Professional Documents

Culture Documents

Untitled

Uploaded by

number one0 ratings0% found this document useful (0 votes)

6 views1 pageThis document provides a quiz for an income taxation pre-finals course. It lists 10 terms related to income taxation and financial concepts and asks the student to identify each term, including escalating tax, added expense, added-value tax, tax on capital gains, tax on capital transfers, income tax, tax fraud, tax evasion, depreciation, and disincentive.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides a quiz for an income taxation pre-finals course. It lists 10 terms related to income taxation and financial concepts and asks the student to identify each term, including escalating tax, added expense, added-value tax, tax on capital gains, tax on capital transfers, income tax, tax fraud, tax evasion, depreciation, and disincentive.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageUntitled

Uploaded by

number oneThis document provides a quiz for an income taxation pre-finals course. It lists 10 terms related to income taxation and financial concepts and asks the student to identify each term, including escalating tax, added expense, added-value tax, tax on capital gains, tax on capital transfers, income tax, tax fraud, tax evasion, depreciation, and disincentive.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

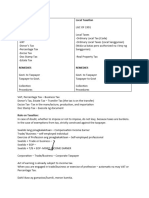

INCOME TAXATION PRE FINALS

QUIZ #6

DIRECTIONS: IDENTIFY

1. Escalating tax - a fee assessed at a greater rate in relation to income

2. Added expense - a fee imposed on purchases, sales, transactions,

imports, and other activities

3. Added-value tax - a tax collected at each stage of the manufacturing

process, excluding expenditures that have already been taxed at earlier

stages.

4. Tax on capital gains- Earnings from the sale of assets are often subject

to taxes.

5. Tax on capital transfers - Beyond a particular value, gifts and

inheritances are frequently subject to a

6. Income tax - the yearly wealth tax levied on persons (in some

countries)

7. Tax fraud - giving tax officials false information

8. Tax evasion - Keeping your tax payments to a legal minimum

9. Depreciation - lowering a fixed asset's value by deducting it from

earnings

10. Disincentive - something that makes a decision less likely

You might also like

- Tax Reviewer (UP)Document163 pagesTax Reviewer (UP)Rap ReyesNo ratings yet

- TAX-Chap 2-3 Question and AnswerDocument13 pagesTAX-Chap 2-3 Question and AnswerPoison Ivy100% (1)

- Fundamentals of TaxationDocument36 pagesFundamentals of TaxationAyesha Pahm100% (1)

- International Taxation & Transfer PricinglDocument84 pagesInternational Taxation & Transfer Pricinglnaveen pachisiaNo ratings yet

- TAXATION With ActivityDocument14 pagesTAXATION With ActivityAriel Rashid Castardo BalioNo ratings yet

- IAS 12 Income TaxDocument43 pagesIAS 12 Income TaxMinal BihaniNo ratings yet

- Chapter 12 Reviewer IncotaxDocument2 pagesChapter 12 Reviewer IncotaxJere Mae MarananNo ratings yet

- Chapter 2Document4 pagesChapter 2Frances Garrovillas100% (1)

- TAX-Chap 2-3 Question and AnswerDocument9 pagesTAX-Chap 2-3 Question and AnswerPoison Ivy0% (1)

- Chapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSDocument3 pagesChapter 13 REGULAR ALLOWABLE ITEMIZED DEDUCTIONSAlyssa BerangberangNo ratings yet

- Chapter 2 - Taxes, Tax Laws, and Tax AdministrationDocument7 pagesChapter 2 - Taxes, Tax Laws, and Tax Administrationreymardico100% (2)

- Final Tax PDFDocument50 pagesFinal Tax PDFMicol Villaflor Ü100% (1)

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- Classification of TaxDocument2 pagesClassification of Taxjonniebix9No ratings yet

- Unit 7Document2 pagesUnit 7Nguyễn NamNo ratings yet

- 4 Sources of IncomeDocument16 pages4 Sources of IncomeRommel Espinocilla Jr.No ratings yet

- LESSON Week 9 Introduction To Real Estate TaxationDocument5 pagesLESSON Week 9 Introduction To Real Estate TaxationJheovane Sevillejo LapureNo ratings yet

- SEC 21 Sources of RevenueDocument11 pagesSEC 21 Sources of RevenueJustin LoredoNo ratings yet

