Professional Documents

Culture Documents

Bill To Name and Address

Uploaded by

Shashi Kiran GOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bill To Name and Address

Uploaded by

Shashi Kiran GCopyright:

Available Formats

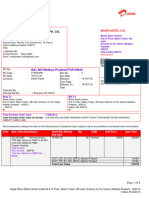

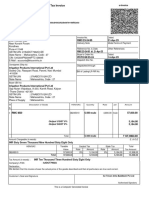

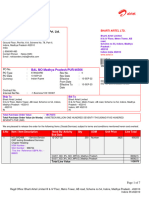

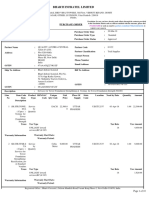

L Purchase Order

4780562 - OP - 4828800037

Bill to Name and Address PO Number must appear on all invoices, shipping notices, and all correspondence

pertaining to this order

Jones Lang LaSalle Property Consultants (India) Private Limited Contract No/Ref

One BKC, 1501, Level 15,

A Wing, Bandra Kurla Complex,

Bandra (E) Attention to FSC

MAIL

Mumbai MAH 400051 INVOICES TO:

India Jones Lang LaSalle Property Consultants

India Pvt Ltd, 8th floor Block B-3

DLF World Tech park

PAN No: AAACL2089B

GST #: 27AAACL2089B1ZS DLF IT SEZ Silokhera, Sec 30,

State Code: 27 Gurugram HYN 122001

India

Bill From Technocrats Safety & Security Solutions Ship To JLL C/o India CC 0076 SAP Labs India

No. 45, P No. 3/1, Seethamma Road, Wing A, Unit No.1, Level 3, Tower 1,

Kammanahalli Cybercity, Magarpatta, Hadapsar

Bangalore KTK 560033 Pune MAH 411028

India India

GST # 29AADCT9444K1ZP

Vendor PAN ID No AADCT9444K

Vendor Fax Buyer

Vendor Contact Vijay Buyer Tel

Vendor No 5307689 Buyer Fax

Currency Code INR PO Originator Sourav Kalita

Payment Terms Net 60 Days Originator Tel

Payment is subjected to clause 3.6 under PO terms and conditions

Ordered 3 01/01/2023 Additional Instructions

Item Quantity Description Unit Price Delivery Total Net

Date Value

1.000 Q1'Jan-23 NCAMC FAPA .00 31/01/2023 70,525.00

INGST18 India GST 18%

555300.601 Fire Alarm System Maint-Fix

2.000 Q2'Apr-23 NCAMC FAPA .00 30/04/2023 70,525.00

Purchase Order 4780562 - OP- 4828800037 Page 1 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

INGST18 India GST 18%

555300.601 Fire Alarm System Maint-Fix

3.000 Q3'Jul-23 NCAMC FAPA .00 31/07/2023 70,525.00

INGST18 India GST 18%

555300.601 Fire Alarm System Maint-Fix

4.000 Q4'Oct-23 NCAMC FAPA .00 31/10/2023 70,525.00

INGST18 India GST 18%

555300.601 Fire Alarm System Maint-Fix

Total net value excl tax INR 282,100.00

Purchase Order 4780562 - OP- 4828800037 Page 2 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

Important PAYMENT information

The following information must be written on the invoice:

1. our purchase order number (is printed on the PO form at the top right)

2. the correct in-country legal entity invoice address (is printed on the PO form at the top left)

3. the correct central invoice mailing address (is printed on the PO form in the Mail-Invoices-To box)

4. As per recent amendment in Income Tax Law, every person is required to quote PAN on all documents in case of

Purchase / Sale of any goods or services regardless of mode of payment as per rule 114B. PAN is required to be

quoted on all documents including service agreements, purchase order, invoices, proforma invoices, delivery challans

etc.

5. All invoices to be submitted to the centralised processing centre either digitally or physically within 10 days

from the date of tax invoice, delayed submission of invoices would lead to rejection of invoices and to be

resubmitted with current dated invoice.

Kindly find our PAN, to be compliant with the requirement: JLL-PC “ AAACL2089B”

We may have to return your invoice, if the key information can not be identified on your invoice. This may result in

the invoice not being paid to terms.

For invoice status or payment related questions please contact our Accounts Payable department :

Contact Phone:

Contact Email :

Vendor Email : murali.p@sap.com,santosh.k02@sap.com,ravi.uma@sap.com,sales@

technocratsindia.biz

PO Originator Email: sourav.kalita@ap.jll.com

Buyer Email :

Customer Reference Number (JLL use only):

The full terms and conditions for this Purchase Order are attached. By accepting and fulfilling all or part of

this Purchase Order, supplier also agrees to these terms and conditions of purchase. However, if a formal contract

or service agreement has been executed between Jones Lang LaSalle and the supplier for this particular client

and/or location, the terms of that agreement shall apply and the attached terms and conditions shall have no

effect.

Purchase Order 4780562 - OP- 4828800037 Page 3 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

JONES LANG LASALLE STANDARD PURCHASE ORDER TERMS AND CONDITIONS WITH VENDORS (AS PRINCIPAL)

1. Definitions

In this Agreement:

Agreement means these Standard Terms and Conditions and any Purchase Order issued by Jones Lang LaSalle from time to time under these Standard Terms and Conditions;

Goods mean the goods and products more particularly described in the Item Description above.

Vendor means your company, the provider of the Services;

Fee means the fee set out in the Purchase Order or as otherwise agreed by the parties in writing, which is stated exclusive of any applicable value added, goods and

services or other consumption tax;

Jones Lang LaSalle means Jones Lang LaSalle Property Consultants (India) Pvt. Ltd. and its affiliates and related bodies corporate;

Client means the client named in the Purchase Order.

Purchase Order means the order issued by Jones Lang LaSalle and or the Client to the Vendor for the provision of the Services

Services means the services (and any goods supplied as part of those services including the Goods) set out in the Purchase Order or the services that Jones Lang

LaSalle requests the Vendor to provide under written instruction or that are otherwise agreed by the parties in writing.

2. Goods and Services

2.1 The Vendor shall provide the Services:

(a) in a good, workmanlike and commercially reasonable manner;

(b) in accordance with the methods, practices and standard of diligence and care normally exercised by similarly qualified and experienced persons in the performance

of comparable work;

(c) in accordance with the reasonable decisions and requirements of Jones Lang LaSalle; and

(d) in accordance with this Agreement.

2.2 The Vendor warrants that the goods materials, workmanship and methods supplied and used by the Vendor are of a kind suitable for their intended purpose and that

they and the Services will be free of defects.

2.3 The Vendor shall take all reasonable precautions to prevent injury (including illness) to any person or damage to any property.

2.4 The Vendor shall be responsible for industrial relations with its employees, subcontractors and agents and ensure that such persons are professional, courteous and

well behaved when providing the Services.

2.5 This Agreement applies to the extent that it is not inconsistent with any current binding agreement the Vendor may have with Jones Lang LaSalle for similar

services.

2.6 The Vendor, its employees, subcontractors and agents shall behave in an ethical manner at all times. The Vendor shall comply with Jones Lang LaSalle Vendor Code of

Conduct as amended from time to time and notified to the Vendor

2.7 Where the Vendor supplies any goods:

(a) the goods must be delivered and be in accordance with this Agreement and any specification notified by Jones Lang LaSalle to the Vendor and any applicable

warranties;

(b) the Vendor must allow Jones Lang LaSalle to have a reasonable opportunity to inspect and test such goods and Jones Lang LaSalle shall have the right to reject and

not be charged for such goods that it may reject;

(c) the Vendor is responsible for all risk with respect to the goods until Jones Lang LaSalle has inspected, tested and accepted such goods;

(d) title in the goods will pass from the Vendor to Jones Lang LaSalle only after paragraph (c) above is satisfied; and

(e) the Vendor must provide appropriate warranties and pass on and not jeopardize any third party or original equipment manufacturer warranties that apply to the goods

provided to Jones Lang LaSalle.

3. Fees and Payment

3.1 The Vendor shall submit an invoice to Jones Lang LaSalle in a format approved by Jones Lang LaSalle no later than the 2nd day of the month following the purchase /

transaction.

3.2 All invoices shall identify Client. All invoices shall be in the name of Jones Lang LaSalle Property Consultants (I) Pvt. Ltd.

3.3 Subject to this Agreement and the receipt of an appropriate invoice by Jones Lang LaSalle, Jones Lang LaSalle shall when in receipt of payment of the invoice by

Client pay the Vendor the Fee. No payment would be made unless a valid tax invoice is provided in terms of applicable VAT/ Service tax laws.

3.4 If the Vendor fails to do something which it is required to do under this Agreement, Jones Lang LaSalle can, at its discretion, remedy that omission and charge the

Vendor for it.

3.5 Jones Lang LaSalle shall not be liable for the cost of any services the Vendor may provide to others.

3.6 Anything in this Schedule to the contrary notwithstanding, the Manager shall pay the Service Provider only as and when the Client provides the Manager with fees to

cover such payment pursuant to the Facilities Management Agreement.

