Professional Documents

Culture Documents

Joint Venture Worked Example Question 5 - Separate Books of Accounts

Uploaded by

Roshan Ramkhalawon0 ratings0% found this document useful (0 votes)

111 views3 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

111 views3 pagesJoint Venture Worked Example Question 5 - Separate Books of Accounts

Uploaded by

Roshan RamkhalawonCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

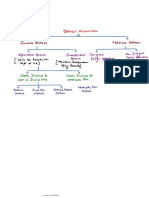

Joint Venture Worked Example Situation 1 – Separate Books of Account

Question 5 A–½;B–½

Capital contributed

Joint Venture Account

Amit: Rent 600 Amit: Sales 700

Bonnie: Equipment 1 100 Bonnie: Sales 3 300

Joint Venture Bank: Purchases 8 080 Joint Venture Bank: Sales 6 100

Joint Venture Bank: Other Joint Venture Bank:

running expenses 620 Equipment 1 100

Share of profit

- Amit (1/2 X 800) 400

- Bonnie (1/2 X 800) 400

11 200 11 200

Bonnie Account

Joint Venture: Sales 3 300 Joint Venture Bank: Capital 850

Joint Venture: Equipment 1 100

Share of profit 400

Joint Venture Bank ?

3 300 3 300

Gross profit of first joint venture = Revenue – Purchases

= (700 + 3 300 + 6 100) – 8 080 = 10 100 – 8 080 = $2 020

Gross profit margin = (2 020 / 10 100) X 100 = 20%

New gross profit margin = 20 + 10 = 30%

New revenue = 10 100 X 2 = $20 200

New gross profit = 30% X 20 200 = $6 060

Increase in gross profit = 6 060 – 2 020 = $4 040

The increase in gross profit of $4 040 is greater than the increase in rent of $1

500. An additional profit of $2 540 can be made. With the doubling of units

sold, other costs are likely to increase which might reduce profit. The doubling

of units sold with selling price remaining constant is an unrealistic assumption.

It is not likely that the gross will increase. There will be an increase in risk

because of the increase in rent which is fixed cost which will have to be paid

even if no profit is made. If sales do not increase, the increase in rent will wipe

off the profit completely.

It is advisable to enter the proposed joint venture because an additional profit

can be made.

They have both taken out of the business more than what they are entitled or

the business has been making losses. They both owe money to the business.

You might also like

- Drawings 4,500: Financial AccountiDocument3 pagesDrawings 4,500: Financial AccountiShamNo ratings yet

- Chap 3Document56 pagesChap 3Basant OjhaNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Contract CostingDocument11 pagesContract CostingMalayaranjan PanigrahiNo ratings yet

- Solutions To Text Book Exercises: Non-Trading ConcernsDocument12 pagesSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUNo ratings yet

- Suggested Answer CAP II Dec 2011Document98 pagesSuggested Answer CAP II Dec 2011Sankalpa NeupaneNo ratings yet

- MTP1 May2022 - Paper 8 FM EcoDocument19 pagesMTP1 May2022 - Paper 8 FM EcoYash YashwantNo ratings yet

- Direct Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesDocument5 pagesDirect Materials APFL Uses A Weighted Average Method For The Pricing of Materials IssuesAbimanyu ShenilNo ratings yet

- Ilovepdf Merged PDFDocument666 pagesIlovepdf Merged PDFchandraNo ratings yet

- 5 Cash Book 08-2022 Regular 2023Document8 pages5 Cash Book 08-2022 Regular 2023jahnaviNo ratings yet

- Accunting ResarchDocument45 pagesAccunting ResarchMubarakNo ratings yet

- Branch AccountingDocument8 pagesBranch AccountingSumit RmcfNo ratings yet

- Review Questions Final Accounts For A Sole TraderDocument3 pagesReview Questions Final Accounts For A Sole TraderdhanyasugukumarNo ratings yet

- Consolidation Question PaperDocument42 pagesConsolidation Question PaperNick VincikNo ratings yet

- Unit 5: Death of A PartnerDocument23 pagesUnit 5: Death of A PartnerKARTIK CHADHANo ratings yet

- RISE All CAF Subj Mocks QP With Solutions Autumn 2022Document130 pagesRISE All CAF Subj Mocks QP With Solutions Autumn 2022Hadeed HafeezNo ratings yet

- Capital Gain & IFOS - PaperDocument6 pagesCapital Gain & IFOS - PaperVenkataRajuNo ratings yet

