Professional Documents

Culture Documents

FORMULA SHEET For Final - FM

Uploaded by

Najia Siddiqui0 ratings0% found this document useful (0 votes)

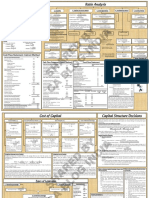

48 views1 pageThis document contains a formula sheet for key financial management concepts:

- It lists formulas for net present value (NPV), profitability index (PI), weighted average cost of capital (WACC), return on assets (ROA), return on equity (ROE), debt ratios, dividend metrics, earnings per share (EPS), price-earnings ratio (P/E), discounted cash flow valuations, bond valuations, equity valuations, and the Gordon growth model.

- There are over 20 financial formulas listed for calculating and analyzing metrics like leverage, profitability, valuation, and cash flows.

Original Description:

Finacial Management

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains a formula sheet for key financial management concepts:

- It lists formulas for net present value (NPV), profitability index (PI), weighted average cost of capital (WACC), return on assets (ROA), return on equity (ROE), debt ratios, dividend metrics, earnings per share (EPS), price-earnings ratio (P/E), discounted cash flow valuations, bond valuations, equity valuations, and the Gordon growth model.

- There are over 20 financial formulas listed for calculating and analyzing metrics like leverage, profitability, valuation, and cash flows.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views1 pageFORMULA SHEET For Final - FM

Uploaded by

Najia SiddiquiThis document contains a formula sheet for key financial management concepts:

- It lists formulas for net present value (NPV), profitability index (PI), weighted average cost of capital (WACC), return on assets (ROA), return on equity (ROE), debt ratios, dividend metrics, earnings per share (EPS), price-earnings ratio (P/E), discounted cash flow valuations, bond valuations, equity valuations, and the Gordon growth model.

- There are over 20 financial formulas listed for calculating and analyzing metrics like leverage, profitability, valuation, and cash flows.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Final Examination, Spring 2022

Financial Management Formula Sheet

NPV = PVinflows – PVoutflows Capital Asset Pricing Model

PI = PVinflows / PVoutflows 𝐤 𝐢 = 𝐤 𝐑𝐅 + (𝐤 𝐌 − 𝐤 𝐑𝐅 )(𝛃𝐢 )

WACC = 𝐖𝐝 𝐤 𝐝𝐚𝐭 + 𝐖𝐩𝐬 𝐤 𝐩𝐬 + 𝐖𝐒 𝐤 𝐬 Yield till Maturity

𝐏𝐚𝐫−𝐕

Return on Assets (ROA) 𝑰 + ( 𝐧 𝐁)

𝐍𝐞𝐭 𝐏𝐫𝐨𝐟𝐢𝐭 YTM = [__________________]

𝐗 𝟏𝟎𝟎 𝐏𝐚𝐫+𝐕𝐁

𝐓𝐨𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬

Return on Equity (ROE) 𝟐

𝐍𝐞𝐭 𝐏𝐫𝐨𝐟𝐢𝐭 Coefficient of Variation

𝐗 𝟏𝟎𝟎 𝛅

𝐒𝐡𝐚𝐫𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 ′ 𝐄𝐪𝐮𝐢𝐭𝐲 𝐂𝐕 =

Debt Ratio

𝐓𝐨𝐭𝐚𝐥 𝐃𝐞𝐛𝐭𝐬 Beta

𝐓𝐨𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬 𝛅𝐢

𝛃𝐢 = 𝐫

Debt to Equity Ratio 𝛅𝐌 𝐢𝐌

𝐓𝐨𝐭𝐚𝐥 𝐃𝐞𝐛𝐭𝐬 𝛃𝐩 = 𝐰𝟏 𝛃𝟏 + 𝐰𝟐 𝛃𝟐 +. . . + 𝐰𝐧 𝛃𝐧

𝐓𝐨𝐭𝐚𝐥 𝐒𝐡𝐚𝐫𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐄𝐪𝐮𝐢𝐭𝐲 𝐧

Equity Ratio

𝐓𝐨𝐭𝐚𝐥 𝐒𝐡𝐚𝐫𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬 𝐄𝐪𝐮𝐢𝐭𝐲 ∑ 𝐰𝐢 𝛃𝐢

𝐢=𝟏

𝐓𝐨𝐭𝐚𝐥 𝐀𝐬𝐬𝐞𝐭𝐬

Dividend Per Share Value of Bond

= Dividend / No. of outstanding shares 𝟏 − (𝟏 + 𝐤 𝐝 )−𝐧

𝐈[ ] + 𝐏(𝟏 + 𝐤 𝐝 )−𝐧

Payout ratio = Dividend / Net Profit 𝐤𝐝

Value of Perpetual Bond

Earnings Per Share (EPS) 𝐈𝐧𝐭𝐞𝐫𝐞𝐬𝐭

= Net Profit / No. of outstanding shares 𝐕𝐁 =

𝐤𝐝

Price Earnings Ratio (P/E) Current Yield:

