Professional Documents

Culture Documents

Gartner Market Guide For Com 737675 NDX CPaaS p.1-p.10

Uploaded by

dickysophiantoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gartner Market Guide For Com 737675 NDX CPaaS p.1-p.10

Uploaded by

dickysophiantoCopyright:

Available Formats

Market Guide for Communications Platform as a

Service

Published 27 September 2021 - ID G00737675 - 41 min read

By Analyst(s): Lisa Unden-Farboud, Brian Doherty, Daniel O'Connell

Initiatives: Software Engineering Technologies; CSP Digital Transformation and

Innovation

Business units need to improve operational efficiency and

customer experience digitally. Software engineering leaders should

embrace CPaaS to embed SMS, application to person, voice and

emerging CPaaS (like advanced messaging, video, enhanced

security and digital payments) into applications.

Additional Perspectives

■ Summary Translation: Market Guide for Communications Platform as a Service

(29 November 2021)

■ Invest Implications: Market Guide for Communications Platform as a Service

(29 September2021)

Overview

Key Findings

■ CPaaS business adoption remains robust as software engineering leaders seek to

deepen digital engagement with customers and stakeholders on a variety of use

cases. Their teams are increasingly embedding communications APIs into

applications and business systems.

■ Many large and multinational organizations have IT staff members with the API and

software engineering skills to leverage CPaaS tools today. Those lacking such skills

can hire third-party consultants or SIs to get them up and running.

■ End customers are requiring deeper engagement with enterprises over the

communications channel of their preference. CPaaS vendors have moved to

advanced messaging capabilities (led by WhatsApp with omnichannel that

combines traditional modes of communications) with advanced components to

enhance customer engagement.

Gartner, Inc. | G00737675 Page 1 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

Recommendations

Application and software engineering leaders whose teams are pursuing CPaaS as part of

their digital transformation to set the customer experience strategy should:

■ Engage their developers in the CPaaS selection process by empowering them with

access to the rich ecosystem of APIs, SDKs, IDEs, blogs, training and events

available for understanding CPaaS vendor emerging offerings.

■ Evaluate visual builders as part of their CPaaS selection process. They are a

valuable tool for designing business flow logic, enabling noncoders to access CPaaS

and make logic modifications in a low-code environment.

■ Promote an expansive CPaaS strategy by encouraging developers to deliver

advanced CPaaS functionality (such as video, messaging apps, bots, omnichannel)

for richer conversations, and look at areas where it can be adopted across business

units.

Strategic Planning Assumptions

By 2025, 95% of global enterprises will leverage API-enabled CPaaS offerings as a

strategic IT skill set to enhance their digital competitiveness, up from 20% in 2020.

By 2025, at least 40% of midsize enterprises will scale up digital capabilities for customer

experience using CPaaS tools, up from less than 10% in 2021.

Market Definition

This document was revised on 12 October 2021. The document you are viewing is the

corrected version. For more information, see the Corrections page on gartner.com.

Communications platform as a service (CPaaS) offers application and software

engineering leaders a cloud-based middleware from which they can integrate

communications software into business processes programmatically. A CPaaS platform

provides developers with APIs, software development kits (SDKs), integrated development

environments (IDEs) and documentation to (for example):

■ Facilitate simplified access to an array of communications tools (spanning voice,

SMS, messaging and video)

■ Build communications solutions

Gartner, Inc. | G00737675 Page 2 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

■ Better run their business

■ Enhance customer experience

■ Improve speed to market for new products and services

CPaaS vendors are also expanding low-code/visual builder capabilities to help

nontechnical enterprise roles. Some have consultants to help enterprises optimize CPaaS

business uses.

Market Description

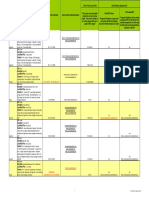

Figure 1 captures the framework of services that can be offered in the CPaaS market. A

given CPaaS provider typically only offers a subset of these modules. The five layers in

the middle of Figure 1 represent the communications modules and intelligence layers. The

colors indicate market demand and maturity.

■ Foundational — These modules (green) are common communications APIs

requested by customers today. Gartner believes they represent ~80% of today’s

enterprise CPaaS spend. Many of today’s users still focus on SMS (along with the

requisite short code or long codes), where they can build application-to-person (A2P)

or bulk SMS implementations to tie in their business processes. Messaging app

WhatsApp has also entered this group. Basic security like two-factor authentication

(2FA) is included here too.

■ Emerging — These modules (mid-blue) are receiving increasing customer demand.

Advanced multifactor authentication (MFA) modules are replacing less secure 2FA.

Omnichannel features, including bots, are needed to straddle a variety of advanced

messaging. Video is being introduced to enhance voice conversations. Payment

capabilities are being integrated into core CPaaS APIs. Basic contact center agent

management features are being introduced. Analytics for both monitoring the

robustness of the network and for profiling the customer are also being introduced.

■ Potential differentiation — These modules (dark blue) represent potential sources of

differentiation or nascent market demand. Gartner sees CPaaS vendors deploying

custom solutions to verticals such as healthcare, education and emergency services.

A few vendors have unified communications as a service (UCaaS) solutions, and

some have differentiated to focus on the area of CDP to tie into CRMs and with

campaign management solutions. Some vendors are adding Internet of Things (IoT)

to support use cases like connected homes and trash collection.

Gartner, Inc. | G00737675 Page 3 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

Figure 1: Five-Layer CPaaS Architecture

CPaaS vendors now have programs (left side of Figure 1) to improve their competitive

positioning. This includes:

■ Marketplace — Vendors are expanding their partner capabilities through internal and

add-on marketplaces, via partner programs and ecosystems. An example of this

could be at a networking level for connectivity into regions where they don’t have

local capabilities. Another could be for working with specific agents or professional

services companies for integration capabilities. CPaaS vendors may provide

marketplaces of third-party add-ons such as those for sentiment analysis or

language translation to complement their own offerings and to further build a

partner ecosystem.

■ Customer success plans — These plans help customers get the most out of their

CPaaS deployments (often at an additional charge), and in many cases go on to

build new CPaaS use cases across business units.

Gartner, Inc. | G00737675 Page 4 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

■ Vertical and regulatory compliances — These involve adherence to vertical

compliances (for example, Health Insurance Portability and Accountability Act

[HIPAA], General Data Protection Regulation [GDPR] and Payment Card Industry Data

Security Standard [PCI DSS]) so that their CPaaS offerings are authorized for use.

■ Developer blogs, developer relations, certifications, training and events — These

build a deeper bond with the developer community. This is in addition to the core

developer APIs, SDKs and documentation (on the right side of Figure 1).

The right side of Figure 1 presents the assortment of tools and capabilities CPaaS

providers bring to the table. Visual builders are more important. Now, most vendors offer a

visual builder or low-code capability in addition to their developer toolsets. They allow

business analysts or other nontechnical roles, such as knowledge workers, access to the

CPaaS toolset. Through a graphical user interface, nontechnical, noncoding roles can

design business workflows by configuring drag-and-drop communications modules.

Market Direction

Spurred by COVID-19 in 2020 and into 2021, the CPaaS market has witnessed growth of

at least 30% over the past five years. It is forecast to grow with a CAGR of around 30%

through to 2025 (see Forecast Analysis: CPaaS, Worldwide). Enterprises recognize a need

to build a digital DNA using CPaaS for contactless engagement and for driving business

efficiencies. Gartner often sees a single business unit adopting CPaaS for a particular use

case. It then virally spreads to other business units as they learn the CPaaS value

proposition, in such areas as marketing campaigns, e-commerce and field service

automation.

CPaaS is a fragmented market. Gartner has witnessed mergers and acquisitions,

partnerships, new entrants (Microsoft) and telco plays. Acquisitions are made to enter a

new geographic market, gain access to additional developer networks or fill in for a

technology gap. Notable M&A activity includes MessageBird’s acquisition of email

provider SparkPost (April 2021), Sinch’s acquisition of Chatlayer for AI (March 2020) and

Twilio’s acquisition of customer data platform (CDP) Segment (October 2020).

