Professional Documents

Culture Documents

EN FRA Country Brief Jun2020

Uploaded by

MaraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EN FRA Country Brief Jun2020

Uploaded by

MaraCopyright:

Available Formats

June 2020

France

The OECD Inventory of Support Measures for Fossil Fuels identifies, documents and estimates direct

budgetary support and tax expenditures supporting the production or consumption of fossil fuels in OECD

countries, eight partner economies (Argentina, Brazil, the People’s Republic of China, Colombia, India,

Indonesia, the Russian Federation, and South Africa) and EU Eastern Partnership (EaP) countries

(Armenia, Azerbaijan, Belarus, Georgia, Moldova and Ukraine).

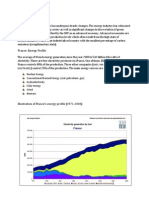

Energy resources and market structure Total Primary Energy Supply* in 2018

France has very limited fossil-energy resources

and imports most of its oil, natural gas, and all Nuclear,

Geothermal, 43%

of its coal. The country has pursued a policy of solar &

developing its nuclear energy industry to wind, 2%

reduce its dependence on fossil energy

imports, though almost all of the uranium Hydro, 2%

needed to fuel its nuclear power plants is

imported (mostly from Canada and Niger). In

Coal, 4%

2018, nuclear power accounted for roughly

Oil, 28%

three-quarters of France’s electricity Natural gas,

Biofuels & waste, 7%

generation and 44% of its total primary energy 15%

supply, fossil fuels accounting for 47%. *excluding net electricity import

Treating nuclear power as domestic supply, Source: IEA

indigenous production meets just over half of

the country’s energy use. Petroleum products accounted for 29% of energy use in 2018, having dropped

steadily from 37% in 1990 and nearly two-thirds in the 1970s.

France has liberalised its electricity and natural-gas sectors progressively to comply with EU directives,

eliminating the monopoly rights of the two state companies, Électricité de France (EDF) and Gaz de

France (GDF). As a result, high government ownership of energy companies has somewhat diminished in

recent years. Further actions taken included the unbundling of the transmission and distribution

networks of natural gas and electricity, the introduction of negotiation of third-party access to

underground storage of natural gas, and the establishment of both a regulator, the Commission de

Régulation de l’Énergie (CRE), and a mediator to protect electricity and gas consumers.

The oil industry has been private since the state divested from the shares of its then international oil

company, Total, completed in the late 1990s. A number of other private companies, many of them

foreign-based multinationals, are also active in the French refining, distribution, and marketing

businesses. Despite efforts to liberalise the electricity sector, EDF and its subsidiaries still account for the

bulk of power generation, transmission, and distribution. This is reflected by low consumer-switching

rates (less than 10%), although electricity consumers in France have been able to choose their supplier

since 2000. Similarly, Engie (formerly GDF Suez) remains the dominant player in the natural-gas market,

importing the bulk of the country’s gas needs, mainly from Norway, Russia, Algeria and Nigeria. Engie

and other historical gas suppliers have retained most of the retail market (79% of residential customers

and 78% of non-residential customers in September 2018, but only 68% of non-residential consumption).

Energy prices and taxes

Prices of all forms of energy other than electricity and natural gas are set freely by the market in France.

The CRE is responsible for proposing changes to the regulated tariffs and for regulating tariffs for access

by third parties to gas and electricity infrastructure, but the government still has the final say over

whether or not to approve the proposed changes (though not modify them). Energy products and

www.oecd.org/fossil-fuels/ ffs.contact@oecd.org @OECD_ENV

services are subject to normal VAT at the rate of 20% (since 2014), with the exception of some segments

of electricity supply, natural gas, and LPG, for which the rate is 5.5%. Excise duties in the form of the

TICPE (Taxe intérieure de consommation sur les produits énergétiques) are payable on all sales of oil

products at varying rates while separate consumption taxes apply to deliveries of coal, natural gas and

electricity. A part of this rate is directly linked to the fuel carbon emissions.

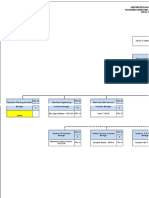

Total support for fossil fuels in France by support indicator (left) and fuel type (right)

Note: CSE=Consumer Support Estimate; PSE=Producer Support Estimate; GSSE=General Services Support Estimate.

Recent developments and trends in support

There exists a number of different mechanisms and arrangements supporting the use of specific fuels

and categories of end users in France. These mainly take the form of partial or full exemptions and

refunds from VAT and excise duties on oil products. In many cases, the total volume of the different

forms of support is modest, though it can still represent a substantial transfer from the perspective of

the recipient. In 2015, with the addition of a carbon tax to the taxation of energy products in France,

exemptions to energy-intensive industries that are not part of the EU ETS and are exposed to the risk of

carbon leakage were introduced to shield concerned sectors from increases in excise tax rates on fossil

fuels. The resulting positive growth in support to fossil fuels from 2014 to present, as illustrated in the

graph above, is directly linked to the exclusion of energy-intensive industries from the new carbon tax on

fossil fuels. There are also significant amounts from VAT exemptions for certain petroleum products

applicable in overseas French departments as well as reduced excise tax rates on certain diesel fuel uses.

Most recent data indicate that France’s support measures mostly benefit the transportation (48% of

Total Support Estimate (TSE)) and Industrial, Commercial and Agricultural sector (52% of TSE). No

support measure was listed benefitting fossil-fuel production.

Examples of measures

Excise Refund for Diesel The excise tax levied on diesel fuel used in road freight vehicles weighing at least

Used in Road Freight 7.5 tonnes is, under this tax provision, partly refunded to eligible beneficiaries.

Transport Freight companies registered in other EU countries can benefit from this measure

(1999-) provided they are able to attest having purchased diesel fuel in France for use in

eligible vehicles.

Overseas Excise Tax for Motor fuels consumed in French overseas départements (Guadeloupe, Guyane,

Fuels Martinique, Mayotte and La Réunion) are subject to a special tax (Taxe Spéciale sur

(2001-) la Consommation), whose rate is decided locally, generally lower than the final

consumption tax and cannot exceed the excise tax rate applied in Metropolitan

France. In addition, there are no taxes applied to fuel for heating or cooking

purposes. This concession aims at supporting investment in territories that are

both geographically and economically disadvantaged.

www.oecd.org/fossil-fuels/ ffs.contact@oecd.org @OECD_ENV

You might also like

- Neoen Equity ReportDocument11 pagesNeoen Equity ReportTiffany SandjongNo ratings yet

- Greece Brief - Phase-Out 2020 - Monitoring Europe's Fossil Fuel SubsidiesDocument8 pagesGreece Brief - Phase-Out 2020 - Monitoring Europe's Fossil Fuel SubsidiesSKataNo ratings yet

- FRANCE-A Case Study: Energy Consumption & Emission Patterns, Climate Policy, Action PlanDocument17 pagesFRANCE-A Case Study: Energy Consumption & Emission Patterns, Climate Policy, Action PlanVishvesh TextbooknoteNo ratings yet

- Luxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-FuelsDocument3 pagesLuxembourg: Inventory of Estimated Budgetary Support and Tax Expenditures For Fossil-Fuelssagetarius92No ratings yet

- EN SWE Country Brief Apr2019 PDFDocument2 pagesEN SWE Country Brief Apr2019 PDFFrancisco Javier Ari QuintanaNo ratings yet

- Situation Report All 7-8-2012!0!1Document242 pagesSituation Report All 7-8-2012!0!1Christos MyriounisNo ratings yet

- Iceland 1Document2 pagesIceland 1Daniela ArandaNo ratings yet

- Briefing Energy en WebDocument2 pagesBriefing Energy en WebSơn TrầnNo ratings yet

- Europe Emissions Targets and Implications For Business 2015Document4 pagesEurope Emissions Targets and Implications For Business 2015Matt MaceNo ratings yet

