Professional Documents

Culture Documents

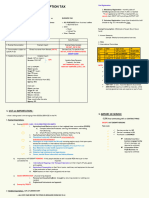

VAT, business tax, and import tax overview

Uploaded by

ronniel tiglao0 ratings0% found this document useful (0 votes)

51 views12 pages1. Consumption tax is levied on the purchase or consumption of goods and services by buyers, or on the sale of goods and services by sellers. It includes value added tax (VAT) imposed on importation and domestic sales.

2. VAT is imposed on the importation of goods at 12% of the total import cost. For domestic sales, VAT is collected from sellers and constitutes an explicit part of the sales invoice.

3. In addition to VAT, businesses may be subject to percentage taxes levied on their gross sales or receipts if their sales are below the VAT registration threshold. Both VAT and percentage taxes constitute forms of consumption tax.

Original Description:

tax

Original Title

BUSTAX HANDOUTS

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Consumption tax is levied on the purchase or consumption of goods and services by buyers, or on the sale of goods and services by sellers. It includes value added tax (VAT) imposed on importation and domestic sales.

2. VAT is imposed on the importation of goods at 12% of the total import cost. For domestic sales, VAT is collected from sellers and constitutes an explicit part of the sales invoice.

3. In addition to VAT, businesses may be subject to percentage taxes levied on their gross sales or receipts if their sales are below the VAT registration threshold. Both VAT and percentage taxes constitute forms of consumption tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

51 views12 pagesVAT, business tax, and import tax overview

Uploaded by

ronniel tiglao1. Consumption tax is levied on the purchase or consumption of goods and services by buyers, or on the sale of goods and services by sellers. It includes value added tax (VAT) imposed on importation and domestic sales.

2. VAT is imposed on the importation of goods at 12% of the total import cost. For domestic sales, VAT is collected from sellers and constitutes an explicit part of the sales invoice.

3. In addition to VAT, businesses may be subject to percentage taxes levied on their gross sales or receipts if their sales are below the VAT registration threshold. Both VAT and percentage taxes constitute forms of consumption tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 12

BUSINESS AND TRANSFER should not be charged within JPIA-HA

TAXATION consumption tax.

Types of Taxable Domestic Consumption

Overview of the Handouts: 1) Importation

I. INTRODUCTION TO CONSUMPTION 12% of the total import cost

TAX “Value Added Tax (VAT)” on

II. VALUE ADDED TAX ON Importation – paid prior to the

IMPORTATION withdrawal of goods from the

III. INTRODUCTION TO BUSINESS warehouse.

TAXATION “Withholding VAT” – import on

IV. EXEMPT SALES OF GOODS, VAT on services (12%)

PROPERTIES & SERVICES Goods = VAT on Importation = BOC

V. PERCENTAGE TAX Services = Withholding VAT = BIR

VI. INTRODUCTION TO VALUE ADDED 2) Sales – Consumption Tax on Purchases

TAX of Residents is collected from the seller.

VII. THE REGULAR OUTPUT VAT Seller

VIII. OUTPUT VAT: ZERO RATED SALES o Statutory taxpayers

o The one named by the law to

pay tax.

I. INTRODUCTION TO Buyer

CONSUMPTION TAX o Economic taxpayers

Consumption- occurs when one acquires o The one who actually pays

goods or services by purchase, exchange, or the tax.

other means. Invoice price

o Consumption Tax

Consumption Tax- tax upon the utilization of o Purchase Price

goods or services

Business Tax

- Tax on the purchase or

Tax levied on sales or receipts of a

consumption of the buyer

resident seller only when the seller is

or on the sale of seller.

engaged in business.

Rationale of Consumption Tax

1) Promotes Savings - a residual income Other term for “Consumption Tax”

that remains after consumption. Often viewed as a “privilege tax”

- promotes capital A tax on the privilege to do business.

formation and investment. Basis of Business Tax

2) Helps in wealth redistribution – a tax 1) Sales – for businesses which sells

on consumption makes the rich pay goods or properties.

more. 2) Receipts – for businesses that sells

3) Supports the Benefit Received services.

Theory – everyone receives from the Types of Business Taxpayers

government; everybody should be 1) VAT Taxpayers – required to pay VAT

taxed. 2) Non – VAT Taxpayers – those who pay

Consumption Tax is leveled on percentage tax.

necessities such as foods, education, Characteristics of VAT on Sales

health, shelter, or housing. 1) Tax on Value Added – a tax on the

mark – up or price increases.

Types of Consumption 2) Top – up on Sales – amount added to

1) Domestic Consumption – the selling price to arrive at the invoice

consumption on purchases of Philippine price which will be billed to the

residents. consumer.

2) Foreign Consumption – consumption Invoice Price – VAT, Selling Price

or purchases of non – residents. 3) Tax Credit Method

Destination Principle – goods and o VAT on Sales less VAT on

services destined for use or Purchase = + Excess (Payable)

consumption in the Philippines are o Output VAT – Input VAT = VAT

subject to consumption tax. Payable (Excess – deduction)

- goods and 4) Explicit Consumption Tax – VAT is

services destined for use or consumption in disclosed in the invoice / Official

abroad are not subject to consumption tax. Receipt.

Cross Border Doctrine – states that 5) Quarterly Tax

those destined toward foreign territories

Business and Transfer Taxation

o BIR FORM 2550M – 25th of next c) Automobiles JPIA-HA

month d) Non – essential commodities

o BIR FORM 2550Q – 25th of next e) Metallic or non-metallic materials

month after the quarter.

Methods of Computing VAT II. VALUE ADDED TAX ON

1) Direct Method IMPORTATION

o (Sales – Purchases) x VAT RATE Importation

2) Tax Credit Method o Refers to the purchase of goods

o Output VAT – Input VAT = VAT by a resident buyer to a non-

PAYABLE resident seller.