3.7 Jones Lang LaSalle shall be entitled to recover any amount lost in respect of input tax credit due to any actions of the Vendor including but not limited to:

(a) Non submission of tax return to VAT department

(b) Delayed submission of Tax return

(c) Incorrect submission of TIN number on invoice of Vendor for itself and in VAT returns for Jones Lang LaSalle

Purchase Order 4780562 - OP- 4828800037 Page 4 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

(d) Incorrect invoice rose resulting in Jones Lang LaSalle being unable to avail itself of a tax credit

(e) Tax Charged at incorrect rates

(f) Non-payment of tax liability as per the due dates

(g) Any other action/inaction by Vendor resulting in loss of VAT input credit to Jones Lang LaSalle

3.8 Other General Terms related to Taxation:-

(a) The Vendor shall be responsible to deposit the relevant Indirect taxes applicable on this Agreement with the appropriate tax authorities and also undertake

necessary statutory compliances.

(b)Taxes may be reimbursed subject to Vendor itemizing them separately on invoice(s)/ submitting proof of payment/ requisite declaration.

(c) The Vendor shall not be entitled to recover any amount over and above Fee on account of tax/ interest/ penalty or any other statutory payment in relation to the

Agreement

(d) All payments shall be subject to applicable tax withholding

(e) TDS/WCT as applicable shall be deducted by Jones Lang LaSalle Jones Lang LaSalle unless the Vendor provides a Tax Exemption Certificate from a Competent

Authority to that effect.

(f) Jones Lang LaSalle is authorized to ask for any Tax Declaration Certificate from the Vendor and they will be liable to submit the same as and when required.

(g) Tax Invoice along with Jones Lang LaSalle Invoicing Address and Client Delivery Address with Ship From, Ship To etc. and VAT/CST/LST/SVC/Service Tax No. (as

applicable) should be submitted to the respective SITE INCHARGE at above mentioned Delivery Address only.

3.9 Other General Terms related to PO:-

(a) No rate revision shall be applied without the prior written consent of Jones Lang LaSalle.

(b) The Vendor shall alone be liable for all acts, deeds matters and things done by its staff including property damage, death or physical injury caused to any persons

while providing services and for all matters concerning hiring, recruitment, salary, leave, promotion, insurance, statutory, legal compliance etc., concerning its

staff and the Vendor shall keep Jones Lang LaSalle indemnified against all suits, claims, damages, actions, liability or penalty which it may face as a consequence of

its staff acts and /or omissions, including those claiming that they are Jones Lang LaSalle employees."

(c) Any information/records or data provided by Jones Lang LaSalle to the Vendor for the purpose of entering into any contract for delivery of goods or services, will

be strictly treated as the confidential information and the Vendor will maintain the same in utmost trust and will not disseminate any such information, whether marked

as confidential or not. The Vendor or any other person on its behalf shall not disclose or misuse any such information which may cause harm, damage, falsification,

manipulation or loss to Jones Lang LaSalle or its customers, in any manner, whatsoever.

(d) By signing the Purchase Order attached to these terms and conditions the signatory acknowledges that he/she is dully authorized to execute the same on behalf of

the Vendor and that is legally binding on both the parties.

(e) The PO No. and Date and Line No. shall be quoted on all Challan, Invoice and Correspondence related to this Purchase Order.

(f) Vendor shall provide copies of all requested statutory documents including but not limited to PF, ESI, and Muster Roll (as applicable) along with each applicable

invoice.

4.Insurance

4.1 The Vendor shall (and shall ensure that every approved sub Vendor shall), during the term of this Agreement, maintain:

(a) Workers’ compensation insurance (or its equivalent) in accordance with any applicable law; and

(b) Commercial general liability or public liability insurance with a registered and reputable insurer for no less that INR 50000 and otherwise INR 50000 in aggregate

or such other amount as the parties may agree in writing.

4.2 The Vendor shall not provide any Service for Jones Lang LaSalle if it does not comply with clause 4.1.

4.3 The Vendor shall provide evidence of such insurances to Jones Lang LaSalle before commencing provision of the Services.

5. Litigation

5.1 The Vendor shall provide all assistance as reasonably required by Jones Lang LaSalle in the event that it or the Services that it provides relate in any way to any

litigation, insurance claim or dispute that arises in respect of the Services.

5.2 In the event that the Vendor receives any claim or is involved in any dispute that may affect the insurance or liability of Jones Lang LaSalle it must notify Jones

Lang LaSalle as soon as possible.