- 2013 Renewable Energy ProgressDocument451 pages2013 Renewable Energy Progressmkbg12No ratings yet

- Bioenergy in FranceDocument2 pagesBioenergy in FrancerougailtonioNo ratings yet

- EN 403 Energy Balance Assignment: Guide Prof. Manoj NeergatDocument24 pagesEN 403 Energy Balance Assignment: Guide Prof. Manoj NeergatSanchay SaxenaNo ratings yet

- Global Fuel Economy Initiative 2021Document195 pagesGlobal Fuel Economy Initiative 2021Berl MNo ratings yet

- 2009 - Italian Biogas (Economics)Document9 pages2009 - Italian Biogas (Economics)ilariofabbianNo ratings yet

- Louis-GaëtanGiraudet - 2021Document15 pagesLouis-GaëtanGiraudet - 2021Jin WANGNo ratings yet

- Accelerating hydrogen deployment in the G7: Recommendations for the Hydrogen Action PactFrom EverandAccelerating hydrogen deployment in the G7: Recommendations for the Hydrogen Action PactNo ratings yet

- Financing Reductions in Oil and Gas Methane EmissionsDocument31 pagesFinancing Reductions in Oil and Gas Methane EmissionsVeselina VasilevaNo ratings yet

- En IDN Country Brief Jun2020Document2 pagesEn IDN Country Brief Jun2020yedasompark3No ratings yet

- Aluminium EU ETSDocument45 pagesAluminium EU ETSDouglas Uemura NunesNo ratings yet

- Examining Market Power in The European Natural Gas Market: Rudolf G. Egging, Steven A. GabrielDocument17 pagesExamining Market Power in The European Natural Gas Market: Rudolf G. Egging, Steven A. GabrielBryan Anders AguilarNo ratings yet

- McSharry Reform NewDocument9 pagesMcSharry Reform NewAdriana Mihaela PașcalăuNo ratings yet

- Oil and Petroleum Products - A Statistical: Statistics ExplainedDocument11 pagesOil and Petroleum Products - A Statistical: Statistics ExplainedSKataNo ratings yet

- Lv-03-06-Eu IndcDocument5 pagesLv-03-06-Eu IndcSalton GerardNo ratings yet

- CausesDocument2 pagesCausesReswitaDeryGisrianiNo ratings yet

- Applsci 10 03571 v2Document28 pagesApplsci 10 03571 v2MARJORIE PEÑANo ratings yet

- Presse - 2023 10 19 - 07 32Document7 pagesPresse - 2023 10 19 - 07 32uir.enrNo ratings yet

- CountryReport2021 Germany FinalDocument22 pagesCountryReport2021 Germany FinalRudi SuwandiNo ratings yet

- Trabajo Con AlvaroDocument3 pagesTrabajo Con AlvaroNicolas MariéNo ratings yet

- Energy Production in FranceDocument2 pagesEnergy Production in FranceSheik MelowNo ratings yet

- Biokuro Brosiura BLDocument4 pagesBiokuro Brosiura BLDalius DapkusNo ratings yet

- EU 28 ElectricityDocument22 pagesEU 28 ElectricityAdisa WilosoNo ratings yet

- Comparative Compliance Task - Jonathan KayDocument4 pagesComparative Compliance Task - Jonathan KayJonathan K.No ratings yet

- Annual Market Update 2020 0Document63 pagesAnnual Market Update 2020 0jlskdfjNo ratings yet

- MJ0121372ENN enDocument114 pagesMJ0121372ENN enAlexandru FloricicaNo ratings yet

- European Electricity Markets Report - Q1 2022 - 1658824737Document51 pagesEuropean Electricity Markets Report - Q1 2022 - 1658824737APinboxNo ratings yet

- Tax Incentives To Promote Green Electricity An Overview of EU 27 CountriesDocument9 pagesTax Incentives To Promote Green Electricity An Overview of EU 27 Countriesdurga_85100% (1)

