Professional Documents

Culture Documents

Banking

Uploaded by

LISHA AVTANICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking

Uploaded by

LISHA AVTANICopyright:

Available Formats

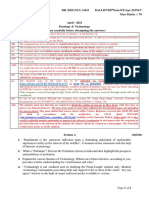

Enrollment No…………………… DR. RMLNLU, LKO BALLB/VIthSem.

/Repeat/June-21/B&I

Time - 05 Hours Max-Marks :- 70

Repeat/Another Chance Exam June - 2021

Banking and Insurance Law

Note: Read the instructions carefully before attempting the answers:

(i) The Question Paper is divided into 2 Sections i.e. Section - A and Section - B.

(ii) The Examinee is required to attempt any 3 (three) Questions from Section - A, and any 2 (two) Questions from Section-

B. Figures in the margin indicate the Marks.

(iii) The assignment has to be submitted in a handwritten form. No other format would be acceptable.

(iv) The examinee has to write the answer in A4 Size or equivalent size sheets, ruled or un-ruled.

(v) The examinee must write his/her name, enrollment number, name of the subject on the first page of the answer.

(vi) The examinee has to mention his/her name and enrollment on every subsequent page.

(vii) The examinee must write down the page no. on every page in the format (No. of page of total pages) example-1 of

12, 2 of 12 etc.

(viii) The examinee must ensure that the scanned copy of the answer script is clear and legible, in PDF format and uploaded

as a single file and size should not be more than 30 MB. In case the office receives multiple files of the answer script,

only first response received shall be considered and other responses shall be ignored.

(ix) The name of the PDF file of the answer script must be (Enrollment No) (underscore) (Paper Name) for Example

150101154_Jurisprudence.

(x) The Scanned copy of the same has to be uploaded on Google form through the link-

https://forms.gle/YnnJdAd3Fc1WMWpN7 till 04:00 PM on 08-06-2021. Examinee must be careful while

uploading the answer script as only first response would be accepted. Examinees must also take care before uploading

the PDF file of answer script that all the pages of the script have been added in the PDF file.

Only responses received through Google Form will be accepted. Answers received through email will not be

considered.

(xi) In case of any technical difficulty the examinee may contact Dr. Aman Deep Singh, Associate Controller of

Examinations on +91-9793085772, +91-8840353326 or 0522-2425902, 3, 4 Extn. 136.

(xii) The students must note that they are required to finish the writing of answers in three hours while they have to

answer one long question less. The time of two hours is more than sufficient for downloading paper and uploading

the answer-sheets. They must submit their answer sheets within 5 hours. Responses received after 04:00 PM shall

be dealt in accordance with the notification no. 332-21 dated 10.03.2021

(http://rmlnlu.ac.in/pdf/Notice_regarding_110321.pdf) available on the University Website. If they fail to do so they

would be afforded another opportunity to appear in the physical examination in such papers after the reopening of

the University but, in the interests of the students, the chance will not be counted as a repeat paper. The University

would ensure justice to all the students.

Section A (03X20)

1. Discuss in detail the provisions of the Banking Regulation Act, 1949 pertaining to the

conditions and the latest norms regarding the New Bank Licensing Policy under which

the R.B.I. may extend license to Banking Company.

2. What are quantitative credit control methods of Reserve Bank of India? Explain.

3. How the Debt Recovery Tribunals have expedited the recovery of bad loans by Banks

and Financial Institutions? Amplify the procedure and mode of recovery of debts of the

Tribunal constituted under the recovery of debt due to Banks and Financial Institutions

Act 1993.

4. Explain how subrogation supports the principle of Indemnity and what rights insurers

have on being subrogated? Support your answer with the help of case law, if any.

5. Explain the doctrine of good faith with reference to the duty of disclosure of material

facts by the insured to the insurer. Cite the classical case of Carter v Boehm.(1766 AII

ER) .

Repeat / Another Chance Examination June 2021 Page 1 of 2

6. Explain Banking Ombudsman Scheme, 2006 with special reference to its jurisdiction,

power and complaint mechanism. Whether an appeal lies against the award of the

Banking Ombudsman?

Section B (02X05)

7. Distinguish between 'insurance contracts' and 'wagering agreements'.

8. Explain the concept of Insurable Interest. How it is determined?

9. Moratorium.

10. Role and functions of NABARD.

*******************

Repeat / Another Chance Examination June 2021 Page 2 of 2

You might also like

- Alternative Dispute Resolution: Dr. Rmlnlu, LkoDocument2 pagesAlternative Dispute Resolution: Dr. Rmlnlu, Lkoआकाश स्व.No ratings yet

- BALLB 6 Sem ET April 2021Document12 pagesBALLB 6 Sem ET April 2021Alok KumarNo ratings yet

- Etiquettes For Advocates?Document2 pagesEtiquettes For Advocates?Aditya MaheshwariNo ratings yet

- Etiquettes For Advocates?Document13 pagesEtiquettes For Advocates?Priyanjali SinghNo ratings yet

- BALLB 6 Sem ET April 2020Document12 pagesBALLB 6 Sem ET April 2020Alok KumarNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowAbhishekNo ratings yet

- Enrollment No. Special Contract Law ExamDocument2 pagesEnrollment No. Special Contract Law ExamVipul GautamNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredSushil JindalNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredVipul GautamNo ratings yet

- Civil Procedure Code Sem-IVDocument2 pagesCivil Procedure Code Sem-IVSimone JainNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowAbhishekNo ratings yet

- Semester 1 ExamDocument2 pagesSemester 1 ExamAnurag RaiNo ratings yet

- B.A. LL.B 5th SemesterET 2021Document12 pagesB.A. LL.B 5th SemesterET 2021Ritesh ThakurNo ratings yet

- RMLNLU End Term Exam Economics-II QuestionsDocument2 pagesRMLNLU End Term Exam Economics-II QuestionsShashwat SinghNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredSushil JindalNo ratings yet

- RMLNLU End Term Exam Questions on Land Law (UP) and Women and LawDocument37 pagesRMLNLU End Term Exam Questions on Land Law (UP) and Women and LawTUSHAR ANANDNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredAakash ChauhanNo ratings yet

- International Criminal Law Ques. PaperDocument38 pagesInternational Criminal Law Ques. PaperTUSHAR ANAND SINGHNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredNimisha PathakNo ratings yet

- Indian Penal Code-IDocument2 pagesIndian Penal Code-ISimone JainNo ratings yet

- Contract 1Document2 pagesContract 1Anushka VermaNo ratings yet

- Ballb 1 Sem Et March 2021Document42 pagesBallb 1 Sem Et March 2021Shreya YadavNo ratings yet

- Law of Banking and FinanceDocument3 pagesLaw of Banking and FinanceTanna SenapatiNo ratings yet

- Civil Society & Public Grievances Sem-VIIIDocument1 pageCivil Society & Public Grievances Sem-VIIIVipul GautamNo ratings yet

- RMLNLU Citizenship and Emigration Law ExamDocument1 pageRMLNLU Citizenship and Emigration Law ExamVipul GautamNo ratings yet

- D - Rmlnlu, L April - 2020 Indian Penal Code-IDocument12 pagesD - Rmlnlu, L April - 2020 Indian Penal Code-IPriyanjali SinghNo ratings yet

- BALLB 8 Sem ET April 2020Document31 pagesBALLB 8 Sem ET April 2020TUSHAR ANAND SINGHNo ratings yet

- How to write law exam answersDocument2 pagesHow to write law exam answersNisen ShresthaNo ratings yet

- Criminal Procedure CodeDocument1 pageCriminal Procedure CodeShaurya Dev SinghNo ratings yet

