Professional Documents

Culture Documents

Journal Entry

Uploaded by

Bea Dela PeniaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Journal Entry

Uploaded by

Bea Dela PeniaCopyright:

Available Formats

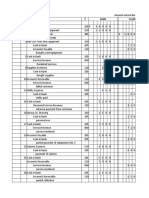

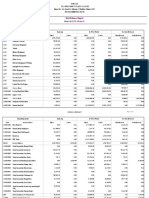

Date Particular REF Debit Credit

July 1 Cash 101 1 8 0 0 0 0 0 00

Jessie Halverson, Capital 301 1 8 0 0 0 0 0 00

Transfer cash from personal bank

account to an account

4 Rent Expense 540 1 7 5 0 0 00

Cash 101 1 7 5 0 0 00

Paid Rent

10 Truck 150 8 0 0 0 0 0 00

Cash 101 4 0 0 0 0 0 00

Accounts Payable 201 4 0 0 0 0 0 00

Purchase a truck for cash and note

payable

13 Equipment 130 7 0 0 0 0 00

Accounts Payable 201 7 0 0 0 0 00

Purchase Equipment on account

14 Office Supplies 115 1 2 0 0 00

Cash 101 1 2 0 0 00

Purchase supplies for cash

15 Prepaid Insurance 120 2 7 0 0 0 00

Cash 101 2 7 0 0 0 00

Paid Annual premium on Insurance

15 Cash 101 1 0 5 0 0 0 00

Fees Earned 400 1 0 5 0 0 0 00

Received Cash for Job completed

21 Accounts Payable 201 2 5 0 0 0 00

Cash 101 2 5 0 0 0 00

Paid creditor a portion amount owed

for equipment

24 Accounts Receivable 105 1 4 6 0 0 0 00

Fees Earned 400 1 4 6 0 0 0 00

Record jobs completed and sent invoices

26 Repair and Maintenance 550 8 0 0 0 00

Accounts Payable 201 8 0 0 0 00

Received an invoice for truck repairs

27 Utilities Expense 505 9 0 0 0 00

Cash 101 9 0 0 0 00

Paid Utilities Expense

27 Miscellaneous Expense 560 3 0 0 0 00

Cash 101 3 0 0 0 00

Paid Miscellaneous Expense

29 Cash 101 3 6 0 0 0 00

Accounts Receivable 105 3 6 0 0 0 00

Received cash from consumer on

account

30 Salaries Expense 515 2 4 0 0 0 00

Cash 101 2 4 0 0 0 00

Paid Salaries

31 Jessie Halverson, Drawings 302 2 0 0 0 0 00

Cash 101 2 0 0 0 0 00

Withdrew cash for personal use

31 Depreciation Expense 520 3 3 3 3 33

Accumulated Depreciation- Truck 155 3 3 3 3 33

Truck has a useful life of 20 years

31 Depreciation Expense 520 5 8 3 33

Accumulated Depreciation - Equipment 135 5 8 3 33

Equipment has a useful life of 10 years

31 Supplies Expense 510 7 5 0 00

Office Supplies 115 7 5 0 00

Supplies used for the month is ₱750

31 Insurance Expense 530 2 2 5 0 00

Prepaid Insurance 120 2 2 5 0 00

Paid annual insurance

You might also like

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel TolentinoNo ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel TolentinoNo ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel Tolentino100% (1)

- Summa Cum Laude Company Adjusted Trial BalanceDocument1 pageSumma Cum Laude Company Adjusted Trial BalanceDJazel TolentinoNo ratings yet

- Description PR Debit Credit Date General Journal Pg.1Document3 pagesDescription PR Debit Credit Date General Journal Pg.1Andrea Nicole SalesNo ratings yet

- 10.29 Acctg Cycle FIRST PRELIM Answer Key BlankDocument31 pages10.29 Acctg Cycle FIRST PRELIM Answer Key BlankRhadzmae OmalNo ratings yet

- 3Document1 page3Samuel HutchkinsNo ratings yet

- 2Document1 page2Samuel HutchkinsNo ratings yet

- Accounting Activities - MerchandisingDocument6 pagesAccounting Activities - MerchandisingJoyNo ratings yet

- Repetitio Activity IIIDocument35 pagesRepetitio Activity IIIJesa TanNo ratings yet

- Edgar DetoyaDocument16 pagesEdgar DetoyaAngelica EltagonNo ratings yet

- Account AccountDocument12 pagesAccount AccountblackghostNo ratings yet

- Comp 2 Activity 5Document13 pagesComp 2 Activity 5Jhon Lester MagarsoNo ratings yet