- RECIPES Country Info SenegalDocument5 pagesRECIPES Country Info SenegalAna OrriolsNo ratings yet

- 2015-12-09 Securing Energy Effciency To Secure The Energy Union Executive SummaryDocument8 pages2015-12-09 Securing Energy Effciency To Secure The Energy Union Executive Summaryandy131078No ratings yet

- Cost Benefi of Renewable EnergyDocument7 pagesCost Benefi of Renewable EnergySadhish KannanNo ratings yet

- EN EN: European CommissionDocument24 pagesEN EN: European Commissionandrea bottazziNo ratings yet

- Hydrogen Strategy PDFDocument24 pagesHydrogen Strategy PDFAlper KzNo ratings yet

- RES Support SchemesDocument33 pagesRES Support SchemeshashimhasnainhadiNo ratings yet

- Sustainability 13 01346Document14 pagesSustainability 13 01346Gary Test1No ratings yet

- The French District Heating Market - Overview Opportunities and ChallengesDocument33 pagesThe French District Heating Market - Overview Opportunities and ChallengesdasyogNo ratings yet

- 2009 09 Car Company Co2 Report FinalDocument20 pages2009 09 Car Company Co2 Report FinalPatrick RobinsonNo ratings yet

- Eprs Bri (2021) 690663 enDocument6 pagesEprs Bri (2021) 690663 enRohinish DeyNo ratings yet

- Energies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsDocument31 pagesEnergies: Italian Biogas Plants: Trend, Subsidies, Cost, Biogas Composition and Engine EmissionsHuy ĐoànNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- PEEB - Tunisia - Country Brief - Mar 2019Document3 pagesPEEB - Tunisia - Country Brief - Mar 2019sayhi souhaNo ratings yet

- Electricity Information: Statistics ReportDocument23 pagesElectricity Information: Statistics ReportDiego Martínez FernándezNo ratings yet

- Federal Inventory of Fossil Fuel Subsidies (Summary - 2023)Document10 pagesFederal Inventory of Fossil Fuel Subsidies (Summary - 2023)Climate Change BelgiumNo ratings yet

- Tackling The European Energy CrisisDocument28 pagesTackling The European Energy CrisisTran Thanh ThaoNo ratings yet

- GlobalMethaneTracker DocumentationDocument39 pagesGlobalMethaneTracker DocumentationabnerstbrNo ratings yet

- Study On The Taxation of The Air Transport Sector: Final ReportDocument281 pagesStudy On The Taxation of The Air Transport Sector: Final ReportIsmael GouwsNo ratings yet

- Factsheet Ets enDocument6 pagesFactsheet Ets enHjkkkkNo ratings yet

- The EU EmissionDocument3 pagesThe EU EmissionhdvdfhiaNo ratings yet

- Renewable Factsheet PDFDocument34 pagesRenewable Factsheet PDFdep25No ratings yet

- Carbon Tax: What Environmental and Economic Impact in The French Manufacturing Sector?Document21 pagesCarbon Tax: What Environmental and Economic Impact in The French Manufacturing Sector?Josua Desmonda SimanjuntakNo ratings yet

- Date Date Eventevent: Cape and TargetDocument3 pagesDate Date Eventevent: Cape and TargetsfgusdNo ratings yet

- The European (EU) Dependence On Imported Natural Gas 2003Document25 pagesThe European (EU) Dependence On Imported Natural Gas 2003Ike Ikechukwu MbachuNo ratings yet

- Bongkot Field 20 Year AnniversaryDocument8 pagesBongkot Field 20 Year AnniversaryAnonymous ntK705RtNo ratings yet

- BlowoutDocument14 pagesBlowoutNelson TorresNo ratings yet

- July August 2013Document52 pagesJuly August 2013awhk2006No ratings yet

- Revista Turbomaquinas Ene-Feb 2021Document44 pagesRevista Turbomaquinas Ene-Feb 2021GIUSEPPE PIZZINo ratings yet