Special Features of Tax Credit Method o A form of domestic consumption

1) Invoice – based crediting Types of Consumption Tax on Importation

o Input VAT is to be substantiated 1) VAT on Importation

with invoices. o Import of goods.

2) Non – observance of the matching of o Payable to BOC

costs or expenses and sales. o Paid prior to withdrawal of goods

VAT Registered Taxpayers from warehouse.

o Businesses which exceed 3M o 12%

sales / receipts in a 12-month 2) Final Withholding VAT

period. o Purchase of Service from non-

o Mandatory required to register as resident

VAT Taxpayer o 12%

VAT Registrable Taxpayers Exempt Consumption

o Exceeded 3M sales but did not register o Basic Necessities

as VAT Taxpayers. o Priority goods and services (for

o Cannot claim input VAT development)

Percentage Tax Exempt Importation for Human

o Generally, 3% Consumption

o Imposed upon gross sales or gross 1) Agricultural and Marine Food

receipts of non-VAT Taxpayers. Products (Original State)

o Paid by the Seller. o Are natural objects of human

Characteristics of Percentage Tax consumption

1. Tax on sales / gross receipts o Taxing these tends to limit normal

2. Presented as an expense deductible processes of life.

against sales. o Exempt products are:

3. Implicit Consumption Tax (need to be a) Fruits

disclosed) b) Vegetables, tea, ginsen

4. Monthly or Quarterly Tax c) Edible form products

Who Pays Percentage Tax d) Marine Foods

1) Non – VAT Taxpayers e) Poultry and Livestock

2) Taxpayers who sell services specifically f) Milk, eggs, meat for human

subject to percentage tax consumption

Important Points Livestock – cows, bulls, calves, pig, sheep,

1) VAT Taxpayers goats, rabbits

o Invoice Price = Sales + VAT Marine Food – fish, crustaceans

Percentage Taxpayers Poultry – fowls, ducks, geese, turkey

o Invoice Price = Sales Original State

2) VAT and Percentage Tax are mutually o Means unprocessed.

exclusive. o Simple process still considered being in

Except: VAT Taxpayers has activities original state:

mandated by law to be subject to a) Preparation (boiling, roasting, etc.)

percentage tax. b) Preservation (freezing, drying, etc.)

Excise Tax c) Packaging

Imposed in addition to VAT or i. Shrink wrapping in plastic

Percentage Tax ii. Vacuum packing

Imposed on Production, not equal on iii. Tetra – packing

sales. iv. Others

Levied on: Agricultural and Marine Products

a) Sin Products Considered in Original State

b) Petroleum Products a) Husked Rice

Business and Transfer Taxation

b) Corn Grits o Conditions: JPIA-HA

c) Raw Cane Sugar a) Appear at regular intervals with

d) Roasted Coffee beans fixed prices

e) Ordinary Salt b) Not be devoted principally to the

f) Copra publication of paid advertisement

g) Dried Fish Note: Exemption does not extend on

h) Sundried Fruits other school supplies

i) Ground Meat 6) Importation of fuel, goods, and

j) Smoked fish supplies by persons engaged in

Processed Agricultural and Marine Food international shipping or air

Products transport operations

o Undergone changes in their chemical o They are intended for consumption

compositions. abroad

o Have undergone complex processing or o If mixed, allocate

treatment. 7) Importation of cooperatives of direct

o Examples: farm inputs, machineries and

a) Refined Sugar equipment, including their spare

b) Wine or Vinegar parts

c) Butter o Conditions for exemption:

d) Canned Sardines or Mackarel a) Must be an agricultural

e) Vegetable or Coconut Oil cooperative

f) Soy b) In good standing with CDA

o Subject to VAT on Importation c) Involves direct farm inputs,

2) Importation of Fertilizers, seeds, machineries and equipment

seedlings, fingerlings, fish, prawn, o Used directly and exclusively in the

livestock, and poultry feeds production

o Exempt o Cooperative must be

o Specialty feeds – taxable AGRICULTURAL

o Inputs for agricultural products 8) Special Laws

- Feeds= “ingredients” – not taxable 9) International Treaty

and if can be used for human 10) Importation of Vessels, Aircrafts,

consumption, then taxable and spare parts

- Herbicides, pesticides are not Presumption of Vatability

included o States that “importation is generally

3) Importation of personal and subject to VAT unless it can be

household effects proven as exempt”

o Conditions: Subsequent Sale by Exempt Person to Non-

a) Belongs to Philippine Resident Exempt

intending to resettle in the o The non – exempt buyer will be

Philippines subject to VAT on importation

b) Goods are exempt from custom Tax Basis of VAT on Importation

duties. o 12% of the total landed cost of the

o They are no longer taxable for they were importation

already taxed before a) Dutiable Value

o Reasonable in number b) Custom Duty

4) Importation of Professional c) Excise Tax

Instruments and Implements, wearing d) Other in- land act

apparel, domestic animal, and o Berthing Fee

personal household effects. a) Bank Charge

o Conditions: b) Brokerage fee

a) Goods must accompany the person c) Wharfage fee

upon arrival d) Customs PST

b) Goods belong to persons who come to e) Import Processing fee

settle in Philippines Landed Cost – cost incurred prior to

c) There is evidence of change in withdrawal of goods from the warehouse.

residency Dutiable Value – total value used by BOC in

d) Not a vehicle, machinery or equipment determining the tariff and custom duties.

