0% found this document useful (0 votes)

59 views7 pagesFinancial Feasibility Analysis Report

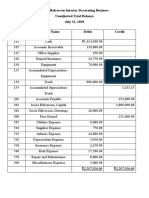

The document summarizes the financial feasibility analysis of a proposed palabok business. It includes projections for sales, costs, expenses, income statements and cash flows for the first three years. Key details are sales are projected to increase 3% annually while costs of goods sold increase 5% per year. The total initial capital requirement is ₱107,823 which will be contributed equally by business partners. If executed as planned, the business is projected to be financially feasible and profitable in each of the first three years.

Uploaded by

Bea Dela PeniaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

59 views7 pagesFinancial Feasibility Analysis Report

The document summarizes the financial feasibility analysis of a proposed palabok business. It includes projections for sales, costs, expenses, income statements and cash flows for the first three years. Key details are sales are projected to increase 3% annually while costs of goods sold increase 5% per year. The total initial capital requirement is ₱107,823 which will be contributed equally by business partners. If executed as planned, the business is projected to be financially feasible and profitable in each of the first three years.

Uploaded by

Bea Dela PeniaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd