Professional Documents

Culture Documents

The Stinson Corp Laporan Laba Rugi Periode: 31 Desember 1981 Manufacturing Cost

The Stinson Corp Laporan Laba Rugi Periode: 31 Desember 1981 Manufacturing Cost

Uploaded by

Melani NasutionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Stinson Corp Laporan Laba Rugi Periode: 31 Desember 1981 Manufacturing Cost

The Stinson Corp Laporan Laba Rugi Periode: 31 Desember 1981 Manufacturing Cost

Uploaded by

Melani NasutionCopyright:

Available Formats

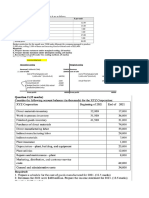

THE STINSON CORP

LAPORAN LABA RUGI

PERIODE : 31 DESEMBER 1981

a.) Net income = Sales - Cost of Good Sold - Operating Expenses Sales

$20,000 = Sales - 150% (Operating Expense) - 30% (Sales) Manufacturing Cost :

$20,000 = Sales - 150% (30% x sales) - 30% (sales) Material Used $ 12,000.00

$20,000 = y - 1,5 (0,3y) - 0,3 y Direct Labor $ 7,200.00

$ 20,000 = y - 0,45y - 0,3y Factory Overhead $ 4,800.00

$ 20,000 = 0,25 y Goods in process $ 3,000.00

y = $20,000/0,25 Cost of goods manufature $ 27,000.00

y = $80.000 Finished goods $ 9,000.00

Sales = $80,000 Cost of good sold

Gross profit

Operating Expense

Net Income

b.) Operating expense = 30% (sales)

Operating expense = 30% ($80,000)

Operating expense = $24,000

c.) Cost of gold sold = 150% (Operating expense)

Cost of gold sold = 150% ($24,000)

Cost of gold sold = $36,000

d.) Finished goods = 25% (Cost of gold sold)

Finished goods = 25% ($36,000)

Finished goods = $9,000

e.) Goods in process = 33,33% (Finished goods)

Goods in process = 33,33% ($9,000)

Goods in process = $3,000

f.) Material Used = 50% (Cost of good manufactured - Goods in process)

Material used = 50% ($27,000 - $3,000)

Material used = $12,000

g.) Direct Labor = 30% (Cost of good Manufactured - Goods in process)

Direct Labor = 30% ($27,000 - $3,000)

Direct Labor = $7,200

h.) Factory Overhead = 20% (Cost of good manufactured - Goods in process)

Factory Overhead = 20% ($27,000 - $3,000)

Factory Overhead = $4,800

$ 80,000.00

$ 36,000.00

$ 44,000.00

$ -24,000.00

$ 20,000.00

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- CVP AnalysisDocument40 pagesCVP AnalysisFatima's WorldNo ratings yet

- Chapter 3 Job Order CostingDocument20 pagesChapter 3 Job Order Costingazam_rasheedNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- HW2Document16 pagesHW2Nevan NovaNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- B1031181069 Enelia LabAkuntansiBiayaDocument5 pagesB1031181069 Enelia LabAkuntansiBiayaEneliaNo ratings yet

- Chapter 13 ExcelDocument42 pagesChapter 13 ExcelMd Al Alif Hossain 2121155630No ratings yet

- SolutionDocument3 pagesSolutionHilary GaureaNo ratings yet

- Cost Until4oct.2020Document19 pagesCost Until4oct.2020Manar AnabousiNo ratings yet

- MA1 Sample of Midterm TestDocument4 pagesMA1 Sample of Midterm TestLoan VũNo ratings yet

- Tutorial 2Document10 pagesTutorial 2Shah ReenNo ratings yet

- Q3Document11 pagesQ3anik022No ratings yet

- Chapter 1 Assignment Cost AccountingDocument3 pagesChapter 1 Assignment Cost AccountingSydnei HaywoodNo ratings yet

- HW AcctDocument4 pagesHW AcctTrung TranNo ratings yet

- David A Carrucini Assignment Chapter 22Document8 pagesDavid A Carrucini Assignment Chapter 22dcarruciniNo ratings yet

- Acct 202 Exam 2 ReviewDocument4 pagesAcct 202 Exam 2 ReviewDrew TaylorNo ratings yet

- Cordova, Alexander JR - Individual TaskDocument6 pagesCordova, Alexander JR - Individual TaskAlexander CordovaNo ratings yet

- 20123400024Document7 pages20123400024Phạm Công KiênNo ratings yet

- Accounting - Exercise Chapter 22Document2 pagesAccounting - Exercise Chapter 22AmelynieNo ratings yet

- Ans: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementDocument3 pagesAns: Q2 Moon Manufacturing Company (Dec31, 2017) : Cost of Goods Manufactured StatementAsma HatamNo ratings yet

- EntornoDocument2 pagesEntornoaggniNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- ACCCOB3Document10 pagesACCCOB3Jenine YamsonNo ratings yet

- Cost Lectures DR - Mohiy SamyDocument12 pagesCost Lectures DR - Mohiy SamyEiad WaleedNo ratings yet

- Muhammad Abdul Rehman Walija 49691 Management Accounting AssignmentDocument35 pagesMuhammad Abdul Rehman Walija 49691 Management Accounting AssignmentuOwOuNo ratings yet

- Hasan Yaseen 9990Document3 pagesHasan Yaseen 9990Haris KhanNo ratings yet

- AC and VC Plus CVPDocument6 pagesAC and VC Plus CVPEunice CoronadoNo ratings yet

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Shah ReenNo ratings yet

- Problem 2-29Document6 pagesProblem 2-29Love IslamNo ratings yet

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- Cost of Goods ManufacturedDocument26 pagesCost of Goods ManufacturedAb.Rahman AfghanNo ratings yet

- Tugasan 6 Bab 6Document4 pagesTugasan 6 Bab 6azwan88No ratings yet

- HW Acct 2Document4 pagesHW Acct 2tatuan311No ratings yet

- Problem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000Document6 pagesProblem 5-1A:: Selling Prices ($500 X 2.000 Units) $1.000.000Võ Triệu VyNo ratings yet

- 102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Document4 pages102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Darasin, Mhirasol B.No ratings yet

- Homework Chapter 6Document6 pagesHomework Chapter 6Lê Vũ Phương DungNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Cost Concepts AssignmentDocument4 pagesCost Concepts AssignmentInageaNo ratings yet

- ASsignemts SCIDocument25 pagesASsignemts SCIPedro PelaezNo ratings yet

- Assignment On Cost SheetDocument3 pagesAssignment On Cost SheetRashmi KumariNo ratings yet

- Q1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetDocument4 pagesQ1.What Is Meant by Cost Sheet?explain The Importance of Cost SheetHeena SorenNo ratings yet

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Practice For Chapter 7 and 8 Standard CostingDocument12 pagesPractice For Chapter 7 and 8 Standard CostingNCT33% (3)

- Week 5 - Test 1 Review Chap 1 To 5Document25 pagesWeek 5 - Test 1 Review Chap 1 To 5Alenne FelizardoNo ratings yet

- Vicenzo Bernard Leandro Tioriman - 01011182025009Document6 pagesVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNo ratings yet

- Solution Cost AccountingDocument3 pagesSolution Cost AccountingHaris KhanNo ratings yet

- CVP - GitttDocument15 pagesCVP - GitttFarid RezaNo ratings yet

- ACCTG7 Additional Probs 24Document7 pagesACCTG7 Additional Probs 24freaann03No ratings yet

- Part 1: Net Income For Merchandising Is $168,750. Part 2: Net Income For Manufacturing Is $437,500Document8 pagesPart 1: Net Income For Merchandising Is $168,750. Part 2: Net Income For Manufacturing Is $437,500Jane VillanuevaNo ratings yet

- ACT202 - Assignment 2 - 18204001 - Mohammed RashedDocument6 pagesACT202 - Assignment 2 - 18204001 - Mohammed RashedAnkur SahaNo ratings yet

- Manufacturing Account Worked Example Question 12Document6 pagesManufacturing Account Worked Example Question 12Roshan RamkhalawonNo ratings yet

- Answer To Exercises To AnswerDocument9 pagesAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- MAC2601-SuggestedsolutionOct November2013Document12 pagesMAC2601-SuggestedsolutionOct November2013DINEO PRUDENCE NONGNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet