Professional Documents

Culture Documents

Concept of Consumption and Consumption Taxes and Vat On Importation

Uploaded by

Jamaica DavidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Concept of Consumption and Consumption Taxes and Vat On Importation

Uploaded by

Jamaica DavidCopyright:

Available Formats

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY

MID-YEAR 2021

TAX 2 – BUSINESS AND TRANSFER TAXATION

CONCEPT OF CONSUMPTION AND CONSUMPTION

TAXES; AND VAT ON IMPORTATION

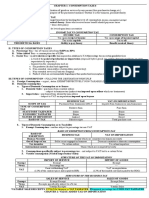

CONSUMPTION TAX TYPES OF TAXABLE DOMESTIC CONSUMPTION

is a tax imposed upon the utilization of goods or

1. Purchase of residents of goods, properties, or

services by consumers or buyers. It is a tax imposed on

services from resident sellers. This is a “sale”

the purchase or consumption of the buyer and not on

transaction on the seller’s perspective.

the sale of the seller.

2. Purchase of residents of goods or services from

TYPES OF CONSUMPTION non-residents abroad. This is commonly known as

“importation” on the buyer’s perspective.

1. Domestic – refers to consumption or purchase of

Philippine residents.

TWO TYPES OF CONSUMPTION TAX ON DOMESTIC

2. Foreign – refers to consumption or purchase of

CONSUMPTION

non-residents.

1. VAT on Importation – tax imposed uniformly to all

Territoriality rule – only domestic consumptions are

taxpayers, whether engaged in business or profession

subject to Philippine Taxation.

or not.

TYPES OF BUSINESS TAXES 2. Business Tax – imposed only if the seller is engaged

1. VAT on Sales in business or profession.

2. Percentage Taxes

3. Excise Tax

Description VAT on Sales Percentage Tax Excise Tax

Tax Imposed on VATable sales VATable sales and those Excisable goods or articles

specifically subject to

percentage tax

Accrual / Timing of Point of sale for goods or Point of collection Point of production

Imposition of Tax Point of collection for sale of

services

Tax Rate Currently at 12% Generally, 3%. Various ad valorem and

Those specifically subject to specific rates (Sec. 141 to

percentage tax at various 151 of NIRC)

percentages

Basis Mark-up or value added Sales or receipts Sales value per unit of

article

Effect On Selling Added on the selling price Specifically included in the Included in the cost of

Price selling price production

Presentation In the Output VAT Reported as a deductible Capitalized then expensed

Financial Less: Input VAT expense under taxes and upon sale of the excisable

Statement = VAT Payable (liability) or licenses expense. article (included in the cost

VAT Refundable or prepaid of sales)

taxes (assets)

Export Sales Subject to 0% VAT Exempt Exempt (tax is reimbursable)

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY

MID-YEAR 2021

TAX 2 – BUSINESS AND TRANSFER TAXATION

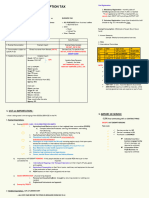

IMPOSABLE TAX PER TYPE OF CONSUMPTION

Buyer/ Consumer

SELLER OF GOODS

Resident Non-Resident

Domestic Businesses

• VAT Registered / VAT Registrable 12% VAT on gross sales 0% VAT on gross selling price

• Non-VAT Registered 3% Percentage Tax on gross sales Exempt

12% VAT on importation based on

Foreign Businesses Exempt

landed cost

Buyer/ Consumer

SELLER OF SERVICES

Resident Non-Resident

Domestic Businesses

0% VAT on gross receipts

• VAT Registered/ VAT Registrable 12% VAT on gross receipts (services must be rendered in the

Philippines, if not, exempt)

3% Percentage Tax

• Non-VAT Registered Exempt

on gross receipts

12% Final Withholding VAT

Foreign Businesses (applies regardless of the place Exempt

where it is rendered)

EXCISE TAX IMPORTATION

Imposed, in addition to VAT or percentage tax, on Refers to the purchase of goods including services by

certain goods manufactured, produced, or imported in the Philippine residents from non-resident sellers.

the Philippines for domestic consumption. Importation is a form of domestic consumption.