- Contract Law Exam QuestionsDocument3 pagesContract Law Exam QuestionsNimisha PathakNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be Consideredayush singhNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- B.A. LL.B - 7th - SemesterET - 2021Document12 pagesB.A. LL.B - 7th - SemesterET - 2021Mancee PandeyNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowAbhishekNo ratings yet

- 2022 PDFDocument8 pages2022 PDFRiya NitharwalNo ratings yet

- D - Rmlnlu, L Time - 03 Hours Max-Marks:-70 April - 2020 Indian FederalismDocument1 pageD - Rmlnlu, L Time - 03 Hours Max-Marks:-70 April - 2020 Indian FederalismprachiNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowVipul GautamNo ratings yet

- BALLB 3 Sem ET Nov 2020Document3 pagesBALLB 3 Sem ET Nov 2020AsthaNo ratings yet

- 2023 Ballb End Term Sem 6Document8 pages2023 Ballb End Term Sem 6VISHAKHA SHAKYANo ratings yet

- BALAW6001C04 - Company Law - II, 21-06-21Document2 pagesBALAW6001C04 - Company Law - II, 21-06-21Satyam Kumar AryaNo ratings yet

- N.L.S I.U: Bangalore Ii Year MBL Supplementary Examination (Feb.) 2017 Investment LawsDocument8 pagesN.L.S I.U: Bangalore Ii Year MBL Supplementary Examination (Feb.) 2017 Investment LawsShrikant BudholiaNo ratings yet

- Nirma University: Institute of Law Continuous Evaluation, October 2021Document3 pagesNirma University: Institute of Law Continuous Evaluation, October 2021kapil shrivastavaNo ratings yet

- LW GLO S22-A23 examiner's reportDocument6 pagesLW GLO S22-A23 examiner's reportS RaihanNo ratings yet

- Political Science I Sem IDocument2 pagesPolitical Science I Sem IDeependra sNo ratings yet

- Central University of South Bihar: Department of Law and GovernanceDocument2 pagesCentral University of South Bihar: Department of Law and GovernanceShazaf KhanNo ratings yet

- Only Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDocument2 pagesOnly Responses Received Through Google Form Will Be Accepted. Answers Received Through Email Will Not Be ConsideredDeependra sNo ratings yet

- Understanding the development of psychologyDocument2 pagesUnderstanding the development of psychologyRoop ChaudharyNo ratings yet

- IPR RegistrationDocument1 pageIPR RegistrationYamini SinghNo ratings yet

- Bchde5312 - Regular EveningDocument4 pagesBchde5312 - Regular EveningDhruv ShahNo ratings yet

- BALLB 5 Sem ET Nov 2020Document8 pagesBALLB 5 Sem ET Nov 2020Ritesh ThakurNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, LucknowDocument2 pagesDr. Ram Manohar Lohiya National Law University, LucknowAbhishekNo ratings yet

- Dr. Ram Manohar Lohiya National Law University, Lucknow: B.A. LL.B./II Sem./ET/Aug-21/Psy-IIDocument2 pagesDr. Ram Manohar Lohiya National Law University, Lucknow: B.A. LL.B./II Sem./ET/Aug-21/Psy-IIJahanvi RajNo ratings yet

- Central University of South Bihar: End-Term Open Book Examinations Session: 2019-2020 Semester: 2Document3 pagesCentral University of South Bihar: End-Term Open Book Examinations Session: 2019-2020 Semester: 2Shazaf KhanNo ratings yet

- English I Sem IDocument2 pagesEnglish I Sem IAnurag RaiNo ratings yet

- Indian Pencal Code-II - V - SemesterDocument2 pagesIndian Pencal Code-II - V - SemesterAbhishekNo ratings yet

- ICE Civil Engineering Law and Contract Management Exams 2013Document51 pagesICE Civil Engineering Law and Contract Management Exams 2013Mdms PayoeNo ratings yet

- Budget Optimization and Allocation: An Evolutionary Computing Based ModelFrom EverandBudget Optimization and Allocation: An Evolutionary Computing Based ModelNo ratings yet