- Total Income Questions Set A Assessment Year 2021-22-18th EditionDocument30 pagesTotal Income Questions Set A Assessment Year 2021-22-18th EditionKaran Singh RanaNo ratings yet

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- 4 Branch AccountsDocument18 pages4 Branch AccountsBAZINGA100% (1)

- Suggested - Answer - CAP - II - June - 2011 4Document64 pagesSuggested - Answer - CAP - II - June - 2011 4Dipen Adhikari100% (1)

- 4.hire Purchase SystemDocument34 pages4.hire Purchase SystemBharat ThackerNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- 01 Notes NPO WA For HasanDocument86 pages01 Notes NPO WA For HasanHassan MasoodNo ratings yet

- Problem 5: XY LTDDocument4 pagesProblem 5: XY LTDAF 1 Tejasri PamujulaNo ratings yet

- TYBAF UnderwritingDocument49 pagesTYBAF UnderwritingJaimin VasaniNo ratings yet

- Crescent All CAF Mocks With Solutions Compiled by Saboor AhmadDocument123 pagesCrescent All CAF Mocks With Solutions Compiled by Saboor AhmadsheldonjabrazaNo ratings yet

- INCOME TAX Professional Income ProblemsDocument7 pagesINCOME TAX Professional Income ProblemsKulsum FathimaNo ratings yet

- Not For Profit Organisation: Basic ConceptsDocument48 pagesNot For Profit Organisation: Basic Conceptsmonudeep aggarwalNo ratings yet

- Illustrations AmalgamationDocument4 pagesIllustrations Amalgamationajay2741100% (1)

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Document52 pagesPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3No ratings yet

- Hire Purchase PeqDocument21 pagesHire Purchase PeqRishikaNo ratings yet

- Financial Accounting Punjab University B.com Part 1 Solved Past Papers 2013Document12 pagesFinancial Accounting Punjab University B.com Part 1 Solved Past Papers 2013aneebaNo ratings yet

- Linear Programming IDocument16 pagesLinear Programming IS PatNo ratings yet

- Branch Accounts Gr-II 2Document12 pagesBranch Accounts Gr-II 2Dipen AdhikariNo ratings yet

- SGR WAGH Bills of Exchange Full - 20210819 - 210205Document59 pagesSGR WAGH Bills of Exchange Full - 20210819 - 210205UrfiNo ratings yet

- Suggested - Answer - CAP - II - June - 2016 6Document75 pagesSuggested - Answer - CAP - II - June - 2016 6Dipen AdhikariNo ratings yet

- CA Inter Adv Accounts (New) Suggested Answer Dec21Document30 pagesCA Inter Adv Accounts (New) Suggested Answer Dec21omaisNo ratings yet

- Item (A) Type of Adjustment (B) Accounts Before AdjustmentDocument11 pagesItem (A) Type of Adjustment (B) Accounts Before Adjustmentsuci monalia putriNo ratings yet

- Running Head: Leighton Holdings: Building Bribery Case StudyDocument11 pagesRunning Head: Leighton Holdings: Building Bribery Case StudySky SoronoiNo ratings yet

- Unit 5: Account Current: Learning OutcomesDocument16 pagesUnit 5: Account Current: Learning OutcomessajedulNo ratings yet

- Branch - QB Jan 22Document40 pagesBranch - QB Jan 22Nikitaa SanghviNo ratings yet

- Law MTPDocument21 pagesLaw MTPMohit SharmaNo ratings yet

- Past Papers YEAR 3 PDFDocument172 pagesPast Papers YEAR 3 PDFraina mattNo ratings yet

- WN - 1 Resource Test WN-2 Shares Outstanding TestDocument8 pagesWN - 1 Resource Test WN-2 Shares Outstanding TestSimran KhandujaNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Adv Accounts - AmalgamationDocument31 pagesAdv Accounts - Amalgamationmd samser50% (2)

- Far2 Icap Chapter Wise Past Papers With Solution Prepared by Fahad IrfanDocument172 pagesFar2 Icap Chapter Wise Past Papers With Solution Prepared by Fahad IrfanmiketrumpNo ratings yet

- Credit: Adjustments RequiredDocument6 pagesCredit: Adjustments RequiredBlaze MysticNo ratings yet

- CH 03Document4 pagesCH 03flrnciairnNo ratings yet

- Investment Accounts: Attempt Wise AnalysisDocument54 pagesInvestment Accounts: Attempt Wise AnalysisJaveedNo ratings yet