Excise Tax is imposed on the production or imposed on

TYPES OF CONSUMPTION TAX ON IMPORTATION

the production or importation of the following:

1. VAT on Importation – the consumption on the

a. Sin products, such as tobacco and alcoholic

import of goods

products

2. Final Withholding VAT – consumption tax on the

b. Petroleum and petroleum related products

purchase of services from non-resident.

c. Automobiles, yacht and sports cars

d. Non-essential commodities such as jewelries and

VAT on Final Withholding

perfumes

Importation VAT

e. Metallic or non-metallic minerals, mineral

Object of

products and quarry resources such as coal, coke, Goods Service

consumption

gold, chromite and silver.

Foreign service

f. Sweetened beverages and vanity tax on cosmetic Imposed upon Importer/buyer

provider

surgeries (TRAIN Law)

Statutory Resident purchaser

Importer/buyer

taxpayer of the service

Direct Indirect business

Nature

consumption tax tax

Tax basis Landed cost Contract price

Collecting

BOC BIR

agency

Before

Timing of After the month of

withdrawal of

Payment payment

goods

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY

MID-YEAR 2021

TAX 2 – BUSINESS AND TRANSFER TAXATION

IMPORTATION OF GOODS parts thereof for domestic or international

a. Exempt Importation transport operations

b. Vatable Importation

B. Importation by VAT-Exempt Persons

- International shipping or air transport

VAT ON IMPORTATION AND BASIS

operators

The importation of goods is subject to VAT based on

- Agricultural cooperatives of direct farm

Total Landed Cost regardless of whether the:

inputs, machineries, and equipment including

a. Importer is engaged or not in trade or business

spare parts thereof, to be used directly and

b. Importer is a VAT or non-VAT registered

exclusively in the production and or

c. Importation is for business or personal use

processing of their produce

d. Non-resident seller is engaged or not engaged in

- PEZA locator on their import of goods or

business.

services

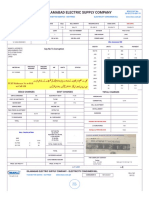

COMPOSITION OF TOTAL LANDED COST C. Quasi-Importation

1. Dutiable Value - Personal and household effects belonging to

a. Cost of Goods residents of the Philippines returning from

b. Freight and Insurance abroad and non-resident citizens coming to

c. Other directly related charges and costs resettle in the Philippines

2. Customs Duty - Professional instruments and implements,

(Dutiable Value x Exchange Rate x Rate of Duty) wearing apparel, domestic animals, and

3. Excise Tax (if applicable) personal household effects belonging to

4. Other In-Land-Cost persons coming to settle in the Philippines

a. Bank charge D. Importation which are exempt Special Laws and

b. Brokerage fee International Agreement

c. Arrastre charge - New Provisions under CREATE Law related to

d. Wharfage due Importations of equipment and materials to

e. Customs documentary stamp tax fight COVID-19

f. Processing fees on importation - Exempt Importations under RA 11494 –

Bayanihan Act II

PRESUMPTION OF VATABILITY

All importations are generally subject to VAT unless it SUBSEQUENT SALE BY EXEMPT PERSONS TO NON-

can be proven as exempt under any of those EXEMPT PERSONS

specifically exempt under the NIRC or other special If an exempt importer subsequently sells his exempt

laws. The burden of proof in establishing VAT importation to a non-exempt person, the non-exempt

exemption rests upon the taxpayer. buyer shall be subject to VAT on importation. The tax

due on such importation shall constitute a lien on the

VAT-EXEMPT IMPORTATION goods, superior to all charges or liens, irrespective of

A. Importation of Exempt Goods the possessor of said goods. (Sec.4 107-1(c); RR 16-

- Agricultural and marine food products in their 2005)

original state

- Livestock or poultry used as, or producing However, the rule does not apply to exempt

food for human consumption importation of exempt goods. Exempt goods are

- Breeding stock and genetic materials exempt from consumption tax. They are not subject to

- Fertilizers, seeds, seedlings and fingerlings, VAT on importation and VAT on sales.

fish, prawn, livestock and poultry feeds,

including ingredients used in the manufacture TECHNICAL IMPORTATION

of finish feeds. Refers to the purchase of non-Ecozone Philippine

- Books and any newspaper, magazine, review, residents from Philippine Ecozone-registered

or bulletin (as amended by CREATE Law) enterprises. Legally speaking, Ecozones are considered