5) Importation of books, newspapers, a) Cost of goods sold

magazine, review or bulletin b) Freight

o Based upon the necessity of education c) Insurance

and information d) Other charges and costs

Business and Transfer Taxation

Technical Importation Exemptions to Rules of Regularity JPIA-HA

o Importations from Economic Zones 1) Business Principally for subsistence

are subject to VAT or livelihood

o Ecozones are considered foreign o Gross sales of net more than 100,000

territories per year

Sales from ecozones are exempt from o Self – employed (marginal income

VAT earners)

Withholding VAT on Import of Service 2) Sales by non-residents are

o 12% payment to BIR considered made in the course of the

o The sale by non-resident to a resident is business

always presumed made in the course of o In essence, it is a form of import

business purchase by the resident buyer

o The real object of taxation is purchase Commercial Activity – engagement in sales

of service by a non-resident. of goods and services for profit

Payment of the Withholding VAT Not Businesses under the “Commercial

o BIR Form 1600 Activity Rule”

o Monthly – 10th day of the following 1) Government Agencies and

month except December, January 25 of Instrumentalies – primary motive:

the next year provide public services

Treatment of the VAT on importation and 2) Non-profit organizations or associations

the Withholding VAT – do not generate income

1) If resident citizen is VAT-registered 3) Employment – “compensation” only

o VAT on Importation or Withholding VAT 4) Directorship in a corporation

can be claimed as Input VAT, creditable Other Persons Considered Engaged in

against output VAT Business

2) If resident citizen is non-VAT registered 1) Consultants

o VAT on importation or withholding VAT 2) Sales agents or brokers

3) Television or movie talents and artists

shall be part of the cost of purchase

4) Cooking Instructors

o Shall be treated as asset or expense

5) Martial Art Instructors

3) If not engaged in business

Nature of Business Taxes

o VAT on importation or withholding VAT

1) Consumption Tax

is merely added to the costs of 2) Indirect Tax – imposed to seller rather

importation than the buyer

0% VAT - can still claim input VAT, 3) Privilege Tax – privilege to do business

thus can also claim tax credit / Person – individual, trust, estate, partnership,

deduction. corporation, joint venture, cooperative, or

Exempt Vat – cannot claim input VAT. association.

Taxable Person – Taxable unit in business

III. INTRODUCTION TO BUSINESS taxation

TAXATION Registration of Business

Business Tax – a consumption tax payable by 1) Register to the appropriate RDO with

persons engaged in business BIR form

Business – habitual engagement in a 2) Pay annual registration fee of P500

commercial activity o BIR Form 0605 (on or before

Habitual Engagement – there is regularity in

January 31)

transactions and normally manifested in

o Through accredited bank in the ROD

registration

or RD

Non – registration does not exonerate

In the case of storage places,

one who is actually engaged in regular

application = 30 days from the date of

trade or business from being liable to

using the premise as storage

pay business tax.

3) Get Registration Certificate – issued

Not Considered Businesses

after complying with requirements

1) Sale by non – dealers

4) Post Registration Certificate in the

o Make casual sale of goods or properties

principal place of business and at each

2) Privilege Stores

branch.

a) Tiangge

Types of Business as to Activities

b) Stalls or markets not permanently

1) Sale of goods or properties

fixed to the ground

o Tangible and intangible

c) Put up during special events

o Includes:

d) Not 15 days operation (cumulative

and the 15 days is annual count)

Business and Transfer Taxation

a) Sale of real property (ordinary JPIA-HA

j) Brokers in effecting sales of stocks

course) through PSE

b) Lease

c) Right / privilege to use properties IV. EXEMPT SALES OF GOODS,

(intangible) or rights PROPERTIES & SERVICES

d) Right / privilege to use an Exempt Sales

Philippine industrial, commercial 1. Agricultural and Marine Food

or scientific equipment Products in Original State

e) Right to use motion picture film a) For human consumption (includes

2) Sale or exchange of Services – breeding stocks and genetic

providing services for a fee, materials)

remuneration, or consideration b) Inputs for agricultural products feeds

Tax Bases of Business Taxpayers except specialty feeds

1) Goods = Gross sales, inclusive of VAT c) Services of agricultural contract growers

and Excise tax (it uses accrual basis)

o Allowable deductions: Original State

a) Discounts = trade discount o Unprocessed

b) Sales Returns and Allowances – Not o Simple process of preparation,

deductible preservation, packaging

2) Services – Gross Receipts (Uses cash State Altering

basis) o Use of heat (cooking products)

Constructive Receipt – money consideration o Use of complex process such as

is put / placed at the control of the service chemical treatment or curing in solution

provider without restrictions by the payor. o Marinating

Agency Monies – payment to an unrelated o Mixing flavoring / ingredients

third party or received as reimbursement for 2. Sale of Certain Farm or Fishery

advanced payment on behalf of other. Inputs

Insurance Proceeds on Damaged Assets- Exemption is qualified and limited to:

not viewed as sales or receipts. a. For plants or fruit cultivation – fertilizers,

seeds, and seedlings

Categories of Business Sales b. For animal husbandry – livestock, feeds

1. Exempt Sales and ingredients for livestock and poultry

a) VAT Exempt Importation feeds

b) VAT Exempt Sales c. For fishery operation – fingerlings, fish,

i. Basic Necessities prawn

ii. Exempt by law 3. Sale of Livestock / Poultry Feeds or

iii. Casual Sales ingredients in the manufacture of

iv. Export Sales of Non-VAT feeds

registered person o Must be unfit for human consumption

2. Sales Subject to Percentage Tax

otherwise it is vatable

a) Common Carriers transport of

4. Services by agricultural contract

passengers by land and keepers of

growers and nulling for others of

garage

palay into rice, corn into grits, and

b) International Carriers (Cargos, excess

sugar cane into raw sugar.

baggage, mails)

Agricultural Contract Growers – refers to

c) Franchise Grantees

persons producing for others

i. Radio/Television broadcasting

Agricultural and Marine Food products in their

(<10m = 3%)

original state.

ii. Gas and Water Utilities (2%)

5. Education Services

d) Telephone Companies on overseas

o Rendered by private educational

communication (exempt: government ,

institution

international organization, diplomatic

Accredited by:

services)

a) DepEd

e) Banks and non-banks financial

b) CHED

intermediaries

c) TESDA

f) Life Insurance Companies

o Rendered by government educational

g) Agents of foreign Insurance Companies

h) Certain Amusement Places institutions

i) Jai-alai and cockpit operator on o Includes books, newspapers,

winnings magazines, reviews or bulletins.

o Except: seminars, trainings, review

classes.

Business and Transfer Taxation

6. Health or Hospital Services JPIA-HA

o Its purpose for being exempt is to

o Medicinal, dental, hospital, and provide tax incentives for keeping

veterinary services the rentals low

o Except : rendered by professionals, 12. Transport of Passengers by

sales of drugs by hospital, drugstore, if International Carriers

part of the hospital bill o Receipts from:

Under Train Law 2019 – medicines for a. Outgoing Flight – 0% VAT

diabetes, high cholesterol & high blood b. Incoming Flight – Exempt

– exempt c. Domestic Flight – 12% VAT

7. Employment 13. Sale of Cooperatives

7.1 Services performed in pursuant to an o Electronic Cooperatives – VATABLE

employer – and – employee o Transaction to members- EXEMPT

relationship o Transaction to non – members =

exceed 10m ; VATABLE

Job / Profession that are VATABLE 14. Export Sales of Non-VAT Taxpayers

1) Professional Practitioners o 0% VAT and;

2) Consultants o Exempt OPT

3) Talents 15. Sale to exempt parties under

4) Artists of TV international agreements or Special

5) Brokers and Agents Laws (Exempt VAT & OPT)

7.2 Director’s Fees Example:

o Not earned in the course of business a. PEZA registered enterprises

o Do not arise from an undertaking that is b. Asian Development Bank

intended to be pursued in the course of c. International Rice Research Institute

business which includes: d. Philippine National Red Cross

a) Continuity of Activity e. Embassies of foreign government

b) Objective to earn unrestricted amounts f. Philippine Amusement and Gaming

of profits Corporation

c) Unrestricted offering of goods or

services To VAT Taxpayers

8. Regional Area Headquarter of a o Exempt sales must be specifically

Multinational Company designated as such by indicating or pre-

o Act as supervisory, communications and printing the caption “Exempt” at the

coordinating centers for their affiliates invoice or receipt.

o Do not derive income from the Failure to Comply = 12% VAT or 3% OPT

Philippines o Can be applied by VAT – registered who

Regional Operating Headquarters are entered in transaction exempt for tax

Taxable o Must be made within 10 days before the

9. Casual Sales beginning of the taxable quarter

o Sale by a non-dealer o Could decrease pricing competitiveness

Sale of Properties held for use are o Subject to pre-dominance test

Vatable

10. Sale by dealers that complied with Option is allowed if 50% of its gross

price ceilings sales comes from business subject to

o Socialized Housing VAT

a) House and Lot Package – 450,000 Sales to Senior Citizen & PWD

b) Residential Lot Only – 180,000 o Subject to 20% discount on certain

o Low Cost Housing business establishment

a) Price Unit Ceiling – 750,000 (RA 7279) a. Lodging

o Sale of Residential Lot- 3,000,000 and b. Restaurants

below c. Recreational Centers

o Sale of Residential dwelling – 3,199,200 d. Other places of culture, leisure, and

& below amusements

Sale of adjacent lots house and lots, e. Hospitals

and other residential dwelling within 12 f. Drugstores and health services

month period is treated as one for the g. Transport Fares

purpose of the ceiling

11. Lease of residential unit with Exempt Sales under Goods

monthly rental not exceeding 12,800 a. Senior Citizen & PWD

b. Sale of Exempt Goods

i. Agricultural & Marine

Business and Transfer Taxation

ii. Fertilizers Exempt: BSP – legally mandated functionJPIA-HA

iii. Books, newspapers, magazine for Bank – refers to entities engaged in the

educational services lending of funds obtained in the form of

iv. Medicine for diabetes & hypertension deposits.

v. Passenger or Cargo Vessels Example:

c. Sale of Goods by Cooperative a. Commercial Bank

d. Sale of Residential Properties b. Savings Bank

i. Low – costing = 750,000 c. Mortgage Banks

ii. Socialized d. Development Banks

House & Lot – 450,000 e. Rural Banks

Lot – 180,000 f. Stocks and Saving Associations

e. Export Salles by Non-VAT Persons g. Branches and Agencies of Foreign

f. Treaty Banks

Example: PEZA h. Cooperative Banks

g. Tax free exchange i. Islamic Banks

o Gain on control to another entity j. Others determined by monetary board

o Merger of BSP

o Consolidation Non – Bank Financial Intermediaries - refer

h. Sale of gold to BSP to persons or entities whose principal function

include the lending, investing, or placement of

Exempt Sales on Services fund, or evidences of indebtedness, or equity

a. Schools Accredited by: deposited with them

o DepEd Quasi – Banking Function – borrowing of

o CHED funds from 20 or more personal or corporate

o TESDA lenders at any one time through issuance,

endorsements, or acceptance of debt

b. Employees – because it is not a

instrument.

business

c. Agricultural Contract Growers

Tax Rates on Bank and Quasi – Banks

d. Residential Leasing – 15,000 per month

1) Interest Income, Commissions, and

e. Cooperative Services

discounts from lending activities, and income

o Members = exempts

from financial leasing on the basis of remaining

o Non – members = 10m – exempt

maturities of instruments from which the

f. Hospital receipts were derived

g. Home – owners association / a) Maturity period of five years or less = 5%

condominium dues b) Maturity period of more than five years = 1%

h. Lease of passenger or cargo vessels 2) Dividend and equity shares in the net

i. Treaty – exempt income of subsidiaries = 0%

j. Regional Area Headquarters 3) On royalties, rentals of property, real or

k. International Carriers personal profits from exchange and all other

o Transport of passengers only items treated as gross income under section

l. Printers or publishers 32 of NIRC = 7%

o For educational purposes like books, 4) On net trading gains within the taxable year

magazines, etc. on foreign currency, debt securities,

m. Senior Citizen and PWD derivatives, and other similar financial

instruments (RA 9337) = 7%

Other Exempt Sales of Goods or Services

a. Sales exempt by special laws Items of gross income

i. Sales by Ecozone Locators o Gross income subject to RIT

ii. Sale of Amusement Service by theaters o For banks, gross income subject to FT

and cinemas Net trading gains

b. Sales by not engaged in business o Cumulative total of the net trading gain

c. Sales of Assets held for use.

or loss

o Reported figures in the previous month

V. PERCENTAGE TAX

Net trading loss

Percentage Tax – is a national tax measured

o Shall be deductible only on the gains

by a certain percentage at the gross selling

price or gross receipts. from trading on the same category

o Cannot be carried over as deduction in

Services Subject to Percentage Tax the following years

1. Banks and Non – banks financial Tax on other Financial Intermediaries

intermediaries without Quasi – Banking Functions

Business and Transfer Taxation

1) Interest income, commissions and o Up to 25% = 2% tax rate JPIA-HA

discounts from lending activities income from o Over 35% but not over 33 1/3% = 1%

financial leasing, on the basis of remaining tax rate

maturity of instruments from which the receipts Clearly held Corporations – atleast 50% of

were denied the value of outstanding capital stock is

o Maturity period is five years or less = 5% owned directly or indirectly by not more than

o Maturity period is more than five years = 20 individuals.

1%

2) From all other items treated as gross Determination of the Proportion of

income under the NIRC = 5% stocks sold in an IPO

1) Primary Offering

2. Percentage Tax on International o Unissued shares of the closely held

Carriers corporation to be sold in the IPO

o 3% of quarterly gross receipts on: o Primary shares / Outstanding shares

a. Transport of cargoes after IPO

b. Baggage 2) Secondary Offering

c. Mails from Philippines to another o Issued shares being sold through IPO

country o Secondary shares / Outstanding shares

o Does not apply to offline international before IPO

carriers Follow through Offering – subsequent sale

3. Percentage Tax on Domestic Carriers after than IPO

and keepers of garage (Common 6. Franchises

Carrier Tax) o Generally franchises are VATABLE

Common Carrier o Subject to OPT

o Engaged in business of carrying or Radio or television broadcasting

transporting passengers of goods by companies (annual gross = 10m or less)

land, water, or air = 3%

o Exempt from local tax Gas and Water Utilities = 2%

o Example: Vatable Franchises

a. Cars for rent driven by lessee 1) Electricity

b. Transportation of contractors 2) Telecommunication

c. Person who transport passengers Except: Overseas Communications =

4. Amusement Places 10%

o Amusement taxes (20 day after the end 3) Transportation

of quarter) Except: Common Carriers by land =

o Places of taxing exhibitions = 10% 3%

o Places of professional basketball games 4) Private Franchises

= 15% 7. Life Insurance Companies

o Cockpits, night, or day clubs = 18% o 2% on the premiums collected

o Jai – alai and race – tracks = 30% (previous tax)

o Operators of amusement places = Life Insurance Company – is a company

VATABLE which deals with the insurance on human lives

Exempt: and insurance appertaining there to or

a. World or Oriental Championship connected therewith.

b. At least one the contender is a Filipino

c. Promoter is Filipino Citizen Not included in gross receipts of an

d. Promoter is a corporation 60% of which insurance company:

is owned by Filipino Citizen a. Premiums refunded within 6 months

Gross Receipts – receipts of proprietor, b. Re – insurance premiums

lessee operator plus income from television, c. Premiums of life insurance of non -

radio, and motion picture rights. residents received from abroad

d. Excess of premiums on variable

5.Sale of Shares through PSE or IPO contracts.

o Stock transaction tax Types of Insurance Business

o 60% of 1% 1) Direct Insurance Business – underwrites

insurance policy and negotiate them to

o Meets 10% of the minimum public

policy holders through insurance agents

ownership in the PSE

2) Reinsurers – assumes part of the rise of

Shares sold through IPO

insurers ; insurers of the insurers

o Proportion of Shares sold, bartered, or

3) Retrocessionaries – insurers of the

exchanged = 4% tax rate reinsurers

Business and Transfer Taxation

Cooperative – companies conducted by the c.4 Philippine Red Cross JPIA-HA

members thereof with the money collected c.5 Foreign Embassies

from among themselves and solely for their 3) Exempt Sales

own protection and not for profit. Other Sales Subject to VAT

8. Overseas Communication 1) Sales to registrable persons

o 10% OPT 2) Sales of Non-VAT Taxpayers who

o Exempt: issues VAT invoice or receipt

a. Government 3) Exempt Sales billed by VAT

b. Diplomatic Services Taxpayers as regular sales.

c. International Organizations

d. News Services VII. THE REGULAR OUTPUT VAT

9. Winnings from horse race or jai – alai Sources of Regular Output VAT (Sales

o In general, 1-% Subject to VAT)

o Doble/ forecast/ quirella & trifecta bets = 1. Sale of VATABLE Goods

4% o 12% VAT on gross selling price / gross

o Owners of winning race horses = 10% sales

o Payable within 20 days from date o VAT is reported on the month of sale

withheld Unreasonably lower price

Exempt from OPT The selling price is lower by more

o VAT Taxpayers than 30% if the actual market value

o Self – Employed (Professional who of the goods

VAT basis will be FAIR VALUE

opted the 8% income tax – BIR Form

Except: Government = uses actual

1701 A)

selling price

o Cooperatives

2. Sale of VATABLE Services

o 12% VAT on gross receipts

VI. INTRODUCTION TO VALUE

o Reported in the month of collection

ADDED TAX (VAT)