6. Indemnity

6.1 The Vendor is liable for and must release and fully indemnify Jones Lang LaSalle and Client against any action, claim, proceeding, demand, damages, loss,

liability, cost or expense (“ claim” ) which Jones Lang LaSalle or Client may suffer or incur arising out of or connected with any act or omission in providing the

Services or the Goods, negligence, default, misconduct of or breach of this Agreement by the Vendor, its directors, officers, employees, subcontractors or agents

except to the extent such claim is caused or contributed to directly by the negligence or breach of this Agreement by Jones Lang LaSalle.

6.2 The Vendor shall at all times be solely responsible for payment of all salaries and benefits to its employees and warrants that the personnel performing the

Services or supplying the Goods as the case may be shall at all times be either contractors or employees of the Vendor and that nothing in these standard terms and

conditions shall create an employment relationship between any employee or contractor of the Vendor and Jones Lang LaSalle or its affiliates, employees, agents and

clients

7. Effect, Term and Termination

Purchase Order 4780562 - OP- 4828800037 Page 5 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

7.1 This Agreement comes into effect from the date Vendor starts providing the Services and remains in effect until the Vendor completes such Services to the

satisfaction of Jones Lang LaSalle.

7.2 Jones Lang LaSalle may terminate this Agreement for any reason on 30 days’ written notice.

7.3 Jones Lang LaSalle may terminate this Agreement immediately if:

(a) the Vendor breaches this Agreement and fails to remedy such breach within 14 days of being notified by Jones Lang LaSalle;

(b) the Vendor is unable to pay its debts as and when they fall due;

(c) the Vendor enters into a scheme of arrangement or composition with its creditors;

(d) the Vendor is placed under management or administration or a receiver is appointed, or a winding up order is made in respect of the Vendor;

(e) Jones Lang LaSalle determines in its absolute discretion that the Vendor’ s performance of any of the Services or obligations under this Agreement is unacceptable;

(f) the Facilities Management Agreement between Jones Lang LaSalle and Client is terminated for any reason whatsoever.

8. Occupational Health and Safety

8.1 The Vendor must specifically comply with all applicable occupational health and safety legislation.

9. Applicable Law

9.1 The Vendor shall comply with all applicable law, licensing requirements, international or national standards, industry standards, the requirements of any

statutory, competent or other regulatory authority and any property house rules or other policies as notified in carrying out the Services.

9.2 This Agreement shall be governed and construed by the law of the jurisdiction in which the Services are provided.

10. General

10.1 The Vendor must not assign any of its rights under this Agreement or subcontract the Services or part of the Services without the prior written approval of Jones

Lang LaSalle. In the event that part or all of the Services are subcontracted, the Vendor shall remain fully responsible in respect of the Services carried out by such

sub Vendor.

10.2 Jones Lang LaSalle may assign its rights and transfer its obligations under this Agreement, including without limitation, by novating this Agreement and

substituting another party or parties in its place. If requested by Jones Lang LaSalle, the Vendor must execute a novation agreement prepared by Jones Lang LaSalle to

give effect to such transfer.

10.3 Jones Lang LaSalle may vary the Services at any time in writing but accepts that this may change the Fee, in which case, the Vendor shall notify Jones Lang

LaSalle of any proposed new Fee. If Jones Lang LaSalle does not agree with such proposal, the Vendor shall be entitled to a reasonable adjustment to the Fee. Any

change to the Services will be subject to the same terms and conditions as this Agreement. Any other variation to this Agreement must be agreed by the parties in

writing.

10.4 Any provision of this Agreement which is void, illegal or otherwise unenforceable will be severed to the extent permitted by law without affecting any other

provision of this Agreement, and, if reasonably practicable, will be replaced by another provision of economic equivalence which is not so void, illegal or

unenforceable.

10.5 The failure or omission of a party at any time to enforce or require compliance with any provision of this Agreement or exercise any election or discretion under

this Agreement shall not operate as a waiver of them or any others.

10.6 This Agreement is the entire agreement between the parties for the Services and supersedes all previous agreements, proposals, representations, correspondence and

discussions in connection with the Services.

10.7 This Agreement overrides any terms that the Vendor may seek to impose.

10.8 For any change in the minimum wages prescribed by the respective States, the Service Provider will make a request to the respective Facility Manager of the site

giving details of existing and revised rates along with a copy of State Circular, to take it forward to the Client.

11. GST Clause

11.1 Definitions

GST Laws: GST Laws shall mean and include Central Goods and Services Tax Act, 2017, Integrated Goods and Services Tax Act, 2017, State Goods and Services Tax Act, 2017

and Union Territory Goods and Services Tax Act, 2017 and any amendment thereto as notified in the official gazette.