Growth is projected to continue across all CPaaS segments, while SMS APIs increasingly

part of A2P represent nearly 50% of enterprise CPaaS spend. WhatsApp is a major CPaaS

growth engine, followed by Apple Business Chat (ABC), Google Rich Business Messenger

(RBM), WeChat, LINE and Telegram. The adoption of messaging apps enables richer

conversations through enabling mechanisms such as artificial intelligence (AI), bots and

natural language processing (NLP).

Gartner, Inc. | G00737675 Page 5 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

The vertical solution area has also seen strong adoption in gig food delivery, education,

healthcare, retail and supply chain logistics, among others. We also see enterprises

evaluating CPaaS payment, security and contact centers. CPaaS vendors are expanding

integration and partnering capabilities into enterprise systems such as contact centers,

CRM, CDPs and ERP, or are building their own campaign management solutions.

Market Analysis

Top Emerging CPaaS Trends for 2022

Advanced Messaging Apps Grow for Richer Communications

Consumers want to converse with their brands on their terms, in their preferred

communications channels for a richer engagement. This means messaging apps like

WhatsApp (now a foundational service), Google RBM, ABC, Facebook Messenger,

Telegram, WeChat, Viber, KakaoTalk and LINE are being assessed. These messaging apps

provide deeper conversational capabilities than basic SMS. They support such use cases

as customer support, e-commerce and food ordering, ticket purchasing, location tracking,

loan payments and others.

WhatsApp is the most prevalent advanced messaging app brought up by Gartner clients,

particularly in the financial, public sector and utility industries. Other messaging apps are

strong in a particular country market, such as WeChat in China.

Omnichannel and Orchestration Scales With Bots

Omnichannel allows businesses to connect with customers across multiple channels,

while maintaining context across those channels. A conversation can therefore start in

one channel, switch to a second, and then be completed in a third (for example, from SMS

to WhatsApp and to video). CPaaS users have a strong interest in visual builders to build

out an omnichannel customer experience. Vendors have enabled conversational APIs,

adding to the functionality of one “inbox” regardless of the channel within.

Bots, both chatbots and voicebots, are increasingly attached to messaging apps. They

can be used to completely fulfill simple requests, such as a password reset or address

change, or they can be used to automate routine tasks, such as gathering name, address,

account number and reason for calling. Amazon Lex, Google Dialogflow, [24]7.ai,

yellow.ai, Kore.ai, and OneReach.ai are among the many available bot options. Some

vendors like Twilio and Infobip have their own bots.

Video Usage Expands

Gartner, Inc. | G00737675 Page 6 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

Although CPaaS video has been around for more than five years, injecting video into

industry-specific applications is still emerging. Enterprise usage expanded greatly in 2020

to 2021 due to COVID-19, with such use cases as work from home, remote schooling and

telehealth leading the charge, along with live (and interactive) streaming events. Gartner

has also seen other use cases such as insurance, banking, telejustice, social (such as

gaming, dating, events) and training. New cases continue to appear. Growth of CPaaS

video is projected to be roughly 80% in 2022.

Not all CPaaS vendors aggressively pursue video solutions, but others view video as a

strategic growth market. Building in-app video with APIs enables integrated workflow,

boosting the overall value proposition. Enterprises can build according to their specific

uses and requirements, removing the friction of OTT video (Zoom, Microsoft Teams and

Cisco Webex). The CPaaS video application can embed adjacent CPaaS capabilities, such

as voice, chat, authentication, AI and analytics, for customized solutions.