- Passenger or cargo vessels and aircrafts, foreign territories, hence, the purchase from Economic

including engine, equipment, including spare Zones is subject to VAT on Importation. Similarly, sales

to Ecozones are subject to zero-rated VAT for VAT

TARLAC STATE UNIVERSITY - COLLEGE OF BUSINESS AND ACCOUNTANCY

MID-YEAR 2021

TAX 2 – BUSINESS AND TRANSFER TAXATION

taxpayers. Likewise, sales to Ecozones are exempt from

business tax for non-VAT taxpayers. (Sec. 109 (K and V)

of NIRC)

IMPORTATION OF SERVICES

a. Exempt Importation

b. Subject to Specific Percentage Tax

c. Subject to Final Withholding VAT

VAT-EXEMPT IMPORT OF SERVICES

A. Purchase of services from non-residents when the

service is rendered abroad

B. Purchase of services from non-residents when the

individual purchaser is not engaged in business

C. Purchase of services from non-residents by VAT-

exempt persons

SPECIFICALLY SUBJECT TO PERCENTAGE TAX

A. Premium payment on insurance policies directly

sourced abroad is subject to a 5% percentage tax.

WITHHOLDING VAT ON IMPORTATION OF SERVICES

In the cases of sale of services by non-residents, the

regulations required the resident buyers to “withhold”

the VAT which is presumed to have been passed-on by

the non-resident seller. The real object of taxation is

the purchase of service by the resident buyer, it is not

the sale of the non-resident seller.

PAYMENT OF WITHHOLDING VAT

Using BIR Form 1600, the withholding VAT is remitted

monthly on or before the 10th day of the following

month after the withholding was made, except for

taxes withheld for December which shall be filed or

paid on or before January 25 of the following year.

TREATMENT OF THE VAT ON IMPORTATION AND THE

WITHHOLDING VAT

1. If the resident purchaser is a VAT-registered

business, it can claim the VAT on importation or

withholding VAT as Input VAT creditable against

its Output VAT.

2. If the resident purchaser is a non-VAT business,

the VAT on importation or Withholding VAT shall

be part of the cost of purchase or services and

shall be treated as asset or expense whichever is

applicable.

3. If the purchaser is not engaged in business, the

VAT on importation or withholding VAT is merely

added to the costs of the importation.

You might also like

- Tax 202 - Chapter 1 Consumption TaxDocument4 pagesTax 202 - Chapter 1 Consumption TaxLizandraArceoBarteNo ratings yet

- Business and Transfer Taxes: An Introduction To Consumption TaxesDocument16 pagesBusiness and Transfer Taxes: An Introduction To Consumption TaxesAngelo Delos SantosNo ratings yet

- TAX2Document6 pagesTAX2DeyNo ratings yet

- Tax 2 NotesDocument2 pagesTax 2 NotesMark LapidNo ratings yet

- Importation by Importers) : Income Tax Vs Consumption TaxDocument2 pagesImportation by Importers) : Income Tax Vs Consumption TaxMark LapidNo ratings yet

- Jpia-Hau: Business and Transfer TaxationDocument12 pagesJpia-Hau: Business and Transfer Taxationronniel tiglaoNo ratings yet

- Business Tax Chapter 1Document3 pagesBusiness Tax Chapter 1Mamin ChanNo ratings yet

- Bustax Chapters 1 4Document6 pagesBustax Chapters 1 4Naruto UzumakiNo ratings yet

- Tax 01 Introduction To Consumption TaxesDocument3 pagesTax 01 Introduction To Consumption TaxesShiela LlenaNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Business TaxesDocument20 pagesBusiness TaxesAnime ScreenshotsNo ratings yet

- 01 BustaxDocument10 pages01 BustaxJake Raphael Cruz CalaguasNo ratings yet

- Introduction To Consumption Taxes NotesDocument2 pagesIntroduction To Consumption Taxes NotesSelene DimlaNo ratings yet

- Rationale of Consumption TaxDocument3 pagesRationale of Consumption Taxmy miNo ratings yet

- Introduction To Consumption Tax PDFDocument20 pagesIntroduction To Consumption Tax PDFShamae Duma-anNo ratings yet

- Business TaxesDocument98 pagesBusiness TaxesAbigailRefamonteNo ratings yet

- M7 - Intro To Consumption Tax & VAT On Importation Students'Document54 pagesM7 - Intro To Consumption Tax & VAT On Importation Students'Elaiza RegaladoNo ratings yet

- Topic 1 - Consumption and Business TaxDocument4 pagesTopic 1 - Consumption and Business TaxNicole Daphne FigueroaNo ratings yet

- Business and Transfer TaxationDocument9 pagesBusiness and Transfer Taxationcj8kim8maggayNo ratings yet

- Tax 2 - BanggawanDocument175 pagesTax 2 - BanggawanJessica IslaNo ratings yet

- Chapter 1 Tax 2Document5 pagesChapter 1 Tax 2Hazel Jane EsclamadaNo ratings yet

- TAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)Document50 pagesTAX 221-AVP (Atillo, Cañete, Dejan, Manlimos, Hortellano)reymardicoNo ratings yet

- Business and Transfer Taxation: TO Consumption TaxesDocument40 pagesBusiness and Transfer Taxation: TO Consumption TaxesKC GutierrezNo ratings yet

- Chapter 1 and 2 BUSTAXDocument6 pagesChapter 1 and 2 BUSTAXCory RitaNo ratings yet

- Module 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingDocument33 pagesModule 1 & 2: at The End of This Topic, We Should Be Able To Learn The FollowingAlicia FelicianoNo ratings yet

- Topic 1 - Business TaxDocument9 pagesTopic 1 - Business Taxalexissosing.cpaNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument6 pagesChapter 1 Introduction To Consumption TaxesJason MablesNo ratings yet

- Consumption Taxes: Business Tax Is A Form of Consumption TaxDocument8 pagesConsumption Taxes: Business Tax Is A Form of Consumption TaxDenvyl MangsatNo ratings yet

- Intro To Consumption TaxesDocument9 pagesIntro To Consumption TaxesAnna CynNo ratings yet

- Introduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTDocument56 pagesIntroduction To Consumption Taxes: Prepared By: Mrs. Nelia I. Tomas, CPA, LPTTokis SabaNo ratings yet

- Combine PDFDocument198 pagesCombine PDFliamdrlnNo ratings yet

- Ch. 1Document3 pagesCh. 1abibiNo ratings yet

- Business Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaDocument32 pagesBusiness Taxation Intro To Consumption Taxes: Anie P. Martinez, Cpa, MbaAnie MartinezNo ratings yet

- Lesson 6Document6 pagesLesson 6Iris Lavigne RojoNo ratings yet

- Chapter 1 Introduction To Consumption TaxesDocument21 pagesChapter 1 Introduction To Consumption TaxesNacpil, Alyssa JesseNo ratings yet

- Module 7 - Introduction To Business TaxesDocument6 pagesModule 7 - Introduction To Business TaxesKyrah Angelica DionglayNo ratings yet

- BSTX Reviewer (Midterm)Document7 pagesBSTX Reviewer (Midterm)alaine daphneNo ratings yet

- Concept MapDocument9 pagesConcept MapMuadz HassanNo ratings yet

- Introduction To Value Added TaxDocument5 pagesIntroduction To Value Added TaxNYSHAN JOFIELYN TABBAYNo ratings yet

- Chapter 1 Introduction To Consumption TaxDocument15 pagesChapter 1 Introduction To Consumption TaxNesrill Joyce AntonioNo ratings yet

- Module 6. Nature and Concepts of Business TaxesDocument6 pagesModule 6. Nature and Concepts of Business TaxesYolly DiazNo ratings yet

- Consumption TaxDocument6 pagesConsumption TaxSha MagondacanNo ratings yet

- Tax 43 - Business TaxationDocument8 pagesTax 43 - Business TaxationFemie AmazonaNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- CTT Examination Reviewer (Notes) Page A - 30Document13 pagesCTT Examination Reviewer (Notes) Page A - 30Seneca GonzalesNo ratings yet

- Other Percentage Taxes PDFDocument16 pagesOther Percentage Taxes PDFJociel De GuzmanNo ratings yet

- Tax 2 Reviewer Atty. Bolivar NotesDocument66 pagesTax 2 Reviewer Atty. Bolivar NotesMaree BajamundeNo ratings yet

- Chapter 8Document6 pagesChapter 8my miNo ratings yet

- Tax Midterms Reviewer - VatDocument8 pagesTax Midterms Reviewer - VatAgot GaidNo ratings yet

- At A GlanceDocument22 pagesAt A GlanceThakur RinkiNo ratings yet

- Concept of Business and Business TaxesDocument3 pagesConcept of Business and Business TaxesHazel Joy DemaganteNo ratings yet