GST Rules: GST Rules shall mean and include the rules made under the GST Laws and any amendment thereto as notified in the official gazette.

11.2 It is agreed between the Parties that Jones Lang LaSalle shall be liable to make payment to the Vendor only after the receipt of valid invoice as per the

provisions of GST Laws and GST Rules. The Vendor covenants and expressly agrees to comply with the following requirements:

(a) Invoices shall be raised strictly in accordance with the applicable provisions of the GST Laws and GST Rules and must be addressed to the correct registration of

Jones Lang LaSalle. The invoice shall also mention the GST registration number of the respective location of Jones Lang LaSalle where the Vendor has rendered /

provided services as per place of supply rule along with complete and detailed breakup of all the applicable taxes, including but not limited to HSN code, SAC code

etc.

(b) Pursuant to GST Law and GST Rules, Vendor undertakes to upload details of all sale invoices/ bill of supply/credit notes/ debit note/ / receipt voucher raised by

the Vendor on the goods and services tax network portal (“ GSTN Portal” ) on a monthly basis based on which credit will be available to Jones Lang LaSalle. Jones Lang

LaSalle reserves the right to withhold payment equivalent to goods and services tax (as defined under GST Laws and GST Rules) charged by Vendor in its invoice unless

a) Vendor uploads the invoice details on GSTN portal correctly, b) discharges its liability as required by the GST Laws and GST Rules with the relevant authority and

Purchase Order 4780562 - OP- 4828800037 Page 6 of 7 02/01/2023 2:55:14

Item Quantity Description Unit Price Delivery Total Net

Date Value

file returns within the stipulated time, in order to enable Jones Lang LaSalle to successfully claim input tax credit. Without prejudice to any other rights and

remedies under law, Jones Lang LaSalle reserves the right to set-off/recover the due amount from Vendor with applicable interest and penalty, if the Vendor breaches

any of the provisions of this clause;

(c) Any rectification of mismatches in relation to the invoices submitted to Jones Lang LaSalle in compliance with GST Laws and GST Rules, if required, shall be done

by the Vendor. In case of any delay or default by the Vendor in this regard, Jones Lang LaSalle shall not be held liable for delay in payments.

(d) Vendor shall strictly ensure to maintain at all times a minimum compliance rating of <<this can be inserted once the rating norms are finalized. As on today we

don’ t know whether 1 is better or 5 is better or they would use Alphabets>> for continued relationship with Jones Lang LaSalle.

(e) Vendor agrees to, unconditionally and without limitation, indemnify and shall keep indemnified Jones Lang LaSalle against all and any loss, liabilities or expenses

arising out of or in connection with non- compliance of its obligations under the GST Laws and GST Rules by the Vendor. Jones Lang LaSalle shall have the right to

suspend and/or terminate this Agreement and/or PO (as applicable) at any time and with no further liability to Jones Lang LaSalle, if Vendor breaches any provision of

this clause.

12. Turnover Declaration

12.1 In case your turnover is in the preceding financial year is below INR 5 crore, a declaration on your invoice to be mentioned as below:

“ We would like to confirm you that, our aggregate turnover in the preceding financial year is below INR 5 crore as per notification No 78/2020 central tax dated 15th

October 2020 and notification No 06/2020 integrated tax dated 15th October 2020”

Purchase Order 4780562 - OP- 4828800037 Page 7 of 7 02/01/2023 2:55:14

You might also like

- Ability 6100648Document1 pageAbility 6100648Vedant DesaiNo ratings yet

- Po SRV 4513Document1 pagePo SRV 4513Ankit KumarNo ratings yet

- 46840Document8 pages46840Sanjeev KumarNo ratings yet

- RMC 23 24 85Document1 pageRMC 23 24 85gepsofodruNo ratings yet

- GPS 23-02-29Document1 pageGPS 23-02-29Chetan RandhawaNo ratings yet

- RMC 23 24 84Document1 pageRMC 23 24 84gepsofodruNo ratings yet

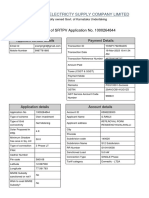

- E-Invoices of PSPCL Jun-2023Document17 pagesE-Invoices of PSPCL Jun-2023contactajaysidharNo ratings yet

- LARAN Sales Invoice - TT Steel 79Document3 pagesLARAN Sales Invoice - TT Steel 79likith.mallesh.14No ratings yet

- Inv Vimal 397Document2 pagesInv Vimal 397GANUNo ratings yet

- Inv 232409Document1 pageInv 232409Sneha SharmaNo ratings yet

- HG InfraDocument2 pagesHG InfraPreeti SinghNo ratings yet

- Screenshot 2023-12-16 at 1.28.00 PMDocument1 pageScreenshot 2023-12-16 at 1.28.00 PMshashikumarsk0711No ratings yet