Artificial Intelligence/Analytics Enhances CDP and CRM

AI, NLP, bots and sentiment analysis are coming to the CPaaS forefront. CDP also brings

an AI element by providing a predictive behavior to CRMs (such as Salesforce and

Microsoft Dynamics), which contain customer records. The CDP layer becomes a

centralized customer behavior hub. CDP tracks customer activity across e-commerce,

websites, messaging apps, social media, business cloud applications and public records,

along with past activity with the CPaaS customer. This past behavior represents a picture

of likely future behavior. The result is a dynamic layer of business and consumer

intelligence over the static CRM records.

With CDP intelligence, the CPaaS customer secures insight into its customer behavior.

This is valuable in predicting customer buying behavior, financial wealth, brand loyalty,

sentiment, unmet needs and frustrations. CDP within CPaaS is relatively new, and only

came on Gartner’s radar screen in 2020. Twilio (Segment acquisition, October 2020),

MessageBird (Hull acquisition, March 2021) and Route Mobile are examples of CPaaS

vendors investing in CDP.

Other Trends

CPaaS and CCaaS

In some ways, the CPaaS and contact center as a service (CCaaS) markets are starting to

overlap. CCaaS platforms support SMS, advanced messaging and social media channels.

They are also incorporating chatbots for automation and self-service. Meanwhile, CPaaS

user journeys sometimes involve use cases in which customers interact with a live agent

(specifically for complex problems that cannot be resolved via AI).

Gartner, Inc. | G00737675 Page 7 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

Some CPaaS providers can support basic contact center features such as interactive

voice response (IVR), automatic call distribution (ACD), surveys, routing engine and

reporting tools. This can be API-connected with third-party vendors for workforce

management (WFM) and quality monitoring (QM) (such as NICE, Verint and Calabrio).

The customer can assemble these modules and build a customizable contact center. The

most notable CPaaS-CCaaS providers to date are Amazon Connect and Twilio Flex, which

are gaining traction with large customers (or midsize tech-savvy customers) whose

CPaaS use cases occasionally require human interaction. Other CPaaS-CCaaS solutions

are available from IntelePeer and Infobip.

Advanced Security (Multifactor Authentication and Biometrics)

CPaaS providers have offered 2FA for more than five years for enhanced security over

traditional usernames/passwords. But 2FA is vulnerable to compromise by malicious

hackers. CPaaS providers are starting to roll out more robust security capabilities,

including silent mobile verification (which matches both the device and the phone number

for authentication).

There is a shift toward more robust multifactor authentication (MFA), which layers in

additional resiliency through biometric security tools such as voice recognition, facial

recognition, iris scanning and palm print/fingerprint verification. Investments have

expanded in this space, such as Twilio’s May 2021 acquisition of Ionic Security.

Application and software engineering leaders should evaluate CPaaS security tools as a

means to address critical application security requirements, including those in industry-

specific scenarios such as Strong Customer Authentication (SCA) in open banking.

Payments

COVID-19 spurred demand for B2C digital engagement, with enterprises increasingly using

CPaaS platforms to build customized apps and flows for customer journeys. Customers

on messaging apps expect simple “click through” to purchase via digital wallets and

credit/debit cards. They expect a similarly effortless experience when paying via voice as

well.

As a result, CPaaS vendors such as Clickatell, CM.com, Twilio, Vonage API, Infobip,

Kaleyra and IntelePeer are promoting their payment capabilities. This may be through

their own payment capabilities or through partnering with third-party payment

providers/gateways. Payments are typically integrated with messaging apps like SMS,

WhatsApp, WeChat, Apple Business Chat and Google RBM.

Pricing

Gartner, Inc. | G00737675 Page 8 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

A few of the developer-focused CPaaS providers display list prices for many of their

services. Depending on the CPaaS capability, pricing can vary by country. Volume

discounts may exceed 67% for large commitments. Hence, a $0.0075 (0.75 cents) list

price for SMS may be $0.0025 (0.25 cents) for a $500,000 annual commitment.

CPaaS pricing is becoming more complicated because CPaaS vendors are expanding

their base of services in such areas as bots, advanced messaging, email, video and voice

translation. In addition, not all CPaaS vendors offer the same CPaaS modules. As a

general rule, Gartner sees list prices staying firm, but street pricing going down, because

buyer total spend goes up as CPaaS becomes a foundational IT tool.

Many customers seek professional services to build customized solutions. Some CPaaS

vendors make this a core competency. Other CPaaS vendors call on partners to fulfill this

role. Some CPaaS contracts include customer success fees (perhaps 5% of the total bill)

for ongoing customer service and support.

CPaaS Vendor Focus Convergence

CPaaS has matured from early offerings that were solely aimed at users with coding

capabilities. CPaaS now encompasses the availability of tools that enable access to a

wider range of users, such as business analysts and marketing users. These latter user

groups don’t have deep coding capabilities. Although CPaaS vendors have expanded from

one of these two approaches to expand their addressable market (developer or co-

creation; see Note 2), it’s still an important segmentation. The ones with strong developer

self-service with typically low transparent pricing such as Twilio and Sinch (for example)

have expanded their customer success teams and consulting partners, and added visual

builders and low-code capabilities, along with consulting support. Typical co-creators

such as IntelePeer focus on helping customers solve business problems through the use

of fusion teams combining technical and nontechnical members. This is often

supplemented with professional services. Co-creators’ initial go-to-market provides

customer success teams and consulting support for enterprise solution approach, and is

now extending to provide developer toolkits, SDKs and documentation. So, a blurring of

distinction is now starting to occur, but the distinction is still important for enterprises that

may select a vendor based on its developer capability or co-creation capability. Figure 2

depicts the different focuses.

Gartner, Inc. | G00737675 Page 9 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

Figure 2: Developer and Co-Creation Vendor Focus

Representative Vendors

The vendors listed in this Market Guide do not imply an exhaustive list. This section is

intended to provide more understanding of the market and its offerings.

Market Introduction

Representative Vendors

Table 1 shows 20 representative vendors of the CPaaS market, spanning North America,

Europe, Africa, Asia/Pacific and Latin America. CPaaS is a fragmented, emerging market,

and Gartner expects new entrants to emerge, with many large telcos evaluating the

landscape. Mergers and acquisitions will continue. See Note 1.

Gartner, Inc. | G00737675 Page 10 of 28

This research note is restricted to the personal use of tomy.hendratmoko@telin.net.

You might also like

- Gartner - Magic Quadrant For Digital Experience Platforms-2021Q2Document26 pagesGartner - Magic Quadrant For Digital Experience Platforms-2021Q2Guille LopezNo ratings yet

- Magic Quadrant For Digital Experience Platforms, 2021Document31 pagesMagic Quadrant For Digital Experience Platforms, 2021openid_dr4OPAdENo ratings yet

- 451 Research - 2021-Tech-Ma-Outlook-DatacenterDocument4 pages451 Research - 2021-Tech-Ma-Outlook-DatacenterHashNo ratings yet

- Forrester Wave In-Memory Data GridsDocument16 pagesForrester Wave In-Memory Data GridslumbrigackNo ratings yet

- Genesys IDC SpotlightDocument5 pagesGenesys IDC SpotlightEdinson SanchezNo ratings yet

- Gartner Magic Quadrant For Network Services Global March 2021Document28 pagesGartner Magic Quadrant For Network Services Global March 2021ta peiNo ratings yet

- Wildix Gartner Magic Quadrant 2021Document40 pagesWildix Gartner Magic Quadrant 2021MK ULTRANo ratings yet

- IoTAL Product Overview 0122Document38 pagesIoTAL Product Overview 0122Sami SørensenNo ratings yet

- DownloadDocument1 pageDownloadDinesh SanodiyaNo ratings yet

- SECO 12 2021 01 InitiationDocument63 pagesSECO 12 2021 01 InitiationJoachim HagegeNo ratings yet

- NASA FINS Partner SummitDocument36 pagesNASA FINS Partner Summithanisami666No ratings yet

- Gartner - Magic Quadrant For B2B Marketing AutomationDocument36 pagesGartner - Magic Quadrant For B2B Marketing AutomationRandoNo ratings yet

- Aniview CTV Advertising PlatformDocument10 pagesAniview CTV Advertising PlatformVaibhav PandeyNo ratings yet

- Messaging: Alberto Pasi - Solution Leads EmeaDocument19 pagesMessaging: Alberto Pasi - Solution Leads EmeaBlasius Sinthato LicaNo ratings yet

- Outlook For Network SecurityDocument21 pagesOutlook For Network Securityscott tangNo ratings yet

- Gartner Critical Capabilities For Network Services Global March 2021Document37 pagesGartner Critical Capabilities For Network Services Global March 2021ta pei100% (1)

- The Future of Cloud - 1637260882900001mwcMDocument26 pagesThe Future of Cloud - 1637260882900001mwcMOscar JunyentNo ratings yet

- Video Landscape Report Highlights Fast Growth of Digital VideoDocument55 pagesVideo Landscape Report Highlights Fast Growth of Digital VideoJeremias C KlausnerNo ratings yet

- Investor Presentation Feb 2021 - FinalDocument26 pagesInvestor Presentation Feb 2021 - FinalemiliousterNo ratings yet

- Service Definition Document 2022 05 12 1340Document13 pagesService Definition Document 2022 05 12 1340NaserNo ratings yet

- ADA Partner Roadshow (-External-)Document22 pagesADA Partner Roadshow (-External-)Coleen Angel FowlNo ratings yet

- 106 Cybersecurity Startups in A Market MapDocument7 pages106 Cybersecurity Startups in A Market MapNaveen S YeshodaraNo ratings yet

- Next Gen SD WanDocument13 pagesNext Gen SD WanTrNo ratings yet

- Gartner Storage 2019Document39 pagesGartner Storage 2019Roohy ShaterNo ratings yet

- Blog Ine Com 2008-02-09 Understanding Redistribution Part IDocument1 pageBlog Ine Com 2008-02-09 Understanding Redistribution Part Iअमित सिंहNo ratings yet

- Unit - II (Cloud Computing)Document46 pagesUnit - II (Cloud Computing)NikitaNo ratings yet

- BofA SaaS IndiaDocument18 pagesBofA SaaS IndiaTejas JosephNo ratings yet

- The State of Data Engineering 2022 - LakeFSDocument15 pagesThe State of Data Engineering 2022 - LakeFSJorge WillemsenNo ratings yet

- SR Dci Amsterdam 4 2021 ExecsumDocument58 pagesSR Dci Amsterdam 4 2021 ExecsumJohn DuffinNo ratings yet

- 1. AWS - Công Nghệ Đám Mây Động Lực Chính Trong Chuyển Đổi Số Ngành Tài ChínhDocument26 pages1. AWS - Công Nghệ Đám Mây Động Lực Chính Trong Chuyển Đổi Số Ngành Tài ChínhLương Huy HoàngNo ratings yet

- Partner MAP ChecklistDocument6 pagesPartner MAP ChecklistDeepak PandeNo ratings yet

- Application Performance Management Advanced For Saas Flyer PDFDocument7 pagesApplication Performance Management Advanced For Saas Flyer PDFIrshad KhanNo ratings yet

- Falcon Forensics Deployment Guide - 01192022Document21 pagesFalcon Forensics Deployment Guide - 01192022Sandi ACNo ratings yet

- TL Operational Cost Strategies For Mobile Operators in EuropeDocument15 pagesTL Operational Cost Strategies For Mobile Operators in Europeashuu_guptaNo ratings yet

- MicroStrategy Analytics Product HarnessingDocument16 pagesMicroStrategy Analytics Product HarnessingHugo CarriónNo ratings yet

- Reliance Jio Infocomm LTD.: Digital Marketing CampaignsDocument9 pagesReliance Jio Infocomm LTD.: Digital Marketing Campaignsnandini swamiNo ratings yet

- Gartner Reprint - TigergraphDocument13 pagesGartner Reprint - TigergraphHenkNo ratings yet

- AirtelDocument71 pagesAirtelHarshit0% (1)