VAT Threshold 3. Sale of VATABLE Properties

o 12% VAT = 3m and up – all other than o Under regularities:

radio & television Gross Selling Price – Actual Selling

o 12% VAT = 10m and up – franchise Price or Fair Value, whichever is higher

o Under NIRC

grantees (radio and tv)

Subsidiaries = Separate Entity Gross Selling Price – Zonal Value or

Branch = Not separate Entity Fair Value per assessor’s office,

Optional VAT Registration – lock-in period of whichever is higher

3 years Sale of Ordinary Assets

o 12% VAT

VAT Model o The transaction is incidental to the tax-

Output VAT xxx payers main business

Less: Input VAT xxx Sale of Capital Assets

VAT Due xxx o Exempt from VAT

Less: Tax Credits xxx 4. Transactions deemed as Sales (for VAT

VAT Still Due xxx Taxpayers Only)

o Consumption in nature but are not

Sales Subject to Special VAT Rules coursed through a purchase transaction

1) Sales to the Government (GOCCs) o Generally VAT is based on market value

o 12% normal rate of goods

List of Transactions Deemed as Sales

7% input VAT 5% Withholding 1) Transfer, use, or consumption not in the

ordinary course of business

VAT Payable is 0 a. Goods/ Properties held for sale are no

o Presumed input VAT (7%) is closed to longer sold but are disposed of other

“Cost of Sales” rears

2) Zero – rated Sales (0%) b. Properties intended for use are no

Examples longer used but are transferred,

a. Foreign Assumption – export sales disposed, or exchanged through other

b. International Transport Operations means

c. VAT Exempt Persons 2) Distribution or transfer to:

c.1 PEZA a. Shareholders / investors share in the

c.2 International Rice Research Institute profit of VAT – registered person

c.3 Asian Development Bank

Business and Transfer Taxation

b. Creditors in payment of debt / PEZA JPIA-HA

obligation Cagayan Special

3) Consignment of goods not withdrawn in Economic Zone

60 days – VATABLE Clark Special Economic

4) Retirement of Cessation of Business Zone

o Results in the transfer of all business Zamboanga Special

goods and properties to the personal Economic Zone

account of the owner Poro Point Special

o When it is acquired by the new Economic and

owners Freepoint Zone

5) Cessation of Status as VAT-registered Aurora Special Economic

person Zone (ASZ)

a. Change of business activity (VAT c. Sale of goods, supplies, equipment,

taxable to VAT exempt) and fuel to persons engaged in

b. Approval of a request of cancellation international shipping or international

of registration due to: air transport operations.

b.1 Reversion to exempt states o Considered foreign

b.2 Desire to revert to exempt status consumption

after lapse of 3 years by persons 2) Effectively Zero – Rated Sales

who voluntary registered despite o Exempt under special laws /

being exempt treaty

b.3 Of one who command business o Examples: Sales to:

with the expectation of 3m gross Asian Development

sales but failed to achieve it. Bank

Determination of Fair Value International Rice

o Determination by CIR in cases of: Research Institute

a. Transaction is a deemed sales United States Agency

b. Gross selling price is reasonably for International

lower Development (USAID)

Invoicing Requirement for subsequent sale with personel and

of goods or properties deemed as sales contractors

o Not VATABLE Foreign Embassies

o Requirements: (including qualified

a. Sales invoice number where employees and

output tax was imposed developments

b. Corresponding tax paid Philippine National Red

Cross

VIII. OUTPUT VAT – ZERO RATED PAGCOR and its

SALES licenses or contractors

Zero – Rated Sales United Nation, and

o Foreign consumption & equivalents Various Organization

o International Agreements World Health

o Export Sales Organization

VAT Taxpayer – 0% UNICEF

Non – VAT Taxpayer – Exempt

Zero Rated Sales of Goods Requirement to avail 0% VAT

1) Export Sales a. Apply to appropriate BIR Office

a. Direct Export a.1 Audit, Information, Tax Exemption

i. Sale / Shipment of goods from and Incentives Division (AITEIO) under

Philippines to abroad, in Assessment Office Service

respective of shipping b. For Large Taxpayers:

arrangement b.1 Large Taxpayer Audit Card and

ii. Requirements: Investigation Division I and II BIR National

paid for in acceptable foreign Office.

currency or equivalent

accounted for in accordance with the Zero Rated Sales of Services

rules and regulations of BSP 1) Services to non – residents

b. Sale to Economic Zones / Tourism a. Services other than manufacturing,

Zones processing, repacking

b. Requirement:

Technical importation

Examples of Ecozones:

Business and Transfer Taxation

b.1 services must be performed in JPIA-HA

Sale by Export Oriented

the Philippines Enterprise – Export Sales

b.2 paid in acceptable foreign should be 70% of total

currency or its equivalent production per annum

b.3 payment is accounted for under Export Sales under E.O.

the rules and regulations of BSP 226 & Special Laws

2) Effectively Zero - Rated Services

a. Exempt Under Special Laws / Treaty

b. Same as Zero – Rated Sales of

Goods.

3) Services Rendered to persons

engaged in International shipping or air

transport operations, including leases of

property for use thereof.

4) Transport of passengers and cargo by

Domestic, Air, or Sea carriers from the

Philippines to Foreign Country

i. Outgoing Flight = 0% VAT

ii. Incoming Flight = Exempt

5) Sale of Power or Fuel Generated

Through Renewable Sources of Energy

o Examples of Renewable Sources of

Energy

Biomass

Solar

Wind

Hydropower

Geothermal and steam

Ocean energy

o Not included are services to these

sources of energy

Types of Electricity Business

1. Generation Companies

o Authorized by Energy Regulatory

Commission

o Operates facility used in production of

electricity

2. Transmission Companies

o Conveys electricity through high voltage

backbone system or transition assets.

