Professional Documents

Culture Documents

Activity 3: Direct Labor: ST ND RD

Uploaded by

Tricia MaeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Activity 3: Direct Labor: ST ND RD

Uploaded by

Tricia MaeCopyright:

Available Formats

ACTIVITY 3: DIRECT LABOR

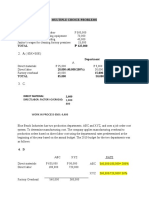

Problem 1. Overtime premium

Victory Manufacturing Company produces a variety of products. The firm operates 24 hours per

day with three daily work shifts. The first shift workers receive regular pay. The second shift

receive 10% pay premium, and the third shifts receive 20% pay premium. In addition, the firm pays

overtime premium of 50% based on the pay rate for the first shifts. All labor premium are included

in overhead.

The actual payroll for the month is as follows:

Total wages for 16,000 hours ?

Wage rate for the 1st shift P35 per hour

Total regular hours worked 15,000

The total amount of total payroll for the period is P630,000

1st shift 5,000 hrs x 35 175,000

2nd shift 5,000 hrs x 35 x 110% 192,500

3rd shift 5,000 hrs x 35 x 120% 210,000

Overtime premium 1,000 hrs x 35 x 150% 52,500

Total 630,000

Problem 2. LCC company uses only one account for all materials and adopts the perpetual inventory

system. The accounting records for 2020 of LCC Co. showed the following: Decreased in raw

materials inventory, P450,000; Increased in finished goods inventory, P150,000; Total debits to

Raw Materials; P1,290,000; Total factory payroll, P600,000; Applied FOH, P900,000, excluding

indirect labor of P50,000 and indirect materials of P45,000; Freight in, P20,000, decrease in WIP

inventory, P90,000.

The total factory costs amounted to P2,455,000

Direct Materials Direct Labor FOH

Total Debits to raw materials: P1,290,000 Total Factory payroll: Applied FOH:

Less: Decrease in raw materials (450,000) 600,000 P900,000

Add: Freight-in 20,000 Indirect labor:

TOTAL DIRECT MATERIALS: 860,000 50,000

Indirect materials:

45,000

TOTAL FOH:

P995,000

Total factory cost = Direct Materials + Direct Labor + Factory overhead

Direct Materials: 860,000

Direct Labor: 600,000

Factory overhead: 995,000

TOTAL FACTORY COSTS P2,455,000

You might also like

- CostAccounting Compre1Document15 pagesCostAccounting Compre1Ivan Fausto OranteNo ratings yet

- Practice Problems AcctgDocument10 pagesPractice Problems AcctgRichard ColeNo ratings yet

- Problem For Chapter 3Document3 pagesProblem For Chapter 3Clarisse Angela PostreNo ratings yet

- MX - Cost Accounting PDFDocument5 pagesMX - Cost Accounting PDFZamantha TiangcoNo ratings yet

- Statement of COGSDocument3 pagesStatement of COGSIan CalinawanNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Probs AnswerDocument4 pagesProbs AnswerLABASBAS, Alexidaniel I.No ratings yet

- Cost of Goods Sold StatementDocument18 pagesCost of Goods Sold StatementCherrylane EdicaNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Cost Accounting DrillsDocument13 pagesCost Accounting DrillsViky Rose EballeNo ratings yet

- Answers To Activity 1Document5 pagesAnswers To Activity 1jangjangNo ratings yet

- Job Order Costing SolutionDocument9 pagesJob Order Costing SolutionMariah VillanNo ratings yet

- Exercise 1 Key PDF Cost of Goods Sold InvenDocument1 pageExercise 1 Key PDF Cost of Goods Sold InvenAl BertNo ratings yet

- Bacostmx-1tay2223-Midterms Quiz 1 ReviewerDocument4 pagesBacostmx-1tay2223-Midterms Quiz 1 ReviewerCzarina Jean ConopioNo ratings yet

- Week 4 Managerial AccountingDocument7 pagesWeek 4 Managerial AccountingMari SylvesterNo ratings yet

- D. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Document14 pagesD. Depends On The Significance of The Amount.: Cost Accounting Comprehensive Examination 1Ferb CruzadaNo ratings yet

- ActivityDocument7 pagesActivityTrina Mae BarrogaNo ratings yet

- Juarez, Jenny Brozas - Activity 1 MidtermDocument19 pagesJuarez, Jenny Brozas - Activity 1 MidtermJenny Brozas JuarezNo ratings yet