- Reviewerrrr Tax 2 PDFDocument11 pagesReviewerrrr Tax 2 PDFAnthony EboraNo ratings yet

- Introduction To Business TaxesDocument3 pagesIntroduction To Business Taxesyatot carbonelNo ratings yet

- Tax 2 AssignmentDocument6 pagesTax 2 AssignmentKim EcarmaNo ratings yet

- 04 VAT 132-159 (Edited May 27)Document29 pages04 VAT 132-159 (Edited May 27)Argel CosmeNo ratings yet

- Tax 301 - Midterm Activity 1Document4 pagesTax 301 - Midterm Activity 1Nicole TeruelNo ratings yet

- Gruba Tax 2 NotesDocument13 pagesGruba Tax 2 NotesPJezrael Arreza FrondozoNo ratings yet

- WrittenReport-Group 1 - BSAIS 4E WITH HIGHLIGHTDocument13 pagesWrittenReport-Group 1 - BSAIS 4E WITH HIGHLIGHTJamaica DavidNo ratings yet

- Step AcquisitionDocument2 pagesStep AcquisitionJamaica DavidNo ratings yet

- Chapter 3 PDFDocument50 pagesChapter 3 PDFJamaica DavidNo ratings yet

- Purposive Communication Module Chapter 1 4Document54 pagesPurposive Communication Module Chapter 1 4bethrice melegritoNo ratings yet

- Final Term Module Purposive Communication 2 PDFDocument119 pagesFinal Term Module Purposive Communication 2 PDFJamaica David100% (1)

- Cash N Cash Equivalent Problem Set 1Document3 pagesCash N Cash Equivalent Problem Set 1Jamaica DavidNo ratings yet

- Dear Students, Good Day and Welcome!!Document46 pagesDear Students, Good Day and Welcome!!Jenjen Gammad100% (1)

- Special Midterm Exam PDFDocument9 pagesSpecial Midterm Exam PDFJamaica DavidNo ratings yet

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting AnswersJamaica DavidNo ratings yet

- Nature of Internal Control: Multiple Choice QuestionsDocument11 pagesNature of Internal Control: Multiple Choice QuestionsJamaica David100% (1)

- Audit Testbank-Bobadilla PDFDocument560 pagesAudit Testbank-Bobadilla PDFNir Noel Aquino100% (12)

- Fifo Costing Problems - Even and UnevenDocument3 pagesFifo Costing Problems - Even and UnevenDarra MatienzoNo ratings yet

- Quizzer Home Office 3Document11 pagesQuizzer Home Office 3Jamaica David100% (1)

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- MODULE 4 Home Office and Branch Accounting PPT PDFDocument95 pagesMODULE 4 Home Office and Branch Accounting PPT PDFDanicaNo ratings yet

- Cebu Branch Submitted The Following Data To Its Home Office in Manila For 2016, Its First Year of OperationDocument31 pagesCebu Branch Submitted The Following Data To Its Home Office in Manila For 2016, Its First Year of OperationPappy Tres100% (1)

- This Study Resource Was: Key To Exercise ProblemsDocument8 pagesThis Study Resource Was: Key To Exercise ProblemsJamaica DavidNo ratings yet

- Quizzer Home Office 3Document11 pagesQuizzer Home Office 3Jamaica David100% (1)

- Quizzer Home Office 3Document11 pagesQuizzer Home Office 3Jamaica David100% (1)

- Statement of DefficiencyDocument22 pagesStatement of DefficiencyJamaica DavidNo ratings yet

- Home Office Branch and Agency Accounting AnswersDocument25 pagesHome Office Branch and Agency Accounting Answersjammy AgnoNo ratings yet

- Docxdocx 53 PDF FreeDocument61 pagesDocxdocx 53 PDF FreeJamaica DavidNo ratings yet

- Quizzer Home Office 3Document11 pagesQuizzer Home Office 3Jamaica David100% (1)

- Afar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFDocument11 pagesAfar First Mock Cpa Board Exam Nov 20 2020 FOR POSTING PDFJamaica David50% (2)

- Home Office and Branch AccountingDocument3 pagesHome Office and Branch AccountingPrecious Ivy Fernandez100% (1)

- Home Office Branch Accounting 2020 PDFDocument22 pagesHome Office Branch Accounting 2020 PDFJamaica DavidNo ratings yet