- Unit 3: Trial Balance: Learning OutcomesDocument13 pagesUnit 3: Trial Balance: Learning Outcomesviveo23No ratings yet

- Accounts Ques Nov06Document48 pagesAccounts Ques Nov06api-3825774No ratings yet

- CAP III - Suggested Answer Papers - All Subjects - June 2019 PDFDocument133 pagesCAP III - Suggested Answer Papers - All Subjects - June 2019 PDFsantosh thapa chhetriNo ratings yet

- CAP II - Revision Test Paper - Dec 2019Document206 pagesCAP II - Revision Test Paper - Dec 2019Shraddha NepalNo ratings yet

- Cash Budget Example BUS242Document2 pagesCash Budget Example BUS242İrem AksoyNo ratings yet

- 123 - AS Question Bank by Rahul MalkanDocument182 pages123 - AS Question Bank by Rahul MalkanPooja GuptaNo ratings yet

- Joint Venture Worked Example Question 3 - Separte Books of AccountsDocument3 pagesJoint Venture Worked Example Question 3 - Separte Books of AccountsRoshan RamkhalawonNo ratings yet

- Summary of Advanced Accounting Chapter-0Document5 pagesSummary of Advanced Accounting Chapter-0Gly Balmeo MatayaNo ratings yet

- FAR610 Consolidated Cashflow Past Semester FinalexamDocument18 pagesFAR610 Consolidated Cashflow Past Semester FinalexamANIS SYAKIRAH ADHWA MAHDILLAHNo ratings yet

- Manufacturing Accounts Notes and QuestionsDocument31 pagesManufacturing Accounts Notes and QuestionsRoshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 16Document5 pagesManufacturing Account Worked Example Question 16Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 18Document5 pagesManufacturing Account Worked Example Question 18Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 13Document6 pagesManufacturing Account Worked Example Question 13Roshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 17Document6 pagesManufacturing Account Worked Example Question 17Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 7Document4 pagesManufacturing Account Worked Example Question 7Roshan Ramkhalawon100% (1)

- Manufacturing Account Worked Example Question 3Document3 pagesManufacturing Account Worked Example Question 3Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 8Document7 pagesManufacturing Account Worked Example Question 8Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 2Document4 pagesManufacturing Account Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 4Document5 pagesManufacturing Account Worked Example Question 4Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Examples Question 6 - No Separate Books of AccountsDocument3 pagesJoint Venture Worked Examples Question 6 - No Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Manufacturing Account Worked Example Question 9Document5 pagesManufacturing Account Worked Example Question 9Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 4 - Separate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 4 - Separate Books of AccountsRoshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 8 - No Seperate Books of AccountsDocument4 pagesJoint Venture Worked Example Question 8 - No Seperate Books of AccountsRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 2Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 2Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 1 - Separate Books of AccountDocument2 pagesJoint Venture Worked Example Question 1 - Separate Books of AccountRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 5Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 5Roshan RamkhalawonNo ratings yet

- Joint Venture Worked Example Question 3 - Separte Books of AccountsDocument3 pagesJoint Venture Worked Example Question 3 - Separte Books of AccountsRoshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 20Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 20Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 21Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 21Roshan RamkhalawonNo ratings yet

- Allocation and Apportionment and Job and Batch Costing Worked Example Question 10Document2 pagesAllocation and Apportionment and Job and Batch Costing Worked Example Question 10Roshan RamkhalawonNo ratings yet

- Solution Balancing of AccountsDocument5 pagesSolution Balancing of AccountsRoshan Ramkhalawon100% (1)

- Grade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Document2 pagesGrade Thresholds - June 2021: Cambridge International AS & A Level Accounting (9706)Roshan RamkhalawonNo ratings yet

- Posting To The Ledger SolutionDocument4 pagesPosting To The Ledger SolutionRoshan RamkhalawonNo ratings yet

- Balancing of Accounts SolutionDocument3 pagesBalancing of Accounts SolutionRoshan RamkhalawonNo ratings yet

- Posting To The Ledger Solution1Document1 pagePosting To The Ledger Solution1Roshan RamkhalawonNo ratings yet

- Posting To The Ledger Solution14Document2 pagesPosting To The Ledger Solution14Roshan RamkhalawonNo ratings yet

- PAPER-3 Worked SolutionsDocument401 pagesPAPER-3 Worked SolutionsRoshan Ramkhalawon100% (1)