- Pga 080800Document7 pagesPga 080800pulpsenseNo ratings yet

- Chapter 9 - Taxes and Foreign InvestmentDocument15 pagesChapter 9 - Taxes and Foreign InvestmentKazi HasanNo ratings yet

- Delloitee CaymanDocument2 pagesDelloitee CaymananalystbankNo ratings yet

- TaxationDocument20 pagesTaxationKlare CadornaNo ratings yet

- Unit - 4 Sales Tax and Corporate Tax PlanningDocument24 pagesUnit - 4 Sales Tax and Corporate Tax PlanningAshok KumarNo ratings yet

- Taxes: (Is The Excess of Allowable Deductions Over Gross Income)Document2 pagesTaxes: (Is The Excess of Allowable Deductions Over Gross Income)john paulNo ratings yet

- TAXESDocument2 pagesTAXESMagia ŚwiatłaNo ratings yet

- Lesson 6Document2 pagesLesson 6Bãdïs BäNo ratings yet

- Taxation - UP 2008Document163 pagesTaxation - UP 2008Martoni SaliendraNo ratings yet

- UP Tax Review NotesDocument163 pagesUP Tax Review NotesramlivsolisNo ratings yet

- Rule:: Revenue From Sales Revenue From ProfessionDocument2 pagesRule:: Revenue From Sales Revenue From Profession在于在No ratings yet

- Capital Gain IrelandDocument7 pagesCapital Gain IrelandAYAN AHMEDNo ratings yet

- International Tax: Dominican Republic Highlights 2019Document4 pagesInternational Tax: Dominican Republic Highlights 2019Juan Enrique GuilianiNo ratings yet

- Chapter 05 DDocument74 pagesChapter 05 DnewonemadeNo ratings yet

- IntroDocument22 pagesIntroBlaise AngelesNo ratings yet

- Sushant S Narvekar Smriti Nair Dev Anand Krutika Dadlani Mamta Tawade Nikhil PawaskarDocument18 pagesSushant S Narvekar Smriti Nair Dev Anand Krutika Dadlani Mamta Tawade Nikhil PawaskarSushant NarvekarNo ratings yet

- Unit 8 - TAXATION - To StsDocument5 pagesUnit 8 - TAXATION - To StsNguyễn LnhNo ratings yet

- Accounting For Government and Non-Profit Organizations: Give 5 Types of Tax in The Philippines. 1. Income TaxDocument1 pageAccounting For Government and Non-Profit Organizations: Give 5 Types of Tax in The Philippines. 1. Income TaxRandelle James FiestaNo ratings yet

- Dealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxDocument24 pagesDealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxJezza Mae Gomba RegidorNo ratings yet

- Simonpagef1lesson2 13314551374677 Phpapp01 120311034324 Phpapp01Document18 pagesSimonpagef1lesson2 13314551374677 Phpapp01 120311034324 Phpapp01je-ann montejoNo ratings yet

- English Exam 23'Document4 pagesEnglish Exam 23'Beata MickevičNo ratings yet

- Group 6 Tax AssignmentDocument16 pagesGroup 6 Tax AssignmentFolake DavisNo ratings yet

- Chapter 12: International Taxation and Transfer PricingDocument38 pagesChapter 12: International Taxation and Transfer PricingSara AlsNo ratings yet

- National Taxation Local TaxationDocument13 pagesNational Taxation Local TaxationjoanamaetaclasNo ratings yet

- Kinds of Taxes 1. Income Tax: Net Taxable Income-The Amount of Income That Is Used To Calculate AnDocument3 pagesKinds of Taxes 1. Income Tax: Net Taxable Income-The Amount of Income That Is Used To Calculate AnTharina SalvatoreNo ratings yet

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoNo ratings yet

- ScriptDocument2 pagesScriptxecife6933No ratings yet

- Tax.02 Taxes, Tax Laws and Tax AdministrationDocument6 pagesTax.02 Taxes, Tax Laws and Tax AdministrationRhea Royce CabuhatNo ratings yet

- International Tax: Guatemala Highlights 2017Document3 pagesInternational Tax: Guatemala Highlights 2017daggoNo ratings yet

- CHAPTER 13 - SummarizeDocument13 pagesCHAPTER 13 - SummarizejsgiganteNo ratings yet