= Market Value per share / EPS 𝐀𝐧𝐧𝐮𝐚𝐥 𝐘𝐢𝐞𝐥𝐝

𝐂𝐘 = 𝐗 𝟏𝟎𝟎

𝐕𝐁

Operating Cash Flows Capital Gain Yield:

∆CFAT = (∆S - ∆C - ∆D) (1-T) + ∆D 𝐂𝐆𝐘 = 𝐘𝐓𝐌 − 𝐂𝐘

Rate of Return 𝐏𝟏 − 𝐏𝟎

𝐀𝐦𝐨𝐮𝐧𝐭 𝐑𝐞𝐜𝐞𝐢𝐯𝐞𝐝 − 𝐀𝐦𝐨𝐮𝐧𝐭 𝐈𝐧𝐯𝐞𝐬𝐭𝐞𝐝 𝐂𝐆𝐘 = 𝐗 𝟏𝟎𝟎

= 𝐏𝟎

𝐀𝐦𝐨𝐮𝐧𝐠 𝐈𝐧𝐯𝐞𝐬𝐭𝐞𝐝 Value of Common Stock

𝐃 (𝟏 + 𝐠) 𝐃𝟏

Expected Rate of Return 𝐕𝐬 = 𝐏̂𝟎 = 𝟎 =

𝐤𝐬 − 𝐠 𝐤𝐬 − 𝐠

= 𝐏𝟏 𝐤 𝟏 + 𝐏𝟐 𝐤 𝟐 +. . . + 𝐏𝐧 𝐤 𝐧 𝐃

𝐧 𝐕𝐬 = 𝐏̂𝟎 =

𝐤𝐬

∑ 𝐏𝐢 𝐤 𝐢

Value or Cost of Preferred Stock:

𝐢=𝟏

𝐃𝐩𝐬

𝐕𝐩𝐬 =

p = 𝐰𝟏 𝟏 + 𝐰𝟐 𝟐 +. . . + 𝐰𝐧 𝐧

𝐤 𝐩𝐬

𝐧

𝐃𝐩𝐬

∑ 𝐰𝐢 𝐢 𝐤 𝐩𝐬 =

𝐢=𝟏 𝐏𝟎 − 𝐅

Gordon Growth Model Dividend Yield:

𝐃𝟏 𝐃𝟏

𝐤𝐬 = +𝐠 𝐃𝐘 = 𝐗 𝟏𝟎𝟎

𝐏𝟎 𝐏𝟎

Cost of debt before tax = Krf + Spread

𝐃𝟏 Cost of debt after tax = Kd (1 – tax)

𝐤𝐬 = +𝐠

𝐏𝟎 − 𝐅 Initial Outlay = DCF + IDCF

Page 1 of 1

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Financial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementDocument6 pagesFinancial Management Formula Sheet: Chapter 1: Nature, Significance and Scope of Financial ManagementEilen Joyce Bisnar100% (1)

- Project Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaDocument48 pagesProject Report On Comparative Analysis of Public and Private Sector Steel Companies in IndiaHillary RobinsonNo ratings yet

- RSM430 Final Cheat SheetDocument1 pageRSM430 Final Cheat SheethappyNo ratings yet

- Accounting and Finance For Business Key Formulas: Statement of Financial PositionDocument3 pagesAccounting and Finance For Business Key Formulas: Statement of Financial PositionZOn YêuNo ratings yet

- FMSM Formula SheetDocument8 pagesFMSM Formula Sheetjacob michelNo ratings yet

- FMSM FORMULA SHEET-Executive-RevisionDocument8 pagesFMSM FORMULA SHEET-Executive-RevisionHenrick Ian AmarlesNo ratings yet

- RatiosDocument4 pagesRatiosIbrahim AymanNo ratings yet

- FMSM Formula SheetDocument10 pagesFMSM Formula SheetRani LohiaNo ratings yet

- Bonds and Their Valuation FormulasDocument1 pageBonds and Their Valuation FormulasGabrielle VaporNo ratings yet