- XKXYS2-CF-Tax InvoiceDocument1 pageXKXYS2-CF-Tax InvoiceNikith KrishnaNo ratings yet

- Invoice 7272206521Document5 pagesInvoice 7272206521Bhagawant KamatNo ratings yet

- Primetech Dta 08-03-2019Document2 pagesPrimetech Dta 08-03-2019Vikk SuriyaNo ratings yet

- Baker Hughes Singapore Pte PO Manufacture ToolsDocument9 pagesBaker Hughes Singapore Pte PO Manufacture ToolsYusuf BagewadiNo ratings yet

- Havells MSBI 18092017 PSSL 17-18 00037Document1 pageHavells MSBI 18092017 PSSL 17-18 00037ashish10mca9394No ratings yet

- Enclosures and Accessories QuotationDocument2 pagesEnclosures and Accessories Quotationmkbhat17kNo ratings yet

- Pi 092639Document1 pagePi 092639Manmeet SunghNo ratings yet

- Tax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24Document2 pagesTax Invoice: Sri Kakatiya Industries (India) Private Limited - 2023-24BJRUSS PKG-2No ratings yet

- PPWC Static MeterDocument3 pagesPPWC Static Meterpant.vk8514No ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceDhayananthNo ratings yet

- Application 1000264844 03032023 201054 PDFDocument2 pagesApplication 1000264844 03032023 201054 PDFMohammed AbidNo ratings yet

- 46566Document7 pages46566Sanjeev KumarNo ratings yet

- 4177 BVCPSDocument1 page4177 BVCPSpawansinghpk9993No ratings yet

- TMT Quote 08.05.2023Document1 pageTMT Quote 08.05.2023sathya narayanaNo ratings yet

- 1176-Veermani Engineering Co.Document1 page1176-Veermani Engineering Co.NILAY VASANo ratings yet

- BETL2023000412Document1 pageBETL2023000412karthisekarNo ratings yet

- AV Tech 04 2023 Invoice Kaviyarasan.Document1 pageAV Tech 04 2023 Invoice Kaviyarasan.Director LMNo ratings yet

- Data Services: Your Account SummaryDocument3 pagesData Services: Your Account SummaryAvijitNo ratings yet

- Spectra Technovision Sales Quotation for Fingerprint Attendance Recorder and Access Management SoftwareDocument1 pageSpectra Technovision Sales Quotation for Fingerprint Attendance Recorder and Access Management SoftwareSantu PaniNo ratings yet

- GST Invoice PVA239563Document2 pagesGST Invoice PVA239563TMB ClaimNo ratings yet

- STSCN056Document1 pageSTSCN056Shilpa AmitNo ratings yet

- K7-1711194161274Document1 pageK7-1711194161274sajithkariyam62No ratings yet

- S.No. HSN Code Description of Goods or Service ERP Code Qty Unit Rate INR Disc.% Total Value of Orders CGST %rate SGST %rate Igst %rateDocument3 pagesS.No. HSN Code Description of Goods or Service ERP Code Qty Unit Rate INR Disc.% Total Value of Orders CGST %rate SGST %rate Igst %raterajend thakurNo ratings yet

- Purchase Order: Baker Hughes Singapore PteDocument3 pagesPurchase Order: Baker Hughes Singapore PteYusuf BagewadiNo ratings yet

- Screenshot 2023-12-12 at 12.26.03 PMDocument1 pageScreenshot 2023-12-12 at 12.26.03 PMshashikumarsk0711No ratings yet

- Tax Invoice: 1 MB1CWCHD9PPNU4141 996799 3,500 350Document1 pageTax Invoice: 1 MB1CWCHD9PPNU4141 996799 3,500 350Chetan RandhawaNo ratings yet

- TAX INVOICE FOR MACHINERY SALEDocument3 pagesTAX INVOICE FOR MACHINERY SALEKrishnendu NairNo ratings yet

- Sujadevi: Digitally Signed by SUJADEVI Date: 2020.11.03 12:51:07 +05'30'Document1 pageSujadevi: Digitally Signed by SUJADEVI Date: 2020.11.03 12:51:07 +05'30'Manu KNo ratings yet

- To PrintDocument1 pageTo PrintrajasthanexpiryNo ratings yet

- Google Workspace Invoice for UnTRAMELLED BUSINESS SOLUTIONSDocument3 pagesGoogle Workspace Invoice for UnTRAMELLED BUSINESS SOLUTIONSCA Shrikant VaranasiNo ratings yet

