Professional Documents

Culture Documents

VAT Calculation

VAT Calculation

Uploaded by

Md. Abdul HaiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VAT Calculation

VAT Calculation

Uploaded by

Md. Abdul HaiCopyright:

Available Formats

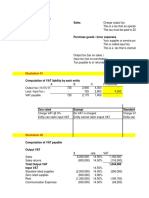

a) DHL will not be able to claim VAT rebate on GC’s invoice.

b) GC can claim rebate of VAT he paid at input stage (e.g. purchase of steel) only when he applies

15% VAT at output stage (i.e. while invoicing to DHL, applying VAT rate @ 15% instead of 7.5%).

c) Unless there is a price efficiency over additional VAT burden, 7.5% is cost effective for DHL.

However, price efficiency may turn out differently; example may be as follows-

Scenario – 1 Revised Remarks

price

Input cost 80 Sale price to 100 90

DHL

VAT rate @ 15% 12 VAT @ 15% 15 13.5

Total 92 Total 115 103.5 Cost to DHL

Additional VAT burden borne by GC nil Nil

Input cost to GC (as GC can claim full VAT 80 80

rebate)

GC’s Profit 20 10

Scenario – 2 Remarks

Input cost 80 Sale price to 100

DHL

VAT rate @ 15% 12 VAT @ 7.5% 7.5

Total Cost 92 Total 107.5 Cost to DHL

Additional VAT burden borne by GC 12

Input cost to GC (as GC cannot claim VAT 92

rebate)

GC’s Profit 8

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Saqib's Daraz Profit Calculation SheetDocument2 pagesSaqib's Daraz Profit Calculation Sheetsyed munawer ali100% (1)

- BPS QN Inclusion WKGDocument1 pageBPS QN Inclusion WKGadi_mrmarkNo ratings yet

- Memo On VAT Rate of Service of BS 23 LTDDocument3 pagesMemo On VAT Rate of Service of BS 23 LTDMd. Mazharul Islam KhanNo ratings yet

- At The Time of Purchase by Dealer at The Time of Resale by DealerDocument8 pagesAt The Time of Purchase by Dealer at The Time of Resale by Dealerjhanvi1992No ratings yet

- Vat ReportDocument6 pagesVat Reportqeffeq ejffjNo ratings yet

- Environmental Taxes: Tax On PetroleumDocument4 pagesEnvironmental Taxes: Tax On PetroleumIRSNo ratings yet

- Week 9 Various Taxes Part ADocument64 pagesWeek 9 Various Taxes Part Alindokuhlentuli75No ratings yet

- Deferred Tax IAS 12Document5 pagesDeferred Tax IAS 12prahladnair6No ratings yet

- Goods and Services TaxDocument12 pagesGoods and Services Taxd.malhotra2605No ratings yet

- Frequently Asked Questions About GST: GST - General Info & Customs ImplicationsDocument14 pagesFrequently Asked Questions About GST: GST - General Info & Customs Implicationsprakash mishraNo ratings yet

- Value To Manufacturer Production Cost 100000 100000Document2 pagesValue To Manufacturer Production Cost 100000 100000d_narnoliaNo ratings yet

- ABC Singapore Question (Mobile Screen Capture) (Nov Dec 2019)Document11 pagesABC Singapore Question (Mobile Screen Capture) (Nov Dec 2019)Tahsin AbrarNo ratings yet

- Adm Guidelines Cov 19 LevyDocument12 pagesAdm Guidelines Cov 19 LevyFuaad DodooNo ratings yet

- VAT Training Day 3Document31 pagesVAT Training Day 3iftekharul alamNo ratings yet

- Manufacturing Accounts 2021 Lecture 2Document13 pagesManufacturing Accounts 2021 Lecture 2Boi NonoNo ratings yet

- VAT FormDocument2 pagesVAT FormGbenga Ogunsakin67% (3)

- Idt Compiler 2.0 CA Final New by CA Ravi AgarwalDocument402 pagesIdt Compiler 2.0 CA Final New by CA Ravi AgarwalAnisha PujNo ratings yet

- Heriot-Watt University Finance - December 2020 Section I Case StudiesDocument13 pagesHeriot-Watt University Finance - December 2020 Section I Case StudiesSijan PokharelNo ratings yet

- Ziva Chic Studio Tribellb 6 Kg وﻠﯾﻛ 6 نﯾﺗﻌطﻗ ﺔﯾﺿﺎﯾرﻟا نﯾرﺎﻣﺗﻠﻟ رﺑار لﺑﯾرﺗ ﺎﻔﯾز زﻠﺑﻣد - ... - Turqoise - Turquoise Blue 1Document4 pagesZiva Chic Studio Tribellb 6 Kg وﻠﯾﻛ 6 نﯾﺗﻌطﻗ ﺔﯾﺿﺎﯾرﻟا نﯾرﺎﻣﺗﻠﻟ رﺑار لﺑﯾرﺗ ﺎﻔﯾز زﻠﺑﻣد - ... - Turqoise - Turquoise Blue 1Adel HamdyNo ratings yet

- CHAPTER 10 - VAT Still DueDocument1 pageCHAPTER 10 - VAT Still Duenewlymade641No ratings yet

- Form 231Document9 pagesForm 231Pushkar JoshiNo ratings yet

- Chapter 10 - Concepts of Vat 7thDocument11 pagesChapter 10 - Concepts of Vat 7thEl Yang100% (3)

- Reviewer BusinessTaxDocument3 pagesReviewer BusinessTaxBSA Alexandrea PeñaNo ratings yet

- Value-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument6 pagesValue-Added Tax: Business and Transfer Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersiajycNo ratings yet

- UAE Comprehensive VAT GuideDocument19 pagesUAE Comprehensive VAT GuidefasmekbakerNo ratings yet

- Goods and Service Tax: The Way Ahead: Saturday, 22 August 2009Document27 pagesGoods and Service Tax: The Way Ahead: Saturday, 22 August 2009Priya TharwaniNo ratings yet

- CA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalDocument463 pagesCA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalRonita DuttaNo ratings yet

- IFBL Oats Cost Model Comparison Statement Draft V1 24.4.24Document2 pagesIFBL Oats Cost Model Comparison Statement Draft V1 24.4.24Md. Habibullah ACCANo ratings yet

- Introduction To and It's Implications: by - Uday PrabhupatkarDocument23 pagesIntroduction To and It's Implications: by - Uday PrabhupatkarMonisha ParekhNo ratings yet

- CH 7-11Document319 pagesCH 7-11anynameNo ratings yet

- CHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1Document8 pagesCHAPTER 12-InPUT VAT2013 - Valencia T&BT6thed - Docx Version 1kathNo ratings yet

- AirPods InvoiceDocument1 pageAirPods Invoicexavier francis100% (1)

- 18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionDocument2 pages18-19 - CT - Annual - 19dec19 - 05.35PM - SEE & Financial InstitutionWUTYI THINNNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxTendai ZamangweNo ratings yet

- Tax Base For VAT: Import StageDocument2 pagesTax Base For VAT: Import StageS. M. Saz Lul HoqueNo ratings yet

- Overview-Of-Gst-2 2Document22 pagesOverview-Of-Gst-2 2132 CHETANYANo ratings yet

- Value-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument7 pagesValue-Added Tax: Business and Transfer Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersCha DumpyNo ratings yet

- Return For Remittance of Value Added TaxDocument2 pagesReturn For Remittance of Value Added TaxDSM DRIVING SCHOOLNo ratings yet

- TAX SOLUTIONS (2) Corrected 2aaDocument12 pagesTAX SOLUTIONS (2) Corrected 2aaketty sambaNo ratings yet

- IB BM Paper 1-MSDocument13 pagesIB BM Paper 1-MSDANIYA GENERALNo ratings yet

- An Insight Into GST in IndiaDocument26 pagesAn Insight Into GST in IndiaSrikantNo ratings yet

- ITC Related AspectsDocument21 pagesITC Related AspectsRahul AkellaNo ratings yet

- Income Statement Report Form 11Document5 pagesIncome Statement Report Form 11mesfin eshete100% (13)

- Final CMADocument6 pagesFinal CMAManjari AgrawalNo ratings yet

- Baldwin Bicycle Company - Final Assignment - Group F - 20210728Document4 pagesBaldwin Bicycle Company - Final Assignment - Group F - 20210728ApoorvaNo ratings yet

- Pinnacle IPCC Value Added TaxDocument44 pagesPinnacle IPCC Value Added TaxSneh ShahNo ratings yet

- Chapter 15 PDFDocument12 pagesChapter 15 PDFDarijun SaldañaNo ratings yet

- Taxation 2 First Semester: Capital AllowancesDocument20 pagesTaxation 2 First Semester: Capital AllowancesAmogelangNo ratings yet

- Introduction To GST June 24 RevisionDocument47 pagesIntroduction To GST June 24 RevisionNamasviNo ratings yet

- Sample Problem No. 1: Ñas, CaviteDocument24 pagesSample Problem No. 1: Ñas, Cavite2 BNo ratings yet

- Packet - Ii: Signature Not Verified Signature Not Verified Signature Not VerifiedDocument3 pagesPacket - Ii: Signature Not Verified Signature Not Verified Signature Not VerifiedJaimin PopatNo ratings yet

- GST (Goods and Services Tax) : Biggest Tax Reform Since IndependenceDocument66 pagesGST (Goods and Services Tax) : Biggest Tax Reform Since IndependenceAbhishek IbrahimNo ratings yet

- Sip Calculator UpdatedDocument3 pagesSip Calculator UpdatedWaseem KhanNo ratings yet

- Projected P&L and BSDocument9 pagesProjected P&L and BSbipin kumarNo ratings yet

- ICAB-Mahbub - Dec 2023 (17th Batch)Document25 pagesICAB-Mahbub - Dec 2023 (17th Batch)hiakashNo ratings yet

- Billing Statement: Address ToDocument4 pagesBilling Statement: Address Tomqhy9b622hNo ratings yet

- Preliminary Foundation Design Report - 8-8Document1 pagePreliminary Foundation Design Report - 8-8Md. Abdul HaiNo ratings yet

- Preliminary Foundation Design Report - 1-1Document1 pagePreliminary Foundation Design Report - 1-1Md. Abdul HaiNo ratings yet

- DHL Package A - Volume II - Information To Be Provided With TenderDocument1 pageDHL Package A - Volume II - Information To Be Provided With TenderMd. Abdul HaiNo ratings yet

- DHL Package A - Volume I - Instruction To Tenderer and Condition of ContractDocument49 pagesDHL Package A - Volume I - Instruction To Tenderer and Condition of ContractMd. Abdul HaiNo ratings yet

- Signed NDADocument3 pagesSigned NDAMd. Abdul HaiNo ratings yet

- Revised EstimateDocument2 pagesRevised EstimateMd. Abdul HaiNo ratings yet

- Offer For Ink and Chemical StorageDocument5 pagesOffer For Ink and Chemical StorageMd. Abdul HaiNo ratings yet

- Paxar OfferDocument5 pagesPaxar OfferMd. Abdul HaiNo ratings yet

- Summary of OfferDocument1 pageSummary of OfferMd. Abdul HaiNo ratings yet