Professional Documents

Culture Documents

Submit original return and retain copy

Uploaded by

wonderboy NkosiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Submit original return and retain copy

Uploaded by

wonderboy NkosiCopyright:

Available Formats

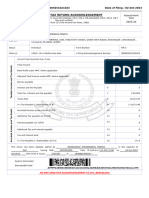

Please submit the original return and retain a copy for your records.

Monthly Employer Return EMP201

Employer Details

Trading or

Other Name RUPEE CONSULTING

PAYE Ref No. 7300775733 SDL Ref No. L300775733 UIF Ref No. U300775733

Contact Details

First Name SUNIL

Surname RUPEE

Position held at Business MEMBER

Bus Tel No. 0110231949 Cell No. 0828944386

Email AHMED@A2QUARED.CO.ZA

Financials

Penalty of 10% is payable on late payments. Interest is calculated on a daily basis at the applicable prescribed rate. To view the table of rates, go to www.sars.gov.za

ETI Indicator Y N Compliance status Compliant Non-Compliant

Payroll Tax Calculation ETI Calculation Total Payable

PAYE Liability R 123794.77 ETI Brought R PAYE Payable R 123794.77

Forward

0.00

SDL Liability R 5631.19 ETI Calculated R SDL Payable R 5631.19

UIF Liability R 4715.12 ETI Utilised R UIF Payable R 4715.12

Payroll R 134141.08 ETI Carry Forward R 0.00 Penalty & Interest R

Liability

Payment Total Payable R ,

Reference No. 7300775733LC2022093 Payment Period (CCYYMM) 202209 134141.08

Voluntary Disclosure Programme Tax Practitioner Details (if applicable) Declaration

Is this declaration made in respect of a VDP agreement Y N Tax Practitoner

with SARS? Registration No. PR I declare that the information given on this form is complete and correct. xxxxxxxxxxxxxxxxxxxxxxxxx

xxxxxxxxxxxxxxxxxxxxxxxxx

VDP Application No. Tax Practitioner

Tel No.

Date (CCYYMMDD) 20221004 Please ensure you sign over

the 2 lines of “X”s above

For enquiries go to www.sars.gov.za or call 0800 00 7277

EMP201 L Engl FV 2022.02.00 SV 1201 CT 03 NO 7300775733

P 202209

Y 2019

b97c-121-0a17-4a26-a09w-d5980eb532db 001/001

You might also like

- 1040 Tax Return SummaryDocument29 pages1040 Tax Return SummaryBonilla Cesar100% (2)

- S Reg PayslpDocument3 pagesS Reg Payslpjaggu_gram0% (1)

- Tax Rates AS2024-25Document9 pagesTax Rates AS2024-25DRK FrOsTeRNo ratings yet

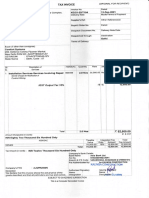

- Tax Invoice for Housing MouldDocument1 pageTax Invoice for Housing MouldSrishti GaurNo ratings yet

- Tax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsDocument1 pageTax Year To 5 April 2020 This Is A Printed Copy of An Ep60: To The Employee: Pay and Income Tax DetailsNatalino GuterresNo ratings yet

- Wage Easy ATO Payment Summaries (2018 Jun 28)Document1 pageWage Easy ATO Payment Summaries (2018 Jun 28)Haillander Lopes viannaNo ratings yet

- Tax Invoice: Invoice Address Invoice Details Delivery AddressDocument2 pagesTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneNo ratings yet

- Tax Invoice: Invoice Address Invoice Details Delivery AddressDocument2 pagesTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneNo ratings yet

- Income Taxation ReviewerDocument9 pagesIncome Taxation ReviewerAira MabezaNo ratings yet

- RGTL-22-23 Sajco Pi 039Document1 pageRGTL-22-23 Sajco Pi 039Ahmed AdelNo ratings yet

- Act ch10 l04 EnglishDocument7 pagesAct ch10 l04 EnglishLinds Rivera100% (1)

- General Instructions For The Completion PDF Form 1770 SDocument14 pagesGeneral Instructions For The Completion PDF Form 1770 SHafiedz S100% (1)

- TC 0201182-20240212 1707740880Document1 pageTC 0201182-20240212 1707740880suparnoplaosanNo ratings yet

- Tax Invoice: State Name Delhi, Code 07Document1 pageTax Invoice: State Name Delhi, Code 07Ritesh pandeyNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- MAC Jan-2022 Pending InvDocument1 pageMAC Jan-2022 Pending InvSree ganapathy Facilitation servicesNo ratings yet

- Brochure Graphic Design Work InvoiceDocument1 pageBrochure Graphic Design Work InvoicePrabal Pratap SinghNo ratings yet

- 40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Document1 page40/3 Side 4 Industrial Area Sahibabad Ghaziabad (U.P) 201010Srishti GaurNo ratings yet

- Octane Interiors LLP 13Document1 pageOctane Interiors LLP 13heebaairsystemlgNo ratings yet

