Professional Documents

Culture Documents

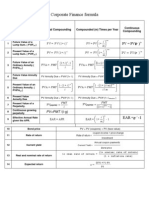

Level 1 2022 Formula Sheet

Uploaded by

xxOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Level 1 2022 Formula Sheet

Uploaded by

xxCopyright:

Available Formats

Other Helpful Keys

Quantitative Methods STO = allows you to store values. Effective Annual Rate (EAR)

RCL = allows you to recall stored values.

Financial Calculator Keys 𝐸𝐴𝑅 = (1 + 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒)𝑚 − 1

N = Number of Compounding Periods FORMAT

I/Y = Interest Rate per Year 2nd + FORMAT allows you to change the number of 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒

*In whole numbers (i.e. 5% is entered as 5) decimal places displayed on the calculator. 𝑆𝑡𝑎𝑡𝑒𝑑 𝐴𝑛𝑛𝑢𝑎𝑙 𝑅𝑎𝑡𝑒

=

PV = Present Value 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟

PMT = Payment DATA & STAT

𝑚 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟

FV = Future Value Computes multiple values (mean, standard

deviation, etc...)

End-of-period payments

EAR with continuous compounding

nd

*Used for regular annuity 2 + DATA allows you to your input variables. Once

𝐸𝐴𝑅 = 𝑒 𝑟𝑠 − 1

2nd [BGN] inputted, exit the page, and click 2nd + STAT to find

2nd Enter the computed outputs. Use the down arrow keys

Display END scroll through the various outputs. Relative Frequency

Relative Frequency

Beginning-of-period payments 𝐴𝑏𝑠𝑜𝑙𝑢𝑡𝑒 𝑓𝑟𝑒𝑞𝑢𝑒𝑛𝑐𝑦 𝑜𝑓 𝑒𝑎𝑐ℎ 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙

Future Value (FV) of a single cash flow =

*Used for annuity due 𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠

2nd [BGN] 𝐹𝑉 = 𝑃𝑉 × (1 + 𝑟)𝑁

2nd Enter Cumulative Relative Frequency

Display BGN Cumulative Relative Frequency

Present Value (PV) of a single cash flow = 𝐴𝑑𝑑 𝑡ℎ𝑒 𝑟𝑒𝑙𝑎𝑡𝑖𝑣𝑒 𝑓𝑟𝑒𝑞𝑢𝑒𝑛𝑐𝑖𝑒𝑠 𝑤ℎ𝑖𝑙𝑒 𝑝𝑟𝑜𝑐𝑒𝑒𝑑𝑖𝑛𝑔

𝑓𝑟𝑜𝑚 𝑡ℎ𝑒 𝑓𝑖𝑟𝑠𝑡 𝑡𝑜 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙

Cash Flow Worksheet 𝐹𝑉

CFn = cash flow at time period n 𝑃𝑉 =

(1 + 𝑟)𝑁 Arithmetic Mean

Using the arrow keys and the ENTER key to input

cash flow amounts and their frequencies. ∑𝑛𝑡=1 𝑋

x̅ =

Solving for net present value: the NPV key will Present Value (PV) of Perpetuity 𝑁

prompt you to input a discount rate (I). Then 𝐴

pressing the down key and CPT to find the NPV. 𝑃𝑉(𝑃𝑒𝑝𝑒𝑡𝑢𝑖𝑡𝑦) =

𝑟 Median

Solving for the internal rate of return: use the IRR 𝐴 = 𝑃𝑎𝑦𝑚𝑒𝑛𝑡 𝑎𝑚𝑜𝑢𝑛𝑡 In an ordered sample of n items:

key and press CPT. For even number of observations

𝑛 𝑛+2

= Mean of values &

2 2

ICONV Future Value (FV) with continuous

Used to calculate effective rates compounding For odd number of observations =

𝑛+1

Nom = Nominal Rate 2

C/Y = Compounding Frequency 𝐹𝑉𝑁 = 𝑃𝑉𝑒 𝑟𝑠𝑁 Mode

EFF-> CPT = outputs effective rate 𝑀𝑜𝑑𝑒

I.D87618567.

= most frequently occurring value in a distribution

QM (1/12) QM (2/12) QM (3/12)

Weighted Average Mean Population Variance Probability of A or B

𝑛 𝑁 𝑃(𝐴 𝑜𝑟 𝐵) = 𝑃(𝐴) + 𝑃(𝐵) − 𝑃(𝐴𝐵)

∑𝑖=1(𝑥𝑖 − 𝜇)2

̅

X 𝑤 = ∑ 𝑤𝑖 × 𝑋𝑖 𝜎2 =

𝑁

𝑖=1 Joint Probability of Two Events

Geometric Mean Sample Variance

𝑃(𝐴𝐵) = 𝑃(𝐴|𝐵) × 𝑃(𝐵)

𝑛

𝑛 ∑𝑖=1(𝑥𝑖 − 𝑥̅ )2

G = √(1 + 𝑟1 )(1 + 𝑟2 ) … (1 + 𝑟𝑛 ) 𝑠2 =

𝑛−1

Conditional Probability of A given B

with 𝑟𝑖 ≥ 0 for i = 1,2, … , n

Standard Deviation

Square root of the variance value 𝑃(𝐴𝐵)

Harmonic Mean 𝑃(𝐴|𝐵) =

n 𝑃(𝐵)

HM = 𝑛 Sample Target Semi-Deviation

1

∑ (𝑋 )

𝑖=1 𝑖 Joint Probability of any number of

𝑛 independent events

with X𝑖 > 0 for i = 1,2, … , n

(𝑋𝑖 − 𝐵)2

𝑠Target = √ ∑ 𝑃(𝐴𝐵𝐶𝐷𝐸) = 𝑃(𝐴) × 𝑃(𝐵) × 𝑃(𝐶) × 𝑃(𝐷)

Mean Absolute Deviation 𝑛−1 × 𝑃(𝐸)

𝑓𝑜𝑟 𝑎𝑙𝑙 𝑋𝑖 ≤ 𝐵

∑𝑛𝑖=1|𝑥𝑖 − 𝑥̅ | Where B is the target and n is the total number of

MAD =

𝑛 sample observations.

Total Probability Rule

Percentile Coefficient of Variation 𝑃(𝐴) = 𝑃(𝐴|𝐵1 ) × 𝑃(𝐵1 ) + 𝑃(𝐴|𝐵2 ) × 𝑃(𝐵2 )

y

Percentile = Ly = (n + 1) × + 𝑃(𝐴|𝐵3 ) × 𝑃(𝐵3 )

100 𝑆𝑡𝑎𝑛𝑑𝑎𝑟𝑑 𝐷𝑒𝑣𝑖𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑥 𝑠𝑥

𝐶𝑉 = = + ⋯ 𝑃(𝐴|𝐵𝑛 ) × 𝑃(𝐵𝑛 )

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑥 𝑥̅

Distribution

Quartile =

4 Skewness

Distribution Positive Skew; Mean > Median > Mode Expected Value of a Random Variable

Quintile = Negative Skew; Mean < Median < Mode

5

𝑛

Distribution 𝐸(𝑋) = 𝑃(𝑋1 )𝑋1 + 𝑃(𝑋2 )𝑋2 +. . . 𝑃(𝑋𝑛)𝑋𝑛 = ∑ 𝑃(𝑋𝐼 )𝑋𝑖

Decile =

10

Probability Stated as Odds 𝑖=1

𝑃(𝐸)

Range 𝑂𝑑𝑑𝑠 𝑓𝑜𝑟 𝑎𝑛 𝐸𝑣𝑒𝑛𝑡 ′𝐸′ =

1 − 𝑃(𝐸)

Range = Maximum value – Minimum value

I.D87618567.

1 − 𝑃(𝐸)

𝑂𝑑𝑑𝑠 𝑎𝑔𝑎𝑖𝑛𝑠𝑡 𝑎𝑛 𝐸𝑣𝑒𝑛𝑡 ′𝐸′ =

𝑃(𝐸)

QM (4/12) QM (5/12) QM (6/12)

Variance of a Random Variable Multinomial Formula for Labeling Expected Value and Variance of a

Problems Binomial Random Variable

𝑛 n!

n! =

𝜎 2 (𝑋) = ∑ 𝑃(𝑋𝑖 ) [𝑋𝑖 − 𝐸(𝑋)]2 n1! n2! … nk! 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑋 = nP

𝑖=1 𝑉𝑎𝑟𝑖𝑎𝑛𝑐𝑒 𝑜𝑓 𝑋 = nP(1 − p)

Combination Formula

# of ways we can choose r objects from a total of n objects,

Portfolio Expected Return when order does not matter. Continuous Uniform Distribution

n! 1

nCr = 𝑓(𝑥) = { 𝑓𝑜𝑟 𝑎 < 𝑥 < 𝑏 𝑜𝑟 0

𝐸(𝑅𝑝 ) = 𝑤1̇ 𝐸(𝑅1̇ ) + 𝑤2̇ 𝐸(𝑅2̇ ) + 𝑤3 𝐸(𝑅3 ) … 𝑤𝑛𝐸(𝑅𝑛̇ ) (n − r)! r! 𝑏−𝑎

𝑥−𝑎

𝐹(𝑥) = 𝑓𝑜𝑟 𝑎 < 𝑥 < 𝑏

Portfolio Variance Permutation Formula 𝑏−𝑎

# of ways that we can choose r objects from a total of n

objects, when order does matter. Standardizing a Random Normal Variable

𝑣𝑎𝑟(𝑅𝑃 ) = 𝑤𝐴2 𝜎 2 (𝑅𝐴 )

+ 𝑤𝐵2 𝜎 2 (𝑅𝐵 )

n! 𝑋−µ

+ 2𝑤𝐴 𝑤𝐵 𝜎(𝑅𝐴 )𝜎(𝑅𝐵 )𝜌(𝑅𝐴 , 𝑅𝐵 ) nPr =

(n − r)! 𝑍=

Covariance 𝜎

approximately…

𝑐𝑜𝑣(𝑅1 , 𝑅𝑗 ) = 𝐸[(𝑅𝑖 − 𝐸(𝑅𝑖̇ )(𝑅𝑗 − 𝐸(𝑅𝑗̇ )]

Probabilities for a Random Variable given 50% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± (2 ∕ 3)𝜎

its Cumulative Distribution Function 68% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 1𝜎

To find F(x), sum up, or cumulate, values of the 95% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 2𝜎

Correlation probability function for all outcomes less than or 99% 𝑜𝑓 𝑎𝑙𝑙 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 𝑓𝑎𝑙𝑙 𝑤𝑖𝑡ℎ𝑖𝑛 𝜇 ± 3𝜎

equal to x.

𝑐𝑜𝑣(𝑅𝑖 , 𝑅𝑗 ) Safety-First Ratio

𝜌(𝑅𝑖 , 𝑅𝑗 ) =

𝜎(𝑅𝑖 )𝜎(𝑅𝑗 )

Probabilities given the Discrete Uniform

[𝐸(𝑅𝑝 ) − 𝑅𝑙 )]

Function 𝑆𝐹𝑅𝑎𝑡𝑖𝑜 =

𝜎𝑝

Bayes’ Formula 𝐶𝑢𝑚𝑢𝑙𝑎𝑡𝑖𝑣𝑒 𝑑𝑖𝑠𝑡𝑟𝑖𝑏𝑢𝑡𝑖𝑜𝑛 𝑓𝑢𝑛𝑐𝑡𝑖𝑜𝑛 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑛𝑡ℎ 𝑜𝑢𝑡𝑐𝑜𝑚𝑒

Portfolio with the highest ratio is preferred

𝐹(𝑋𝑛) = 𝑛𝑃(𝑋)

𝑃(𝐸𝑣𝑒𝑛𝑡|𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛)

Probability function for a Binomial Continuously Compounded Return

𝑃(𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛|𝐸𝑣𝑒𝑛𝑡) from t = 0 to t = 1

= × 𝑃(𝐸𝑣𝑒𝑛𝑡) Random Variable 𝑆1

𝑃(𝐼𝑛𝑓𝑜𝑟𝑚𝑎𝑡𝑖𝑜𝑛)

𝑃𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 𝑜𝑓𝑥 𝑠𝑢𝑐𝑐𝑒𝑠𝑠𝑒𝑠 𝑖𝑛 𝑛 𝑡𝑟𝑖𝑎𝑙𝑠 𝑟0,1 = ln( )

n! 𝑆0

= × 𝑝 𝑥 (1 − 𝑝)𝑛−𝑥

(n − x)! x!