3. Distribution Companies

o Electric Cooperatives which operates

distribution system

6) Services Rendered to Ecozones or

Tourism Enterprise Zones

Enhanced VAT System

o DOF – VAT refund center in BIR and

BOC

Refund should be generated within

90 days

5% of total VAT Collection will be

appropriated as funds for VAT refund

o Could result to changes of 0% VAT to

12% VAT

Not included in the possible charges

are

Export Sales – sale of raw

materials or packaging

materials

Business and Transfer Taxation

JPIA-HA

Source: Business and Transfer Taxation by

Rex B. Banggawan

Business and Transfer Taxation

You might also like

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- 01 BustaxDocument10 pages01 BustaxJake Raphael Cruz CalaguasNo ratings yet

- TAX2Document6 pagesTAX2DeyNo ratings yet

- Business Tax and VAT on Importation ExplainedDocument2 pagesBusiness Tax and VAT on Importation ExplainedMark LapidNo ratings yet

- Tax 2 NotesDocument2 pagesTax 2 NotesMark LapidNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Consumption Tax RulesDocument8 pagesConsumption Tax RulesDenvyl MangsatNo ratings yet

- Introduction To Consumption Taxes NotesDocument2 pagesIntroduction To Consumption Taxes NotesSelene DimlaNo ratings yet

- Tax 202 - Chapter 1 Consumption TaxDocument4 pagesTax 202 - Chapter 1 Consumption TaxLizandraArceoBarteNo ratings yet

- Bustax Chapters 1 4Document6 pagesBustax Chapters 1 4Naruto UzumakiNo ratings yet

- Introduction to Consumption TaxesDocument9 pagesIntroduction to Consumption Taxescj8kim8maggayNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Chapter 1 and 2 BUSTAXDocument6 pagesChapter 1 and 2 BUSTAXCory RitaNo ratings yet

- VAT on Importation and Consumption Taxes ExplainedDocument4 pagesVAT on Importation and Consumption Taxes ExplainedJamaica DavidNo ratings yet

- Introduction To Consumption Tax PDFDocument20 pagesIntroduction To Consumption Tax PDFShamae Duma-anNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- M7 - Intro To Consumption Tax & VAT On Importation Students'Document54 pagesM7 - Intro To Consumption Tax & VAT On Importation Students'Elaiza RegaladoNo ratings yet

- Introduction To Value Added TaxDocument5 pagesIntroduction To Value Added TaxNYSHAN JOFIELYN TABBAYNo ratings yet

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- Rationale of Consumption TaxDocument3 pagesRationale of Consumption Taxmy miNo ratings yet

- Intro To Consumption TaxesDocument9 pagesIntro To Consumption TaxesAnna CynNo ratings yet

- Module 7 - Introduction To Business TaxesDocument6 pagesModule 7 - Introduction To Business TaxesKyrah Angelica DionglayNo ratings yet

- VAT Module OverviewDocument9 pagesVAT Module OverviewCSJNo ratings yet

- Tax 2 - BanggawanDocument175 pagesTax 2 - BanggawanJessica IslaNo ratings yet

- Introduction to Consumption TaxesDocument5 pagesIntroduction to Consumption TaxesHazel Jane EsclamadaNo ratings yet

- Understanding Key Concepts of Business TaxationDocument6 pagesUnderstanding Key Concepts of Business TaxationYolly DiazNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument1 pageChapter 1 Introduction To Consumption TaxesMicko LagundinoNo ratings yet

- Introduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument56 pagesIntroduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTTokis SabaNo ratings yet

- Value Added Taxes Part 1 ExplainedDocument75 pagesValue Added Taxes Part 1 ExplainedLEILALYN NICOLAS100% (1)

- Ch. 1Document3 pagesCh. 1abibiNo ratings yet

- Business TaxesDocument98 pagesBusiness TaxesAbigailRefamonteNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument6 pagesChapter 1 Introduction To Consumption TaxesJason MablesNo ratings yet

- TAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)Document50 pagesTAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)reymardicoNo ratings yet

- Value Added Tax NotesDocument12 pagesValue Added Tax NotesAimeeNo ratings yet

- Lesson-6Document6 pagesLesson-6Iris Lavigne RojoNo ratings yet

- Tax 43 - Business TaxationDocument8 pagesTax 43 - Business TaxationFemie AmazonaNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Business and Transfer Taxes: An Introduction To Consumption TaxesDocument16 pagesBusiness and Transfer Taxes: An Introduction To Consumption TaxesAngelo Delos SantosNo ratings yet

- Concept of Business and Business TaxesDocument3 pagesConcept of Business and Business TaxesHazel Joy DemaganteNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- VAT Input DeductionsDocument3 pagesVAT Input DeductionsMarionne GNo ratings yet

- Business Tax Chapter 7 ReviewerDocument2 pagesBusiness Tax Chapter 7 ReviewerMurien LimNo ratings yet

- Business and Transfer Taxation: TO Consumption TaxesDocument40 pagesBusiness and Transfer Taxation: TO Consumption TaxesKC GutierrezNo ratings yet

- Gruba Tax 2 NotesDocument13 pagesGruba Tax 2 NotesPJezrael Arreza FrondozoNo ratings yet

- Lecture On VAT Output Vat PDFDocument7 pagesLecture On VAT Output Vat PDFCarl's Aeto DomingoNo ratings yet

- Topic 1 - Business TaxDocument9 pagesTopic 1 - Business Taxalexissosing.cpaNo ratings yet

- Introduction To Business TaxDocument7 pagesIntroduction To Business TaxDrew BanlutaNo ratings yet

- VAT Outline: Shashi Jayatissa Acca, Mba (Uk)Document23 pagesVAT Outline: Shashi Jayatissa Acca, Mba (Uk)ashfaqNo ratings yet

- Consumption Tax BasicsDocument4 pagesConsumption Tax BasicsNicole Daphne FigueroaNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument21 pagesChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JesseNo ratings yet