- Saraf Real Infra Pvt. Ltd generates e-invoice and e-way bill for steel structure saleDocument2 pagesSaraf Real Infra Pvt. Ltd generates e-invoice and e-way bill for steel structure salemsNo ratings yet

- Tax Invoice: Signed by Ramesh Natarajan Date: 2021.04.19 12:01:00 IST Location: ChennaiDocument4 pagesTax Invoice: Signed by Ramesh Natarajan Date: 2021.04.19 12:01:00 IST Location: Chennaiwahid ahmadNo ratings yet

- Apc Bx600C-In Back - Ups 600 Ups: Grand Total 2799.00Document3 pagesApc Bx600C-In Back - Ups 600 Ups: Grand Total 2799.00mohammed nisarNo ratings yet

- Document DetailsDocument1 pageDocument DetailszaidkhanNo ratings yet

- E-Invoice of PSPCL of Jul-2023Document17 pagesE-Invoice of PSPCL of Jul-2023contactajaysidharNo ratings yet

- Po 4800004673Document5 pagesPo 4800004673ranjana.jNo ratings yet

- Bharti Infratel Limited: Purchase OrderDocument10 pagesBharti Infratel Limited: Purchase OrderRaghvendra Singh YadavNo ratings yet

- Inv 2023240884Document1 pageInv 2023240884Soumya SwainNo ratings yet

- 9QW5FE-CF-Tax InvoiceDocument1 page9QW5FE-CF-Tax Invoicealpha2omega0007No ratings yet

- BT Pre3Document1 pageBT Pre3msNo ratings yet

- SMC Nov2023, Kolkata OfficeDocument12 pagesSMC Nov2023, Kolkata OfficeSib MktgNo ratings yet

- 1661h Dsiend HSDBDocument5 pages1661h Dsiend HSDBMatiullahNo ratings yet

- Laxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanDocument5 pagesLaxmi Metal Press Ing Works Pvt. LTD.: Invoice Cum ChallanSujit Kumar SinghNo ratings yet

- Bharti Infratel Limited: Purchase OrderDocument10 pagesBharti Infratel Limited: Purchase OrderRaghvendra Singh YadavNo ratings yet

- Quarterly Account Statement XUV723Document1 pageQuarterly Account Statement XUV723Sachin AchrekarNo ratings yet

- EPC - 4201170000613 - V. D. PATKAR - PGCIL Vemagiri Pkg. PO For Design & Detail Engineering of Illumination System For Madhugiri & Srikakulam Sites.Document8 pagesEPC - 4201170000613 - V. D. PATKAR - PGCIL Vemagiri Pkg. PO For Design & Detail Engineering of Illumination System For Madhugiri & Srikakulam Sites.Vanraj DodiaNo ratings yet

- Shri Balaji SportsDocument1 pageShri Balaji SportsRavi KumarNo ratings yet

- Successful Service Design for Telecommunications: A comprehensive guide to design and implementationFrom EverandSuccessful Service Design for Telecommunications: A comprehensive guide to design and implementationNo ratings yet

- Book ERS ticket Krishnarajapuram to MGR ChennaiDocument2 pagesBook ERS ticket Krishnarajapuram to MGR ChennaiShashi Kiran GNo ratings yet

- 1606805945MCPDocument2 pages1606805945MCPShashi Kiran G100% (1)

- Installation Manual: Liquid Crystal DisplayDocument53 pagesInstallation Manual: Liquid Crystal DisplayAlvaro ReyesNo ratings yet

- 8 Zone Voice Alarm Controller: EvacliteDocument2 pages8 Zone Voice Alarm Controller: EvacliteShashi Kiran GNo ratings yet

- Henrich EvacLiteDataSheetDocument3 pagesHenrich EvacLiteDataSheetShashi Kiran GNo ratings yet

- 2.phil Phoenix Surety vs. Woordworks, Inc.Document9 pages2.phil Phoenix Surety vs. Woordworks, Inc.Russel LaquiNo ratings yet

- Negotiation 9Th Edition Lewicki download pdf chapterDocument41 pagesNegotiation 9Th Edition Lewicki download pdf chaptereugenia.goodness634100% (3)

- Petitioner vs. vs. Respondents Regulus E. Cabote & Associates Benito P. FabieDocument7 pagesPetitioner vs. vs. Respondents Regulus E. Cabote & Associates Benito P. FabieKaryl Eric BardelasNo ratings yet

