Professional Documents

Culture Documents

Collect Now or Pay Later White Paper

Uploaded by

Shyam Sunder Rao ChepurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Collect Now or Pay Later White Paper

Uploaded by

Shyam Sunder Rao ChepurCopyright:

Available Formats

Collect Now or Pay Later

Capturing patients’ growing

out-of-pocket charges to avoid

downstream consequences

An Experian Health White Paper

Collect Now or Pay Later

Executive Summary

Cost is arguably the biggest, most challenging issue plaguing the U.S. healthcare

system. Every healthcare stakeholder – patients, providers, employers and insurers –

is trying to rein in costs for various reasons. But spending continues to rise.

Healthcare expenditures account for nearly $0.18 of every dollar spent in the U.S. The

$2.9 trillion (yes, trillion) Americans spend on healthcare already approaches $10,000

per person and is expected to account for 19.6 percent of the Gross Domestic Product

within the next decade.

As overall healthcare spending increases, so too does patients’ financial responsibility.

Out-of-pocket spending grew 3.2 percent to $339.4 billion in 2013, or 12 percent of

total national health expenditures. Meanwhile, hospitals and health systems go on

providing care, gallantly carrying out their missions, sometimes giving away non-

emergent services to people who can and should pay.

Healthcare organizations looking for ways to limit accounts receivable (A/R), avoid

bad debt, overcome shrinking reimbursements and keep margins from dipping into

the red (if they aren’t there already) find some solutions in patients’ pockets.

Situation Analysis

The American Hospital Association reports that since 2000, U.S. hospitals have given

away more than $459 billion in uncompensated care to their patients. Hospitals

provided $46.4 billion of uncompensated care in 2014, and while the percent of

uncompensated care relative to total expenses has hovered around 6 percent since

1984, the total dollar figures continue to climb, essentially doubling in the last decade.

Hospitals’ traditional “treat first, bill later”

mentality is fiscally unsustainable.

An Experian Health White Paper | Page 1

Collect Now or Pay Later

Part of the problem is patients have come to expect treatment with little to no

upfront expense and receive an invoice after 30 days or later, after a claim has been

billed to their insurer. If all patients paid their bills and paid them in a timely manner

then this approach could work without risk or complication. But data shows that

once a patient leaves the facility, regardless of whether the patient has insurance, the

likelihood of collecting out-of-pocket portion decreases dramatically.

A McKinsey & Company study found that providers can expect to collect only 50 to

70 percent of an insured patient’s balance after treatment. For uninsured patients,

providers can expect to collect only 5 to 10 percent after service.

And patient payments have become a bigger, much more important piece of the pie.

Employers are increasingly choosing to offer high-deductible plans to hold down

their costs, passing more of the financial burden to their employees. Workers, in turn,

may benefit from lower monthly premiums, but are more accountable for the overall

cost of their own care when factoring in co-pays, deductibles and other out-of-pocket

expenses.

• From 2013 to 2014, enrollment in high-deductible, consumer-directed health

plans jumped from 18 percent to 23 percent. It was the largest single-year

increase since the products hit the market. (Mercer)

• The number of enrollees with health savings accounts and high deductible health

plans (HDHPs) rose to nearly 17.4 million in January 2014 and has grown at a rate

of approximately 15 percent annually since 2011. (AHIP)

• The portion of workers with annual deductibles — what consumers must pay out-

of-pocket before insurance kicks in — is up to 80 percent from 55 percent just

eight years ago. (Kaiser Family Foundation)

An Experian Health White Paper | Page 2

Collect Now or Pay Later

Thresholds for out-of-pocket expenses are also getting larger. The Kaiser Family

Foundation reports that the average employee contribution (premiums and out-of-

pocket expenses) to his or her health plan now approaches $5,000 per year. Lower-

premium plans on the federal marketplace exchange, which is an outlet for many

individuals and families who do not have access to employer-sponsored benefits,

carry maximum out-of-pocket expenses of $6,600 for an individual plan and $13,200

for a family plan.

The percentage of covered workers with an annual deductible of at least $1,000

increased to 41 percent in 2014, up from just 10 percent in 2006. (Kaiser Family

Foundation)

Collecting nominal co-pays is one thing. Collecting an entire $6,600 deductible for a

single episode of care is an entirely different challenge, one that demands an effective

end-to-end collections strategy with a heavy front-end emphasis.

Fewer Uninsured but More Underinsured

The U.S. Department of Health and Human Services projected that hospitals would

save $5.7 billion in uncompensated care costs in 2014, mostly in states that have

expanded Medicaid, where for-profit hospital chains reported uninsured admissions to

be down by 50 percent or more. That’s good news for hospitals. The bad news is the

Affordable Care Act has done nothing to address the underinsured population.

Consumers are bearing more of the costs for their own healthcare whether they can

afford it or not. Low-premium, high-deductible health plans provide enough coverage

to help in a catastrophic scenario but have fewer associated benefits and can leave

consumers in a difficult spot trying to cover high out-of-pocket expenses.

A Commonwealth Fund report estimates that in 2012 there were 31.7 million people

under age 65 who were underinsured, up from an estimated 25 million in 2009

(PricewaterhouseCoopers). A staggering 1 in 5 people (20 percent) under age 65 with

middle incomes are believed to be either underinsured or without health insurance

altogether.

An Experian Health White Paper | Page 3

Collect Now or Pay Later

The economic recession beginning in 2008 and federal policies implemented in the

ensuing years have created new financial challenges for patients, and the healthcare

organizations treating them.

• Nearly half of middle-class Americans skipped healthcare services or fell into

financial hardship because of health expenses (Associated Press and NORC

Center for Public Affairs Research).

• Use of hospital care among insured workers has been dropping since 2010

(Health Care Cost Institute).

• Nearly 30 percent of privately insured, working Americans with deductibles

of at least 5 percent of their income had a medical problem but didn’t go to

the doctor, skipped recommended medical tests, treatments or follow-ups

(Commonwealth Fund).

Patients who skip needed medical care often exacerbate the original issue, costing

themselves and their provider more in the long run. Insured or not, most patients

share a common thread: In tough economic times the mortgage, groceries and other

household expense payments take precedence over a medical bill.

The Retail Mindset

The numbers tell the story. Collecting patient payments is one of many mounting

financial challenges for healthcare organizations. Providers must acknowledge

the changing market around them and respond with more proactive, retail-like

patterns. These concepts may seem like common sense to the rest of the world but in

healthcare this approach requires a combination of significant investments in people,

technology and internal process improvement.

An Experian Health White Paper | Page 4

Collect Now or Pay Later

Often the required cultural shift is the most daunting obstacle to overcome in

implementing a new or revamped collections strategy. Longtime employees get

accustomed to a certain way of doing things and can resist change. A patient access

employee who has never had to ask a patient for money may be reluctant to buy into

what he or she considers a big role change. Management must see that tools and

training are consistently put into practice, and can establish trust by soliciting input

from employees on the front line. Earning commitment from everyone involved early

in the process builds morale, camaraderie and enables an organization to achieve its

objectives quicker.

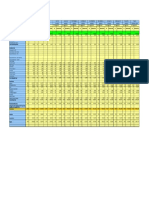

Hospital patient collections efforts do not appear to be keeping pace with the

growth in patient costs. Average collections from insured patients’ copayments and

deductibles increased just slightly from the first quarter of 2014 to the first quarter of

2015. This is despite a 13 percent increase in the amount of insured patients’ balances

moving to A/R (Crowe Horwath), in a market that saw employees’ share of healthcare

costs—including premium contributions and out-of-pocket costs—increase more than

52 percent in just five years (Aon Hewitt).

Fiscal Health is Mission Critical

For some healthcare organizations, particularly faith-based, nonprofit systems, asking

a patient to pay for care seems to go against the core purpose of community service.

But not collecting out-of-pocket charges unnecessarily saddles the organization

with uncollectable A/R that eventually turns to bad debt write-offs. Too much bad

debt could ultimately lead to bankruptcy, which obviously prevents the hospital from

being able to serve the community at all.

Without a front-end collections strategy, missed co-payments and deductibles and

uncollectable self-pay balances could eventually be enough to sink the entire ship.

So what’s the right balance?

Successful healthcare organizations implement sophisticated, yet straightforward

policies that support quality care and create positive patient experiences:

• They use data to determine with certainty who cannot pay versus those who will

not pay.