- Washy Wash Inc. Acctg For Already Existing BusinessDocument20 pagesWashy Wash Inc. Acctg For Already Existing BusinessmapapashishsasarapNo ratings yet

- Activity 1 & 2 - TolentinoDocument13 pagesActivity 1 & 2 - TolentinoDJazel TolentinoNo ratings yet

- Docsity Fundamentals of Accounting 1 3Document5 pagesDocsity Fundamentals of Accounting 1 3Timothy Arbues ReyesNo ratings yet

- General Journal ExcelDocument10 pagesGeneral Journal ExcelJoy Mikaela GozonNo ratings yet

- Journal EdaelDocument1 pageJournal Edaelelijah daelNo ratings yet

- 11 ABM Sean Jairus Lauta FABM PT #1 (AutoRecovered)Document20 pages11 ABM Sean Jairus Lauta FABM PT #1 (AutoRecovered)Sean LautaNo ratings yet

- Format Jurnal Perusahaan JasaDocument20 pagesFormat Jurnal Perusahaan JasasainahNo ratings yet

- General Journal - General Ledger - Trial BalanceDocument5 pagesGeneral Journal - General Ledger - Trial BalanceJasminNo ratings yet

- SEATWORK6Document6 pagesSEATWORK6dumpanonymouslyNo ratings yet

- Chapter 4 Solution Problem 4 5 Page 2Document3 pagesChapter 4 Solution Problem 4 5 Page 2saphirejunelNo ratings yet

- Journal Layout (Black)Document3 pagesJournal Layout (Black)Andrea Nicole SalesNo ratings yet

- Acctg Cycle Excel Format - Answer Key Liz Cee Cleaning Service - 10.12.2021 BlankDocument33 pagesAcctg Cycle Excel Format - Answer Key Liz Cee Cleaning Service - 10.12.2021 BlankRhadzmae Omal100% (1)

- Module 1Document28 pagesModule 1Ayanna Camero100% (1)

- Problem 1Document8 pagesProblem 1HazeNo ratings yet

- Qualifying ExamDocument12 pagesQualifying ExamKathleen Laica P. SablayNo ratings yet

- T Act. 2Document41 pagesT Act. 2DJazel TolentinoNo ratings yet

- Perilla Geriqjoedn 1Document20 pagesPerilla Geriqjoedn 1Geriq Joeden PerillaNo ratings yet

- V1620034 - Dzaky FarhansyahDocument11 pagesV1620034 - Dzaky FarhansyahDzaky FarhansyahNo ratings yet

- Comp 2 Activity 5 SUPER FINAL1Document11 pagesComp 2 Activity 5 SUPER FINAL1Jhon Lester MagarsoNo ratings yet

- Book 2Document1 pageBook 2mildred-rivera-2636No ratings yet

- Accounting Cycle ServiceDocument29 pagesAccounting Cycle ServiceElsa Abaño De GuiaNo ratings yet

- Projected One-Year Cash Flow Lip Redux Cash Flow Statement As of October 2020 Account Titles Debit Credit Source of FundsDocument1 pageProjected One-Year Cash Flow Lip Redux Cash Flow Statement As of October 2020 Account Titles Debit Credit Source of Fundsmjmj.lorenzo0805No ratings yet

- Official Template For Abm ProjectDocument17 pagesOfficial Template For Abm ProjectPersephoneeeiNo ratings yet

- AccountingDocument6 pagesAccountingbalanagmweNo ratings yet

- Accounting CycleDocument7 pagesAccounting CycleJenny BernardinoNo ratings yet

- 2021 FAR Straight Problem - Hyc2Document2 pages2021 FAR Straight Problem - Hyc2Mariecris BatasNo ratings yet

- Acctg Cycle Assign Answer KeyDocument32 pagesAcctg Cycle Assign Answer KeyAdrian Jay BeloyNo ratings yet

- Accounting CycleDocument18 pagesAccounting CycleIris Joy JobliNo ratings yet

- M. VILLANUEVA GO KART GROCERY - xlsx-1Document51 pagesM. VILLANUEVA GO KART GROCERY - xlsx-1belliissiimmaaNo ratings yet

- FDNACCT K85 - Individual Project - Lim, MarriottDocument13 pagesFDNACCT K85 - Individual Project - Lim, MarriottmarriottlimNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- 2.3 SAMPLE - WorkbookDocument11 pages2.3 SAMPLE - WorkbookJonalyn BedesNo ratings yet