- G.R. No. 226240. March 6, 2019. Myra M. Moral, Petitioner, vs. Momentum Properties Management CORPORATION, RespondentDocument17 pagesG.R. No. 226240. March 6, 2019. Myra M. Moral, Petitioner, vs. Momentum Properties Management CORPORATION, RespondentKatNo ratings yet

- Dwnload Full Fundamentals of Corporate Finance Australasian 2nd Edition Parrino Test Bank PDFDocument19 pagesDwnload Full Fundamentals of Corporate Finance Australasian 2nd Edition Parrino Test Bank PDFchristabeldienj30da100% (8)

- Unit-5 Chapter-3: Insurance-Contract and ImportanceDocument34 pagesUnit-5 Chapter-3: Insurance-Contract and ImportanceRammohanreddy RajidiNo ratings yet

- Transpo BAR QADocument27 pagesTranspo BAR QAchan.aNo ratings yet

- Labor Canonical DoctrinesDocument17 pagesLabor Canonical DoctrinesJake MendozaNo ratings yet

- Joining Instructions 2019 PDFDocument50 pagesJoining Instructions 2019 PDFanil8688844700No ratings yet

- Honeywell - Garrett Motion - Plan Support Deal in Chapter 11Document97 pagesHoneywell - Garrett Motion - Plan Support Deal in Chapter 11Kirk HartleyNo ratings yet

- Hitendra Purohit: QUESS Corp Limited (Formerly IKYA Human Capital Solutions)Document5 pagesHitendra Purohit: QUESS Corp Limited (Formerly IKYA Human Capital Solutions)LOKENDRA SINGHNo ratings yet

- NJPC Building Nominated Subcontract - Edition 1 (10/04/2000)Document44 pagesNJPC Building Nominated Subcontract - Edition 1 (10/04/2000)Oscar Wilde100% (12)

- RIBA Standard PSC 2020 Final PDF Consultation VersionDocument56 pagesRIBA Standard PSC 2020 Final PDF Consultation VersionAmbright Muller100% (2)

- Corporate Law RTP CAP-II June 2016Document18 pagesCorporate Law RTP CAP-II June 2016Artha sarokar100% (1)

- Full Download Operations and Supply Chain Management 8th Edition Russell Test BankDocument18 pagesFull Download Operations and Supply Chain Management 8th Edition Russell Test Bankbenjaminlaw0o100% (37)

- Bob LetterDocument3 pagesBob LetterAbhilasha PrabhaNo ratings yet

- TP Offer LetterDocument9 pagesTP Offer Letterkaushal.kk37.kkNo ratings yet

- Advertising ProposalDocument24 pagesAdvertising ProposalTSS DTNo ratings yet

- Travellers Insurance & Surety Corporation v. Hon. Court of Appeals, G.R. No. 82036, May 22, 1997Document5 pagesTravellers Insurance & Surety Corporation v. Hon. Court of Appeals, G.R. No. 82036, May 22, 1997Tin LicoNo ratings yet

- Test Bank For Accounting 28th Edition Carl Warren Christine Jonick Jennifer Schneider 2Document8 pagesTest Bank For Accounting 28th Edition Carl Warren Christine Jonick Jennifer Schneider 2AmandaColewajg100% (42)

- C5 - PCI 2014 ManualDocument46 pagesC5 - PCI 2014 ManualThandabantu MagengeleleNo ratings yet

- Simple Research Flow ChartDocument1 pageSimple Research Flow ChartNisa ZainNo ratings yet

- Rights of Surety FDDocument19 pagesRights of Surety FDMuskan SharanNo ratings yet

- Deceased Claim Settlement DocumentDocument16 pagesDeceased Claim Settlement DocumentRathod PratiksinhNo ratings yet

- E-POSLAJU General Terms & ConditionsDocument7 pagesE-POSLAJU General Terms & ConditionsMacksNo ratings yet

- Instant Download Interpretative Phenomenological Analysis Theory Method and Research Ebook PDF Version PDF FREEDocument11 pagesInstant Download Interpretative Phenomenological Analysis Theory Method and Research Ebook PDF Version PDF FREEedward.coleman132No ratings yet

- Chnrvsbs 130219Document24 pagesChnrvsbs 130219Thamarai ElanthirayanNo ratings yet

- Provisional Remedies and Special Civil ActionsDocument13 pagesProvisional Remedies and Special Civil ActionsEmman FernandezNo ratings yet

- 11 Business Studies Notes ch04 Business Services PDFDocument8 pages11 Business Studies Notes ch04 Business Services PDFbharani dharanNo ratings yet

- Barandino, Abigail T. SET-1 PDFDocument19 pagesBarandino, Abigail T. SET-1 PDFAbigail Talosig BarandinoNo ratings yet