• They adhere to price transparency initiatives, including providing upfront

estimates of charges for every patient encounter.

• They ask every non-emergent patient who is able to pay to make some payment

prior to or at the point of service.

• They continue providing charity care for patients who are truly unable to pay and

connect others with financial assistance programs, where applicable.

No one expects to enter a grocery store, fill a cart full of food and take it home

without going through the checkout line. In the same way, a driver wouldn’t expect

a service station to fill the gas tank and send an invoice 60 or 90 days later. A retail

business must protect its own financial interests to continue operating and serving its

customer. The same goes for a hospital and its patients.

An Experian Health White Paper | Page 5

Collect Now or Pay Later

Components of a Successful Collections Strategy

Payment Points

While the healthcare revenue cycle spans an entire episode of care, the focus on

patient payments should clearly be at the front-end, beginning with the very first

patient encounter. Payment requests should be made at any and all points during the

patient access process.

From the moment an appointment is scheduled, a debit or credit card can be taken

via phone or via self-service web portal. Even standalone hospitals in the infant

stages of a point-of-service collections program should be able to easily, quickly and

accurately give price estimates, set policies that require minimum deposits and use

them consistently.

Once a patient arrives at the facility, there should be multiple locations within

the facility equipped to collect payment, from self-service kiosks to registration

desks. Every point with an internet connection should be set up with software for

processing payments, and each staff member should be trained and comfortable

doing so.

An Experian Health White Paper | Page 6

Collect Now or Pay Later

Payment Options

Patients are growing more accustomed to making pre- and point-of-service

payments. Younger people who have only known HDHPs probably expect it. Still,

dealing with the cost of a visit can be a frustrating step for someone focused with

his or her personal health. Offering flexible payment options increases the likelihood

patients will pay something up front and creates a better overall patient experience.

A hospital is essentially the only place where people of any socioeconomic status

can easily obtain an interest-free loan for services rendered. Most hospitals double

as lenders and can even have more outstanding A/R on the books than their banking

neighbors have in their loan portfolios.

Patient payment plans are good customer service and a good method for securing

payment from patients who cannot pay in full. Hospitals should be sure to set up

payment plans correctly using a credit or debit card that has been verified as active

and belonging to the patient or guarantor. Before setting up any payment plan

the hospital should verify the patient’s identity, address, and credit history, and

immediately process the first payment with the patient present.

Staff Training

The most innovative technology and best processes won’t help a healthcare

organization achieve its mission if front line employees are not engaged. Staff

must be trained well so they are comfortable asking for payment. Scripting and

role-playing will help prepare staff for any type of patient in any scenario. Many

organizations have also found success motivating employees with incentives and

measuring and rewarding performance based on collected amounts against total

opportunities to collect.

Front line employees carry out the hospital’s collection policies and set the proper

expectations with patients. They should understand the “big picture” and how their

performance impacts not only hospital revenue, but also patient satisfaction and the

employee’s own job satisfaction.

Statistically speaking, hospitals fail to collect 100

percent of the patient payments they don’t request.

Technology

A complete range of healthcare IT solutions are available to help organizations

improve patient collections at every conceivable point in the revenue cycle. The best,

most effective solutions are integrated with other revenue cycle management (RCM)

software and hospital information systems to streamline workflows and maximize

return on investment.

A survey by Black Book Market Research found that 90 percent of hospital CFOs

fear that outdated, non-integrated RCM systems will force the hospital to outsource

end-to-end functions, or purchase a newer RCM solution by 2016.

An Experian Health White Paper | Page 7

Collect Now or Pay Later

An Experian Health White Paper | Page 8

Collect Now or Pay Later

Conclusion

Moody’s Investors Service summarized well the increasing importance of patient

payments in a 2014 report, saying, “Today’s high deductibles are tomorrow’s bad

debt.” It is a harsh reality for healthcare organizations that continue to operate

without an effective, proactive patient collections strategy, and the market is trending

against them.

Those looking to avoid the crippling effects of repeated missed payment

opportunities, however, have an easy-to-follow blueprint from the retail sector: Ask

for payment prior to or at the point of service.