- Lesson 15: TaxationDocument2 pagesLesson 15: TaxationMa. Luisa RenidoNo ratings yet

- Taxation 1 Mod 4Document48 pagesTaxation 1 Mod 4Harui Hani-31No ratings yet

- International Taxation IssuesDocument35 pagesInternational Taxation IssuesAdrin Ma'rufNo ratings yet

- Module 2 Income Tax Basic ConceptsDocument41 pagesModule 2 Income Tax Basic ConceptsAriza CastroverdeNo ratings yet

- TaxationDocument15 pagesTaxationHani NazrinaNo ratings yet

- FAC512 Financial Accounting - Pre-Reading For Session 2 PDFDocument3 pagesFAC512 Financial Accounting - Pre-Reading For Session 2 PDFVrutik Jentibhai SanghaniNo ratings yet

- Pas 12 Income TaxesDocument3 pagesPas 12 Income TaxesKristalen ArmandoNo ratings yet

- 06 Overview of Income Taxation and Income Tax For IndividualsDocument7 pages06 Overview of Income Taxation and Income Tax For IndividualsRonn Robby RosalesNo ratings yet

- International Tax: Philippines Highlights 2017Document4 pagesInternational Tax: Philippines Highlights 2017Tony MorganNo ratings yet

- Jpia-Hau: Business and Transfer TaxationDocument12 pagesJpia-Hau: Business and Transfer Taxationronniel tiglaoNo ratings yet

- UntitledDocument1 pageUntitlednumber oneNo ratings yet

- Obli 1.0Document1 pageObli 1.0number oneNo ratings yet

- Obli 2.0Document1 pageObli 2.0number oneNo ratings yet

- Income Taxation Pre Finals Quiz #7Document1 pageIncome Taxation Pre Finals Quiz #7number oneNo ratings yet

- Without An Explicit Constitutional Provision Allowing It, The State, As TheDocument2 pagesWithout An Explicit Constitutional Provision Allowing It, The State, As Thenumber oneNo ratings yet

- UntitledDocument1 pageUntitlednumber oneNo ratings yet

- 03 Performance Task 16Document4 pages03 Performance Task 16number oneNo ratings yet

- CourseheroDocument3 pagesCourseheronumber oneNo ratings yet

- Quiz 3Document1 pageQuiz 3number oneNo ratings yet

- Obligation CaseDocument1 pageObligation Casenumber oneNo ratings yet

- Supply ChainDocument1 pageSupply Chainnumber oneNo ratings yet

- CH2 0Document1 pageCH2 0number oneNo ratings yet

- Worksheet 2Document1 pageWorksheet 2number oneNo ratings yet

- Corpo LawDocument1 pageCorpo Lawnumber oneNo ratings yet

- Notes in PPCDocument1 pageNotes in PPCnumber oneNo ratings yet

- Constitution of The Republic of The PhilippinesDocument1 pageConstitution of The Republic of The Philippinesnumber oneNo ratings yet

- Pop CultureDocument1 pagePop Culturenumber oneNo ratings yet

- Case DigestDocument1 pageCase Digestnumber oneNo ratings yet

- Obligation and ContractDocument1 pageObligation and Contractnumber oneNo ratings yet

- Case Study 3.0Document1 pageCase Study 3.0number oneNo ratings yet

- Excel LessonDocument4 pagesExcel Lessonnumber oneNo ratings yet

- Determinate ThingDocument1 pageDeterminate Thingnumber oneNo ratings yet

- Case Study 4.0Document1 pageCase Study 4.0number oneNo ratings yet

- Week 4 - PracticumDocument42 pagesWeek 4 - Practicumnumber oneNo ratings yet

- Case Study 7.0Document2 pagesCase Study 7.0number oneNo ratings yet

- Week 8 - PracticumDocument22 pagesWeek 8 - Practicumnumber oneNo ratings yet

- Case Study 3.0Document1 pageCase Study 3.0number oneNo ratings yet

- Case Study 8.0Document2 pagesCase Study 8.0number oneNo ratings yet

- Case Study Visitor Mangement in Kakadu ParkDocument1 pageCase Study Visitor Mangement in Kakadu Parknumber oneNo ratings yet

- Values and PlanningDocument1 pageValues and Planningnumber oneNo ratings yet