- Merchandising Perpetual Inv Sys Coco Computer StoreDocument18 pagesMerchandising Perpetual Inv Sys Coco Computer StoreMadelyn Espiritu100% (4)

- Happy Tours and Travel Agency Chart of Accounts To Balance SheetDocument11 pagesHappy Tours and Travel Agency Chart of Accounts To Balance SheetChristine Tiprado100% (3)

- Practice Problem in General Accounting Ytac, Bacalso, MajaduconDocument25 pagesPractice Problem in General Accounting Ytac, Bacalso, Majaduconeunice demaclid100% (1)

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- Act110 Accounting CycleDocument109 pagesAct110 Accounting CycleKilwa Dy100% (2)

- Virtudazo Ween Trading GJDocument15 pagesVirtudazo Ween Trading GJMary Rose Ann VirtudazoNo ratings yet

- General Journal Page 1 Date Description P/R Debit CreditDocument10 pagesGeneral Journal Page 1 Date Description P/R Debit CreditGonzalo FerrerNo ratings yet

- Budget Driving Institute Prob 2&3Document94 pagesBudget Driving Institute Prob 2&3Ma Sophia Mikaela EreceNo ratings yet

- FAR1 1.4BSA CASE2 Igsoc KristaNina IrabonDocument13 pagesFAR1 1.4BSA CASE2 Igsoc KristaNina IrabonKrishta IgsocNo ratings yet

- Henry Labasan Rent-A-Car: Folio 140 100 300Document16 pagesHenry Labasan Rent-A-Car: Folio 140 100 300Matt Erwin Gulle100% (7)

- ACC 01 - Recording of Transactions For Service - Journal EntriesDocument3 pagesACC 01 - Recording of Transactions For Service - Journal EntriesAlbert BugasNo ratings yet

- 3RD Activity - ComprehensiveDocument19 pages3RD Activity - ComprehensiveJJ Longno100% (2)

- Crystal Report ViewerDocument17 pagesCrystal Report ViewerFaheem KamalNo ratings yet

- Fabm 1-PTDocument12 pagesFabm 1-PTMaxene YbañezNo ratings yet

- Uts Notes (Midterm) Lesson 2Document5 pagesUts Notes (Midterm) Lesson 2Bea Dela PeniaNo ratings yet

- Business PlanDocument11 pagesBusiness PlanBea Dela PeniaNo ratings yet

- Lesson 3 EconDocument2 pagesLesson 3 EconBea Dela PeniaNo ratings yet

- Business Ethics ReviewerDocument1 pageBusiness Ethics ReviewerBea Dela PeniaNo ratings yet

- Anti Smoking CampaignDocument4 pagesAnti Smoking CampaignBea Dela PeniaNo ratings yet

- Operation Management FormulaDocument2 pagesOperation Management FormulaBea Dela PeniaNo ratings yet

- Book 1Document13 pagesBook 1Bea Dela PeniaNo ratings yet

- GR 7Document7 pagesGR 7Bea Dela PeniaNo ratings yet

- Chapter 1 2 Applied Econ Part I PDFDocument108 pagesChapter 1 2 Applied Econ Part I PDFBea Dela PeniaNo ratings yet

- CHAPTER5DRAFTDocument4 pagesCHAPTER5DRAFTBea Dela PeniaNo ratings yet

- FinalMarketSurvey BEADocument4 pagesFinalMarketSurvey BEABea Dela PeniaNo ratings yet

- Chapter 1-4 (Draft)Document43 pagesChapter 1-4 (Draft)Bea Dela PeniaNo ratings yet

- Group7 (Financial Statements)Document6 pagesGroup7 (Financial Statements)Bea Dela PeniaNo ratings yet

- English For Academic and Professional Purposes EAPP 111 - 1Document221 pagesEnglish For Academic and Professional Purposes EAPP 111 - 1Bea Dela PeniaNo ratings yet

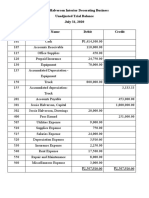

- Income StatementDocument1 pageIncome StatementBea Dela PeniaNo ratings yet

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceBea Dela PeniaNo ratings yet

- ABM A Chapter1Document4 pagesABM A Chapter1Bea Dela PeniaNo ratings yet

- Halverson With AdjusmentsDocument1 pageHalverson With AdjusmentsBea Dela PeniaNo ratings yet