Sources

• America’s Health Insurance Plans: 2014 HSA Census

• American Hospital Association: Uncompensated Hospital Care Cost Fact Sheet, 2015

• Aon Hewitt Analysis, 2014

• Associated Press

• Black Book Market Research: Third Quarter Study, 2014

• Centers for Medicare and Medicaid Services: National Health Expenditure Data

• The Commonwealth Fund: America’s Underinsured Report, 2014

• The Commonwealth Fund: Healthcare Affordability Tracking Survey 2014

• Crowe Horwath RCA Benchmarking Analysis, 2015

• Health Care Cost Institute

• Kaiser Family Foundation: 2014 Employer Health Benefits Survey”

• McKinsey & Company: “U.S. Health Care Payments: Remedies for an ailing system,” 2009

• Mercer National Survey of Employer-Sponsored Health Plans

• Moody’s Investor Service: Three risks reduce credit positives of Affordable Care Act for not-for-profit

hospitals, 2014

• NORC Center for Public Affairs Research

• U.S. Department of Health and Human Services, Office of the Assistant Secretary for Planning and

Evaluation: Impact of Insurance Expansion on Hospital Uncompensated Care Costs in 2014

© 2015 Experian Information Solutions, Inc. • All rights reserved

Experian and the Experian marks used herein are service marks or registered trademarks of Experian

Information Solutions, Inc. Other product and company names mentioned herein are the property of their

respective owners.

An Experian Health White Paper | Page 9

You might also like

- 2015 Health Care Providers Outlook: United StatesDocument5 pages2015 Health Care Providers Outlook: United StatesEmma Hinchliffe100% (1)

- Midwest Edition: Wellpoint at Bottom of Hospitals' ListDocument5 pagesMidwest Edition: Wellpoint at Bottom of Hospitals' ListPayersandProvidersNo ratings yet

- The Finance of Health Care: Wellness and Innovative Approaches to Employee Medical InsuranceFrom EverandThe Finance of Health Care: Wellness and Innovative Approaches to Employee Medical InsuranceNo ratings yet

- The Great Cost ShiftDocument31 pagesThe Great Cost ShiftCenter for American ProgressNo ratings yet

- Medical Savings Accounts: Answering The Critics, Cato Policy AnalysisDocument12 pagesMedical Savings Accounts: Answering The Critics, Cato Policy AnalysisCato InstituteNo ratings yet

- If You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerFrom EverandIf You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerNo ratings yet

- Situational Analysis-1Document6 pagesSituational Analysis-1Bassem BeshayNo ratings yet

- Social Issue & Social Policy (Healthcare)Document10 pagesSocial Issue & Social Policy (Healthcare)my_aqilahNo ratings yet

- Home Health& Hospice Update 2018Document5 pagesHome Health& Hospice Update 2018Ghyias MirNo ratings yet

- Trends in Healthcare Payments Annual Report 2015 PDFDocument38 pagesTrends in Healthcare Payments Annual Report 2015 PDFAnonymous Feglbx5No ratings yet

- NAHC WhitePaper Value-of-HomeHealthDocument8 pagesNAHC WhitePaper Value-of-HomeHealthZied JemmeliNo ratings yet

- International Social Welfare ProgramsDocument10 pagesInternational Social Welfare ProgramsZaira Edna JoseNo ratings yet

- LWV CausesRisingHealthCareCostsDocument2 pagesLWV CausesRisingHealthCareCostsjrfh50No ratings yet

- Communicating The Real Costs of Accidents and Illnesses: Broker World MagazineDocument2 pagesCommunicating The Real Costs of Accidents and Illnesses: Broker World MagazineHelene Tripodi CurtoNo ratings yet

- NSG 436 Analysis of A UDocument6 pagesNSG 436 Analysis of A Uapi-521018364No ratings yet

- The Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperDocument7 pagesThe Establishment Strikes Back: Medical Savings Accounts and Adverse Selection, Cato Briefing PaperCato InstituteNo ratings yet

- Revamp Shady Health Care System with Partnerships and Non-Profit StatusDocument16 pagesRevamp Shady Health Care System with Partnerships and Non-Profit StatusKen ComeiroNo ratings yet

- Ten Steps For A Market-Oriented Health Care SystemDocument2 pagesTen Steps For A Market-Oriented Health Care SystemahmedNo ratings yet

- engl 138t issue brief 1Document10 pagesengl 138t issue brief 1api-741545560No ratings yet

- Healthcare White PaperDocument4 pagesHealthcare White Paperramakanta_sahu100% (1)

- An Alternative Approach To Providing Universal CareDocument5 pagesAn Alternative Approach To Providing Universal CareAnonymous yFIsD9kTCA100% (4)

- Northwestern Callahan Esman Neg Ndtatwichitastate Round3Document58 pagesNorthwestern Callahan Esman Neg Ndtatwichitastate Round3Viveth KarthikeyanNo ratings yet

- Health SectorDocument84 pagesHealth SectorRahul MandalNo ratings yet

- Financial Environment of Health Care OrganizationsDocument40 pagesFinancial Environment of Health Care OrganizationsNeicy Wilson100% (1)

- The Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesDocument3 pagesThe Shifting Landscape of The US Healthcare System Through The ACA and Specific InitiativesPhoebe MwendiaNo ratings yet

- LWV RecentHealthCareChangesDocument4 pagesLWV RecentHealthCareChangesjrfh50No ratings yet

- Majority of Companies Taking Immediate Steps To Minimize Exposure To Excise TaxDocument4 pagesMajority of Companies Taking Immediate Steps To Minimize Exposure To Excise TaxAutomotive Wholesalers Association of New EnglandNo ratings yet

- Consumer-Driven Health Plans Show More Patient Involvement in Their Health CareDocument4 pagesConsumer-Driven Health Plans Show More Patient Involvement in Their Health CareAutomotive Wholesalers Association of New EnglandNo ratings yet

- Talking PointsDocument1 pageTalking Pointszeke1999No ratings yet

- High Deductible Health PlansDocument6 pagesHigh Deductible Health PlansiggybauNo ratings yet

- The Case For Universal HealthcareDocument10 pagesThe Case For Universal Healthcarejay100% (1)

- Research Paper On MedicaidDocument7 pagesResearch Paper On Medicaidafnkhujzxbfnls100% (1)

- Aco + PCMH PDFDocument7 pagesAco + PCMH PDFsandhyasrNo ratings yet

- Satisfaction Gap Narrowing Between Traditional and Consumer-Driven Health PlansDocument4 pagesSatisfaction Gap Narrowing Between Traditional and Consumer-Driven Health PlansAutomotive Wholesalers Association of New EnglandNo ratings yet

- Consumer Driven Health CareDocument9 pagesConsumer Driven Health CareKevin VarnerNo ratings yet

- Rapidcare Medical Billing ManualDocument93 pagesRapidcare Medical Billing Manualapi-19789919100% (3)

- Health Insurance Research PaperDocument7 pagesHealth Insurance Research Paperxfeivdsif100% (1)

- Managed Healthcare: Industry OverviewDocument11 pagesManaged Healthcare: Industry Overviewt6166asNo ratings yet

- Health CareDocument5 pagesHealth Care6xmarkNo ratings yet

- DRC Oct 2012 Without CartoonsDocument21 pagesDRC Oct 2012 Without CartoonsdallaschamberNo ratings yet

- Hcentive Health Insurance Exchange PlatformDocument16 pagesHcentive Health Insurance Exchange PlatformalishanorthNo ratings yet

- Thesis On Health InsuranceDocument8 pagesThesis On Health Insurancekimberlyjonesnaperville100% (2)

- Healthcare Whitepaper 2013Document15 pagesHealthcare Whitepaper 2013Fouad LfnNo ratings yet

- Hospital FinancaDocument3 pagesHospital FinancaHihiNo ratings yet

- One in Five Insured Americans Avoid Seeing A Doctor Due To Fear of CostDocument4 pagesOne in Five Insured Americans Avoid Seeing A Doctor Due To Fear of CostAutomotive Wholesalers Association of New EnglandNo ratings yet

- HCR Backgrounder Cost 090209Document2 pagesHCR Backgrounder Cost 090209Satriya PranataNo ratings yet

- Averting The Medicare Crisis: Health IRAs, Cato Policy AnalysisDocument8 pagesAverting The Medicare Crisis: Health IRAs, Cato Policy AnalysisCato InstituteNo ratings yet

- Running Head: Health Care Plans 1Document4 pagesRunning Head: Health Care Plans 1Ignatius TisiNo ratings yet

- Hca-600-Week 4 Assignment - Health Care Policy IssuesDocument5 pagesHca-600-Week 4 Assignment - Health Care Policy Issuesapi-290742611No ratings yet

- Research Paper in Health EconomicsDocument6 pagesResearch Paper in Health Economicscaqllprhf100% (1)

- Many Turning To Personalized Healthcare For Financial Relief Under "Obamacare"!Document21 pagesMany Turning To Personalized Healthcare For Financial Relief Under "Obamacare"!Timothy Christian TeNo ratings yet

- Cost-Effective Urgent Care Center Reduces ED OveruseDocument6 pagesCost-Effective Urgent Care Center Reduces ED Overusedaron_vchulekNo ratings yet

- Obamacare Fact SheetDocument1 pageObamacare Fact Sheetapi-254040217No ratings yet

- 9.4 Ethical Issues in The Provision of Health CareDocument7 pages9.4 Ethical Issues in The Provision of Health CareAngelica NatanNo ratings yet

- Medicare Public Option Over Private InsuranceDocument4 pagesMedicare Public Option Over Private InsuranceAnthony Sanglay, Jr.No ratings yet

- Draft 2Document61 pagesDraft 2jeyologyNo ratings yet

- Health Care Schemes Project at KamineniDocument78 pagesHealth Care Schemes Project at KamineniVenugopal VutukuruNo ratings yet

- UntitledDocument3 pagesUntitledShyam Sunder Rao ChepurNo ratings yet

- UntitledDocument1 pageUntitledShyam Sunder Rao ChepurNo ratings yet

- Equipment PicsDocument12 pagesEquipment PicsShyam Sunder Rao ChepurNo ratings yet

- Cerner Iu-Healths-Cerner-Powerchart-View-OnlyDocument22 pagesCerner Iu-Healths-Cerner-Powerchart-View-OnlyShyam Sunder Rao ChepurNo ratings yet

- PerformanceDocument2 pagesPerformanceShyam Sunder Rao ChepurNo ratings yet

- PerformanceDocument2 pagesPerformanceShyam Sunder Rao ChepurNo ratings yet

- Budget 2010-11 (Radlabs)Document1 pageBudget 2010-11 (Radlabs)shyamchepurNo ratings yet

- Class of 2016 Graduate ListsDocument16 pagesClass of 2016 Graduate ListscallertimesNo ratings yet

- Phillips Petroleum Co. v. Mississippi, 484 U.S. 469 (1988)Document21 pagesPhillips Petroleum Co. v. Mississippi, 484 U.S. 469 (1988)Scribd Government DocsNo ratings yet

- Macalloy Corporate Brochure September 2018 LR PDFDocument12 pagesMacalloy Corporate Brochure September 2018 LR PDFsampathkumarNo ratings yet

- C32 IMO II 950bhp 1600rpm Spec Sheet (LEHM0271-00)Document2 pagesC32 IMO II 950bhp 1600rpm Spec Sheet (LEHM0271-00)Kuswanto MarineNo ratings yet

- Interconnection of Power SystemsDocument5 pagesInterconnection of Power SystemsRohan Sharma50% (2)

- Happy Shopping PDFDocument21 pagesHappy Shopping PDFVinutha NayakNo ratings yet

- ResearchDocument44 pagesResearchGwend MemoracionNo ratings yet

- Managing An Angry PatientDocument15 pagesManaging An Angry Patientmasa.dalati.1No ratings yet

- The Impact of Interest Rates On Economic Growth in KenyaDocument41 pagesThe Impact of Interest Rates On Economic Growth in KenyaSAMUEL KIMANINo ratings yet

- Summer Training Report at B H E L BhopalDocument66 pagesSummer Training Report at B H E L BhopalshantanuNo ratings yet

- Treatment: Animated Text Onstage:: Topic: Learning Objective: WMS Packages Module Introduction Display 1Document8 pagesTreatment: Animated Text Onstage:: Topic: Learning Objective: WMS Packages Module Introduction Display 1hikikNo ratings yet