- This Study Resource Was: Key To Exercise ProblemsDocument8 pagesThis Study Resource Was: Key To Exercise ProblemsJamaica DavidNo ratings yet

- MODULE 4 Home Office and Branch Accounting PPT PDFDocument95 pagesMODULE 4 Home Office and Branch Accounting PPT PDFDanicaNo ratings yet

- Manish Payslip May 2019Document1 pageManish Payslip May 2019ManishNo ratings yet

- BIR Form 1901Document1 pageBIR Form 1901Abdul Nassif Faisal80% (5)

- Written Assignment Beep3013 Public Finance A192Document3 pagesWritten Assignment Beep3013 Public Finance A192Chin Yee LooNo ratings yet

- Master CTC Calculator & Salary Hike CalculatorDocument6 pagesMaster CTC Calculator & Salary Hike Calculatorvirag_shahsNo ratings yet

- Basic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFDocument2 pagesBasic Understanding of Composition Scheme Under GST Law - Taxguru - in PDFSanthanakrishnan VenkatNo ratings yet

- Insights IPB 2.0Document6 pagesInsights IPB 2.0Vinod KumarNo ratings yet

- Corporate Taxes in The PhilippinesDocument2 pagesCorporate Taxes in The PhilippinesAike SadjailNo ratings yet

- Annex A - RMC 58-2017 PDFDocument3 pagesAnnex A - RMC 58-2017 PDFCaitlin Elise O. CornelNo ratings yet

- Od124589158429235000 1Document1 pageOd124589158429235000 1Akanksha KumariNo ratings yet

- VAT Invoice - 2023-02-28 - 00000006062065-2302-9647607Document2 pagesVAT Invoice - 2023-02-28 - 00000006062065-2302-9647607falparslan5265No ratings yet

- Certificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasDocument2 pagesCertificate of Creditable Tax Withheld at Source: Kawanihan NG Rentas InternasWeng Tuiza EstebanNo ratings yet

- EY Tax Immigration Issues PDFDocument15 pagesEY Tax Immigration Issues PDFEugene FrancoNo ratings yet

- Ad Valorem TaxDocument6 pagesAd Valorem TaxPRINCESSLYNSEVILLANo ratings yet

- CH10 PPTDocument42 pagesCH10 PPTAnonymous rWn3ZVARLgNo ratings yet

- FYCE BM1804 - Income Taxation HandoutDocument17 pagesFYCE BM1804 - Income Taxation HandoutLisanna DragneelNo ratings yet

- The Three Basic Economic ProblemsDocument27 pagesThe Three Basic Economic ProblemstinaNo ratings yet

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountsGraceeyNo ratings yet

- Islamabad Electric Supply Company: Say No To CorruptionDocument2 pagesIslamabad Electric Supply Company: Say No To CorruptionMubashir AttiqeNo ratings yet

- Fiscal Policy Impact On Developing CountriesDocument35 pagesFiscal Policy Impact On Developing CountriesBharati Shet100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruProfit MartNo ratings yet

- 10 Bad Things About Water PrivatisationDocument8 pages10 Bad Things About Water Privatisationdr_kurs7549No ratings yet

- August MAYNILAD BILLDocument1 pageAugust MAYNILAD BILLJIRA JINN GONZALESNo ratings yet

- 1.0 Accounting Period and MethodDocument22 pages1.0 Accounting Period and MethodJem ValmonteNo ratings yet

- EC Tools Fiscal Policy HWK L8A30 AnswersDocument4 pagesEC Tools Fiscal Policy HWK L8A30 AnswersAmjad ThasleemNo ratings yet

- Module-1.1 PUBLIC FINANCEDocument5 pagesModule-1.1 PUBLIC FINANCEPauline Joy Lumibao100% (2)

- ADF Army Recruit Course Day by Day V8 PDFDocument1 pageADF Army Recruit Course Day by Day V8 PDFR ShoosmithNo ratings yet

- Instructions For Form 941: (Rev. April 2020)Document19 pagesInstructions For Form 941: (Rev. April 2020)suscripcionesbrmNo ratings yet

- GST NotesDocument39 pagesGST NotesCrick CompactNo ratings yet

- Pertemuan 12 Chapter 19 KiesoDocument90 pagesPertemuan 12 Chapter 19 KiesoJordan SiahaanNo ratings yet

- MBA - Report MediclaimDocument79 pagesMBA - Report MediclaimMohd Asif100% (1)