- Carbon Conversion Landscape Analysis 2014 PDFDocument23 pagesCarbon Conversion Landscape Analysis 2014 PDFAnonymous IVMaKL6No ratings yet

- Risk Management For CNG Based VehiclesDocument5 pagesRisk Management For CNG Based VehiclesusafonlineNo ratings yet

- Heat Recovery - EfficiencyDocument58 pagesHeat Recovery - EfficiencyEshref AlemdarNo ratings yet

- Evs - Unit V - Pollution: Pollution-Meaning and DefinitionDocument33 pagesEvs - Unit V - Pollution: Pollution-Meaning and DefinitionVetrivelNo ratings yet

- Liquid Cargo Ships: Prof. Crescencio MarottaDocument16 pagesLiquid Cargo Ships: Prof. Crescencio MarottahantonyNo ratings yet

- Prem Singh ResumeDocument3 pagesPrem Singh ResumezeeshanNo ratings yet

- Indian Oil CorporationDocument1 pageIndian Oil Corporationjunet123123No ratings yet

- Renewable EnergyDocument5 pagesRenewable EnergyWalid MaheriNo ratings yet

- Offshore Salt Caverns Enable A 'Mega' Sized LNG Receiving TerminalDocument11 pagesOffshore Salt Caverns Enable A 'Mega' Sized LNG Receiving TerminalRizka KholistianiNo ratings yet

- ACCT3203 Week 3 Tutorial Questions Joint Products S2 2022: Product Separable Costs Sales ValueDocument7 pagesACCT3203 Week 3 Tutorial Questions Joint Products S2 2022: Product Separable Costs Sales ValueJingwen YangNo ratings yet

- Energy Resource and ManagementDocument43 pagesEnergy Resource and ManagementMaham MansoorNo ratings yet

- Struktur Organisasi Tambun FieldDocument15 pagesStruktur Organisasi Tambun Fieldrezkiyani kikiNo ratings yet

- Full ThesisDocument110 pagesFull ThesisfazlulfaisalNo ratings yet

- Liebherr Oc Ram Luffing Knuckle Boom Crane Series Brochure 170e174 EngDocument2 pagesLiebherr Oc Ram Luffing Knuckle Boom Crane Series Brochure 170e174 EngCarlos Gonzalez TorresNo ratings yet

- 2012 2030 PEP Executive Summary PDFDocument12 pages2012 2030 PEP Executive Summary PDFraul_bsuNo ratings yet

- HydrogenDocument38 pagesHydrogenClaudio Ibarra Casanova0% (2)

- RBC Energy Made SimpleDocument92 pagesRBC Energy Made SimpleSean GinhamNo ratings yet

- FUS 1010 CatalogDocument20 pagesFUS 1010 CatalogRaul CavaleruNo ratings yet

- A Physical Absorption Process For The Capture of Co From Co - Rich Natural Gas StreamsDocument6 pagesA Physical Absorption Process For The Capture of Co From Co - Rich Natural Gas StreamssinhleprovietNo ratings yet

- WFI0032 DF Conversion PresentationDocument36 pagesWFI0032 DF Conversion PresentationDesri TandiNo ratings yet

- PipeCalc ManualDocument13 pagesPipeCalc Manualavinashpatil2408No ratings yet

- SGT800 Verification ReportDocument58 pagesSGT800 Verification ReportThanapaet RittirutNo ratings yet

- Industry Reference Architecture Sample ReportDocument42 pagesIndustry Reference Architecture Sample ReportLeandro Dodoy Frincillo CrebelloNo ratings yet

- Energy in Sweden 2020 - An OverviewDocument18 pagesEnergy in Sweden 2020 - An OverviewigoralcNo ratings yet

- PDFDocument124 pagesPDFEmanuel Conde100% (1)

- Booklet RMG Group GB 2010 04Document546 pagesBooklet RMG Group GB 2010 04sukanya_ravichandranNo ratings yet