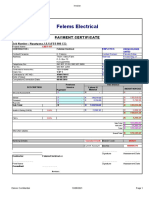

- Dimensional Service Corporation 2307Document3 pagesDimensional Service Corporation 2307Randy RosasNo ratings yet

- Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"Document5 pagesFill in All Applicable Spaces. Mark All Appropriate Boxes With An "X"May Joy DepalomaNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument4 pagesMobile Services: Your Account Summary This Month'S ChargesManjul SinghNo ratings yet

- Remita Stamp DutyDocument1 pageRemita Stamp Dutymaedalman44No ratings yet

- Tax Invoice: Invoice Address Invoice Details Delivery AddressDocument2 pagesTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneNo ratings yet

- To Get Your Monthly Bills On Your Email Id SMS STARTEBILLFL On 121 From Your Registered Airtel Mobile or 9650096500 From Non Airtel NoDocument6 pagesTo Get Your Monthly Bills On Your Email Id SMS STARTEBILLFL On 121 From Your Registered Airtel Mobile or 9650096500 From Non Airtel Novikash srivastavaNo ratings yet

- Tax Invoice for Construction ServicesDocument2 pagesTax Invoice for Construction ServicesVikas MantriNo ratings yet

- Om Engineering Works: Tax InvoiceDocument1 pageOm Engineering Works: Tax InvoiceSrishti GaurNo ratings yet

- Airtel Bill EgDocument3 pagesAirtel Bill Egvikash srivastavaNo ratings yet

- Proforma Invoice: I I'ii+iiDocument2 pagesProforma Invoice: I I'ii+ii220479No ratings yet

- Tax Invoice GST Details Housing Cavity ManufacturingDocument1 pageTax Invoice GST Details Housing Cavity ManufacturingSrishti GaurNo ratings yet

- Pay practicing fee receipt for Medical and Dental Council of NigeriaDocument1 pagePay practicing fee receipt for Medical and Dental Council of NigeriaAngelita RuntukNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument5 pagesMobile Services: Your Account Summary This Month'S ChargesManjul SinghNo ratings yet

- Ranjit ItrrDocument1 pageRanjit ItrrRadha SureshNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument4 pagesMobile Services: Your Account Summary This Month'S ChargesManjul SinghNo ratings yet

- It 000147087234 2024 12Document1 pageIt 000147087234 2024 12Revenue sectionNo ratings yet

- Maponya TradersDocument2 pagesMaponya Tradersntetemamello93No ratings yet

- ZZZZZZDocument3 pagesZZZZZZZizamele ShabalalaNo ratings yet

- Telephone No Amount Payable Due Date: Pay NowDocument3 pagesTelephone No Amount Payable Due Date: Pay NowJAYNo ratings yet

- Tax Invoice DetailsDocument2 pagesTax Invoice DetailsSARFRAZ ALAMNo ratings yet

- Tax Invoice: Mudass Ir Syed ZaidiDocument2 pagesTax Invoice: Mudass Ir Syed ZaidiRohit ChhabraNo ratings yet

- Q1B Memo Without Marks PDFDocument3 pagesQ1B Memo Without Marks PDFFolaNo ratings yet

- GST SALES A - 9259-A - 23-Nov-23Document1 pageGST SALES A - 9259-A - 23-Nov-23prabhat088No ratings yet

- 10rajendra JiDocument1 page10rajendra JiBs RaoNo ratings yet

- Telephone Number Amount Payable Due Date: Pay NowDocument3 pagesTelephone Number Amount Payable Due Date: Pay NowIT Team ParkAMRCNo ratings yet

- Howe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesDocument1 pageHowe Engineering Projects India PVT LTD: Earnings Amount Deductions Amount Perks/Other income/Exempton/RebatesSumantrra ChattopadhyayNo ratings yet

- Project LEAP - Purchase Report: Lead Sourcing InformationDocument4 pagesProject LEAP - Purchase Report: Lead Sourcing InformationPavan Singh RajputNo ratings yet

- Difference Bill NewDocument76 pagesDifference Bill NewMuneeb Usmani100% (1)

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S Chargesarpit tyagiNo ratings yet

- Adobe Scan 12 Dec 2023Document1 pageAdobe Scan 12 Dec 2023Ranjan DasNo ratings yet

- 120 Led Anuj JiDocument1 page120 Led Anuj Jiamit testNo ratings yet

- Comp 21Document6 pagesComp 21aprna SharmaNo ratings yet

- Tax Invoice: Invoice Address Invoice Details Delivery AddressDocument2 pagesTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument4 pagesMobile Services: Your Account Summary This Month'S ChargesManjul SinghNo ratings yet

- Bir1600 July52019 - 2 PDFDocument2 pagesBir1600 July52019 - 2 PDFMaureen AlapaapNo ratings yet

- Fdla 170528Document2 pagesFdla 170528smriti.sinha323No ratings yet

- Adobe Scan 15-Apr-2023Document1 pageAdobe Scan 15-Apr-2023VISHAL JANGRANo ratings yet

- Airtel broadband and fixedline bill detailsDocument2 pagesAirtel broadband and fixedline bill detailsRohtash SethiNo ratings yet

- Income Tax Payment Challan: PSID #: 161602500Document1 pageIncome Tax Payment Challan: PSID #: 161602500Muhammad Asif BashirNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- Mobile Services Tax Invoice SummaryDocument5 pagesMobile Services Tax Invoice SummaryManjul SinghNo ratings yet

- Tax Invoice GeneratorDocument1 pageTax Invoice Generatoromkar daveNo ratings yet

- Attendance Leave: Aslenah12 00days)Document2 pagesAttendance Leave: Aslenah12 00days)Vishnu DattNo ratings yet

- Soa Sbfcrhahdel000047209Document5 pagesSoa Sbfcrhahdel000047209Prabha MajumdarNo ratings yet

- ANDSLITEDocument1 pageANDSLITESrishti GaurNo ratings yet

- Tax Invoice SummaryDocument1 pageTax Invoice SummaryRajkumar WadhwaniNo ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Document78 pagesIndian Income Tax Return Acknowledgement: Acknowledgement Number:380069251021023 Date of Filing: 02-Oct-2023Mohit DuhanNo ratings yet

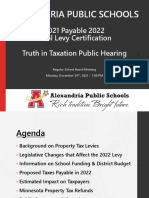

- Alexandria Public Schools Tax LevyDocument74 pagesAlexandria Public Schools Tax LevyinforumdocsNo ratings yet

- SalSlipJan 2022Document1 pageSalSlipJan 2022T TiwariNo ratings yet

- Tax Invoice: Vidhata Traders (23-24) 4520 40 4520 Dt. 6-Dec-23 6-Dec-23Document1 pageTax Invoice: Vidhata Traders (23-24) 4520 40 4520 Dt. 6-Dec-23 6-Dec-23cp7582463No ratings yet

- Zisanda Ncanywa Payslip - November - 2023Document1 pageZisanda Ncanywa Payslip - November - 2023Goitseona Koikoi IVNo ratings yet

- Ackowledgement Received Documents: (Biraddali Inter-Island Shipping Corporation Records) Philippine Port Authority NODocument53 pagesAckowledgement Received Documents: (Biraddali Inter-Island Shipping Corporation Records) Philippine Port Authority NOBoalan OfficeNo ratings yet

- P00059591 InvoiceDocument2 pagesP00059591 InvoiceVijay SinghNo ratings yet

- Itr Acknowledgement A.Y. 2021-22Document1 pageItr Acknowledgement A.Y. 2021-22Akshat MittalNo ratings yet

- E-filing Income Tax ReturnsDocument41 pagesE-filing Income Tax ReturnsRicha KalyaniNo ratings yet

- Sri Ram SilksDocument1 pageSri Ram SilksMathanagopal KNo ratings yet

- Jawapan Lembaran PBD: Bab 1: UbahanDocument13 pagesJawapan Lembaran PBD: Bab 1: UbahanLOVENNATH A/L RAVI MoeNo ratings yet

- Contemporaray Taxation Acc: 300: PerquisitesDocument5 pagesContemporaray Taxation Acc: 300: PerquisitesALEEM MANSOORNo ratings yet

- ITAD BIR Ruling No. 141-13 Dated May 21, 2013Document9 pagesITAD BIR Ruling No. 141-13 Dated May 21, 2013KriszanFrancoManiponNo ratings yet

- DLCPM00312970000241958 NewDocument2 pagesDLCPM00312970000241958 NewAnshul KatiyarNo ratings yet

- US Internal Revenue Service: f1040 - 1996Document2 pagesUS Internal Revenue Service: f1040 - 1996IRSNo ratings yet

- 2014 AllslipsDocument3 pages2014 Allslipsapi-652848320No ratings yet

- National Pension SystemDocument2 pagesNational Pension Systemjyotsna jhaNo ratings yet

- Invoices CR - Sale 129 VDPM Lnd4nTfROp4mieDocument1 pageInvoices CR - Sale 129 VDPM Lnd4nTfROp4mieAcer UserNo ratings yet

- 100 Pioneer SteelDocument1 page100 Pioneer SteelRanjan MishraNo ratings yet

- Australian Taxation Law Questions ExplainedDocument3 pagesAustralian Taxation Law Questions ExplainedgeorgeNo ratings yet

- Chapter 7Document24 pagesChapter 7Jalem Putro100% (1)

- DP ExemptDocument2 pagesDP Exemptnavdeepsingh.india8849100% (24)

- Survey of Manila RatesDocument5 pagesSurvey of Manila RatesMarcus DoroteoNo ratings yet

- Ucc Mock Board Exam 2021 Taxation 70Document15 pagesUcc Mock Board Exam 2021 Taxation 70Veronika BlairNo ratings yet