- Carco h90vsDocument9 pagesCarco h90vsRoxana Elizabeth Valencia NavarrteNo ratings yet

- Teaching English Poetry at Secondary LevelDocument15 pagesTeaching English Poetry at Secondary LevelEngr Saud shahNo ratings yet

- AGUILA Automatic Coffee Machine User Manual - Instructions for Use EN DE FR ITDocument19 pagesAGUILA Automatic Coffee Machine User Manual - Instructions for Use EN DE FR ITPena Park HotelNo ratings yet

- Mystic Mystique Face Reading-IIDocument10 pagesMystic Mystique Face Reading-IIVijay KumarNo ratings yet

- Does Cash App Have Business Accounts - Google SeaDocument1 pageDoes Cash App Have Business Accounts - Google SeaAdedayo CrownNo ratings yet

- GROWTH ASSESSMENT FOR 10-YEAR-OLD SCHOOLERDocument4 pagesGROWTH ASSESSMENT FOR 10-YEAR-OLD SCHOOLERYashoda SatputeNo ratings yet

- Mechanical installation and maintenance guidelines for length counterDocument2 pagesMechanical installation and maintenance guidelines for length countervinod kumarNo ratings yet

- Three Thousand Years of Longing 2022Document93 pagesThree Thousand Years of Longing 2022Ppper pepperNo ratings yet

- Orienteering Lesson PlanDocument34 pagesOrienteering Lesson PlanJuan Carlos Guillen BayonNo ratings yet

- Southwest Globe Times - Sep 8, 2011Document16 pagesSouthwest Globe Times - Sep 8, 2011swglobetimesNo ratings yet

- 03 Agriculture GeofileDocument4 pages03 Agriculture GeofilejillysillyNo ratings yet

- Splices: S100 S100 S101 S101 S101 S102Document3 pagesSplices: S100 S100 S101 S101 S101 S102Albert BriceñoNo ratings yet

- Dead Reckoning and Estimated PositionsDocument20 pagesDead Reckoning and Estimated Positionscarteani100% (1)

- 4 McdonaldizationDocument17 pages4 McdonaldizationAngelica AlejandroNo ratings yet

- Digital Media TYBMM (Advertising & Journalism) Semester VIDocument5 pagesDigital Media TYBMM (Advertising & Journalism) Semester VIKartavya JainNo ratings yet

- Superb Estate: PricesDocument10 pagesSuperb Estate: PricesReal GandeaNo ratings yet

- TM Journal Class 5 Pharma Trademarks 2018Document1,192 pagesTM Journal Class 5 Pharma Trademarks 2018Tahir LabbeNo ratings yet

- NES 362 Type and Production Testing of Mechanical Equipment Category 3Document36 pagesNES 362 Type and Production Testing of Mechanical Equipment Category 3JEORJENo ratings yet

- Kendriya Vidyalaya Sangathan: Observation & ReportingDocument6 pagesKendriya Vidyalaya Sangathan: Observation & ReportingSravan KumarNo ratings yet

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouFrom EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouRating: 5 out of 5 stars5/5 (5)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (82)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsFrom EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNo ratings yet

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- Sacred Success: A Course in Financial MiraclesFrom EverandSacred Success: A Course in Financial MiraclesRating: 5 out of 5 stars5/5 (15)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeFrom EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeRating: 5 out of 5 stars5/5 (4)

- Minimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingFrom EverandMinimalist Living Strategies and Habits: The Practical Guide To Minimalism To Declutter, Organize And Simplify Your Life For A Better And Meaningful LivingNo ratings yet

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningFrom EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningRating: 4.5 out of 5 stars4.5/5 (8)

- Budgeting: The Ultimate Guide for Getting Your Finances TogetherFrom EverandBudgeting: The Ultimate Guide for Getting Your Finances TogetherRating: 5 out of 5 stars5/5 (14)

- The Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitFrom EverandThe Money Mentor: How to Pay Off Your Mortgage in as Little as 7 Years Without Becoming a HermitNo ratings yet

- Retirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyFrom EverandRetirement Reality Check: How to Spend Your Money and Still Leave an Amazing LegacyNo ratings yet

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayFrom EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayRating: 3.5 out of 5 stars3.5/5 (2)