- VAT rules for domestic, foreign, and deemed salesDocument8 pagesVAT rules for domestic, foreign, and deemed salesKenneth MatabanNo ratings yet

- Tax.3213-7 Output Input and Vat PayableDocument11 pagesTax.3213-7 Output Input and Vat PayableMira Louise HernandezNo ratings yet

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- Consumption TaxDocument6 pagesConsumption TaxSha MagondacanNo ratings yet

- MIDTERMS Business and Transfer TaxationDocument13 pagesMIDTERMS Business and Transfer Taxationabrylle opinianoNo ratings yet

- Kjaefncl (Complete)Document42 pagesKjaefncl (Complete)Kenzo RodisNo ratings yet

- A331 6256 Andrade Kyla Assignment On PERT CPMDocument5 pagesA331 6256 Andrade Kyla Assignment On PERT CPMronniel tiglaoNo ratings yet

- Exploring Potential Expansion into South KoreaDocument101 pagesExploring Potential Expansion into South Korearonniel tiglaoNo ratings yet

- Cost Accounting - HandoutsDocument3 pagesCost Accounting - Handoutsronniel tiglaoNo ratings yet

- Case Study 1 Course of Action and RecommendationDocument5 pagesCase Study 1 Course of Action and Recommendationronniel tiglaoNo ratings yet

- OBLICON Chapter 3 Section 3Document6 pagesOBLICON Chapter 3 Section 3ronniel tiglaoNo ratings yet

- Artificer Infusions: Boots of The Winding PathDocument6 pagesArtificer Infusions: Boots of The Winding PathKylisseNo ratings yet

- Land Titling and Transfer Legal Services in Trece Martirez and DasmarinasDocument1 pageLand Titling and Transfer Legal Services in Trece Martirez and DasmarinasMark RyeNo ratings yet

- Wax Rolls For Your Success: Yarn Yearns For The One and OnlyDocument9 pagesWax Rolls For Your Success: Yarn Yearns For The One and Onlyangga widayantoNo ratings yet

- Nick & Sammy - Baby You Love Me (Bass Tab)Document6 pagesNick & Sammy - Baby You Love Me (Bass Tab)Martin MalenfantNo ratings yet

- Here are the answers to the questions:1. Country or nation2. Archipelago 3. Peninsula4. Island5. Mainland6. Seven7. Asia8. ColonyDocument8 pagesHere are the answers to the questions:1. Country or nation2. Archipelago 3. Peninsula4. Island5. Mainland6. Seven7. Asia8. ColonyShiela Mae FernandezNo ratings yet

- Remedies in TortDocument4 pagesRemedies in TortAhmad Irtaza Adil100% (2)

- Research Proposal GE4 3506Document7 pagesResearch Proposal GE4 3506Renalisa PontemayorNo ratings yet

- Mind Map of Emphasis MarkersDocument1 pageMind Map of Emphasis MarkersJHONA THE IGUANANo ratings yet

- Conditional TensesDocument2 pagesConditional TensesccrrzzNo ratings yet

- Billy: Bookcase SeriesDocument4 pagesBilly: Bookcase SeriesDImkaNo ratings yet

- NITI AayogDocument6 pagesNITI Aayogs100% (1)

- Investigation of An Animal Mutilation Injuries in Cache County, UtahDocument33 pagesInvestigation of An Animal Mutilation Injuries in Cache County, UtahLionel Elyansun100% (1)

- Meridian Analysis Energy DeviceDocument4 pagesMeridian Analysis Energy Devicehistory APNo ratings yet

- PSMB Certified Trainer Curriculum StructureDocument19 pagesPSMB Certified Trainer Curriculum StructureFlankerSparrowNo ratings yet

- Project Report TemplateDocument9 pagesProject Report TemplatePriyasha BanerjeeNo ratings yet

- Four Modes of DeliveryDocument21 pagesFour Modes of DeliveryRyan AbellaNo ratings yet

- New Holland E55Bx Tier 4 Compact Hydraulic Excavator Service Repair ManualDocument21 pagesNew Holland E55Bx Tier 4 Compact Hydraulic Excavator Service Repair ManualggjjjjotonesNo ratings yet

- Mis11e ch03Document42 pagesMis11e ch03Vasudha RaoNo ratings yet

- Ticket 3586662689Document2 pagesTicket 3586662689dev dNo ratings yet

- The Cappadocian Cuneiform TabletsDocument60 pagesThe Cappadocian Cuneiform TabletskoutetsuNo ratings yet

- Jag MandirDocument10 pagesJag MandirMadan ChaudharyNo ratings yet

- 4g 6 Traits Writing Rubric StudentDocument3 pages4g 6 Traits Writing Rubric Studentapi-295344358No ratings yet

- Present Value of Growth OpportunitiesDocument8 pagesPresent Value of Growth OpportunitiesPrabhpuneet PandherNo ratings yet

- Kami Export - Year 11 Spring Break RevisionDocument90 pagesKami Export - Year 11 Spring Break Revisionbkhmnrq4d6No ratings yet

- Hydraulic Pumps Lec NotesDocument30 pagesHydraulic Pumps Lec NotesDarsh MenonNo ratings yet

- Payment Instruction Form (Pif) : Davao CentralDocument1 pagePayment Instruction Form (Pif) : Davao Centralhue sageNo ratings yet

- EDP 3 Product DevelopmentDocument15 pagesEDP 3 Product DevelopmentatulkirarNo ratings yet

- (Case Brief) M - S Haridas Exports V - S All India Float Glass Association & Others, 2002 - Law BriefsDocument3 pages(Case Brief) M - S Haridas Exports V - S All India Float Glass Association & Others, 2002 - Law BriefsPrashansa100% (1)

- ResumeDocument2 pagesResumeAbhinav kaliaNo ratings yet

- Certificates Search For King and Queen 2019Document13 pagesCertificates Search For King and Queen 2019Kebu YenNo ratings yet