- Adjusting EntryDocument1 pageAdjusting EntryBea Dela PeniaNo ratings yet

- Radio One - For ClassDocument26 pagesRadio One - For ClassRicha ChauhanNo ratings yet

- Jollibee Foods CorporationDocument6 pagesJollibee Foods CorporationJudi CruzNo ratings yet

- Bank - Reconciliatio Statement PowerpointDocument61 pagesBank - Reconciliatio Statement PowerpointLoida Yare LauritoNo ratings yet

- Indian Startup Funding Lab3Document15 pagesIndian Startup Funding Lab3Commerce ConferenceNo ratings yet

- Dilla University: Department of EconomicsDocument40 pagesDilla University: Department of EconomicsOromay Elias100% (1)

- Bdo PresentationDocument28 pagesBdo PresentationTen Balestramon100% (1)

- Working Capital ManagementDocument102 pagesWorking Capital Managementvarun206383% (12)

- Business Feasibility of Manufacturing Coir Fibre and Coir YarnDocument6 pagesBusiness Feasibility of Manufacturing Coir Fibre and Coir YarnAkshay JainNo ratings yet

- Common Abbreviations of Garments TechnologyDocument3 pagesCommon Abbreviations of Garments TechnologyTirupathi RaoNo ratings yet

- 09b - Micro - Demand and Supply - Changes in Market Price - Concept Consolidation Worksheet - Q&ADocument10 pages09b - Micro - Demand and Supply - Changes in Market Price - Concept Consolidation Worksheet - Q&Arrrrr88888No ratings yet

- FOREX Part1Document1 pageFOREX Part1lender kent alicanteNo ratings yet

- The Impact of Stock Market On Indian Economy Introduction: Conference PaperDocument11 pagesThe Impact of Stock Market On Indian Economy Introduction: Conference PaperfunnyNo ratings yet

- Money Demand and SupplyDocument22 pagesMoney Demand and SupplyHarsh Shah100% (1)

- John Taskinsoy 2022 SSRN Financial Crisis Continue Strike FebruaryDocument47 pagesJohn Taskinsoy 2022 SSRN Financial Crisis Continue Strike FebruaryJohn TaskinsoyNo ratings yet

- The Wall Street Journal - 31-07-2021Document42 pagesThe Wall Street Journal - 31-07-2021SEBASNo ratings yet

- MujiDocument5 pagesMujiHương PhanNo ratings yet

- MGT Chap 6Document5 pagesMGT Chap 6tomNo ratings yet

- D.E. 108 MSJ, Ex. 9 (198) Ltr. Smith To Schneider July 7, 2016, May 25, 2017Document1 pageD.E. 108 MSJ, Ex. 9 (198) Ltr. Smith To Schneider July 7, 2016, May 25, 2017larry-612445No ratings yet

- Lesson 4 Sources of IncomeDocument9 pagesLesson 4 Sources of IncomeErick MeguisoNo ratings yet

- ANZ Bank Analysis: Name: Lucky Steven F Noris ID: 11900055Document11 pagesANZ Bank Analysis: Name: Lucky Steven F Noris ID: 11900055Ein LuckyNo ratings yet

- 31 - Term Sheets For Private Equity InvestmentsDocument3 pages31 - Term Sheets For Private Equity InvestmentsshakibalamNo ratings yet

- OverHead ClassificationDocument17 pagesOverHead ClassificationKookie12No ratings yet

- Chapter 1 Evolution and Fundamental of BusinessDocument211 pagesChapter 1 Evolution and Fundamental of BusinessDr. Nidhi KumariNo ratings yet

- Partnership AccountingDocument3 pagesPartnership AccountingDan RyanNo ratings yet

- Monzo Bank StatementDocument2 pagesMonzo Bank StatementAlpamis100% (1)

- Brunello Cucinelli Case StudyDocument16 pagesBrunello Cucinelli Case StudyJASPREET KAURNo ratings yet

- Midterm - Special ExamDocument2 pagesMidterm - Special ExamDhanica C. MabignayNo ratings yet

- House of Risk: A Model For Proactive Supply Chain Risk ManagementDocument16 pagesHouse of Risk: A Model For Proactive Supply Chain Risk ManagementFifi UmmahNo ratings yet

- Republika NG Pilipinas Kawaran NG Pananalapi Kawanihan NG Rentas InternasDocument12 pagesRepublika NG Pilipinas Kawaran NG Pananalapi Kawanihan NG Rentas InternasdanieladiezNo ratings yet

- History of Indian EconomyDocument3 pagesHistory of Indian EconomyNILESH KUMARNo ratings yet