- IT SECTOR ANALYSIS FOR INVESTING TRENDSDocument78 pagesIT SECTOR ANALYSIS FOR INVESTING TRENDSAngyNo ratings yet

- 2020 en Study Everest Group Peak Matrix For Open Banking It Service ProvideDocument15 pages2020 en Study Everest Group Peak Matrix For Open Banking It Service ProvidetheeffaniNo ratings yet

- Measuring The Cost Effectiveness of Confluent Cloud: White PaperDocument10 pagesMeasuring The Cost Effectiveness of Confluent Cloud: White PaperDeni DianaNo ratings yet

- Gartner - Magic Quadrant For Sales Force Automation-2020Q3Document32 pagesGartner - Magic Quadrant For Sales Force Automation-2020Q3Guille LopezNo ratings yet

- Intertraffic Amsterdam Exhibitor List 2016Document15 pagesIntertraffic Amsterdam Exhibitor List 2016Anonymous jI4EEbTNo ratings yet

- Java Banking SystemDocument134 pagesJava Banking SystemShlok MalhotraNo ratings yet

- BrandZ 2015 LATAM Top50 ReportDocument83 pagesBrandZ 2015 LATAM Top50 ReportmperdomoqNo ratings yet

- AryakaDocument4 pagesAryakaHarsh BhardwajNo ratings yet

- Rippling Memo RedactedDocument11 pagesRippling Memo RedactedAntonius TaufanNo ratings yet

- Emerging Technologies in CloudDocument5 pagesEmerging Technologies in CloudTechnical GulabiNo ratings yet

- The Future of Cloud Is The Network: Published: March 2022Document16 pagesThe Future of Cloud Is The Network: Published: March 2022Ndaru PrakosoNo ratings yet

- IAB Europe AdEx Benchmark 2013 Report v2 PDFDocument57 pagesIAB Europe AdEx Benchmark 2013 Report v2 PDFdee.hostingNo ratings yet

- CB Insights - Unbundling TeslaDocument18 pagesCB Insights - Unbundling TeslaRaúlNo ratings yet

- PWC Outlook22Document28 pagesPWC Outlook22Karthik RamanujamNo ratings yet

- LUMA S State of Digital 2021Document84 pagesLUMA S State of Digital 2021Simona MolonfaleanNo ratings yet

- Gartner - Magic Quadrant For Multichannel Marketing Hubs-2021Q2Document37 pagesGartner - Magic Quadrant For Multichannel Marketing Hubs-2021Q2Guille LopezNo ratings yet

- FY19 IAB Internet Ad Revenue Report - FinalDocument32 pagesFY19 IAB Internet Ad Revenue Report - FinalMatheus AlvesNo ratings yet

- Insead Student Emerging Role of Venture Builders Oct 2018Document29 pagesInsead Student Emerging Role of Venture Builders Oct 2018Isha RahitNo ratings yet

- Where The Future BeginsDocument47 pagesWhere The Future BeginsDr Rami B HNo ratings yet

- Digital Banking Transformation - Application of Artificial Intelligence and Big Data Analytics For Leveraging Customer Experience in The Indonesia Banking SectorDocument7 pagesDigital Banking Transformation - Application of Artificial Intelligence and Big Data Analytics For Leveraging Customer Experience in The Indonesia Banking SectorRaghavendra Vishwas KNo ratings yet

- Cascade 56 Strategy ExamplesDocument43 pagesCascade 56 Strategy ExamplesAnthony RezaNo ratings yet

- Gartner Magic Quadrant - Customer Engagement Center 2021Document30 pagesGartner Magic Quadrant - Customer Engagement Center 2021Wygor AlvesNo ratings yet

- The History of Marketing ThoughtDocument2 pagesThe History of Marketing ThoughtemlakNo ratings yet

- SUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Document5 pagesSUPPLY CHAIN MANAGEMENT (LinkedIn Learning)Floretta FellingNo ratings yet

- Consumer Behaviour CompressedDocument15 pagesConsumer Behaviour CompressedSimone SegattoNo ratings yet

- Green Food GroupDocument91 pagesGreen Food GroupAli El MaisNo ratings yet

- WW IBP Price List PDFDocument26 pagesWW IBP Price List PDFMukesh PatilNo ratings yet

- RBC Financial Group Lifetime Customer Profit AnalysisDocument1 pageRBC Financial Group Lifetime Customer Profit AnalysisLaxmikanta NayakNo ratings yet

- Understanding Consumer Behavior Module 3Document3 pagesUnderstanding Consumer Behavior Module 3Chin Keanna BuizonNo ratings yet

- Absolut Vodka Case StudyDocument4 pagesAbsolut Vodka Case StudyKhushbooNo ratings yet

- Case KokaDocument6 pagesCase KokaLora Hasku0% (1)

- Course Outline Social Media MarketingDocument3 pagesCourse Outline Social Media MarketingAzeem SubhaniNo ratings yet

- Singapore Furniture Industry: An OverviewDocument37 pagesSingapore Furniture Industry: An OverviewAminul IslamNo ratings yet

- Swot AnalysisDocument2 pagesSwot AnalysisJULIO ERNESTO MORAN AVELARNo ratings yet

- International Marketing Report EXEMPLARDocument40 pagesInternational Marketing Report EXEMPLARQuỳnhNo ratings yet

- Final Ipapasa-RevisedDocument111 pagesFinal Ipapasa-RevisedGem. SalvadorNo ratings yet

- Bibliometric Analysis in - AIDocument9 pagesBibliometric Analysis in - AIRishabNo ratings yet

- Direct Response Copywriting Guide That Will Make You A Brand AuthorityDocument11 pagesDirect Response Copywriting Guide That Will Make You A Brand AuthorityAyman LamkhazniNo ratings yet

- eMDP SM-3 S6 Corporate StrategyDocument32 pageseMDP SM-3 S6 Corporate StrategyshankarNo ratings yet

- The Upstart's AssaultDocument8 pagesThe Upstart's AssaultPrashant LaleNo ratings yet

- Frooti PDFDocument1 pageFrooti PDFAkshit DharNo ratings yet

- Factors of ProductionDocument3 pagesFactors of ProductionBusiness ClubNo ratings yet

- The Five Elements of StrategyDocument9 pagesThe Five Elements of Strategytinashe chavundukatNo ratings yet

- Consumer Buying Behavior DoneDocument72 pagesConsumer Buying Behavior DoneRahul NishadNo ratings yet

- Stakeholder Analysis and Strategy Development ReportDocument14 pagesStakeholder Analysis and Strategy Development Reportchetna sharmaNo ratings yet

- CRM Process: Dr. Savita SharmaDocument15 pagesCRM Process: Dr. Savita SharmaShaurya VirmaniNo ratings yet

- Prelim Topics BM 2Document32 pagesPrelim Topics BM 2ME ValleserNo ratings yet

- Sri Lanka Volume 1 ClogardDocument2 pagesSri Lanka Volume 1 ClogardHelitha AmarakoonNo ratings yet

- Course Code: 546 Course: Strategic Management Seminar Student: Mercy Katini Shallo STUDENT NO: BUS-3-6149-3/2009 Lecturer: C. NyamongoDocument26 pagesCourse Code: 546 Course: Strategic Management Seminar Student: Mercy Katini Shallo STUDENT NO: BUS-3-6149-3/2009 Lecturer: C. NyamongoMaria Maganda MalditaNo ratings yet

- PVC Pipe, Hdpe Pipe ManufacuringDocument10 pagesPVC Pipe, Hdpe Pipe ManufacuringDijin MaroliNo ratings yet

- Power Point Slide On Daraz (Revised)Document25 pagesPower Point Slide On Daraz (Revised)John AbrahamNo ratings yet

- Classification and Types of EntrepreneurshipDocument7 pagesClassification and Types of Entrepreneurshipynkamat83% (30)