- VC Formula (C1 - C7)Document3 pagesVC Formula (C1 - C7)Brandon LowNo ratings yet

- CH 3 Capital StructureDocument28 pagesCH 3 Capital StructureSayeed AhmadNo ratings yet

- FS Analysis FormulasDocument2 pagesFS Analysis FormulasMaryrose SumulongNo ratings yet

- FS Analysis FormulasDocument2 pagesFS Analysis FormulasMaryrose SumulongNo ratings yet

- Accounting Ratios NewDocument3 pagesAccounting Ratios NewAnkit RoyNo ratings yet

- FIN2704 NotesDocument4 pagesFIN2704 NotesYan KaiNo ratings yet

- Abfm Formula PDFDocument20 pagesAbfm Formula PDFSandeep KumarNo ratings yet

- CH 8 LeverageDocument51 pagesCH 8 LeverageNikita AggarwalNo ratings yet

- Finance Formula SheetDocument2 pagesFinance Formula SheetBrandon RaoNo ratings yet

- Formula SheetDocument2 pagesFormula SheetAnarghyaNo ratings yet

- Common Financial RatiosDocument1 pageCommon Financial RatiosTuấn Phạm NgọcNo ratings yet

- Common Financial RatiosDocument1 pageCommon Financial RatiosTuấn Phạm NgọcNo ratings yet

- FM1 - 15Document15 pagesFM1 - 15Namitha ShajanNo ratings yet

- Cost of Capital FormulasDocument2 pagesCost of Capital FormulasGabrielle VaporNo ratings yet

- Mba Finance Placement ReadyDocument18 pagesMba Finance Placement Readyabhishek.abhishek1994No ratings yet

- McsformulaDocument1 pageMcsformulaHirat BrarNo ratings yet

- Formula Sheet-2nd QuizDocument6 pagesFormula Sheet-2nd QuizEge MelihNo ratings yet

- Cost of Capital Cost of Debt I. Cost of Irredeemable DebtDocument6 pagesCost of Capital Cost of Debt I. Cost of Irredeemable DebtAbi ShekNo ratings yet

- Gyaan Capsule - Ratio AnalysisDocument15 pagesGyaan Capsule - Ratio Analysissaheb167No ratings yet

- CH 7 Cost of CapitalDocument59 pagesCH 7 Cost of CapitalAsmi SinglaNo ratings yet

- Central Banking and Financial RegulationsDocument9 pagesCentral Banking and Financial RegulationsHasibul IslamNo ratings yet

- cf2 - Term 3 - Mba2023 - Final Exam - SolutionsDocument11 pagescf2 - Term 3 - Mba2023 - Final Exam - SolutionsAmlan GainNo ratings yet

- Formula Sheet For AFB by - Ambitious - BabaDocument11 pagesFormula Sheet For AFB by - Ambitious - BabaKiran PatelNo ratings yet

- Shared by Ca Blog India: Cash Flow Statement: Indirect MethodDocument4 pagesShared by Ca Blog India: Cash Flow Statement: Indirect MethodRaghav BhatNo ratings yet

- Shared by Ca Blog India: Cash Flow Statement: Indirect MethodDocument4 pagesShared by Ca Blog India: Cash Flow Statement: Indirect MethodpoojaNo ratings yet

- Formula Sheet Corporate Finance (COF) : Stockholm Business SchoolDocument6 pagesFormula Sheet Corporate Finance (COF) : Stockholm Business SchoolLinus AhlgrenNo ratings yet

- Total Dollar Return: Investment Portfolio Management WEEK 1: A Brief History of Risk and ReturnDocument43 pagesTotal Dollar Return: Investment Portfolio Management WEEK 1: A Brief History of Risk and ReturnVenessa Yong100% (1)

- Presented By: Shahzada Zaheer Ahmad Muhammad Kamran Zain UmarDocument22 pagesPresented By: Shahzada Zaheer Ahmad Muhammad Kamran Zain UmarUmer ZeeshanNo ratings yet

- Stock Valuation FormulasDocument2 pagesStock Valuation FormulasEliseNo ratings yet

- BusFin FormulasRatioDocument3 pagesBusFin FormulasRatiojpNo ratings yet

- Chapter 11 - Project Analysis and EvaluationDocument11 pagesChapter 11 - Project Analysis and EvaluationNelson FernandoNo ratings yet

- CA M K: Ayank OthariDocument4 pagesCA M K: Ayank Otharigagan vermaNo ratings yet

- ROE and ROA Ratios For Accounting SummaryDocument3 pagesROE and ROA Ratios For Accounting SummarymyzevelNo ratings yet

- Study Unit 2Document20 pagesStudy Unit 2pphelokazi54No ratings yet

- Công thức IM tự luận- cho finalDocument6 pagesCông thức IM tự luận- cho finalTuấn NguyễnNo ratings yet

- Study Unit 2Document19 pagesStudy Unit 2Irfaan CassimNo ratings yet

- Chapter 1 NumericalsDocument10 pagesChapter 1 NumericalsPradeep GautamNo ratings yet

- Lecture 2.7 - SlidesDocument12 pagesLecture 2.7 - Slidessfalcao91No ratings yet

- Formulas: Wace Accounting and FinanceDocument4 pagesFormulas: Wace Accounting and FinanceJikoseNo ratings yet

- Lecture 2.8 - SlidesDocument8 pagesLecture 2.8 - Slidessfalcao91No ratings yet

- To Find The Interest To Find The Principal To Find The Rate To Find The TimeDocument1 pageTo Find The Interest To Find The Principal To Find The Rate To Find The Timebonifacio gianga jrNo ratings yet

- Learning Objectives: FormulaDocument3 pagesLearning Objectives: FormulaFrancisca FusterNo ratings yet

- FormulaDocument4 pagesFormulaZIKIE CHOYNo ratings yet

- 03 FM Main Book Solution File (Not To Print)Document152 pages03 FM Main Book Solution File (Not To Print)prince soniNo ratings yet

- SFM Formulas Sheet For Quick Revision Before ExamDocument28 pagesSFM Formulas Sheet For Quick Revision Before ExamKamakshi AdadadiNo ratings yet

- Modified by Lufi - Exercise For Working CapitalDocument8 pagesModified by Lufi - Exercise For Working CapitalMiranda SantikaNo ratings yet

- Ividend Ecision: LOS 1: IntroductionDocument7 pagesIvidend Ecision: LOS 1: IntroductionSUBHAJEET DASGUPTANo ratings yet

- Valuation ALLDocument107 pagesValuation ALLAman jhaNo ratings yet

- Exam Formulas To Memorize and Not Provided On ExamDocument1 pageExam Formulas To Memorize and Not Provided On ExamYeji KimNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Project Status Report TemplateDocument7 pagesProject Status Report TemplateNajia SiddiquiNo ratings yet

- Financial Markets and Institutions Course Outline - SINDHUDocument4 pagesFinancial Markets and Institutions Course Outline - SINDHUNajia SiddiquiNo ratings yet

- Frequency of Test NHA, AASHTO & ASTM: C/AggDocument1 pageFrequency of Test NHA, AASHTO & ASTM: C/AggNajia SiddiquiNo ratings yet

- Ques Risk and Return & CAPM (S-17Revised)Document6 pagesQues Risk and Return & CAPM (S-17Revised)Najia SiddiquiNo ratings yet

- English Vocabulary For CSSDocument19 pagesEnglish Vocabulary For CSSNajia SiddiquiNo ratings yet

- Job ShadowingDocument2 pagesJob ShadowingNajia SiddiquiNo ratings yet

- FINANCIAL ACCOUNTING Notes (MBA)Document9 pagesFINANCIAL ACCOUNTING Notes (MBA)Najia SiddiquiNo ratings yet

- Applied Research Methods: Dr. Sahar AwanDocument20 pagesApplied Research Methods: Dr. Sahar AwanNajia SiddiquiNo ratings yet

- Human Resource Management: Lesson - 01Document11 pagesHuman Resource Management: Lesson - 01Najia SiddiquiNo ratings yet

- Literature Review: 2.1 E-CommerceDocument2 pagesLiterature Review: 2.1 E-CommerceNajia SiddiquiNo ratings yet

- Mid Term - ARMDocument2 pagesMid Term - ARMNajia SiddiquiNo ratings yet

- Mid Term Assessment (Assignment) Spring 20201: HRM (Sec A) Marks 20 Monday 5 April, 2021 Google ClassroomDocument2 pagesMid Term Assessment (Assignment) Spring 20201: HRM (Sec A) Marks 20 Monday 5 April, 2021 Google ClassroomNajia SiddiquiNo ratings yet

- Literature ReviewDocument2 pagesLiterature ReviewNajia SiddiquiNo ratings yet

- Course Outline (Spring 2021)Document4 pagesCourse Outline (Spring 2021)Najia SiddiquiNo ratings yet

- IMPORTANT Instructions:: Best of LuckDocument3 pagesIMPORTANT Instructions:: Best of LuckNajia SiddiquiNo ratings yet

- Luxembourg Makes It SimpleDocument3 pagesLuxembourg Makes It SimpleBianci Sentini VirinNo ratings yet

- T NG H PDocument31 pagesT NG H PPhúc Hưng Thịnh NguyễnNo ratings yet

- Indian Companies That Take Great Care of Their EmployeesDocument21 pagesIndian Companies That Take Great Care of Their EmployeesGirish LakheraNo ratings yet

- Accounting: Wilma G. OstanDocument11 pagesAccounting: Wilma G. OstanHelpo BadoyNo ratings yet

- TO STUDY CUSTOMER RELATIONSHIP MANAGEMENT IN RETAIL SECTOR (BIG BAZAAR) MarketingDocument66 pagesTO STUDY CUSTOMER RELATIONSHIP MANAGEMENT IN RETAIL SECTOR (BIG BAZAAR) MarketingDeep ChoudharyNo ratings yet

- One97 Communications Limited, B 121, Sector 5, Noida - 201301 GSTIN - 09AAACO4007A1Z3 Pan - Aaaco4007ADocument1 pageOne97 Communications Limited, B 121, Sector 5, Noida - 201301 GSTIN - 09AAACO4007A1Z3 Pan - Aaaco4007Arahul parakhNo ratings yet

- You Decide AssignmentDocument10 pagesYou Decide AssignmentBella DavidovaNo ratings yet

- Companies Vision and MissionDocument3 pagesCompanies Vision and MissionAnonymous cwC8kTyNo ratings yet

- Abacus Securities V AmpilDocument4 pagesAbacus Securities V AmpilThameenah ArahNo ratings yet

- 16 4th Edition PDFDocument412 pages16 4th Edition PDFRudrin DasNo ratings yet

- Promotion Budget and MediaDocument15 pagesPromotion Budget and MediaKyla DuntonNo ratings yet

- Job DesignDocument4 pagesJob DesignM RABOY,JOHN NEIL D.No ratings yet

- Case Digests: Topic AuthorDocument2 pagesCase Digests: Topic Authormichelle zatarainNo ratings yet

- Economic Crisis of PakistanDocument3 pagesEconomic Crisis of PakistanMaan ZaheerNo ratings yet

- Final - Malayao-Et-Al - Assessing The Effectiveness of Inventory Management Practices of Convenience Stores in Tuguegarao CityDocument13 pagesFinal - Malayao-Et-Al - Assessing The Effectiveness of Inventory Management Practices of Convenience Stores in Tuguegarao CityWere dooomedNo ratings yet

- BUSM4622Document7 pagesBUSM4622Huỳnh Ngọc TuyềnNo ratings yet

- RHP of OPL Octo 27 2019 P 278Document278 pagesRHP of OPL Octo 27 2019 P 278Rumana SharifNo ratings yet

- Purchasing Power Parity & The Big Mac IndexDocument9 pagesPurchasing Power Parity & The Big Mac Indexpriyankshah_bkNo ratings yet

- Industry Supply CurveDocument11 pagesIndustry Supply Curvedtracy4No ratings yet

- Your Electricity Account: Account Number Invoice No Issue DateDocument2 pagesYour Electricity Account: Account Number Invoice No Issue DateHamza HanifNo ratings yet

- Retirement AnswersDocument7 pagesRetirement AnswersshubhamsundraniNo ratings yet

- Assignment Question For Marketing ManagementDocument2 pagesAssignment Question For Marketing ManagementDipti Baghel100% (1)

- CH 16Document3 pagesCH 16vivienNo ratings yet

- Organisational Study On Hailey Buria Tea Estates LTDDocument68 pagesOrganisational Study On Hailey Buria Tea Estates LTDanees elyasNo ratings yet

- J-CAPS-03 (MAT+SSC) Class X (12th To 18th June 2020) by AAKASH InstituteDocument4 pagesJ-CAPS-03 (MAT+SSC) Class X (12th To 18th June 2020) by AAKASH InstitutemuscularindianNo ratings yet

- Srilanka 11111Document6 pagesSrilanka 11111aasimshaikh111No ratings yet

- Determinants of Industrial LocationDocument16 pagesDeterminants of Industrial LocationRajeev Rajan0% (1)

- CEMDocument9 pagesCEMChristineNo ratings yet

- Chap 2 FeasibDocument17 pagesChap 2 FeasibChristian Villa100% (1)