL Basic Overheads: A. State One (1) Suitable Overheads Cost For The Respective Basic BelowNur ImaninaNo ratings yet

- Swinburne University ACC10007 Discussion QuestionsDocument5 pagesSwinburne University ACC10007 Discussion QuestionsRenee WongNo ratings yet

- BÀI TẬP CHƯƠNG 2 PPEsDocument5 pagesBÀI TẬP CHƯƠNG 2 PPEsHoàng HuyNo ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Example 11 PDFDocument13 pagesExample 11 PDFNeo WilliamNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 13Document6 pagesManufacturing Account Worked Example Question 13Roshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 16Document5 pagesManufacturing Account Worked Example Question 16Roshan RamkhalawonNo ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 18Document5 pagesManufacturing Account Worked Example Question 18Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 3Document3 pagesManufacturing Account Worked Example Question 3Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked ExampleDocument6 pagesManufacturing Account Worked ExampleRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 3 - Separte Books of AccountsDocument3 pagesJoint Venture Worked Example Question 3 - Separte Books of AccountsRoshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 2Document4 pagesManufacturing Account Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 9Document5 pagesManufacturing Account Worked Example Question 9Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 4 - Separate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 4 - Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 8 - No Seperate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 8 - No Seperate Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Examples Question 6 - No Separate Books of AccountsDocument3 pagesJoint Venture Worked Examples Question 6 - No Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 5 - Separate Books of AccountsDocument3 pagesJoint Venture Worked Example Question 5 - Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Balancing of Accounts SolutionDocument3 pagesBalancing of Accounts SolutionRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 1 - Separate Books of AccountDocument2 pagesJoint Venture Worked Example Question 1 - Separate Books of AccountRoshan RamkhalawonNo ratings yet

- Posting To The Ledger Solution1Document1 pagePosting To The Ledger Solution1Roshan RamkhalawonNo ratings yet

- Solution Balancing of AccountsDocument5 pagesSolution Balancing of AccountsRoshan Ramkhalawon100% (1)

- Grade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Document2 pagesGrade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Roshan RamkhalawonNo ratings yet

- PAPER-3 Worked SolutionsDocument401 pagesPAPER-3 Worked SolutionsRoshan Ramkhalawon100% (1)

- Posting To The Ledger SolutionDocument4 pagesPosting To The Ledger SolutionRoshan RamkhalawonNo ratings yet

- Posting To The Ledger Solution14Document2 pagesPosting To The Ledger Solution14Roshan RamkhalawonNo ratings yet

- Date Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivableDocument15 pagesDate Cash Supplies Equipment A/C Payble Notes Payable Capital Remarks Accounts ReceivablesnigdhaNo ratings yet

- 14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Document26 pages14-6: A (At Fair Value at Date of Acquisition) 14-7: D: Total Net Income P1,800,000Love FreddyNo ratings yet

- Vanderbilt University Endowment Allocation ChangesDocument2 pagesVanderbilt University Endowment Allocation ChangesPrasanna ApNo ratings yet

- ACC501 Mod 1 Case Financial StatementsDocument12 pagesACC501 Mod 1 Case Financial StatementsNoble S WolfeNo ratings yet

- Ind AS 2 InventoriesDocument9 pagesInd AS 2 InventoriesBHUPENDRA SINGH HADA COMMERCE NCRNo ratings yet

- Quiz 1Document2 pagesQuiz 1Rynette FloresNo ratings yet

- ACTG 431 QUIZ Week 3 Theory of Accounts (Part III) PROPERTY, PLANT AND EQUIPMENT QUIZDocument6 pagesACTG 431 QUIZ Week 3 Theory of Accounts (Part III) PROPERTY, PLANT AND EQUIPMENT QUIZMarilou Arcillas PanisalesNo ratings yet

- Start Up ValuationDocument17 pagesStart Up ValuationSaurabh SachanNo ratings yet

- Working Backwards From Net Income - CFO GuyDocument2 pagesWorking Backwards From Net Income - CFO GuyMessias MorettoNo ratings yet

- Ifrs at A Glance: IFRS 5 Non-Current Assets Held For SaleDocument4 pagesIfrs at A Glance: IFRS 5 Non-Current Assets Held For SaleRaven SiaNo ratings yet

- 4.1 Mat112 DepreciationDocument1 page4.1 Mat112 Depreciation2023300633No ratings yet

- Piotrowski Score: AssumptionsDocument2 pagesPiotrowski Score: AssumptionsMayur ZambareNo ratings yet

- LAPORAN TRANSAKSI KEUANGANDocument2 pagesLAPORAN TRANSAKSI KEUANGANSupebriasa AmdNo ratings yet

- Audit of The Inventory and Warehousing Cycle Business Functions in The Cycle and Related Documents and RecordsDocument3 pagesAudit of The Inventory and Warehousing Cycle Business Functions in The Cycle and Related Documents and RecordsvvNo ratings yet

- Effects of Changes in Foreign Exchange Rates Ias 21Document11 pagesEffects of Changes in Foreign Exchange Rates Ias 21cykenNo ratings yet

- Solution Aud589 Feb 2021Document7 pagesSolution Aud589 Feb 2021RABIATULNAZIHAH NAZRINo ratings yet

- 03 Retirement of PartnerDocument21 pages03 Retirement of PartnerKeerat singhNo ratings yet

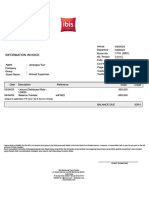

- Information Invoice: Subject To Applicable 21% Govt. Tax & Service ChargeDocument1 pageInformation Invoice: Subject To Applicable 21% Govt. Tax & Service Chargehijrah maju jayaNo ratings yet

- Statement of GagandeepDocument2 pagesStatement of Gagandeepbaniboutique9No ratings yet

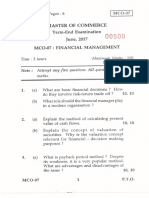

- MCO-7 June17Document6 pagesMCO-7 June17BinayKPNo ratings yet

- AnswerQuiz - Module 10Document4 pagesAnswerQuiz - Module 10Alyanna Alcantara100% (1)

- AssignDocument18 pagesAssignRalph Adrian MielNo ratings yet

- Ashwani Gujral Trading Workshop Day 1 HighlightsDocument212 pagesAshwani Gujral Trading Workshop Day 1 Highlightsbalaje99 k100% (4)

- Briones, Jomel S. Bsma - 1A Cost AccountingDocument1 pageBriones, Jomel S. Bsma - 1A Cost AccountingLorenzo PanchoNo ratings yet

- Ril Case StudyDocument2 pagesRil Case StudyHema Sharist100% (1)

- EACC 1614 - Test 1Document7 pagesEACC 1614 - Test 1sandilefanelehlongwaneNo ratings yet

- Nike Brokerage Report Credit SuisseDocument13 pagesNike Brokerage Report Credit SuisseSarat GudlaNo ratings yet

- Annexure 2Document13 pagesAnnexure 2Shalini SrivastavNo ratings yet

- Joint & by ProductDocument22 pagesJoint & by ProductanggandakonohNo ratings yet

- Comprehensive Portfolio ChartDocument4 pagesComprehensive Portfolio ChartsssmouNo ratings yet