Multiplication Rule of Counting Degrees of Freedom of Student’s

n! = n(n − 1)(n − 2)(n − 3) … 1 T-distribution

𝑑𝑓 = 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠𝑎𝑚𝑝𝑙𝑒 𝑜𝑏𝑠𝑒𝑟𝑣𝑎𝑡𝑖𝑜𝑛𝑠 − 1 = 𝑛 − 1

I.D87618567.

QM (7/12) QM (8/12) QM (9/12)

Test of a Single Mean Test of a Correlation

Standard Error of the Sample Mean 𝑋̅ − 𝜇0 𝑋̅ − 𝜇0 𝑟√𝑛 − 2

𝑧= 𝜎 or 𝑡𝑛−1 = 𝑠 𝑡=

(σ known) ⁄ 𝑛 ⁄ 𝑛 √1 − 𝑟 2

σ √ √

𝜎𝑋 =

√n

Test of the Difference in Means Coefficient of Determination

(σ unknown)

s ∑𝑛𝑖=1(𝑌̂𝑖 − 𝑌̅)2

𝑠𝑥 = (Equal Variances) 𝑅2 =

√n (𝑋̅1 − 𝑋̅2 ) − (𝜇1 − 𝜇2 ) ∑𝑛𝑖=1(𝑌𝑖 − 𝑌̅)2

𝑡= 1

Normally Distributed Population with 𝑠𝑝2 𝑠𝑝2 2 Mean Square Regression (MSR)

(𝑛 + 𝑛 ) 𝑛

1 2

Known Variance ∑ (𝑌̂𝑖 − 𝑌̅)2

σ 𝑖=1

𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙𝑠 = 𝑋̅ ± 𝑧𝜎/2 × ( )

√n (𝑛1 − 1)𝑠12 + (𝑛2 − 1)𝑠22

𝑧𝜎/2 𝑤ℎ𝑒𝑟𝑒 𝑠𝑝2 =

𝑛1 + 𝑛2 − 2 Mean Square Error (MSE)

≅ 1.65 𝑓𝑜𝑟 90% 𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝐼𝑛𝑡𝑒𝑟𝑣𝑎𝑙, 5% 𝑖𝑛 𝑒𝑎𝑐ℎ 𝑡𝑎𝑖𝑙

𝑧𝜎/2

Test of the Difference in Means ∑𝑛𝑖=1(𝑌𝑖 − 𝑌̂𝑖 )2

= 1.96 𝑓𝑜𝑟 95% 𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝐼𝑛𝑡𝑒𝑟𝑣𝑎𝑙, 2.5% 𝑖𝑛 𝑒𝑎𝑐ℎ 𝑡𝑎𝑖𝑙 (Unequal Variances) 𝑛−2

𝑧𝜎/2

≅ 2.58 𝑓𝑜𝑟 99% 𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝐼𝑛𝑡𝑒𝑟𝑣𝑎𝑙, 0.5% 𝑖𝑛 𝑒𝑎𝑐ℎ 𝑡𝑎𝑖𝑙 (𝑋̅1 − 𝑋̅2 ) − (𝜇1 − 𝜇2 )

𝑡= 1

F-distributed Test Statistic (F)

𝑠2 𝑠22 2 F = MSR / MSE

Large sample, Population Variance (𝑛1 + 𝑛2 )

1

Unknown

s 2

Standard Error of the Estimate

𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙𝑠 = 𝑋̅ ± 𝑧𝛼/2 × ( ) 𝑠2 𝑠2

√n (𝑛1 + 𝑛2 ) (𝑠𝑒 ) = √𝑀𝑆𝐸

1 2

𝑤ℎ𝑒𝑟𝑒 𝑑𝑓 =

(𝑠12⁄𝑛1 )2 (𝑠22⁄𝑛2)2

Small sample, Population Variance + Forecasted Value of Dependant Variable

𝑛1 𝑛2

Unknown Test of Mean of Differences 𝑌̂𝑓 = 𝑏̂0 + 𝑏̂1 𝑋 𝑓

s 𝑛

𝐶𝑜𝑛𝑓𝑖𝑑𝑒𝑛𝑐𝑒 𝑖𝑛𝑡𝑒𝑟𝑣𝑎𝑙𝑠 = 𝑋̅ ± 𝑡𝛼/2 × ( ) 𝑑̅ − 𝜇𝑑0 1

√n 𝑡= ̅

𝑤ℎ𝑒𝑟𝑒 𝑑 = ∑ 𝑑𝑖

𝑠𝑑̅ 𝑛 Standard Error of a Forecast

𝑖=1

Type I and II Errors

Type I – Reject H0 when true Test of a Single Variance 1 (𝑋𝑓 − 𝑋̅)2

Type II – Accept H0 when false 𝑠𝑓 = 𝑠𝑒 √1 + + 𝑛

(𝑛 − 1)𝑠 2 𝑛 ∑𝑖=1(𝑋𝑖 − 𝑋̅ )2

𝜒2 =

𝜎02

Power of a Test Test of the differences in Variances

1 − 𝑃(𝑇𝑦𝑝𝑒 𝐼𝐼 𝑒𝑟𝑟𝑜𝑟) Prediction Interval

𝑠12

𝐹=

𝑠22

𝑌̂𝑓 ± 𝑡𝑐𝑟𝑖𝑡𝑖𝑐𝑎𝑙 𝑓𝑜𝑟 𝛼/2𝑆𝑓

I.D87618567.

QM (10/12) QM (11/12) QM (12/12)

Economics

Price Elasticity of Demand Firm Structures National income, Personal income &

%∆𝑄 𝑃𝑜 ∆𝑄 Perfect Competition: Numerous firms; low barriers

= ( )×( ) Personal disposable Income

%∆𝑃 𝑄𝑜 ∆𝑃 to entry; homogenous products; no pricing power; National income

∆𝑄

( ) 𝑖𝑠 𝑡ℎ𝑒 𝑠𝑙𝑜𝑝𝑒 𝑐𝑜𝑒𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑡 Monopolistic Competition: Numerous firms; low = 𝐶𝑜𝑚𝑝𝑒𝑛𝑠𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑒𝑚𝑝𝑙𝑜𝑦𝑒𝑒𝑠

∆𝑃 + 𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝑎𝑛𝑑 𝑔𝑜𝑣𝑒𝑟𝑛𝑚𝑒𝑛𝑡 𝑒𝑛𝑡𝑒𝑟𝑝𝑟𝑖𝑠𝑒 𝑝𝑟𝑜𝑓𝑖𝑡𝑠 𝑏𝑒𝑓𝑜𝑟𝑒 𝑡𝑎𝑥𝑒𝑠

Demand Elastic if absolute value > 1 barriers to entry; differentiated products; some

pricing power + 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑖𝑛𝑐𝑜𝑚𝑒

Demand Inelastic if absolute value < 1 + 𝑢𝑛𝑖𝑛𝑐𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒𝑑 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑛𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 + 𝑟𝑒𝑛𝑡

Oligopoly: Few firms; high barriers to entry; + 𝑖𝑛𝑑𝑖𝑟𝑒𝑐𝑡 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑡𝑎𝑥𝑒𝑠 𝑙𝑒𝑠𝑠 𝑠𝑢𝑏𝑠𝑖𝑑𝑖𝑒𝑠

products can be homogeneous or differentiated;

Income Elasticity of Demand significant pricing power

%∆𝑄 𝐼𝑜 ∆𝑄 Personal Income

= ( )×( ) Monopoly: Single firm; high barriers to entry; high = 𝑁𝑎𝑡𝑖𝑜𝑛𝑎𝑙 𝐼𝑛𝑐𝑜𝑚𝑒 − 𝐼𝑛𝑑𝑖𝑟𝑒𝑐𝑡 𝑏𝑢𝑠𝑖𝑛𝑒𝑠𝑠 𝑡𝑎𝑥𝑒𝑠

%∆𝐼 𝑄𝑜 ∆𝐼

∆𝑄 pricing power − 𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝑖𝑛𝑐𝑜𝑚𝑒 𝑡𝑎𝑥𝑒𝑠

( ) 𝑖𝑠 𝑡ℎ𝑒 𝑠𝑙𝑜𝑝𝑒 𝑐𝑜𝑒𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑡 − 𝑈𝑛𝑑𝑖𝑠𝑡𝑟𝑖𝑏𝑢𝑡𝑒𝑑 𝑐𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝑝𝑟𝑜𝑓𝑖𝑡

∆𝐼

Normal good if positive + 𝑇𝑟𝑎𝑛𝑠𝑓𝑒𝑟 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠

Profit Maximization Point (All Firms)

Inferior good if negative Marginal Revenue = Marginal Cost

𝑃𝑒𝑟𝑠𝑜𝑛𝑎𝑙 𝑑𝑖𝑠𝑝𝑜𝑠𝑎𝑏𝑙𝑒 𝑖𝑛𝑐𝑜𝑚𝑒 = 𝑝𝑒𝑟𝑠𝑜𝑛𝑎𝑙 𝑖𝑛𝑐𝑜𝑚𝑒 −

𝑝𝑒𝑟𝑠𝑜𝑛𝑎𝑙 𝑡𝑎𝑥𝑒𝑠

Gross Domestic Product (GDP)

Cross Elasticity of Demand GDP (Expenditure Approach) = Consumption +

%∆𝑄 𝑃𝑐 ∆𝑄 Aggregate Demand

= ( )×( ) Investment + Government Spending + Net Exports

%∆𝑃𝑐 𝑄𝑜 ∆𝑃𝑐 Shifts due to changes in household wealth,

∆𝑄

( ) 𝑖𝑠 𝑡ℎ𝑒 𝑠𝑙𝑜𝑝𝑒 𝑐𝑜𝑒𝑓𝑓𝑖𝑐𝑖𝑒𝑛𝑡 GDP (Income Approach) = Household Income + consumer and business expectations, capacity

∆𝑃𝑐

𝑃𝑐 = 𝑃𝑟𝑖𝑐𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑟𝑒𝑙𝑎𝑡𝑒𝑑 𝑔𝑜𝑜𝑑 Business Income + Government Income utilization, monetary policy, fiscal policy, exchange

Substitute good if positive rates and foreign GDP

Complementary good if negative GDP (Value-Added Approach): Sum Incremental

Value-Added at each Stage of Production Aggregate Supply

Breakeven and Shutdown Points Short-Run Shifts: changes in changes in potential

Breakeven Point: Total Revenue = Total Cost Nominal and Real GDP GDP, nominal wages, input prices, future price

Shutdown Point (Short-Run): Total Revenue < Total 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝐺𝐷𝑃 = 𝑃𝑡 × 𝑄𝑡 expectations, business taxes and subsidies and

Variable Cost 𝑅𝑒𝑎𝑙 𝐺𝐷𝑃 = 𝑃𝑏 × 𝑄𝑡 exchange rate

b = base year price

Shutdown Point (Long-Run): Total Revenue < Total

Cost Long-Run Shifts: changes in labor supply, supply of

GDP Deflator physical and human capital and productivity and

𝐺𝐷𝑃 𝐷𝑒𝑓𝑙𝑎𝑡𝑜𝑟 technology

Value of current year output at current year prices

=

Value of current year output at base year prices

× 100

Growth Accounting Equation

𝐺𝑟𝑜𝑤𝑡ℎ 𝑖𝑛 𝑃𝑜𝑡𝑒𝑛𝑡𝑖𝑎𝑙 𝐺𝐷𝑃

= 𝐺𝑟𝑜𝑤𝑡ℎ 𝑖𝑛 𝑡𝑒𝑐ℎ𝑛𝑜𝑙𝑜𝑔𝑦

I.D87618567.

+ 𝑤𝐿 (𝐺𝑟𝑜𝑤𝑡ℎ 𝑖𝑛 𝑙𝑎𝑏𝑜𝑟)

+ 𝑤𝑐 (𝐺𝑟𝑜𝑤𝑡ℎ 𝑖𝑛 𝑐𝑎𝑝𝑖𝑡𝑎𝑙)

ECON (1/7) ECON (2/7) ECON (3/7)

Business Cycle Phases Fiscal Policy Balance of Payments

Trough (Lowest Point); Expansion; Peak (Highest Fiscal Policy: government decisions about taxation Current Account: measures flow of goods and

Point); Contraction and spending; expansionary when government services (Merchandise Trade, Services, Income

budget balance decreasing; contractionary when Receipts, Unilateral Transfers)

government budget balance increasing Capital Account: measures transfers of capital

Economic Indicators 1

𝐹𝑖𝑠𝑐𝑎𝑙 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟 =

(Capital Transfers, Sales and Purchases of Non-

Leading: Turn ahead of peaks and troughs of 1 − MPC(1 − t) Produced, Non-Financial Assets)

business cycle (S&P500, manufacturing new orders,

Financial Account: records investment flows

building permits)

Equation of Exchange (Financial Assets Abroad, Foreign-Owned Financial

Coincidental: Turns coincide with phase of business

MxV=PxY Assets)

cycle (Employee Payrolls, Manufacturing Sales,

Personal Income)

Lagging: Turns after the business cycle movements Gross Domestic Product vs Gross National Real Exchange Rate

(Average Prime Rate, Inventory-Sales Ratio, 𝑑

Product 𝑅𝑒𝑎𝑙 𝑒𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑟𝑎𝑡𝑒 ( )

𝑓

Duration of Unemployment)

GDP: Final value of goods and services produced d 𝐶𝑃𝐼 𝑓𝑜𝑟𝑒𝑖𝑔𝑛

within a country/economy = Spot rate ( ) ×

f 𝐶𝑃𝐼 𝑑𝑜𝑚𝑒𝑠𝑡𝑖𝑐

Types of Unemployment GNP: Final value of goods and services produced by

Frictional: Unemployment from time lag to find new citizens of a country/economy

Change in Nominal Exchange Rate

job 𝑑

Cyclical: Unemployment due to business cycle ∆𝑒𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑟𝑎𝑡𝑒 ( )

Regional Trading Agreements (RTA) 𝑓

fluctuations d

Free trade areas (FTA): Trade barriers removed Spot rate ( f ) at the end of the period

Structural: Unemployment due to lack of skills for = −1

among members; Countries still have own policies d

job openings or distance factors Spot rate ( f ) at the beginning of the period

against non-members

Customs Union: FTA with common policy against

Consumer Price Index (CPI) non-members Change in Real Exchange Rate

Cost of basket at current prices Common Market: Customs union with free 𝑑

𝐶𝑃𝐼 = × 100 ∆𝑅𝑒𝑎𝑙 𝑒𝑥𝑐ℎ𝑎𝑛𝑔𝑒 𝑟𝑎𝑡𝑒 ( )

Cost of basket at base period prices movement of factors of production among 𝑓

members ΔP

ΔS𝑑 1 + P𝑓

Monetary Policy Economic Union: All aspects of common market = (1 +

𝑓 𝑓

)× −1

with common economic institutions and economic S𝑑 ΔP𝑑

Monetary Policy: central bank activities that 𝑓

1+

P

policy ( 𝑑 )

influence the supply of money and credit;

Monetary Union: If members of economic union Forward Discount/Premium

expansionary when policy rate < neutral interest

adopt a common currency 𝐹𝑜𝑟𝑤𝑎𝑟𝑑 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 𝑜𝑟 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡

rate; contractionary when policy rate > neutral 𝑑

interest rate 𝐹𝑜𝑟𝑤𝑎𝑟𝑑 𝑟𝑎𝑡𝑒 (𝑓 )

= −1

Central Bank Objectives: Full Employment and Price 𝑑

𝑆𝑝𝑜𝑡 𝑟𝑎𝑡𝑒 (𝑓 )

Stability

1

𝑀𝑜𝑛𝑒𝑦 𝑀𝑢𝑙𝑡𝑖𝑝𝑙𝑖𝑒𝑟 =

Reserve Requirement

I.D87618567.

ECON (4/7) ECON (5/7) ECON (6/7)

No-Arbitrage Forward Exchange Rate Financial Statement Analysis Framework 𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝐶𝑜𝑛𝑣𝑒𝑟𝑡𝑖𝑏𝑙𝑒 𝐷𝑒𝑏𝑡 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 (1 − 𝑡)

𝑑 1) Articulate the purpose and context of the

𝐹𝑜𝑟𝑤𝑎𝑟𝑑 𝑅𝑎𝑡𝑒 ( ) −𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

𝑓 analysis. =

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝑑 2) Collect input data.

= 𝑆𝑝𝑜𝑡 𝑟𝑎𝑡𝑒 ( ) +𝐴𝑑𝑑𝑖𝑡𝑖𝑜𝑛𝑎𝑙 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑤𝑜𝑢𝑙𝑑

𝑓 3) Process data. ℎ𝑎𝑣𝑒 𝑏𝑒𝑒𝑛 𝑖𝑠𝑠𝑢𝑒𝑑 𝑎𝑡 𝐶𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛

𝐴𝑐𝑡𝑢𝑎𝑙 *if-converted method with convertible debt

(1 + 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒 𝑑𝑜𝑚𝑒𝑠𝑡𝑖𝑐 × 360 ) 4) Analyze/interpret the processed data

×

𝐴𝑐𝑡𝑢𝑎𝑙 5) Develop and communicate conclusions and

(1 + 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒 𝑓𝑜𝑟𝑒𝑖𝑔𝑛 × 360 ) 𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

recommendations (𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠)

6) Follow-Up =

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

Exchange Rate Regimes +

𝑁𝑒𝑤 𝑠ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑤𝑜𝑢𝑙𝑑 𝑏𝑒 𝑖𝑠𝑠𝑢𝑒𝑑 𝑓𝑟𝑜𝑚 𝑂𝑝𝑡𝑖𝑜𝑛 𝐸𝑥𝑒𝑟𝑐𝑖𝑠𝑒 −

Monetary Union: Members adopt common Revenue Recognition Principles (

𝑆ℎ𝑎𝑟𝑒𝑠 𝑡ℎ𝑎𝑡 𝑐𝑜𝑢𝑙𝑑 𝑏𝑒 𝑝𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑑 𝑤𝑖𝑡ℎ 𝑐𝑎𝑠ℎ 𝑝𝑟𝑜𝑐𝑒𝑒𝑑𝑠 𝑓𝑟𝑜𝑚 𝑒𝑥𝑒𝑟𝑐𝑖𝑠𝑒

)

currency [ × (𝑃𝑟𝑜𝑝𝑜𝑟𝑡𝑖𝑜𝑛 𝑜𝑓 𝑌𝑒𝑎𝑟 𝐹𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝐼𝑛𝑠𝑡𝑟𝑢𝑚𝑒𝑛𝑡𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔) ]

Requirements: 1) Risk and reward of ownership is

Dollarization: Members adopt foreign currency *treasury stock method

transferred 2) Collectability is probable

Fixed Parity: ±1 percent around the parity level

Target Zone: up to ±2 percent around the parity Five-Step Revenue Recognition Model Comprehensive Income

level 1. Identify the contract(s) with a customer Comprehensive Income = Net Income + Other

Crawling Peg: Pegged exchange rate periodically 2. Identify the separate or distinct performance Comprehensive Income

adjusted

obligations in the contract

Managed Float: Central Bank acts to influence 3. Allocate the transaction price to the performance

exchange rate without a specific target Financial Asset Measurement

obligations in the contract

Independent Float: Exchange rate freely Held-for-trading: measured at fair value on B/S,

4. Recognize revenue when (or as) the entity

determinedly by the market Dividends/Interest and Unrealized/Realized PnL on

satisfies a performance obligation

I/S

Available-for-sale: measured at fair value on B/S;

Basic Earnings Per Share

Financial Reporting and 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

realized PnL I/S; unrealized PnL OCI

Held-to-maturity: Amortized cost on B/S;

Basic EPS =

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒

Analysis 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

Coupons/Dividends through I/S; realized Pnl I/S

Accounting Equation (Balance Sheet)

Assets = Liabilities + Owners’ Equity

Expense Recognition Principles IFRS vs US GAAP

Assets = Liabilities + Contributed Capital + Ending IFRS

Matching principle – match expenses with the

Retained Earnings Interest Received: Operating or Investing

revenues they help generate

Assets = Liabilities + Contributed Capital + Beginning Interest Paid: Operating or Financing

Retained Earnings + Revenues – Expenses - Dividends Received: Operating or Investing

Dividends Diluted Earnings Per Share Dividends Paid: Operating or Financing

𝐷𝑖𝑙𝑢𝑡𝑒𝑑 𝐸𝑃𝑆

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒

Income Statement Equation = US GAAP

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝐴𝑣𝑒𝑟𝑎𝑔𝑒

Revenues + Other Income – Expenses = Net Income 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 Interest Received: Operating

+ 𝑁𝑒𝑤 𝐶𝑜𝑚𝑚𝑜𝑛 𝑆ℎ𝑎𝑟𝑒𝑠 𝐼𝑠𝑠𝑢𝑒𝑑 𝑎𝑡 𝐶𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 Interest Paid: Operating

I.D87618567.

*if-converted method Dividends Received: Operating

Dividends Paid: Financing

ECON (7/7) FRA (1/10) FRA (2/10) FRA (3/10)

Direct Method vs Indirect Method Liquidity Ratios Profitability Ratios

Direct Method: disclose cash inflows by source and 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑠𝑠𝑒𝑡𝑠 𝐺𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑟𝑎𝑡𝑖𝑜 = 𝐺𝑟𝑜𝑠𝑠 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 =

cash outflows by use 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑅𝑒𝑣𝑒𝑛𝑢𝑒

Indirect Method: reconcile change in cash from net 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒

𝑄𝑢𝑖𝑐𝑘 𝑟𝑎𝑡𝑖𝑜

income with non-cash items and net changes in 𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠 + 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝑁𝑒𝑡 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 =

𝑅𝑒𝑣𝑒𝑛𝑢𝑒

working capital =

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑝𝑟𝑜𝑓𝑖𝑡 𝑚𝑎𝑟𝑔𝑖𝑛 =

𝑅𝑒𝑣𝑒𝑛𝑢𝑒

Free Cash Flow to the Firm (FCFF) 𝐶𝑎𝑠ℎ 𝑟𝑎𝑡𝑖𝑜

𝐹𝐶𝐹𝐹 𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒

= ROA =

= NI + NCC + Int(1 – Tax rate)– FCInv – WCInv 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠

𝐹𝐶𝐹𝐹 = CFO + Int(1 – Tax rate)– FCInv

Defensive interval ratio 𝑁𝑒𝑡 𝑖𝑛𝑐𝑜𝑚𝑒

𝐶𝑎𝑠ℎ + 𝑆ℎ𝑜𝑟𝑡 𝑡𝑒𝑟𝑚 𝑀𝑎𝑟𝑘𝑒𝑡𝑎𝑏𝑙𝑒 𝑠𝑒𝑐𝑢𝑟𝑖𝑡𝑖𝑒𝑠 + 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 ROE =

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑡𝑜𝑡𝑎𝑙 𝑒𝑞𝑢𝑖𝑡𝑦

Free Cash Flow to Equity (FCFE) =

Daily cash expenditures

𝐹𝐶𝐹𝐸 = 𝐶𝐹𝑂 – 𝐹𝐶𝐼𝑛𝑣 + 𝑁𝑒𝑡 𝑏𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔

𝐹𝐶𝐹𝐸 = 𝑁𝐼 + 𝑁𝐶𝐶 – 𝐶𝑎𝑝𝐸𝑥 – 𝛥𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐶𝑎𝑠ℎ 𝑐𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 𝑐𝑦𝑐𝑙𝑒 Du Pont Analysis

+ 𝑁𝑒𝑡 𝐵𝑜𝑟𝑟𝑜𝑤𝑖𝑛𝑔 = Days of Inventory on hand ROE = ROA × Leverage

+ Day Sales Outstanding – Number of days of payables

Traditional Dupont

Activity Ratios ROE = Net profit margin × Total asset turnover

Receivables Turnover =

Revenue Solvency Ratios × Leverage

Average receivables 𝑇𝑜𝑡𝑎𝑙 𝑑𝑒𝑏𝑡

𝐷𝑒𝑏𝑡 𝑡𝑜 𝐴𝑠𝑠𝑒𝑡𝑠 =

𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑆𝑎𝑙𝑒𝑠 𝐴𝑠𝑠𝑒𝑡𝑠

Number of days in period ROE = × ×

Days of sales outstanding = 𝑆𝑎𝑙𝑒𝑠 𝐴𝑠𝑠𝑒𝑡𝑠 𝐸𝑞𝑢𝑖𝑡𝑦

Receivables turnover

𝑇𝑜𝑡𝑎𝑙 𝑑𝑒𝑏𝑡

𝐷𝑒𝑏𝑡 𝑡𝑜 𝑒𝑞𝑢𝑖𝑡𝑦 = Extended Dupont

Cost of sales or cost of goods sold 𝑇𝑜𝑡𝑎𝑙 𝑒𝑞𝑢𝑖𝑡𝑦

Inventory turnover = ROE = Tax burden × Interest burden × EBIT margin

Average inventory

× Total asset turnover × Leverage

Number of days in period 𝑇𝑜𝑡𝑎𝑙 𝑎𝑠𝑠𝑒𝑡𝑠

𝐹𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝑙𝑒𝑣𝑒𝑟𝑎𝑔𝑒 = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐸𝐵𝑇 𝐸𝐵𝐼𝑇

Days of inventory on hand = 𝑇𝑜𝑡𝑎𝑙 𝑒𝑞𝑢𝑖𝑡𝑦 ROE = × ×

Inventory turnover 𝐸𝐵𝑇 𝐸𝐵𝐼𝑇 𝑅𝑒𝑣𝑒𝑛𝑢𝑒

𝑅𝑒𝑣𝑒𝑛𝑢𝑒 𝐴𝑠𝑠𝑒𝑡𝑠

Purchases × ×

Coverage Ratios 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐸𝑞𝑢𝑖𝑡𝑦

Payables turnover =

Average trade payables 𝐸𝐵𝐼𝑇

Interest coverage =

Number of days in period

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 Dividend Related Ratios

Number of days of payables = Dividends payout ratio

Payables turnover

Common share dividends

Fixed charge coverage =

Revenue 𝐸𝐵𝐼𝑇 + 𝐿𝑒𝑎𝑠𝑒 𝑝𝑎𝑦𝑚𝑒𝑛𝑡𝑠 Net income attributable to common shares

Fixed asset turnover = =

Average net fixed assets Interest payments + Lease payments Retention rate

Net income attributable to common shares

Revenue

Total asset turnover = = – Common share dividends

Average total assets I.D87618567.

Net income attributable to common shares

Sustainable growth rate (g) = 𝑏 × ROE

FRA (4/10) FRA (5/10) FRA (6/10)

Weighted Average Cost per Unit Inventory Measure Effective Tax Rate

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡 IFRS: Lower of Cost and Net Realisable Value (NRV) 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑎𝑥 𝐸𝑥𝑝𝑒𝑛𝑠𝑒

𝐶𝑜𝑠𝑡 𝑜𝑓 𝑔𝑜𝑜𝑑𝑠 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑠𝑎𝑙𝑒 𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑇𝑎𝑥 𝑅𝑎𝑡𝑒 =

𝑃𝑟𝑒𝑡𝑎𝑥 𝐼𝑛𝑐𝑜𝑚𝑒

=

𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑢𝑛𝑖𝑡𝑠 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑠𝑎𝑙𝑒

US GAAP: Lower of Cost, Market Value or Net

Deferred Tax Asset (DTA)

𝐶𝑂𝐺𝑆 𝑢𝑠𝑖𝑛𝑔 𝑤𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑠𝑡 Realisable Value (NRV)

Arise when excess amount paid for income taxes

= 𝑈𝑛𝑖𝑡𝑠 𝑠𝑜𝑙𝑑 × 𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑 𝑎𝑣𝑒𝑟𝑎𝑔𝑒 𝑐𝑜𝑠𝑡 𝑝𝑒𝑟 𝑢𝑛𝑖𝑡

(taxable income > pre-tax income)

𝑁𝑅𝑉 = 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑠𝑎𝑙𝑒𝑠 𝑝𝑟𝑖𝑐𝑒

𝐷𝑇𝐴 = (𝑇𝑎𝑥 𝐵𝑎𝑠𝑒 − 𝐶𝑎𝑟𝑟𝑦𝑖𝑛𝑔 𝐴𝑚𝑜𝑢𝑛𝑡) × 𝑇𝑎𝑥 𝑅𝑎𝑡𝑒

Cost of Goods Sold (FIFO/LIFO) − 𝐸𝑠𝑡𝑖𝑚𝑎𝑡𝑒𝑑 𝑠𝑒𝑙𝑙𝑖𝑛𝑔 𝑐𝑜𝑠𝑡𝑠

𝐶𝑂𝐺𝑆 = 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 + 𝑃𝑢𝑟𝑐ℎ𝑎𝑠𝑒𝑠 − 𝐶𝑜𝑚𝑝𝑙𝑒𝑡𝑖𝑜𝑛 𝑐𝑜𝑠𝑡𝑠

− 𝐸𝑛𝑑𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 Depreciation Methods Deferred Tax Liabilities (DTL)

LIFO to FIFO Conversion Straight-Line Appear when a deficit amount exists for income tax

𝐹𝐼𝐹𝑂 𝐶𝑂𝐺𝑆 = 𝐿𝐼𝐹𝑂 𝐶𝑂𝐺𝑆 − (𝐸𝑛𝑑𝑖𝑛𝑔 𝐿𝐼𝐹𝑂 𝑟𝑒𝑠𝑒𝑟𝑣𝑒 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 payment (taxable income < pre-tax income)

− 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝐿𝐼𝐹𝑂 𝑟𝑒𝑠𝑒𝑟𝑣𝑒) 𝑂𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑐𝑜𝑠𝑡 − 𝑆𝑎𝑙𝑣𝑎𝑔𝑒 𝑣𝑎𝑙𝑢𝑒 𝐷𝑇𝐿 = (𝐶𝑎𝑟𝑟𝑦𝑖𝑛𝑔 𝐴𝑚𝑜𝑢𝑛𝑡 − 𝑇𝑎𝑥 𝐵𝑎𝑠𝑒) × 𝑇𝑎𝑥 𝑅𝑎𝑡𝑒

=

𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒

𝐹𝐼𝐹𝑂 𝐸𝑛𝑑𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 Double Declining Balance

= 𝐿𝐼𝐹𝑂 𝐸𝑛𝑑𝑖𝑛𝑔 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 Permanent Differences

+ 𝐿𝐼𝐹𝑂 𝑟𝑒𝑠𝑒𝑟𝑣𝑒 2 Permanent Differences

=

𝑈𝑠𝑒𝑓𝑢𝑙 𝐿𝑖𝑓𝑒 Income or expense items not allowed by tax

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒(𝐹𝐼𝐹𝑂) = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒(𝐿𝐼𝐹𝑂) × 𝑁𝑒𝑡 𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑎𝑡 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑜𝑓 𝑌𝑒𝑎𝑟 𝑋 legislation

+ (𝐸𝑛𝑑𝑖𝑛𝑔 𝐿𝐼𝐹𝑂 𝑟𝑒𝑠𝑒𝑟𝑣𝑒 Units of Production Method Tax credits for some expenditures that directly

− 𝐵𝑒𝑔𝑖𝑛𝑖𝑛𝑔 𝐿𝐼𝐹𝑂 𝑟𝑒𝑠𝑒𝑟𝑣𝑒) × (1 𝐴𝑚𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 reduce taxes

− 𝑡𝑎𝑥 𝑟𝑎𝑡𝑒) 𝑂𝑟𝑖𝑔𝑖𝑛𝑎𝑙 𝑐𝑜𝑠𝑡 − 𝑆𝑎𝑙𝑣𝑎𝑔𝑒 𝑣𝑎𝑙𝑢𝑒

=

𝑇𝑜𝑡𝑎𝑙 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑢𝑡𝑝𝑢𝑡 𝑢𝑛𝑖𝑡𝑠

LIFO liquidation occurs when older LIFO inventory is × 𝑂𝑢𝑡𝑝𝑢𝑡 𝑢𝑛𝑖𝑡𝑠 𝑝𝑟𝑜𝑑𝑢𝑐𝑒𝑑 𝑖𝑛 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 Temporary Differences

sold (Ending LIFO reserve < Beginning LIFO reserve) Asset; Carrying Amount > Tax Base; DTL

Revaluation of Long-Lived Assets Asset; Carrying Amount < Tax Base; DTA

US GAAP: Revaluation Prohibited Liability; Carrying Amount > Tax Base; DTA

LIFO vs FIFO Liability; Carrying Amount < Tax Base; DTL

IFRS: Revaluation recognized in net income to the

LIFO is only allowed under US GAAP

point it reverses previous impairment losses;

Under a period of rising prices and stable or Interest Expense

additional gains go into revaluation surplus

increasing inventory: 𝑇𝑜𝑡𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 𝑜𝑓 𝑎 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑏𝑜𝑢𝑛𝑑

LIFO leads to: = 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑎𝑦𝑚𝑒𝑛𝑡

Higher COGS Capitalizing vs. Expensing + 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡

Lower Gross Profit Capitalizing: smooths net income impact; higher

Lower Ending Inventory ROE and ROA initially; lower ROE and ROA later on; 𝑇𝑜𝑡𝑎𝑙 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 𝑜𝑓 𝑎 𝑝𝑟𝑒𝑚𝑖𝑢𝑚 𝑏𝑜𝑢𝑛𝑑

Expensing: short-term net income decline; lower = 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑎𝑦𝑚𝑒𝑛𝑡

Higher CFO from tax savings

− 𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝑝𝑟𝑒𝑚𝑖𝑢𝑚

ROE and ROA initially; higher ROE and ROA later on;

FIFO leads to:

Lower COGS Income Tax Expense

Higher Gross Profit 𝐼𝑛𝑐𝑜𝑚𝑒 𝑇𝑎𝑥 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 I.D87618567.

Higher Ending Inventory = 𝑇𝑎𝑥𝑒𝑠 𝑝𝑎𝑦𝑎𝑏𝑙𝑒 + ∆𝐷𝑇𝐿 − ∆𝐷𝑇𝐴

Lower CFO higher relative taxes

FRA (7/10) FRA (8/10) FRA (9/10)

Corporate Issuers Sustainable Growth Rate

Effective Interest Method 𝑔 = (1 −

𝐷

) × 𝑅𝑂𝐸

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 Net Present Value (NPV) 𝐸𝑃𝑆

= 𝐶𝑎𝑟𝑟𝑦𝑖𝑛𝑔 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑏𝑜𝑛𝑑 𝑎𝑡 𝑡ℎ𝑒 𝑏𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑜𝑓 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑 𝑁𝑃𝑉 = 𝑃𝑉 𝑜𝑓 𝑐𝑎𝑠ℎ𝑓𝑙𝑜𝑤𝑠 − 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑜𝑢𝑡𝑙𝑎𝑦

𝑁

× 𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑟𝑎𝑡𝑒

CFt Bond Yield plus Risk Premium Approach

=∑

(1 + r)t 𝑟𝑒 = 𝑟𝑑 + 𝑅𝑖𝑠𝑘 𝑝𝑟𝑒𝑚𝑖𝑢𝑚

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑃𝑎𝑦𝑚𝑒𝑛𝑡 = 𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑏𝑜𝑛𝑑

𝑡=0

× 𝐶𝑜𝑢𝑝𝑜𝑛 𝑅𝑎𝑡𝑒

𝐶𝐹𝑡 = 𝑡ℎ𝑒 𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑎𝑓𝑡𝑒𝑟 𝑡𝑎𝑥 𝑐𝑎𝑠ℎ 𝑓𝑙𝑜𝑤 𝑎𝑡 𝑡𝑖𝑚𝑒 𝑡

Project Beta (Pure-Play Method)

𝐴𝑚𝑜𝑟𝑡𝑖𝑧𝑎𝑡𝑖𝑜𝑛 𝑜𝑓 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡(𝑃𝑟𝑒𝑚𝑖𝑢𝑚) 𝑁 = 𝑡ℎ𝑒 𝑝𝑟𝑜𝑗𝑒𝑐𝑡’𝑠 𝑒𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑙𝑖𝑓𝑒 Delever beta from comparables

= 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑒𝑥𝑝𝑒𝑛𝑠𝑒 1

𝑟 = 𝑡ℎ𝑒 𝑟𝑒𝑞𝑢𝑖𝑟𝑒𝑑 𝑟𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 𝑓𝑜𝑟 𝑝𝑟𝑜𝑗𝑒𝑐𝑡 𝑜𝑟 β𝐴𝑠𝑠𝑒𝑡 = β𝐸𝑞𝑢𝑖𝑡𝑦 [

− 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑝𝑎𝑦𝑚𝑒𝑛𝑡 D ]

Leasing vs Purchasing 𝑜𝑝𝑝𝑜𝑟𝑡𝑢𝑛𝑖𝑡𝑦 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 [1 + ((1 − t) × E )]

*Refer to Cash Flow Worksheet under TVM section Then lever the beta for the project

Tax incentives (if lessee is in a low tax bracket and

D

lessor in a high tax bracket) β𝑃𝑟𝑜𝑗𝑒𝑐𝑡 = β𝐴𝑠𝑠𝑒𝑡 [1 + ((1 − t) × )]

E

Usually less costly for lessee Internal Rate of Return (IRR)

𝑁

Lessor better able to bear risk associated with

CFt

ownership ∑ =0 Country Risk Premium

(1 + IRR)t

Economies of scale for lessor 𝑡=0

CRP

= Sovereign yield spread

IRR is the discount rate that sets NPV to zero

Capital Lease vs Operating Lease × [

(Annualized standard deviation of equity index)

*Refer to Cash Flow Worksheet under TVM section Annualized standard deviaition of the sovereign bond

]

Operating Lease; Lessee reports lease payments; No ( )

B/S recognition; All risks and ownership remain with market in terms of the developed market currency

lessor Weighted Average Cost of Capital (WACC)

𝐸(𝑅𝑖 ) = 𝑅𝐹 + 𝛽𝑖 [𝐸(𝑅𝑀 ) − 𝑅𝐹 + 𝐶𝑅𝑃]

𝑊𝐴𝐶𝐶 = 𝑤𝑑 𝑟𝑑 (1 – 𝑡) + 𝑤𝑝 𝑟𝑝 + 𝑤𝑒 𝑟𝑒

Capital Lease; Lessee reports asset and loan on B/S;

All risks and benefits of property are transferred to Cost of Equity using CAPM Yield-to-Maturity Approach

𝑛

lessee 𝐸(𝑅𝑖 ) = 𝑅𝐹 + 𝛽𝑖 [𝐸(𝑅𝑀 ) − 𝑅𝐹 ] 𝑃𝑀𝑇𝑡 𝐹𝑉

𝑃0 = [∑ 𝑟𝑑 𝑡 ] + 𝑟𝑑 𝑛

(1 + ) (1 +

𝑡=1 2 2)

Pension Plans Cost of Debt Capital where,

Defined Contribution Plan: Amount of contribution 𝑃0 = the current market price

After tax cost of debt = r𝑑 (1 – t)

is expensed. 𝑃𝑀𝑇𝑡 = the interest payment in period t

Cost of Preferred Stock 𝑟𝑑 = the yield to maturity

Defined Benefit Plan: Contributions also expensed. D𝑝 N = the number of periods remaining to maturity

Underfunded/Overfunded status appears on B/S as 𝑟𝑝 =

P𝑝 FV = the maturity value of the bond

an A or L.

Cost of Equity using DDM Approach

𝐷1 Cost of Equity with Floatation Costs

𝑟𝑒 = +𝑔

𝑃0 1 𝐷

𝑟𝑒 = (𝑃 −𝐹 )+𝑔

0

I.D87618567.

FRA (10/10) CI (1/4) CI (2/4)

Floatation Cost Treatment Operating & Cash Conversion Cycle Price Weighted Index

NPV 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑐𝑦𝑐𝑙𝑒 ∑𝑁

𝑡=1 𝑛𝑖 𝑃𝑖

= 𝑃𝑉 𝑜𝑓 𝐶𝑎𝑠ℎ 𝑖𝑛𝑓𝑙𝑜𝑤𝑠 − 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝑂𝑢𝑡𝑙𝑎𝑦 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑉𝑎𝑙𝑢𝑒𝑃𝑅𝐼 =

𝐷𝑖𝑣𝑖𝑠𝑜𝑟

− 𝐹𝑙𝑜𝑡𝑎𝑡𝑖𝑜𝑛 𝐶𝑜𝑠𝑡 𝑖𝑛 % + 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝑃𝑖

𝑤 𝑃𝑖 = 𝑁

× 𝐴𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝐸𝑞𝑢𝑖𝑡𝑦 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝑅𝑎𝑖𝑠𝑒𝑑 ∑𝑡=1 𝑃𝑖

𝐶𝑎𝑠ℎ 𝑐𝑜𝑛𝑣𝑒𝑟𝑠𝑖𝑜𝑛 𝑐𝑦𝑐𝑙𝑒

= 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑖𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦

Break Point for the Amount of Capital + 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑟𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 Market-Value Weighted Index

𝐵𝑟𝑒𝑎𝑘 𝑝𝑜𝑖𝑛𝑡 − 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑑𝑎𝑦𝑠 𝑜𝑓 𝑝𝑎𝑦𝑎𝑏𝑙𝑒𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑡𝑜𝑡𝑎𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒

𝐴𝑚𝑜𝑢𝑛𝑡 𝑜𝑓 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑎𝑡 𝑤ℎ𝑖𝑐ℎ 𝑡ℎ𝑒 𝑉𝑎𝑙𝑢𝑒𝑀𝑉𝑊 =

𝐵𝑎𝑠𝑒 𝑦𝑒𝑎𝑟 𝑡𝑜𝑡𝑎𝑙 𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒

𝑠𝑜𝑢𝑟𝑐𝑒 ′ 𝑠 𝑐𝑜𝑠𝑡 𝑜𝑓 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑐ℎ𝑎𝑛𝑔𝑒𝑠 × 𝐵𝑎𝑠𝑒 𝑦𝑒𝑎𝑟 𝑖𝑛𝑑𝑒𝑥 𝑣𝑎𝑙𝑢𝑒

= Accounts Payable Management

𝑃𝑟𝑜𝑝𝑜𝑟𝑡𝑖𝑜𝑛 𝑜𝑓 𝑛𝑒𝑤 𝑐𝑎𝑝𝑖𝑡𝑎𝑙 𝑟𝑎𝑖𝑠𝑒𝑑 𝑓𝑟𝑜𝑚 𝑡ℎ𝑒 𝑠𝑜𝑢𝑟𝑐𝑒 𝑄𝑖 𝑃𝑖

%𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡

365

𝑑𝑎𝑦𝑠 𝑝𝑎𝑠𝑡 𝑑𝑖𝑠𝑐𝑜𝑢𝑛𝑡

𝑤𝑖𝑀 = 𝑁

Cost of trade credit = (1 + 1−%𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 ) −1 ∑𝑗=1 𝑄𝑗 𝑃𝑗

Degree of Operating Leverage

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒

𝐷𝑂𝐿 = Short-Term Borrowing Costs Equal Weighted Index

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑈𝑛𝑖𝑡𝑠 𝑆𝑜𝑙𝑑

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 + 𝐶𝑜𝑚𝑚𝑖𝑡𝑚𝑒𝑛𝑡 𝑓𝑒𝑒 𝑉𝑎𝑙𝑢𝑒𝐸𝑊 = 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑖𝑛𝑑𝑒𝑥 𝑣𝑎𝑙𝑢𝑒

𝐿𝑖𝑛𝑒 𝑜𝑓 𝐶𝑟𝑒𝑑𝑖𝑡 𝐶𝑜𝑠𝑡 =

𝐿𝑜𝑎𝑛 𝑎𝑚𝑜𝑢𝑛𝑡 × (1 + % 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒)

𝑄(𝑃 − 𝑉) 1

𝐷𝑂𝐿 = 𝐸

𝑤𝑖 =

𝑄(𝑃 − 𝑉) − 𝐹 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑁

𝐵𝑎𝑛𝑘𝑒𝑟 ′ 𝑠 𝐴𝑐𝑐𝑒𝑝𝑡𝑎𝑛𝑐𝑒 𝐶𝑜𝑠𝑡 =

𝐿𝑜𝑎𝑛 𝑎𝑚𝑜𝑢𝑛𝑡 − 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 Price and Total Return of an Index

Degree of Financial Leverage 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒1 − 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

Additional Fees 𝑃𝑟𝑖𝑐𝑒 𝑅𝑒𝑡𝑢𝑟𝑛𝑖𝑛𝑑𝑒𝑥 =

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

𝐷𝐹𝐿 = 𝐶𝑜𝑠𝑡

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 + 𝐷𝑒𝑎𝑙𝑒𝑟 ′ 𝑠𝑐𝑜𝑚𝑚𝑖𝑠𝑠𝑖𝑜𝑛 + 𝐵𝑎𝑐𝑘𝑢𝑝 𝑐𝑜𝑠𝑡𝑠

= 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑡𝑢𝑟𝑛𝑖𝑛𝑑𝑒𝑥

𝐿𝑜𝑎𝑛 𝑎𝑚𝑜𝑢𝑛𝑡 − 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡

𝑄(𝑃 − 𝑉) − 𝐹 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒1 − 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0 + 𝐼𝑛𝑐𝑜𝑚𝑒

𝐷𝐹𝐿 = =

𝑄(𝑃 − 𝑉) − 𝐹 − 𝐶 𝐼𝑛𝑑𝑒𝑥 𝑉𝑎𝑙𝑢𝑒0

Equity Forms of Market Efficiency

Degree of Total Leverage

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝑐ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 Margin Call Price Weak Form; security prices fully reflect all past

𝐷𝑇𝐿 = 1 − 𝑖𝑛𝑖𝑡𝑖𝑎𝑙 𝑚𝑎𝑟𝑔𝑖𝑛 market data; past trading data is already reflected

𝑃𝑒𝑟𝑐𝑒𝑛𝑡𝑎𝑔𝑒 𝐶ℎ𝑎𝑛𝑔𝑒 𝑖𝑛 𝑈𝑛𝑖𝑡𝑠 𝑆𝑜𝑙𝑑 𝑀𝑎𝑟𝑔𝑖𝑛 𝑐𝑎𝑙𝑙 𝑝𝑟𝑖𝑐𝑒 = 𝑃0 × ( )

𝑄(𝑃 − 𝑉) 1 − 𝑚𝑎𝑖𝑛𝑡𝑒𝑛𝑎𝑛𝑐𝑒 𝑚𝑎𝑟𝑔𝑖𝑛 in prices; technical analysis won’t lead to superior

𝐷𝑇𝐿 = Leverage

𝑄(𝑃 − 𝑉) − 𝐹 − 𝐶 risk-adjusted performance

𝐶 = 𝐹𝑖𝑥𝑒𝑑 𝑓𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝑐𝑜𝑠𝑡 1 Semi-Strong Form; prices reflect all publicly known

𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑒𝑞𝑢𝑖𝑡𝑦 % =

𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑎𝑡𝑖𝑜 and available information; new information is

𝐷𝑇𝐿 = 𝐷𝑂𝐿 𝑥 𝐷𝐹𝐿

𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑝𝑜𝑠𝑖𝑡𝑖𝑜𝑛

rapidly reflected in prices; fundamental and

Breakeven Quantity of Sales 𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒 𝑟𝑎𝑡𝑖𝑜 = technical analysis can’t achieve excess returns

𝐹+𝐶 𝑉𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑒𝑞𝑢𝑖𝑡𝑦 𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡

𝑄 𝐵𝐸 = Strong Form; security prices fully reflect both public

𝑃−𝑉

𝐶 = 𝐹𝑖𝑥𝑒𝑑 𝑓𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝑐𝑜𝑠𝑡 and private information; technical analysis,

Rate of Return on Margin Transaction fundamental analysis and private information can’t

𝑅𝑒𝑚𝑎𝑖𝑛𝑖𝑛𝑔 𝐸𝑞𝑢𝑖𝑡𝑦 − 𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑂𝑢𝑡𝑙𝑎𝑦

I.D87618567. be used to achieve excess returns

Operating Breakeven Point 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑟𝑒𝑡𝑢𝑟𝑛 =

𝐼𝑛𝑖𝑡𝑖𝑎𝑙 𝑂𝑢𝑡𝑙𝑎𝑦

𝐹

𝑄𝑂𝐵𝐸 =

𝑃−𝑉

CI (3/4) CI (4/4) EQ (1/4) EQ (2/4)

Industry Life-Cycle Value of Preferred Stock Portfolio Management

Embryonic: Slow Growth; High Prices; Significant 𝐷0

𝑉0 = Return Measures

Investment; High Risk 𝑟𝑛

Growth: Rapidly Increasing Demand; Improving Holding Period Return

𝐷𝑡 𝑃𝑎𝑟 𝑉𝑎𝑙𝑢𝑒

𝑉𝑜 = ∑ + 𝑃1 − 𝑃0 + 𝐷1

Profitability; Falling Prices; Low Competition (1 + 𝑟)𝑡 (1 + 𝑟)𝑛 HPR =

𝑃0

Shakeout: Slowing Growth; Intense Competition; 𝑡=1

Declining Profitability

Arithmetic Return

Mature; Little or no growth; Industry Consolidation; Price Multiples 𝑅1 + 𝑅2 + 𝑅3 + 𝑅4 + ⋯ 𝑅𝑛

High Barriers to Entry; 𝐷1 𝐴𝑟𝑖𝑡ℎ𝑚𝑒𝑡𝑖𝑐 𝑟𝑒𝑡𝑢𝑟𝑛 =

𝐸1 𝑝𝑎𝑦𝑜𝑢𝑡 𝑟𝑎𝑡𝑖𝑜 𝑛

Decline; Negative Growth; Excess Capacity; High 𝐽𝑢𝑠𝑡𝑖𝑓𝑖𝑒𝑑 𝑃/𝐸 = =

Competition 𝑟−𝑔 𝑟−𝑔

Geometric Mean Return

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 𝐺𝑒𝑜𝑚𝑒𝑡𝑟𝑖𝑐 𝑚𝑒𝑎𝑛 𝑟𝑒𝑡𝑢𝑟𝑛

𝑃/𝐸 = = [(1 + R1 ) × (1 + R 2 ) × …

Porter’s Five Forces and Competitive 𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 1

Strategies × (1 + R 𝑛 )]n − 1

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

Threat of Entry 𝑃/𝐶𝐹 =

𝐶𝑎𝑠ℎ 𝑓𝑙𝑜𝑤 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 Money Weighted Rate of Return

Power of Suppliers 𝑁

Power of Buyers 𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 CFt

Threat of Substitutes 𝑃/𝑆 = ∑ =0

𝑆𝑎𝑙𝑒𝑠 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 (1 + MWRR)t

Rivalry among existing Competitors 𝑡=0

*Use IRR function on calculator to solve this

𝑃𝑟𝑖𝑐𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒

Two Competitive Strategies: Product 𝑃/𝐵 =

𝐵𝑜𝑜𝑘 𝑣𝑎𝑙𝑢𝑒 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒 Time Weighted Rate of Return

Differentiation and Cost Leadership 1

𝑟𝑇𝑊 = [(1 + r1 ) × (1 + r2 ) × … × (1 + r𝑁 )]N − 1

Value of Common Stock Enterprise Value Multiples

𝐸𝑉 𝐸𝑛𝑡𝑒𝑟𝑝𝑟𝑖𝑠𝑒 𝑣𝑎𝑙𝑢𝑒 Nominal Return

Dividend Discount Model =

𝑛 𝐸𝐵𝐼𝑇𝐷𝐴 𝐸𝐵𝐼𝑇𝐷𝐴 𝑁𝑜𝑚𝑖𝑛𝑎𝑙 𝑟𝑒𝑡𝑢𝑟𝑛 (𝑟) = (1 + rrF ) × (1 + π) − 1

𝐷0 × (1 + 𝑔𝑠 )𝑡 𝑉𝑛

𝑉𝑜 = ∑ +

(1 + 𝑟)𝑡 (1 + 𝑟)𝑛 Asset Based Model Variance (Asset Returns)

𝑡=1

𝐸𝑞𝑢𝑖𝑡𝑦 𝑣𝑎𝑙𝑢𝑒 𝑇

∑𝑡=1(𝑅𝑡 − 𝜇)2

= 𝑀𝑎𝑟𝑘𝑒𝑡 𝑜𝑟 𝑓𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ′ 𝑠 𝑎𝑠𝑠𝑒𝑡𝑠 𝜎2 =

Gordon Growth Model − 𝑀𝑎𝑟𝑘𝑒𝑡 𝑜𝑟 𝑓𝑎𝑖𝑟 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑡ℎ𝑒 𝑐𝑜𝑚𝑝𝑎𝑛𝑦 ′ 𝑠 𝑙𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠 𝑇

𝐷0 × (1 + 𝑔)

𝑉0 = 𝑇

𝑟−𝑔 ∑𝑡=1 (𝑅𝑡 − 𝑅̅)2

𝑆𝑢𝑠𝑡𝑎𝑖𝑛𝑎𝑏𝑙𝑒 𝑔𝑟𝑜𝑤𝑡ℎ = (1 − 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑝𝑎𝑦𝑜𝑢𝑡 𝑟𝑎𝑡𝑖𝑜) 𝑠2 =

𝑇−1

× 𝑅𝑂𝐸

𝑔 = 𝑏 × 𝑅𝑂𝐸

Standard Deviation

Square root of variance

I.D87618567.

EQ (3/4) EQ (4/4) PM (1/3)

Covariance (Asset Returns) Security Market Line Types of Bonds

𝒏

∑𝒕=𝟏 [(𝑅𝑖 − 𝐸(𝑅𝑖̇ )(𝑅𝑗 − 𝐸(𝑅𝑗̇ )] Expected Return and Beta Plot with CAPM used to Callable Bonds: Issuer can force investors to sell

𝑐𝑜𝑣(𝑅𝑖 , 𝑅𝑗 ) = form the SML. Stocks above the line are their bonds. Increases yield and lowers duration.

𝑛−1

undervalued. Stocks below the line are overvalued. Putable Bonds: Investor can sell bond back to

Correlation (Asset Returns) issuer. Lowers yield and duration.

Convertible Bonds: Bondholders can convert bonds

𝑐𝑜𝑣(𝑅𝑖 , 𝑅𝑗 ) Sharpe Ratio

𝜌(𝑅𝑖 , 𝑅𝑗 ) = 𝑅𝑝 − 𝑅𝑓 to common shares

𝜎(𝑅𝑖 )𝜎(𝑅𝑗 ) 𝑆ℎ𝑎𝑟𝑝𝑒 𝑅𝑎𝑡𝑖𝑜 =

𝜎𝑝 Eurobond: international bond denominated in

currency not native to country where it is issued.

Investment Utility Treynor Ratio

𝑅𝑝 − 𝑅𝑓

1 𝑇𝑟𝑒𝑦𝑛𝑜𝑟 𝑚𝑒𝑎𝑠𝑢𝑟𝑒 = 𝐸𝑚𝑏𝑒𝑑𝑑𝑒𝑑 𝑂𝑝𝑡𝑖𝑜𝑛 𝑉𝑎𝑙𝑢𝑒

𝑈𝑡𝑖𝑙𝑖𝑡𝑦 = 𝐸(𝑟) − 𝐴𝜎 2 𝛽𝑝

2 = 𝐵𝑜𝑛𝑑 𝑉𝑎𝑙𝑢𝑒 𝑤𝑖𝑡ℎ 𝑂𝑝𝑡𝑖𝑜𝑛

𝐴 = 𝑚𝑒𝑎𝑠𝑢𝑟𝑒 𝑜𝑓 𝑟𝑖𝑠𝑘 𝑎𝑣𝑒𝑟𝑠𝑖𝑜𝑛 M-Squared − 𝐵𝑜𝑛𝑑 𝑉𝑎𝑙𝑢𝑒 𝑤𝑖𝑡ℎ𝑜𝑢𝑡 𝑂𝑝𝑡𝑖𝑜𝑛

𝜎𝑀

𝑀2 = (𝑅𝑝 − 𝑅𝑓 ) − (𝑅𝑀 − 𝑅𝑓 ) Structured Financial Instruments

𝜎𝑝

Portfolio Return Collateralized Debt Obligations (CDO): securities

𝑅𝑝 = 𝑤1̇ (𝑅1̇ ) + 𝑤2̇ (𝑅2̇ ) + 𝑤3 (𝑅3 ) … 𝑤𝑛 (𝑅𝑛̇ ) Jensen’s Alpha backed by pool of debt obligations

𝛼𝑝 = 𝑅𝑝 − [𝑅𝐹 + 𝛽𝑖 (𝐸(𝑅𝑀 ) − 𝑅𝐹 )] Capital Protected Instruments: Zero coupon bond +

Option Payoff

Portfolio Standard Deviation

Total Risk Yield Enhancement Instruments: Credit Linked Note

𝜎𝑝 = √(𝑤12̇ 𝜎12̇ + 𝑤22̇ 𝜎22̇ + 2𝑤1̇ 𝑤2̇ 𝜌1,2 𝜎1 𝜎2 ) Total Risk = Systematic Risk + Nonsystematic Risk Participation Instruments: Floating Rate Bonds

Leveraged Instruments: Inverse Floater

𝜎𝑝 = √(𝑤12̇ 𝜎12̇ + 𝑤22̇ 𝜎22̇ + 2𝑤1̇ 𝑤2̇ 𝐶𝑜𝑣(𝑅1 , 𝑅2 ))

Investment Policy Statement (IPS)

Introduction Bond Pricing

Capital Allocation Line (CAL) Statement of Purpose Annual Bond

Portfolio Expected Return and Standard Deviation Statement of Duties and Responsibilities 𝑃𝑉

Plot of combinations Risk-Free and Risky Asset 𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛

Procedures = +

𝐸(𝑟𝑃 ) − 𝑟𝑓 (1 + 𝑌𝑇𝑀) (1 + 𝑌𝑇𝑀)2

𝐸(𝑟𝐶 ) = 𝑟𝑓 + 𝜎𝐶 Investment Objectives (Risk and Return Objectives) 𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

𝜎𝑃 Investment Constraints (Liquidity, Time Horizon, + +. . +

(1 + 𝑌𝑇𝑀)3 (1 + 𝑌𝑇𝑀)𝑁

Regulatory Requirements, Tax Status) Semi-Annual Bond

Capital Market Line (CML) Investment Guidelines 𝑃𝑉

Tangency point of efficient frontier on Capital Evaluation and Review 𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛

= +

𝑌𝑇𝑀 2

Allocation Line. The risky portfolio becomes the (1 + 2 ) (1 + 𝑌𝑇𝑀 )

2

market portfolio. Fixed Income +

𝐶𝑜𝑢𝑝𝑜𝑛

+. . +

𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

Basic Features of Fixed-Income Securities 𝑌𝑇𝑀 3 𝑌𝑇𝑀 𝑁×2

(1 + 2 ) (1 + 2 )

Beta Coupon Rate: Interest rate issuer agrees to pay

𝐶𝑜𝑣(𝑅𝑖 , 𝑅𝑚 ) 𝜌𝑖,𝑚 𝜎𝑖 Pricing with Spot Rates

𝛽𝑖 = = Maturity: Time until principal paid 𝑁𝑜 𝑎𝑟𝑏𝑖𝑡𝑟𝑎𝑔𝑒 𝑝𝑟𝑖𝑐𝑒

2

𝜎𝑚 𝜎𝑚 Par Value: Bond’s Principal/Face Value 𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛

= +

Issuer: Sovereign Governments,

I.D87618567.

Corporate Issuers (1 + 𝑆1 ) (1 + 𝑆2 )2

Expected Return (CAPM) Sinking Fund Provision: Periodic payments to retire 𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛 + 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙

+ +. . +

𝐸(𝑅𝑖 ) = 𝑅𝐹 + 𝛽𝑖 [𝐸(𝑅𝑀 ) − 𝑅𝐹 ] bonds early (1 + 𝑆3 )3 (1 + 𝑆𝑛 )𝑁

PM (2/3) PM (3/3) FI (1/7) FI (2/7)

Pricing with Forward Rates Money Market Instruments Asset-Backed Securities

𝐵𝑜𝑛𝑑 𝑣𝑎𝑙𝑢𝑒 𝑀𝑜𝑛𝑒𝑦 𝑚𝑎𝑟𝑘𝑒𝑡 𝑦𝑖𝑒𝑙𝑑 Collateralized Debt Obligations (CDOs): MBS,

𝐶𝑜𝑢𝑝𝑜𝑛 𝐶𝑜𝑢𝑝𝑜𝑛 𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 − 𝑃𝑟𝑖𝑐𝑒

= + =( ) Automotive Loans, Credit Card Loans

1 + 𝑆1 (1 + 𝑆1 ) × (1 + 1𝑦1𝑦) 𝑃𝑟𝑖𝑐𝑒

𝐶𝑜𝑢𝑝𝑜𝑛 360 *Can be tranched by credit risk and prepayment risk

+ ×( ) Prepayment Risk: Contraction and Extension Risk

(1 + 𝑆1 ) × (1 + 1𝑦1𝑦) × (1 + 2𝑦1𝑦) 𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦

𝐵𝑜𝑛𝑑 𝑒𝑞𝑢𝑖𝑣𝑎𝑙𝑒𝑛𝑡 𝑦𝑖𝑒𝑙𝑑 𝑃𝑎𝑠𝑠 𝑡ℎ𝑟𝑜𝑢𝑔ℎ 𝑟𝑎𝑡𝑒

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 − 𝑃𝑟𝑖𝑐𝑒 = 𝑀𝑜𝑟𝑡𝑔𝑎𝑔𝑒 𝑟𝑎𝑡𝑒 𝑜𝑛 𝑡ℎ𝑒 𝑢𝑛𝑑𝑒𝑟𝑙𝑖𝑛𝑔 𝑝𝑜𝑜𝑙 𝑜𝑓 𝑚𝑜𝑟𝑡𝑔𝑎𝑔𝑒𝑠

Forward rate and Spot rate calculation =( ) − 𝑆𝑒𝑟𝑣𝑖𝑐𝑖𝑛𝑔 𝑓𝑒𝑒 − 𝑂𝑡ℎ𝑒𝑟 𝑓𝑒𝑒

(1 + 𝑆2 )2 = (1 + 𝑆1 )1 × (1 + 1𝑦1𝑦) 𝑃𝑟𝑖𝑐𝑒

365

×( ) 𝑆𝑖𝑛𝑔𝑙𝑒 𝑀𝑜𝑛𝑡ℎ 𝑀𝑜𝑟𝑡𝑎𝑙𝑖𝑡𝑦 𝑅𝑎𝑡𝑒 (𝑆𝑀𝑀)

𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦

Flat Price 𝑃𝑟𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑚𝑜𝑛𝑡ℎ

𝐹𝑙𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 = 𝐷𝑖𝑟𝑡𝑦 𝑝𝑟𝑖𝑐𝑒(𝐹𝑢𝑙𝑙 𝑝𝑟𝑖𝑐𝑒) =

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒−𝑃𝑟𝑖𝑐𝑒 𝐵𝑒𝑔𝑖𝑛𝑛𝑖𝑛𝑔 𝑀𝑜𝑛𝑡ℎ𝑙𝑦 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 −

− 𝑎𝑐𝑐𝑟𝑢𝑒𝑑 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐷𝑖𝑠𝑐𝑜𝑢𝑛𝑡 𝑏𝑎𝑠𝑖𝑠 𝑦𝑖𝑒𝑙𝑑 = ( )×

𝐹𝑎𝑐𝑒 𝑣𝑎𝑙𝑢𝑒 𝑆𝑐ℎ𝑒𝑑𝑢𝑙𝑒𝑑 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 𝑅𝑒𝑝𝑎𝑦𝑚𝑒𝑛𝑡

360

Accrued Interest (𝐷𝑎𝑦𝑠 𝑡𝑜 𝑚𝑎𝑡𝑢𝑟𝑖𝑡𝑦)

𝐴𝑐𝑐𝑟𝑢𝑒𝑑 𝑖𝑛𝑡𝑒𝑟𝑒𝑠𝑡

= 𝐶𝑜𝑢𝑝𝑜𝑛 𝑝𝑎𝑦𝑚𝑒𝑛𝑡

Credit Risk Ratios

Debt-Service-Coverage Ratio (DSCR)

×

(𝐷𝑎𝑦𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑡ℎ𝑒 𝑙𝑎𝑠𝑡 𝑐𝑜𝑢𝑝𝑜𝑛 𝑑𝑎𝑡𝑒 𝑎𝑛𝑑 𝑠𝑒𝑡𝑡𝑙𝑒𝑚𝑒𝑛𝑡 𝑑𝑎𝑡𝑒) Yield Spreads 𝑁𝑒𝑡 𝑜𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑖𝑛𝑐𝑜𝑚𝑒

(𝐷𝑎𝑦𝑠 𝑏𝑒𝑡𝑤𝑒𝑒𝑛 𝑡ℎ𝑒 𝑡𝑤𝑜 𝑐𝑜𝑢𝑝𝑜𝑛 𝑑𝑎𝑡𝑒𝑠) G-Spread =

𝐷𝑒𝑏𝑡 𝑠𝑒𝑟𝑣𝑖𝑐𝑒

𝐺 𝑠𝑝𝑟𝑒𝑎𝑑 = 𝑌𝑇𝑀𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐵𝑜𝑛𝑑 − 𝑌𝑇𝑀𝐺𝑜𝑣𝑒𝑟𝑛𝑚𝑒𝑛𝑡 𝐵𝑜𝑛𝑑

Full Price Loan-to-Value ratio (LTV)

𝑃𝑉 𝐹𝑢𝑙𝑙 = 𝑃𝑉(1 + 𝑟)𝑡/𝑇 = 𝑃𝑉 𝐹𝑙𝑎𝑡 + 𝐴𝑐𝑐𝑟𝑢𝑒𝑑 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 I-Spread 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑚𝑜𝑟𝑡𝑔𝑎𝑔𝑒 𝑎𝑚𝑜𝑢𝑛𝑡

=

𝐼 𝑠𝑝𝑟𝑒𝑎𝑑 = 𝑌𝑇𝑀𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐵𝑜𝑛𝑑 − 𝑆𝑤𝑎𝑝 𝑟𝑎𝑡𝑒 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑎𝑝𝑝𝑟𝑎𝑖𝑠𝑒𝑑 𝑣𝑎𝑙𝑢𝑒

Option-Adjusted Price Bond Return

Value of non-callable bond Z-Spread 𝑇𝑜𝑡𝑎𝑙 𝑅𝑒𝑡𝑢𝑟𝑛

= 𝐹𝑙𝑎𝑡 𝑝𝑟𝑖𝑐𝑒 𝑜𝑓 𝑐𝑎𝑙𝑙𝑎𝑏𝑙𝑒 𝑏𝑜𝑛𝑑 𝑃𝑀𝑇 𝑃𝑀𝑇 𝑃𝑀𝑇 + 𝐹𝑉 1

+ 𝑣𝑎𝑙𝑢𝑒 𝑜𝑓 𝑒𝑚𝑏𝑒𝑑𝑑𝑒𝑑 𝑐𝑎𝑙𝑙 𝑜𝑝𝑡𝑖𝑜𝑛 𝑃𝑉 = + + ..+ 𝐶𝑜𝑢𝑝𝑜𝑛 & 𝑅𝑒𝑖𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝑃𝑛 𝑛

(1 + 𝑧1 + 𝑍) (1 + 𝑧2 + 𝑍)2 (1 + 𝑧𝑛 + 𝑍)𝑁 =( ) −1

𝑃0

Yield Measures

Current Yield Duration

Option-Adjusted-Spread

𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑎𝑠ℎ 𝑐𝑜𝑢𝑝𝑜𝑛 𝑝𝑎𝑦𝑚𝑒𝑛𝑡 𝑂𝐴𝑆 = 𝑍 𝑠𝑝𝑟𝑒𝑎𝑑 − 𝑂𝑝𝑡𝑖𝑜𝑛 𝑣𝑎𝑙𝑢𝑒 (bps per year)

Macaulay Duration

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑌𝑖𝑒𝑙𝑑 = 1+𝑟 1 + 𝑟 + [𝑁 × (𝑐 − 𝑟)] 𝑡

𝑏𝑜𝑛𝑑 𝑝𝑟𝑖𝑐𝑒 𝑀𝑎𝑐𝐷𝑢𝑟 = { − }−( )

𝑟 (𝑐 × [(1 + 𝑟)𝑁 − 1] + 𝑟} 𝑇

Effective Annual Yield Securitization Parties

𝐸𝐴𝑌 = (1 + 𝑃𝑒𝑟𝑖𝑜𝑑𝑖𝑐 𝑟𝑎𝑡𝑒)𝑚 − 1 Seller of the Collateral (Pool of Loans) Modified Duration

Loan Servicer 𝑀𝑎𝑐𝐷𝑢𝑟

𝑀𝑜𝑑𝐷𝑢𝑟 =

𝑚 = 𝑁𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝐶𝑜𝑚𝑝𝑜𝑢𝑛𝑑𝑖𝑛𝑔 𝑃𝑒𝑟𝑖𝑜𝑑𝑠 𝑂𝑛𝑒 𝑌𝑒𝑎𝑟 Special Purpose Entity (SPE) 1 + 𝑌𝑇𝑀

𝑉− − 𝑉+

𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝑀𝑜𝑑𝐷𝑢𝑟 =

Conversion for Periodicity (2 × 𝑉0 × ∆𝑌𝑇𝑀)

𝐴𝑃𝑅𝑚 𝑚 𝐴𝑃𝑅𝑛 𝑛

(1 + ) = (1 + ) Effective Duration

𝑚 𝑛

𝑉− − 𝑉+

𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛 =

(2 × 𝑉0 × ∆𝐶𝑢𝑟𝑣𝑒)

I.D87618567.

FI (3/7) FI (4/7) FI (5/7)

Portfolio Duration Yield Buildup Put Option

𝑃𝑜𝑟𝑡𝑓𝑜𝑙𝑖𝑜 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛 = 𝑤1̇ (𝐷1̇ ) + 𝑤2̇ (𝐷2̇ ) 𝑌𝑖𝑒𝑙𝑑𝐶𝑜𝑟𝑝𝑜𝑟𝑎𝑡𝑒 𝐵𝑜𝑛𝑑 = 𝑅𝑒𝑎𝑙 𝑅𝑖𝑠𝑘 − 𝐹𝑟𝑒𝑒 𝑅𝑎𝑡𝑒 Expiration Value (Long)

+ 𝑤3 (𝐷3 ) … 𝑤𝑛 (𝐷𝑛̇ ) + 𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝐼𝑛𝑓𝑙𝑎𝑡𝑖𝑜𝑛 𝑝𝑇 = 𝑀𝑎𝑥(0, 𝑋 − 𝑆𝑇 )

Money Duration + 𝑀𝑎𝑡𝑢𝑟𝑖𝑡𝑦 𝑃𝑟𝑒𝑚𝑖𝑢𝑚

𝑀𝑜𝑛𝑒𝑦 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 = 𝐴𝑛𝑛𝑢𝑎𝑙 𝑀𝑜𝑑𝑖𝑓𝑖𝑒𝑑 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 + 𝐿𝑖𝑞𝑢𝑖𝑑𝑖𝑡𝑦 𝑃𝑟𝑒𝑚𝑖𝑢𝑚 Profit (Long)

× 𝑃𝑉 𝐹𝑢𝑙𝑙 + 𝐶𝑟𝑒𝑑𝑖𝑡 𝑆𝑝𝑟𝑒𝑎𝑑 Π = 𝑝𝑇 − 𝑝0

Credit Ratings

∆𝑃𝑉 𝐹𝑢𝑙𝑙 = −𝑀𝑜𝑛𝑒𝑦 𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 × ∆𝑌𝑖𝑒𝑙𝑑

Investment Grade Expiration Value (Short)

𝐷𝑢𝑟𝑎𝑡𝑖𝑜𝑛 𝑔𝑎𝑝 = 𝑀𝑎𝑐𝑎𝑢𝑙𝑎𝑦 𝑑𝑢𝑟𝑎𝑡𝑖𝑜𝑛 Aaa to Baa3 (Moody’s) −𝑝𝑇 = −𝑀𝑎𝑥(0, 𝑋 − 𝑆𝑇 )

− 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡 ℎ𝑜𝑟𝑖𝑧𝑜𝑛 AAA to BBB- (S&P)

Anything below is high-yield/junk Profit (Short)

Price Value of a Basis Point Π = −𝑝𝑇 + 𝑝0

𝑉− − 𝑉+

𝑃𝑉𝐵𝑃 =

2 Derivatives European Option: Only exercisable at maturity

Convexity Exchange Traded vs OTC Derivatives American Option: Can be exercised at any time;

𝑉− + 𝑉+ − 2 × 𝑉0 Exchange Traded Can’t be priced less than European options

𝐴𝑝𝑝𝑟𝑜𝑥𝑖𝑚𝑎𝑡𝑒 𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝐶𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦 =

(∆𝑌𝑇𝑀)2 × 𝑉0 Public

Standardized Future/Forward Payoff

𝑉− + 𝑉+ − 2 × 𝑉0

𝐸𝑓𝑓𝑒𝑐𝑡𝑖𝑣𝑒 𝐶𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦 = Regulated 𝐿𝑜𝑛𝑔 𝑃𝑎𝑦𝑜𝑓𝑓 = 𝑆𝑇 – 𝐹0 (T)

(∆𝑐𝑢𝑟𝑣𝑒)2 × 𝑉0

No counterparty risk

𝑆ℎ𝑜𝑟𝑡 𝑃𝑎𝑦𝑜𝑓𝑓 = 𝐹0 (T)− 𝑆𝑇

Price Change Estimate OTC Derivatives

∆𝑃𝑟𝑖𝑐𝑒 = −𝑎𝑛𝑛𝑢𝑎𝑙 𝑀𝑜𝑑𝐷𝑢𝑟 × (∆𝑌𝑖𝑒𝑙𝑑) Private

1

+ × 𝑎𝑛𝑛𝑢𝑎𝑙 𝑐𝑜𝑛𝑣𝑒𝑥𝑖𝑡𝑦 Customizable Interest Rate Swaps

2 Can be viewed as series of Forward Rate

× (∆𝑌𝑖𝑒𝑙𝑑)2 Lower regulation

Counterparty Risk Agreements to lend/borrow at a future date.

Expected Loss Helpful for transforming the nature of debt.

𝐸𝑥𝑝𝑒𝑐𝑡𝑒𝑑 𝑙𝑜𝑠𝑠 = 𝐷𝑒𝑓𝑎𝑢𝑙𝑡 𝑝𝑟𝑜𝑏𝑎𝑏𝑖𝑙𝑖𝑡𝑦 × (1

− 𝑟𝑒𝑐𝑜𝑣𝑒𝑟𝑦 𝑟𝑎𝑡𝑒) Option Payoff

Call Option Forward Price

Loss Given Default (LGD) Expiration Value (Long) 𝐹0 (T) = 𝑆0 (1 + 𝑟)𝑇

𝐿𝑜𝑠𝑠 𝐺𝑖𝑣𝑒𝑛 𝐷𝑒𝑓𝑎𝑢𝑙𝑡(𝐿𝐺𝐷) = (1 − 𝑟𝑒𝑐𝑜𝑣𝑒𝑟𝑦 𝑟𝑎𝑡𝑒) 𝑐𝑇 = 𝑀𝑎𝑥(0, 𝑆𝑇 – 𝑋) 𝐹0 (T) = (𝑆0 − γ + θ)(1 + 𝑟)𝑇

𝐹0 (T) = 𝑆0 (1 + 𝑟)𝑇 − (γ − θ)(1 + 𝑟)𝑇

Profit (Long) γ= benefits

Four C’s of Credit θ= costs

Π = 𝑐𝑇 − 𝑐0

Capacity

Collateral

Covenants Expiration Value (Short)

Character −𝑐𝑇 = −𝑀𝑎𝑥(0, 𝑆𝑇 – 𝑋)

I.D87618567.

Profit (Short)

Π = −𝑐𝑇 + 𝑐0

FI (6/7) FI (7/7) DER (1/3) DER (2/3)

Value of Forward Alternative Investments

𝑉𝑡 (T) = 𝑆𝑇 − 𝐹0 (T)(1 + 𝑟)−(𝑇−𝑡) Commodities

Hedge Funds

Precious Metals

𝑉𝑡 (T) = 𝑆𝑇 − (γ − θ)(1 + r)𝑡 Equity Hedge: Market Neutral, Fundamental

Base Metals

− 𝐹0 (T)(1 + 𝑟)−(𝑇−𝑡) Growth, Fundamental Value, Quantitative

Energy Products

Directional, Short Bias, Sector Specific

Agricultural Products

𝑉𝑡 (T) = 𝑆𝑇 + 𝑃𝑉𝑡 (𝑐𝑜𝑠𝑡) − 𝑃𝑉𝑡 (𝑏𝑒𝑛𝑒𝑓𝑖𝑡) Event-Driven: Merger Arbitrage,

𝐹0(𝑇) Distressed/Restructuring, Activist, Special Situations

− Managed Futures: actively managed investment

(1 + 𝑅𝐹 )𝑇−𝑡 Relative Value: FI Convertible Arbitrage, FI Asset

funds

Option Value Factors Backed, FI General, Volatility, Multi-Strategy

Futures price ≈ Spot price (1 + r) + Storage costs –

Option Value = Time Value + Intrinsic Value Macro

Convenience yield

Fee Structure: Typically, 2 and 20; 2% of AUM and

Return Sources: Roll Yield, Collateral Yield, Changes

Increase in: 20% of Profits

in Spot Price

Stock Price: (C ↑); (P ↓)

Exercise Price: (C ↓); (P ↑) Private Equity

Time to Expiration: (C ↑); (P ↑) Leveraged Buyouts (LBOs): substantial use of Infrastructure

leverage to take companies private Long lived and capital intensive. These assets are

Volatility: (C ↑); (P ↑)

LBO Target Characteristics: Strong and Sustainable intended for public use, as they provide essential

Risk-Free-Rate: (C ↑); (P ↓)

Cash Flows; Depressed Prices; Inefficient Companies services.

Put-Call Parity Venture Capital: Characterized by stage of company

𝑋 Fee Calculations

𝑆0 + 𝑝0 = 𝑐0 + of interest 𝑀𝑎𝑛𝑎𝑔𝑒𝑚𝑒𝑛𝑡 𝐹𝑒𝑒 = 𝐴𝑠𝑠𝑒𝑡𝑠 𝑢𝑛𝑑𝑒𝑟 𝑚𝑎𝑛𝑎𝑔𝑒𝑚𝑒𝑛𝑡

(1 + 𝑟)𝑇 1. Formative-stage financing: a) Angel Investing b) × % 𝑀𝑎𝑛𝑎𝑔𝑒𝑚𝑒𝑛𝑡 𝑓𝑒𝑒

*can be rearranged Seed-Stage c) Early-Stage 𝐼𝑛𝑐𝑒𝑛𝑡𝑖𝑣𝑒 𝐹𝑒𝑒 = 𝐺𝑎𝑖𝑛𝑠 𝑛𝑒𝑡 𝑜𝑓 𝑚𝑎𝑛𝑎𝑔𝑒𝑚𝑒𝑛𝑡 𝑓𝑒𝑒

2. Later-stage financing × % 𝐼𝑛𝑐𝑒𝑛𝑡𝑖𝑣𝑒 𝑓𝑒𝑒

Options Strategies 3. Mezzanine-stage financing

Hurdle Rate: Rate above which incentive fees are

Protective Put: Long Underlying, Long Put

Exit Strategies: Trade Sale, IPO, Recapitalization, paid. Hard hurdle rate: fess only apply to returns

Covered Call: Long Underlying, Short Call

Secondary Sales, Write-Off/Liquidation that exceed the hurdle rate. Soft hurdle rate: fees

Fiduciary Call: Long Call, Long Risk-Free Bond

Valuation Methods: market or comparables, apply to the entire return.

discounted cash flow (DCF) and asset-based

Binomial Option Model High Water Mark: Highest cumulative return used

π𝑐 + + (1 − π)𝑐 − to calculate incentive fees

𝑐0 = Real Estate

1+𝑟

Private Debt (Mortgages, Construction Lending)

1+ 𝑟−𝑑 Public Debt (MBS, CMOs)

π= Private Equity (Direct/Indirect Ownership)

𝑢−𝑑

Public Equity (REITs, Real Estate Development

Hedge Ratio Companies)

I.D87618567.

𝑐+ − 𝑐−

𝑛 = + Valuation Approaches: Comparables Sales, Income,

𝑆 − 𝑆−

Cost

DER (3/3) AI (1/2) AI (2/2)

You might also like

- Corporate Finance FormulasDocument3 pagesCorporate Finance FormulasMustafa Yavuzcan83% (12)

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument6 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementEilen Joyce Bisnar100% (1)

- Exam FM: You Have What It Takes To PassDocument5 pagesExam FM: You Have What It Takes To Passenquiry no100% (2)

- L1 2024 Formula SheetDocument17 pagesL1 2024 Formula SheetfofyibaydoNo ratings yet

- T3 FormulasDocument9 pagesT3 FormulasmartinNo ratings yet

- FMSM FORMULA SHEET-Executive-RevisionDocument8 pagesFMSM FORMULA SHEET-Executive-RevisionHenrick Ian AmarlesNo ratings yet

- FMSM Formula SheetDocument8 pagesFMSM Formula Sheetjacob michelNo ratings yet

- ExamFM 2018Document3 pagesExamFM 2018nargizireNo ratings yet

- 2022 Level I Key Facts and Formulas SheetDocument13 pages2022 Level I Key Facts and Formulas Sheetayesha ansari100% (2)

- Mba Finance Placement ReadyDocument18 pagesMba Finance Placement Readyabhishek.abhishek1994No ratings yet

- FMSM Formula SheetDocument10 pagesFMSM Formula SheetRani LohiaNo ratings yet

- Mathematics of Investment FormulasDocument4 pagesMathematics of Investment FormulasaileeNo ratings yet

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocument6 pagesFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNo ratings yet

- Study Unit 2Document20 pagesStudy Unit 2pphelokazi54No ratings yet

- Study Unit 2Document19 pagesStudy Unit 2Irfaan CassimNo ratings yet

- McsformulaDocument1 pageMcsformulaHirat BrarNo ratings yet

- Finance Formula SheetDocument2 pagesFinance Formula SheetBrandon RaoNo ratings yet

- Finance Mba PlacementDocument14 pagesFinance Mba Placementabhishek.abhishek1994No ratings yet

- FORMULA SHEET For Final - FMDocument1 pageFORMULA SHEET For Final - FMNajia SiddiquiNo ratings yet

- Accounting and Finance For Business Key Formulas: Statement of Financial PositionDocument3 pagesAccounting and Finance For Business Key Formulas: Statement of Financial PositionZOn YêuNo ratings yet

- Financial Functions and CalculationsDocument6 pagesFinancial Functions and CalculationsbertinNo ratings yet

- Evaluation Accounting Edited by JasserDocument10 pagesEvaluation Accounting Edited by Jasserljasser10lNo ratings yet

- Time Value of Money Cheat Sheet: by ViaDocument3 pagesTime Value of Money Cheat Sheet: by ViaTechbotix AppsNo ratings yet

- Quants MMDocument65 pagesQuants MMTu DuongNo ratings yet

- FM Formula Sheet - Not GivenDocument4 pagesFM Formula Sheet - Not GivenSophie ChopraNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- FMFormulasDocument5 pagesFMFormulasMadlearner 3No ratings yet

- Lab PKSB Session 1 - BlankDocument34 pagesLab PKSB Session 1 - Blankalanablues1No ratings yet

- Project Management Professional PMP FormulasDocument4 pagesProject Management Professional PMP FormulassachingandhiNo ratings yet

- Bonds and Their Valuation FormulasDocument1 pageBonds and Their Valuation FormulasGabrielle VaporNo ratings yet

- Interest Rates That Vary With Time: I A I CWDocument3 pagesInterest Rates That Vary With Time: I A I CWTepe HolmNo ratings yet

- TN1 Basic Pre-Calculus: AcronymsDocument11 pagesTN1 Basic Pre-Calculus: AcronymsMohamed HussienNo ratings yet

- IE255 Formulas BookletDocument14 pagesIE255 Formulas BookletMuhammad AdilNo ratings yet

- CH 2Document6 pagesCH 2Hemant GoyalNo ratings yet

- AFM Formula SheetDocument15 pagesAFM Formula Sheetganesh bhaiNo ratings yet

- Finance - Time Value of MoneyDocument2 pagesFinance - Time Value of MoneyMaria Inês AzevedoNo ratings yet

- Basic Finance FormulasDocument1 pageBasic Finance Formulasmafe moraNo ratings yet

- C1M1 QRG PDFDocument1 pageC1M1 QRG PDFRamen ACCANo ratings yet

- Corporate Finance Professional Certificate MOOCDocument1 pageCorporate Finance Professional Certificate MOOCEmmanuel PonceNo ratings yet

- C1M1 QRG PDFDocument1 pageC1M1 QRG PDFRamen ACCANo ratings yet

- Corporate Finance Professional Certificate MOOCDocument1 pageCorporate Finance Professional Certificate MOOCkolya viktorNo ratings yet

- Summary Notes Columbia Uni PDFDocument1 pageSummary Notes Columbia Uni PDFNIKHIL SODHINo ratings yet

- CF Notes (Session 1-8)Document52 pagesCF Notes (Session 1-8)Harsh SharmaNo ratings yet

- Formula Sheet For AFB by - Ambitious - BabaDocument11 pagesFormula Sheet For AFB by - Ambitious - BabaKiran PatelNo ratings yet

- Engineering Economy Module 3Document16 pagesEngineering Economy Module 3pickyypotatoNo ratings yet

- Time Value of MoneyDocument7 pagesTime Value of Moneysincere sincereNo ratings yet

- Quantitative Analysis: © EdupristineDocument17 pagesQuantitative Analysis: © EdupristineANASNo ratings yet

- P&RLIP Chapter BDocument30 pagesP&RLIP Chapter BSamyak ZaveriNo ratings yet

- MM L1 Formula SheetDocument20 pagesMM L1 Formula SheetMlungisi MalazaNo ratings yet

- Quantization NoiseDocument18 pagesQuantization NoiseHernán Damián Duy RomeroNo ratings yet

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- When To Add An IndexDocument1 pageWhen To Add An IndexxxNo ratings yet

- ACID PropertiesDocument1 pageACID PropertiesxxNo ratings yet

- Movies Off Platform Project PDFDocument4 pagesMovies Off Platform Project PDFxxNo ratings yet

- Numpy - ArraysDocument2 pagesNumpy - ArraysxxNo ratings yet

- Chapter4 (The Evaluating Multiple Models Chapter Is Really Good!)Document47 pagesChapter4 (The Evaluating Multiple Models Chapter Is Really Good!)xxNo ratings yet

- Case Study - General InfoDocument1 pageCase Study - General InfoxxNo ratings yet