- 1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Document8 pages1.2.1 Assignments - Cost Concepts and Classifications (Answers and Solutions)Roselyn LumbaoNo ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingNike ColeNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Costcon 1Document3 pagesCostcon 1Frances Clayne GonzalvoNo ratings yet

- Finals in AE23 First Sem 2324Document8 pagesFinals in AE23 First Sem 2324tone30412No ratings yet

- Costing Accounting ProblemsDocument3 pagesCosting Accounting Problemstrixie maeNo ratings yet

- Bacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesDocument7 pagesBacolod, Queenie Rose C. BSA2-B Summary of Answers Problem 5-Chapter 3 Requirement 1-Journal EntriesQueenie Rose BacolodNo ratings yet

- Finals Unit 4 Exercise - Variable and Absorption CostingDocument2 pagesFinals Unit 4 Exercise - Variable and Absorption CostingMelo RiegoNo ratings yet

- 05 Quiz 1Document3 pages05 Quiz 1Goose ChanNo ratings yet

- Job Order CostingDocument12 pagesJob Order CostingDanna ClaireNo ratings yet

- Accounting QuestionsDocument7 pagesAccounting QuestionsleneNo ratings yet

- Job Order Costing ProblemsDocument15 pagesJob Order Costing ProblemsClarissa Teodoro100% (2)

- Chapter 1 ExercisesDocument18 pagesChapter 1 ExercisesJenny Brozas JuarezNo ratings yet

- Quiz No. 4 - Variable and Absorption CostingDocument2 pagesQuiz No. 4 - Variable and Absorption CostingRio Cyrel CelleroNo ratings yet

- ExercisesDocument7 pagesExercisesMaryjane De GuzmanNo ratings yet

- Income Statement Under Job Order and Activity-Based CostingDocument10 pagesIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanNo ratings yet

- Sdathn Ripsryd@r@ea@pis - Unit) : - SolutionDocument16 pagesSdathn Ripsryd@r@ea@pis - Unit) : - SolutionAnimesh VoraNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- DRAFTLevel 2Document37 pagesDRAFTLevel 2Mark Paul RamosNo ratings yet

- Problems - Accounting For Factory OverheadDocument3 pagesProblems - Accounting For Factory OverheadShaina Jean PiezonNo ratings yet

- Cost AccumulationDocument3 pagesCost AccumulationJan TadsNo ratings yet

- Assignment 01Document3 pagesAssignment 01LUCILENE ROSITNo ratings yet

- WK 2c Lesson 2 Problem Solving IllustrationDocument2 pagesWK 2c Lesson 2 Problem Solving IllustrationRosethel Grace GallardoNo ratings yet

- QUIZ - Cost1.atest PaperDocument3 pagesQUIZ - Cost1.atest PaperArnold Ramos ChuidianNo ratings yet

- Exercises On Introduction To Cost AccountingDocument4 pagesExercises On Introduction To Cost AccountingAsi Cas Jav100% (1)

- Problem 9 43Document5 pagesProblem 9 43SuperNo ratings yet

- Salce Prelim Act102 E2Document8 pagesSalce Prelim Act102 E2Joshua P. SalceNo ratings yet

- Multiple Choice-Problems 1. A: Direct MaterialDocument11 pagesMultiple Choice-Problems 1. A: Direct MaterialIT GAMINGNo ratings yet

- Standard CostingDocument3 pagesStandard CostingElijah MontefalcoNo ratings yet

- A3. Activity 1 COST CONCEPTS AND COST BEHAVIORDocument8 pagesA3. Activity 1 COST CONCEPTS AND COST BEHAVIORSittie Ainna A. UnteNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Mas TestbanksDocument25 pagesMas TestbanksKristine Esplana ToraldeNo ratings yet

- 1ST QUIZ Cost AccountingDocument6 pages1ST QUIZ Cost AccountingJoseph Francis PamaongNo ratings yet

- Quiz Feb24Document5 pagesQuiz Feb24E RDNo ratings yet

- Hassan Exame 21 AugustrDocument4 pagesHassan Exame 21 Augustrsardar hussainNo ratings yet

- Exercise 1 Case 1 Case 2Document11 pagesExercise 1 Case 1 Case 2Chin FiguraNo ratings yet

- TOPIC 6 - Accounting For OHDocument2 pagesTOPIC 6 - Accounting For OHAnna WilliamsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet